Black & Veatch Bundle

Can Black & Veatch Sustain Its Growth Trajectory?

Black & Veatch, a cornerstone in critical human infrastructure, is charting a course for future expansion. Founded in 1915, this employee-owned engineering company has evolved into a global leader, boasting $4.7 billion in revenue in 2023. This report delves into Black & Veatch's Black & Veatch SWOT Analysis to understand its growth strategy and future prospects.

Black & Veatch's commitment to sustainability, demonstrated by significant reductions in greenhouse gas emissions, underscores its strategic vision. This focus, coupled with its strong position in the Power and Water markets, positions the Engineering Company for continued success. This analysis examines how Black & Veatch plans to leverage innovation, expand its global footprint, and navigate the evolving demands of Infrastructure Projects, providing a comprehensive Market Analysis of its future.

How Is Black & Veatch Expanding Its Reach?

The expansion initiatives of Black & Veatch are primarily focused on capitalizing on the growing global demand for sustainable and resilient infrastructure. This strategy is driven by the increasing need for advanced solutions in key sectors such as energy, water, telecommunications, and government. The company aims to broaden its reach by entering new markets and strengthening its position in existing ones through strategic projects and partnerships. This approach is supported by a strong commitment to innovation and a focus on delivering high-value solutions to its clients.

Black & Veatch's commitment to innovation and its strategic focus on core markets have positioned it for significant growth. By leveraging its expertise in engineering, procurement, and construction, the company is well-equipped to meet the evolving needs of its clients. Its expansion strategy is designed to address the challenges and opportunities presented by global trends such as climate change, urbanization, and the increasing demand for reliable infrastructure. The company's future prospects are promising, with a clear focus on sustainable and resilient solutions.

As a leading Engineering Company, Black & Veatch continues to expand its operations through strategic initiatives. In 2024, the company solidified its position in the renewable energy sector. It became the top solar design firm in the country, having installed over 50 gigawatts (GW) of renewable solar projects globally. This includes a 600-megawatt (MW) project in Texas. Furthermore, Black & Veatch is a leader in the design of hydrogen facilities and battery storage systems, ranking No. 2 in both categories in 2024.

In the telecommunications sector, Black & Veatch remains a top 20 telecommunications firm for 2024, despite divesting its public carrier wireless telecommunications infrastructure business. The company has shifted its focus to providing wireline and fiber connectivity, private wireless telecom networks, and grid modernization solutions. This strategic move aims to enhance the resilience of national power infrastructure.

Black & Veatch is actively involved in advancing data centers, offering end-to-end solutions. These solutions range from site sourcing and zoning advocacy to infrastructure delivery, design, and construction oversight. This comprehensive approach allows the company to provide complete solutions for its clients.

The company is expanding its construction services through acquisitions, such as Bird Electric, as noted in its 2024 Annual Sustainability Report. This expansion strengthens Black & Veatch's capabilities in delivering comprehensive infrastructure solutions.

International expansion is a key component of Black & Veatch's growth strategy. The company leverages its PRICO® technology for floating liquefied natural gas (FLNG) projects. This patented technology is used in half of the world's FLNG projects either in operation, under construction, or under contract.

In November 2024, Black & Veatch announced a collaboration with Baker Hughes to offer a standard LNG solution capable of producing up to 2 million tonnes per annum (MTPA) per train. The company is targeting mid-scale LNG solutions for both onshore and floating facilities. Additionally, Black & Veatch continues to participate in the BV IgniteX Sustainable Infrastructure Accelerator program.

- The BV IgniteX program opened applications for its 2025 program in May 2025.

- The program empowers infrastructure-focused startups with developing technologies.

- It provides non-dilutive grants and in-kind services of up to $35,000, along with potential equity investments.

- These initiatives highlight Black & Veatch's commitment to innovation and its role in the Infrastructure Projects.

For more insights into the company's structure and ownership, you can refer to Owners & Shareholders of Black & Veatch. This comprehensive approach, combined with strategic partnerships, positions Black & Veatch for sustained growth and success in the future. This Growth Strategy is designed to capitalize on emerging market opportunities and technological advancements.

