Bilia Bundle

How Does Bilia Navigate the Complex Automotive Retail World?

The automotive industry is undergoing a massive transformation, driven by electric vehicles and digital innovation. Bilia AB, a major player in European car sales and services, has a rich history dating back to 1957. Understanding Bilia SWOT Analysis is crucial to grasping its position in this dynamic market.

This article provides a deep dive into the Bilia competitive landscape, offering a comprehensive Bilia market analysis. We'll explore Bilia's company overview, examine its Bilia competitors, and dissect its business strategy to understand its strengths and weaknesses. Furthermore, we'll analyze Bilia's expansion strategies and competitive positioning to provide actionable insights for investors and industry observers.

Where Does Bilia’ Stand in the Current Market?

Bilia AB, a prominent player in the European automotive retail sector, focuses on the sale of new and used cars, along with light transport vehicles. Its core operations extend beyond vehicle sales, encompassing financing, insurance, car washes, and fuel sales, which are integral to its revenue model. The company's business strategy revolves around providing a comprehensive service, aiming to meet diverse customer needs and foster long-term relationships.

The company's value proposition lies in its extensive brand portfolio and comprehensive service network, particularly in Sweden and Norway. Bilia's strategic focus includes enhancing its digital presence to adapt to evolving customer preferences. This approach allows Bilia to maintain a competitive edge within the automotive industry. For a deeper look into the company's marketing strategies, you can read about the Marketing Strategy of Bilia.

Bilia's market position is strongest in Sweden and Norway, where it operates a significant number of dealerships. It has also expanded into Germany, Luxembourg, and Belgium, broadening its European market reach. The company's financial health is robust, as evidenced by its 2023 operating profit of SEK 1,228 million and a profit margin of 3.3%, demonstrating strong financial performance compared to industry averages. This performance underscores Bilia's competitive advantage in the premium and mid-range segments.

Bilia consistently ranks among the top automotive retailers in Sweden and Norway. While specific 2024-2025 market share figures are still emerging, the company's strong presence is evident. This leadership is often attributed to its extensive brand portfolio and service network, which attract a broad customer base.

Bilia's primary markets are Sweden and Norway, where it has a substantial number of dealerships. Expansion into Germany, Luxembourg, and Belgium strategically broadens its reach across Europe. This geographic diversification supports its competitive positioning and growth objectives.

Supplementary services, including financing, insurance, and car washes, significantly contribute to Bilia's revenue. These services are crucial for customer retention and overall financial performance. This integrated service model enhances its competitive advantage.

Bilia is actively enhancing its digital presence by integrating online sales and service capabilities. This strategic shift allows the company to cater to evolving customer preferences. Digital transformation is key to maintaining its competitive edge in the automotive retail space.

Bilia's competitive advantages include its extensive brand portfolio, comprehensive service offerings, and strong presence in key European markets. These elements contribute to its ability to attract and retain customers. The company's strategic focus on digital transformation further strengthens its market position.

- Extensive brand portfolio catering to diverse customer preferences.

- Comprehensive service network, including financing, insurance, and maintenance.

- Strong financial performance, with a 3.3% profit margin in 2023.

- Strategic expansion into key European markets like Germany and Belgium.

