Brilliant Earth Bundle

Can Brilliant Earth Continue to Shine in the Jewelry Market?

Founded in 2005, Brilliant Earth revolutionized the jewelry industry by championing ethically sourced diamonds and gemstones, setting a new standard for transparency. This Brilliant Earth SWOT Analysis delves into the company's journey from an online pioneer to a key player in the fine jewelry sector. With a growing market capitalization, understanding Brilliant Earth's growth strategy and future prospects is crucial for investors and industry watchers alike.

Brilliant Earth's commitment to being an ethical diamond company and sustainable jewelry brand has resonated with consumers, influencing jewelry market trends. The company's success hinges on its ability to navigate the competitive landscape, optimize its online sales strategy, and capitalize on its core strengths. Analyzing Brilliant Earth's business model, financial performance, and expansion plans provides valuable insights into its potential for continued growth and its impact on the diamond industry.

How Is Brilliant Earth Expanding Its Reach?

The Brilliant Earth growth strategy centers on expanding both its physical presence and product offerings. This dual approach aims to capture a larger share of the jewelry market and cater to a wider customer base. The company's future prospects appear promising, driven by its commitment to ethical sourcing and sustainable practices, which resonate with today's consumers.

Brilliant Earth's company analysis reveals a focus on an omnichannel strategy. This strategy combines a strong online presence with physical showrooms. This allows customers to experience the products in person.

The company's expansion plans include opening new showrooms in key markets. Furthermore, they are broadening their product lines beyond engagement rings and wedding bands. This diversification includes expanding into fashion jewelry.

Brilliant Earth is actively increasing its physical retail footprint. This strategy aims to offer customers an in-person experience. Showrooms are strategically located in major metropolitan areas.

The company is expanding its product offerings beyond core engagement and wedding jewelry. This includes new collections and designs. The goal is to attract a broader customer base and increase revenue streams.

Brilliant Earth maintains a strong focus on its online platform. The website provides a seamless shopping experience. The company uses digital marketing to reach a wide audience.

A key part of Brilliant Earth's strategy is ethical sourcing and sustainable practices. This includes using recycled metals and lab-grown diamonds. These practices appeal to environmentally conscious consumers.

Brilliant Earth's expansion initiatives are designed to drive revenue growth and solidify its market position. The company is focused on reaching new customer segments. This is achieved through a combination of physical and digital strategies.

- Showroom Openings: Strategic expansion into new markets with physical showrooms.

- Product Line Extensions: Introduction of new jewelry collections to broaden appeal.

- Digital Marketing: Enhanced online presence and targeted advertising campaigns.

- Sustainability Focus: Continued emphasis on ethical sourcing and sustainable practices.

