Boston Scientific Bundle

How Does Boston Scientific Navigate the Cutthroat Medical Device Market?

Boston Scientific has carved a significant niche in the medical device industry since its inception in 1979, driven by a commitment to less invasive medical solutions. Its impressive financial performance, including robust growth in 2024 and Q1 2025, highlights its strong market position. But how does this industry leader maintain its edge in a sector defined by fierce competition and rapid innovation?

To understand Boston Scientific's trajectory, a deep dive into its competitive landscape is essential. This analysis will explore the Boston Scientific SWOT Analysis, its key rivals, and the strategies that fuel its success. We'll examine the company's market share analysis, financial performance compared to competitors, and its competitive advantages within the medical technology companies sector, providing a comprehensive Boston Scientific market analysis.

Where Does Boston Scientific’ Stand in the Current Market?

Boston Scientific holds a strong position within the medical device industry, focusing on interventional medical specialties. The company's operations are primarily divided into two segments: Cardiovascular and MedSurg. This strategic focus enables Boston Scientific to offer specialized products and services, catering to specific medical needs and procedures, which helps them maintain a competitive edge in the market.

The company's value proposition centers on providing innovative medical solutions that improve patient outcomes and enhance clinical efficiency. Through continuous research and development, Boston Scientific aims to deliver cutting-edge technologies and therapies. This commitment to innovation, combined with a global presence and strong financial performance, positions Boston Scientific as a key player in the medical technology sector.

In fiscal year 2024, the Cardiovascular segment generated $10.76 billion, representing 64.22% of total revenue with a 21.95% growth over 2023. The MedSurg segment brought in $5.99 billion in revenue in FY 2024. The Rhythm & Neuro segment is projected to contribute $5.9 billion in revenues for FY2025.

Boston Scientific has a global footprint, operating in over 100 countries. In Q1 2025, the United States saw a 31.1% increase in net sales. Emerging markets also showed strong momentum, with operational net sales growth of 9.8% year-over-year in Q1 2025.

As of April 2025, Boston Scientific's market capitalization was approximately $138.53 billion. The company's free cash flow reached $354 million in Q1 2025. For 2025, the company projects organic net sales growth between 12% and 14% and adjusted EPS in the range of $2.87 to $2.94.

The company focuses on expanding its presence in key regions. EMEA sales grew by 11.60% operationally in Q4 2024. Boston Scientific continues to invest in research and development to maintain its competitive edge in the Boston Scientific competitive landscape.

Boston Scientific's strong market position is supported by its financial health and strategic focus. The company's performance in the Cardiovascular and MedSurg segments drives its overall revenue growth, while its global presence ensures diversified market exposure. The projected financial results for 2025 indicate continued growth and profitability.

- Cardiovascular segment revenue: $10.76 billion in FY 2024.

- MedSurg segment revenue: $5.99 billion in FY 2024.

- Projected organic net sales growth for 2025: Between 12% and 14%.

- Market capitalization (April 2025): Approximately $138.53 billion.