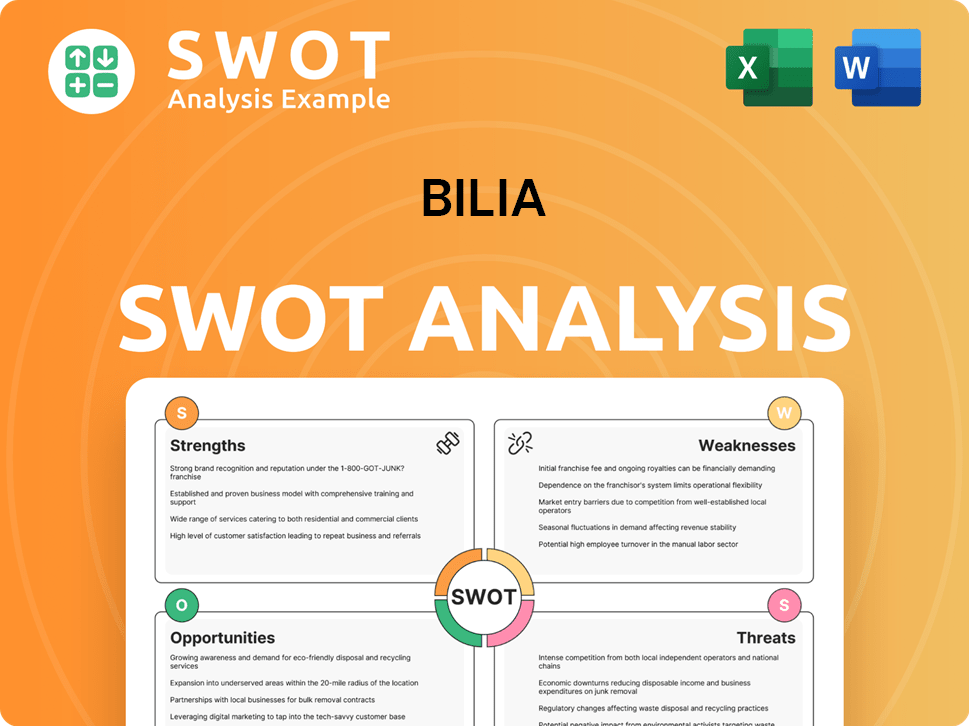

Bilia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bilia?

The Owners & Shareholders of Bilia face a dynamic and complex competitive landscape. The automotive retail sector is characterized by intense competition, with numerous players vying for market share. Understanding the key competitors is essential for evaluating Bilia's position and future prospects.

Bilia's competitive environment includes both direct and indirect rivals. Direct competitors are primarily other large dealership groups and authorized dealerships. Indirect competitors include online platforms and emerging sales models. This multifaceted competition requires Bilia to continually adapt its strategies to maintain and grow its market presence.

Analyzing the Bilia competitive landscape involves assessing various factors, including market share, financial performance, and strategic initiatives. This analysis helps in understanding the challenges and opportunities Bilia faces and how it can differentiate itself in the market. Effective Bilia market analysis is crucial for making informed decisions.

Direct competitors are other large dealership groups and authorized dealerships. These rivals often offer similar services and compete on price, brand offerings, and regional presence. Understanding their strategies is vital for Bilia's success.

In Sweden and Norway, Bilia's main competitors include Hedin Bil and Volvo Car Retail. Hedin Bil has expanded aggressively, while Volvo Car Retail benefits from its association with the Volvo brand. These competitors significantly impact Bilia's market share.

Hedin Bil is a major competitor, offering a wide range of brands and services. They often compete on price and regional presence, posing a significant challenge to Bilia's market share, particularly in Sweden and Norway. Hedin Bil's expansion strategies directly impact Bilia.

Volvo Car Retail, especially strong in its home market, is a key competitor for Bilia. Given its direct association with the Volvo brand, a significant part of Bilia's offerings, Volvo Car Retail presents a formidable challenge. This association gives them a competitive edge.

Indirect competitors include online car marketplaces and new sales models. These rivals challenge Bilia's traditional dealership model. Their impact is seen in the used car sales segment and the shift towards direct-to-consumer sales.

Online car marketplaces like Blocket (Sweden) and mobile.de (Germany) facilitate peer-to-peer sales. They offer a digital alternative to traditional dealerships, impacting Bilia's used car sales. These platforms attract customers seeking convenience and competitive pricing.

The automotive retail industry faces rapid changes, including the rise of EVs and digital sales. This requires Bilia to adapt its business strategy and innovate to stay competitive. Understanding these dynamics is crucial for long-term success.

- Electric Vehicle (EV) Sales and Infrastructure: Competitors are aggressively pushing into EV sales and charging infrastructure, directly challenging Bilia's efforts in these growing segments.

- Direct-to-Consumer Sales: Manufacturers like Tesla and Polestar are bypassing traditional dealerships. This shift poses a long-term challenge to Bilia's business model.

