Altron Bundle

Who Really Owns Altron?

Understanding the Altron SWOT Analysis is crucial, but have you ever wondered about the power dynamics behind this tech giant? Altron, a key player in South Africa's technology landscape, has undergone significant ownership shifts. These changes have reshaped its strategic direction and influence.

This exploration of Altron's ownership structure reveals a fascinating journey from its roots in 1965, when Dr. Bill Venter founded Allied Electric in Johannesburg, South Africa, to its current status as a prominent technology solutions provider. We'll examine the evolution of Altron ownership, tracing the influence of its shareholders, including major shareholders and the impact of Altron executives on the company's trajectory. Discover how these shifts have shaped Altron's strategy, financial performance, and its position on the JSE, ultimately impacting its value and future prospects.

Who Founded Altron?

The story of the Altron company begins in 1965 with Dr. Bill Venter. He founded the company in Johannesburg, South Africa, initially naming it United Electric (Pty) Ltd, later changing it to Allied Electric (Pty) Limited. His vision was to create a South African-controlled entity in the electrical, electronics, and telecommunications sectors.

Dr. Venter started with a modest investment of R24,000 – which is roughly equivalent to R2.71 million today – and a team of just three employees. The company's initial focus was on designing and manufacturing semiconductor rectifier equipment and battery chargers. This marked the beginning of what would become a significant player in South Africa's technology landscape.

Altron's early expansion included ventures into telecommunications and consumer electronics. The establishment of Allied Technologies (Altech) in 1975 and Powertech in 1979, both of which were later listed on the JSE, was a key step in the company's growth. The Venter family maintained a strong influence for many years, ensuring the company's strategic direction.

Dr. Bill Venter founded Altron in 1965. The initial capital was R24,000, and the company began with a small team.

Altron expanded into telecommunications and consumer electronics. Altech and Powertech were key subsidiaries.

The Venter family held significant control. They maintained a substantial portion of voting rights.

Altech and Powertech were listed on the JSE. This move solidified Altron's presence in the industry.

Ventron Corporation was formed to manage Altron's growing portfolio. This included Altech, Powertech, and Fintech.

The Venter family's control was maintained through a dual-class share structure. This allowed them to retain control despite not holding a majority economic interest.

Understanding the Altron ownership structure requires looking at its history. The company, founded by Dr. Bill Venter, initially focused on electrical equipment. Over time, Altron expanded, with subsidiaries like Altech and Powertech playing crucial roles. The Venter family's influence remained significant for many years. In 2016, the Venter family held 17.8% of the economic rights and exercised 57% of the voting rights, highlighting their control. For more details on the company's business model, consider reading Revenue Streams & Business Model of Altron.

Altron's journey began with Dr. Bill Venter in 1965. The company's early focus was on electrical and electronic equipment. The Venter family played a crucial role in Altron's history.

- Altron was founded by Dr. Bill Venter.

- The initial investment was R24,000.

- Altech and Powertech were key subsidiaries.

- The Venter family maintained significant control.

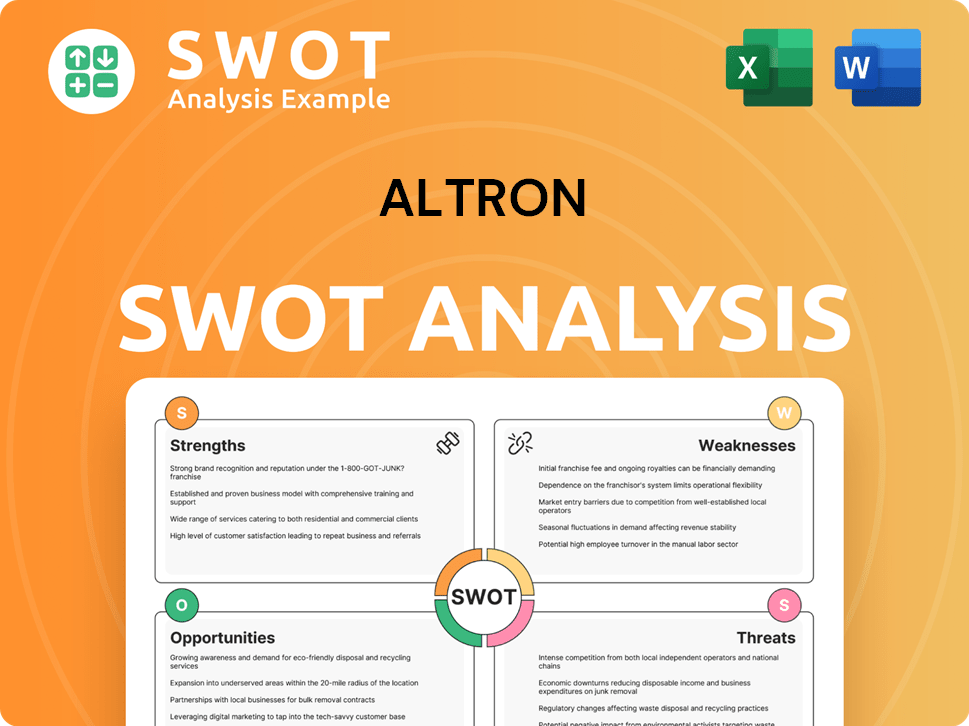

Altron SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Altron’s Ownership Changed Over Time?

