Allegion Bundle

How Does Allegion Navigate the Security Industry's Competitive Waters?

Allegion, a global leader in access solutions, has consistently demonstrated impressive financial results, including record revenues and earnings in 2024 and continued growth into early 2025. But how does this industry giant maintain its edge in a dynamic market? This exploration delves into the Allegion SWOT Analysis, revealing the company's strategic positioning and competitive dynamics.

To understand Allegion's success, we must examine its competitive landscape, including its main competitors and market share. This in-depth Allegion market analysis will uncover the key strategies driving its growth and innovation within the security industry, specifically focusing on the door hardware market and access control systems. We will also explore how Allegion's financial performance compares to its rivals, providing valuable insights for investors and industry observers alike.

Where Does Allegion’ Stand in the Current Market?

Allegion maintains a robust market position in the global security industry. The company focuses on providing a diverse product portfolio, extensive geographic presence, and adapting to evolving customer needs. Its core offerings include mechanical and electronic locks, door closers, exit devices, and access control systems, serving commercial, residential, and institutional sectors. This comprehensive approach allows Allegion to address a wide range of security needs across various markets, solidifying its competitive stance.

Allegion's value proposition centers on delivering innovative and reliable security solutions. The company emphasizes product quality, technological advancements, and customer service. This strategy has enabled Allegion to build strong relationships with customers and maintain a competitive edge. The company's commitment to innovation is evident in its investments in smart home technology and cybersecurity, ensuring its products remain relevant and secure in a rapidly changing market.

In 2024, Allegion reported full-year net revenues of $3,772.2 million, reflecting a 3.3% increase from 2023. Organic revenue growth was 2.1%. The operating margin for 2024 was 20.7%, with an adjusted operating margin of 22.8%, demonstrating strong operational efficiency. These figures highlight Allegion's ability to maintain profitability and growth in a competitive market.

In the first quarter of 2025, Allegion's net revenues reached $941.9 million, a 5.4% increase year-over-year. Organic revenue growth was 4.0%. The adjusted operating margin for Q1 2025 expanded to 22.7%, a 150-basis-point improvement. Available cash flow in Q1 2025 was $83.4 million, a nearly 250% increase.

Allegion operates in over 130 countries, utilizing a global distribution network to reach a broad customer base. The Americas segment showed strong growth in Q1 2025, with a 6.8% revenue increase (4.9% organically). The International segment's organic revenue increased by 0.9% in Q1 2025 despite foreign currency headwinds. These figures demonstrate Allegion's diversified market presence.

Allegion has strategically expanded its offerings through acquisitions. Recent acquisitions include Krieger, Unicel Architectural, Dorcas, Lemaar, and Trimco Hardware. These moves have strengthened its position in specialty door solutions and architectural hardware. To learn more about the company, check out a Brief History of Allegion.

Allegion's key strengths include a diversified product portfolio, global presence, and strong financial performance. The company's strategies focus on innovation, strategic acquisitions, and customer-centric solutions. These approaches have helped Allegion maintain its competitive advantage in the security industry.

- Strong financial performance with increasing revenues and margins.

- Strategic acquisitions to expand product offerings and market reach.

- Focus on innovation in access control and cybersecurity.

- Global distribution network spanning over 130 countries.

