Tokyo Century Bundle

How has the Tokyo Century Company evolved over time?

Embark on a journey through the Tokyo Century SWOT Analysis to understand the financial services landscape. From its humble beginnings in 1951 as Toshiba Lease Co., Ltd., this Japanese company has transformed into a global financial powerhouse. Discover the key milestones that shaped the Tokyo Century history and its strategic adaptation to market dynamics.

This brief history of Tokyo Century Company reveals a fascinating trajectory of growth and diversification. The company's evolution from a leasing specialist to a multifaceted financial services provider showcases its resilience and strategic acumen. Understanding the Tokyo Century timeline provides valuable insights into its business model and its ability to capitalize on emerging opportunities, making it a compelling case study for investors and business strategists alike. The company's financial performance, including the impressive JPY 1,368.6 billion in consolidated revenues for fiscal year 2025, further highlights its market position.

What is the Tokyo Century Founding Story?

The story of the Tokyo Century Company begins with two key predecessors, setting the stage for its evolution into a major player in the financial services sector. Understanding the Tokyo Century history requires a look back at its origins in the Japanese economy.

The initial vision was to provide financial solutions for businesses, particularly through leasing services. This approach aimed to support industrial development and corporate investment by offering flexible financial arrangements. The company's growth and strategic moves have shaped its current position in the market.

The Tokyo Century Company overview shows a journey of strategic mergers and expansions, reflecting its adaptability and commitment to growth. The company's evolution highlights its ability to identify opportunities and adapt to changing market dynamics.

The Tokyo Century Company's roots are in two companies: Tokyo Leasing Co., Ltd. and Century Leasing System, Inc. These companies were established in the mid-1960s and late 1960s, respectively, to address the growing need for financing solutions in Japan. The early business model focused on leasing services to support industrial development.

- Tokyo Leasing Co., Ltd. was founded in August 1964, with an initial capitalization of 1 million yen.

- Century Leasing System, Inc. was established in July 1969, with a capitalization of 500 million yen.

- The founders identified the need for financing solutions for businesses to acquire equipment without large upfront costs.

- The company's early focus was on leasing essential assets to support corporate investment.

A pivotal moment occurred in April 2009 when Century Leasing System, Inc. merged with Tokyo Leasing Co., Ltd., creating Century Tokyo Leasing Corporation. This merger combined strengths in leasing and IT services. The company later rebranded as Tokyo Century Corporation in October 2016.

- The merger aimed to pioneer a new leasing business model and enhance capabilities.

- The rebranding to Tokyo Century Corporation in 2016 reflected a broader scope of services.

- The company's growth strategy included expanding its global presence.

- Tokyo Century Company's acquisitions have played a key role in its expansion.

For a deeper understanding of how Tokyo Century Company compares with its rivals, you can explore the Competitors Landscape of Tokyo Century.