The evolution of Altron's ownership has been marked by strategic shifts and significant investments. A pivotal moment occurred in 2016 when Value Capital Partners (VCP) injected R400 million into the company. This investment reshaped Altron's control structure in 2017. The historical dual-class share structure, which had granted the Venter family significant voting power, was replaced with a single class of voting shares. This change reduced the Venter family's voting position to 25.1% plus one vote, contingent on maintaining an economic interest exceeding 10% in Altron's A class shares. Dr. Bill Venter transitioned from his role as non-executive chairman to chairman emeritus.

The company's strategic direction has also been influenced by these ownership changes, including the de-merger and listing of Bytes Technology Group in 2020. Bytes UK was subsequently listed separately on the London Stock Exchange to enhance shareholder value. These actions have been crucial in shaping the current ownership landscape of the Altron company.

| Shareholder | Shares Held | Percentage of Ownership |

|---|---|---|

| Dfa Investment Trust Co - The Emerging Markets Small Cap Series | Data Not Available | Data Not Available |

| DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class | Data Not Available | Data Not Available |

| EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class | Data Not Available | Data Not Available |

Currently, Altron Limited (JSE:AEL) has 17 institutional owners and shareholders, collectively holding 1,747,399 shares. Key institutional investors include Dfa Investment Trust Co - The Emerging Markets Small Cap Series, DFCEX - Emerging Markets Core Equity Portfolio - Institutional Class, and EITEX - Parametric Tax-Managed Emerging Markets Fund Institutional Class. Other significant shareholders include Coronation Asset Management (Pty) Ltd, Biltron (Pty) Ltd, and Centaur Asset Management Pty Ltd. Value Capital Partners (Pty) Ltd remains a notable institutional investor. The shifts in Altron shareholders reflect a dynamic ownership structure.

Understanding the ownership structure of Altron is crucial for investors and stakeholders. The company's history includes significant changes in ownership and strategic direction.

- Value Capital Partners' investment in 2016 was a turning point.

- The dual-class share structure was collapsed in 2017.

- Bytes Technology Group's de-merger and listing in 2020.

- Altron has 17 institutional owners.

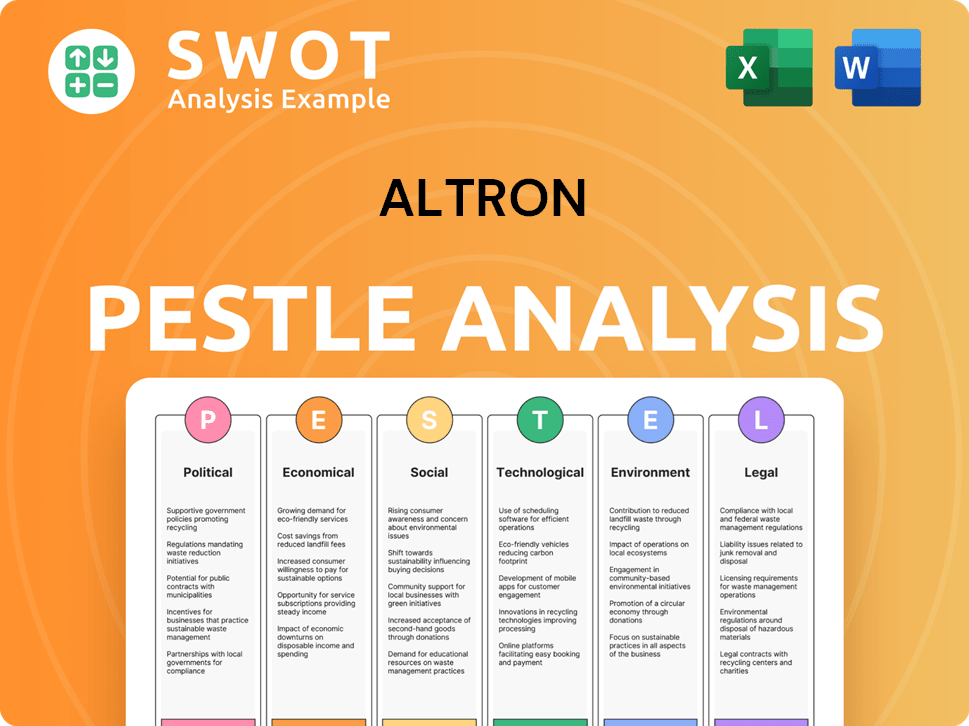

Altron PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Altron’s Board?