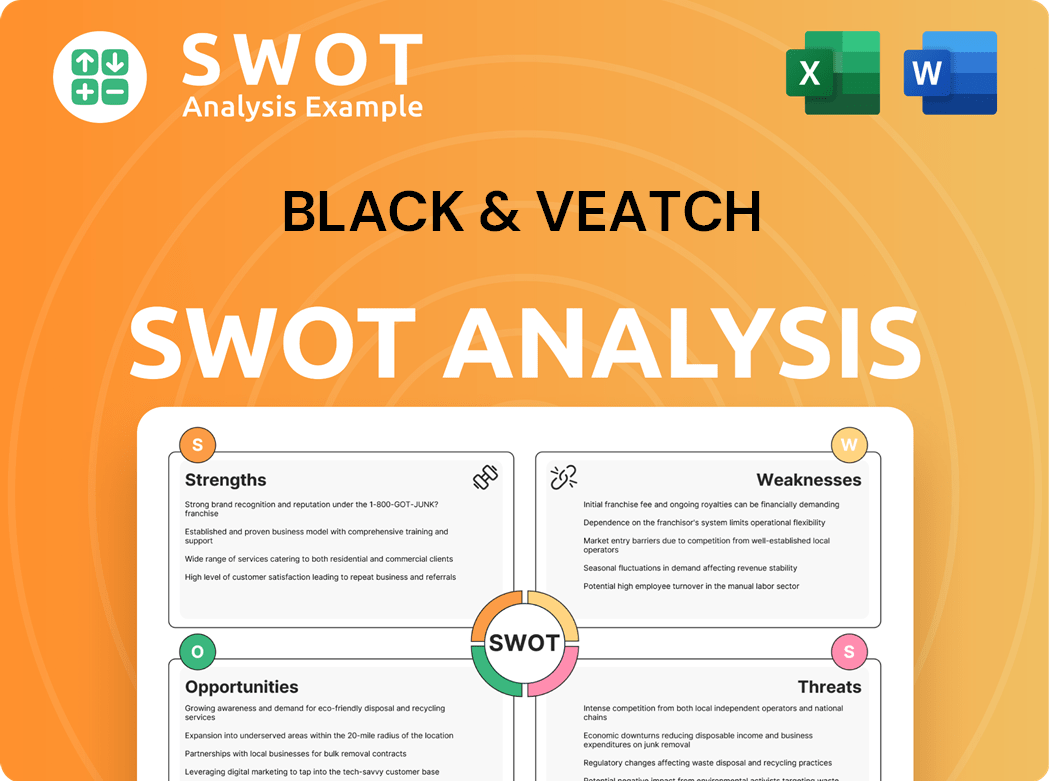

Black & Veatch SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Black & Veatch Invest in Innovation?

As an Engineering Company, Black & Veatch's Growth Strategy is significantly shaped by its commitment to innovation and technology. This approach is crucial for tackling complex challenges in Infrastructure Projects and maintaining a competitive edge in a rapidly evolving market. Their focus on digital transformation and strategic partnerships demonstrates a forward-thinking approach to meet the changing demands of clients and the industry.

Black & Veatch actively integrates cutting-edge technologies such as AI and IoT into its solutions. This proactive stance allows them to optimize operations, improve project outcomes, and provide sustainable solutions. Their investments in research and development, along with collaborations, position them to lead in innovation within the engineering sector.

The company's strategic use of technology and innovation plays a vital role in its long-term Black & Veatch Future. By embracing digital transformation and fostering a culture of innovation, they are well-prepared to address the evolving needs of the market and drive sustainable growth. This approach is essential for maintaining their market position and expanding into new opportunities.

Black & Veatch is deeply involved in digital transformation, integrating advanced technologies like AI and IoT into its solutions. This strategy helps in improving efficiency and providing innovative solutions for clients. This approach is critical for remaining competitive in the engineering industry.

The company is scaling its Data, Analytics, and AI competency to optimize talent and gain a competitive edge. An internal initiative, 'Enterprise Knowledge Chat,' uses AI to streamline access to internal knowledge documents. This demonstrates their commitment to using AI to advance engineering practices.

Black & Veatch recognizes the significance of strategic partnerships in advancing Generative AI (GenAI). They collaborate with external companies and clients to drive innovation. These partnerships are essential for staying at the forefront of technological advancements.

The BV IgniteX accelerator program supports startups, providing funding and in-kind services. The 2025 program, accepting applications until June 8, 2025, focuses on sustainable infrastructure. This program offers mentorship and access to their industry network.

