Triumph Financial Bundle

How Does Triumph Financial Navigate the Cutthroat Financial Services Arena?

Triumph Financial Company (TFIN) isn't just another financial institution; it's a specialized powerhouse in the transportation sector. But in a market brimming with competitors, how does Triumph Financial carve out its niche and maintain its edge? This exploration delves into the Triumph Financial SWOT Analysis, examining its key rivals and the strategies that fuel its success.

This deep dive into the Triumph Financial competitive landscape will dissect its market position, analyze its financial performance, and identify its key players. We'll uncover Triumph Financial's competitive advantages, assess its growth strategies, and examine the challenges it faces. Through rigorous market analysis and competitor analysis, we aim to provide actionable insights for investors and business strategists alike, offering a comprehensive understanding of Triumph Financial Company and its future prospects within the financial services industry.

Where Does Triumph Financial’ Stand in the Current Market?

Triumph Financial, Inc. carves out a distinct market position by zeroing in on the transportation sector. This specialization allows them to offer tailored financial solutions, setting them apart in the broader Financial Services industry. Their core operations revolve around providing financial tools like factoring services, equipment lending, and truck brokerage, all designed to meet the unique needs of trucking companies and owner-operators.

The company's value proposition lies in its comprehensive suite of services. They offer immediate cash flow through factoring, assist in acquiring essential equipment, and provide brokerage services, payment processing, and insurance solutions. This integrated approach simplifies financial management for their target customers, making them a one-stop shop for financial needs within the transportation industry. To understand more about their business model, you can read about the Revenue Streams & Business Model of Triumph Financial.

Geographically, Triumph Financial primarily serves the North American market, concentrating its efforts in the United States. Their strategic shift from a general community bank to a specialized financial services provider has allowed them to deepen their expertise and tailor their offerings to the unique needs of the transportation sector. This focus has strengthened their market position, particularly in factoring and equipment lending for trucking companies.

Triumph Financial's core operations include factoring services, equipment lending, and truck brokerage. These services provide essential financial support to trucking companies and owner-operators. They also offer payment processing and insurance solutions, creating a comprehensive financial ecosystem for their clients.

Their primary customer segments include small to medium-sized trucking companies, owner-operators, and freight brokers. These businesses often require specialized financial solutions not readily available from traditional banks. The focus on this niche market allows Triumph Financial to build strong relationships and provide tailored services.

Triumph Financial has a strong presence in the North American market, especially within the United States. While specific market share figures are not widely available, the company is recognized as a significant player in factoring and equipment lending within the trucking industry. They have strategically positioned themselves to serve this niche effectively.

As of March 31, 2024, Triumph Financial reported total assets of approximately $3.7 billion. The company's net income for the first quarter of 2024 was $12.3 million, or $0.49 per diluted share. These figures indicate a stable financial footing, reflecting their specialized focus and operational efficiency within the transportation sector.

Triumph Financial's key strengths include its specialized focus, comprehensive service offerings, and strong presence in the North American market. The company's ability to tailor financial solutions to the transportation sector sets it apart from competitors. Their financial performance demonstrates stability and growth potential.

- Specialized focus on the transportation sector.

- Comprehensive suite of financial services.

- Strong presence in the North American market.

- Stable financial performance, as evidenced by the 2024 Q1 results.

Triumph Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Triumph Financial?

The competitive landscape for Owners & Shareholders of Triumph Financial is multifaceted, encompassing various players across financial services and transportation sectors. The company faces both direct and indirect competition, necessitating a thorough understanding of its rivals to maintain and grow its market position. Analyzing the competitive environment is crucial for strategic decision-making and identifying opportunities for expansion.

Understanding the competitive dynamics within the factoring, equipment lending, truck brokerage, and payment processing segments is essential for assessing TFIN’s market position. The intensity of competition is influenced by factors such as pricing, service offerings, technological innovation, and strategic alliances. A detailed competitor analysis helps in evaluating the company's strengths, weaknesses, opportunities, and threats.

The competitive landscape is dynamic, with market share shifts often driven by pricing pressures, service quality, and technological advancements. Mergers and acquisitions also play a significant role, as larger entities seek to expand their service offerings and market reach. The ability to adapt to these changes is critical for TFIN’s long-term success.

Direct competitors in the factoring space include large commercial banks with factoring divisions, independent factoring companies, and specialized finance firms. These entities offer working capital solutions to trucking companies. For example, some banks have dedicated factoring divisions that compete directly with TFIN.

