Beiersdorf Bundle

How does Beiersdorf navigate the cutthroat world of skincare?

Founded in 1882, Beiersdorf has evolved from a medical plaster producer to a global skin and personal care giant. This remarkable transformation showcases the company's adaptability and commitment to innovation. Understanding the Beiersdorf SWOT Analysis is crucial to grasping its competitive position within a constantly shifting market.

This exploration of the Beiersdorf competitive landscape will dissect its key rivals and market dynamics. We'll analyze the Beiersdorf market analysis, including Nivea competition and the strategies employed to maintain and grow its skin care market share. Furthermore, the analysis will provide insights into Beiersdorf competitors and the overall cosmetics industry rivals, offering a comprehensive view of the company's strengths and challenges.

Where Does Beiersdorf’ Stand in the Current Market?

Beiersdorf AG holds a significant position in the global skin and personal care industry, particularly in dermocosmetics and mass-market skincare. The company's diverse brand portfolio and strategic market positioning contribute to its competitive advantages. Beiersdorf's operations are segmented into Consumer, which includes skincare brands like Nivea, Eucerin, and La Prairie, and tesa, specializing in adhesive solutions.

The company's market presence spans across Europe, Asia, and Latin America, with ongoing expansion in emerging markets. Beiersdorf targets a broad consumer base, from mass-market through Nivea to premium segments with La Prairie, and those seeking dermatological solutions via Eucerin. Over time, Beiersdorf has strategically focused on premiumization and digitalization across its brand portfolio, including investments in e-commerce and personalized skincare solutions.

For the fiscal year 2023, Beiersdorf reported sales of €9.4 billion, marking a significant organic increase of 10.8% compared to the previous year. The Consumer Business Segment achieved organic sales growth of 12.2%, reaching €7.8 billion. This performance underscores the segment's robust health and its contribution to the overall company's success. Beiersdorf’s operating profit (EBIT) for the Consumer Business Segment also saw a substantial increase, reaching €1.2 billion in 2023, with an EBIT margin of 15.3%. These figures highlight Beiersdorf's strong financial health and its ability to generate significant profits compared to industry averages.

Beiersdorf's Nivea brand is consistently ranked among the leading skincare brands globally, demonstrating strong consumer loyalty. The company has a particularly strong position in the European skincare market. Beiersdorf continues to invest in regions like China and North America to solidify its global standing.

In 2023, the Consumer Business Segment reported €7.8 billion in sales, with an organic growth of 12.2%. The operating profit (EBIT) for the Consumer Business Segment reached €1.2 billion, with an EBIT margin of 15.3%. This financial success showcases the effectiveness of Beiersdorf's business strategies.

Beiersdorf emphasizes premiumization and digitalization across its brand portfolio. Investments in e-commerce and personalized skincare solutions are key strategies. The company aims to expand its footprint in emerging markets to drive further growth.

The company caters to a broad range of customer segments, from mass-market consumers with Nivea to premium and luxury segments with La Prairie. Eucerin targets those seeking dermatological solutions. This diversified approach allows Beiersdorf to capture a wide range of consumers.

Understanding the Growth Strategy of Beiersdorf is crucial for a comprehensive Beiersdorf competitive landscape analysis. Key factors include Beiersdorf's market share in Europe and its global market presence. The company's financial performance versus competitors and analysis of its brand portfolio are also important.

- Beiersdorf's strengths include a strong brand portfolio and global presence.

- The company focuses on innovation in skincare and effective marketing strategies.

- Digital transformation and e-commerce are key competitive factors.

- Ongoing strategic alliances and partnerships support Beiersdorf's growth.

