Univar Solutions Bundle

Who Really Controls Univar Solutions?

The ownership structure of a company fundamentally dictates its strategic trajectory and market influence, and this is especially true for a major player like Univar Solutions. Understanding "Who owns Univar" is crucial for anyone seeking to understand its future direction. A pivotal shift occurred in 2023 when Apollo Global Management acquired the company, transforming its governance model.

Univar Solutions, originally established in 1924, has evolved significantly, making its ownership a critical element in understanding its competitive strategy. This analysis will explore the evolution of Univar ownership, from its initial structure to its current status as a privately held entity. To gain a deeper understanding of the company's strategic landscape, consider exploring a detailed Univar Solutions SWOT Analysis.

Who Founded Univar Solutions?

The specifics of the founding ownership structure of Univar Solutions, including the exact equity split among its original founders in 1924, are not available in public records. The company's beginnings trace back to its establishment in 1924. Early chemical distribution companies often began with individual entrepreneurs or small partnerships.

Without specific historical documents detailing the initial equity distribution, it's difficult to provide exact percentages or share numbers for the founders. Similarly, detailed information about early backers, angel investors, or friends and family who acquired stakes during its initial phase isn't widely publicized. Early agreements like vesting schedules or founder exits from the company's early period are also not publicly documented.

Any initial ownership disputes or buyouts from the early 20th century are not prominent in the company's publicly accessible history. The founding team’s vision for a robust chemical distribution network was likely reflected in a concentrated ownership structure typical of privately held companies in that era, where control was closely held by those who initiated the business.

The precise details of the initial ownership of Univar Solutions in 1924 are not available in public records. Early chemical distribution companies often started with individual entrepreneurs or small partnerships. Historical documents with exact equity splits are not accessible.

Information about early investors, angel investors, or friends and family who acquired stakes is not widely publicized. Early agreements, such as vesting schedules or founder exits, are also not publicly documented. The company's history lacks details about initial ownership disputes or buyouts.

The founding team's vision likely led to a concentrated ownership structure. This was typical of privately held companies at the time. Control was primarily held by those who started the business.

Over time, the ownership of Univar Solutions has evolved significantly. The company has undergone various changes, including acquisitions and mergers. These changes have impacted its ownership structure.

The transition from a privately held company to a publicly traded entity has also influenced ownership. The shift has introduced a broader range of shareholders. This has changed the dynamics of the company.

Understanding the historical context is crucial to analyzing Univar Solutions' ownership. The company's early years were shaped by the business environment of the time. This context helps in interpreting the available information.

The initial ownership details of Univar Solutions remain largely unknown due to limited public documentation. The company's evolution from a private to a public entity has broadened its shareholder base. For more insights into the company's market position, consider exploring the Target Market of Univar Solutions.

- The exact ownership structure from 1924 is not available.

- Early ownership was likely concentrated among founders.

- The company's ownership has changed significantly over time.

- Univar Solutions is a publicly traded company.