The current board of directors of the Altron company reflects a blend of executive, non-executive, and independent non-executive members, representing a diverse range of stakeholders following the ownership restructuring. The board is led by Stewart van Graan as the Independent Non-Executive Director and Chairman of the Board. Werner Kapp, appointed in October 2022, serves as the Altron Group Chief Executive Officer and directly owns 0.38% of the company's shares, which is valued at approximately €1.56 million. Carel Snyman is the Executive Director and Chief Financial Officer, having joined the board in June 2023.

Other key board members include Grant Gelink (Independent Non-Executive Director and Chairman of Audit & Risk Committee), Dr. Phumla Mnganga (Independent Non-Executive Director and Chairperson of the Remuneration Committee), Sharoda Rapeti (Independent Non-Executive Director), Tapiwa Ngara (Non-Executive Director), Alupheli Sithebe (Independent Non-Executive Director), Grigoris Kouteris (Independent Non-Executive Director), Antony Ball (Non-Executive Director), and Brett Dawson (Non-Executive Director). Antony Ball and Tapiwa Ngara represent Value Capital Partners (VCP) on the board, highlighting VCP's continued influence as a significant shareholder.

| Board Member | Position | Notes |

|---|---|---|

| Stewart van Graan | Independent Non-Executive Director and Chairman | Leads the board |

| Werner Kapp | Group Chief Executive Officer | Appointed October 2022, owns 0.38% of shares |

| Carel Snyman | Executive Director and Chief Financial Officer | Joined the board in June 2023 |

Following the 2017 restructuring, the dual-class share structure was eliminated, leading to a one-share-one-vote system. This change removed the Venter family's previous absolute voting control. The Venter family's voting position was diluted to 25.1% plus one vote, contingent on their economic interest remaining above 10%. Recent board committee structure changes were announced on January 29, 2025. Shareholders participate in Annual General Meetings (AGMs), with the 2024 AGM held on July 31, 2024. For more information on the company's target market, you can read this article about the Target Market of Altron.

The board consists of executive, non-executive, and independent directors. Werner Kapp, the CEO, holds 0.38% of shares. The Venter family's voting power was diluted after the restructuring.

- Board led by Stewart van Graan.

- Werner Kapp is the current CEO.

- VCP has representation on the board.

- One-share-one-vote system in place.

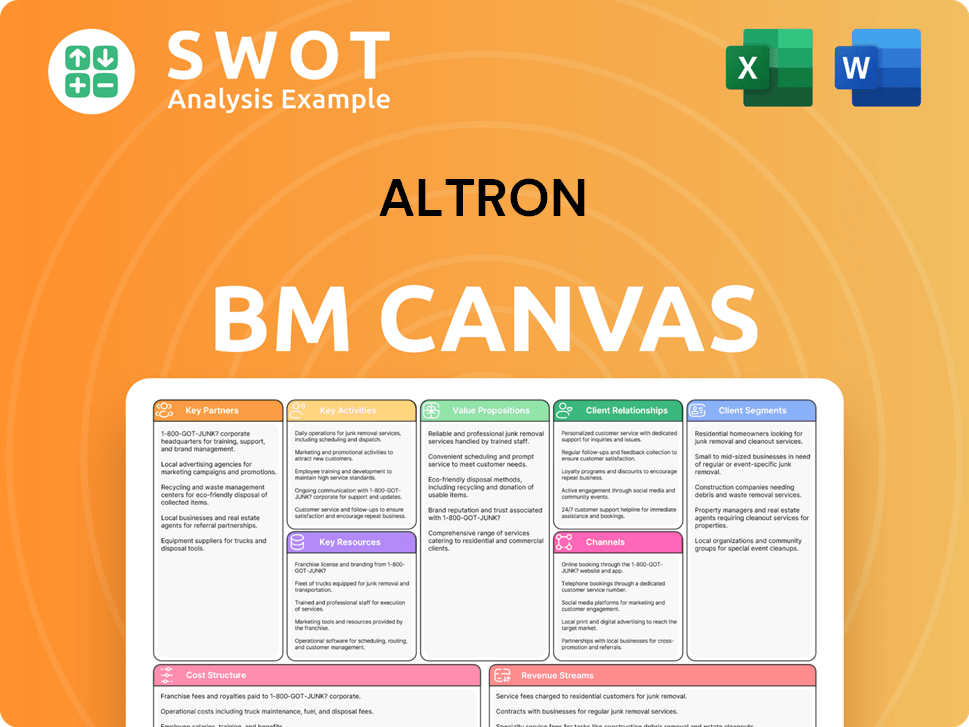

Altron Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Altron’s Ownership Landscape?