- Market Share Shifts: The competitive landscape sees frequent market share shifts for specific car brands. This requires Bilia to respond quickly to maintain its position.

- Digital Sales Tools: Rapid adoption of new digital sales tools is essential. Bilia must invest in these technologies to stay competitive.

- Consolidation: Mergers and acquisitions among dealership groups impact competitive dynamics. This can create larger, more formidable rivals.

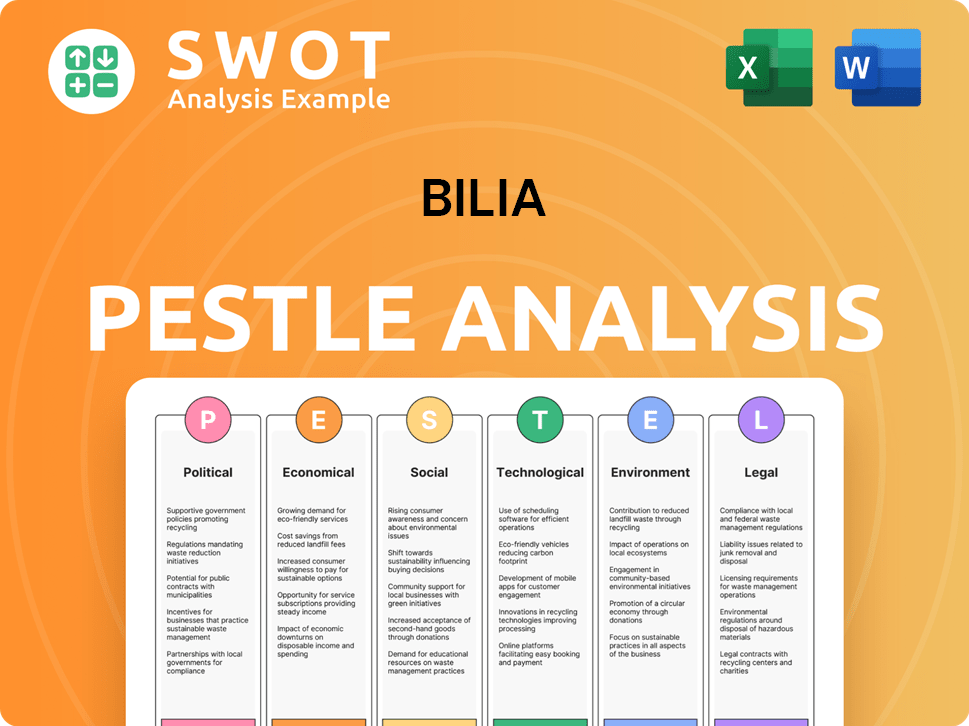

Bilia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bilia a Competitive Edge Over Its Rivals?

The competitive landscape for Bilia AB is shaped by its strategic moves and sustained focus on operational excellence. Bilia's growth has been marked by strategic acquisitions and continuous investment in infrastructure and technology. These moves have solidified its position in the automotive industry, allowing it to adapt to evolving market dynamics and maintain a competitive edge.

Bilia's competitive advantages are multifaceted, stemming from its extensive operational scale, strong brand relationships, and comprehensive service offerings. The company's wide geographical presence across Sweden, Norway, Germany, Luxembourg, and Belgium, coupled with its representation of numerous strong car brands, allows it to cater to a diverse customer base. This broad portfolio helps mitigate risks associated with reliance on a single brand or market.

Bilia's well-established distribution network and numerous service centers provide convenience and accessibility for customers, fostering strong brand loyalty. Its comprehensive suite of supplementary services, including financing, insurance, car washes, and fuel sales, creates an ecosystem that enhances customer stickiness and generates additional revenue streams beyond vehicle sales. Understanding the Target Market of Bilia is crucial for appreciating its competitive strategy.

Bilia operates across multiple countries, including Sweden, Norway, Germany, Luxembourg, and Belgium. This broad geographical presence allows Bilia to diversify its revenue streams and mitigate risks associated with regional economic fluctuations. This expansive reach is a key aspect of its competitive strategy.

