Belden Bundle

How Does Belden Inc. Stack Up in Today's Tech-Driven Market?

The industrial automation and network infrastructure sectors are undergoing a massive shift, and Belden Company is right in the thick of it. With a strategic focus on industrial networking and cybersecurity, Belden is positioning itself to meet the growing demand for high-performance connectivity solutions. Understanding the Belden SWOT Analysis is key to grasping its market position.

This analysis dives deep into the Belden competitive landscape, providing a detailed look at its key rivals and market share. We'll explore Belden's competitive advantages, evaluating its market position and strategies for growth within the Belden industry. Furthermore, this report will dissect Belden's financial performance compared to its competitors, offering actionable insights for investors and industry professionals alike, addressing questions like "Who are Belden's top competitors in the industrial automation market?" and "How does Belden compare to its competitors in terms of innovation?"

Where Does Belden’ Stand in the Current Market?

Belden Inc. holds a significant position in the signal transmission solutions market, particularly within the industrial automation, enterprise, and broadcast sectors. A thorough Belden market analysis reveals that the company is consistently recognized as a leading provider of connectivity and networking products. Its core operations revolve around offering a broad range of products, including industrial cables, connectors, network devices, and cybersecurity solutions.

The value proposition of Belden lies in its ability to provide reliable and high-performance solutions for data, audio, and video applications. This is supported by its strong global presence, which allows it to cater to diverse customer segments across North America, Europe, and Asia. Belden's strategic shift towards higher-value networking and cybersecurity solutions reflects the broader digital transformation occurring in its target industries, enhancing its market competitiveness.

Financially, Belden demonstrates robust performance, supported by consistent revenue streams and strategic acquisitions. For instance, in Q1 2024, Belden reported strong financial results, showcasing its continued strength in the market. The company's specialized knowledge and comprehensive product portfolio provide a significant competitive edge, particularly in industrial networking and infrastructure.

Belden's market share fluctuates but consistently places it among the top players in its specialized segments. The company's strong position is supported by its extensive product range and global distribution network. This allows Belden to maintain a competitive edge in the Belden competitive landscape.

Belden has a strong global presence, serving customers in North America, Europe, Asia, and other key regions. This extensive reach allows the company to cater to diverse customer segments. Its global footprint is a key factor in its ability to compete effectively.

Belden's product lines include industrial cables, connectors, network devices, and cybersecurity solutions. These products are designed for reliable and high-performance data, audio, and video applications. The breadth of its portfolio allows Belden to serve a wide range of customer needs.

Belden's financial performance demonstrates a robust scale, supported by consistent revenue streams and strategic acquisitions. The company's financial health supports its ability to invest in innovation and expansion. This is a key factor in understanding Belden's market position analysis.

Belden’s strengths include its established brand, extensive product range, and global distribution network. The company strategically focuses on higher-value networking and cybersecurity solutions. For more insights, consider reading about the Marketing Strategy of Belden.

- Focus on high-value solutions.

- Global distribution network.

- Strategic acquisitions to enhance capabilities.

- Strong presence in industrial automation.

