Advanced Info Service Bundle

Can AIS Conquer Thailand's Telecom Titans?

Thailand's Advanced Info Service SWOT Analysis (AIS) stands as a pivotal player in a fiercely contested telecommunications industry, constantly evolving with 5G and digital transformation. Founded in 1990, AIS has transformed from a mobile service pioneer into Thailand's leading mobile network operator. This evolution highlights the company's strategic adaptation and innovation in a dynamic market.

This exploration delves into AIS's competitive landscape, dissecting its rivals and advantages within the telecommunications industry. We'll analyze AIS's market share, examine its service offerings, and assess its financial performance alongside key competitors like True Corporation and DTAC. Understanding the AIS business strategy and its 5G rollout is crucial for anyone seeking to navigate the complexities of the Thai market and make informed decisions, providing a comprehensive market analysis.

Where Does Advanced Info Service’ Stand in the Current Market?

AIS, a leading player in Thailand's telecommunications industry, holds a strong market position, particularly in the mobile segment. As of Q4 2023, AIS had a substantial mobile subscriber base, which is a key indicator of its market dominance. The company's core operations encompass mobile services, fixed broadband, and a growing suite of digital offerings.

The value proposition of AIS lies in its comprehensive range of services and extensive network infrastructure. This allows the company to cater to a diverse customer base, from individual consumers to large corporations. AIS's strategic diversification into fixed broadband and digital services demonstrates its commitment to meeting evolving customer needs and maintaining its competitive edge.

AIS leads the Thai mobile market with a significant subscriber base. In Q4 2023, AIS reported a mobile subscriber base of 49.2 million. This large subscriber base translates to a market share of approximately 46.2%, making it the largest mobile network operator in Thailand.

AIS has expanded its services to include fixed broadband under the AIS Fibre brand. As of Q4 2023, AIS Fibre had 2.4 million subscribers. This represents a market share of approximately 28.1% in the fixed broadband market, showcasing successful diversification.

AIS demonstrated robust financial health in 2023. The company reported a revenue of 186,076 million THB for the full year 2023. AIS also achieved a net profit of 29,103 million THB, reflecting strong financial performance compared to industry averages.

AIS has a widespread presence across Thailand, ensuring broad network coverage. The company has a strong presence in urban and semi-urban areas due to its extensive network infrastructure. AIS continues to expand its reach into rural regions to serve a diverse customer base.

AIS's strategic focus is on providing integrated connectivity and digital solutions. This strategy supports its strong market position in the telecommunications industry. The company's success is built on its extensive network infrastructure, diverse service offerings, and commitment to digital transformation.

- Mobile Dominance: Leading market share in the mobile segment.

- Diversification: Expansion into fixed broadband and digital services.

- Financial Strength: Robust revenue and profitability.

- Customer Base: Serving a wide range of customers across Thailand.

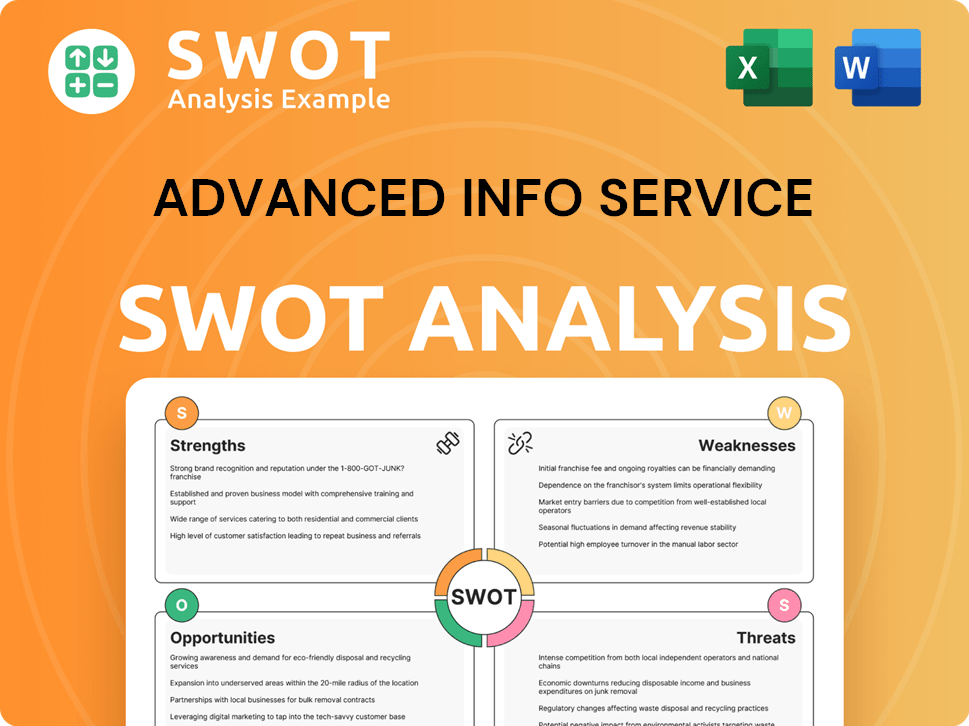

Advanced Info Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Advanced Info Service?

