Univar Solutions Bundle

How did Univar Solutions evolve from a Seattle startup to a global chemical giant?

Embark on a journey through time to uncover the fascinating Univar Solutions SWOT Analysis and the remarkable transformation of Univar Solutions, a leading force in chemical distribution. From its inception in 1924 as Van Waters & Rogers, this company's story is one of strategic expansion and unwavering adaptability. Discover the key milestones and pivotal moments that shaped Univar's trajectory in the competitive landscape of industrial chemicals.

This brief history of Univar Solutions explores its founding, early ventures, and the pivotal decisions that fueled its growth. The company's evolution reflects broader trends in the chemical industry, including significant Univar acquisitions and strategic partnerships. Understanding the Univar company profile provides valuable insights for investors, analysts, and anyone interested in the dynamics of the chemical distribution sector and its financial performance.

What is the Univar Solutions Founding Story?

The Univar Solutions story began on August 8, 1924, marking the start of a journey that would transform the chemical distribution landscape. Founded by George Van Waters and Nat S. Rogers in Seattle, Washington, the company initially focused on buying and selling naval supplies, paint, raw materials, and cotton linters.

This early venture into the chemical distribution sector set the stage for Univar history. The founders quickly recognized the potential in the market, expanding their offerings to include laundry supplies, which proved to be a crucial step toward their future in chemicals.

The original business model revolved around acting as a broker and distributor of essential raw materials. By the end of the 1920s, Van Waters & Rogers had moved into a 5,000-square-foot facility in Seattle, which they soon expanded to include an entire plant next door. The company's name, Van Waters & Rogers, directly reflected its founders.

Univar Solutions, a key player in chemical distribution, was established in 1924.

- George Van Waters and Nat S. Rogers founded the company.

- The initial focus was on naval supplies and raw materials.

- The company quickly expanded into laundry supplies.

- By 1936, sales had exceeded $1 million.

Initial funding sources are not explicitly detailed, but the organic growth from a small firm to a larger facility suggests a bootstrapped approach or early private investment. By 1936, Van Waters & Rogers' sales had topped $1 million, nearing $2 million by the close of the decade, indicating rapid early success and market acceptance. To understand the company's target market, you can read more here: Target Market of Univar Solutions.

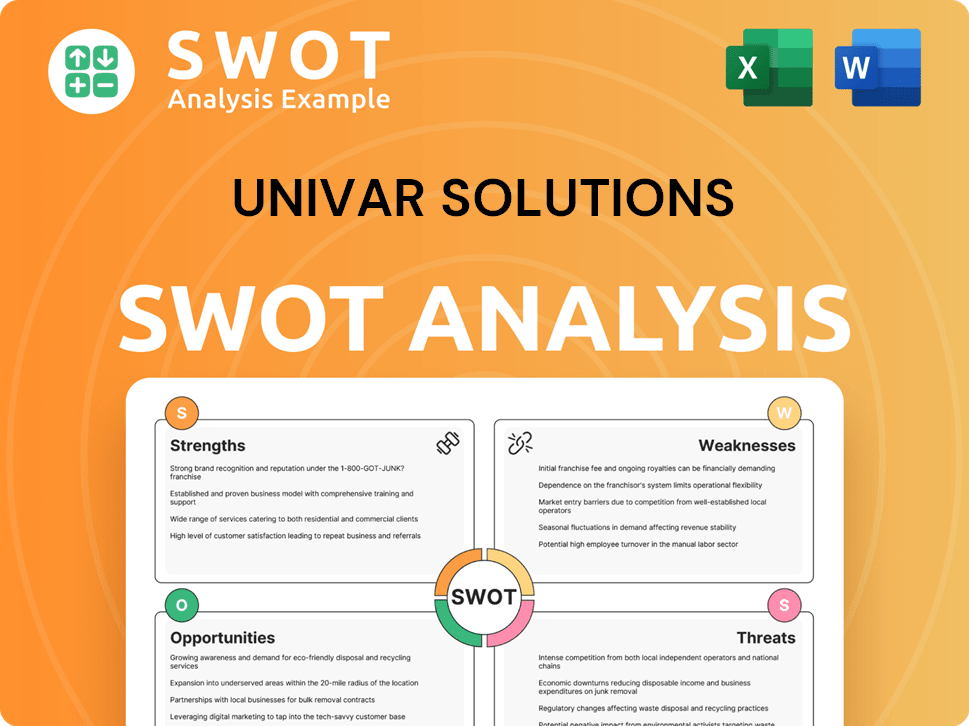

Univar Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Univar Solutions?

