Brilliant Earth Bundle

How Does Brilliant Earth Stack Up in the Jewelry Arena?

The jewelry industry is experiencing a seismic shift, with consumers increasingly prioritizing ethical sourcing and sustainability. Brilliant Earth has emerged as a frontrunner in this evolving market, captivating customers with its commitment to transparency and responsible practices. Founded in 2005, the company has redefined how we approach fine jewelry purchases.

This exploration delves into the Brilliant Earth SWOT Analysis and its position within the competitive landscape. We'll dissect the company's market share analysis, examine its direct competitors, and evaluate its business model. This comprehensive jewelry market analysis will provide insights into Brilliant Earth's financial performance, pricing strategy, and brand reputation within the ethical and sustainable jewelry space, comparing it to industry giants and online jewelry retailers alike.

Where Does Brilliant Earth’ Stand in the Current Market?

Brilliant Earth has carved out a significant market position within the fine jewelry sector, particularly excelling in the ethically sourced and sustainable segment. The company's focus on lab-grown diamonds and recycled precious metals resonates with a consumer base that increasingly values sustainability and transparency. In fiscal year 2024, the company reported net sales of $464.3 million, a 1.7% increase year-over-year, indicating continued growth in a competitive market.

The company's core operations revolve around the sale of engagement rings, wedding bands, and other fine jewelry, primarily through its online platform and a growing network of showrooms. Brilliant Earth's value proposition centers on offering premium jewelry with a commitment to ethical sourcing and environmental responsibility. This approach has allowed the company to differentiate itself from traditional jewelers and attract a loyal customer base.

Geographically, Brilliant Earth has expanded its physical presence, operating 37 showrooms across 21 states as of early 2025. This hybrid model caters to both online shoppers and those who prefer in-person consultations. The target customer segment includes millennials and Gen Z consumers, who are often more socially conscious and willing to invest in products that align with their values. Over time, Brilliant Earth has solidified its positioning as a premium brand, offering a responsible alternative to traditional jewelers.

While precise market share data for the ethical jewelry niche is often proprietary, Brilliant Earth's sustained revenue growth and expanding brand recognition suggest a strong and growing presence. The company's financial performance in 2024, with net sales of $464.3 million, demonstrates its robust scale compared to many smaller independent jewelers. This positions it as a significant player in the online and ethical jewelry space.

Brilliant Earth primarily targets millennials and Gen Z consumers. These demographics are often more socially conscious and value transparency and ethical sourcing. This focus allows the company to build brand loyalty and attract customers who align with its values. This customer focus is a key element of its business model.

Brilliant Earth's competitive advantages include its commitment to ethical sourcing, its focus on lab-grown diamonds, and its omnichannel retail strategy. The company's brand reputation is built on transparency and sustainability, which differentiates it from competitors. The company's financial health is another advantage, allowing for investments in marketing and expansion.

As of early 2025, Brilliant Earth operates 37 showrooms across 21 states, expanding its physical presence beyond its online model. This hybrid approach allows the company to cater to both online shoppers and those who prefer an in-person experience. The showrooms provide a tangible touchpoint for customers, enhancing the overall brand experience and driving sales.

Brilliant Earth's market position is strong within the ethical jewelry segment, driven by its brand reputation and commitment to sustainability. The company's financial performance, including its $464.3 million in net sales for 2024, demonstrates its ability to compete effectively. For a deeper dive into the company's ownership structure and financial details, consider exploring Owners & Shareholders of Brilliant Earth.

- Strong brand recognition and reputation in the ethical jewelry market.

- Growing physical presence through showrooms, complementing its online platform.

- Focus on lab-grown diamonds and recycled precious metals appeals to a socially conscious consumer base.

- Continued revenue growth indicates a solid market position and expansion potential.