Bilia maintains long-standing relationships with leading car manufacturers, providing access to the latest models and authorized service capabilities. These relationships are crucial for maintaining customer trust and ensuring quality. These partnerships are a cornerstone of Bilia's market position.

Bilia offers a wide range of services, including financing, insurance, car washes, and fuel sales, creating an integrated customer experience. This comprehensive approach enhances customer stickiness and generates additional revenue streams. This diversification is a key differentiator.

Bilia has invested in digital platforms for sales and service bookings, enhancing customer experience and operational efficiency. This digital focus allows for streamlined processes and improved customer engagement. This investment is crucial for staying competitive.

Bilia's competitive advantages are substantial, but they face threats from increasing digital direct sales by manufacturers and the rapid innovation cycles of new entrants. Continuous adaptation and investment in customer-centric solutions are essential for maintaining its market position.

- Extensive geographical presence and market reach, diversifying revenue streams.

- Strong brand relationships with leading car manufacturers, ensuring access to the latest models.

- Comprehensive service offerings, creating an integrated customer experience and additional revenue streams.

- Digital transformation initiatives, enhancing customer experience and operational efficiency.

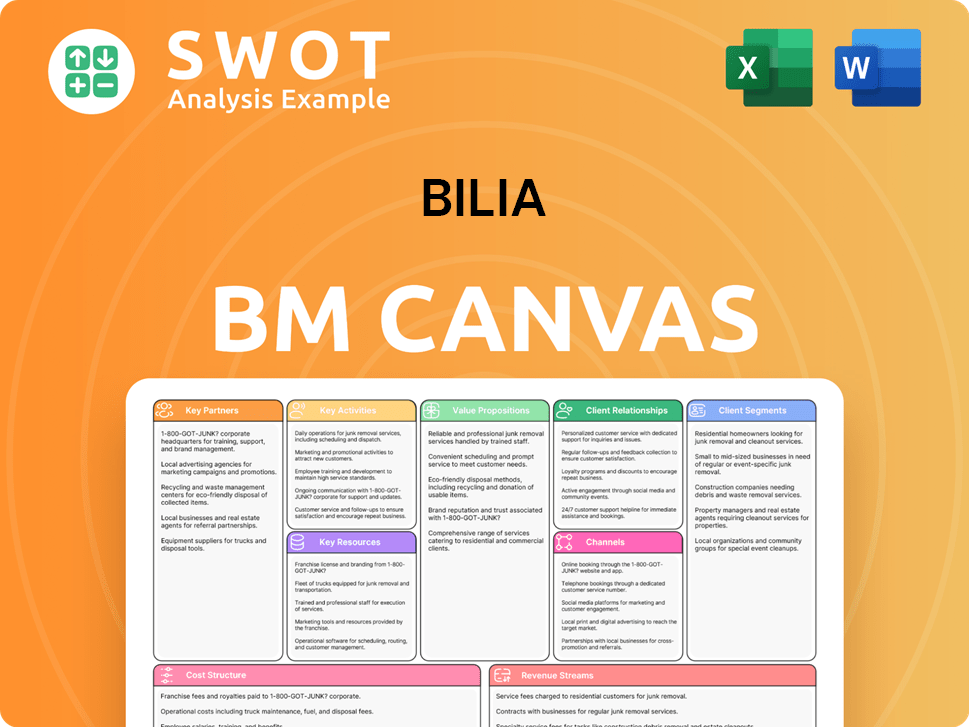

Bilia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bilia’s Competitive Landscape?

The automotive retail industry is experiencing significant shifts, particularly with the rise of electric vehicles (EVs) and digital customer experiences. These trends are reshaping the competitive landscape for companies like Bilia, demanding strategic adaptations to maintain and grow market share. A detailed Bilia market analysis reveals the need for proactive responses to emerging challenges and opportunities.

