Altron Bundle

How Does Altron Navigate the Tech Titan Arena?

In today's fast-paced digital world, understanding the Altron SWOT Analysis is crucial for investors and strategists alike. Altron, a leading South African technology firm, is constantly evolving in a sector defined by relentless innovation and shifting client needs. This article dives deep into the Altron competitive landscape, providing essential insights for informed decision-making.

This comprehensive Altron market analysis will dissect Altron competitors, evaluating their strengths and weaknesses to offer a clear view of the competitive dynamics. Explore Altron's business strategy and its impact on the Altron industry, including its financial performance compared to rivals. We'll explore Altron's main competitors in South Africa, examining Altron's market share analysis 2024, and its competitive advantages within the IT sector while considering Altron's challenges in the current market.

Where Does Altron’ Stand in the Current Market?

Altron holds a significant market position within the South African technology solutions and services industry. The company is particularly strong in digital transformation and managed services. Altron's consistent revenue generation and strategic partnerships highlight its strong standing in the market. For the financial year ending February 2024, Altron reported revenue of R8.5 billion, demonstrating its scale within the South African market. This financial performance is a key indicator of Altron's market position.

The core operations of Altron encompass cloud services, data analytics, cybersecurity, IoT, and managed IT services. These services cater to a broad spectrum of clients, including those in financial services, healthcare, and the public sector. Altron's value proposition lies in providing comprehensive technology solutions that drive digital transformation and improve operational efficiency for its clients. This is a crucial aspect when considering the Altron competitive landscape.

Over time, Altron has strategically shifted its positioning, emphasizing digital transformation and cloud-based solutions to meet the evolving demands of its clientele. This shift reflects a move towards higher-value services and a focus on integrating complex technological solutions. Geographically, Altron's core operations are concentrated in South Africa, where it has established a robust customer base and delivery infrastructure. You can learn more about the company's background in Brief History of Altron.

While specific recent market share figures are not readily available, Altron's revenue of R8.5 billion for the year ending February 2024 indicates its substantial presence in the South African market. This financial performance is a key indicator of the company's market position and its ability to compete within the Altron industry.

Altron's key business segments include cloud services, data analytics, cybersecurity, IoT, and managed IT services. These segments cater to a diverse client base, including financial services, healthcare, and the public sector. Understanding these segments is crucial for a detailed Altron market analysis.

Altron's primary focus is in South Africa, where it has a strong customer base and infrastructure. The company also has a presence in other African countries and the UK. This geographic diversification supports Altron's growth strategy and outlook.

Altron emphasizes digital transformation and cloud-based solutions. This strategic shift meets evolving client demands and focuses on higher-value services. This positioning helps Altron navigate the Altron competitive landscape.

Altron's financial health, as demonstrated by its recent financial performance and strategic investments, positions it as a resilient player. This resilience enables the company to navigate competitive pressures effectively and invest in future growth. This is a key factor when assessing Altron's strengths and weaknesses.

- Strong revenue generation indicates a robust market presence.

- Strategic investments support future growth and innovation.

- Focus on digital transformation aligns with market trends.

- Diversified service offerings cater to a broad client base.