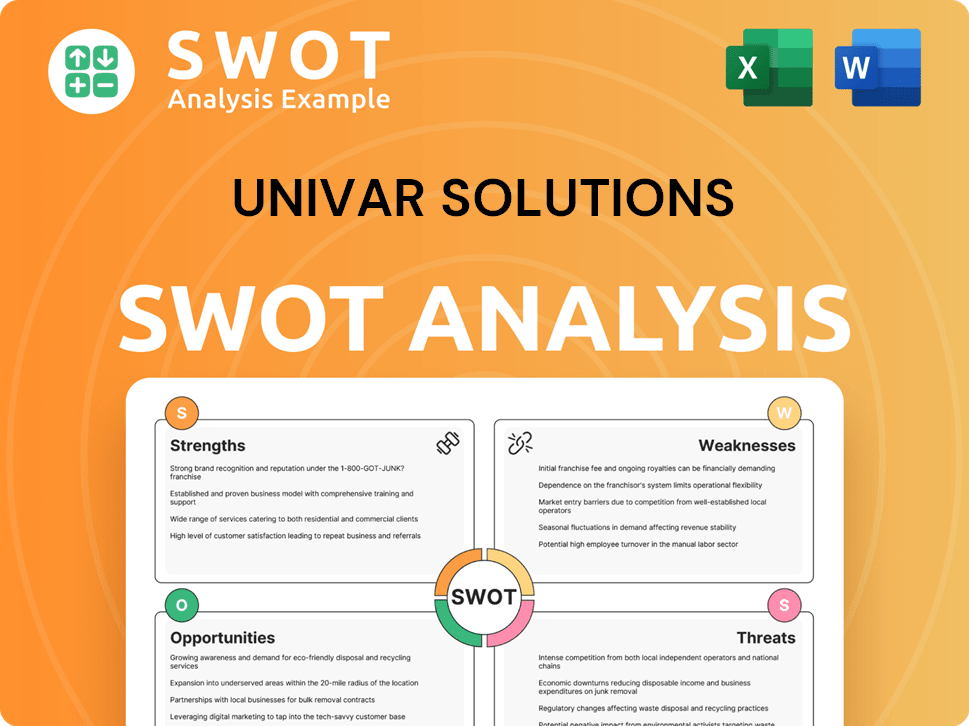

Univar Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Univar Solutions’s Ownership Changed Over Time?

The ownership structure of Univar Solutions has seen a significant transformation, particularly its shift from a publicly traded entity to a privately held one. Initially, as Univar Inc., the company went public on June 24, 2015, through an initial public offering (IPO). The IPO offered 20 million shares at $22.00 each, opening the door for a wider range of investors to participate. Following this, major shareholders included institutional investors, mutual funds, and index funds, reflecting typical public company ownership patterns. For example, before the acquisition, as of March 31, 2023, major institutional holders included Vanguard Group Inc., BlackRock Inc., and State Street Corp.

A pivotal change occurred on March 14, 2023, when Apollo Global Management, Inc. (NYSE: APO) announced an agreement to acquire Univar Solutions Inc. (NYSE: UNVR). The acquisition, valued at approximately $8.1 billion, involved an all-cash transaction of $36.15 per share. This deal, finalized in the latter half of 2023, effectively took Univar Solutions private. Consequently, Apollo Global Management now holds the primary ownership stake. This transition has altered the company's governance and strategic direction, moving from public reporting to a more concentrated ownership structure with a focus on long-term value creation.

| Event | Date | Impact |

|---|---|---|

| IPO | June 24, 2015 | Univar Solutions became a publicly traded company, broadening its shareholder base. |

| Acquisition Announcement | March 14, 2023 | Apollo Global Management agreed to acquire Univar Solutions, leading to its privatization. |

| Acquisition Completion | 2023 (Second Half) | Univar Solutions transitioned to a privately held company under the ownership of Apollo Global Management. |

The current major stakeholder of Univar Solutions is primarily Apollo Global Management and its associated funds. This shift in ownership is expected to influence the company's strategy, potentially focusing on operational efficiencies, strategic acquisitions, and divestitures to enhance value. For more insights, you can refer to the Brief History of Univar Solutions.

Univar Solutions' ownership has evolved significantly, transitioning from public to private ownership.

- Apollo Global Management now holds the primary ownership stake.

- The IPO in 2015 marked a key moment, opening up the company to public investors.

- The acquisition in 2023 reshaped the company's strategic direction.

- This change is set to influence Univar Solutions' future strategies.

Univar Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Univar Solutions’s Board?

With the shift to private ownership under Apollo Global Management, the composition of the board of directors for Univar Solutions has changed significantly. While specific details about current board members and their affiliations are not always publicly available immediately, it's typical for private equity-owned companies to have a board largely composed of representatives from the acquiring firm, along with some independent directors and key company executives. This structure ensures alignment with Apollo's investment objectives and strategic vision for Univar Solutions.

