Bilia Bundle

Can Bilia Company Continue Its Dominance in the European Automotive Market?

Bilia AB, a leading European car dealer, has strategically navigated the ever-changing Bilia SWOT Analysis to solidify its position within the automotive industry. Its expansion into new markets and diversification of services have been key to its success. This proactive approach has allowed Bilia to adapt to evolving consumer demands and technological advancements, setting the stage for future growth.

From its origins in Sweden, Bilia's journey reflects a commitment to providing comprehensive car ownership solutions. Today, with a presence across multiple European countries, Bilia's extensive network and diverse service offerings highlight its evolution. This article delves into Bilia's growth strategy, exploring its expansion plans, innovation, and financial performance. We will analyze Bilia's future prospects, considering the challenges and opportunities within the dynamic automotive sector, including the electric vehicle market and Bilia's strategic partnerships.

How Is Bilia Expanding Its Reach?

The Bilia growth strategy is heavily reliant on expansion initiatives, focusing on both geographical market entry and broadening its product and service offerings. The company consistently seeks to expand its footprint in existing markets and explore opportunities in new European countries. This approach aims to access new customer segments and diversify revenue streams, which is crucial for long-term Bilia future prospects.

A key aspect of this strategy involves identifying and integrating new car brands into its portfolio. This allows the company to cater to a wider range of customer preferences and market niches. Strategic acquisitions, such as the purchase of RøhneSelmer in Norway, demonstrate Bilia's commitment to strengthening its presence in key markets and improving its Bilia market analysis.

Furthermore, Bilia is actively pursuing the expansion of its service business, including increased capacity for car washes and the development of new digital services. The company's focus on electric vehicles (EVs) is also a significant expansion initiative. Bilia plans to increase charging infrastructure and offer a wider range of EV models, aligning with the industry's shift towards electrification and sustainability. For a detailed look at their business model, check out the Revenue Streams & Business Model of Bilia.

Bilia targets expansion within Europe, focusing on both existing and new markets. This strategy aims to increase market share and diversify revenue streams. The company seeks to capitalize on opportunities in various European countries, adapting to local market dynamics.

The acquisition of RøhneSelmer in Norway, expected to add SEK 6.5 billion in annual sales, is a key example of strategic expansion. This move significantly boosts Bilia's market share in Norway. It highlights the company's commitment to growth through strategic acquisitions.

Bilia is expanding its service offerings, including car washes and digital services. The goal is to enhance customer convenience and improve efficiency. This expansion is crucial for maintaining customer loyalty and driving revenue growth.

The company is focusing on electric vehicles (EVs) by increasing charging infrastructure and expanding its EV model range. This initiative aligns with the growing demand for sustainable transportation. Bilia is positioning itself to capitalize on the EV market's growth.

Bilia's expansion strategy focuses on both geographical growth and service diversification. These initiatives are designed to strengthen the company's market position and drive long-term growth. The company's approach is data-driven, with a focus on adapting to changing consumer preferences.

- Strategic Acquisitions: Acquiring dealerships to expand market share.

- Service Enhancements: Increasing car wash capacity and digital services.

- EV Market Focus: Investing in charging infrastructure and EV models.

- Market Diversification: Entering new European markets.

Bilia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bilia Invest in Innovation?

The company's approach to innovation and technology is crucial for its Bilia growth strategy within the competitive automotive industry. It focuses on digital transformation to enhance customer experiences and streamline operations. This strategy is essential for adapting to changing consumer preferences and maintaining a strong market position.

Bilia invests in technology to improve efficiency across its network, including online platforms for sales and service bookings. The implementation of advanced diagnostic tools in workshops is another example of its commitment. These initiatives are designed to support Bilia's future prospects by optimizing service delivery and enhancing customer satisfaction.

The company's strategic focus includes embracing sustainable solutions, such as expanding its offerings in electric vehicles (EVs) and related services. This forward-thinking approach positions Bilia company to capitalize on the growing demand for sustainable transportation, supporting long-term growth projections. Furthermore, data analytics and AI are being explored to personalize customer interactions, optimize inventory management, and predict market trends.

Bilia is actively pursuing digital transformation to improve customer experience. This includes developing online platforms for vehicle sales and service bookings. These platforms are designed to offer convenience and efficiency to customers.

The company is expanding its offerings in electric vehicles and associated services. This expansion is a key part of its sustainability initiatives, catering to the growing demand for EVs. This demonstrates a commitment to adapting to changing consumer preferences.

