Black & Veatch Bundle

Who are Black & Veatch's Main Rivals in the Infrastructure Arena?

Black & Veatch, a titan in engineering and construction, is at the forefront of global infrastructure development. With a century-long legacy, the company tackles critical projects in energy, water, and telecommunications. Understanding the Black & Veatch SWOT Analysis is key to grasping its competitive standing.

The competitive landscape for Black & Veatch is dynamic, shaped by evolving market demands and technological advancements. This analysis will delve into the Black & Veatch competition, examining its Black & Veatch competitors and their impact on Black & Veatch market share. We'll also explore the Black & Veatch industry analysis to identify Black & Veatch key players and assess their strategies within the Competitive landscape Black & Veatch.

Where Does Black & Veatch’ Stand in the Current Market?

Black & Veatch holds a prominent market position in the global infrastructure development sector, focusing on energy, water, telecommunications, and government services. As a privately held company, precise market share figures are not publicly available. However, it consistently ranks among the top international design firms and power companies, indicating a significant influence in the industry. The firm's comprehensive services span the entire project lifecycle, from consulting and design to construction and management, serving a diverse customer base including utilities and government agencies.

The company's core operations revolve around providing engineering, procurement, construction (EPC), and consulting services for critical infrastructure projects. Their value proposition lies in delivering integrated solutions that enhance efficiency, sustainability, and reliability across various sectors. This approach allows them to offer end-to-end project management, ensuring projects are completed effectively and to the highest standards. Black & Veatch's commitment to innovation and sustainability further strengthens its market position, especially in the context of global climate change and the energy transition.

Geographically, Black & Veatch maintains a strong global presence, with projects and offices across North America, South America, Europe, Asia, Africa, and Australia. This widespread reach enables the company to leverage local expertise while adhering to global standards of excellence. Over time, Black & Veatch has strategically positioned itself, emphasizing sustainable and innovative solutions, particularly in response to climate change and the energy transition. This includes significant investments and project wins in renewable energy, grid modernization, and advanced water treatment. This is further explored in the Marketing Strategy of Black & Veatch.

Black & Veatch's primary focus areas include power generation, water treatment, telecommunications, and government services. These sectors represent significant revenue streams and opportunities for growth. The company's expertise in these areas allows it to offer specialized solutions that meet the unique needs of each sector.

Black & Veatch operates globally, with a strong presence in North America, Europe, and Asia-Pacific. This global footprint enables it to serve clients worldwide and capitalize on emerging market opportunities. The company's international reach is a key factor in its competitive advantage.

While specific financial details are not always public due to its private status, Black & Veatch reports revenues in the billions of dollars annually. This financial strength allows the company to undertake large-scale projects and invest in research and development. The company's financial health is indicative of its strong market standing.

Black & Veatch's competitive advantages include its integrated service offerings, global presence, and expertise in sustainable solutions. Its ability to provide end-to-end project management and its focus on innovation set it apart. The company's long-standing relationships with clients and its reputation for quality also contribute to its success.

Black & Veatch's market position is robust, supported by its strong financial performance and diverse service offerings. The company consistently ranks among the top firms in the engineering and construction industry. Its strategic focus on sustainable solutions and its global reach further enhance its competitive standing.

- Strong presence in the power and water sectors.

- Extensive global operations.

- Emphasis on sustainable and innovative solutions.

- Financial stability demonstrated by multi-billion dollar revenues.

