Tower Semiconductor Bundle

How has Tower Semiconductor shaped the semiconductor landscape?

Embark on a journey through the Tower Semiconductor SWOT Analysis and discover the remarkable story of Tower Semiconductor, a leading Israeli tech company that has significantly impacted the global semiconductor manufacturing industry. From its humble beginnings in 1993, the company, often referred to as TowerJazz, has consistently pushed the boundaries of what's possible in specialized manufacturing.

This brief history of Tower Semiconductor Ltd will delve into the key milestones, strategic decisions, and technological innovations that have defined the company's trajectory. Explore the Tower Semiconductor timeline, from its founding to its present-day position, examining its impact on various sectors. We'll also explore the Tower Semiconductor company's financial performance, acquisitions, and the evolution of its manufacturing facilities, including its fab locations and customer base.

What is the Tower Semiconductor Founding Story?

The founding of Tower Semiconductor, an Israeli tech company, in 1993 marked a significant moment in the semiconductor industry. It emerged from National Semiconductor's manufacturing facility in Migdal Haemek, Israel. This spin-off was a strategic response to the evolving needs of the semiconductor market.

The company's establishment was driven by the increasing demand for outsourced semiconductor manufacturing services. This trend gained momentum in the early 1990s as integrated device manufacturers sought to reduce capital expenditures and focus on design. The vision was to leverage existing fab infrastructure and expertise to provide specialized foundry services, particularly for analog and mixed-signal integrated circuits.

The founding team recognized an opportunity to serve a growing market of fabless semiconductor companies. These companies required access to advanced manufacturing capabilities without the overhead of building and maintaining their own fabs. Tower Semiconductor's original business model focused on offering customizable process technologies and design services, enabling customers to develop unique products. This approach allowed for greater flexibility and cost-efficiency for clients. Initial funding came from a combination of private investment and public offerings, reflecting confidence in the emerging foundry model. The name 'Tower' symbolized its aspiration to be a strong and reliable pillar in the semiconductor supply chain, providing a foundation for its customers' innovations. Learn more about the Revenue Streams & Business Model of Tower Semiconductor.

Tower Semiconductor's founding was a strategic response to market changes, focusing on outsourced semiconductor manufacturing.

- 1993: Year of establishment in Migdal Haemek, Israel.

- Spin-off: Emerged from National Semiconductor's manufacturing facility.

- Business Model: Focused on providing foundry services, especially for analog and mixed-signal integrated circuits.

- Funding: Combination of private investment and public offerings.

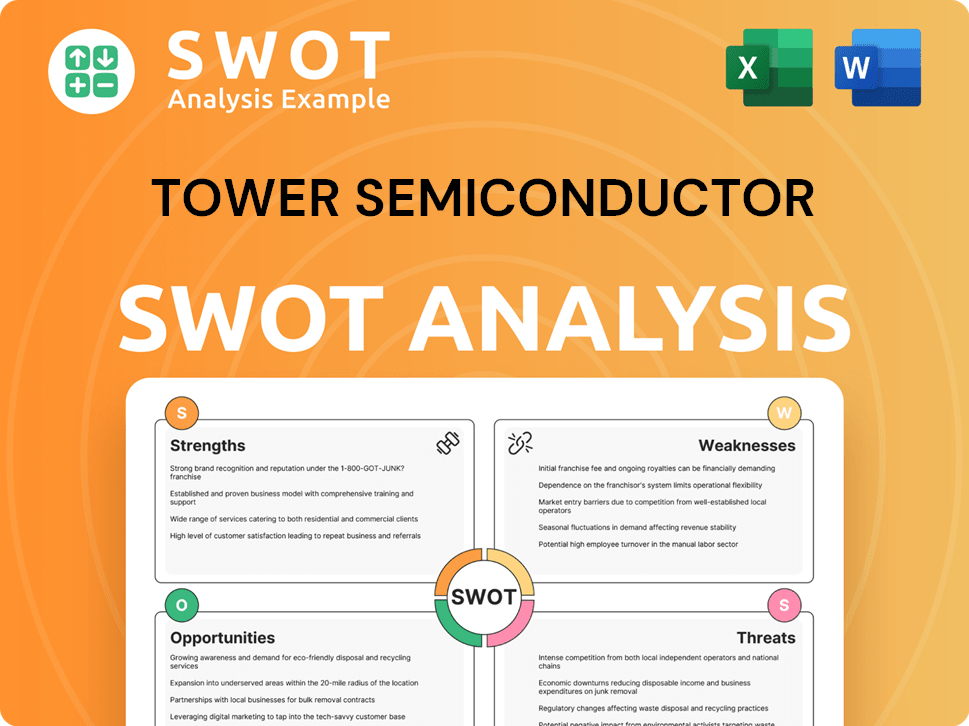

Tower Semiconductor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tower Semiconductor?