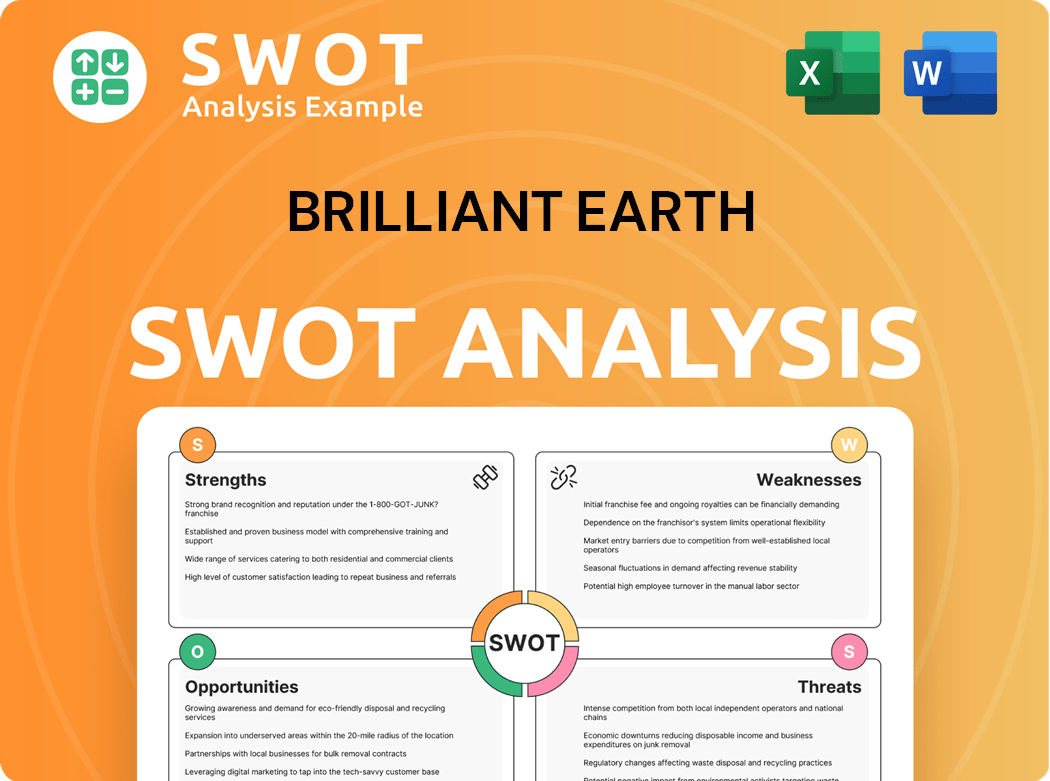

Brilliant Earth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Brilliant Earth?

The Brilliant Earth competitive landscape is complex, encompassing both established luxury brands and online retailers. The jewelry market analysis reveals a dynamic environment where ethical sourcing and online presence are increasingly critical. This analysis is essential for understanding Brilliant Earth's market position.

Brilliant Earth competitors range from direct online rivals to traditional luxury powerhouses. The company faces challenges from competitors who offer similar products and those with broader brand recognition and resources. Understanding these competitors is vital for assessing Brilliant Earth's financial performance and strategic positioning.

Brilliant Earth operates within a diverse and highly competitive jewelry market, facing challenges from both traditional established jewelers and other online-focused, ethically-minded brands. Its most significant direct competitors include James Allen and Blue Nile, both pioneers in online diamond sales. James Allen, known for its 360-degree diamond display technology and extensive inventory, competes directly on price and selection, often offering competitive financing options. Blue Nile, acquired by Signet Jewelers in 2022, also boasts a vast online selection and strong brand recognition, leveraging its scale to offer competitive pricing and a broad range of products. Both James Allen and Blue Nile have also started to emphasize ethically sourced options and lab-grown diamonds, directly encroaching on Brilliant Earth's core differentiator.

Brilliant Earth's direct competitors primarily include online jewelry retailers. James Allen and Blue Nile are key players, focusing on price, selection, and financing options. These competitors also offer ethically sourced options, mirroring Brilliant Earth's core values.

Indirect competitors include traditional luxury jewelers like Tiffany & Co. and Cartier. These brands appeal to a high-end clientele with established brand legacies. They are increasingly under pressure to adopt ethical sourcing practices.

The rise of lab-grown diamond specialists, such as Lightbox, intensifies the competitive landscape. These companies offer more affordable and verifiably ethical diamond options, potentially affecting Brilliant Earth's pricing strategy.

Mergers and acquisitions within the diamond industry, such as Signet's acquisition of Blue Nile, indicate a consolidation trend. This leads to larger, more formidable competitors with enhanced market power.