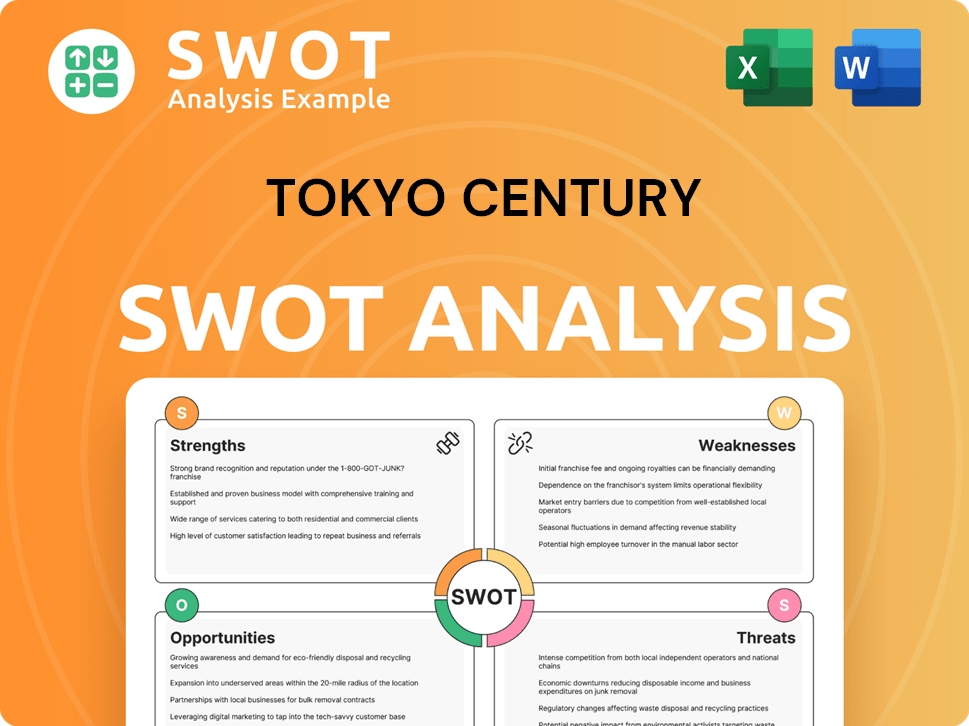

Tokyo Century SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tokyo Century?

Following the merger in April 2009, the Tokyo Century Company (formerly Century Tokyo Leasing Corporation) experienced substantial growth, broadening its services beyond traditional leasing. This expansion was strategically timed, capitalizing on the post-2008 financial crisis environment, and leveraging its existing customer base to enhance financial and service functions. This period marked a crucial phase in the Tokyo Century history, shaping its evolution into a significant player in the financial services sector.

Key to the early growth of the Japanese company were strategic acquisitions and the establishment of joint ventures. In 2010, IHI Finance Support became a consolidated subsidiary. Global expansion was also a priority, with the establishment of Century Tokyo Leasing China Corporation in January 2010 through a merger. These moves demonstrated the company's commitment to diversifying its operations and expanding its global footprint.

The company expanded into new markets and product categories. In April 2012, leasing operations commenced in India through a business alliance with the Tata Group. The establishment of Kyocera TCL Solar LLC in August 2012, a joint venture with Kyocera Corporation, marked an entry into the environmental infrastructure segment. These initiatives highlighted the company's adaptability and its focus on sustainable growth.

The automobility segment saw significant growth with the merger of Tokyo Auto Leasing and Nippon Car Solutions in 2013, converting Nippon Car Solutions into a consolidated subsidiary. International growth continued with the acquisition of shares in a leasing subsidiary of Bank of the Philippine Islands in 2014, eventually converting it into a consolidated subsidiary by 2020. The acquisition of CSI Leasing in 2015, which became a wholly-owned subsidiary in 2016, significantly strengthened the company's global IT equipment leasing and finance business. For further insights into the company's ownership structure, you can read more in our article about Owners & Shareholders of Tokyo Century.

These strategic moves, coupled with a focus on high-value-added financial services, allowed Tokyo Century to grow substantially as a financial services company during this period. The company's ability to adapt and expand its services, particularly in the wake of the 2008 financial crisis, underscored its resilience and strategic foresight. This period laid the foundation for its continued growth and success in the global market.