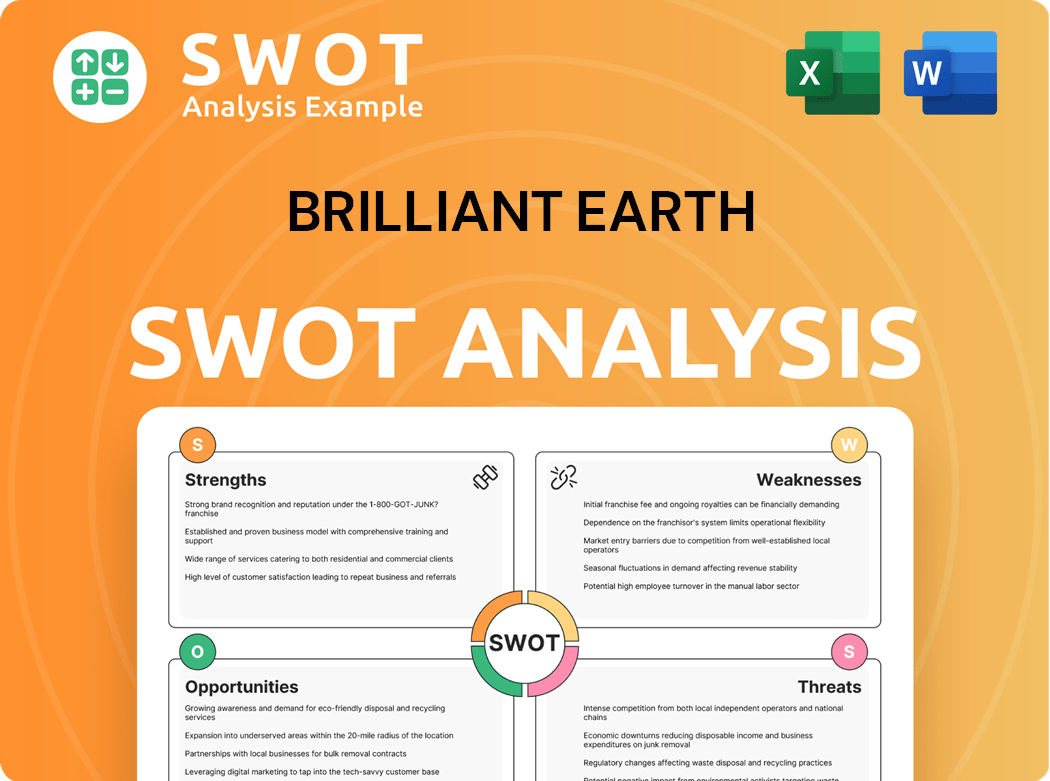

Brilliant Earth SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Brilliant Earth Invest in Innovation?

The digital-first approach of the company is a cornerstone of its growth strategy, leveraging technology to enhance customer experiences and streamline operations. This focus has been instrumental in its success, particularly in the competitive jewelry market. The company's ability to adapt and innovate within the e-commerce space has allowed it to capture a significant share of the market.

The company has invested in advanced e-commerce platforms to showcase its extensive inventory and provide personalized shopping experiences. This includes virtual try-on features and custom design tools, which are crucial for attracting and retaining customers. These digital tools enhance customer engagement and support the company's expansion plans.

Investments in technology extend to optimizing its supply chain for greater transparency and efficiency in sourcing ethically produced diamonds and gemstones. This commitment to ethical sourcing and sustainable practices is a key differentiator in the jewelry market and supports the company's brand image. The company's focus on lab-grown diamonds also aligns with current trends and consumer preferences.

The company continuously improves its online platform to enhance user experience. This includes updates to website functionality, such as improved search capabilities and streamlined checkout processes. These enhancements contribute to increased online sales and customer satisfaction.

The company introduces new digital tools to engage customers and provide personalized shopping experiences. Virtual try-on features allow customers to visualize how jewelry looks on them. Custom design tools enable customers to create unique pieces, increasing customer engagement and sales.

Technology is used to optimize the supply chain, ensuring transparency and efficiency in sourcing. This includes tracking diamonds and gemstones from origin to the customer. This focus on ethical sourcing is a key differentiator in the jewelry market, appealing to environmentally conscious consumers.

The company leverages data analytics to understand customer behavior and preferences. This data informs marketing strategies and product development. Analyzing customer data helps the company personalize the shopping experience and improve customer retention rates.

The company ensures its e-commerce platform is optimized for mobile devices, given the increasing use of smartphones for online shopping. This includes a responsive website design and a seamless mobile shopping experience. Mobile optimization is crucial for reaching a wider audience and driving online sales.

The company uses CRM systems to manage customer interactions and personalize communications. This includes targeted email campaigns and personalized product recommendations. Effective CRM helps build customer loyalty and drive repeat purchases.

The integration of technology supports the company's growth objectives by improving accessibility, personalization, and operational effectiveness. This digital-first approach has been central to the company's success, allowing it to adapt to changing market demands and consumer preferences. The company's commitment to innovation is evident in its continuous efforts to improve its online platform and introduce new digital tools for customers.

- Online Sales Strategy: The company's online sales strategy is heavily reliant on its e-commerce platform, which offers a wide range of products and features.

