BE Semiconductor Industries Bundle

How Does BE Semiconductor Industries Stack Up in the Semiconductor Arms Race?

The semiconductor industry is a battleground of innovation and fierce competition, with companies constantly vying for technological supremacy. BE Semiconductor Industries (Besi) stands as a key player in this dynamic landscape, specializing in advanced assembly equipment. But how does Besi navigate this complex environment, and what strategies does it employ to maintain its position?

This detailed market analysis explores the BE Semiconductor Industries SWOT Analysis, dissecting its competitive advantages and uncovering the strategies that have propelled its growth. By examining its rivals and industry trends, we gain a comprehensive understanding of Besi's market share analysis and future outlook within the ever-evolving semiconductor industry. The analysis will also shed light on the impact of global chip shortages and industry regulations, providing valuable insights for investors and industry professionals alike.

Where Does BE Semiconductor Industries’ Stand in the Current Market?

BE Semiconductor Industries N.V. (Besi) holds a strong market position within the global semiconductor assembly equipment industry. The company specializes in advanced packaging equipment, a critical segment experiencing significant growth due to the increasing complexity and miniaturization of semiconductor devices. The Owners & Shareholders of BE Semiconductor Industries benefit from the company's strategic focus.

Besi's core operations revolve around the design, manufacturing, and sale of assembly equipment used in the production of semiconductor devices. Its product portfolio includes die attach, wire bond, and flip-chip systems. Besi's value proposition lies in providing cutting-edge technology and solutions that enable its customers to produce smaller, faster, and more efficient microchips. This focus on advanced packaging has allowed Besi to maintain robust financial health.

The company's geographic presence is particularly strong in Asia, which accounts for a substantial portion of the global semiconductor manufacturing capacity, alongside significant operations in Europe and North America. Besi serves a diverse customer base, including integrated device manufacturers (IDMs), outsourced semiconductor assembly and test (OSAT) companies, and other electronics manufacturers. Besi's strategic shift towards higher-margin, advanced packaging solutions aligns with industry trends.

While specific market share figures for 2024-2025 are still emerging, Besi has historically been recognized as a key player in its niche. The company's strong position in advanced packaging technologies, particularly in hybrid bonding, is expected to be a significant growth driver in the coming years. Besi's focus on this segment places it at the forefront of the semiconductor industry.

Besi reported strong financial results in its Q1 2024 earnings, indicating continued demand for its advanced equipment. This financial performance demonstrates the company's ability to capitalize on industry trends. The company's strategic focus on advanced packaging solutions has allowed Besi to maintain robust financial health compared to industry averages.

Besi's primary product lines include a comprehensive range of assembly equipment such as die attach, wire bond, and flip-chip systems. These systems cater to various stages of semiconductor device manufacturing. The company's product portfolio is designed to meet the evolving needs of the semiconductor industry.

Besi serves a diverse customer base comprising integrated device manufacturers (IDMs), outsourced semiconductor assembly and test (OSAT) companies, and other electronics manufacturers. This diverse customer base helps to ensure the company's stability. This broad customer base supports Besi's market position.

Besi's competitive advantages include its focus on advanced packaging, strong geographic presence in Asia, and a diverse customer base. The company's strategic shift towards higher-margin solutions has also contributed to its success. These advantages are crucial in the competitive landscape of the semiconductor industry.

- Specialization in advanced packaging equipment.

- Strong presence in key manufacturing regions.

- Robust financial performance.

- Diverse and stable customer base.

BE Semiconductor Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BE Semiconductor Industries?

The competitive landscape within the semiconductor industry is intensely dynamic, and understanding the key players is crucial for market analysis. Growth Strategy of BE Semiconductor Industries is significantly influenced by its position relative to its competitors, industry trends, and the evolving technological demands of its customer base.

The primary focus is on the semiconductor assembly equipment market, where companies compete on innovation, product offerings, and service capabilities. The competitive dynamics are further shaped by factors such as global chip shortages, technological advancements, and the strategic decisions of major players.

The primary direct competitors for BE Semiconductor Industries (Besi) include ASM Pacific Technology (ASMPT), Kulicke & Soffa Industries (K&S), and Shinkawa Electric. These companies offer similar products and services, competing directly for market share.

ASMPT, based in Hong Kong, is a major competitor with a broad portfolio of assembly and packaging solutions. They often compete on scale and the comprehensiveness of their product offerings. In 2024, ASMPT reported a revenue of approximately HKD 18.4 billion, highlighting their significant market presence.