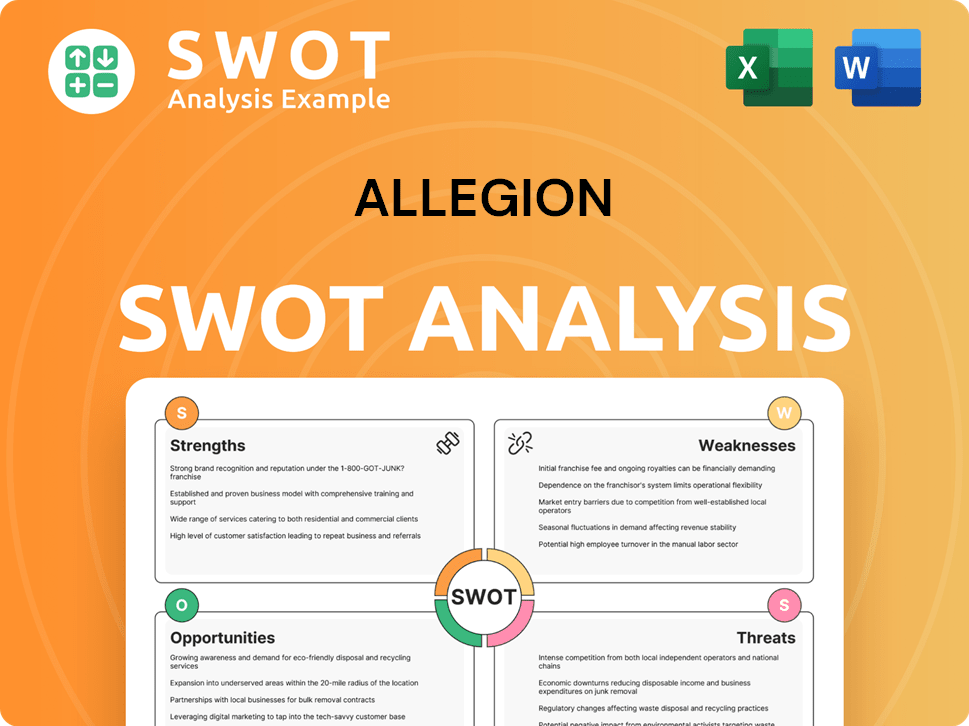

Allegion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Allegion?

The Marketing Strategy of Allegion involves navigating a complex and dynamic competitive landscape. Understanding the key rivals and their strategies is crucial for assessing Allegion's market position and future prospects. This analysis delves into the major players challenging Allegion in the security industry, door hardware market, and access control systems.

Allegion's competitive environment is shaped by both direct and indirect competitors, each vying for market share in the access solutions and security products sectors. These competitors employ various strategies, including product breadth, technological innovation, and strategic acquisitions, to gain an edge. The constant evolution of the smart home and security technologies further intensifies the competition.

The company faces competition from several significant players in the security industry.

Allegion's primary direct competitors include global leaders in access solutions and security products. These companies offer similar products and services, directly challenging Allegion's core offerings. The competitive landscape is dynamic, with companies continuously innovating and expanding their product portfolios.

Assa Abloy is a global leader in access solutions, providing a wide range of products such as locks, doors, and entrance automation. This company is a direct competitor to Allegion, particularly in the access solutions market. Assa Abloy's extensive product portfolio and global presence make it a formidable rival.

Stanley Black & Decker's security division offers comprehensive security solutions, encompassing access control systems, surveillance, and alarm systems. This company competes with Allegion by providing a broad range of security products. Their market presence and brand recognition pose a significant challenge.

Honeywell International offers a diverse portfolio of security and fire safety products, including intrusion detection and access control solutions. Honeywell's broad product range and technological capabilities make it a key competitor in the security market. Their focus on innovation keeps them competitive.

Johnson Controls also competes in the security and building solutions space. Johnson Controls offers a wide array of products and services, including security systems, which directly challenge Allegion's market share. Their integrated solutions approach is a key competitive factor.

Dorma+Kaba specializes in access control and security solutions, ranging from mechanical locks to electronic access systems. This company is a direct competitor, particularly in the access control market. Their focus on innovation and specialized solutions makes them a strong contender.

Other notable competitors also influence the Allegion competitive landscape. These companies offer security solutions and access control products, contributing to the overall competitive dynamics. Allegion's strategic moves, such as acquisitions, are aimed at enhancing its portfolio and maintaining a competitive edge.

The smart security market is a growing area, attracting new entrants and intensifying competition. Companies like Samsung Electronics and Spectrum Brands Holdings are key players in the smart lock market. The smart lock market is projected to reach approximately US$13.14 billion by 2030, which presents both opportunities and challenges for Allegion. Allegion's acquisitions are part of its efforts to enhance its portfolio and maintain competitiveness.

