BAE System Bundle

How Does BAE Systems Stack Up in the Global Defense Arena?

In a world where geopolitical tensions are constantly reshaping the landscape, understanding the competitive dynamics of defense giants like BAE Systems is crucial. This analysis dives deep into the BAE System SWOT Analysis to uncover its strengths, weaknesses, opportunities, and threats. We'll explore the company's strategic positioning within the defense industry and its ongoing evolution.

BAE Systems's position within the defense industry is constantly shifting, making a thorough market analysis essential for investors and strategists alike. This exploration of the competitive landscape will identify BAE Systems's key rivals, assess its market share, and evaluate its financial performance compared to its peers. Understanding BAE Systems's competitive advantage analysis and its global market presence provides critical insights into the future outlook and competition within the complex world of defense.

Where Does BAE System’ Stand in the Current Market?

BAE Systems holds a significant market position within the global defense, aerospace, and security industry. It is consistently ranked among the top defense contractors worldwide. The company's diverse portfolio and global presence contribute to its strong market standing, particularly in key geographic regions such as the United States, the United Kingdom, Australia, and Saudi Arabia.

The company's core operations encompass a wide array of defense and security solutions. These include combat aircraft components, naval vessels, land vehicles, electronic systems, and cybersecurity solutions. BAE Systems serves a diverse customer base, primarily governments and armed forces, demonstrating its critical role in supporting national defense capabilities.

BAE Systems has strategically shifted its focus towards higher-margin, technology-intensive areas, especially in advanced electronics and digital capabilities. This strategic move reflects a broader industry trend towards sophisticated defense technologies. This approach has helped maintain its competitive edge and financial health.

BAE Systems is a leading player in the defense industry, with a substantial market share in key sectors. The specific market share varies by segment and region, but the company's overall position remains strong. BAE Systems' strong market position is supported by its diverse product offerings and global reach.

The company's primary product lines include combat aircraft components (e.g., Eurofighter Typhoon), naval vessels (e.g., submarines, frigates), land vehicles (e.g., armored fighting vehicles), electronic systems, and cybersecurity solutions. These products cater to the needs of governments and armed forces globally. BAE Systems' broad product portfolio supports its strong market position.

BAE Systems has a significant global presence, with key markets in the United States, the United Kingdom, Australia, and Saudi Arabia. This widespread presence allows the company to serve diverse customer needs and maintain a strong competitive position. The company's global footprint is a key factor in its success.

In 2024, BAE Systems reported sales of £25.3 billion and an order intake of £37.7 billion, demonstrating robust demand and a solid financial foundation. This strong financial performance underscores the company's resilience and its ability to secure significant contracts. This financial health is crucial for maintaining its competitive advantage.

BAE Systems' competitive advantages include its diversified product portfolio, global presence, and technological expertise. The company's strategy focuses on high-margin, technology-intensive areas, particularly in advanced electronics and digital capabilities. This strategic focus is supported by its strong financial performance and robust order intake, showcasing its ability to secure major contracts and maintain a leading position in the Marketing Strategy of BAE System.

- Diversified product portfolio across various defense sectors.

- Strong global presence with key markets in the US, UK, Australia, and Saudi Arabia.

- Focus on high-margin, technology-intensive areas like advanced electronics.

- Robust financial performance with £25.3 billion in sales and £37.7 billion in order intake in 2024.

BAE System SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BAE System?

The competitive landscape for BAE Systems, a prominent player in the global defense and aerospace sector, is shaped by a complex interplay of established industry leaders and emerging challengers. Understanding the BAE Systems competitors is crucial for assessing its market position and strategic direction. The Defense industry is characterized by high barriers to entry, significant capital requirements, and long-term contracts, influencing the competitive dynamics.

BAE Systems faces competition across various segments, including military aircraft, naval systems, electronic systems, and cybersecurity. The company's ability to maintain and enhance its market share depends on its technological advancements, strategic partnerships, and responsiveness to evolving global security needs. A thorough market analysis reveals the strengths and weaknesses of BAE Systems compared to its key rivals.

BAE Systems's market share is influenced by its ability to secure and execute contracts with governments worldwide, particularly in the UK, the US, and other allied nations. The company's financial performance is closely tied to its success in winning and delivering on these contracts. For those interested in the ownership structure and financial aspects, you can find more information on the Owners & Shareholders of BAE System.

Lockheed Martin is a major competitor, especially in the aerospace and defense sectors. Its product portfolio includes the F-35 fighter jet and missile defense systems. In 2023, Lockheed Martin's net sales were approximately $67.6 billion.