Black & Veatch participates in industry discussions, such as the '2025 Cleantech Outlook,' to discuss key investments and technologies. Their involvement helps shape industry trends and promotes sustainable practices. They are actively involved in shaping the future of the industry.

They use advanced mapping tools with AI and machine learning for disaster response, demonstrating a proactive approach to building resilient systems. This innovative approach highlights their commitment to using technology for societal benefit. This is a key area of innovation.

Black & Veatch is investing in systems, tools, and data to track greenhouse gas emissions and make informed business decisions. The company's commitment to innovation is further recognized through awards. This commitment is reflected in their Mission, Vision & Core Values of Black & Veatch.

- AI-Powered Tools: 'Enterprise Knowledge Chat' is an AI-powered tool piloted in 2024 to improve access to internal knowledge.

- BV IgniteX Accelerator: Since 2019, the program has supported over 45 startups with more than $3 million in non-dilutive funding and in-kind services.

- Cleantech Outlook: Representatives speak at events like the '2025 Cleantech Outlook' to discuss industry trends.

- Sustainable Infrastructure: The 2025 BV IgniteX program focuses on sustainable infrastructure, accepting applications until June 8, 2025.

- Data Center Water Demands: The 2025 Water Report highlights that 54% of respondents have not yet factored rising data center water demands into long-term resource planning.

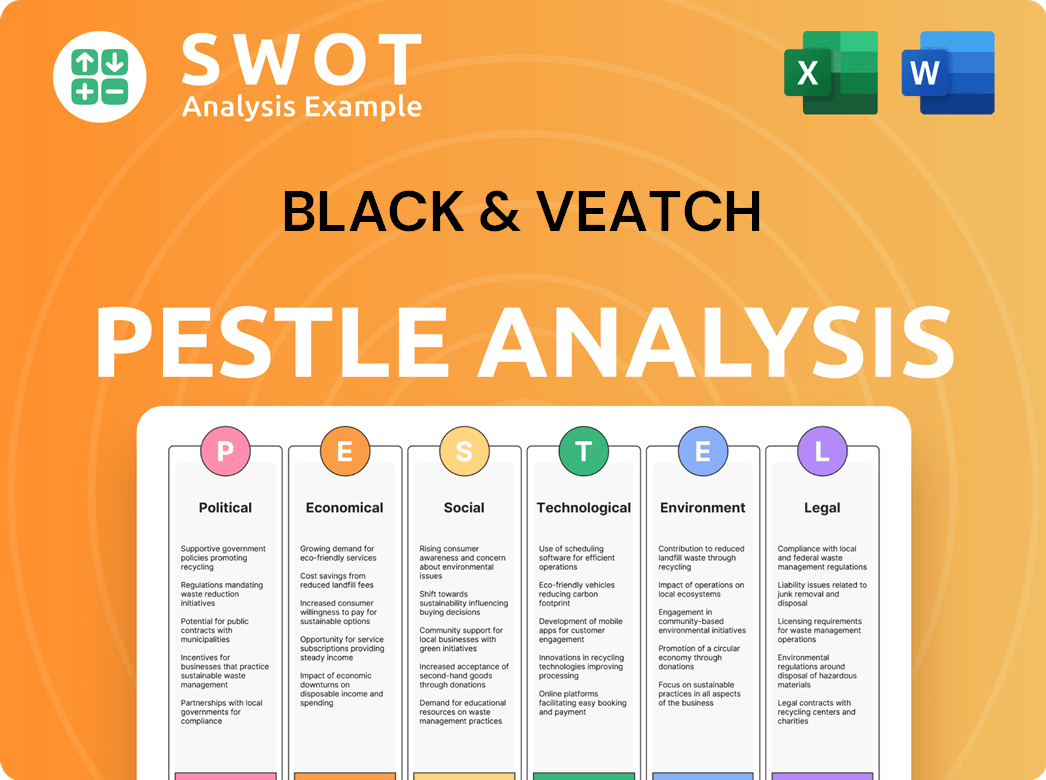

Black & Veatch PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Black & Veatch’s Growth Forecast?

The financial outlook for Black & Veatch appears robust, underpinned by consistent revenue growth and strategic investments. As a 100-percent employee-owned Engineering Company, the firm demonstrated a strong financial performance in 2023, reporting total revenue of $4.735 billion. This positive trend continued into 2024, with revenues reaching $4.70 billion, showcasing the company's sustained expansion in the market.