The early growth of Tower Semiconductor was marked by strategic investments aimed at establishing itself as a leading specialty foundry. The company expanded its process technology offerings beyond basic logic, focusing on specialized areas like mixed-signal and RF processes. Early product launches included analog and mixed-signal integrated circuits, catering to the telecommunications and consumer electronics markets.

Following its founding, Tower Semiconductor focused on expanding its process technology offerings beyond basic logic, venturing into areas such as mixed-signal, RF, and non-volatile memory processes. Early product launches included various analog and mixed-signal integrated circuits, catering to the burgeoning telecommunications and consumer electronics markets. The company secured its first major clients by demonstrating its ability to deliver high-quality, customized manufacturing solutions, fostering strong relationships with fabless design houses.

Initial team expansion focused on attracting experienced engineers and operational staff from the semiconductor industry, bolstering its technical expertise. Tower Semiconductor's first facility, located in Migdal Haemek, Israel, served as its primary manufacturing hub. The company strategically entered new markets by offering its foundry services to a wider range of industries, including automotive and industrial applications, recognizing the increasing demand for specialized semiconductors in these sectors.

Major capital raises through public offerings and strategic partnerships provided the necessary funding for ongoing research and development, as well as capacity expansion. Leadership transitions during this period focused on bringing in executives with deep industry knowledge and a global perspective to guide the company's growth. The market reception to Tower Semiconductor's specialized foundry model was generally positive, as it addressed a critical need for flexible and advanced manufacturing services.

The competitive landscape, while evolving, allowed Tower Semiconductor to carve out its niche by focusing on specialty processes where larger foundries had less emphasis. These growth efforts significantly shaped Tower Semiconductor's trajectory, establishing it as a key player in the specialty foundry segment of the semiconductor industry. To learn more about the company's marketing approach, consider reading about the Marketing Strategy of Tower Semiconductor.

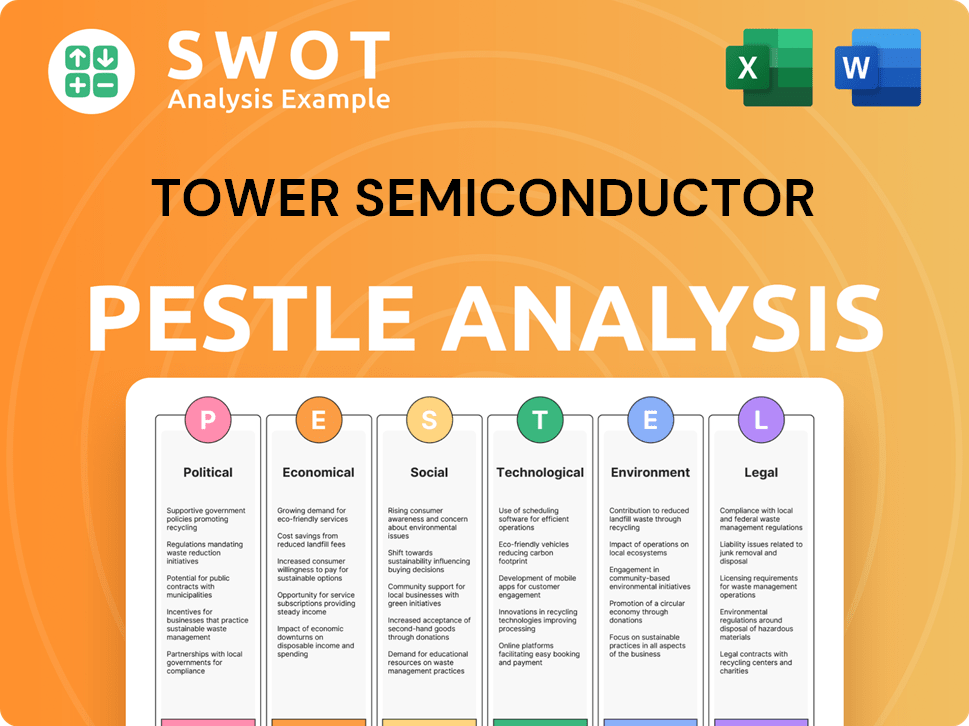

Tower Semiconductor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tower Semiconductor history?