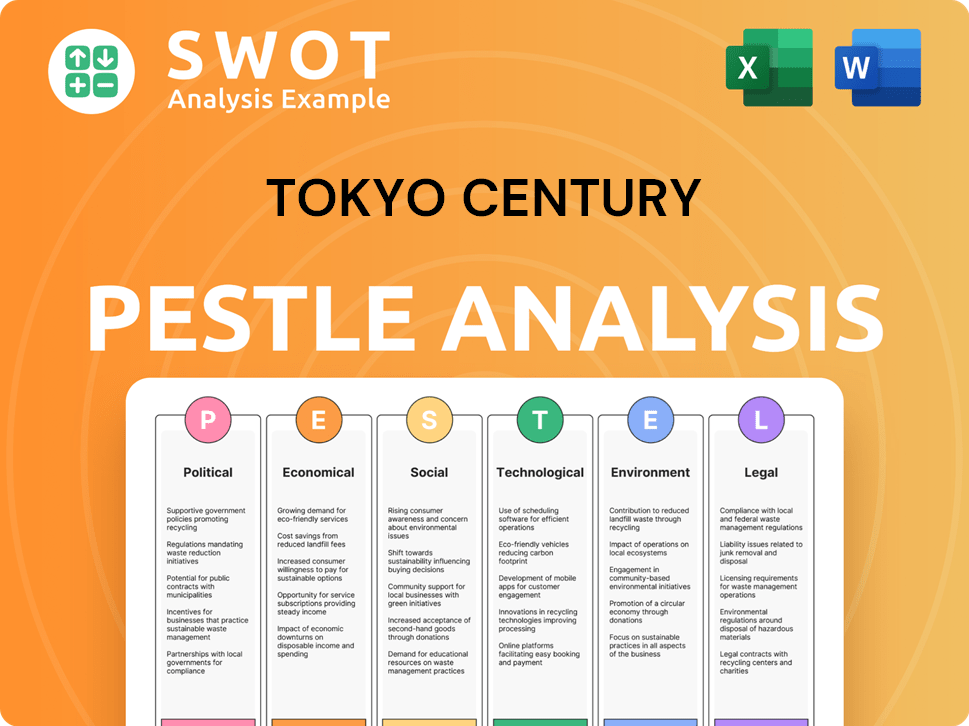

Tokyo Century PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tokyo Century history?

The Tokyo Century Company has achieved several significant milestones throughout its history, marking its growth and evolution as a leading financial services provider. These achievements reflect its strategic vision and adaptability in the face of market changes.

| Year | Milestone |

|---|---|

| 2012 | Established Kyocera TCL Solar LLC, a joint venture focused on solar power generation, showcasing early commitment to environmental infrastructure. |

| 2016 | Launched a Robot Dispatch (Rental) Business with Kawasaki Heavy Industries, Ltd., demonstrating the adoption of new technologies. |

| 2016 | Acquired CSI Leasing, Inc., solidifying its position as a leading global independent leasing company, particularly in IT equipment. |

| 2016 | Changed its name from Century Tokyo Leasing Corporation to Tokyo Century Company, signaling a renewed commitment as a specialized financial services company. |

| 2017 | Became the first Japanese financial services company selected for a project under the Joint Crediting Mechanism (JCM), emphasizing sustainable initiatives. |

| 2020 | Established the dX Strategy Division to advance digital transformation initiatives, focusing on enhancing corporate value and competitiveness. |

The company has consistently embraced innovation to strengthen its market position. One notable example is its early investment in renewable energy through Kyocera TCL Solar LLC. The company also launched a Robot Dispatch (Rental) Business in 2016, demonstrating its forward-thinking approach.

The establishment of Kyocera TCL Solar LLC in 2012 marked a significant step into renewable energy. This venture highlighted the company's commitment to environmental sustainability and infrastructure development.

The dX Strategy Division, established in December 2020, focuses on digital transformation (DX). This initiative aims to enhance corporate value, boost competitiveness, and revise existing systems for digital innovation.

The company actively pursues co-creation of new businesses with corporate partners. This approach helps to diversify its services and stay competitive in the market.

The acquisition of CSI Leasing, Inc. in 2016 expanded the company's global footprint. This move solidified its position as a leading global independent leasing company, particularly in IT equipment.

The launch of the Robot Dispatch (Rental) Business in 2016 with Kawasaki Heavy Industries, Ltd. showcased the company's embrace of new technologies. This demonstrates its commitment to innovation and staying ahead of industry trends.

The company is a leading financial services provider, offering a wide range of leasing and financial solutions. This includes various services across multiple sectors, supporting diverse client needs.