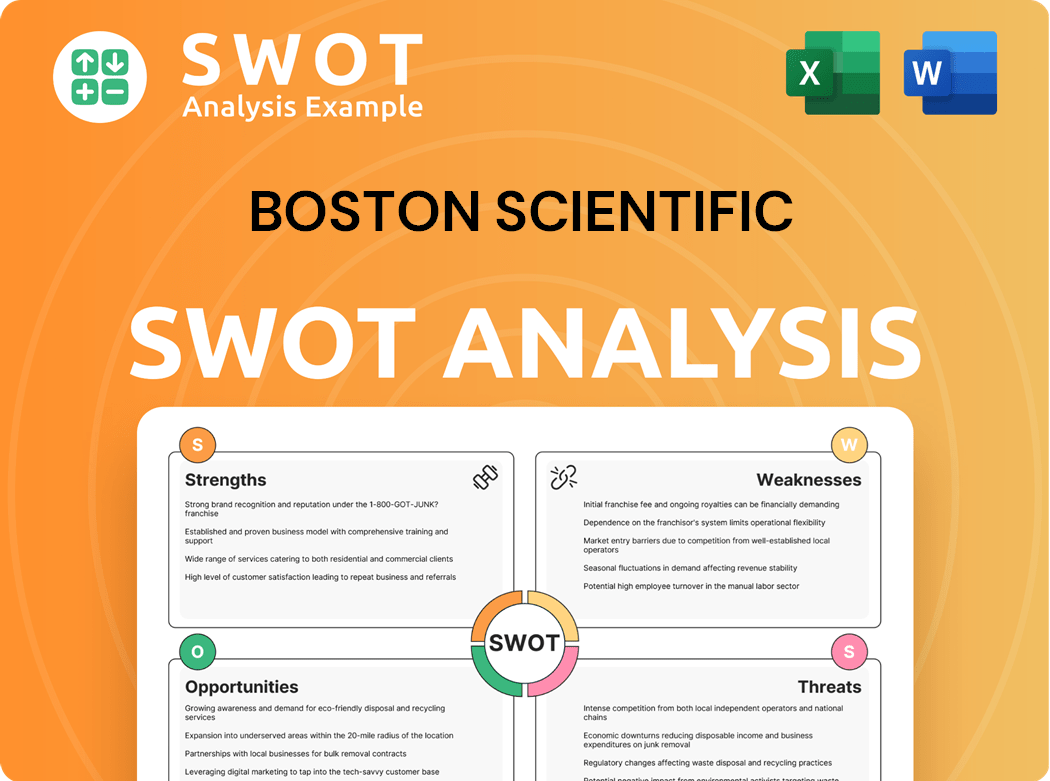

Boston Scientific SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Boston Scientific?

The medical device industry is fiercely competitive, with the Boston Scientific competitive landscape shaped by numerous global players. This environment requires continuous innovation, strategic acquisitions, and robust market strategies to maintain and expand market share. Understanding the Boston Scientific market analysis and its position relative to its competitors is crucial for investors and industry observers.

Boston Scientific faces intense competition across various medical device segments. The company's success depends on its ability to differentiate its products, navigate regulatory hurdles, and effectively compete against well-established rivals. This analysis will delve into the key competitors and their impact on Boston Scientific's market position.

The Boston Scientific competitive landscape is dominated by several major players in the medical device industry. These companies compete in various segments, including cardiovascular devices, surgical technologies, and other medical specialties. Understanding the strengths and weaknesses of these competitors is essential for evaluating Boston Scientific's strategic position.

Boston Scientific's primary competitors include Medtronic, Abbott Laboratories, and Johnson & Johnson. These companies are formidable rivals with significant market capitalization and diverse product portfolios. Their financial performance and strategic moves directly impact Boston Scientific's market share and growth prospects.

Medtronic is a major competitor, reporting revenues of $31.2 billion in 2023. It competes with Boston Scientific across various segments, including cardiovascular, surgical technologies, and neuroscience. Medtronic's scale and diverse product offerings pose a significant challenge.

Abbott Laboratories is another key competitor, particularly in cardiovascular devices. The acquisition of St. Jude Medical in 2017 strengthened its position. Abbott competes directly with Boston Scientific in coronary stents and structural heart products.

Johnson & Johnson's medical device division is a significant competitor, contributing a substantial portion of its total revenue. It has expanded in the intravascular lithotripsy (IVL) space. This expansion increases the competitive pressure on Boston Scientific.

Other notable competitors include Stryker Corporation, Edwards Lifesciences, Becton, Dickinson and Company (BD), Siemens Healthineers, and Zimmer Biomet. These companies compete in specific segments, adding to the complexity of the Boston Scientific competitive landscape.

The IVL space is seeing new entrants like FastWave Medical, Vantis Vascular, and Amplitude Vascular. Boston Scientific's acquisitions, such as Axonics Inc. for approximately $3.7 billion in late 2024 and Silk Road Medical for $1.16 billion in mid-2024, highlight its strategy to strengthen its portfolio against these rivals.

The Boston Scientific competitive landscape is continually evolving, with companies employing various strategies to gain market share. These strategies include acquisitions, product innovation, and strategic partnerships. Understanding these dynamics is essential for assessing Boston Scientific's future growth prospects.

- Acquisitions: Boston Scientific has made strategic acquisitions to expand its product portfolio and market reach.

