Belden Bundle

Can Belden Inc. Continue its Century-Long Evolution?

Belden Inc., a titan in signal transmission, has strategically pivoted towards industrial automation and enterprise solutions. From its humble beginnings in 1902, Belden has consistently adapted, transforming from a wire and cable manufacturer into a global leader. This Belden SWOT Analysis provides insights into the company's current position and future trajectory.

This in-depth Belden company analysis explores the company's growth strategy, examining its strategic initiatives and how they contribute to its market share and financial performance. We'll dissect Belden's future prospects, considering industry trends and the competitive landscape to forecast its revenue growth. Furthermore, we'll evaluate Belden's long-term investment potential, including an overview of its business model and sustainable growth strategies.

How Is Belden Expanding Its Reach?

The expansion initiatives of the company are primarily focused on strengthening its position in high-growth industrial automation and smart building markets. These efforts are supported by strategic portfolio optimization, including targeted mergers and acquisitions (M&A) and strategic divestitures. This approach allows the company to focus on core, higher-growth segments and enhance its competitive advantage in a rapidly transforming digital landscape.

Geographically, the company aims to expand its reach in emerging markets while solidifying its presence in established regions. This involves developing tailored solutions for specific regional needs and leveraging its global distribution networks. Product pipeline expansion is also a critical component, with ongoing development of new products and services to meet the evolving demands of industrial IoT, cybersecurity, and advanced networking.

The company's emphasis on recurring revenue streams through software and services further highlights its strategic shift towards higher-value offerings. This shift is designed to capture new customer segments and adapt to industry changes. These initiatives are vital for sustaining Belden's future prospects and achieving long-term growth.

The company has historically focused on acquiring companies that enhance its industrial automation and enterprise solutions. This strategy allows it to provide more comprehensive solutions and diversify its revenue streams. Strategic divestitures, such as the sale of more cyclical businesses, further streamline the focus on core, higher-growth segments.

The company continues to pursue opportunities in emerging markets while solidifying its strongholds in established regions. This involves developing tailored solutions for specific regional needs and leveraging its global distribution networks. This expansion is critical for increasing its global market presence.

Ongoing development of new products and services addresses the evolving demands of industrial IoT, cybersecurity, and advanced networking. These initiatives are driven by the need to stay ahead of industry changes and capture new customer segments. This approach enhances the company's product portfolio expansion.

The company is strategically shifting towards higher-value offerings by emphasizing recurring revenue streams through software and services. This shift is designed to capture new customer segments and adapt to industry changes. This helps to drive

The company's expansion strategies are multifaceted, focusing on both organic growth and strategic acquisitions. These initiatives are designed to enhance the company's competitive advantage and drive long-term value. The overall aim is to capitalize on

- Strategic M&A to acquire companies with complementary technologies and market access.

- Geographic expansion into emerging markets and strengthening positions in established regions.

- Product pipeline expansion to meet evolving customer demands in industrial IoT and cybersecurity.

- Emphasis on recurring revenue streams through software and services.