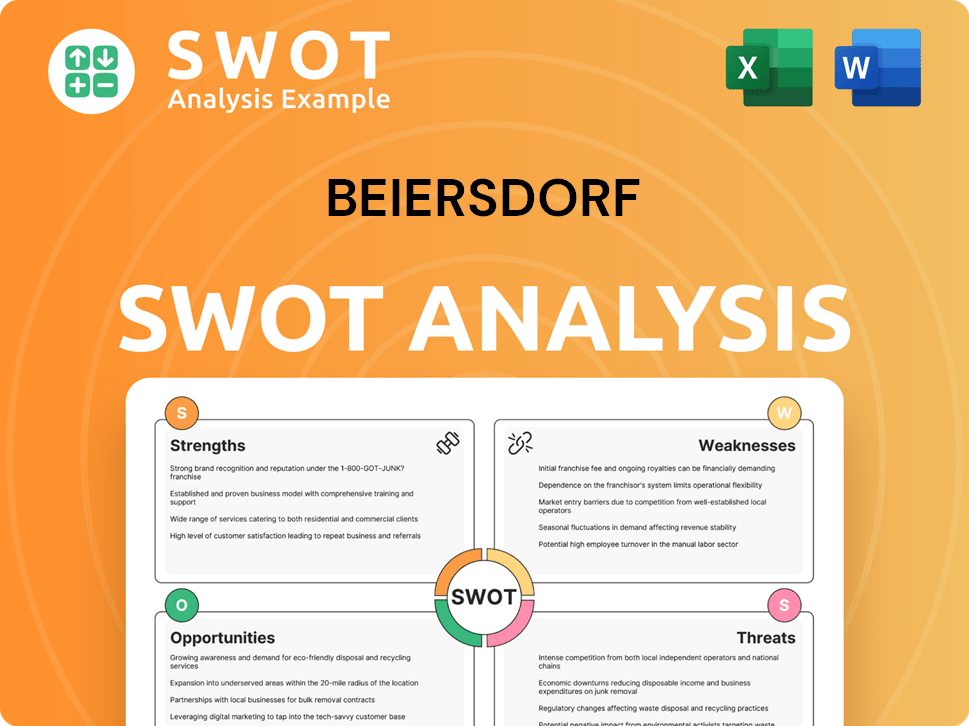

Beiersdorf SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Beiersdorf?

The Beiersdorf competitive landscape is intensely contested, with both global and specialized players vying for market share. This competition spans across its consumer and tesa segments, requiring the company to continually adapt its strategies to maintain its position. Understanding the key players and their strategies is crucial for assessing Beiersdorf's market analysis and future prospects.

The Beiersdorf competitors employ various tactics, from aggressive marketing and innovation to leveraging economies of scale and strong brand recognition. The rise of digital platforms and emerging markets further intensifies the competition, creating new challenges and opportunities for all players involved. For a deeper dive, consider reading the Brief History of Beiersdorf.

L'Oréal, Unilever, Procter & Gamble (P&G), and Estée Lauder are among the most significant competitors in Beiersdorf's consumer segment. These companies compete across various skincare categories, challenging Beiersdorf's brands directly. They often use diverse strategies, including innovation, marketing, and leveraging distribution networks.

L'Oréal's wide-ranging portfolio, including Garnier, Maybelline, and La Roche-Posay, poses a significant challenge. L'Oréal is known for its aggressive innovation and marketing campaigns, which directly impact Beiersdorf's market share. The company's diverse brand offerings allow it to compete across different price points and consumer segments.

Unilever, with brands like Dove, Vaseline, and Simple, competes fiercely in mass-market skincare. Unilever often leverages its extensive distribution networks and strong brand recognition to maintain competitive pricing and reach a broad consumer base. Their focus on consumer needs helps them stay relevant.

P&G's Olay and SK-II brands compete in the skincare and prestige beauty segments. P&G focuses on strong brand building and deep consumer insights to capture market share. Their strategic approach to brand development and consumer understanding is a key factor in their competitiveness.

Estée Lauder competes directly with Beiersdorf's La Prairie brand in the high-end skincare market. Estée Lauder's focus on prestige beauty and luxury products positions it as a key player in the premium segment. Their brand reputation and product quality are central to their strategy.

Beiersdorf also faces competition from regional and local brands with strong local market knowledge. These brands often tailor their product offerings to specific consumer preferences and cultural contexts. Their ability to adapt quickly and understand local markets is a key advantage.

The skin care market share is influenced by various factors, including innovation, marketing, and distribution. Nivea competition comes from both established and emerging brands. The cosmetics industry rivals continually adapt their strategies. Beiersdorf's global market presence is challenged by competitors in both developed and emerging markets. The competitive threats to Beiersdorf include both direct competitors and disruptive forces from independent brands. Beiersdorf's strategic alliances and partnerships are essential for navigating the competitive landscape.