- Product Innovation: Continuous innovation in medical devices is crucial for staying competitive.

- Market Expansion: Companies are focusing on expanding their presence in key geographic markets.

- Strategic Alliances: Collaborations and partnerships are used to leverage expertise and resources.

For a deeper dive into Boston Scientific's overall strategies, consider reading about the Growth Strategy of Boston Scientific.

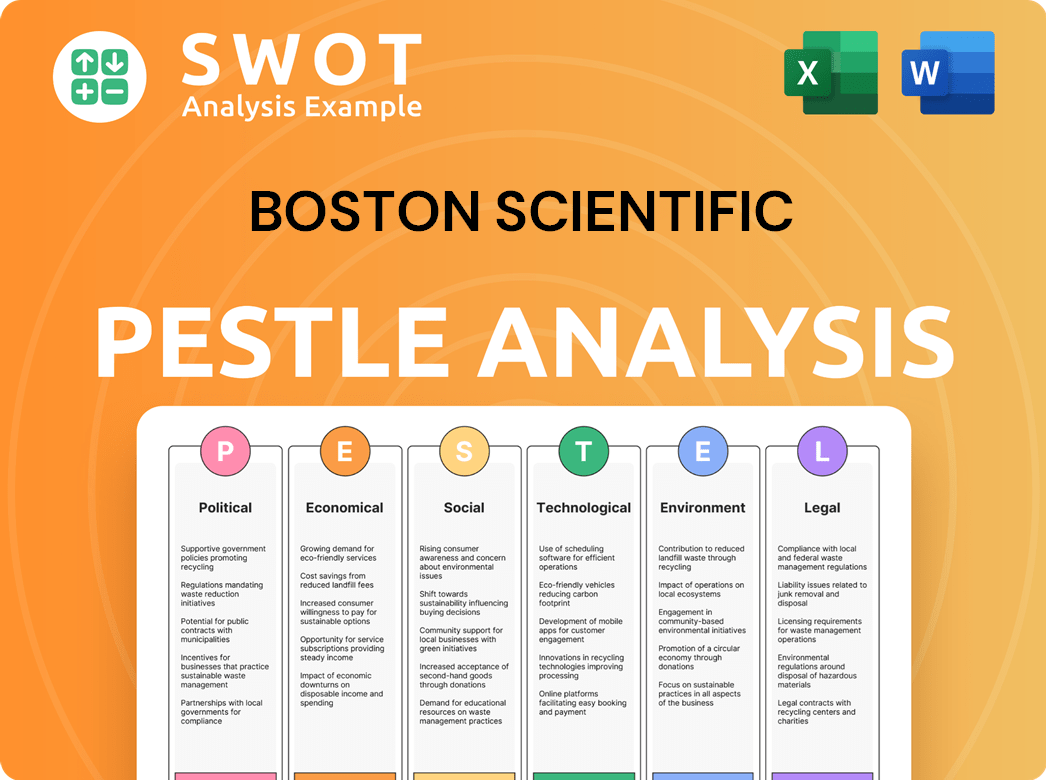

Boston Scientific PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Boston Scientific a Competitive Edge Over Its Rivals?

The competitive landscape for medical device companies is dynamic, with constant innovation and strategic shifts. Understanding the competitive advantages of key players like Boston Scientific is crucial for investors, analysts, and industry observers. This analysis explores the factors that position Boston Scientific within the medical device industry, examining its strengths, strategies, and market position.

Boston Scientific has established itself as a significant player in the medical technology sector. Its focus on innovation, a diversified product portfolio, and a strong global presence are key differentiators. The company's ability to develop and commercialize advanced medical devices, particularly in high-growth areas like cardiovascular and neuromodulation, is a cornerstone of its competitive strategy. For a deeper dive into their strategies, consider reading about the Growth Strategy of Boston Scientific.

The company's performance is closely watched, with financial metrics reflecting its competitive standing. In Q1 2025, Boston Scientific reported an adjusted gross margin of 71.5% and an adjusted operating margin of 28.9%, indicating strong operational efficiency. These figures, along with strategic acquisitions and a focus on global expansion, contribute to its competitive edge in the medical device industry.