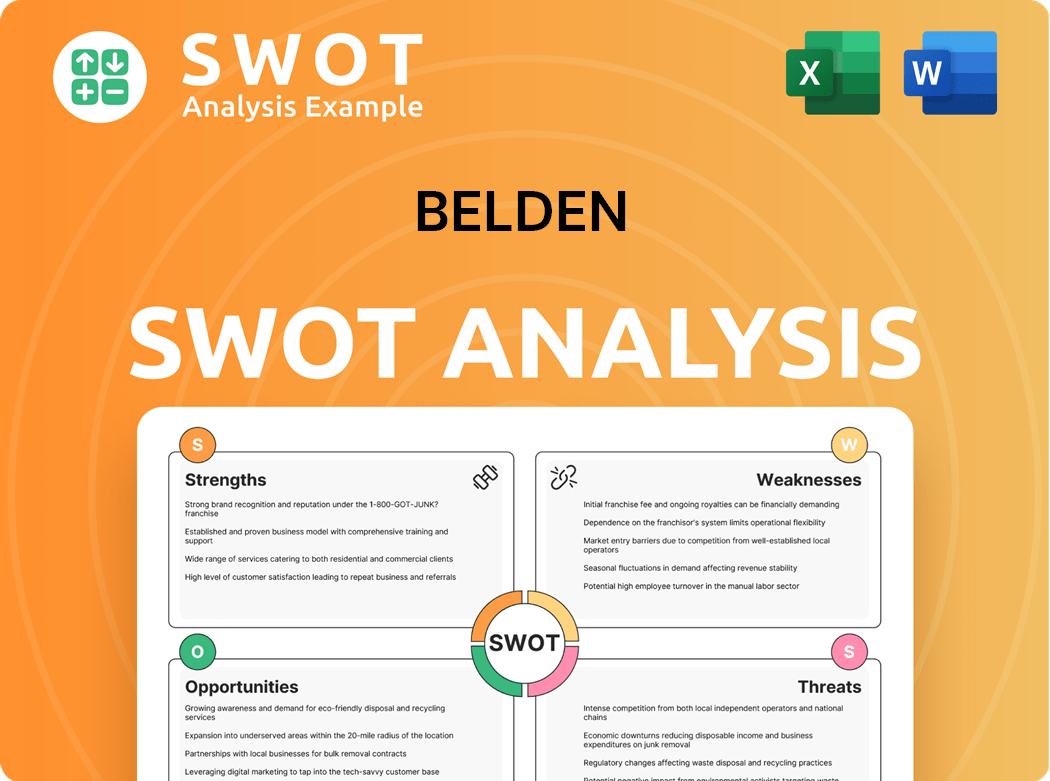

Belden SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Belden Invest in Innovation?

The innovation and technology strategy of the company is crucial for its sustained growth. This strategy focuses on providing advanced signal transmission solutions for an increasingly connected world. The company invests heavily in research and development (R&D) to foster both internal innovation and strategic partnerships. This approach is essential for maintaining and expanding its position in the market.

Digital transformation is a key aspect of the company's strategy, demonstrated through its development of intelligent infrastructure solutions. These solutions leverage technologies such as the Industrial Internet of Things (IIoT) and advanced analytics. This enables customers to achieve greater operational efficiency and gain valuable insights. The company's focus on cutting-edge technologies extends to cybersecurity, recognizing the critical need for secure data transmission in industrial and enterprise environments.

The company is actively involved in sustainability initiatives, developing energy-efficient products and solutions. This commitment to sustainability helps the company contribute to a greener infrastructure. Technological advancements directly contribute to the company's growth objectives by enabling new market opportunities and strengthening its competitive differentiation. For a deeper understanding of how the company approaches its market, consider exploring the Marketing Strategy of Belden.

The company allocates a significant portion of its resources to research and development. This investment is crucial for driving innovation and maintaining a competitive edge. The company’s R&D spending is a key factor in its long-term growth strategy.

The company develops and implements Industrial Internet of Things (IIoT) solutions. These solutions help customers optimize their operations and improve efficiency. IIoT is a critical technology for the company's future prospects.

The company prioritizes cybersecurity in its product development. This focus addresses the growing need for secure data transmission in industrial and enterprise environments. Cybersecurity solutions are essential for the company's market share.

The company is committed to sustainability, developing energy-efficient products. These efforts contribute to a greener infrastructure and align with global sustainability trends. This commitment supports the company's long term investment potential.

The company continuously innovates its product portfolio to meet evolving market demands. This includes advancements in industrial Ethernet connectivity and high-performance cabling. Product innovation is central to the company's business model.

The company engages in strategic collaborations to enhance its technological capabilities. These partnerships help accelerate innovation and expand market reach. Strategic alliances are key to the company's competitive landscape analysis.

The company's technological advancements have a significant impact on its financial performance and market position. These innovations drive revenue growth and strengthen its competitive differentiation. The company’s focus on cutting-edge technologies enables it to capture new market opportunities.

- Industrial Ethernet Connectivity: The company has made significant strides in industrial Ethernet connectivity, providing robust and reliable solutions for industrial automation. This has led to increased efficiency and reduced downtime for customers.

- High-Performance Cabling: The development of high-performance cabling solutions ensures secure and efficient data transmission. This is crucial for supporting the growing bandwidth demands of modern industrial applications.

- Cybersecurity Solutions: The company's cybersecurity solutions protect critical infrastructure from cyber threats. This enhances network security and reliability, addressing a major concern for industrial and enterprise clients.

