Vonovia Bundle

How did Vonovia rise to become a European real estate giant?

Vonovia's story is a compelling narrative of growth and transformation within the dynamic world of German real estate. From its inception, the Vonovia SWOT Analysis reveals strategic decisions that propelled its evolution. This article delves into the pivotal moments that have shaped Vonovia's trajectory.

Tracing the Vonovia history, we uncover the roots of a company that has significantly impacted the German real estate landscape. Understanding Vonovia's journey, including its early years and major acquisitions like Deutsche Annington, provides crucial insights into its current dominance in residential real estate and its ongoing expansion strategy. This exploration of the Vonovia company offers a comprehensive perspective on its business model and its influence on the European housing market.

What is the Vonovia Founding Story?

The story of Vonovia SE begins with the founding of Deutsche Annington Immobilien SE in 2001. This marked the start of a journey that would transform the German residential real estate landscape. The company, later rebranded as Vonovia SE, emerged from the consolidation of various housing portfolios, primarily acquired from former state-owned housing companies in Germany.

The initial focus of Deutsche Annington, and subsequently Vonovia, was to professionally manage these properties. This approach aimed to provide efficient, tenant-focused housing solutions in a market that was previously fragmented. The company's early vision was to modernize and improve the living conditions of residents while creating value through efficient property management.

The creation and early growth of Vonovia were significantly influenced by the cultural and economic context of post-reunification Germany, including evolving housing policies and privatization trends. Initial funding for acquisitions came from institutional investors seeking stable returns from the German real estate market. The company's history is a testament to its strategic evolution and impact on the German housing market.

Deutsche Annington's business model centered on acquiring, managing, and modernizing residential units. This involved improving living conditions and creating value through professional property management. The company's early years were marked by significant acquisitions and the integration of diverse housing portfolios.

- The primary goal was to consolidate a fragmented market.

- Acquisitions were funded by institutional investors.

- The focus was on standardizing management practices.

- The company aimed to modernize residential units.

The early challenges involved integrating diverse portfolios and establishing standardized management practices across a wide geographical area. The company's expansion strategy included acquiring properties across Germany to build a large residential portfolio. The Owners & Shareholders of Vonovia have played a crucial role in the company's growth.

Key milestones in Vonovia's history include the initial acquisitions and the subsequent rebranding from Deutsche Annington. The company's expansion strategy has involved numerous acquisitions, significantly increasing its portfolio. Financial performance has been a key focus, with the company aiming to deliver consistent returns to its investors.

- 2001: Deutsche Annington founded.

- Early years: Focus on acquiring and managing residential properties.

- Later: Rebranding to Vonovia SE.

- Ongoing: Expansion and modernization of housing units.

The company's impact on German housing is significant, with Vonovia becoming a major player in the residential real estate sector. The company has faced controversies, including those related to rent increases and tenant relations. As of early 2024, the company continues to focus on its core business of managing and modernizing residential properties, with a strategic emphasis on sustainability and tenant satisfaction. The company's financial performance in recent years reflects its ongoing efforts to balance growth with social responsibility.