The early growth of the company, formerly known as Van Waters & Rogers, was marked by significant expansion in the chemical distribution sector. This expansion included strategic acquisitions and a focus on increasing its geographical footprint. The company's growth trajectory during this period laid the foundation for its future as a major player in the industry. This is a brief history of Univar Solutions.

During the 1940s, Van Waters & Rogers experienced substantial growth, with sales increasing from $2 million in 1940 to over $18 million by 1949. This period saw the company expanding into new markets, including San Francisco and Texas, through strategic acquisitions. The acquisition of Industrial Materials Ltd. of Vancouver, British Columbia, and Braun-Knecht-Heimann of San Francisco in 1950 further broadened its reach.

A major milestone for the company was its initial public stock offering in 1956. By the end of the 1950s, Van Waters & Rogers had established locations across all 11 western states, Texas, and Western Canada. Sales surged from $18 million to over $80 million by 1959, reflecting its rapid expansion. The company's growth strategy included both organic expansion and strategic acquisitions to enhance its market presence.

In 1966, the company merged with United Pacific Corporation, and the rebranding as VWR United marked a significant shift. Its listing on the New York Stock Exchange on March 6, 1969, further solidified its presence in the financial markets. The name changed to 'Univar' in 1974, reflecting its goal to become a national distributor. For a deeper dive into the company's financial aspects, consider reading about Revenue Streams & Business Model of Univar Solutions.

A pivotal acquisition in 1986 was McKesson Chemical, which made Univar the largest chemical distributor in North America at the time, with revenues exceeding $1 billion. In 2002, Univar spun off from Royal Vopak, establishing itself as an independent global leader in chemical distribution. These strategic moves highlight the company's evolution and its focus on expanding its footprint in the chemical distribution market through Univar acquisitions.

Univar Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Univar Solutions history?

The history of Univar Solutions is marked by significant milestones, strategic acquisitions, and a commitment to adapting to market changes. From its beginnings, Univar Solutions has grown to become a leading player in the chemical distribution industry, expanding its global footprint and service offerings. The Univar Solutions timeline reflects its evolution and strategic decisions that have shaped its current position.

| Year | Milestone |

|---|---|

| 1986 | Acquired McKesson Chemical, solidifying its U.S. presence and becoming the largest chemical distributor in North America. |

| Early 1990s | Introduced ChemCare, a waste management service, in response to new government regulations and environmental concerns. |

| Early 2000s | Expanded into Europe with the acquisition of four chemical distribution companies, forming Univar Europe, and later acquiring Ellis & Everard. |

| March 2019 | Acquired Nexeo Solutions, significantly expanding its presence in North America and leading to the rebranding as Univar Solutions. |

| 2022-2023 | Won multiple gold and silver awards at the U.S. Customer Experience Awards, highlighting its commitment to customer experience. |

| 2024 | Named to the FORTUNE World's Most Admired Company list for the second consecutive year, and recognized on Newsweek's list of America's Most Responsible Companies for the third consecutive year. |

Univar Solutions has consistently pursued innovation, particularly in response to changing market demands and regulations. The introduction of ChemCare in the 1990s, for instance, demonstrated a proactive approach to environmental concerns and regulatory changes.

The introduction of ChemCare was a strategic move to address environmental regulations and provide waste management services, showcasing Univar Solutions's ability to adapt to market needs. This innovation allowed the company to offer comprehensive solutions to its customers, improving its service portfolio.

Univar Solutions has consistently focused on enhancing customer experience, as evidenced by the multiple awards received at the U.S. Customer Experience Awards in 2022 and 2023. This focus has helped to build customer loyalty and improve its market position within the chemical distribution sector.