Bilia explores the use of data analytics and AI to personalize customer interactions. This also includes optimizing inventory management and predicting market trends. The goal is to enhance operational efficiency and customer engagement.

The implementation of advanced diagnostic tools in workshops is a key technological investment. This investment improves the efficiency and accuracy of vehicle servicing. This helps to maintain a high standard of service.

Bilia focuses on increasing charging infrastructure for electric vehicles. This directly supports growth objectives by catering to the growing demand for sustainable transportation solutions. This is a vital part of their expansion plans and strategies.

Streamlining operations is a key aspect of Bilia's technological strategy. This includes implementing digital tools and optimizing processes. The goal is to improve overall efficiency and reduce costs.

Bilia is committed to continuous investment in modernizing its infrastructure and service delivery. This reflects its commitment to technological advancement and supports its Bilia market analysis. This approach is crucial for navigating the challenges and opportunities in the automotive sector.

- Digital platforms for vehicle sales and service bookings.

- Implementation of advanced diagnostic tools in workshops.

- Expansion of electric vehicle offerings and charging infrastructure.

- Exploration of data analytics and AI for customer interaction and inventory management.

For a deeper dive into how Bilia approaches its market strategy, including its technological and innovation focus, you can refer to the Marketing Strategy of Bilia.

Bilia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bilia’s Growth Forecast?

The financial outlook for Bilia is centered on sustained growth and enhanced profitability within the automotive industry. The company's strategic initiatives and operational efficiencies are key drivers of its financial performance. Bilia's approach involves a blend of organic growth and strategic acquisitions, all while maintaining a strong focus on financial discipline.

Bilia's financial performance has been robust, as evidenced by its 2023 results. The company has demonstrated its ability to generate significant returns and manage its capital effectively. The company's financial ambitions are supported by strategic acquisitions and disciplined capital allocation.

For 2024, the company's performance continues to be strong, highlighting its resilience and strategic direction. The company's financial strategy includes disciplined capital allocation to support both organic growth and strategic acquisitions, ensuring a healthy balance sheet while pursuing expansion. For more insights into the company's origins and evolution, you can check out the Brief History of Bilia.

In 2023, Bilia's net sales increased by 13.0%, reaching SEK 41,757 million. The operating income for the same period was SEK 1,845 million. The return on capital employed for the full year 2023 was 22.0%, reflecting strong financial health.

In the first quarter of 2024, Bilia's net sales reached SEK 10,637 million, a 2.1% increase year-over-year. The operating income for Q1 2024 was SEK 476 million, showing continued financial strength.

Acquisitions, such as the RøhneSelmer acquisition, are projected to significantly boost annual sales. These strategic moves are crucial for expanding market presence and enhancing revenue streams. Bilia's growth strategy includes targeted acquisitions to strengthen its market position.

Bilia's financial strategy includes disciplined capital allocation for organic growth and strategic acquisitions. Long-term goals include increasing market share, improving profit margins, and generating strong cash flow. These goals support future investments and shareholder returns.

Bilia's financial performance is marked by consistent growth and strategic investments. The company's focus on profitability and market expansion is evident in its financial results.

- Net sales increased by 13.0% in 2023.

- Operating income for 2023 was SEK 1,845 million.

- Return on capital employed was 22.0% in 2023.

- Q1 2024 net sales increased by 2.1%.

- Q1 2024 operating income was SEK 476 million.

Bilia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bilia’s Growth?

The Bilia company faces several potential risks and obstacles that could impact its Bilia growth strategy and Bilia future prospects. The automotive industry is highly competitive, with numerous established players and new entrants vying for market share. Economic fluctuations and shifts in consumer spending patterns can directly affect vehicle sales and service demand, influencing Bilia financial performance.

Regulatory changes, such as stricter environmental standards and vehicle emissions regulations, present ongoing challenges, requiring continuous adaptation in product offerings and operational practices. Supply chain vulnerabilities, including semiconductor shortages and logistics disruptions, have historically affected the sector and could continue to impact Bilia's ability to procure vehicles and parts. Furthermore, the rapid technological advancements, especially in electric vehicles (EVs) and autonomous driving, necessitate substantial investments.

Internally, managing a large and geographically dispersed workforce and maintaining consistent service quality across all operations adds further complexity. Bilia mitigates these risks through a diversified brand portfolio, robust risk management frameworks, and scenario planning to anticipate and respond to market shifts. Strategic acquisitions also help diversify revenue streams and reduce reliance on single markets or brands. For a deeper dive into the company, consider exploring a detailed Bilia company growth strategy analysis.