Brilliant Earth's competitive advantages include its focus on ethical jewelry, sustainable jewelry, and a strong online presence. However, these advantages are challenged by competitors adopting similar strategies.

Brilliant Earth's brand reputation is built on its commitment to ethical sourcing and sustainability. This reputation is a key differentiator, but it faces competition from other brands emphasizing similar values.

The Brilliant Earth competitive landscape is dynamic, with both direct and indirect competitors vying for market share. Key factors include price, selection, ethical sourcing, and brand reputation. To gain a deeper understanding of Brilliant Earth's position, consider reading more about the company's strategies in a comprehensive analysis like this one: Brilliant Earth's Business Strategy.

- Direct competitors like James Allen and Blue Nile are strong online rivals.

- Traditional luxury brands, such as Tiffany & Co., represent indirect competition.

- Lab-grown diamond specialists offer more affordable options.

- Market consolidation is creating larger, more powerful competitors.

- Brilliant Earth's ethical sourcing is a key differentiator.

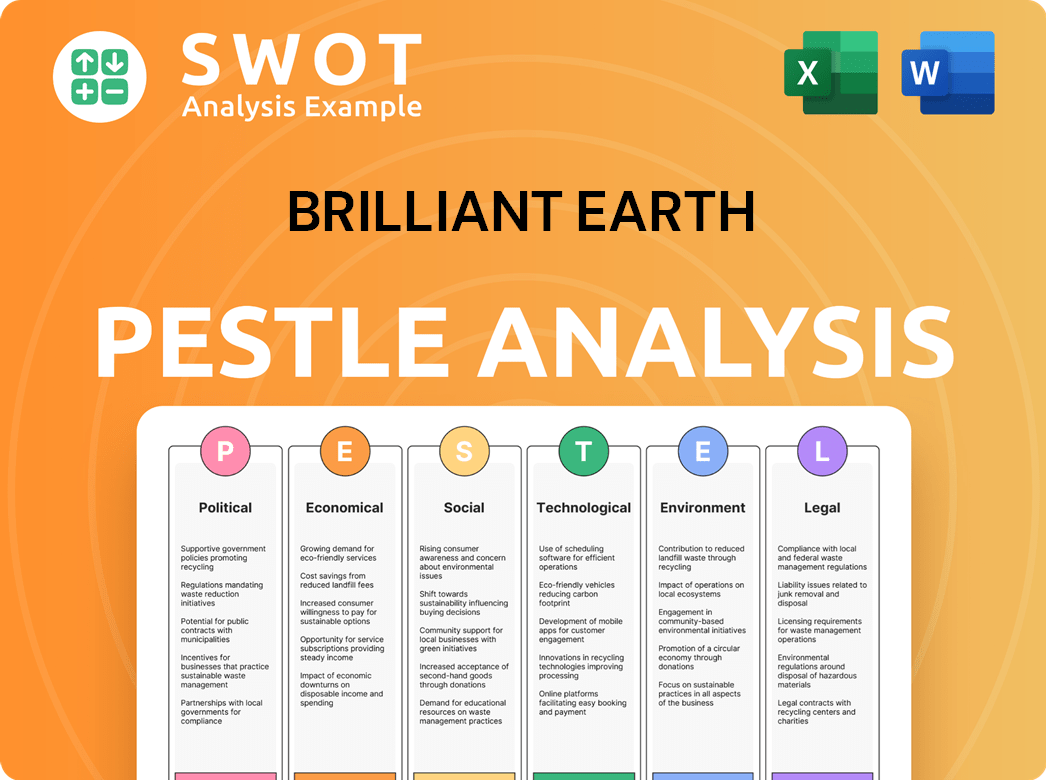

Brilliant Earth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Brilliant Earth a Competitive Edge Over Its Rivals?

Understanding the competitive landscape for ethical jewelry requires a deep dive into the strategies that set companies apart. For Brilliant Earth, several key factors contribute to its competitive advantages, allowing it to maintain a strong position in the market. These advantages stem from a commitment to ethical sourcing, a robust omnichannel retail strategy, and a focus on customer experience.