Over the past few years, the ownership profile of the Altron company has seen significant shifts. These changes reflect a strategic pivot towards core technology services and platform businesses. A key aspect of this has been streamlining operations through divestitures, such as the sale of the ATM Hardware and Support Business in July 2023. The company has also reorganized into distinct operating segments: Platforms, IT Services, and Distribution. This restructuring aims to enhance focus and drive value for Altron shareholders.

Institutional ownership remains a crucial element of the Altron ownership structure. Value Capital Partners (VCP), an activist investor, has shown confidence in the company through substantial share purchases, acquiring over R82 million worth of shares between June and August 2023. This activity, combined with the company's focus on capital allocation, including a R708 million capital expenditure in the year ended February 2025, demonstrates a commitment to long-term value creation. These strategic moves and the company's financial performance suggest a renewed market confidence in Altron and its leadership.

| Metric | Year Ended February 2024 | Year Ended February 2025 |

|---|---|---|

| Operating Profit (R million) | R648 | R972 |

| EBITDA (R million) | R1,410 | R1,800 |

| Headline Earnings Per Share (cents) | 103 | 178 |

| Final Dividend (cents per share) | 35 | 50 |

The financial results for the year ended February 2025 highlight Altron's strong performance. Operating profit increased by 50% to R972 million, while EBITDA surged by 27% to R1.8 billion. Headline earnings per share (HEPS) increased by 73% to 178 cents, and the final dividend was 50 cents per share. The company's share price also saw a significant increase of 75% between April 2024 and April 2025, reflecting positive market sentiment and the success of its strategic initiatives. The company aims to boost operating profits to R1.15 billion by 2026.

Werner Kapp was appointed as Group Chief Executive Officer in October 2022. This appointment was a part of the company's turnaround strategy.

Altron is concentrating on becoming a leading platform and IT services business. This involves strategic restructuring and portfolio streamlining.

Value Capital Partners (VCP) has significantly invested in Altron shares, demonstrating confidence in the company's future performance and value creation.

Strong financial results for the year ended February 2025, including a 50% increase in operating profit and a 73% rise in HEPS, suggest market confidence.

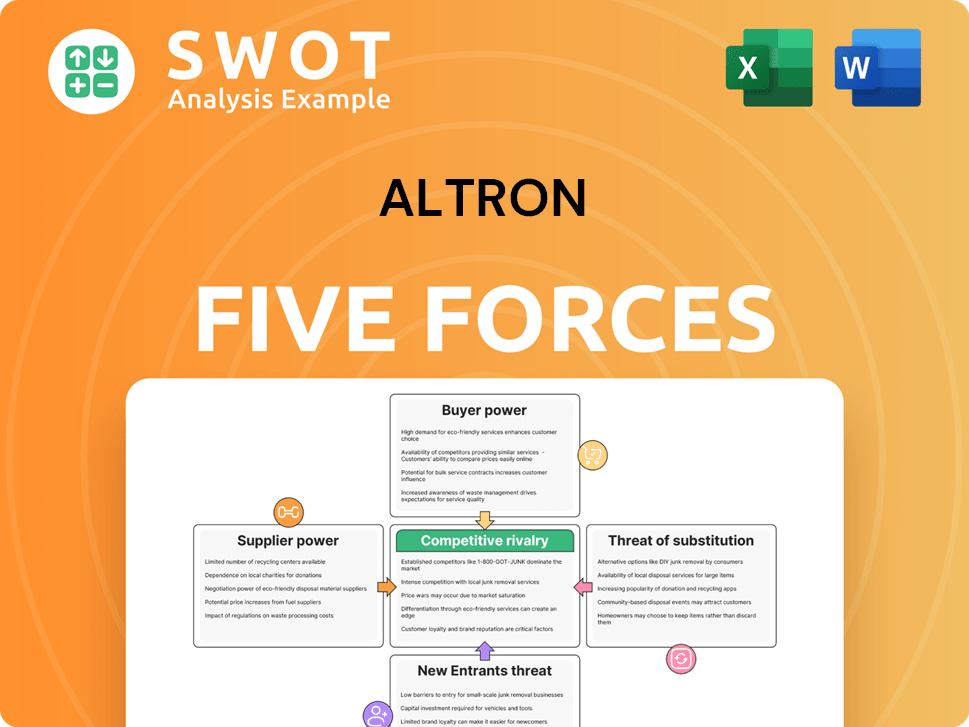

Altron Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Altron Company?

- What is Competitive Landscape of Altron Company?

- What is Growth Strategy and Future Prospects of Altron Company?

- How Does Altron Company Work?

- What is Sales and Marketing Strategy of Altron Company?

- What is Brief History of Altron Company?

- What is Customer Demographics and Target Market of Altron Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.