The board likely includes individuals representing Apollo Global Management, ensuring their influence over major corporate decisions. The transition to private ownership streamlines decision-making, allowing for potentially quicker strategic shifts without the pressures of public shareholder scrutiny. This shift in Univar Solutions' marketing strategy is a direct result of the new ownership structure.

| Board Member Category | Typical Representation | Impact on Decision-Making |

|---|---|---|

| Apollo Global Management Representatives | Significant portion | Controls major decisions |

| Independent Directors | Some | Provides oversight and diverse perspectives |

| Key Company Executives | Limited | Offers operational insights |

Under private ownership, the voting structure consolidates, with voting power primarily held by Apollo Global Management. This gives Apollo outsized control over decisions like executive appointments and strategic direction. Governance issues are typically managed internally between the private equity firm and company management, without public proxy battles or activist investor campaigns.

The board of directors is now largely influenced by Apollo Global Management.

- Decision-making is streamlined under private ownership.

- Voting power is concentrated with Apollo.

- Governance is managed internally.

- This structure allows for potentially faster strategic changes.

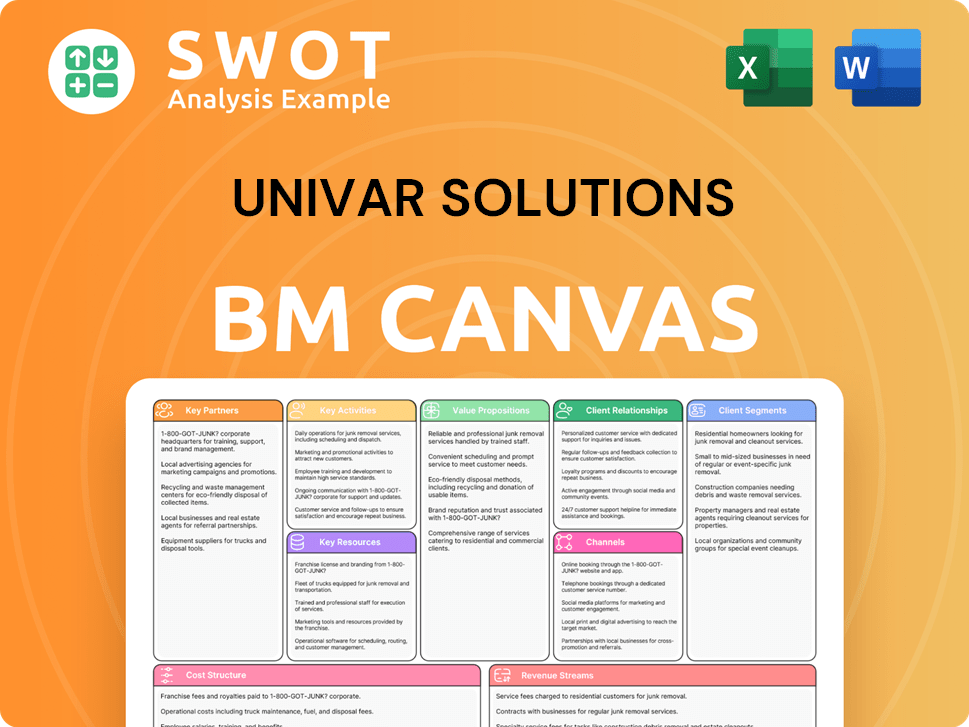

Univar Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Univar Solutions’s Ownership Landscape?

The most significant development in the Univar Solutions ownership profile over the past few years has been its acquisition by Apollo Global Management. This transaction, announced in March 2023 and completed later in the year, shifted the company from a publicly traded entity to a privately held one. Before this, Univar Solutions, like other publicly listed companies, had institutional ownership, including large asset managers and index funds. In early 2023, institutional investors held a significant portion of Univar Solutions shares.