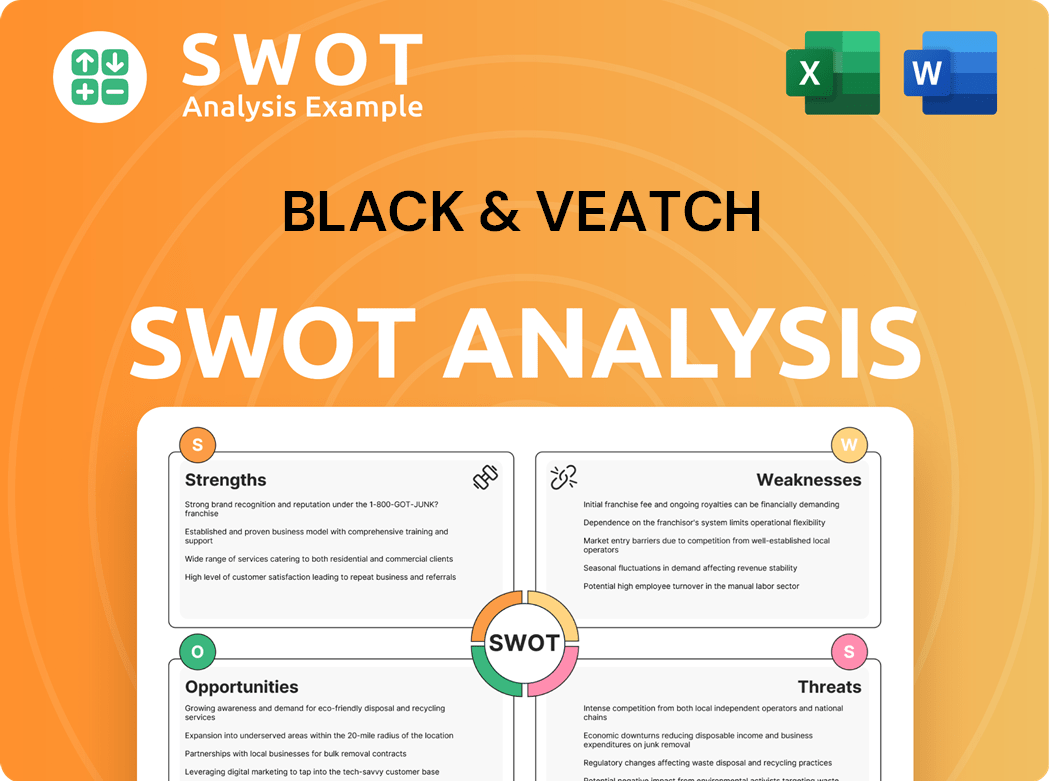

Black & Veatch SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Black & Veatch?

The competitive landscape for Black & Veatch is intense, shaped by a global market with numerous formidable rivals. This environment demands continuous adaptation and innovation to maintain market share and secure lucrative projects. Understanding the key players and their strategies is crucial for assessing Black & Veatch's position and future prospects within the industry.

Black & Veatch faces both direct and indirect competition, requiring it to differentiate itself through specialized expertise, project execution efficiency, and strategic partnerships. The firm's ability to navigate this complex competitive environment will significantly influence its financial performance and growth trajectory, especially in sectors like infrastructure and energy.

The primary competitors of Black & Veatch include large, multinational engineering and construction firms. These companies compete across various sectors, including infrastructure, energy, and environmental projects. The competitive dynamics are influenced by factors like pricing, technological innovation, and global distribution networks.

Bechtel, a privately held company, is a direct competitor, particularly in large-scale infrastructure, nuclear, and security projects. Bechtel's financial performance is not publicly disclosed, but it consistently ranks among the largest engineering and construction firms globally, competing for high-value contracts.

Fluor Corporation competes directly with Black & Veatch, especially in the energy, chemicals, and mining sectors. In 2023, Fluor reported revenues of approximately $15.2 billion, highlighting its significant presence in the market. Fluor's expertise in project execution and its global reach make it a strong competitor.

Jacobs Engineering Group offers a wide array of technical, professional, and construction services, creating direct competition in government, infrastructure, and advanced facilities markets. Jacobs reported revenues of around $16.4 billion in fiscal year 2023. Its diversified service offerings and global presence make it a key rival.

KBR, known for its government services and energy solutions, frequently competes with Black & Veatch for significant contracts. KBR's revenue for 2023 was approximately $6.4 billion. KBR's focus on government contracts and energy projects positions it as a direct competitor.

AECOM is a global infrastructure consulting firm that competes with Black & Veatch across various sectors. AECOM's revenue for fiscal year 2023 was about $14.4 billion. AECOM's broad service offerings and global footprint make it a significant competitor in the infrastructure market.

Indirect competition comes from specialized consulting firms, technology providers, and some large industrial companies. These entities may focus on niche areas, such as smart grid technologies or cybersecurity for critical infrastructure, creating additional competitive pressures.

The competitive landscape for Black & Veatch is shaped by a combination of factors including pricing strategies, technological innovation, and global distribution networks. Firms compete for large-scale projects, especially in renewable energy, leveraging their unique strengths.

- Aggressive Pricing: Competitors often employ aggressive pricing strategies to secure contracts, which can impact profit margins.

- Technological Innovation: Continuous innovation in project delivery and technology is crucial, particularly in areas such as renewable energy and smart infrastructure.

- Brand Recognition: Strong brand recognition and reputation are essential for winning contracts and building client trust.

- Global Distribution: Extensive global distribution networks enable companies to bid on projects worldwide, increasing their market reach.

- Specialized Expertise: Specialized technological expertise and niche market focus are critical for differentiation and competitive advantage.