The Thai telecommunications industry is highly competitive, with several players vying for market share. Advanced Info Service (AIS) faces competition from both direct and indirect rivals. Understanding the competitive landscape is crucial for AIS to maintain its market position and drive future growth.

The competitive dynamics are shaped by technological advancements, evolving consumer preferences, and regulatory changes. AIS's ability to adapt and innovate is essential to stay ahead. This analysis provides insights into AIS's key competitors and the strategies they employ.

AIS's main competitors include True Corporation and National Telecom (NT). Indirect competitors include over-the-top (OTT) service providers like LINE and Facebook. The merger of True and dtac has intensified competition in the market.

True Corporation is a major direct competitor, particularly after its merger with dtac in March 2023. True offers a wide range of services, including mobile, fixed broadband, and pay-TV. The merger has strengthened True's position, allowing it to challenge AIS's dominance.

Before the merger with True, dtac was a significant competitor in the mobile segment. The merger has reshaped the competitive landscape. The combined entity aims to leverage its larger subscriber base and network infrastructure.

National Telecom (NT) is a state-owned enterprise. NT focuses on providing telecommunications infrastructure and services. NT's strategic importance lies in its infrastructure assets and potential for future growth, especially in the enterprise and government sectors.

OTT service providers such as LINE, Facebook, and various streaming platforms are indirect competitors. These platforms compete for consumer attention and data usage. They impact traditional voice and SMS revenues.

Smaller regional internet service providers (ISPs) offer localized competition in the fixed broadband market. These ISPs often provide services tailored to specific geographic areas, competing with larger players like AIS and True.

The merger of True and dtac has intensified competition, leading to aggressive pricing strategies. Operators are vying for market share. Bundled offerings are common as companies try to attract and retain customers. For more insights, check out the Marketing Strategy of Advanced Info Service.

AIS, True, and other competitors employ various strategies to gain a competitive edge in the telecommunications industry. These strategies include network expansion and improvement, pricing and promotion, service bundling, and customer experience enhancement. The competitive landscape is dynamic, with each player adjusting their strategies to respond to market changes and consumer demands.

- Network Expansion and Improvement: Investment in 5G infrastructure and network upgrades. AIS has been actively expanding its 5G network to increase coverage and capacity.

- Pricing and Promotion: Offering competitive pricing plans and promotions to attract and retain customers. This includes discounts, bundled packages, and loyalty programs.

- Service Bundling: Combining mobile, fixed broadband, and pay-TV services to provide comprehensive offerings. True Corporation is a strong player in this area, bundling multiple services.

- Customer Experience Enhancement: Improving customer service, offering user-friendly interfaces, and providing value-added services. This includes digital services and personalized customer support.