Black & Veatch's financial health is further supported by its commitment to Infrastructure Projects and technological advancements. The company's focus on achieving net-zero greenhouse gas emissions by 2050, relative to a 2019 baseline, indicates a strategic shift towards sustainable solutions. This initiative, although requiring significant investment, is expected to generate future revenue streams through sustainable infrastructure projects, aligning with global trends in environmental sustainability.

The company's strong position in key markets, such as being the No. 1 solar design firm in 2024 and ranking No. 2 in the design of hydrogen facilities and battery storage systems, indicates a healthy pipeline of projects in high-growth sectors. Furthermore, its ongoing involvement in the BV IgniteX innovation accelerator program, which provides funding and services to early-stage companies, suggests a strategy of investing in future technologies and market opportunities. To learn more about the company's origins, you can read Brief History of Black & Veatch.

Black & Veatch has shown consistent revenue growth over the years. Revenue increased from $3.3 billion in 2021 to $4.3 billion in 2022, and further to $4.735 billion in 2023. The revenue reached $4.70 billion in 2024.

The company is making significant investments in sustainable infrastructure and technological advancements. This includes a commitment to achieve net-zero greenhouse gas emissions by 2050, which involves investments in new systems and tools.

Black & Veatch holds a strong market position in key sectors. It was the No. 1 solar design firm in 2024 and ranked No. 2 in the design of hydrogen facilities and battery storage systems, indicating a robust project pipeline.

The company is actively involved in the BV IgniteX innovation accelerator program. This program supports early-stage companies, indicating a strategy of investing in future technologies and market opportunities.

Black & Veatch Special Projects Corp. has secured over $4.4 million in combined obligated amounts from Department of Defense contracts with start dates in late 2024 and early 2025. A combined potential award amount exceeds $7.5 million.

Black & Veatch has a global presence, with a specific focus on India. Black & Veatch Private Limited (India) reported revenue of ₹286 Cr for the financial year ending March 31, 2022, with a compounded annual growth rate (CAGR) of 10% in the last year.

Black & Veatch Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Black & Veatch’s Growth?

The Engineering Company, faces several potential risks and obstacles as it pursues its Growth Strategy and aims for a positive Black & Veatch Future. These challenges stem from the dynamic nature of the industries in which it operates, particularly in sectors like water and wastewater, where infrastructure is aging, and cybersecurity threats are escalating. Understanding these risks is crucial for assessing the company's long-term prospects and its ability to execute its strategic plans effectively.

A key challenge involves the aging infrastructure in critical sectors. Additionally, the company must address the workforce challenges, including the need to attract and retain qualified staff. Furthermore, regulatory changes, funding limitations, and ratepayer sensitivity add complexity. The company must navigate these issues to maintain its competitive edge and achieve its growth objectives in the Infrastructure Projects market.

Black & Veatch operates in a landscape where aging infrastructure poses a significant challenge. The 2025 Water Report highlights that only 34% of respondents are 'very confident' in their water systems' resilience, an 11-point drop from 2024, indicating persistent concerns about infrastructure, affordability, and supply reliability. This situation necessitates substantial investment in upgrades and modernization, which can be a significant financial and operational burden.

The aging workforce and the difficulty in hiring qualified personnel are significant obstacles. The U.S. water industry has consistently ranked this as a top concern for the third consecutive year, cited by 47% of respondents in 2024. High retirement rates, with 68% reporting losses among management, operators, and engineers, further exacerbate this issue.

Cybersecurity threats are a growing concern across critical infrastructure. The 2025 Water Report indicates that 95% of stakeholders prioritize cybersecurity investment, with safety and public welfare as the main motivations. The lack of in-house expertise to properly use cybersecurity assessment frameworks and the reliance on external experts pose additional risks.

Regulatory changes and funding limitations also pose risks. Despite recent regulatory rollbacks, half of water sector respondents plan to maintain existing priorities, particularly regarding PFAS remediation and sustainability practices. The cost of PFAS compliance could exceed $3.2 billion annually. Funding limitations and ratepayer sensitivity further constrain capital infrastructure projects.