- NAPCO Security Technologies: Offers a range of security products, including access control systems.

- ADT: Provides security and automation solutions for homes and businesses.

- Resideo: Focuses on smart home and security solutions.

- Samsung Electronics: Enters the smart lock market, increasing competition.

- Spectrum Brands Holdings: Competes in the smart lock market.

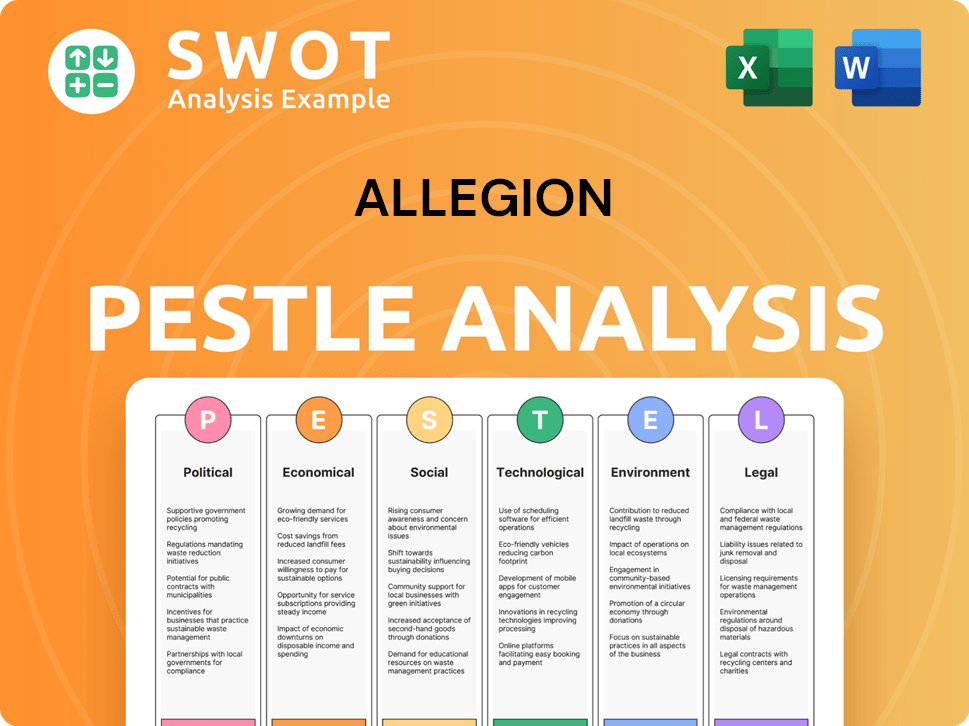

Allegion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Allegion a Competitive Edge Over Its Rivals?

Understanding the Allegion competitive landscape involves assessing its strengths and strategic moves within the security industry. The company's diverse product portfolio, global presence, and focus on innovation are key elements. Allegion's ability to adapt to market changes and leverage technological advancements positions it well against its rivals in the door hardware market and access control systems.

Allegion's market analysis reveals a company that strategically uses acquisitions and partnerships to bolster its offerings. Recent moves, including those in 2024 and early 2025, demonstrate a commitment to expanding its product lines and market reach. These actions contribute to a competitive edge in a dynamic market.

The company's financial performance and strategic direction are crucial in understanding its position. Allegion's focus on innovation, particularly in electronic security, and its collaboration with tech giants like Apple, Google, and Airbnb, highlight its forward-thinking approach. To learn more about the company's growth strategy, see Growth Strategy of Allegion.

Allegion offers a comprehensive range of security products, including mechanical and electronic locks, door closers, and access control solutions. Its global presence spans over 130 countries, providing a robust distribution network. This extensive reach allows the company to serve a wide customer base and capitalize on international market opportunities.

Allegion benefits from a strong brand portfolio, featuring well-established names such as CISA®, Interflex®, LCN®, Schlage®, SimonsVoss®, and Von Duprin®. These brands are recognized for their quality and reliability. This recognition fosters strong brand equity and customer loyalty, which is a key factor in the Allegion competitive landscape.