Kulicke & Soffa, headquartered in Singapore, is a strong competitor, particularly in wire bonding and advanced packaging. K&S often competes directly with Besi for key customer contracts. For the fiscal year 2024, K&S reported revenues of around $1.0 billion, demonstrating their continued relevance in the market.

Shinkawa Electric, based in Japan, is another competitor, specializing in assembly equipment. Their focus on specific technologies allows them to compete effectively in niche areas. While specific revenue figures for recent years are not readily available, Shinkawa remains a significant player.

Indirect competition comes from in-house solutions developed by large integrated device manufacturers (IDMs) and emerging players in specialized niches. This competition can impact Besi's market share and strategic positioning. The industry is also subject to mergers and acquisitions, which can reshape the competitive landscape.

Companies compete through various strategies, including economies of scale, innovation, and service networks. Securing contracts for new fabrication plants and winning over major semiconductor manufacturers are key battlegrounds. The focus is on providing faster, more precise, and more efficient assembly processes.

The semiconductor industry is influenced by several factors, including technological advancements, global chip shortages, and industry regulations. These factors affect the competitive landscape and the strategic decisions of companies like Besi.

- Technological Advancements: Continuous innovation in assembly and packaging technologies is crucial.

- Global Chip Shortages: Supply chain disruptions can impact the demand for assembly equipment.

- Industry Regulations: Compliance with environmental and safety standards is essential.

- Mergers and Acquisitions: These can reshape the competitive landscape.

- Emerging Technologies: New materials and assembly techniques may pose future threats.

BE Semiconductor Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BE Semiconductor Industries a Competitive Edge Over Its Rivals?

The competitive landscape within the semiconductor industry is dynamic, with companies constantly vying for technological leadership and market share. Understanding the competitive advantages of key players like BE Semiconductor Industries (Besi) is crucial for investors and industry analysts. Besi's strategic positioning, technological innovations, and customer relationships are pivotal in this landscape.

Besi's success hinges on its ability to innovate and adapt to evolving industry trends. The company's focus on advanced packaging solutions, such as hybrid bonding and thermo-compression bonding (TCB), positions it at the forefront of high-performance semiconductor device manufacturing. This proactive approach to technological advancements is a cornerstone of its competitive strategy.

The company's financial performance and market strategies are closely watched by investors and competitors alike. Besi's ability to maintain a strong market position and deliver consistent financial results is a testament to its robust business model and operational efficiency. A detailed market analysis provides insights into Besi's strengths and areas for potential growth.

Besi excels through its proprietary technologies, especially in advanced packaging solutions like hybrid bonding and thermo-compression bonding (TCB). These technologies are vital for producing high-performance semiconductor devices, allowing for smaller and more efficient designs. Besi holds numerous patents, creating a significant barrier to entry for competitors, securing its position in next-generation assembly processes.

The company's strong R&D capabilities enable it to consistently introduce cutting-edge equipment, meeting the evolving demands of the semiconductor industry. This focus on innovation is evident in its product development cycles and its ability to anticipate future market needs, such as the increasing demand for heterogeneous integration. Besi invests significantly in R&D to maintain its technological lead.

Besi benefits from deep-rooted customer relationships, often collaborating closely with leading semiconductor manufacturers to develop tailored solutions. This collaborative approach fosters customer loyalty and provides valuable insights for future product development. These partnerships are crucial for understanding and meeting the specific needs of its clients.

Besi's operational efficiencies and supply chain strengths contribute to its competitive edge. The company's global manufacturing and service network ensures timely delivery and support for its international clientele. While not a low-cost producer, Besi's focus on high-value, high-performance equipment allows it to command premium pricing, contributing to its strong financial performance.

Besi's competitive advantages are primarily rooted in its technological leadership, R&D capabilities, strong customer relationships, and operational efficiencies. These factors collectively contribute to the company's ability to maintain a strong market position and deliver consistent financial results. The company's commitment to innovation and customer collaboration is central to its strategy.

- Technological Innovation: Besi's focus on advanced packaging solutions and continuous R&D investments.

- Customer-Centric Approach: Collaborative partnerships with leading semiconductor manufacturers.

- Operational Excellence: Efficient global manufacturing and service network.

- Financial Performance: Ability to command premium pricing due to high-value products.

BE Semiconductor Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BE Semiconductor Industries’s Competitive Landscape?

The Brief History of BE Semiconductor Industries reflects a dynamic journey within the semiconductor industry. The company's competitive landscape is shaped by evolving industry trends, presenting both opportunities and challenges. Understanding these factors is crucial for assessing the company's future outlook and strategic positioning.

The semiconductor industry is experiencing significant transformations. These changes influence companies like BE Semiconductor Industries, which must adapt to stay competitive. The industry's cyclical nature and the pace of technological advancements create both risks and prospects for growth.