The journey of Tower Semiconductor, an Israeli tech company, has been marked by significant achievements and strategic moves. Its Tower Semiconductor history is a testament to its evolution and adaptation within the dynamic semiconductor manufacturing industry.

| Year | Milestone |

|---|---|

| 1993 | Founded as Tower Semiconductor, marking its entry into the semiconductor market. |

| 1994 | Commenced operations at its first manufacturing facility in Migdal HaEmek, Israel. |

| 1999 | Completed its initial public offering (IPO). |

| 2008 | Acquired Jazz Semiconductor, expanding its product portfolio and market reach. |

| 2016 | Acquired Maxim Integrated's fab in San Antonio, Texas, strengthening its manufacturing capacity in the United States. |

| 2023 | Acquisition by Intel Corporation was called off due to regulatory hurdles. |

Tower Semiconductor has consistently pushed the boundaries of semiconductor manufacturing through innovation. Key innovations include advancements in SiGe BiCMOS, RF SOI, and power management platforms, enabling the development of cutting-edge products. These technologies have facilitated groundbreaking product launches for its customers, particularly in high-growth markets like 5G, automotive radar, and power delivery systems.

Development and refinement of advanced process technologies, including SiGe BiCMOS and RF SOI, which are crucial for high-performance applications.

Creation of power management platforms that enhance efficiency and performance in various electronic devices.

Development of specialized manufacturing processes tailored for specific customer needs, leading to differentiated products.

Focus on high-performance RF solutions, which are essential for 5G and other wireless communication applications.

Development of automotive-grade technologies, including sensors and power management, for the automotive industry.

Customized manufacturing solutions that enable customers to create unique products, including specialized sensors and power management ICs.

Tower Semiconductor has faced several challenges in its history. Market downturns and intense competition have required strategic adjustments. The company has also navigated product failures and internal operational adjustments, learning valuable lessons in the process. For instance, in 2023, the deal with Intel Corporation was called off due to regulatory hurdles, which impacted its strategic plans.

The semiconductor industry is highly cyclical, with periods of high demand followed by downturns, requiring agile manufacturing strategies and cost controls.

Competition from larger foundries and emerging players necessitates continuous investment in R&D and differentiation to maintain a competitive edge.

Infrequent product failures have provided opportunities for process optimization and quality control improvements.

Internal crises, such as operational adjustments or technological hurdles, have been overcome through strategic pivots, including capacity expansions and the refinement of its customer engagement model.

Geopolitical factors, including trade tensions and regulatory changes, can impact the company's operations and strategic decisions.

Global supply chain disruptions, which can affect the availability of raw materials and components, impacting production schedules and costs.

To understand the Tower Semiconductor better, read about its target market.