- Customer Acquisition: The company acquires customers through a combination of digital marketing, social media, and search engine optimization (SEO).

- Market Share: The company's market share in the online jewelry market has grown due to its strong e-commerce presence and effective marketing strategies.

- Competitive Advantages: The company's competitive advantages include its ethical sourcing practices, sustainable jewelry brand, and innovative use of technology. Check out the Competitors Landscape of Brilliant Earth to learn more.

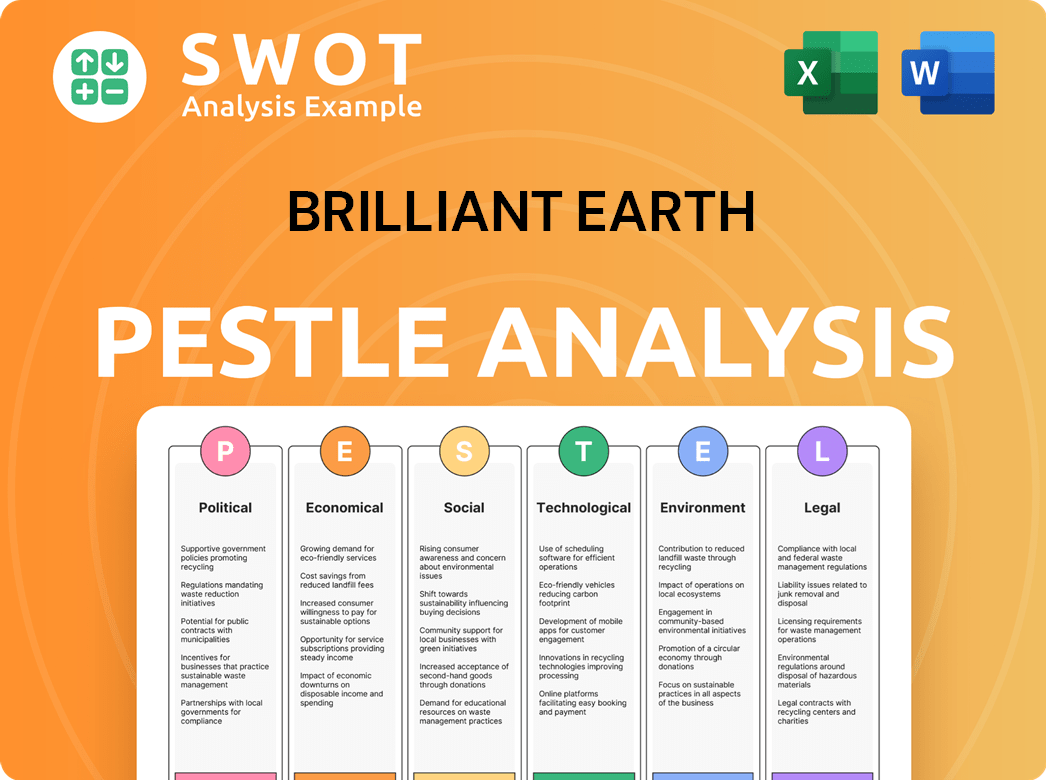

Brilliant Earth PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Brilliant Earth’s Growth Forecast?

Analyzing the financial outlook for the company reveals key insights into its performance and future potential. The company's financial health is a critical factor for investors and stakeholders evaluating its long-term viability and growth prospects within the jewelry market. Understanding the financial metrics, including revenue, profit margins, and strategic investments, provides a comprehensive view of the company's position and its capacity to capitalize on market opportunities.

The company's financial strategy focuses on disciplined capital allocation to support its growth ambitions. This includes investments in showroom expansion, technology enhancements, and marketing initiatives, all aimed at reaching new customers and strengthening its brand presence. The company's approach to financial management is designed to ensure sustainable growth and enhance shareholder value. The company's commitment to ethical sourcing and sustainable practices also resonates with a growing consumer base, further supporting its financial outlook.