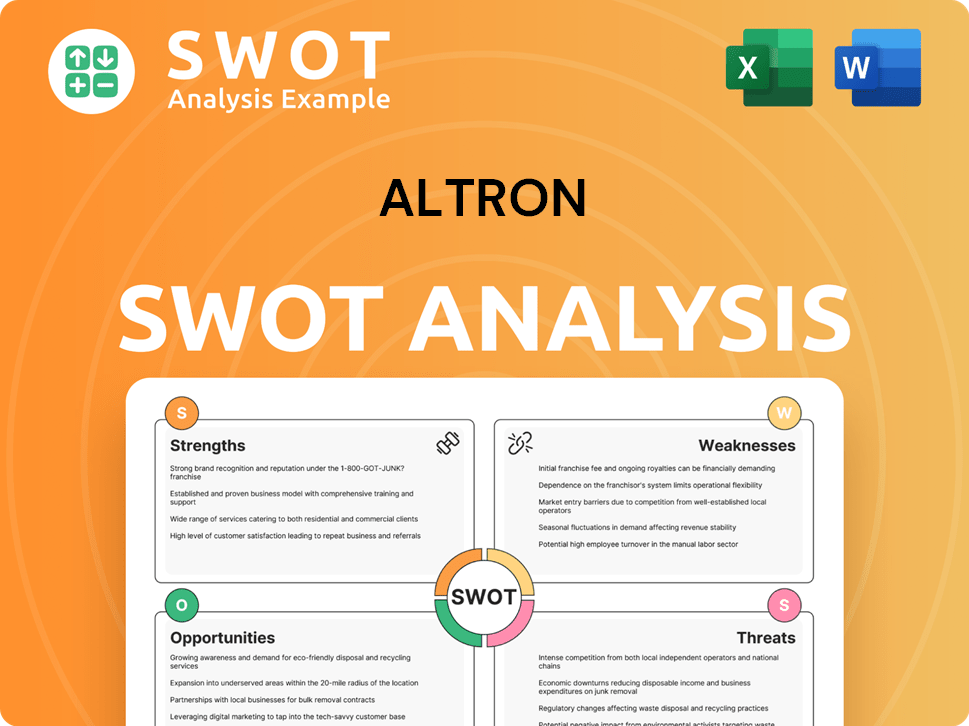

Altron SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Altron?

The Marketing Strategy of Altron is significantly shaped by the competitive environment it operates within. The company faces a diverse set of competitors, from established global players to agile local firms, each vying for market share in the dynamic IT and telecommunications sectors.

Understanding the Altron competitive landscape is crucial for assessing its Altron business strategy and potential for growth. This analysis considers both direct and indirect competitors, their strengths, and how they impact Altron's financial performance.

Direct competitors are those that offer similar services and solutions to Altron. These companies compete head-to-head for the same clients and projects. The main direct competitors are Dimension Data (NTT Ltd.), Vodacom Business, and MTN Business.

Dimension Data, a subsidiary of NTT Ltd., is a major player offering a comprehensive suite of IT services, cloud solutions, and cybersecurity. They often compete with Altron for large enterprise and public sector contracts.

Vodacom Business and MTN Business leverage their extensive telecommunications infrastructure to provide managed network services, IoT solutions, and cloud connectivity. They bundle these services with other IT offerings, making them strong competitors.

Indirect competitors offer alternative solutions or compete in adjacent markets. These competitors may not directly offer the same services but can impact Altron's market share. Indirect competitors include global software vendors, specialized local firms, and emerging players.

Microsoft, Amazon Web Services (AWS), and Google Cloud offer direct-to-customer cloud offerings, which can sometimes bypass traditional IT service providers. This poses a competitive threat, especially in cloud services.

Smaller, specialized local firms focusing on niche areas like cybersecurity or specific software development also compete. These firms can be agile and offer specialized expertise, challenging Altron in specific market segments.

Emerging players in artificial intelligence and specialized cloud consulting are disrupting the traditional landscape. These companies push incumbents, including Altron, to continuously innovate and adapt to new technologies and market demands.

The Altron market analysis reveals that the competitive dynamics are influenced by mergers and alliances. Consolidation efforts by various players aim to expand service portfolios and market reach. High-profile 'battles' often revolve around large government tenders or significant digital transformation projects for major financial institutions, where Altron competes on expertise, integrated solutions, and local presence. Understanding Altron's strengths and weaknesses in this environment is crucial for strategic planning.

Several factors influence Altron's competitive position and drive its Altron's growth strategy and outlook. These include:

- Integrated Solutions: Altron's ability to offer comprehensive, integrated solutions across various IT domains.

- Local Presence: Altron's established presence and deep understanding of the South African market.

- Expertise: The technical expertise and experience of its workforce.

- Innovation: Continuous investment in new technologies and services.

- Partnerships: Strategic alliances and collaborations with other companies.