Boeing competes with BAE Systems in military aircraft and weapons systems. Boeing's defense, space, and security segment generated approximately $25.2 billion in revenue in 2023.

RTX Corporation challenges BAE Systems in advanced electronics and air defense systems. RTX's 2023 sales were around $74.4 billion, highlighting its significant presence in the defense market.

Airbus is a major European competitor, particularly in military transport aircraft and space systems. Airbus Defence and Space reported revenues of approximately €13.7 billion in 2023.

Thales specializes in aerospace, defense, security, and transportation. Thales’s revenues in 2023 were approximately €18.4 billion, with a strong focus on advanced electronics and naval systems.

General Dynamics competes with BAE Systems in combat vehicles and marine systems. General Dynamics' revenue in 2023 was approximately $42.3 billion.

The competitive landscape is shaped by several factors that influence BAE Systems's competitive advantage analysis. These include technological innovation, contract awards, and global market presence.

- Technological Innovation: Continuous investment in research and development is crucial for maintaining a competitive edge.

- Government Contracts: Securing large-scale defense contracts is essential for revenue generation and market share.

- Global Presence: A diversified geographic footprint helps mitigate risks and capitalize on opportunities in different regions.

- Strategic Partnerships: Collaborations with other companies can enhance capabilities and expand market reach.

- Mergers and Acquisitions: Strategic M&A activity can reshape the competitive landscape, as seen with the formation of RTX.

BAE System PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BAE System a Competitive Edge Over Its Rivals?

The competitive landscape for BAE Systems is shaped by its robust competitive advantages, which have been pivotal in its sustained success within the defense industry. BAE Systems' strategic focus on technological innovation, brand equity, and operational efficiency has allowed it to maintain a strong market position. Understanding these advantages is crucial for any comprehensive market analysis of BAE Systems and its competitors.

BAE Systems' ability to navigate the complexities of the global arms market is significantly influenced by its strategic decisions and market positioning. The company's continuous investments in research and development, coupled with its strong relationships with key government customers, underscore its commitment to long-term growth and market leadership. This approach is essential for understanding BAE Systems' competitive strategy.

Analyzing BAE Systems' financial performance compared to rivals reveals its ability to generate consistent revenue and maintain profitability in a highly competitive environment. The company's global market presence is supported by a diverse product portfolio and a strategic focus on integrating digital technologies. This has enabled BAE Systems to adapt to changing market dynamics and maintain a competitive edge. For more insights, consider exploring the Growth Strategy of BAE System.

BAE Systems' significant investment in research and development (R&D) is a cornerstone of its competitive advantage. In 2024, the company allocated approximately £1.4 billion to R&D, focusing on areas like electronic warfare, cyber security, and autonomous systems. This commitment allows it to offer cutting-edge products and solutions, such as advanced components for the Eurofighter Typhoon and sophisticated naval combat systems.

BAE Systems benefits from a strong brand reputation and long-standing relationships with key government customers. Its proven track record in delivering complex defense projects has fostered customer loyalty, particularly in the UK, US, Australia, and Saudi Arabia. These relationships often lead to long-term contracts and repeat business, strengthening its market position.

As a large, integrated defense contractor, BAE Systems benefits from economies of scale in production, procurement, and supply chain management. This allows for cost efficiencies and competitive pricing on large-scale contracts. The company's global footprint and established distribution networks further enhance its ability to serve diverse international markets effectively.

BAE Systems' strong talent pool, comprising highly skilled engineers, scientists, and technical experts, is crucial for developing and maintaining its technological leadership. The company's focus on integrating digital technologies and advanced analytics into its offerings enhances capabilities and improves operational efficiencies. This focus on innovation is key to its competitive strategy.

BAE Systems' competitive advantages are multifaceted, encompassing technological leadership, strong brand equity, operational efficiency, and a skilled workforce. These advantages are critical in the defense industry.

- Technological Edge: Continuous investment in R&D, with approximately £1.4 billion in 2024, drives innovation.

- Customer Loyalty: Long-term relationships with key government customers ensure repeat business.

- Operational Efficiency: Economies of scale and efficient supply chain management reduce costs.

- Talent and Innovation: A skilled workforce and focus on digital technologies enhance capabilities.

BAE System Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BAE System’s Competitive Landscape?

In the dynamic realm of the defense, aerospace, and security sectors, understanding the competitive landscape is crucial. This involves a deep dive into industry trends, potential challenges, and emerging opportunities. The analysis of BAE Systems' position is vital for stakeholders looking to make informed decisions in this complex market.

