Axway Bundle

Can Axway Maintain Its Edge in the Digital Integration Arena?

In today's fast-paced digital environment, businesses are racing to connect their systems and data. Axway is a key player in this landscape, providing essential enterprise software solutions. But who are its rivals, and how does Axway stack up in the competitive arena of API management and integration?

This analysis dives deep into the Axway SWOT Analysis, exploring the Axway competitive landscape and conducting a thorough Axway market analysis. We'll examine Axway competitors, evaluate its Axway company overview, and provide an Axway industry analysis to understand its Axway financial performance. Understanding these factors is crucial for anyone looking to make informed decisions in the dynamic world of digital transformation.

Where Does Axway’ Stand in the Current Market?

The Axway competitive landscape is characterized by its strong standing in enterprise integration and API management. The company is particularly recognized for its expertise in managed file transfer (MFT) and B2B integration, making it a key player in these specialized segments. An Axway company overview reveals a focus on providing secure and reliable data exchange solutions across various industries, including financial services, healthcare, retail, and manufacturing.

Axway's market position is supported by its diverse product lines, such as the Amplify API Management Platform, Managed File Transfer, and B2B Integration. These offerings cater to a wide range of customer needs, from large enterprises to mid-sized businesses. The company has strategically shifted its focus towards its Amplify platform, a hybrid integration platform designed to address the evolving needs of digital transformation and cloud-native architectures. This strategic move underscores its commitment to staying ahead of industry trends and providing comprehensive integration solutions.

Geographically, Axway has a robust presence in North America and Europe, with a growing footprint in other regions. The company's financial performance reflects its stability and growth within the industry. For the full year 2023, Axway reported revenue of €305.1 million, demonstrating its scale and continued investment in its platform and services. This financial health allows Axway to maintain its competitive edge and continue innovating in the API management and integration space. For more details on the company's financial performance, you can refer to this article discussing the Axway market analysis.

Axway holds a significant position in the enterprise integration and API management market. Its expertise in managed file transfer (MFT) and B2B integration is well-recognized. The company's focus on secure and reliable data exchange across various industries solidifies its market presence.

Axway offers a comprehensive suite of products, including the Amplify API Management Platform, Managed File Transfer, and B2B Integration. These offerings cater to diverse customer needs, supporting both large enterprises and mid-sized businesses. The focus on the Amplify platform highlights a commitment to hybrid integration solutions.

Axway has a strong presence in North America and Europe, with expansion in other regions. The company serves a broad spectrum of customers, from large enterprises requiring complex integration solutions to mid-sized businesses. This wide reach underscores its adaptability and market relevance.

Axway's financial performance reflects its stability and growth within the industry. The company reported a revenue of €305.1 million for the full year 2023. This financial health supports its strategic investments and continued innovation in the API management and integration space.

Axway's strengths lie in its specialized expertise in MFT and B2B integration, along with its comprehensive product portfolio. The company's strategic focus on the Amplify platform positions it well for the evolving needs of digital transformation. This focus allows Axway to address the growing demand for cloud-native and hybrid integration solutions.

- Strong market position in MFT and B2B integration.

- Comprehensive product suite, including the Amplify API Management Platform.

- Strategic shift towards hybrid integration solutions.

- Robust presence in North America and Europe.

Axway SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Axway?

The Axway company overview reveals a competitive landscape shaped by established players and emerging innovators. Understanding the dynamics of the Axway competitive landscape is crucial for assessing its market position and growth potential. This market analysis requires a close look at the key Axway competitors and the strategies they employ.

Axway's industry analysis indicates a market driven by digital transformation and the increasing demand for seamless integration solutions. The company faces competition across various segments, including API management, managed file transfer (MFT), and B2B integration. Assessing the competitive advantages in the API gateway market and other areas is essential for a comprehensive understanding of Axway's position.

Axway's financial performance is directly influenced by its ability to compete effectively with its rivals. The company's success hinges on its capacity to innovate, adapt to market changes, and maintain a strong customer base. The following sections delve into the key competitors and their impact on Axway's market share in the digital integration platform space.

In the API management sector, Axway's main competitors include Broadcom (CA API Management), Google (Apigee), Microsoft (Azure API Management), and IBM (API Connect). These companies offer comprehensive API management platforms, often integrated with their cloud ecosystems. For example, Google Apigee is a strong competitor with robust analytics capabilities.