The company's success is not just about selling jewelry; it's about offering a product that aligns with consumers' values. This approach has allowed the company to carve out a significant niche and appeal to a growing customer base. As the demand for sustainable and ethically sourced products increases, the company is well-positioned to capitalize on this trend, differentiating itself from traditional jewelers.

The company's ability to innovate and adapt to changing consumer preferences is also crucial. By leveraging technology and continuously improving its offerings, the company stays ahead of the competition. This proactive approach ensures the company remains relevant and continues to attract customers who value both quality and ethical practices. To learn more about the company's origins, you can read the Brief History of Brilliant Earth.

The company's dedication to ethical sourcing is a primary competitive advantage. It offers conflict-free diamonds and recycled precious metals, which appeals to environmentally and socially conscious consumers. This commitment is integrated into its supply chain, ensuring transparency and building trust. The company's blockchain-enabled diamond origin platform further enhances transparency.

The company's omnichannel approach, blending online and physical showrooms, provides a superior customer experience. This model caters to customers who prefer in-person consultations while maintaining the convenience of online shopping. This hybrid approach allows the company to reach a broader audience and offer a more personalized service compared to competitors.

The company has built a strong brand reputation based on its ethical foundation and modern aesthetic. This fosters significant customer loyalty. The company leverages technology for personalized customer service and custom design capabilities, providing a tailored purchasing experience that stands out in the market.

The company uses technology to enhance the customer experience. This includes personalized service, custom design options, and the blockchain platform for diamond tracking. These innovations contribute to the company's competitive edge by providing transparency and a tailored shopping experience.

The company's competitive advantages are multifaceted, ranging from ethical sourcing to a strong brand presence. These elements collectively position the company favorably within the jewelry market. The company's ability to adapt to changing consumer preferences and leverage technology further strengthens its position.

- Ethical Sourcing: The company's commitment to conflict-free diamonds and recycled metals appeals to conscious consumers.

- Omnichannel Strategy: The hybrid retail model combines online convenience with in-person consultations.

- Brand Reputation: The company's strong brand equity and modern aesthetic drive customer loyalty.

- Technological Innovation: The company uses technology for personalized service and custom design.