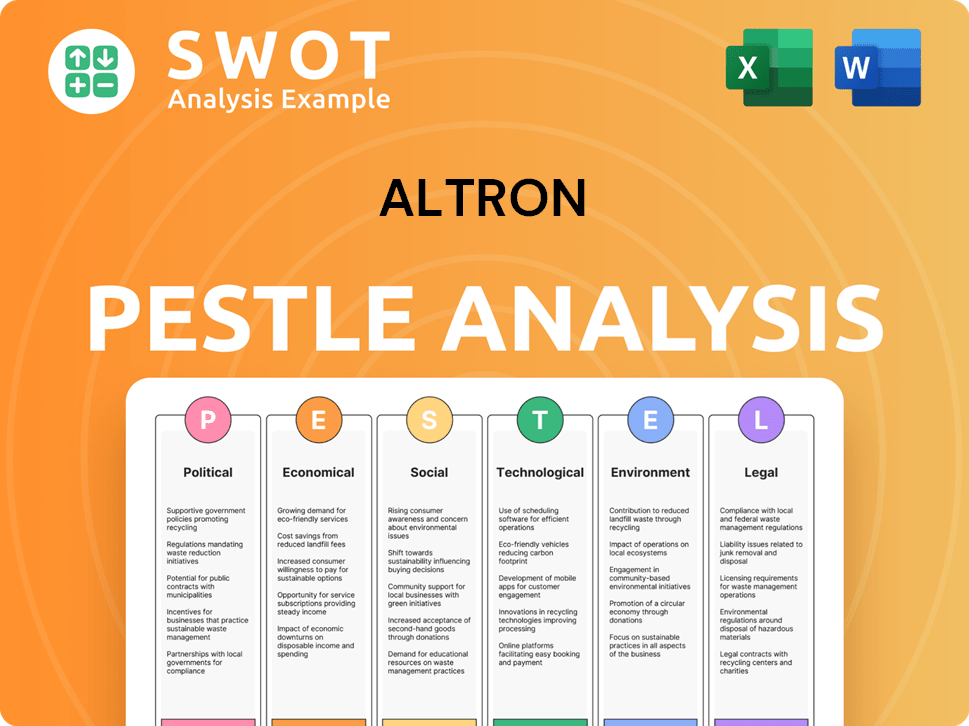

Altron PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Altron a Competitive Edge Over Its Rivals?

Understanding the Altron competitive landscape requires a deep dive into its core strengths. The company has cultivated a strong presence in the South African market, building substantial brand equity over time. This local expertise, combined with a comprehensive portfolio of technology solutions, positions it uniquely within the Altron industry.

Altron's business strategy focuses on integrated digital transformation solutions, encompassing cloud services, data analytics, and cybersecurity. This approach simplifies procurement and management for clients. Strategic partnerships and investments in proprietary technologies, especially in areas like payment solutions through Altron FinTech, further differentiate the company. This comprehensive approach is a key factor in its Altron market analysis.

The company's long-standing presence in South Africa has allowed it to build strong client relationships, particularly in the financial services, healthcare, and public sectors. This deep understanding of the local market enables it to tailor solutions that specifically address the unique challenges and regulatory environments prevalent in the region. To learn more about their overall goals, consider reading about the Growth Strategy of Altron.

Altron's strong market position is built on its ability to offer end-to-end solutions. This includes cloud services, data analytics, cybersecurity, and managed IT services. The company's focus on proprietary technologies and intellectual property, particularly in payment solutions, helps it to stand out. This integrated approach simplifies procurement and management for clients.

Strategic partnerships with global technology leaders enhance Altron's offerings. These partnerships provide access to cutting-edge technologies and expand its service capabilities. The company leverages these relationships to deliver tangible business value to its clients. These collaborations are crucial for staying competitive in the dynamic IT sector.

Altron's competitive advantages include a deep understanding of the South African market and a comprehensive portfolio of integrated technology solutions. Its long-standing presence has enabled it to build significant brand equity. These advantages have evolved over time, adapting to changing market demands. The company focuses on delivering tangible business value to its clients.

Altron faces challenges from rapid technological advancements and aggressive expansion by global players. Continuous innovation and strategic adaptation are necessary to maintain its competitive edge. The company must stay ahead of market trends to remain relevant. This requires ongoing investment in research and development.