Climate change is another significant factor influencing the risks faced by Black & Veatch. Extreme weather events and changing environmental conditions can disrupt infrastructure projects and increase operational costs. Adapting to these impacts requires proactive planning and investment in resilient infrastructure solutions.

Market Analysis reveals that competition within the engineering sector is intense, with various firms vying for projects. Economic fluctuations and shifts in government spending can also impact project pipelines and profitability, necessitating flexible strategies and diversified service offerings to mitigate these risks.

Rapid technological advancements can disrupt traditional engineering practices. Black & Veatch must invest in new technologies and adapt its services to stay competitive. Failure to do so could result in obsolescence and reduced market share, affecting long-term growth prospects.

Black & Veatch addresses these risks through several strategies. They advocate for smarter sustainability practices and adapt to new regulations, modernizing systems to ensure long-term reliability and resilience. Collaboration between public and private entities is emphasized for effective disaster response and proactive identification of vulnerabilities. The company also recommends engaging external cybersecurity professionals and investing in training to build internal capacity for managing cyber risks.

Innovation is critical for navigating these challenges. The company is investing in new technologies and research to enhance its service offerings and maintain a competitive edge. This includes exploring digital solutions, sustainable practices, and advanced engineering techniques to meet evolving client needs and market demands. For more detailed information, you can explore the Revenue Streams & Business Model of Black & Veatch.

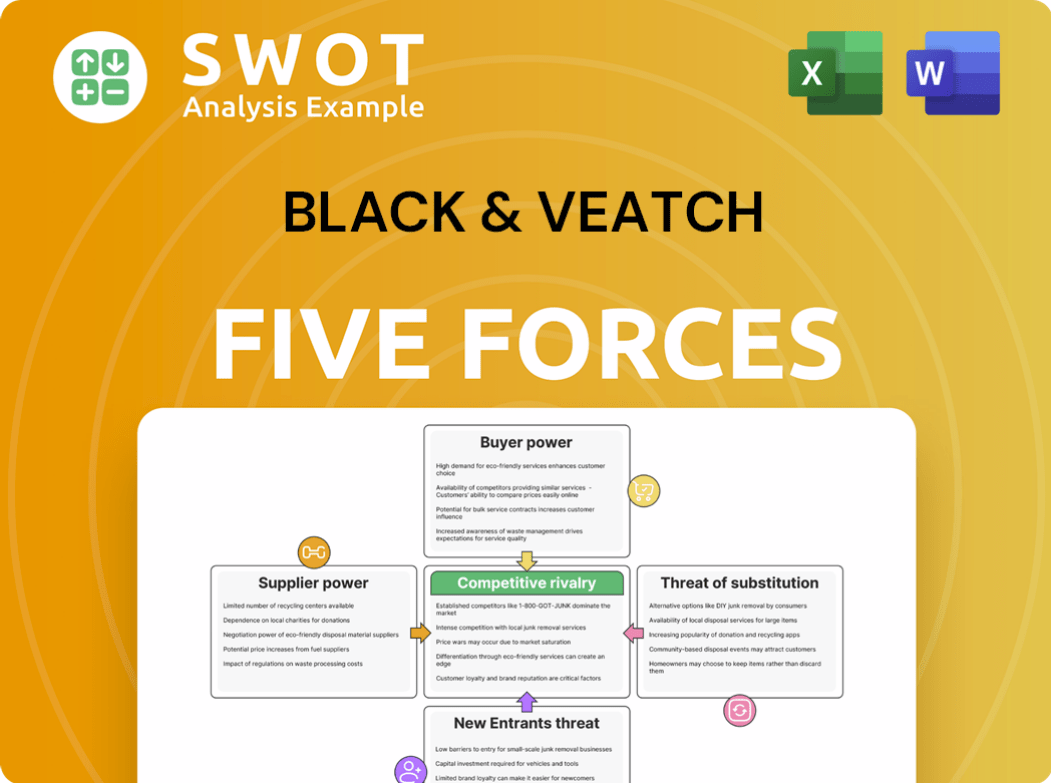

Black & Veatch Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Black & Veatch Company?

- What is Competitive Landscape of Black & Veatch Company?

- How Does Black & Veatch Company Work?

- What is Sales and Marketing Strategy of Black & Veatch Company?

- What is Brief History of Black & Veatch Company?

- Who Owns Black & Veatch Company?

- What is Customer Demographics and Target Market of Black & Veatch Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.