Despite its successes, Univar Solutions has faced challenges, including market downturns and competitive pressures. From 2011 to 2016, the company experienced declining profitability due to its exposure to the volatile oil & gas industry.

The company's exposure to the oil & gas industry led to profitability declines from 2011 to 2016, highlighting the risks associated with reliance on specific sectors. Strategic diversification has since helped mitigate these risks.

The chemical distribution industry is highly competitive, requiring Univar Solutions to continuously innovate and improve its offerings. This competition drives the company to seek strategic acquisitions and partnerships.

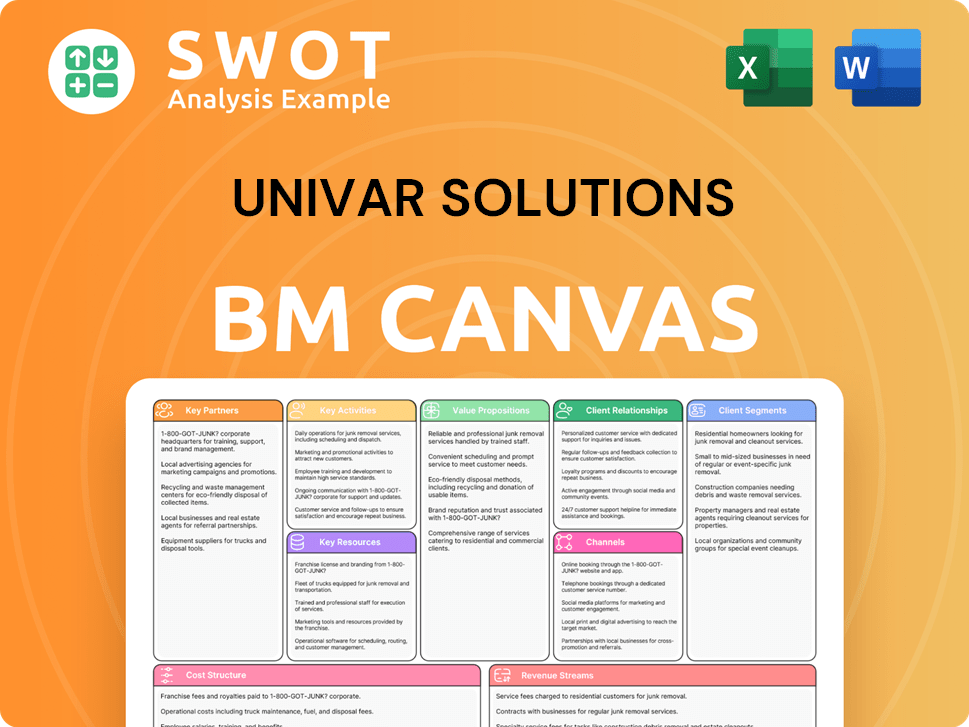

Univar Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Univar Solutions?

The Univar Solutions story began in 1924 and has evolved significantly through strategic moves and acquisitions. The

Univar history

is marked by key milestones, including its founding, expansion through mergers, and adaptation to market changes. These developments have shaped theUnivar company

into a major player in thechemical distribution

sector, serving various industries with a wide range ofindustrial chemicals

.| Year | Key Event |

|---|---|

| 1924 | George Van Waters and Nat S. Rogers founded Van Waters & Rogers in Seattle, Washington. |

| 1936 | Company sales reached over $1 million. |

| 1956 | Van Waters & Rogers made its first public stock offering. |

| 1966 | Merged with United Pacific Corporation, becoming VWR United. |

| 1969 | Listed on the New York Stock Exchange. |

| 1974 | Adopted the name 'Univar'. |

| 1986 | Acquired McKesson Chemical Corporation, becoming the largest chemical distributor in North America. |

| 1996 | Acquired by Royal Pakhoed, which later merged to become Royal Vopak. |

| 2002 | Univar spun off from Royal Vopak, becoming an independent company. |

| 2007 | Acquired ChemCentral, improving market share in North America. |

| 2015 | Completed an oversubscribed IPO and began trading on NYSE. |

| 2019 | Completed acquisition of Nexeo Solutions and rebranded as Univar Solutions on March 1. |