Allegion's commitment to research and development (R&D) and innovation positions it as a leader in advanced security solutions. The company actively invests in creating cutting-edge technologies, such as ultra-wideband (UWB). Collaborations with companies like Apple, Google, and Airbnb highlight its focus on technological advancements.

Allegion's strategic acquisitions, including five companies purchased in 2024 and additional bolt-on acquisitions in early 2025, strengthen its core mechanical portfolio. These moves expand its electromechanical products and enhance its specialty offerings. Acquisitions like Trimco Hardware and Next Door Company contribute positively to growth.

Allegion's competitive advantages of Allegion include a diverse product range, global market presence, and strong brand recognition. The company's focus on innovation and strategic acquisitions further strengthens its position. This focus on innovation is particularly important in the fast-evolving security industry.

- Diverse Product Portfolio: Offers a wide array of security products.

- Global Presence: Operates in over 130 countries, providing a robust distribution network.

- Strong Brand Portfolio: Includes well-established brands known for quality and reliability.

- Innovation: Actively invests in R&D and cutting-edge technologies.

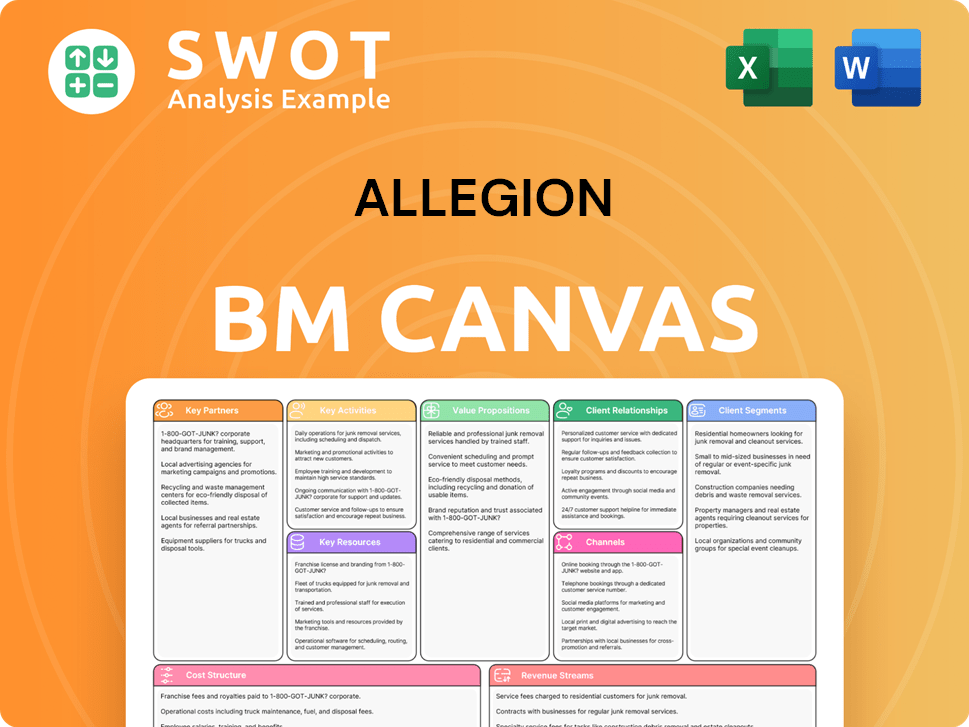

Allegion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Allegion’s Competitive Landscape?

The security industry is experiencing significant shifts driven by technological advancements, consumer behavior, and global economic factors. These changes present both challenges and opportunities for companies like Allegion. A thorough Allegion market analysis reveals the complexities of navigating this dynamic environment.

Allegion's competitive landscape is shaped by the increasing demand for smart security solutions, fueled by the Internet of Things (IoT) and artificial intelligence (AI). While this offers opportunities for growth, the company faces potential threats from competition, supply chain issues, and economic uncertainties. The Allegion company market share analysis indicates the need for strategic adaptation to maintain a strong position.