Within the MFT domain, Axway faces competition from IBM (Sterling File Gateway), GoAnywhere MFT, and OpenText. These vendors provide secure file exchange solutions, competing on scalability, security certifications, and ease of use. IBM Sterling File Gateway is a long-standing competitor known for its enterprise-grade capabilities.

In B2B integration, Axway competes with companies like SEEBURGER AG, IBM (B2B Integrator), and OpenText. These competitors often challenge Axway through industry-specific templates and pre-built integrations. They have established relationships with large enterprises.

New players are disrupting the competitive landscape, particularly in cloud-native integration and iPaaS sectors. MuleSoft (Salesforce), Dell Boomi, and Workato are gaining traction with agile, cloud-based integration solutions. Mergers and acquisitions, like Salesforce's acquisition of MuleSoft, intensify competition.

The competitive landscape is dynamic, with established players and emerging vendors constantly evolving their offerings. Axway's strengths and weaknesses analysis must consider these shifts. Understanding Axway's recent acquisitions and their impact is crucial.

Market trends, such as the growth of the API economy and the demand for cloud integration, influence the competitive dynamics. Axway's challenges and opportunities in the API economy are significant. The company's future outlook and growth strategy depend on its ability to adapt.

Several factors influence the competitive positioning of Axway and its rivals. These factors include technological innovation, customer service, and pricing strategies. Axway's API management platform pricing and its integration solutions for the financial services industry are key considerations.

- Technology: The sophistication and features of integration platforms.

- Cloud Integration: The ability to offer seamless cloud-based solutions.

- Customer Base: The size and loyalty of the customer base.

- Partnerships: The strength of the partnership ecosystem.

- Market Share: The percentage of the market controlled by each company.

Axway PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Axway a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of Axway is crucial for grasping its competitive advantages. Axway's core strengths lie in enterprise integration, specifically API management, managed file transfer (MFT), and B2B integration. These areas form the bedrock of its competitive edge within the Axway competitive landscape.

A key advantage is the Amplify API Management Platform, which offers a unified approach to managing APIs. This comprehensive platform helps Axway stand out from competitors. Axway's long history in MFT and B2B integration bolsters its position, particularly for large enterprises with complex data exchange needs.

Proprietary technologies in secure data exchange and integration protocols further enhance Axway's competitive position. Its MFT solutions are known for strong security features, essential for industries like financial services. Customer loyalty, especially among established enterprise clients, is another significant advantage, fostering long-term relationships.

Axway's Amplify API Management Platform provides end-to-end lifecycle management, from design to analytics. This comprehensive approach helps businesses manage APIs effectively. The platform supports hybrid and multi-cloud environments, offering flexibility for diverse IT infrastructures.

Axway's MFT solutions offer strong security and compliance features, crucial for regulated industries. These solutions are designed for high-volume data exchange, making them suitable for large enterprises. Axway's expertise in B2B integration helps businesses streamline complex data exchange processes.

Axway facilitates a smooth transition to cloud-based solutions while leveraging existing investments. This hybrid integration approach allows customers to modernize their infrastructure at their own pace. It bridges on-premise and cloud environments, providing flexibility and control.

Axway prioritizes data governance and security across all its offerings, addressing growing enterprise concerns. This focus helps businesses comply with evolving data regulations. Axway's commitment to security enhances trust and protects sensitive information.

Axway's competitive advantages are significant, but face challenges from larger competitors and industry shifts. The company's focus on API management, MFT, and B2B integration provides a strong foundation. Axway's ability to offer hybrid integration and its emphasis on data governance further differentiate it.

- API Management: Comprehensive platform with end-to-end lifecycle management.

- MFT and B2B Integration: Robust security and compliance features, suitable for large enterprises.

- Hybrid Integration: Bridges on-premise and cloud environments.

- Data Governance: Focus on security and compliance across all offerings.

Axway Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Axway’s Competitive Landscape?

The competitive landscape for Axway is shaped by industry trends, future challenges, and opportunities. Continuous innovation is crucial for Axway to remain competitive, especially with the rapid adoption of cloud-native architectures and hybrid cloud environments. The increasing demand for robust API security and governance presents a significant opportunity, given Axway's expertise in secure data exchange. This analysis explores these dynamics in detail, providing insights for stakeholders.