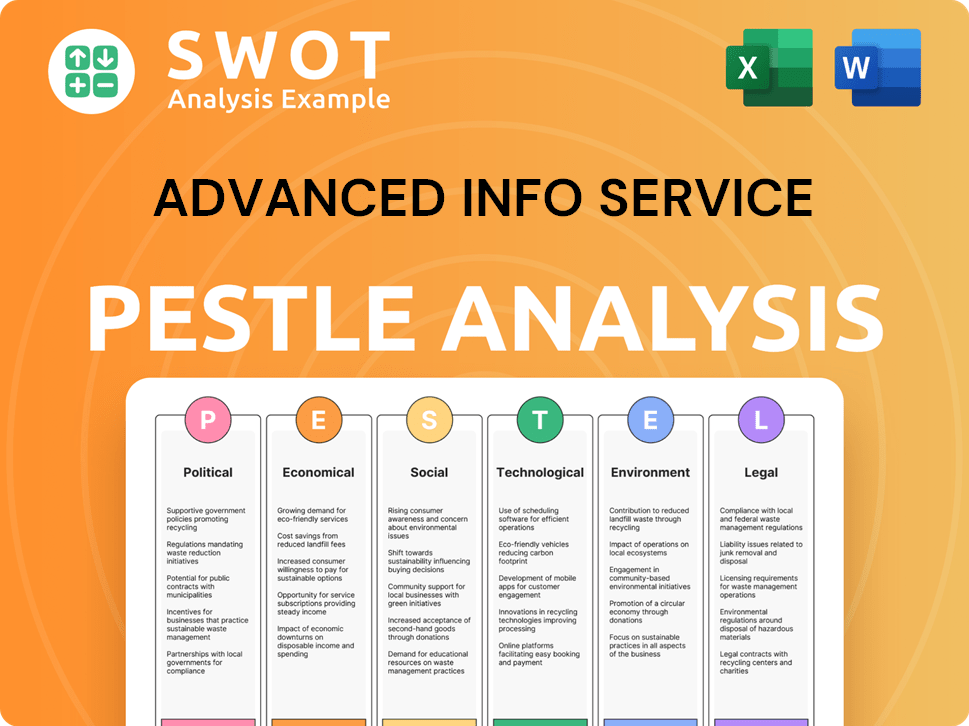

Advanced Info Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Advanced Info Service a Competitive Edge Over Its Rivals?

AIS, a leading player in Thailand's telecommunications industry, distinguishes itself through a multifaceted approach to maintaining a strong competitive edge. Key to its success is its extensive network infrastructure, particularly its 5G coverage. As of Q4 2023, AIS's 5G network reached 87% of the population, a significant advantage in providing superior connectivity and speed. This robust network is a cornerstone of its ability to offer reliable services across a wide geographical area, including underserved regions.

AIS also benefits from strong brand equity and customer loyalty, cultivated through consistent investment in a premium brand image. This has translated into high customer retention rates. Furthermore, AIS leverages its economies of scale in network deployment and operations, which allows for more efficient cost management and competitive pricing strategies. The company's focus on digital transformation and its diverse portfolio of digital services, including cloud solutions, IoT, and enterprise services, provide additional revenue streams and differentiate it from competitors primarily focused on traditional mobile services.

The company's commitment to technological advancement, including AI and data analytics, further enhances its operational efficiencies and customer experience. These advantages have evolved from simply providing mobile connectivity to offering integrated digital ecosystems, allowing AIS to remain at the forefront of a rapidly changing industry. For a deeper understanding of their strategic direction, consider exploring the Growth Strategy of Advanced Info Service.

AIS's extensive network coverage, especially its 5G network, is a primary competitive advantage. The company's 5G network reached 87% of the population by the end of Q4 2023. This widespread coverage ensures reliable service and high-speed connectivity across Thailand, setting it apart from competitors in the telecommunications industry.

AIS has built a strong brand image associated with quality and innovation. This has resulted in high customer retention rates, which are crucial for long-term success. The perception of premium service reinforces customer loyalty, a key factor in the competitive landscape.

AIS's focus on digital transformation and diverse digital services, including cloud solutions and IoT, provides additional revenue streams. This diversification helps AIS differentiate itself from competitors. The company's move into digital services is a strategic advantage in the evolving telecommunications market.

AIS continuously invests in advanced technologies like AI and data analytics. This investment enhances operational efficiencies and improves customer experience. The use of cutting-edge technology provides a sustainable competitive edge in the telecommunications industry.

AIS's competitive advantages are rooted in its extensive network, strong brand, and technological innovation. These factors enable the company to maintain a leading position in the telecommunications market. AIS's strategic focus on these areas has allowed it to adapt to the industry's rapid changes.

- Extensive 5G Network Coverage: Reaching 87% of the population by Q4 2023.

- Strong Brand Equity: Fostering high customer retention rates.

- Digital Transformation: Offering diverse digital services.

- Technological Innovation: Utilizing AI and data analytics for operational efficiency.

Advanced Info Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Advanced Info Service’s Competitive Landscape?

The Thai telecommunications industry is experiencing dynamic shifts, driven by 5G adoption, rising digital service demands, and evolving regulations. As a leading mobile network operator, Advanced Info Service (AIS) navigates this landscape with a focus on maintaining its competitive edge. Understanding the industry's trajectory is crucial for assessing AIS's strategic positioning and future prospects, including its Growth Strategy of Advanced Info Service.

AIS faces both opportunities and challenges. While its investments in 5G infrastructure have been substantial, sustaining this leadership requires continuous innovation and resource allocation. Competitive pressures, particularly from the merged True-dtac entity, and regulatory changes, such as spectrum auctions, are also significant factors shaping its operational environment.