The Tokyo Century has faced several challenges, including market downturns and changes in accounting standards. The company experienced an extraordinary loss in the fiscal year ended March 31, 2023, related to aircraft leased to Russian airlines. However, the company is set to record an extraordinary income for the fiscal year ending March 31, 2026, due to insurance settlement proceeds totaling US$398 million received by its consolidated subsidiary Aviation Capital Group LLC (ACG) related to this exposure.

The company has navigated through economic downturns, such as the 2008 financial crisis. These events have tested the company's resilience and strategic adaptability.

Changes in lease accounting standards have presented challenges to the company. The company has adapted to these changes through adjustments to its financial reporting and operational strategies.

The company faced an extraordinary loss in the fiscal year ended March 31, 2023, due to the unlikelihood of recovering aircraft leased to Russian airlines. However, the company is set to record an extraordinary income for the fiscal year ending March 31, 2026, due to insurance settlement proceeds totaling US$398 million received by its consolidated subsidiary Aviation Capital Group LLC (ACG) related to this exposure.

The financial services and leasing industries are highly competitive. The company continuously works to differentiate itself through innovation, strategic partnerships, and a focus on customer needs.

The company must comply with evolving financial regulations. This requires constant monitoring, adaptation, and investment in compliance measures to maintain its operations.

Economic downturns can impact the demand for leasing services and the financial performance of the company. The company must manage risks and adjust strategies to mitigate the effects of economic cycles.

For further insights into the company's business model and revenue streams, you can refer to this article: Revenue Streams & Business Model of Tokyo Century.

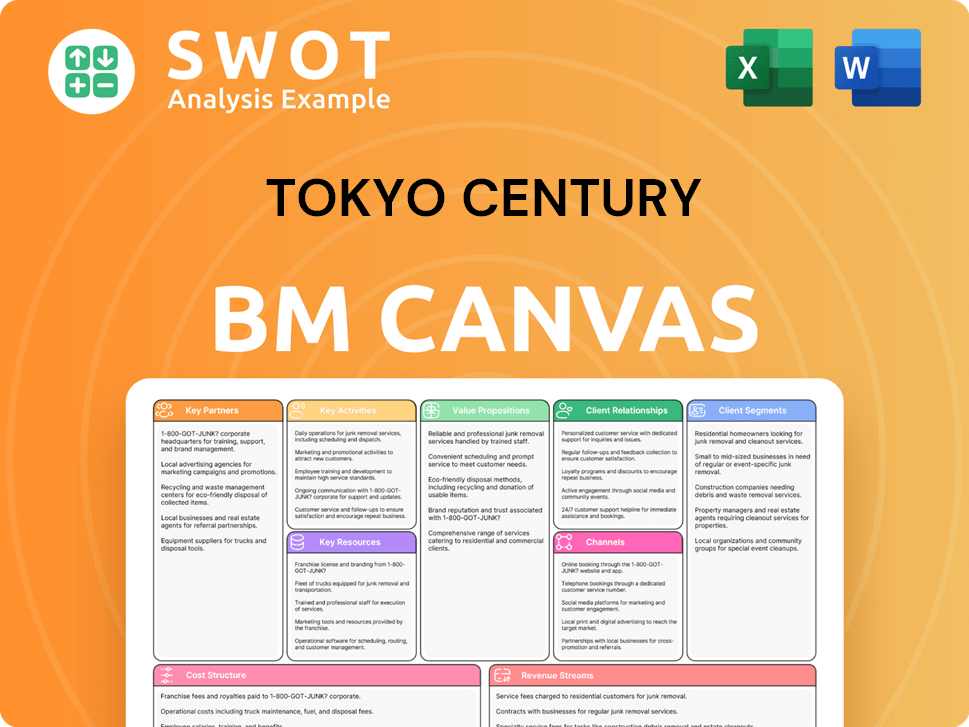

Tokyo Century Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tokyo Century?