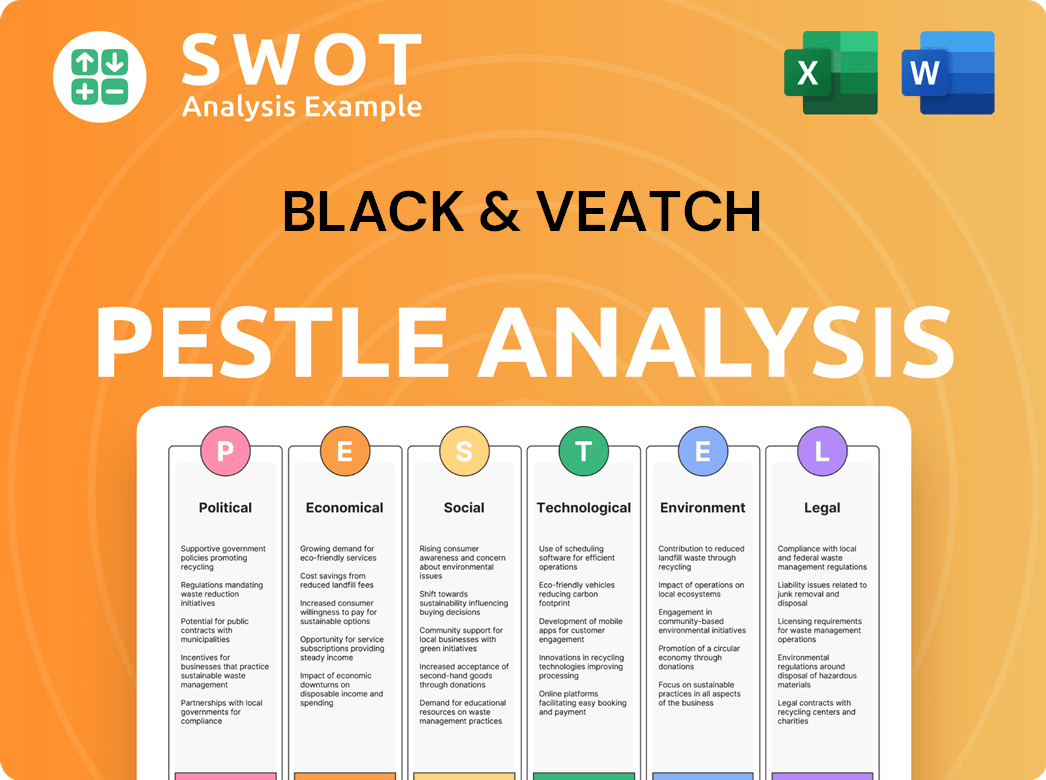

Black & Veatch PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Black & Veatch a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Black & Veatch involves assessing its core strengths and how it positions itself against rivals. Key to its success are its comprehensive service offerings and employee-ownership structure. These elements contribute significantly to its ability to secure and execute large-scale infrastructure projects effectively.

The company's competitive advantages are further solidified by its proprietary technologies and extensive experience. This includes a strong presence in smart infrastructure and advanced energy solutions. These capabilities are crucial in today's market, allowing Black & Veatch to maintain a leading position.

Black & Veatch's long-standing relationships with clients and its commitment to innovation are also critical. The company's focus on research and development ensures it remains at the forefront of industry trends. This helps maintain its competitive edge in a dynamic market.

Black & Veatch offers end-to-end solutions, from planning to asset management. This integrated approach enhances project control and efficiency. This is a key differentiator in the Black & Veatch competition.

The employee-owned structure fosters accountability and client-centricity. Employees benefit directly from the company's success, leading to higher retention. This model contributes to a strong commitment to project outcomes.

Black & Veatch invests heavily in proprietary technologies, particularly in smart infrastructure and energy solutions. This commitment to innovation helps it stay ahead of Black & Veatch competitors. This focus is crucial for maintaining its market position.

The company has cultivated strong client relationships over decades, leading to high customer loyalty. Its extensive experience in complex projects builds significant brand equity and client trust. This is vital for the Black & Veatch market share.

Black & Veatch's competitive strategy centers on integrated services, employee ownership, and technological innovation. These factors are crucial for its sustained success. The company continues to invest in research and development to maintain its competitive edge.

- Integrated Solutions: Providing comprehensive services from planning to asset management.

- Employee Ownership: Fostering a culture of accountability and long-term vision.

- Technological Leadership: Investing in proprietary technologies, especially in smart infrastructure.

- Client Relationships: Cultivating strong, long-term relationships with key clients.

Black & Veatch Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Black & Veatch’s Competitive Landscape?

The competitive landscape for Black & Veatch is shaped by dynamic industry trends and global economic shifts. Understanding the Black & Veatch competition, including its Black & Veatch competitors, is crucial for assessing its market position and future outlook. The company faces both challenges and opportunities driven by technological advancements, sustainability demands, and evolving regulatory frameworks. The Black & Veatch market share and competitive strategies are key factors in its long-term success.

Black & Veatch's industry position is influenced by its ability to adapt to rapid changes in the infrastructure development sector. Risks include increased competition and economic uncertainties, while opportunities arise from the growing demand for sustainable and resilient infrastructure. The company's future outlook depends on its strategic responses to these challenges and its ability to capitalize on emerging market trends, as discussed in the article Growth Strategy of Black & Veatch.