Altron's strengths include its local market expertise and integrated solutions. Its weaknesses involve the need for continuous innovation to counter rapid technological changes. The company's ability to adapt to the evolving market is crucial for sustained success.

- Strengths: Strong brand recognition and established client relationships.

- Weaknesses: Dependence on the South African market and exposure to global competition.

- Opportunities: Expanding into new technologies and markets.

- Threats: Rapid technological advancements and aggressive global competitors.

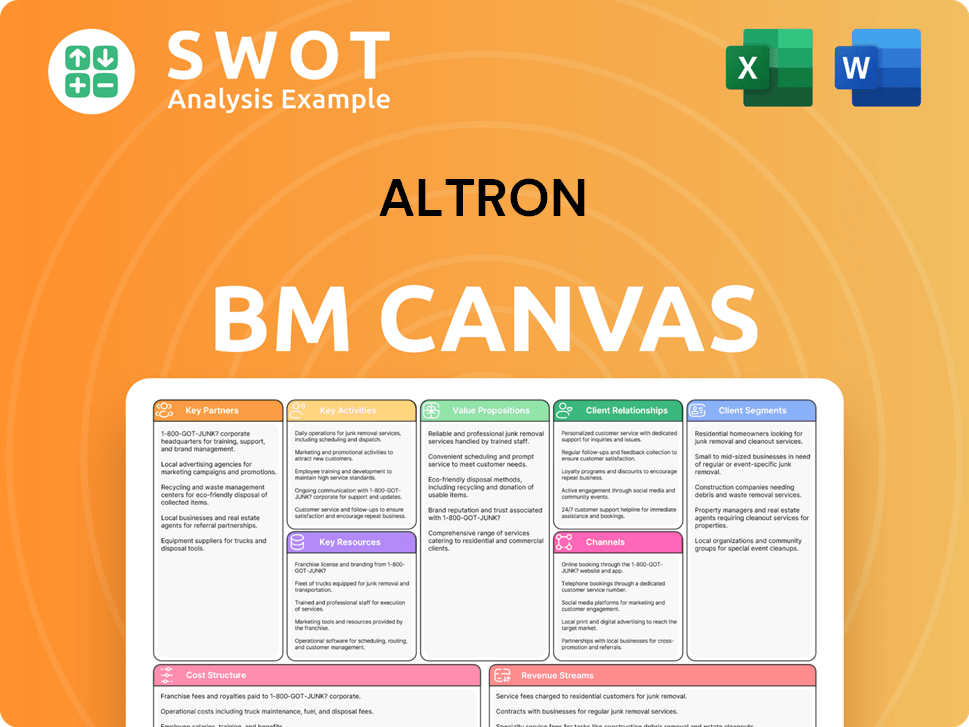

Altron Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Altron’s Competitive Landscape?

The technology solutions and services industry is experiencing rapid transformation, creating both opportunities and challenges for companies like Altron. This dynamic environment is shaped by digital transformation, growing demand for data analytics, and the need for advanced cybersecurity solutions. Understanding the Altron competitive landscape is crucial for navigating these shifts and ensuring sustainable growth. Recent market analyses indicate that the IT sector in South Africa is poised for continued expansion, creating a favorable backdrop for companies that can adapt to evolving technological needs. Revenue Streams & Business Model of Altron provides further insights into the company's operations.

The Altron industry faces intense competition from global tech giants and agile startups. Regulatory changes, particularly in data privacy and cybersecurity, demand constant adaptation. Economic uncertainties can also impact IT spending, affecting revenue. To succeed, Altron's business strategy must focus on innovation, strategic partnerships, and a highly skilled workforce. Addressing these challenges is vital for maintaining a strong Altron market analysis and ensuring long-term success.

Digital transformation continues to drive significant growth, with cloud computing, AI, and cybersecurity solutions becoming increasingly important. Data analytics and business intelligence are also in high demand, creating opportunities for companies that can offer these services. The push for sustainable practices and ESG considerations is gaining traction, influencing investment decisions and business strategies within the Altron competitive landscape.