Key trends include the expansion of 5G, increasing digital service adoption, and evolving regulations. 5G is enabling new services, such as enhanced mobile broadband and fixed wireless access, and advanced enterprise solutions. The demand for digital services, including cloud services, cybersecurity, and data analytics, is growing significantly.

AIS faces challenges from intense price competition, particularly from the merged True-dtac entity. Regulatory changes, such as spectrum auctions and data privacy regulations, also pose potential impacts on operations. The rise of global OTT players challenges traditional revenue streams.

Significant opportunities exist in the expansion of fixed broadband services and the growth of enterprise digital solutions. AIS is well-positioned to capitalize on the increasing demand for cloud services, cybersecurity, and data analytics as businesses accelerate their digital transformation. Strategic focus on a comprehensive digital ecosystem is crucial.

AIS is focusing on developing a comprehensive digital ecosystem through partnerships and acquisitions in related tech sectors. This approach is crucial for mitigating challenges and seizing future growth opportunities. The company aims to maintain its leadership in the evolving competitive landscape.

Recent data indicates the Thai telecommunications market continues to evolve, with 5G adoption rates and digital service usage steadily increasing. AIS has been actively expanding its 5G coverage, aiming for broader reach. Competitive pressures from rivals like True Corporation and the merged DTAC entity are intensifying, impacting market share dynamics and pricing strategies.

- 5G Expansion: AIS continues to expand its 5G network, with coverage expected to reach a significant portion of the population.

- Market Share: AIS maintains a leading position in the mobile market, although competition is increasing.

- Digital Services Growth: Demand for digital services, including cloud, cybersecurity, and data analytics, is growing, presenting opportunities for AIS.

- Financial Performance: AIS's financial results reflect the competitive landscape, with a focus on revenue growth and cost optimization.

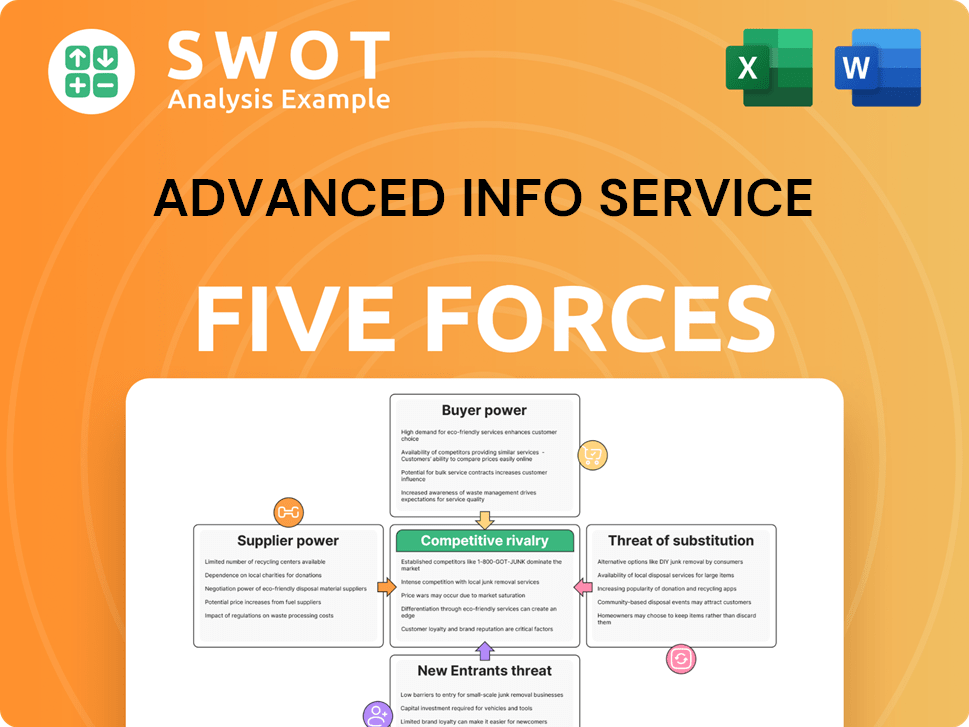

Advanced Info Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Advanced Info Service Company?

- What is Growth Strategy and Future Prospects of Advanced Info Service Company?

- How Does Advanced Info Service Company Work?

- What is Sales and Marketing Strategy of Advanced Info Service Company?

- What is Brief History of Advanced Info Service Company?

- Who Owns Advanced Info Service Company?

- What is Customer Demographics and Target Market of Advanced Info Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.