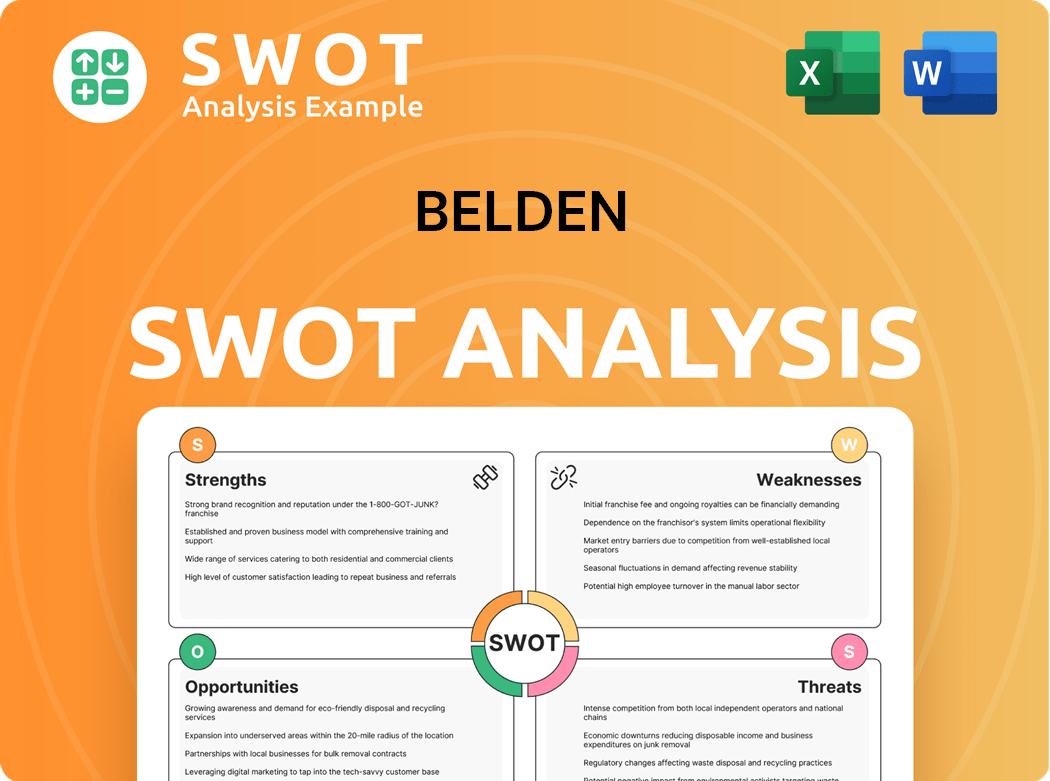

Belden SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Belden?

The Belden competitive landscape is characterized by intense competition across various sectors. The company faces challenges from both direct and indirect competitors, impacting its market share and strategic positioning. Understanding the Belden market analysis requires a deep dive into the strengths, weaknesses, opportunities, and threats (SWOT) posed by its rivals.

Belden company operates in a dynamic environment, constantly adapting to shifts in technology, market demands, and the strategies of its competitors. The Belden industry is influenced by technological advancements, such as the increasing adoption of IoT and the demand for high-speed data transmission, which shapes the competitive dynamics. These factors influence the Belden market position analysis.

Belden's key competitors in data infrastructure include major players such as CommScope, Panduit, and Corning. These companies offer a range of products that directly compete with Belden's offerings. For example, CommScope provides infrastructure solutions for communications networks, including fiber and copper cabling systems.

Rockwell Automation, Siemens, and Schneider Electric are key direct competitors. They offer integrated industrial solutions that compete with Belden's standalone products. For example, Rockwell Automation's PlantPAx system competes with Belden's industrial Ethernet offerings.

CommScope, Panduit, and Corning are major players in this market. They offer cabling and connectivity solutions that compete with Belden's enterprise solutions. Corning, in particular, is significant in the fiber optic market.

Specialized technology providers, SDN vendors, cybersecurity firms, and IoT solution providers indirectly compete. These companies influence network architecture decisions and can affect Belden's market share. Mergers and acquisitions also shift the competitive dynamics.

Belden's market share in specific regions, such as North America, is influenced by its ability to compete with these rivals. The competitive landscape is constantly evolving due to technological advancements and strategic moves by competitors.

Belden's strategies to compete with rivals include focusing on innovation and strategic acquisitions. These moves help Belden to maintain a competitive edge. The company’s ability to adapt to market changes is crucial.

Belden's financial performance compared to competitors is a key indicator of its success. Understanding the financial health of its rivals provides insights into their market strategies and competitive advantages.

Belden's competitive advantages include its specialized product offerings and focus on industrial and enterprise markets. However, the company faces challenges from larger, integrated competitors. Understanding Belden's strengths and weaknesses compared to its rivals is crucial for strategic planning.

- Market Share: In 2024, Belden's market share in specific segments varied, with strong positions in industrial networking and broadcast markets.

- Innovation: Belden continues to invest in research and development to maintain its competitive edge, with recent product launches focused on cybersecurity and high-speed data transmission.

- Acquisitions: Recent acquisitions have expanded Belden's product portfolio and market reach, such as the acquisition of Netscout's communication business in 2023.

- Financial Performance: Belden's revenue in 2024 was approximately $2.6 billion, with a focus on improving profitability through operational efficiency and strategic investments.

Belden PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Belden a Competitive Edge Over Its Rivals?