BAE Systems, a key player in the global defense market, faces a landscape shaped by technological advancements, regulatory changes, and geopolitical shifts. To maintain its leading position, the company must navigate these factors effectively. The following sections provide an overview of the industry trends, future challenges, and opportunities impacting BAE Systems and its competitors. For a detailed look at the company's financial structure, consider exploring the Revenue Streams & Business Model of BAE System.

The defense industry is experiencing rapid technological advancements. Digitalization, AI, and machine learning are driving the development of advanced defense capabilities. These innovations are crucial for maintaining a competitive edge in the market. BAE Systems needs to invest in and integrate these technologies to stay ahead.

Regulatory changes and increased scrutiny over defense spending pose challenges. Geopolitical shifts and supply chain disruptions add to the complexity. The rise of non-traditional defense players and software-defined defense systems could disrupt traditional business models.

Emerging markets, particularly in Asia and the Middle East, offer growth opportunities. The increasing demand for cybersecurity solutions presents a substantial market. Strategic partnerships and dual-use technologies can also drive growth. Sustainability and environmental considerations are becoming increasingly important.

BAE Systems must adapt to technological advancements and geopolitical shifts. The company should focus on emerging markets and cybersecurity. Strategic partnerships and sustainable practices are crucial for future success.

BAE Systems' competitive strategy involves leveraging its strong market position and adapting to industry changes. The company's focus on innovation and strategic partnerships is key. BAE Systems' financial performance compared to rivals is crucial for understanding its market position. BAE Systems' global market presence is significant, with a focus on both developed and emerging markets.

- Market Analysis: BAE Systems' market share is influenced by its product portfolio and strategic initiatives.

- Competitive Landscape: The company faces competition from major players in the defense industry.

- Future Outlook: BAE Systems' future outlook depends on its ability to capitalize on opportunities and mitigate risks.

- Strategic Partnerships: Forming strategic alliances to leverage complementary expertise and access new markets.

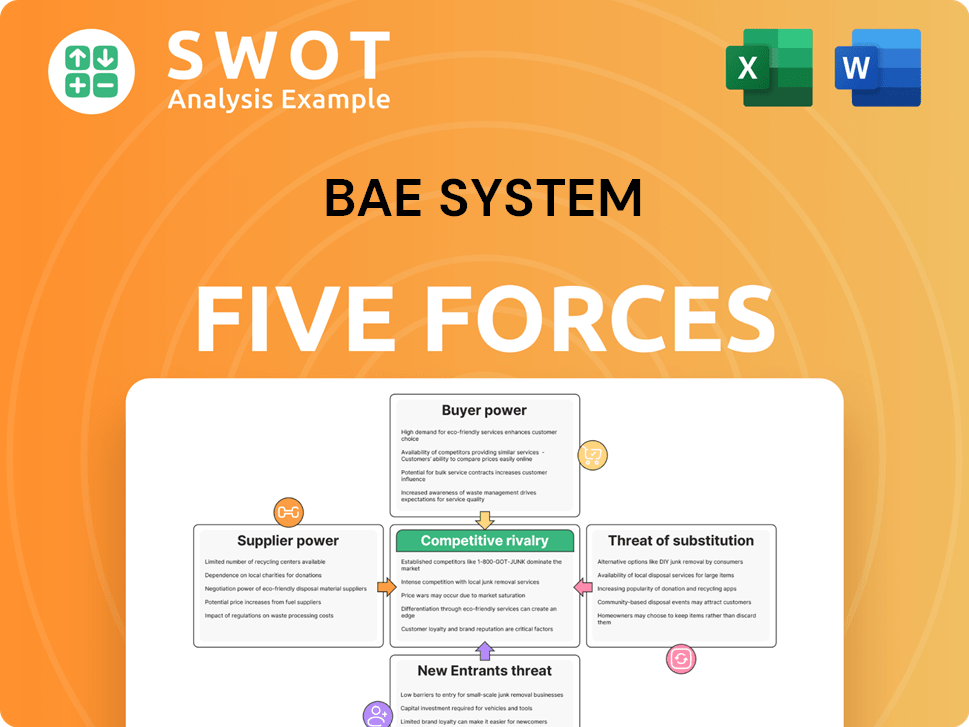

BAE System Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BAE System Company?

- What is Growth Strategy and Future Prospects of BAE System Company?

- How Does BAE System Company Work?

- What is Sales and Marketing Strategy of BAE System Company?

- What is Brief History of BAE System Company?

- Who Owns BAE System Company?

- What is Customer Demographics and Target Market of BAE System Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.