Intense competition from established players and emerging startups requires continuous innovation and investment. Regulatory changes, particularly around data privacy and cybersecurity, necessitate ongoing adaptation of service offerings. Economic uncertainties and talent acquisition challenges could affect Altron's financial performance. The ability to navigate these challenges will be critical for maintaining a competitive edge.

Expanding into emerging markets within Africa, where digital adoption is rapidly increasing, presents significant growth potential. Strategic partnerships and acquisitions can bolster capabilities and market reach. Focusing on niche areas like financial technology and public sector solutions provides avenues for specialized growth. These opportunities can help strengthen Altron's market share analysis 2024.

Altron's business strategy focuses on investing in research and development, fostering strategic alliances, and enhancing service delivery models. The company aims to meet the evolving needs of its diverse client base, ensuring its competitive position in the dynamic technology landscape. Recent financial reports show a focus on sustainable practices and ESG initiatives, which are increasingly important to stakeholders.

To thrive in the evolving technology landscape, Altron should prioritize several key strategies. These include focusing on innovation, strategic partnerships, and talent development. Continuous investment in R&D and adapting to regulatory changes are crucial for long-term success.

- Invest in cutting-edge technologies like AI and cloud computing.

- Forge strategic alliances to expand market reach and capabilities.

- Develop and retain a highly skilled workforce.

- Adapt to changing regulatory environments, especially regarding data privacy and cybersecurity.

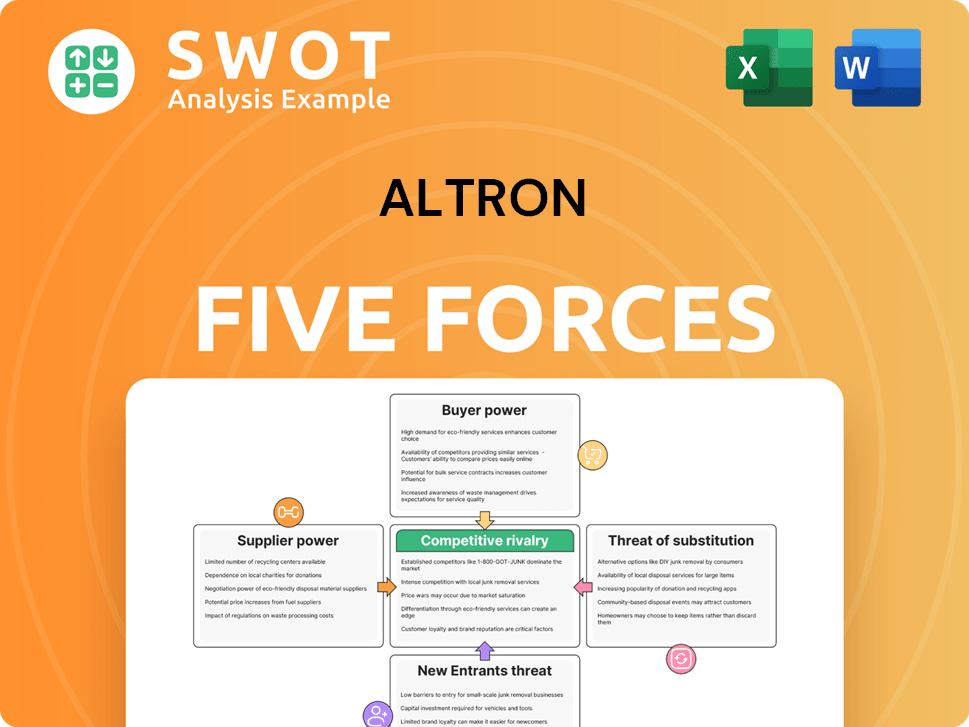

Altron Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Altron Company?

- What is Growth Strategy and Future Prospects of Altron Company?

- How Does Altron Company Work?

- What is Sales and Marketing Strategy of Altron Company?

- What is Brief History of Altron Company?

- Who Owns Altron Company?

- What is Customer Demographics and Target Market of Altron Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.