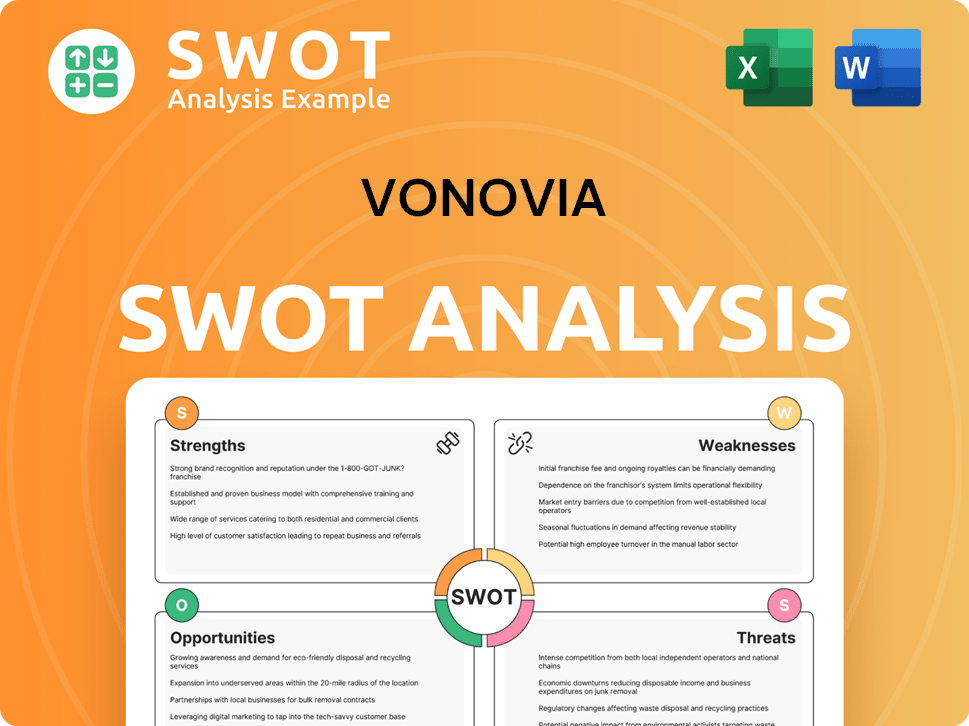

Vonovia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Vonovia?

The early growth and expansion of the Vonovia company, formerly known as Deutsche Annington, were marked by strategic acquisitions and a focus on building a substantial residential real estate portfolio. This journey included integrating various housing portfolios acquired in the early 2000s, establishing a strong presence across different German regions. Key moves involved professionalizing property management and enhancing tenant services. For more insights into their approach, consider exploring the Marketing Strategy of Vonovia.

A pivotal moment in Vonovia's expansion was the acquisition of Gagfah S.A. in 2015. This significantly increased its residential units and market share, solidifying its position as Germany's largest residential landlord. The acquisition led to a substantial increase in its portfolio to approximately 370,000 residential units.

In 2016, Deutsche Annington officially rebranded to Vonovia SE, reflecting its broader European aspirations. The company expanded internationally, notably into Austria and Sweden. Further acquisitions, such as BUWOG in 2018 and Hembla in 2019, added tens of thousands of units to its portfolio, diversifying its market presence.

These expansions were supported by major capital raises and a focus on operational efficiencies, enabling Vonovia to manage a vast and diverse portfolio. The company's growth efforts were shaped by a strategic shift towards comprehensive property management, including maintenance, modernization, and new construction, to enhance tenant satisfaction and property value.

As of the end of 2023, Vonovia's portfolio comprised approximately 545,000 residential units across Germany, Sweden, and Austria. The portfolio's value was around €83.6 billion, demonstrating significant growth and market dominance in the German real estate sector.