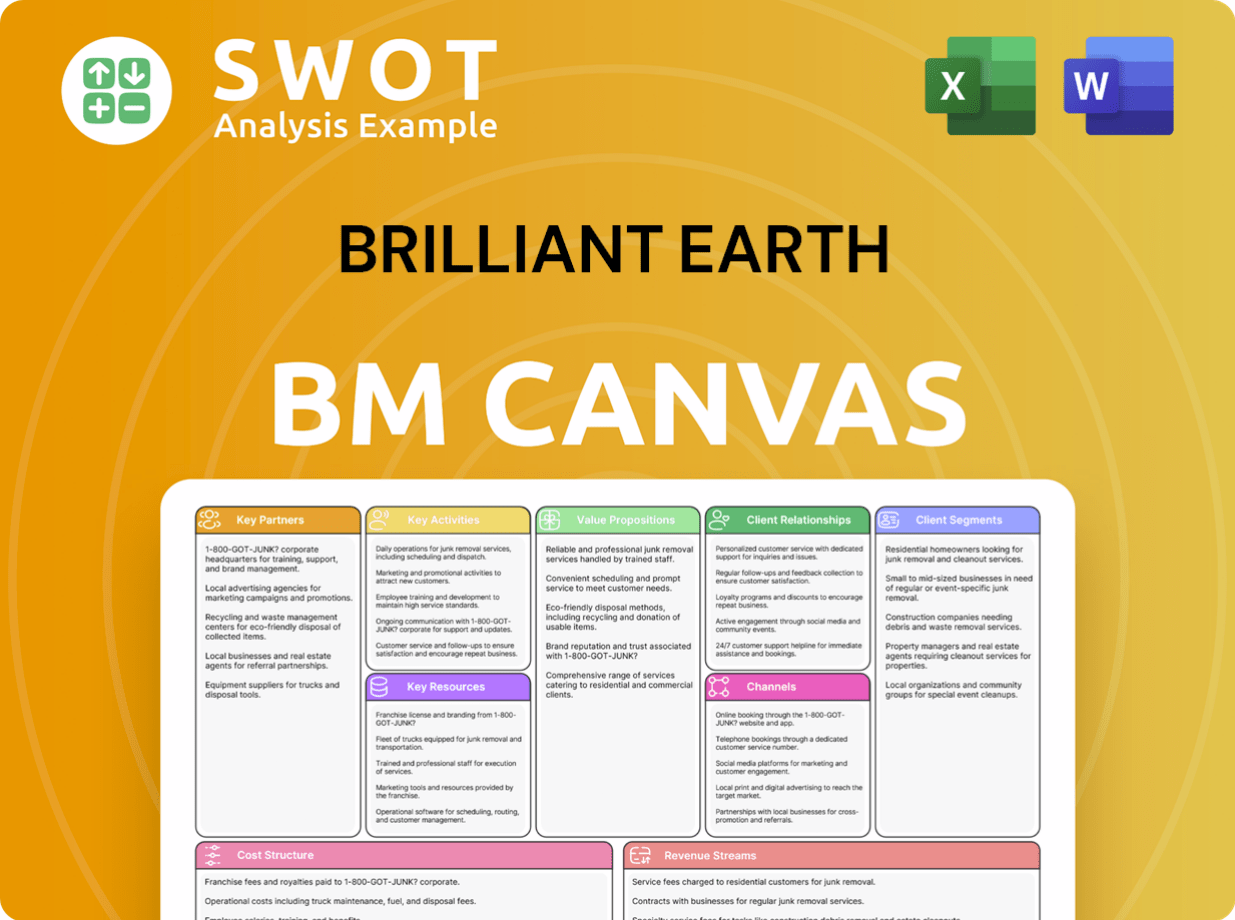

Brilliant Earth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Brilliant Earth’s Competitive Landscape?

The jewelry industry's competitive landscape, specifically for companies like Brilliant Earth, is significantly shaped by evolving consumer preferences and technological advancements. The demand for ethical and sustainable products is on the rise, creating both opportunities and challenges. A thorough Brilliant Earth competitive landscape analysis is crucial for understanding its market position and future prospects. The diamond industry is also experiencing a shift with the increasing popularity of lab-grown diamonds, which are becoming a strong alternative to mined diamonds.

Analyzing the Brilliant Earth competitors is important, as they are adapting to these trends. The company's success will depend on its ability to navigate these shifts while maintaining its brand identity and commitment to ethical sourcing. The market is dynamic, and understanding the jewelry market analysis is essential for strategic decision-making, especially when assessing the Brilliant Earth market share analysis.

The jewelry sector is seeing a surge in lab-grown diamonds, offering a more affordable and ethical choice. Consumers are increasingly seeking transparency and traceability in supply chains. Sustainability is no longer a niche; it's a core value driving purchasing decisions, affecting companies like Brilliant Earth.

Intense competition from both online and traditional jewelers is a significant challenge. Economic downturns could impact the luxury goods market, affecting sales and profitability. Maintaining the perception of luxury while scaling operations presents a delicate balancing act for companies like Brilliant Earth.

Expanding into new geographic markets, especially internationally, offers growth potential. Further product innovation, such as new jewelry categories, can drive growth. Strategic partnerships with complementary brands or influencers could broaden its reach and improve brand awareness.

Brilliant Earth’s approach will likely evolve, balancing its ethical core with broader market appeal. Leveraging its brand and omnichannel strategy will be key to remaining resilient and capitalizing on the demand for sustainable luxury. This will involve adapting to changing consumer demands.

Brilliant Earth's success hinges on its ability to adapt to changing consumer preferences, particularly the demand for ethical jewelry and sustainable jewelry. The company must navigate increased competition while maintaining its brand image. Understanding the Brilliant Earth business model and Brilliant Earth pricing strategy is crucial for long-term success.

- Focus on lab-grown diamonds to meet growing demand.

- Enhance transparency and traceability in the supply chain.

- Explore international market expansion.

- Consider strategic partnerships to expand reach.

Brilliant Earth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brilliant Earth Company?

- What is Growth Strategy and Future Prospects of Brilliant Earth Company?

- How Does Brilliant Earth Company Work?

- What is Sales and Marketing Strategy of Brilliant Earth Company?

- What is Brief History of Brilliant Earth Company?

- Who Owns Brilliant Earth Company?

- What is Customer Demographics and Target Market of Brilliant Earth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.