In equipment lending, TFIN competes with traditional banks, credit unions, and captive finance companies associated with truck manufacturers. These competitors often have established relationships with dealerships. Competition is intense, with players vying for market share through aggressive loan terms.

In the truck brokerage and payment processing segments, TFIN faces competition from freight brokers, logistics technology companies, and payment solution providers. These competitors leverage digital platforms to streamline payments and operations for carriers. The competitive landscape is heavily influenced by technological innovation.

Market share shifts often occur due to pricing pressures, service quality, and technological advancements. A competitor offering a more user-friendly digital platform for invoice factoring could attract clients away from TFIN. New entrants with efficient truck brokerage platforms can quickly gain traction.

Mergers and alliances impact the competitive dynamics, with larger financial institutions or logistics companies acquiring smaller specialized firms. These acquisitions help to expand service offerings and market reach. These strategic moves can significantly alter the competitive landscape.

Technological advancements are a key driver of competition, with new entrants leveraging digital platforms to disrupt traditional models. Companies that invest in technology to streamline operations and improve customer experience often gain a competitive edge. Innovation in payment processing and brokerage services is particularly impactful.

Several factors contribute to the competitive landscape of TFIN. These include pricing strategies, service offerings, technological capabilities, and the ability to form strategic partnerships. Understanding these factors is essential for assessing TFIN’s competitive advantages and potential vulnerabilities.

- Pricing: Competitive pricing is crucial in attracting and retaining customers.

- Service Offerings: Broad and flexible service offerings that meet diverse customer needs.

- Technology: User-friendly digital platforms for invoice factoring and brokerage services.

- Partnerships: Strategic alliances to expand market reach and service capabilities.

Triumph Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Triumph Financial a Competitive Edge Over Its Rivals?

Understanding the Target Market of Triumph Financial and its competitive advantages is crucial for assessing its position in the financial services sector. The company has carved out a niche by specializing in financial solutions for the transportation industry. This focused approach allows for a deeper understanding of the specific needs and risks within this sector, setting it apart from more generalized financial institutions.

The competitive landscape for Triumph Financial Company involves a mix of specialized financial providers and larger, diversified financial institutions. Triumph's success hinges on its ability to maintain its specialized expertise and integrated service model, offering factoring, equipment lending, and other financial products tailored to the transportation industry. Analyzing its competitive advantages helps to understand its market position and growth potential.

Triumph Financial's competitive advantages are significant, stemming from its specialization and integrated service offerings. These factors contribute to its ability to attract and retain clients within the transportation sector. However, the company faces ongoing challenges from competitors and the need to adapt to evolving market dynamics.

Triumph Financial's primary advantage is its deep understanding of the transportation industry. This specialization allows for tailored financial products and services. This focus enables more efficient risk assessment and underwriting processes.

The company offers a comprehensive suite of services, including factoring, equipment lending, and insurance. This integrated approach fosters customer loyalty and streamlines financial management. Clients benefit from a one-stop-shop solution, reducing administrative burdens.

Triumph has invested in technology platforms to optimize factoring and payment processing. This leads to faster funding times and an improved client experience. Technological advancements contribute to operational efficiency and scalability.

Triumph has built a strong brand reputation within the transportation finance community. This enhances its ability to attract and retain clients. Its specialized approach differentiates it from traditional financial institutions.

Triumph Financial's competitive edge is defined by its specialized focus and integrated service offerings. These advantages allow the company to serve the transportation industry effectively. This focus helps in building strong relationships and providing tailored financial solutions.

- Specialization: Deep understanding of the transportation industry.

- Integrated Services: Offering a comprehensive suite of financial products.

- Technology: Investing in platforms for efficient operations.

- Brand Reputation: Strong presence within the transportation finance community.

Triumph Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Triumph Financial’s Competitive Landscape?

The competitive landscape for Triumph Financial Company is shaped by dynamic industry trends, regulatory pressures, and economic shifts. Understanding the Triumph Financial Company's position requires a close examination of its strengths, weaknesses, opportunities, and threats. This analysis informs strategic decisions and investment strategies within the financial services sector, especially for companies catering to the transportation industry. For a deeper dive into the company's background, consider reading the Brief History of Triumph Financial.