- IIoT Integration: The company's integration of IIoT technologies enables real-time data analysis and automated processes. This optimizes production and provides valuable insights for customers.

Belden PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Belden’s Growth Forecast?

The financial outlook for the company reflects a strategic shift towards higher-growth markets, particularly in industrial automation and enterprise solutions. This strategic realignment is designed to enhance financial performance and create a more resilient business model, contributing to the overall Brief History of Belden.

For the first quarter of 2024, the company reported revenues of $622.6 million and an adjusted earnings per share (EPS) of $1.39, showcasing a solid start to the year. The full-year 2024 guidance anticipates revenues between $2.55 billion and $2.60 billion, with adjusted EPS projected to be in the range of $6.05 to $6.35. This indicates a focus on achieving stable growth and improved profitability, which is crucial for the company's future prospects.

The company's financial strategy includes operational efficiency and disciplined capital allocation. This involves expanding profit margins through cost optimization and a shift towards higher-value product offerings. Investment levels are strategically directed towards research and development (R&D) and mergers and acquisitions (M&A) activities that support its long-term growth objectives in industrial and enterprise markets. This approach aims to drive sustainable growth and enhance the company's market share.

The company's revenue for Q1 2024 was $622.6 million, demonstrating a strong start. The full-year 2024 revenue is projected to be between $2.55 billion and $2.60 billion, reflecting the company's growth strategy.

Adjusted EPS for Q1 2024 was $1.39. The company forecasts adjusted EPS between $6.05 and $6.35 for the full year 2024, indicating improved financial performance.

Investments are focused on R&D and M&A to support long-term growth in industrial and enterprise markets. These investments are key to the company's product portfolio expansion and technological advancements.

The company aims to expand profit margins through cost optimization and a focus on higher-value product offerings. This is a part of the sustainable growth strategies.

The company's financial performance is driven by strategic initiatives and market opportunities. These initiatives are critical for long term investment potential.

- Revenue growth is supported by a focus on industrial automation and enterprise solutions.

- Adjusted EPS targets reflect improved profitability and operational efficiency.

- Strategic investments in R&D and M&A are designed to drive long-term growth and enhance the company's competitive landscape analysis.

- The company's financial performance is aligning with industry trends, indicating a move towards more predictable and sustainable growth.