The company's revenue for the fiscal year 2023 was $382.4 million. This figure reflects the company's ability to maintain a significant market presence. Despite the slight decrease compared to the previous year, the company's revenue remains substantial. The company's ability to maintain healthy profit margins, with a gross profit of $213.6 million in 2023, indicates efficient operations and strong brand value. This financial performance is a key indicator of the company's ability to navigate market fluctuations and maintain profitability.

The company reported net sales of $382.4 million for the fiscal year 2023. This represents a slight decrease from the previous year, attributed to broader industry trends in discretionary spending. The company's online sales strategy continues to be a significant revenue driver, reflecting the importance of its digital presence in reaching customers.

The company maintained healthy profit margins, with a gross profit of $213.6 million in 2023. This demonstrates the company's ability to manage costs and maintain profitability despite market challenges. The focus on ethical sourcing and sustainable practices contributes to the company's strong brand reputation and pricing power.

The company strategically allocates capital towards showroom expansion, technology enhancements, and marketing initiatives. These investments are designed to support long-term growth and enhance customer experience. The company's expansion plans include opening new showrooms in key markets to increase its physical presence and reach new customers.

The company's strong brand recognition in the ethical jewelry segment provides a competitive advantage. The company's commitment to sustainable practices and ethical sourcing appeals to a growing segment of consumers. The company's ability to offer a wide range of lab-grown diamonds and ethically sourced natural diamonds further strengthens its market position.

The company projects continued growth in the long term, driven by its expansion initiatives and strong brand recognition. The company's focus on innovation, including the use of lab-grown diamonds, positions it well for future market trends. The company's financial performance and strategic investments support its ability to capitalize on future opportunities.

The company's financial strategy supports its growth ambitions through disciplined capital allocation. This includes investments in showroom expansion, technology enhancements, and marketing. The focus on efficient operations and strong brand value is crucial for maintaining profitability and driving long-term growth. For a deeper dive into the company's origins, check out the Brief History of Brilliant Earth.