The security industry is seeing a rise in smart security solutions, driven by IoT and AI. The global smart lock market is projected to reach US$13.14 billion by 2030, up from US$6.33 billion in 2023. This growth indicates significant potential for companies in the door hardware market.

High costs associated with smart locks could hinder widespread adoption. Allegion faces potential threats from increased competition, supply chain vulnerabilities, and economic uncertainties. The company anticipates managing estimated tariff costs of approximately $80 million in 2025, impacting operating profit and EPS.

Allegion is well-positioned to capitalize on market opportunities. The company expects full-year 2025 revenues to increase by 1% to 3% on a reported basis and 1.5% to 3.5% organically. Electronics revenue is rising in the low double digits. Strategic acquisitions and partnerships are key.

Allegion is focusing on electronics to drive growth and is actively pursuing strategic acquisitions. The company completed three acquisitions in Q1 2025 to strengthen its market position. Strong cash generation and a robust M&A pipeline support future capital deployment.

To maintain a competitive edge, Allegion must focus on several key areas. This includes innovation in access control systems and expanding its product portfolio. Understanding the target market of Allegion is crucial for tailoring strategies.

- Investing in research and development to create advanced smart security solutions.

- Expanding into new geographic markets to increase market presence.

- Strengthening cybersecurity measures to protect against evolving threats.

- Forming strategic alliances to enhance technological capabilities.

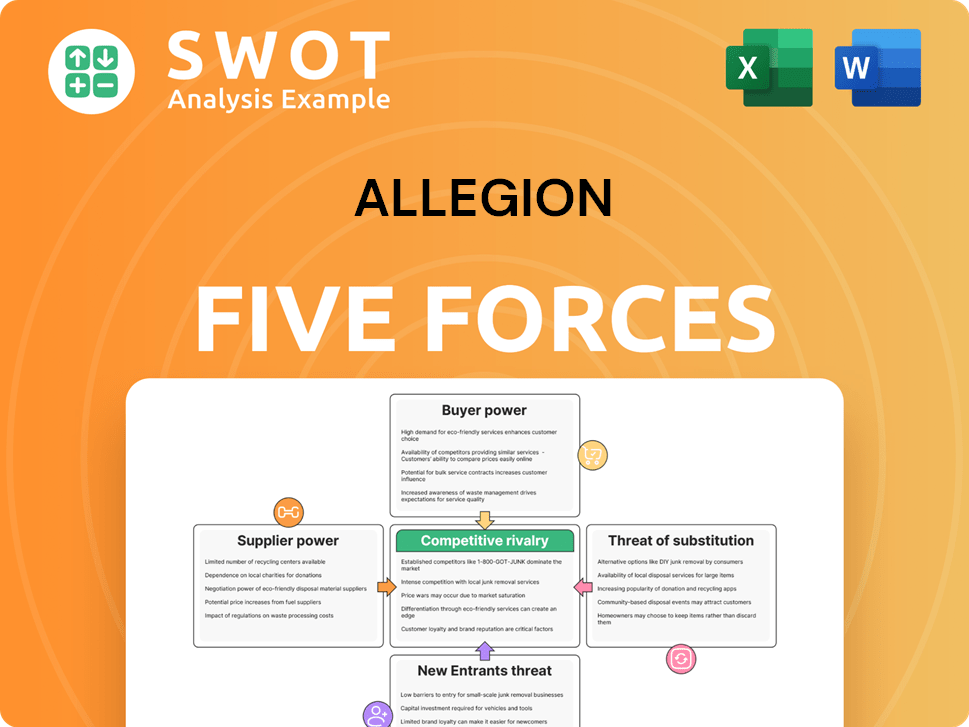

Allegion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Allegion Company?

- What is Growth Strategy and Future Prospects of Allegion Company?

- How Does Allegion Company Work?

- What is Sales and Marketing Strategy of Allegion Company?

- What is Brief History of Allegion Company?

- Who Owns Allegion Company?

- What is Customer Demographics and Target Market of Allegion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.