The acquisition by Apollo Global Management reflects a broader trend of private equity firms taking public companies private. This often involves unlocking value through operational improvements and strategic restructuring, without the pressures of public market scrutiny. For Univar Solutions, this means a shift from public reporting and quarterly earnings focus to a potentially longer-term strategic horizon dictated by Apollo's investment objectives. Private equity firms typically have an exit strategy, which could involve a re-listing, a sale to another buyer, or a dividend recapitalization, usually within a 3-7 year timeframe. This consolidation trend, driven by private equity, impacts companies by allowing for more agile decision-making and significant capital injections for strategic initiatives. You can find more information about the company in this article Revenue Streams & Business Model of Univar Solutions.

Univar Solutions is currently owned by Apollo Global Management after the acquisition completed in the latter half of 2023. This marks a significant change from its previous status as a publicly traded company.

The primary trend in Univar ownership involves the shift from public to private ownership. Before the acquisition, institutional investors held a substantial percentage of the company's shares. Now, Apollo Global Management controls the company's strategic direction.

Since Univar Solutions is now privately held, its stock is no longer traded on public exchanges. Prior to the acquisition, the company's stock performance was subject to market dynamics and public investor sentiment.

Under Apollo's ownership, Univar company may undergo strategic restructuring or operational improvements. The private equity firm typically aims to increase the company's value over a 3-7 year timeframe before an exit strategy.

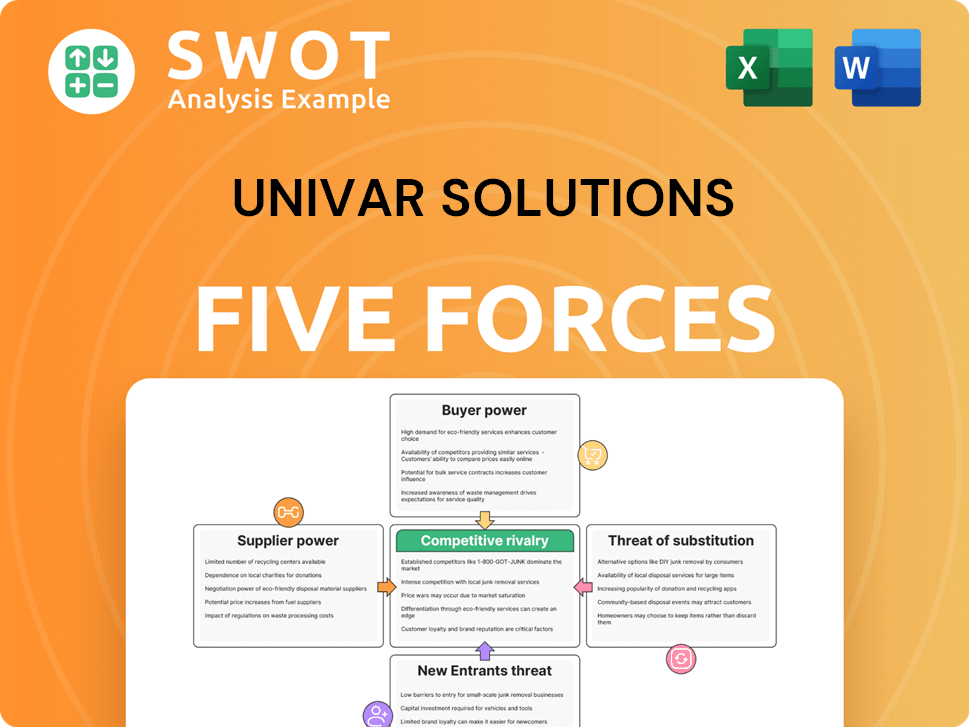

Univar Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Univar Solutions Company?

- What is Competitive Landscape of Univar Solutions Company?

- What is Growth Strategy and Future Prospects of Univar Solutions Company?

- How Does Univar Solutions Company Work?

- What is Sales and Marketing Strategy of Univar Solutions Company?

- What is Brief History of Univar Solutions Company?

- What is Customer Demographics and Target Market of Univar Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.