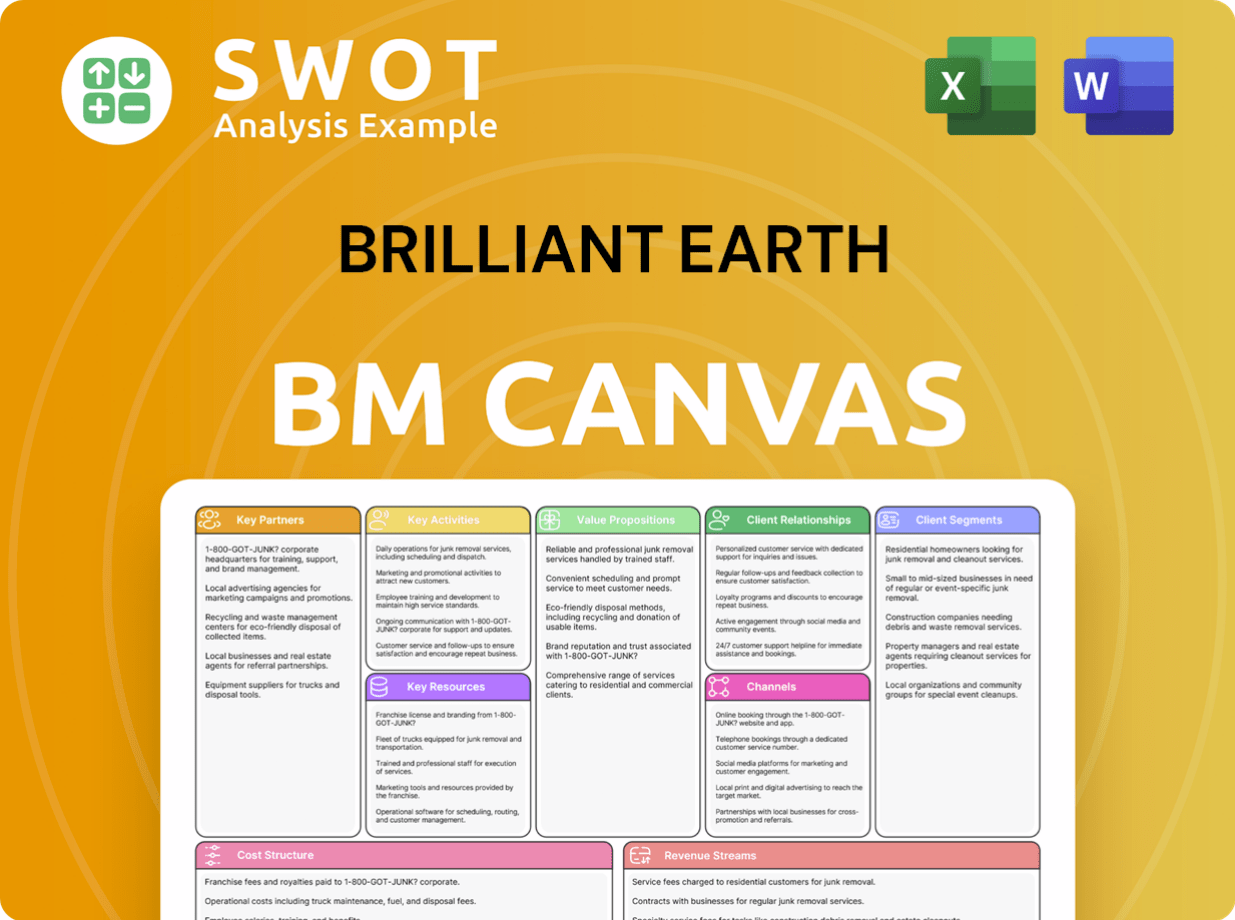

Brilliant Earth Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Brilliant Earth’s Growth?

The path forward for a company like Brilliant Earth, focusing on ethical and sustainable jewelry, is not without its challenges. The jewelry market trends are constantly evolving, and the company must navigate a competitive landscape that includes both established players and emerging online retailers. Understanding these potential pitfalls is crucial for assessing the overall Brilliant Earth company analysis and its future prospects.

Economic factors and shifts in consumer behavior also present significant risks. Discretionary spending, which includes luxury items like jewelry, is sensitive to economic downturns. Furthermore, the company's ability to maintain its ethical sourcing standards for diamonds and gemstones is critical, requiring constant vigilance and strong supplier relationships. These factors directly impact the Brilliant Earth growth strategy and its long-term viability.

To succeed, Brilliant Earth must proactively address these risks. This involves continuous innovation in product offerings, robust supply chain management, and a strong commitment to its brand and customer experience. The company must also stay ahead of evolving consumer preferences and technological advancements to maintain its competitive edge in the jewelry market.

The jewelry market is highly competitive, with both traditional jewelers and online retailers vying for market share. New entrants and shifting consumer preferences demand continuous adaptation and innovation. The company must differentiate itself through its ethical sourcing and brand reputation to maintain a competitive edge.

Economic downturns can significantly impact sales, as consumer spending on discretionary items like jewelry decreases. The slight decline in net sales in 2023 reflects this sensitivity. The company needs to develop strategies to mitigate the effects of economic fluctuations and maintain sales momentum.

Ethical sourcing of diamonds and gemstones is a critical aspect of the company's brand, but it also presents supply chain risks. Ensuring that all materials are ethically sourced requires diligent oversight and strong relationships with suppliers. Any disruption or scandal in the supply chain can damage the company's reputation and sales.

Consumer preferences are constantly changing, and technological advancements can disrupt the jewelry market. The company must adapt to trends such as lab-grown diamonds and online sales strategies to stay relevant. Investment in technology and marketing is crucial for staying competitive.

Maintaining a strong brand reputation and providing excellent customer experience are essential for success. Negative customer reviews or damage to the brand's image can impact sales. The company must continuously invest in customer service and brand building to foster loyalty and trust.