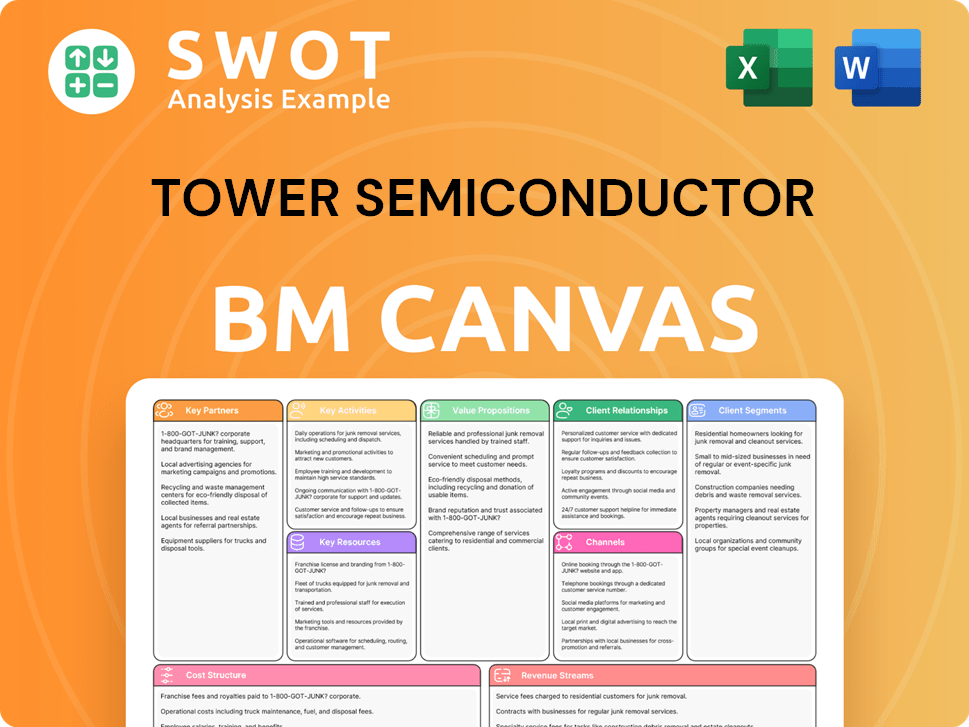

Tower Semiconductor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tower Semiconductor?

The brief history of Tower Semiconductor showcases a journey of strategic growth and technological innovation. Founded in 1993 as a spin-off from National Semiconductor, the Israeli tech company quickly established itself in the semiconductor manufacturing sector. Its evolution includes significant acquisitions, expansions, and a consistent focus on high-growth markets. The company's timeline reflects its adaptation to global supply chain dynamics and its commitment to innovation.

| Year | Key Event |

|---|---|

| 1993 | Founded as a spin-off from National Semiconductor in Migdal Haemek, Israel. |

| 1994 | Initial public offering on the NASDAQ stock exchange. |

| 1990s-2000s | Expansion of process technology offerings, including mixed-signal and RF capabilities. |

| 2001 | Acquisition of Jazz Semiconductor, expanding its presence in the US and strengthening its analog and mixed-signal expertise. |

| 2008 | Entered into a strategic alliance with Panasonic Corporation, leading to the acquisition of Panasonic's semiconductor manufacturing facilities in Japan. |

| 2011 | Expanded its automotive qualified manufacturing capacity. |

| 2014 | Began offering advanced RF SOI process technologies for 5G applications. |

| 2016 | Reached a significant milestone in power management technology development. |

| 2020 | Continued focus on high-growth markets such as automotive, industrial, and medical. |

| 2022 | Announced significant investments in capacity expansion and technology development to meet growing demand. |

| 2023 | Continued to strengthen its position in specialty foundry services, adapting to global supply chain dynamics. |

| 2024 | Focus on advanced packaging solutions and further expansion into high-growth segments like AI and IoT. |

| 2025 | Expected to continue leveraging its specialty foundry model, with ongoing investments in R&D and strategic partnerships. |

Tower Semiconductor is poised for continued growth, targeting high-growth segments such as automotive, industrial, and consumer electronics. The company plans to increase its market share by leveraging its expertise in specialized process technologies. Recent industry trends indicate a sustained demand for specialty foundry services, particularly in analog, mixed-signal, and power management integrated circuits.

Strategic investments in advanced packaging solutions and 300mm wafer technology are expected to enhance Tower Semiconductor's competitive edge. Ongoing R&D efforts and strategic partnerships will be crucial for maintaining its position as a leader in the semiconductor industry. The company's focus on innovation and customer-centric solutions aligns with its founding vision.

Tower Semiconductor is expected to continue its global expansion, potentially through strategic acquisitions or partnerships. This strategy aims to diversify its manufacturing footprint and enhance supply chain resilience. Analyst predictions support a positive outlook for the company's specialty foundry services, particularly in the analog, mixed-signal, and power management sectors.

The company's financial performance is expected to reflect its strategic initiatives. Recent financial reports show a strong focus on investments in R&D and capacity expansion. The continued demand for its specialty foundry services is anticipated to drive revenue growth. Tower Semiconductor's commitment to innovation and customer satisfaction positions it for sustained success in the coming years.

Tower Semiconductor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tower Semiconductor Company?

- What is Growth Strategy and Future Prospects of Tower Semiconductor Company?

- How Does Tower Semiconductor Company Work?

- What is Sales and Marketing Strategy of Tower Semiconductor Company?

- What is Brief History of Tower Semiconductor Company?

- Who Owns Tower Semiconductor Company?

- What is Customer Demographics and Target Market of Tower Semiconductor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.