The automotive industry is intensely competitive, with established manufacturers and new entrants constantly vying for market share. This competition impacts pricing, market share, and profitability. In 2024, the global automotive market saw significant shifts due to the rise of electric vehicles and changing consumer preferences, intensifying the competitive landscape. Bilia's ability to maintain and grow its market share depends on its ability to adapt to these competitive pressures.

Economic downturns and changes in consumer spending habits can significantly affect vehicle sales and service demand. During economic recessions, consumers often postpone major purchases, including vehicles, which can lead to a decrease in revenue. In 2024, economic uncertainties in various regions impacted consumer confidence, influencing purchasing decisions. Bilia's ability to navigate these economic cycles is crucial for sustained financial performance.

Regulatory changes, particularly concerning environmental standards and vehicle emissions, pose ongoing challenges. Compliance with evolving regulations requires significant investment in research, development, and operational adjustments. The transition to EVs and the need to meet stricter emissions standards in 2024 and beyond necessitates that Bilia continuously adapt its product offerings and operational practices.

Supply chain disruptions, including shortages of semiconductors and logistics challenges, can severely impact the automotive sector. These disruptions can limit the availability of vehicles and parts, affecting sales and service operations. The semiconductor shortage in 2024 continued to pose challenges, requiring Bilia to develop resilient supply chain strategies and build strong relationships with suppliers to mitigate these risks.

Rapid technological advancements, especially the shift towards EVs and autonomous driving, require substantial investments in new technologies and training. Failing to adapt quickly can hinder growth. The increasing popularity of EVs and the development of autonomous driving technologies in 2024 demand that Bilia invest in these areas to remain competitive and meet evolving consumer expectations.

Managing a large and geographically dispersed workforce and maintaining consistent service quality across all operations presents operational complexities. Ensuring standardized service levels and effectively managing a large workforce across different locations requires robust management and operational strategies. Bilia's ability to maintain operational efficiency is critical for its long-term success and brand reputation.

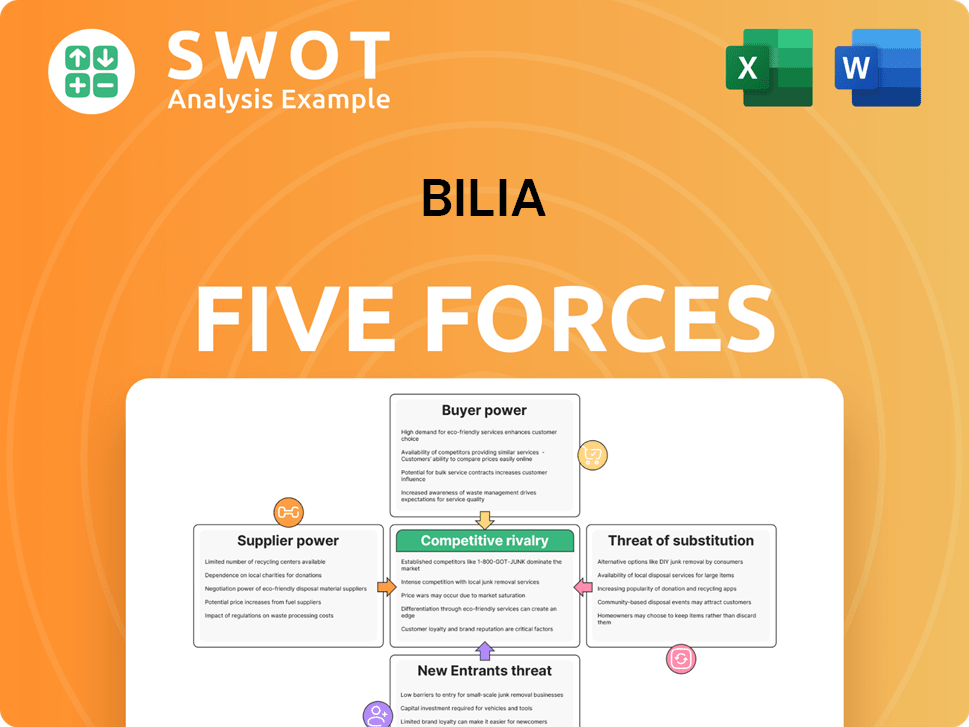

Bilia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bilia Company?

- What is Competitive Landscape of Bilia Company?

- How Does Bilia Company Work?

- What is Sales and Marketing Strategy of Bilia Company?

- What is Brief History of Bilia Company?

- Who Owns Bilia Company?

- What is Customer Demographics and Target Market of Bilia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.