| 2023 | Agreed to be taken private by Apollo Global Management for $8.1 billion, with the acquisition completed in August 2023. |

| 2024 | Named to the FORTUNE World's Most Admired Company list and Newsweek's America's Most Responsible Companies list. |

| 2025 | Acquired UK-based Brad-Chem Holdings in February. |

Univar Solutions is committed to sustainable practices, aiming for net-zero carbon emissions by 2050. This commitment is crucial in the

chemical distribution

industry. The company's emphasis on environmental responsibility is reflected in its strategic initiatives and operational adjustments.The company is focused on expanding its presence in emerging markets, particularly in Latin America, where significant growth potential exists. This expansion strategy is part of Univar Solutions' broader plan to strengthen its global footprint and diversify its revenue streams. This will help the company to stay ahead of its

competitors

.Univar Solutions is focusing on the specialties markets, including Personal Care, Food, CASE, and Pharma. This strategic focus allows the company to capitalize on specific industry trends and customer needs. The company aims to provide innovative services and enhance safety processes.

The company continues to pursue bolt-on

Univar acquisitions

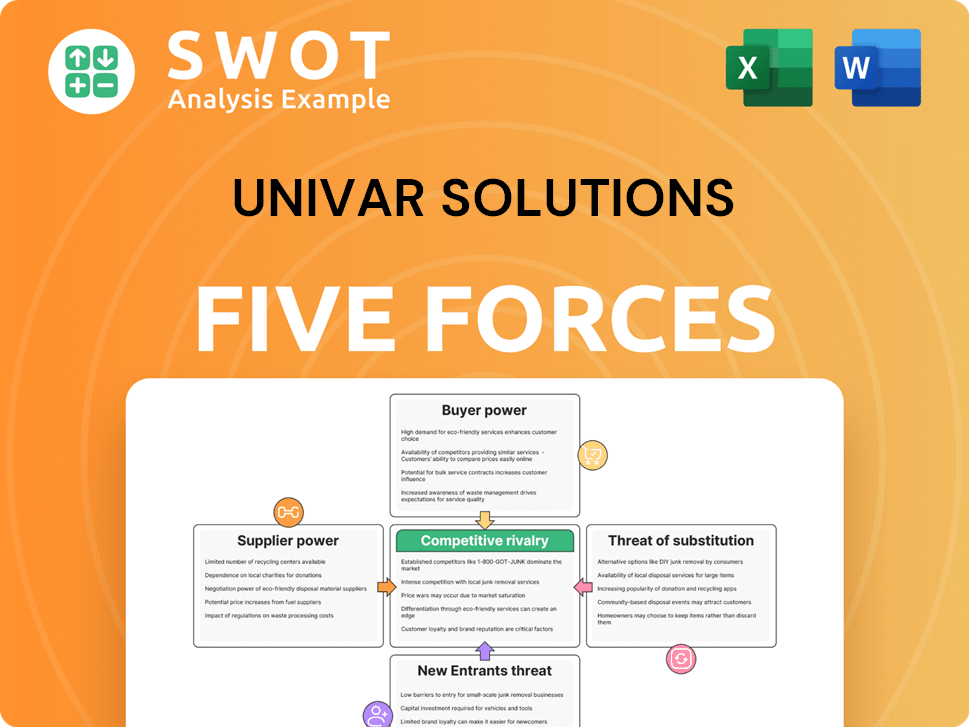

to drive commercial and cost synergies. This approach supports the company's growth strategy by integrating new capabilities and expanding its market reach. The recent acquisition of Brad-Chem Holdings in February 2025 is a prime example.Univar Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Univar Solutions Company?

- What is Growth Strategy and Future Prospects of Univar Solutions Company?

- How Does Univar Solutions Company Work?

- What is Sales and Marketing Strategy of Univar Solutions Company?

- What is Brief History of Univar Solutions Company?

- Who Owns Univar Solutions Company?

- What is Customer Demographics and Target Market of Univar Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.