Understanding the Bilia competitive landscape involves assessing its position within a dynamic industry. This includes evaluating risks associated with technological advancements, changing consumer behaviors, and the strategies of Bilia competitors. The future outlook for Bilia depends on its ability to innovate and adapt to these changes effectively.

The automotive industry is undergoing a rapid transition towards EVs, driven by environmental regulations and consumer demand. Digitalization is transforming customer interactions, with a greater emphasis on online sales and service bookings. The demand for flexible ownership models, such as subscriptions, is also increasing, potentially impacting traditional sales.

Challenges include the high costs associated with EV infrastructure and workforce training. Intense competition from new EV brands and online platforms poses a threat. Regulatory changes and evolving emission standards could also create uncertainties for the company.

The growing EV market presents new sales and service opportunities. Bilia can leverage its existing service network for EV maintenance and charging solutions. Expanding digital capabilities and forming strategic partnerships can enhance market position.

Bilia must focus on sustainable growth, integrating technology and prioritizing customer-centric service. Diversification into new mobility services and expansion into emerging markets could further strengthen its competitive position. Adapting to these trends is critical for long-term success.

To thrive, Bilia needs a robust business strategy focusing on EV infrastructure investments and digital transformation. It should enhance its service offerings to meet the evolving needs of EV owners. Strategic partnerships and geographical expansion could also be crucial.

- Invest in EV charging stations and training programs.

- Enhance digital platforms for sales and service.

- Explore partnerships with EV manufacturers.

- Consider expansion into new markets.

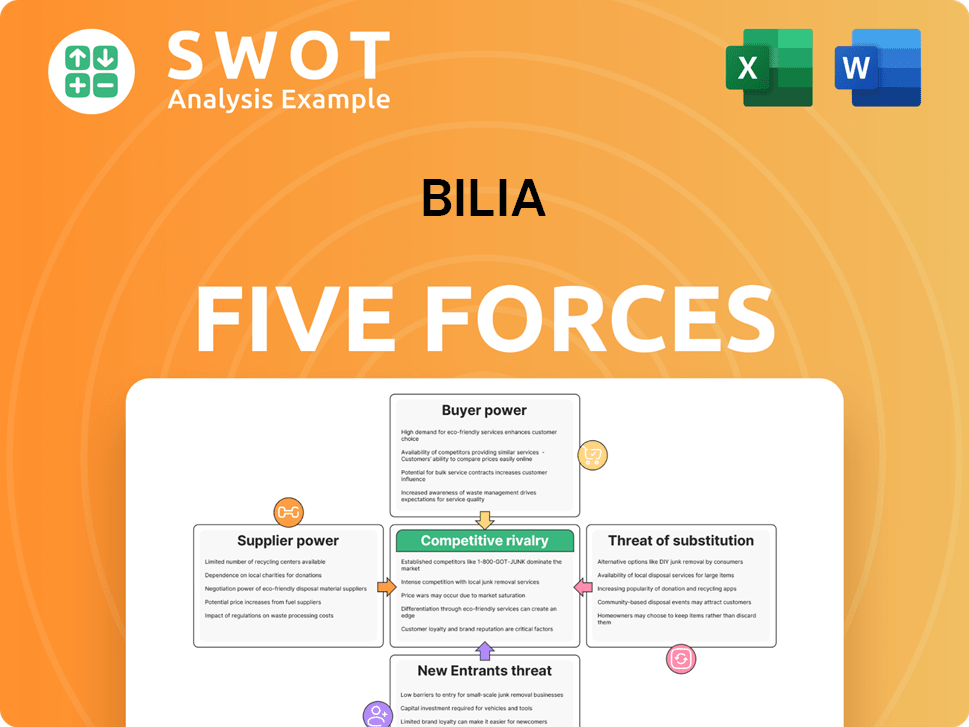

Bilia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bilia Company?

- What is Growth Strategy and Future Prospects of Bilia Company?

- How Does Bilia Company Work?

- What is Sales and Marketing Strategy of Bilia Company?

- What is Brief History of Bilia Company?

- Who Owns Bilia Company?

- What is Customer Demographics and Target Market of Bilia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.