Operational challenges, such as managing inventory, fulfilling online orders, and expanding into new markets, can also pose risks. Efficient operations and effective logistics are crucial for profitability and customer satisfaction. The company needs to streamline its processes to ensure smooth operations.

To address these risks, the company employs several strategies. Diversifying product offerings, including lab-grown diamonds and other gemstones, helps mitigate market competition. Robust risk management frameworks are in place to monitor and manage supply chain vulnerabilities. Ongoing investment in its brand and customer experience is crucial for maintaining its competitive edge. For more insights into the company's values, consider reading about the Mission, Vision & Core Values of Brilliant Earth.

The company's financial performance, including revenue growth, profitability, and market share, is a key indicator of its success. Monitoring financial metrics and adapting to changing market conditions are essential. The company’s financial health will influence its ability to invest in growth initiatives and navigate economic challenges. The company's ability to maintain its ethical sourcing standards for diamonds and gemstones is critical, requiring constant vigilance and strong supplier relationships.

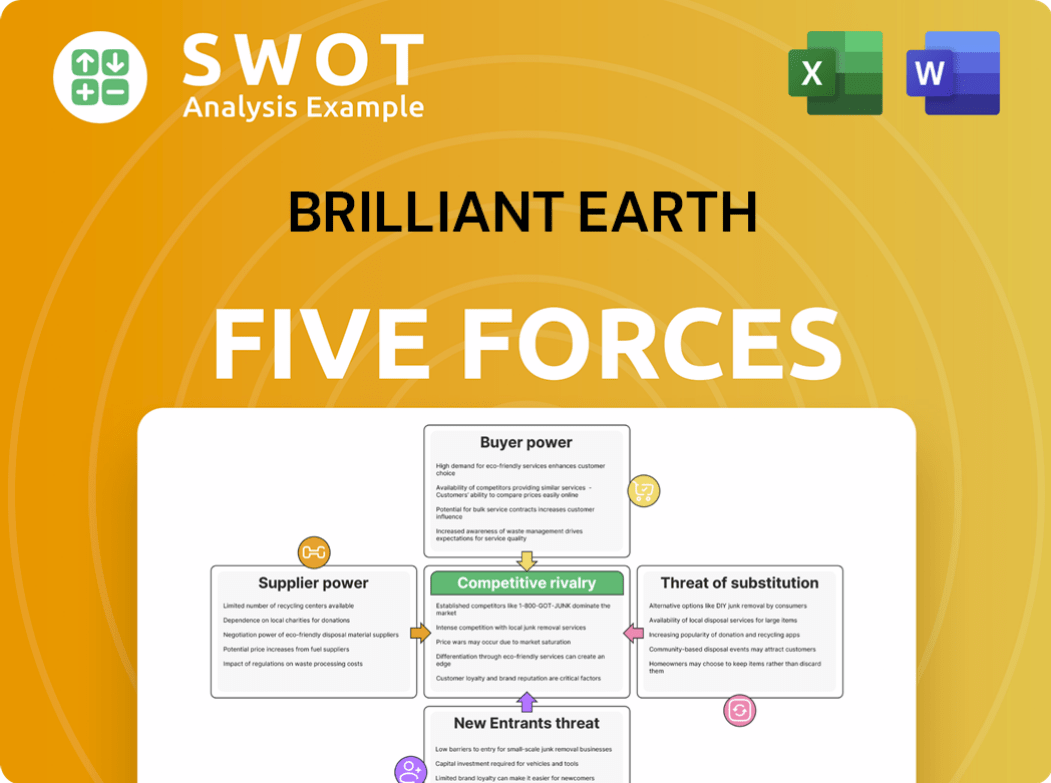

Brilliant Earth Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brilliant Earth Company?

- What is Competitive Landscape of Brilliant Earth Company?

- How Does Brilliant Earth Company Work?

- What is Sales and Marketing Strategy of Brilliant Earth Company?

- What is Brief History of Brilliant Earth Company?

- Who Owns Brilliant Earth Company?

- What is Customer Demographics and Target Market of Brilliant Earth Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.