- Beiersdorf's strengths and weaknesses are constantly tested by its rivals.

- Beiersdorf's product range comparison reveals the need for continuous innovation.

- The impact of e-commerce on Beiersdorf's competition is significant, with direct-to-consumer models gaining importance.

- Beiersdorf's marketing strategies compared to rivals highlight the importance of digital marketing and influencer engagement.

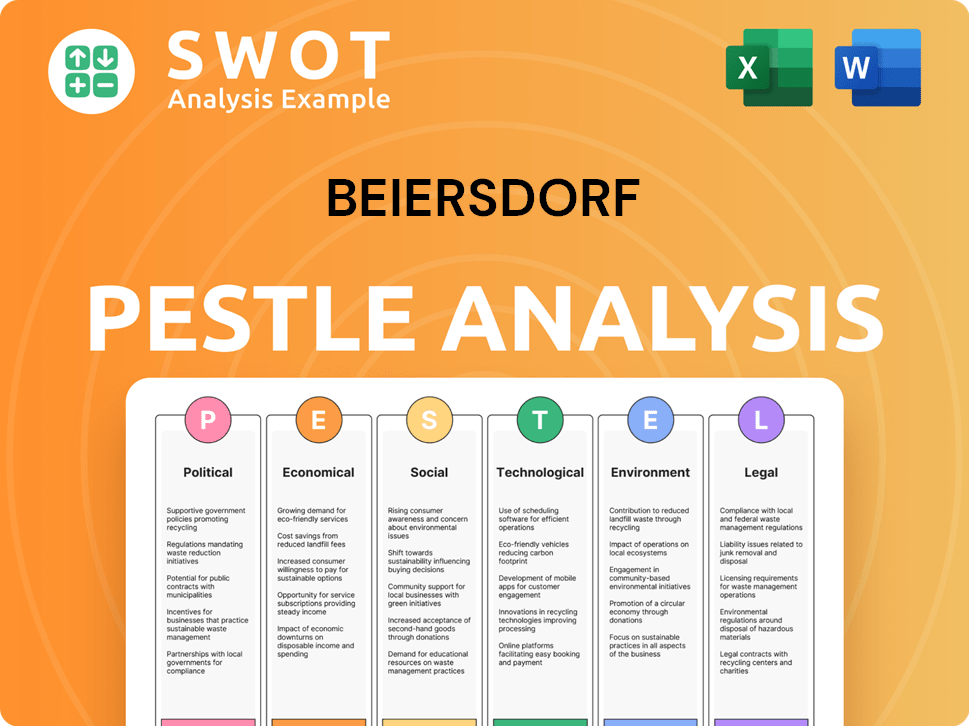

Beiersdorf PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Beiersdorf a Competitive Edge Over Its Rivals?

Understanding the Beiersdorf competitive landscape involves assessing its key strengths and how they position the company against its rivals. The company's success is built upon a foundation of strong brand equity, particularly with its flagship brand, Nivea. This, combined with significant investments in research and development, and a robust global distribution network, allows Beiersdorf to maintain a competitive edge in the cosmetics and skincare industry.

Analyzing Beiersdorf's market analysis reveals its strategic advantages. The company's focus on dermatological expertise, evident in brands like Eucerin, and its presence in the premium market with La Prairie, highlights its ability to cater to diverse consumer needs. These factors contribute to its ability to sustain and grow its market share, even in a highly competitive environment. For a deeper look into the business model, consider reading about the Revenue Streams & Business Model of Beiersdorf.

Beiersdorf's competitive advantages are multifaceted, ensuring its resilience in the face of Nivea competition and other cosmetics industry rivals. These advantages include a strong brand portfolio, extensive R&D capabilities, and a well-established global distribution network. These elements collectively contribute to Beiersdorf's sustained success and market leadership.

Nivea's strong brand recognition and consumer loyalty are key strengths. The brand's heritage and reputation for quality allow Beiersdorf to maintain a significant market share. This brand equity helps in navigating the competitive landscape and maintaining consumer preference.

Beiersdorf's commitment to R&D, particularly in skin science, is another critical advantage. The company continually innovates, developing patented ingredients and advanced formulations for brands like Eucerin and La Prairie. These innovations create a barrier to entry for competitors.

