Tokyo Century Bundle

Unveiling the Inner Workings of Tokyo Century Company: How Does It Thrive?

Tokyo Century Company, a leading Japanese company in the financial services sector, has quietly built a global empire in leasing and financing. With impressive financial results in fiscal year 2025, including a significant revenue increase, the company's influence is undeniable. But what are the core strategies driving this growth, and how does Tokyo Century business model adapt to a rapidly changing world?

This exploration into Tokyo Century SWOT Analysis will reveal the company's multifaceted approach, examining its diverse revenue streams from leasing operations to specialty financing. We'll dissect the strategic partnerships and innovative solutions that have solidified Tokyo Century's position as a key player in the financial landscape, providing valuable insights for investors and industry professionals alike. Understanding Tokyo Century's financial performance and its commitment to sustainability is key to grasping its long-term potential.

What Are the Key Operations Driving Tokyo Century’s Success?

The core operations of the Tokyo Century Company, a leading Japanese company, are centered around providing comprehensive leasing, financing, and related services. This approach allows the company to create and deliver value across five key operating segments. These segments include Equipment Leasing, Automobility, Specialty Financing, International Business, and Environmental Infrastructure, demonstrating the breadth of the Tokyo Century business.

Serving a diverse customer base, from individual clients to large corporations, the company provides financial solutions tailored to various needs. Tokyo Century's integrated 'Finance x Services x Business Expertise' approach sets it apart, offering solutions beyond traditional leasing and financing. This strategy enables the company to adapt to evolving business environments and contribute to decarbonization efforts, making it a key player in the financial services sector.

Tokyo Century's value proposition lies in its ability to offer tailored financial solutions, access to a broad range of assets, and support for sustainable business practices. This is achieved through strategic partnerships and a focus on innovation, particularly in areas such as next-generation mobility and renewable energy. For a deeper understanding of their marketing strategies, you can explore the Marketing Strategy of Tokyo Century.

This segment provides leasing and financing for a wide array of equipment. This includes information and telecommunications equipment, office equipment, transportation equipment, and industrial machinery. The company’s diverse portfolio supports various industries, contributing significantly to its revenue streams.

The Automobility segment offers auto leasing for corporate and individual customers. It also includes car rental and car-sharing services. The focus is on next-generation mobility services like electric vehicles and autonomous driving technologies, aligning with the company's forward-thinking approach.

Specialty Financing encompasses domestic and overseas lease financing for significant assets such as ships, aircraft, and real estate. The subsidiary, Aviation Capital Group LLC (ACG), managed over 500 aircraft as of December 31, 2024. This segment highlights Tokyo Century's expertise in managing large-scale, specialized financial assets.

The International Business segment extends lease financing and ancillary services across East Asia, ASEAN countries, North America, and Latin America. This includes automobile businesses and investments in data center businesses. This segment showcases the company's global presence and diversification efforts.

This segment is dedicated to power generation businesses and related financing, particularly in renewable energy. This includes solar power generation and storage battery solutions. This segment reflects Tokyo Century's commitment to sustainable and environmentally friendly business practices.

Operational processes involve purchasing equipment from dealers and leasing it to customers, along with providing installment sales. Key operational enablers include supply chain management and strategic partnerships. Tokyo Century collaborates with partners like the NTT Group, the NX Group, and the Fujitsu Group to promote co-creation businesses.

- Strategic alliances with domestic and foreign corporations and financial institutions allow the company to offer specialized financial services.

- These partnerships are crucial for expanding business domains and adapting to the unique needs of each country.

- The company's integrated approach combines Finance, Services, and Business Expertise.

- This approach enables comprehensive solutions and supports sustainable business practices.

Tokyo Century SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Tokyo Century Make Money?

The Tokyo Century Company generates revenue through a diverse range of financial services, primarily focusing on leasing and financing activities. This Japanese company operates across five key segments, each contributing to its overall financial performance. The company's business model is built on providing tailored financial solutions to various industries and markets.

For the fiscal year ending March 31, 2025, Tokyo Century reported a total revenue increase of 1.7% to ¥1,368,600 million. The gross profit for the same period increased by 10.7% to ¥280,200 million. This growth reflects the company's ability to capitalize on opportunities across different sectors and geographies. You can learn more about the Growth Strategy of Tokyo Century in this article.

The company's monetization strategies involve providing specialized financing, forming strategic partnerships, and investing in high-growth areas. These approaches enable Tokyo Century to maintain a strong financial position and adapt to evolving market dynamics.

Revenue from leasing and installment sales of IT-related equipment, industrial equipment, and other machinery and facilities.