Boston Scientific consistently invests in research and development, leading to a robust pipeline of new products. The FDA approval of the FARAPULSE™ Pulsed Field Ablation (PFA) System in early 2024 is a prime example. This system is projected to capture a significant share of the atrial fibrillation (AFib) market.

Key differentiators include proprietary technologies and intellectual property. The Watchman FLX Pro Left Atrial Appendage Closure (LAAC) device and the AGENT™ Drug-Coated Balloon, approved in March 2024, showcase the company's commitment to innovation. These advancements strengthen its position in stroke prevention and coronary interventions.

Boston Scientific has a strong brand reputation and established customer relationships. Its diversified product portfolio across various medical specialties helps mitigate risks. Strategic acquisitions like Axonics Inc. and Silk Road Medical have expanded its market reach and enhanced its competitive position.

The company's global footprint, with operations in over 100 countries, provides a significant advantage. Strong growth in emerging markets and a commitment to customer service, including training programs, support this. Operational efficiencies, reflected in its profit margins, further enhance its standing.

Boston Scientific's competitive advantages are multifaceted, encompassing technological innovation, a broad product portfolio, and a global presence. These advantages are continuously refined through product development, strategic partnerships, and market penetration efforts. The company's ability to adapt to market changes and leverage its strengths will be crucial for its continued success.

- Strong R&D investments lead to cutting-edge medical devices.

- Diversified product portfolio across various medical specialties.

- Global expansion with a focus on emerging markets.

- Strategic acquisitions to bolster market reach and product offerings.

Boston Scientific Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Boston Scientific’s Competitive Landscape?

The Target Market of Boston Scientific is significantly influenced by the dynamic shifts within the medical device industry. These changes, driven by technological advancements and demographic trends, present both challenges and opportunities for companies like Boston Scientific. The company must navigate intense competition, regulatory hurdles, and pricing pressures while capitalizing on growth prospects in emerging markets and innovative technologies.

Boston Scientific's competitive landscape is shaped by its ability to adapt to these industry dynamics. The company's strategic focus on product innovation, global expansion, and strategic partnerships is crucial for maintaining its market position. The company's financial performance and market share are closely tied to its ability to execute these strategies effectively in the face of evolving market conditions.

The medical device industry is currently experiencing significant technological advancements, with a growing demand for minimally invasive procedures and personalized medicine. The aging global population is also driving increased demand for advanced healthcare solutions. Boston Scientific is capitalizing on these trends through product innovation and strategic acquisitions.

The industry faces challenges such as intense competition, stringent regulatory hurdles, and pricing pressures. Currency fluctuations and geopolitical risks can also impact costs. Boston Scientific must navigate these challenges while maintaining competitive pricing and managing operational costs effectively.

Expanding into emerging markets and developing new technologies present key growth opportunities. Strategic partnerships and acquisitions are also vital. Boston Scientific's focus on innovation and global expansion positions it well to capitalize on these opportunities and maintain its competitive advantage.

Boston Scientific's Q1 2025 results reflect its strategic initiatives. The company reported 9.8% operational net sales growth in emerging markets. The Urology division is projected to rise 26% year-on-year in 2025. These figures highlight the impact of strategic acquisitions and global expansion.

Boston Scientific employs several key strategies to navigate the competitive landscape and drive growth. These strategies include a focus on product innovation, strategic acquisitions, and global expansion. The company's ability to execute these strategies effectively will be crucial for its long-term success.

- Continuous Product Innovation: The company invests heavily in research and development to introduce new and improved medical devices.

- Strategic Acquisitions: Boston Scientific acquires companies and technologies to expand its product portfolio and enter new markets.

- Global Expansion: The company focuses on expanding its presence in emerging markets to capitalize on growth opportunities.

- Strategic Partnerships: Collaborations with other companies help to share resources, expertise, and accelerate innovation.

Boston Scientific Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Boston Scientific Company?

- What is Growth Strategy and Future Prospects of Boston Scientific Company?

- How Does Boston Scientific Company Work?

- What is Sales and Marketing Strategy of Boston Scientific Company?

- What is Brief History of Boston Scientific Company?

- Who Owns Boston Scientific Company?

- What is Customer Demographics and Target Market of Boston Scientific Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.