A well-established global distribution network allows Beiersdorf to reach diverse markets efficiently. This broad reach, coupled with strong retailer relationships, ensures high product availability and visibility worldwide. Economies of scale in manufacturing also contribute to cost efficiencies.

Beiersdorf's focus on dermatological expertise, especially through Eucerin, appeals to consumers with specific skin concerns. This scientific approach to skincare differentiates the company from competitors. La Prairie's ultra-premium positioning further enhances this advantage.

Beiersdorf's competitive advantages are multifaceted, supporting its strong market position. The company's brand equity, R&D, and global distribution network contribute significantly to its success. These advantages are crucial in a competitive environment.

- Brand Strength: Nivea remains a cornerstone, with a global presence and strong consumer trust.

- Innovation: Continuous investment in R&D leads to patented technologies and advanced formulations.

- Distribution: A robust global network ensures product availability and market reach.

- Financial Performance: Beiersdorf's financial results reflect its competitive strengths, with consistent revenue growth and profitability. In 2023, the company reported organic sales growth of 10.8% (Beiersdorf AG, 2024).

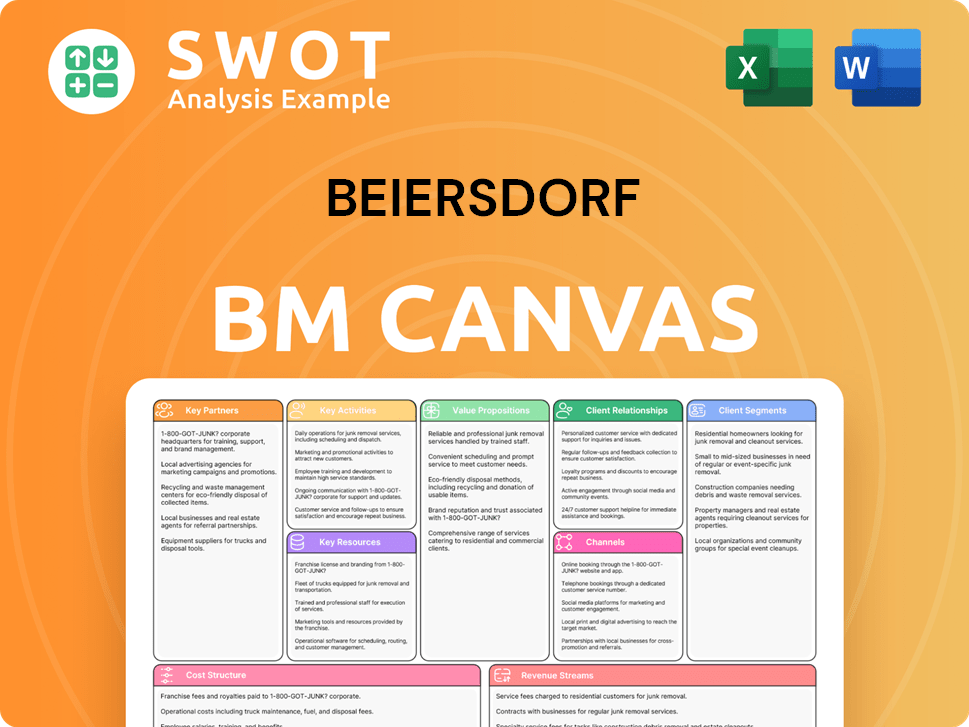

Beiersdorf Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Beiersdorf’s Competitive Landscape?

The skin and personal care industry is experiencing significant shifts, influencing the Beiersdorf competitive landscape. Trends like personalized skincare, sustainability, and digital commerce are reshaping market dynamics. These changes present both challenges and opportunities for companies like Beiersdorf, which must adapt to maintain and grow their market share. The Beiersdorf market analysis shows the company needs to navigate these evolving consumer preferences and technological advancements to stay competitive.

The industry is also seeing increased regulatory scrutiny regarding ingredient safety and environmental impact. Economic factors, including inflation and currency fluctuations, add further complexity. Companies must innovate and adapt to stay ahead. Understanding the Beiersdorf competitors and their strategies is crucial for success in this dynamic environment.