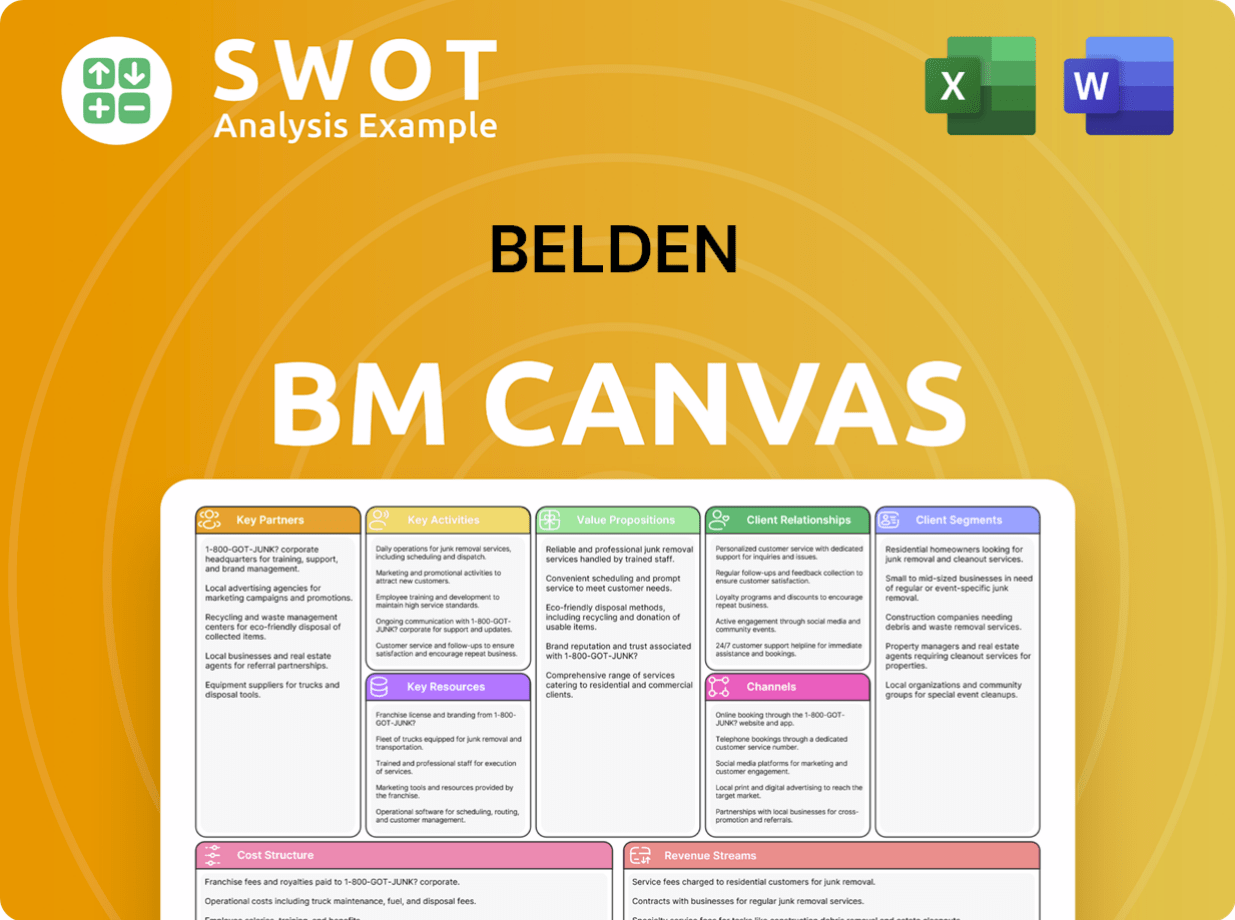

Belden Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Belden’s Growth?

The growth strategy and future prospects of the company are subject to various risks and obstacles. These challenges span from intense competition and technological disruption to supply chain vulnerabilities and regulatory changes. Understanding these potential pitfalls is crucial for assessing the company's long-term viability and investment potential.

One of the primary concerns for the company is the highly competitive landscape within the signal transmission and networking industry. Rapid technological advancements and the emergence of new competitors demand continuous innovation and strategic adaptation. The company's ability to maintain its market share and pricing power will be critical for its future success.

Furthermore, the company must navigate evolving regulatory environments and geopolitical uncertainties. Compliance with data security standards, environmental regulations, and international trade policies can impose significant costs and operational challenges. The company’s strategic agility and risk management capabilities will be essential for mitigating these impacts.

The company faces stiff competition from both established players and emerging disruptors. This competitive dynamic can impact the company's Belden market share and pricing strategies. Staying ahead requires continuous innovation and strategic investments.

Rapid technological advancements necessitate continuous adaptation. Failure to embrace new technologies or respond quickly to competitors' innovations could hinder the company's growth. Strategic investments in R&D are essential.

Geopolitical events and economic volatility can disrupt supply chains. Disruptions in the availability of raw materials or electronic components could lead to production delays and increased expenses. Diversification of suppliers is critical.

Evolving regulations, particularly concerning data security and environmental standards, can increase operational costs. Compliance burdens and international trade policies can affect operational costs. Staying informed and adaptable is key.

Internal resource constraints, such as the availability of skilled talent, can hinder growth initiatives. Securing and retaining talent in specialized areas is crucial for innovation and expansion. Strategic workforce planning is vital.

Increasingly sophisticated cyber threats pose a significant risk. Protecting data and infrastructure requires continuous investment in cybersecurity measures. Robust security protocols are essential for maintaining customer trust.

The company employs a comprehensive risk management framework to address these challenges. This includes diversifying its product portfolio and customer base to mitigate market-specific downturns. Scenario planning helps assess potential impacts of various market and regulatory shifts.

The company continuously monitors

Belden Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Belden Company?

- What is Competitive Landscape of Belden Company?

- How Does Belden Company Work?

- What is Sales and Marketing Strategy of Belden Company?

- What is Brief History of Belden Company?

- Who Owns Belden Company?

- What is Customer Demographics and Target Market of Belden Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.