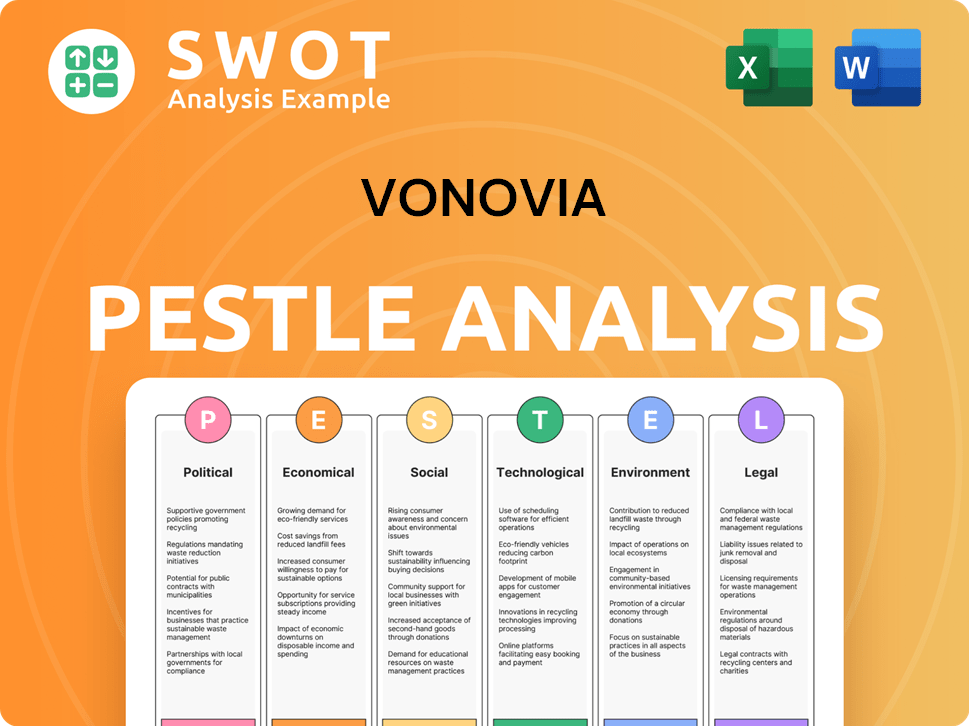

Vonovia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Vonovia history?

The Vonovia history includes several key milestones that have shaped its trajectory in the German real estate market. A significant event was the company's IPO in 2013, which provided substantial capital for expansion. This initial public offering marked a pivotal moment for Vonovia company, fueling its growth and enabling further strategic acquisitions and investments.

| Year | Milestone |

|---|---|

| 2013 | Successful IPO, providing capital for expansion and growth. |

| 2015 | Acquisition of Deutsche Annington, significantly increasing its portfolio. |

| 2019 | Integration of Gagfah, further expanding its residential holdings. |

| 2020 | Significant investments in modernization and sustainability initiatives. |

| 2023 | Continued focus on sustainable property management and digital tenant services. |

Vonovia has embraced several innovations to enhance its operations and tenant services. A primary focus has been on sustainable property management, including extensive modernization programs to improve energy efficiency. The company has also integrated smart home technologies and digital tenant services to improve living quality and operational efficiency, reflecting its commitment to technological advancements.

Vonovia has invested heavily in modernizing its properties to improve energy efficiency. In 2023, the company allocated approximately €2.5 billion to property investments, with a significant portion dedicated to climate-friendly modernization and maintenance.

The implementation of smart home technologies enhances living standards and operational efficiency. These technologies provide tenants with improved control over their living environments and streamline property management processes.

Vonovia offers digital platforms for tenant services, making it easier for tenants to manage their housing needs. These services include online rent payments, maintenance requests, and communication channels.

Energy efficiency programs are a key part of Vonovia's sustainability efforts, reducing environmental impact. These programs include insulation upgrades, efficient heating systems, and renewable energy installations.

Vonovia has encountered several challenges, including scrutiny over rising rents and housing affordability. The company has also faced market downturns and increased interest rates, impacting its financial performance. These factors have necessitated strategic adaptations and restructuring efforts.

Public and political concerns over rising rents have led to increased scrutiny. Vonovia has been working to address these concerns through various initiatives and dialogue with stakeholders.

Market downturns and rising interest rates have impacted Vonovia's financial performance. In 2023, the company reported a significant net loss, primarily due to property revaluations, reflecting the challenging economic environment.

Vonovia has undertaken restructuring efforts to optimize its portfolio and focus on core operations. These efforts include divesting non-strategic assets and prioritizing sustainable development.

Competition from other large real estate companies and smaller developers poses a challenge. Vonovia adapts its strategies to maintain its market position and drive long-term value creation.