Income from auto leasing services for corporate and individual customers, car rental, and car sharing.

Revenue from domestic and overseas lease financing of large assets such as ships, aircraft, and real estate. This segment saw increased income in the fiscal year ended March 31, 2025.

Revenue from lease financing and ancillary services in various regions, including East Asia, ASEAN countries, North America, and Latin America. This segment also saw significant revenue growth, increasing by 25.5% to ¥222,700 million, with segment income rising by 48.9% to ¥16,300 million due to gains on the sale of investment securities and foreign exchange gains. Investments in data center businesses have also contributed to this segment.

Income derived from power generation businesses, particularly renewable energy projects like solar power generation, and related lease financing. This segment is expected to see increased net income in fiscal year 2025 due to the recovery of the biomass co-firing power generation business.

Tokyo Century employs several monetization strategies to maximize revenue and profitability. These strategies include tailored financing solutions, strategic partnerships, and investments in high-growth areas. The company's focus on these areas allows it to adapt to market changes effectively.

- Acquisition of a 5% stake in Tess Holdings Co., Ltd. for ¥27.2 billion in December 2024, expanding into grid-scale battery energy storage systems (BESS) and other power-related areas.

- Involvement in joint ventures for hotel development, such as Hotel Indigo Changi Airport, leveraging real estate and hospitality investments.

- Gains on sales of assets, such as aircraft, which contributed to net cash provided by operating activities amounting to ¥51,400 million in the fiscal year ended March 31, 2025.

- Anticipation of approximately ¥40.0 billion in extraordinary income in fiscal year 2025 from insurance settlement proceeds related to Aviation Capital Group's exposure to Russian airlines.

Tokyo Century PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Tokyo Century’s Business Model?

The evolution of Tokyo Century Company has been marked by significant milestones, strategic initiatives, and a focus on diversification. The merger of Century Leasing System, Inc. and Tokyo Leasing Co., Ltd. was a pivotal event, establishing the foundation for its comprehensive financial services model. The company's growth strategy has consistently involved mergers and acquisitions (M&A) and joint ventures, expanding its operational scope and capabilities within the financial services sector.

Recent strategic moves highlight the company's commitment to emerging sectors and sustainable practices. Investments in autonomous vehicle technology and renewable energy projects demonstrate a forward-thinking approach. Furthermore, partnerships in real estate and infrastructure projects underscore its dedication to sustainable development and global expansion.

As of March 31, 2025, Tokyo Century reported total assets of ¥6,862,861 million and a shareholders' equity ratio of 15.0%, reflecting a strong financial position.

The formation of Tokyo Century Corporation through the merger of Century Leasing System, Inc. and Tokyo Leasing Co., Ltd. was a defining moment. This consolidation created a robust platform for its financial services offerings. The company has consistently utilized M&A and joint ventures to expand its business operations and market presence.

In March 2024, the company invested in May Mobility, Inc., a U.S.-based autonomous vehicle technology firm. In December 2024, Tokyo Century agreed to acquire a 5% stake in Tess Holdings Co., Ltd. In March 2025, the company partnered with OUE Limited to develop Hotel Indigo Changi Airport in Singapore. These moves demonstrate a focus on next-generation mobility, renewable energy, and sustainable real estate.

The 'Finance x Services x Business Expertise' business model, combined with strategic alliances, enables specialized financial services. A diversified business portfolio and strong relationships with major shareholders like Nippon Telegraph and Telephone Corp. and Mizuho Bank, Ltd. support smooth business development. Expertise in asset valuation and securing development sites are also key advantages.

In the Automobility segment, the company focuses on vehicle maintenance and autonomous driving. In the International Business segment, Tokyo Century is collaborating with the NTT Group on data center businesses to meet expanding AI demand. Despite challenges, the company aims to leverage changes for growth.

Tokyo Century's financial health is supported by a diversified business portfolio and strategic partnerships. These partnerships include major financial institutions and prime companies to deliver specialized financial services. The company's approach to asset valuation and securing development sites is also a key component of its competitive advantage.

- The company's business model is centered around "Finance x Services x Business Expertise."

- Strong relationships with major shareholders facilitate business development.

- Focus on sectors like automobility and data centers to adapt to market trends.

- The company has a global presence and is involved in various international projects.

Tokyo Century Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Tokyo Century Positioning Itself for Continued Success?

As a leading financial services provider, Tokyo Century Company maintains a strong position, particularly in leasing and specialty financing. Its diverse portfolio, including equipment leasing, automobility, and international business, supports stable earnings. The company's global presence and tailored services contribute to its strong customer loyalty.