The Tokyo Century Company has a rich history marked by strategic expansions and adaptations in the financial services sector. From its origins in 1964 as Tokyo Leasing Co., Ltd., the company has evolved through mergers, acquisitions, and strategic partnerships, becoming a prominent player in the Japanese financial market and beyond. This journey reflects its commitment to innovation and growth, positioning it for continued success in a dynamic global landscape.

| Year | Key Event |

|---|---|

| 1964 | Tokyo Leasing Co., Ltd. established. |

| 1969 | Century Leasing System, Inc. established. |

| 1998 | Tokyo Century Corporation (then Toshiba Lease Co., Ltd.) became a consolidated subsidiary of the Toshiba Group. |

| 2001 | Toshiba Lease Co., Ltd. rebranded as Tokyo Century Corporation. |

| April 2009 | Century Leasing System, Inc. and Tokyo Leasing Co., Ltd. merged to form Century Tokyo Leasing Corporation. |

| January 2010 | Century Tokyo Leasing China Corporation established through a merger. |

| April 2012 | Began leasing business in India through an alliance with the Tata Group. |

| August 2012 | Established Kyocera TCL Solar LLC, a solar power generation joint venture. |

| 2013 | Merged Tokyo Auto Leasing and Nippon Car Solutions; converted Nippon Rent-A-Car Service into a consolidated subsidiary. |

| 2015 | CSI Leasing, Inc. became an equity-method affiliate, later a wholly-owned subsidiary in 2016. |

| October 2016 | Company name changed from Century Tokyo Leasing Corporation to Tokyo Century Corporation. |

| 2019 | Acquired a majority stake in Australian leasing firm Best Technology Services and acquired the remaining interest in Aviation Capital Group LLC (ACG), making ACG a wholly-owned subsidiary. |

| February 2020 | Formed a capital and business alliance with Nippon Telegraph and Telephone Corporation (NTT) and established NTT TC Leasing Co., Ltd. |

| December 2020 | Established the dX Strategy Division to advance digital transformation. |

| Fiscal Year 2023 (ended March 31, 2024) | Reported consolidated revenues of JPY 1,346.1 billion. |

| March 2024 | Invested in U.S.-based May Mobility, Inc., a developer of autonomous vehicle technology. |

| Fiscal Year 2024 (ended March 31, 2025) | Consolidated revenues increased by 1.7% to JPY 1,368.6 billion. Net income attributable to owners of parent increased by 18.2% to JPY 85.3 billion. |

The Tokyo Century Company is increasing its focus on environmental, social, and governance (ESG) initiatives. They plan to invest around ¥100 billion (approximately USD $900 million) in ESG projects by 2025. This includes expanding their overseas solar power businesses and ventures related to storage batteries, reflecting a commitment to sustainable practices.

Digital transformation is a key strategic focus for Tokyo Century. The company aims to innovate its corporate culture, improve productivity, and transform existing businesses. They are also focused on creating new business opportunities through collaboration, particularly by leveraging AI and big data to enhance their services and operations.

Analysts predict a positive financial trajectory for Tokyo Century. Earnings are expected to grow by 8.6% and revenue by 6.8% annually. The company has a progressive dividend policy, targeting a payout ratio of approximately 35%, with a projected annual dividend of ¥68 per share for fiscal year 2025.

International business is a significant growth area for Tokyo Century. Revenues from this segment increased by 25.5% to ¥222.7 billion in the fiscal year ended March 31, 2025, driven by investments in data center businesses. This global expansion supports the company's long-term vision of providing comprehensive financial services worldwide.

Tokyo Century Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tokyo Century Company?

- What is Growth Strategy and Future Prospects of Tokyo Century Company?

- How Does Tokyo Century Company Work?

- What is Sales and Marketing Strategy of Tokyo Century Company?

- What is Brief History of Tokyo Century Company?

- Who Owns Tokyo Century Company?

- What is Customer Demographics and Target Market of Tokyo Century Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.