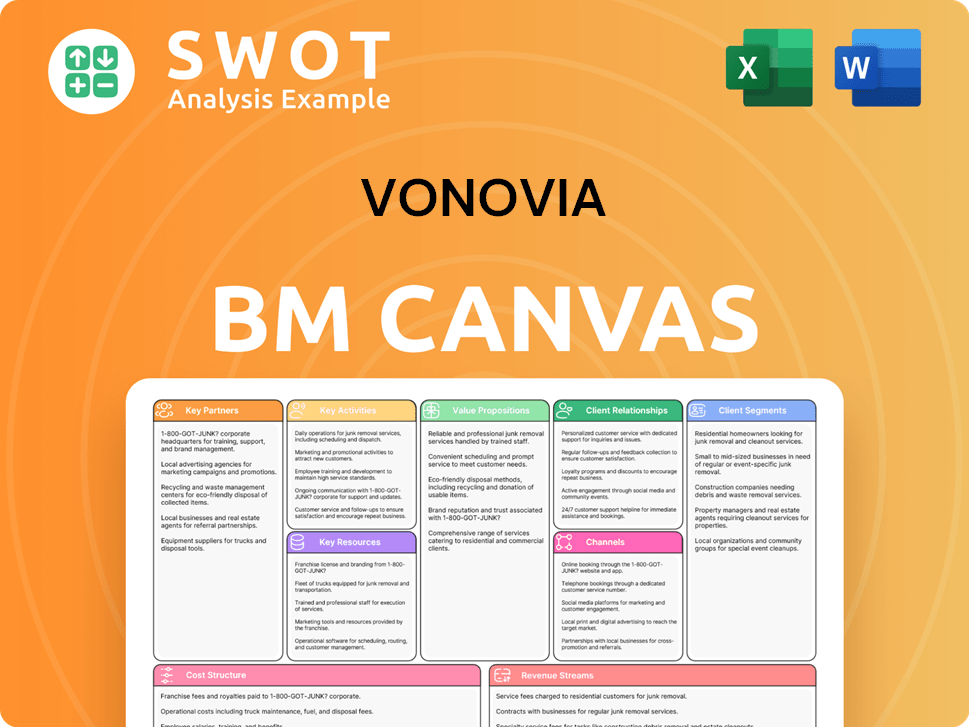

Vonovia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Vonovia?

The journey of the Vonovia company, a prominent player in the European residential real estate market, is marked by significant milestones. Initially established as Deutsche Annington Immobilien SE, the company has evolved through strategic acquisitions and a rebranding process, solidifying its position in the German real estate landscape and expanding its footprint across Europe. These key events showcase the company's growth and adaptation to changing market dynamics.

| Year | Key Event |

|---|---|

| 2001 | Founding of Deutsche Annington Immobilien SE, marking the beginning of the company's journey in the residential real estate sector. |

| 2013 | Initial Public Offering (IPO) of Deutsche Annington, a crucial step in its financial development. |

| 2015 | Acquisition of Gagfah S.A., significantly growing the company's portfolio. |

| 2016 | Deutsche Annington rebrands to Vonovia SE, reflecting a new identity and strategic direction. |

| 2018 | Acquisition of BUWOG, extending its presence into Austria. |

| 2019 | Acquisition of Hembla, entering the Swedish market. |

| 2021 | Acquisition of Deutsche Wohnen, further cementing its market leadership in Germany. |

| 2023 | Investments of approximately €2.5 billion in climate-friendly modernizations and new construction, demonstrating a commitment to sustainability. |

| 2024 | Continued focus on portfolio optimization and debt reduction, including plans for further non-strategic asset sales. |

Vonovia's future strategy emphasizes sustainable urban development. This includes investing in energy-efficient renovations and new construction to meet housing demand while addressing climate goals. The company plans to reduce its carbon footprint through various initiatives. These efforts align with the increasing demand for environmentally friendly housing solutions in the German real estate market.

A key element of Vonovia's future involves reducing its debt and strengthening its balance sheet. The company aims for a loan-to-value (LTV) ratio of 40-45%. This financial strategy is essential for maintaining financial flexibility and resilience in the evolving market. The company's focus on financial health is crucial for long-term stability and growth.

Industry trends such as increasing urbanization, the demand for affordable and sustainable housing, and the ongoing digitalization of real estate will significantly influence Vonovia's future. The company is positioned to capitalize on these trends by adapting its business model. This includes investing in technology and innovation to improve efficiency and enhance the tenant experience.

Leadership statements emphasize a commitment to responsible landlordship and creating long-term value for tenants and shareholders. This includes providing high-quality, professionally managed residential properties. Vonovia's forward-looking strategy remains rooted in its founding vision. It is adapting to evolving market conditions and societal needs to ensure sustainable growth.

Vonovia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Vonovia Company?

- What is Growth Strategy and Future Prospects of Vonovia Company?

- How Does Vonovia Company Work?

- What is Sales and Marketing Strategy of Vonovia Company?

- What is Brief History of Vonovia Company?

- Who Owns Vonovia Company?

- What is Customer Demographics and Target Market of Vonovia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.