The future outlook for Triumph Financial hinges on its ability to adapt to technological advancements and navigate evolving market dynamics. The company must proactively address potential challenges while capitalizing on growth opportunities within the transportation and financial sectors. This involves strategic investments, innovative product development, and a focus on operational efficiency to maintain a competitive edge.

Technological advancements in digital payments, telematics, and data analytics are reshaping the financial and transportation sectors. These innovations drive the need for continuous investment in IT infrastructure and digital platforms. The focus is on enhancing service offerings, improving operational efficiency, and developing new data-driven financial products.

Regulatory changes in both financial and transportation industries can increase costs and complexity. Economic shifts, like fluctuating fuel prices and interest rate changes, directly impact the profitability of Triumph Financial Company's clients. Increased competition from fintech startups and potential downturns in the trucking industry pose additional challenges.

The continued growth of e-commerce fuels demand for efficient logistics and transportation, benefiting Triumph Financial. Expansion into emerging markets within the transportation sector presents growth avenues. Product innovations, such as new insurance products and advanced analytics in factoring services, offer further opportunities.

Strategic partnerships with logistics technology providers and transportation networks can enhance market reach. The company is likely to adopt a more technologically integrated and data-driven approach. The goal is to leverage its niche expertise to remain resilient and capture new market segments.

Triumph Financial Company must manage regulatory compliance costs, which can be substantial. The company should monitor and adapt to economic fluctuations, particularly in fuel prices and interest rates, to mitigate risks. Strategic partnerships and technological investments will be key to maintaining a competitive edge.

- Focus on Fintech Integration: Embrace digital payment solutions and data analytics.

- Diversify Service Offerings: Develop new insurance and factoring products.

- Expand Market Reach: Target emerging markets and form strategic partnerships.

- Enhance Operational Efficiency: Streamline processes to reduce costs and improve service.

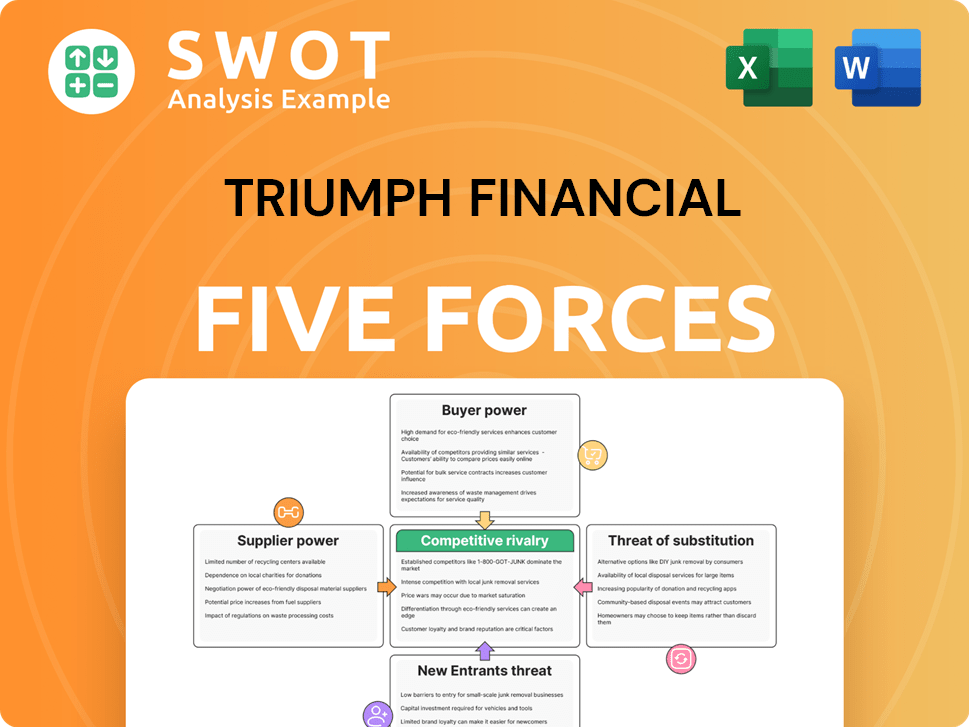

Triumph Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Triumph Financial Company?

- What is Growth Strategy and Future Prospects of Triumph Financial Company?

- How Does Triumph Financial Company Work?

- What is Sales and Marketing Strategy of Triumph Financial Company?

- What is Brief History of Triumph Financial Company?

- Who Owns Triumph Financial Company?

- What is Customer Demographics and Target Market of Triumph Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.