Understanding the Axway competitive landscape requires a close look at its market position, potential risks, and future outlook. The company faces challenges from cloud-native providers and low-code/no-code integration platforms. However, opportunities exist in emerging markets, AI-powered integration, and strategic partnerships. This overview provides a comprehensive view of Axway's strategic environment.

The shift to cloud-native and hybrid cloud environments is a major trend, requiring continuous innovation. The demand for robust API security and governance, driven by data privacy regulations, is increasing. Low-code/no-code integration platforms are democratizing integration capabilities.

Staying ahead of evolving data privacy regulations and ensuring compliance is a constant challenge. Global economic shifts could impact IT spending and integration projects. The potential rise of AI-driven integration and aggressive pricing from competitors also pose risks.

Emerging markets with digital transformation initiatives offer significant growth potential. Product innovations around AI-powered integration and real-time data streaming are promising. Strategic partnerships with cloud providers can expand market reach.

Axway is focusing on continuous platform evolution and strengthening its partner ecosystem. The company emphasizes secure, end-to-end data flow management. It is adopting a platform-centric approach to orchestrate and govern data.

The Axway industry analysis reveals that the company's success depends on adapting to rapid changes. The increasing importance of API security and the growth in digital transformation initiatives present key opportunities. Understanding the competition and market dynamics is critical for strategic decision-making.

- Axway's competitive landscape includes both established players and emerging competitors.

- The company's strengths lie in its expertise in secure data exchange and integration solutions.

- Strategic partnerships and product innovations are key to future growth and market share.

- For more insights, see the Growth Strategy of Axway.

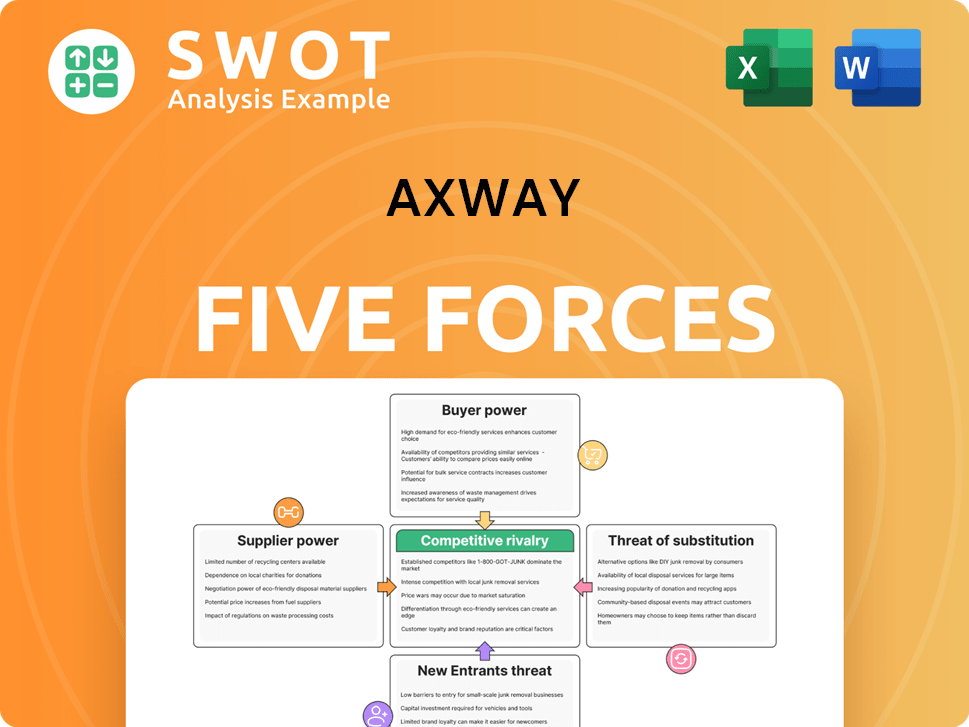

Axway Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axway Company?

- What is Growth Strategy and Future Prospects of Axway Company?

- How Does Axway Company Work?

- What is Sales and Marketing Strategy of Axway Company?

- What is Brief History of Axway Company?

- Who Owns Axway Company?

- What is Customer Demographics and Target Market of Axway Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.