However, the company faces various risks, including property-price fluctuations, credit risks, and regulatory changes. The company is also exposed to uncertainties in interest rates and potential impacts from U.S. tariff policies. Despite these challenges, Tokyo Century is focused on its Medium-Term Management Plan 2027, aiming for sustainable growth and shareholder returns.

Tokyo Century is a prominent leasing company and financial services provider. The company's diversified business model, spanning various sectors, ensures stable revenue streams. As of March 31, 2025, the company's total assets reached ¥6,862,861 million, demonstrating a strong financial foundation.

Key risks include property-price fluctuations, credit risk, and investment-related risks, particularly in the aircraft sector. Regulatory changes, technological disruption, and evolving consumer preferences also present challenges. The company acknowledges the uncertainty in interest rates and potential impacts from U.S. tariff policies, factoring a ¥32 billion risk buffer for potential impacts.

Tokyo Century is committed to its Medium-Term Management Plan 2027, aiming for accelerated growth across its business segments. Strategic initiatives include strengthening existing businesses and exploring new opportunities in automobility and specialty financing. The company is focused on providing stable, long-term returns to shareholders, with a progressive dividend policy.

The company's financial health is reflected in its shareholders' equity ratio of 15.0% as of March 31, 2025. For fiscal year 2025, the company plans to raise its annual dividend to ¥68 per share, up ¥6 from the previous fiscal year. The company's commitment to low-carbon and decarbonization investments is a key future direction.

Tokyo Century's future strategy emphasizes strengthening existing businesses and expanding into new areas. This includes automobility services, specialty financing, and international business collaborations. The company is also focused on sustainability and shareholder returns.

- Expansion in automobility, including vehicle maintenance and data services.

- Increased asset efficiency in the aviation business.

- Collaboration with the NTT Group in data center businesses.

- Expansion of overseas solar power and storage battery-related businesses.

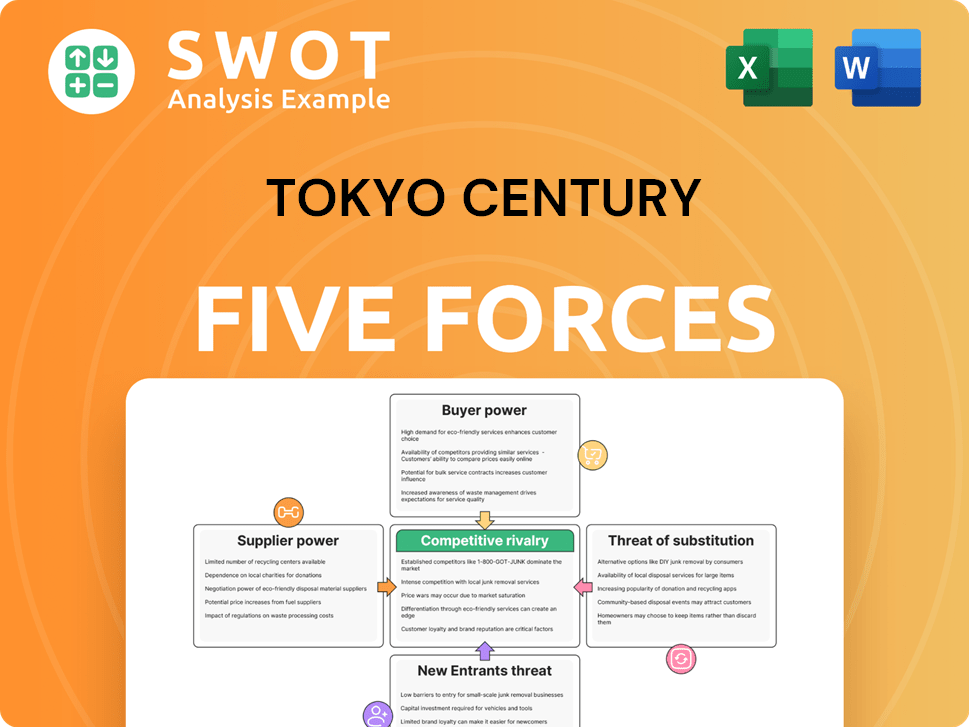

Tokyo Century Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Tokyo Century Company?

- What is Competitive Landscape of Tokyo Century Company?

- What is Growth Strategy and Future Prospects of Tokyo Century Company?

- What is Sales and Marketing Strategy of Tokyo Century Company?

- What is Brief History of Tokyo Century Company?

- Who Owns Tokyo Century Company?

- What is Customer Demographics and Target Market of Tokyo Century Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.