Key trends include the increasing demand for advanced packaging solutions, driven by the need for higher integration density and improved performance in semiconductor devices. The growth of AI, 5G, and high-performance computing further fuels this demand. These technologies require sophisticated and compact semiconductor devices, which aligns with Besi's strengths.

Challenges include the cyclical nature of the industry, geopolitical tensions, and the high capital intensity of advanced semiconductor manufacturing. The rapid pace of technological change requires continuous innovation and investment in R&D. The emergence of new market entrants could also pose a threat to Besi's market position.

Growth opportunities exist in emerging markets, particularly in Asia, and in sectors like automotive electronics and industrial IoT. Strategic partnerships with leading semiconductor manufacturers and research institutions are crucial for co-developing technologies and securing future market share. The increasing adoption of advanced packaging in various applications is also a significant opportunity.

The market analysis reveals that the demand for advanced packaging is growing, with a projected market size increase. Besi can leverage its expertise in this area. The company's ability to innovate and adapt to evolving industry needs will determine its success in this dynamic environment.

Besi's competitive advantages lie in its core competencies in advanced packaging and its focus on high-growth segments. The company's future outlook depends on its ability to navigate industry challenges and capitalize on emerging opportunities. The semiconductor industry is expected to continue growing, with specific segments experiencing rapid expansion.

- Market Share Analysis: Besi's market share in advanced packaging is significant, but subject to competitive pressures.

- Financial Performance: The company's financial performance reflects the industry's cyclical nature, with fluctuations in revenue and profitability. In the latest financial reports, Besi has shown resilience.

- Product Portfolio: Besi's product portfolio is focused on advanced packaging equipment, catering to the evolving needs of the semiconductor industry.

- Customer Base: The company's customer base includes leading semiconductor manufacturers, which provides a stable foundation for future growth.

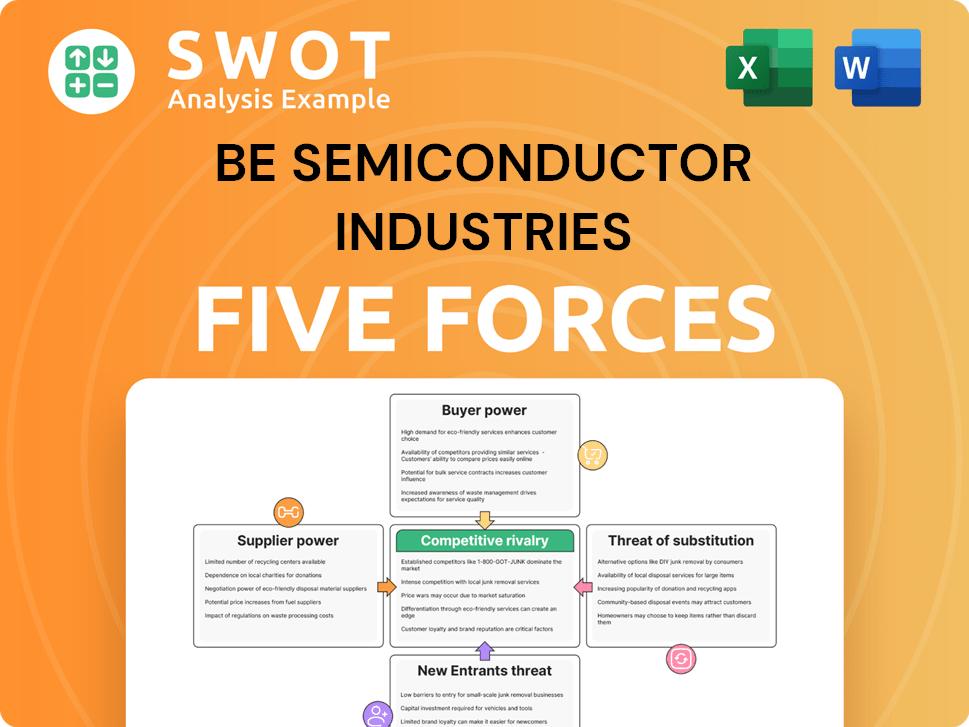

BE Semiconductor Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BE Semiconductor Industries Company?

- What is Growth Strategy and Future Prospects of BE Semiconductor Industries Company?

- How Does BE Semiconductor Industries Company Work?

- What is Sales and Marketing Strategy of BE Semiconductor Industries Company?

- What is Brief History of BE Semiconductor Industries Company?

- Who Owns BE Semiconductor Industries Company?

- What is Customer Demographics and Target Market of BE Semiconductor Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.