Analyzing the Belden competitive landscape reveals a company that has strategically built its advantages over a long history. Key milestones include significant investments in proprietary technologies and strategic acquisitions to broaden its product portfolio and market reach. These moves have allowed the company to maintain a strong position in the Belden industry, especially in critical infrastructure and industrial applications.

Belden's strategic focus on innovation and customer relationships has consistently provided a competitive edge. The company's ability to adapt to evolving market demands and technological advancements is crucial for its continued success. A deep dive into Belden's market position analysis shows a company that is well-positioned but faces challenges from agile competitors.

Belden's competitive advantages are rooted in its proprietary technologies, brand equity, and operational efficiencies. These strengths are essential for navigating the competitive landscape and driving growth in the data infrastructure and broadcast industries. For more information, check out the Target Market of Belden.

Belden holds numerous patents related to connectivity and networking solutions, reinforcing its technological leadership. Its specialized cable designs and connector technologies are optimized for harsh industrial environments and high-performance applications. These technologies are crucial for maintaining a competitive edge in the Belden market analysis.

The Belden brand is synonymous with quality, reliability, and performance, fostering strong customer relationships. This long-standing reputation helps maintain customer loyalty and repeat business. Customers often specify Belden products due to their proven track record and adherence to industry standards.

Belden's global operational footprint enables efficient supply chain management and responsiveness to regional market demands. Economies of scale in manufacturing and procurement optimize production costs, maintaining competitive pricing. This efficiency is critical for Belden's ability to compete effectively.

A talented pool of experienced engineers, product developers, and industry specialists drives continuous innovation. This expertise supports product development, marketing, and strategic partnerships. Belden's focus on innovation allows it to remain at the forefront of technological advancements.

Belden's competitive advantages include a strong brand reputation, proprietary technologies, and operational efficiencies. These strengths are crucial for navigating the Belden competitive landscape. However, the company faces challenges from rapid technological shifts and agile competitors.

- Proprietary Technologies: Specialized cable designs, connector technologies, and network protocols optimized for harsh environments.

- Brand Equity: A long-standing reputation for quality, reliability, and performance in the industries it serves.

- Economies of Scale: Optimized production costs and efficient supply chain management due to a global operational footprint.

- Talent Pool: Experienced engineers, product developers, and industry specialists driving continuous innovation.