Key trends include personalized skincare through AI and data analytics, a rising demand for clean beauty, and a focus on sustainable packaging. These trends are driving innovation and product development across the sector. Consumers are increasingly seeking products that are both effective and environmentally friendly. These shifts are changing how companies like Beiersdorf approach product development and marketing.

Challenges include the need for significant R&D investments in sustainable practices and increased competition from digitally native brands. Economic pressures, such as inflation and currency fluctuations, can affect raw material costs and consumer spending. Navigating these challenges requires strategic agility and a focus on efficiency. The Nivea competition is also intensifying, requiring continuous innovation.

Opportunities include leveraging R&D for personalized and sustainable skincare, expansion into emerging markets, and strategic partnerships to accelerate innovation. Strengthening dermatological brands and capitalizing on the health and well-being trend also present significant growth avenues. The company can also benefit from understanding the skin care market share dynamics.

The company is deploying strategies such as continuous portfolio optimization, digitalization initiatives, and a strong focus on sustainability. Its competitive position is likely to evolve towards a more digitally integrated and environmentally conscious enterprise. These efforts aim to capitalize on new growth avenues while mitigating emerging risks. The Cosmetics industry rivals are also adapting.

Beiersdorf must balance innovation with cost management to maintain its market position. Strategic partnerships can enhance its capabilities in areas like digital marketing and sustainable packaging. A focus on consumer insights and data analytics will be crucial for personalized product development. For more insights, explore the Target Market of Beiersdorf.

- Invest in R&D for sustainable and personalized products.

- Expand into emerging markets with tailored strategies.

- Form strategic partnerships to enhance innovation and market reach.

- Prioritize digital transformation and e-commerce capabilities.

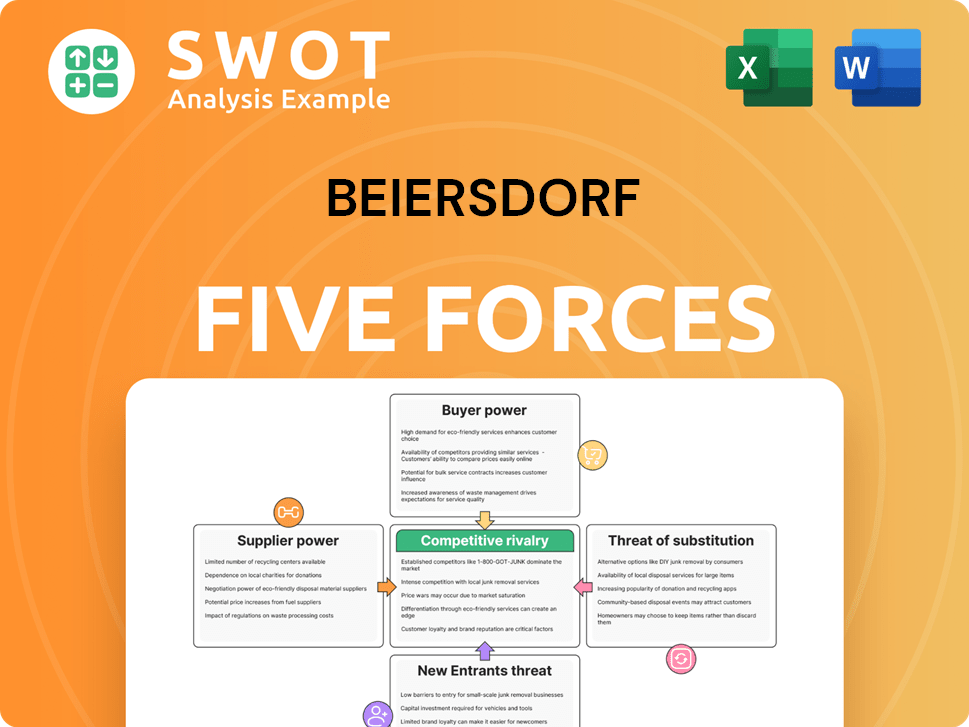

Beiersdorf Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Beiersdorf Company?

- What is Growth Strategy and Future Prospects of Beiersdorf Company?

- How Does Beiersdorf Company Work?

- What is Sales and Marketing Strategy of Beiersdorf Company?

- What is Brief History of Beiersdorf Company?

- Who Owns Beiersdorf Company?

- What is Customer Demographics and Target Market of Beiersdorf Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.