The infrastructure development industry is experiencing significant shifts, including the global energy transition, the need for sustainable infrastructure, and rapid digitalization. These trends are driving demand for innovative solutions in areas like renewable energy, smart infrastructure, and advanced water treatment. These changes require firms to adapt and invest in new technologies and talent.

Key challenges include increased competition from specialized firms and aggressive pricing strategies. Supply chain disruptions and geopolitical instability can impact project timelines and costs. The need to continually upskill the workforce to meet technological advancements also presents a significant hurdle.

Significant growth opportunities exist in emerging markets with substantial infrastructure needs. The increasing use of public-private partnerships and the global push for sustainable solutions also create avenues for expansion. Black & Veatch can leverage its expertise in these areas to secure new projects.

Black & Veatch is strategically investing in innovation, forming partnerships, and deploying resources in high-growth areas. This approach is designed to enhance its competitive position and capitalize on future growth prospects. The company's focus on sustainability and digital solutions is key to its long-term strategy.

Analyzing the Black & Veatch industry analysis involves assessing its competitive advantages, rival companies, and market position. The company's ability to navigate the energy transition and digital transformation is critical. This involves evaluating Black & Veatch's key players and their strategies.

- Black & Veatch competitive advantages include its expertise in water treatment and energy infrastructure.

- Black & Veatch rival companies such as Jacobs Engineering and AECOM are major competitors.

- Understanding Black & Veatch's market position requires evaluating its financial performance compared to rivals.

- The company's Black & Veatch competitive strategy involves adapting to technological advancements and market demands.

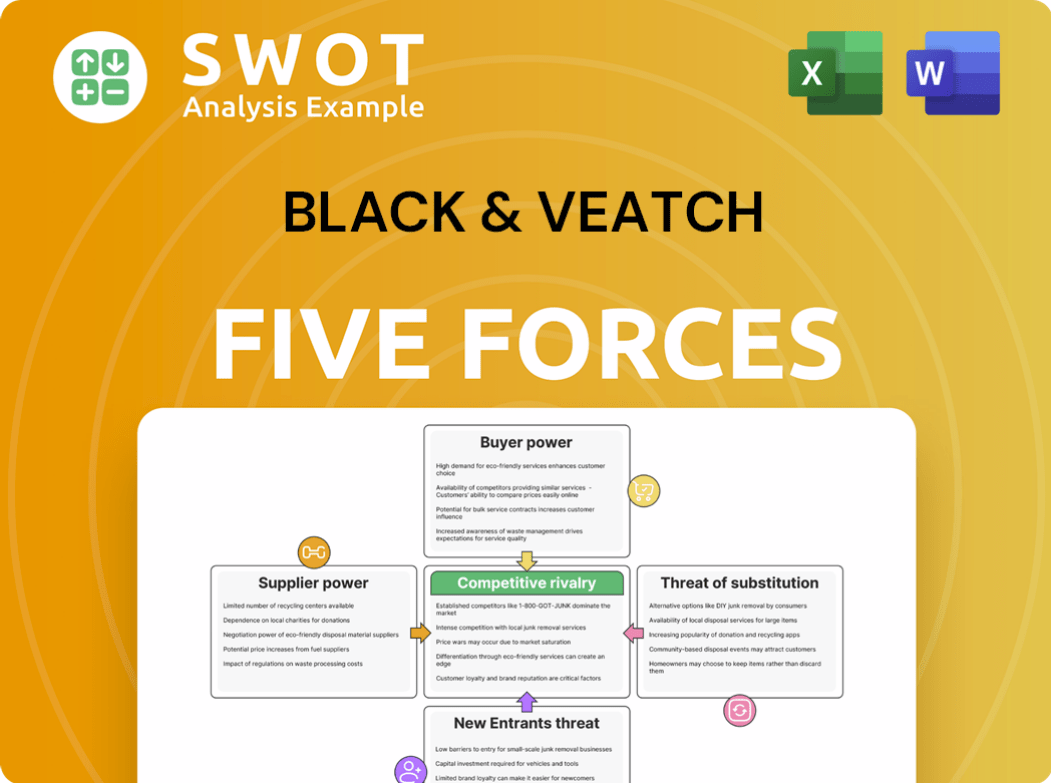

Black & Veatch Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Black & Veatch Company?

- What is Growth Strategy and Future Prospects of Black & Veatch Company?

- How Does Black & Veatch Company Work?

- What is Sales and Marketing Strategy of Black & Veatch Company?

- What is Brief History of Black & Veatch Company?

- Who Owns Black & Veatch Company?

- What is Customer Demographics and Target Market of Black & Veatch Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.