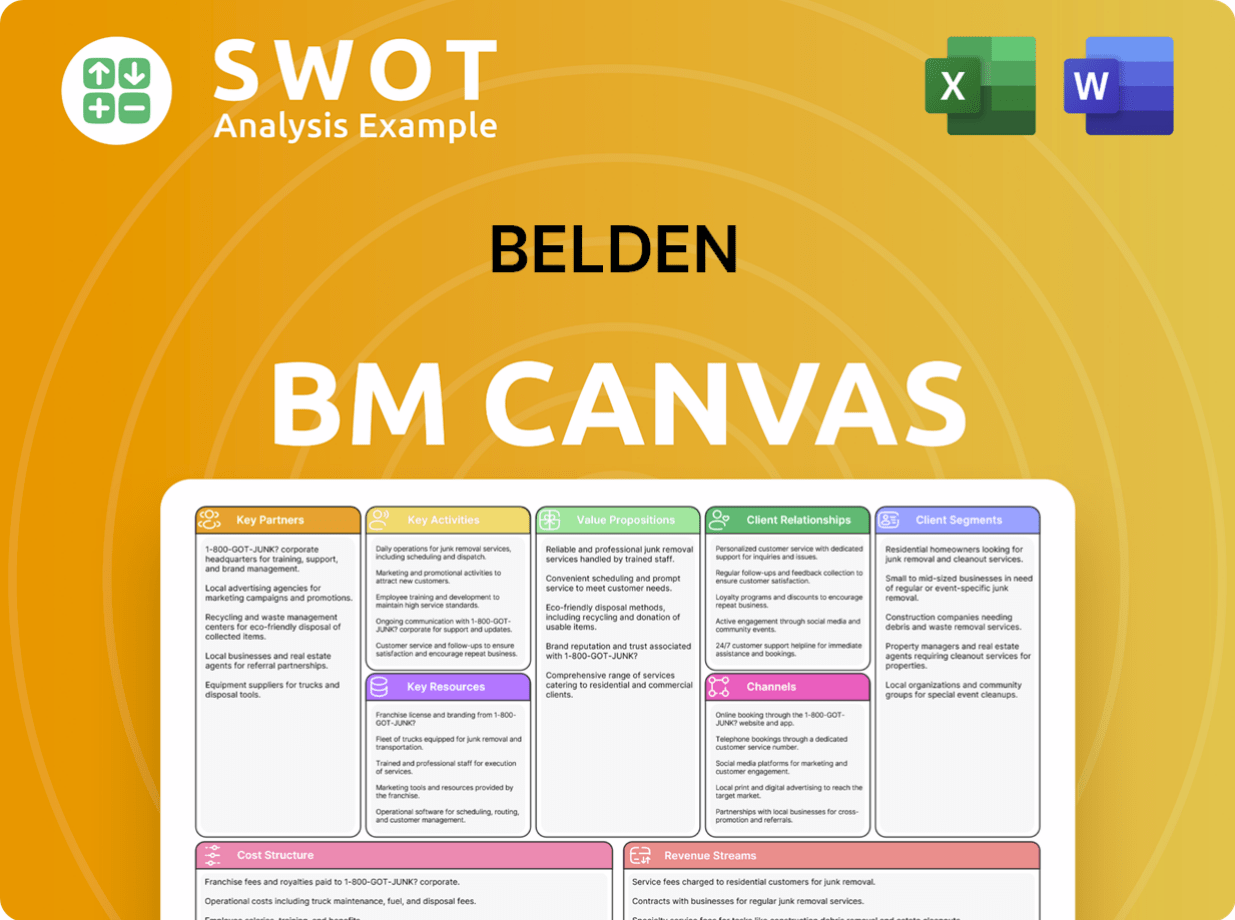

Belden Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Belden’s Competitive Landscape?

The signal transmission and networking industry is currently undergoing significant shifts, presenting both opportunities and challenges for companies like Belden. The rise of the Industrial Internet of Things (IIoT) and Industry 4.0 is driving demand for robust connectivity solutions, while the increasing focus on cybersecurity across all industries creates a need for integrated security products. These trends are reshaping the Belden company's competitive landscape.

Technological advancements, such as 5G and the expansion of fiber optics, are pushing for higher speeds and greater data capacity, necessitating continuous innovation. Regulatory changes and evolving consumer preferences for integrated solutions further influence the market. Understanding these trends is crucial for analyzing the Belden competitive landscape and its future prospects.

The adoption of IIoT and Industry 4.0 is accelerating, demanding robust connectivity solutions. Cybersecurity is becoming increasingly critical, driving demand for integrated security offerings. 5G networks and fiber optic expansion are pushing for higher speeds and data capacity. These trends directly impact Belden's market analysis.

Potential challenges include the emergence of new market entrants specializing in AI-driven network management. Declining demand in legacy product lines and increased regulation in certain sectors could also pose threats. Aggressive new competitors with disruptive technologies may challenge Belden's market position. These factors influence the Belden competitive landscape.

Significant growth opportunities exist in emerging markets experiencing rapid industrialization. Product innovations in areas like edge computing and advanced analytics offer avenues for expansion. Strategic partnerships with software providers or system integrators can enhance market reach. These opportunities can help Belden grow its market share.

Belden is strategically deploying resources to capitalize on opportunities, focusing on expanding its industrial networking and cybersecurity portfolios. The company is investing in R&D for next-generation technologies and strengthening its global presence. This approach aims to evolve its competitive position in the dynamic Belden industry.

Belden needs to navigate the evolving competitive landscape by focusing on innovation, strategic partnerships, and global expansion. The company's ability to adapt to technological advancements and regulatory changes will be crucial. The company's success will depend on its ability to capitalize on growth opportunities in emerging markets and its response to potential challenges. Belden's market position analysis is key to this.

- Prioritize investments in R&D to stay ahead of technological advancements.

- Form strategic partnerships to enhance market reach and solution capabilities.

- Expand presence in emerging markets with high growth potential.

- Strengthen cybersecurity offerings to meet increasing demand.

Belden Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Belden Company?

- What is Growth Strategy and Future Prospects of Belden Company?

- How Does Belden Company Work?

- What is Sales and Marketing Strategy of Belden Company?

- What is Brief History of Belden Company?

- Who Owns Belden Company?

- What is Customer Demographics and Target Market of Belden Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.