CM.com Bundle

How Does CM.com Stack Up in the Cloud Communications Arena?

Founded in 1999, CM.com has evolved from an SMS pioneer to a global cloud communications platform. Their journey, starting with simple SMS messaging, has led to a comprehensive suite of services, including messaging, voice, payments, and identity solutions. With a strategic pivot towards AI, CM.com is poised to redefine how businesses connect with customers.

To truly understand CM.com's position, a deep dive into its CM.com SWOT Analysis is essential. This analysis will reveal its competitive advantages and disadvantages, examining its market share analysis and comparing it to key CM.com competitors like Twilio and Sinch. We will explore the CM.com business model, assess its financial performance analysis, and evaluate its growth strategy within the dynamic CM.com industry.

Where Does CM.com’ Stand in the Current Market?

CM.com is a significant player in the conversational commerce and CPaaS (Communications Platform as a Service) sector, focusing on transforming how businesses communicate and engage with their audiences. In 2024, the company reorganized its operations into four key business units: Connect, Engage, Pay, and Live. This restructuring aimed to boost efficiency and support future profitable growth, integrating AI technologies to enhance its services.

The company's financial performance reflects this strategic shift. CM.com reported a record-level Normalized EBITDA of €18.1 million in 2024, a substantial improvement from -€0.9 million in 2023. The company's focus on profitable growth and strategic shift towards value over volume have improved its business position and strengthened its ability to grow earnings organically. For more insights, you can check out Owners & Shareholders of CM.com.

In Q1 2025, CM.com continued this positive trend, reporting a 63% year-over-year increase in EBITDA to €3.9 million, with gross profit rising by 5% to €20.4 million and gross margin at 33.0%. ARR further accelerated to 8% year-over-year, reaching €34.4 million in Q1 2025.

The Connect (Messaging) segment saw an 18% year-over-year increase in messages processed, reaching 8.3 billion. Revenue in this segment reached €220.3 million, up 3% year-over-year, with a gross profit of €40.3 million, a 7% increase. The CPaaS Net Dollar Retention (NDR) rate improved to 99%, and churn declined to 5%.

The Engage segment, focusing on customer engagement software, experienced a 6% year-over-year growth in Annual Recurring Revenue (ARR), reaching €33.7 million. This growth was driven by new order intake and improved cross-selling strategies. In Q4 2024, Engage revenue grew 15.6% to €7.7 million, with gross profit increasing by 13.6% to €6.7 million.

Total processed payment volumes increased by 14% year-over-year to €2.8 billion in 2024. While Q4 2024 revenue for Pay declined by 24.2% year-over-year to €3.0 million due to online proposition competition, full-year gross profit was €7.4 million, a 3% decrease year-over-year, but gross margin improved to 57%.

The Live (Ticketing) segment saw a marginal rise in ticket sales, with a 4% year-over-year increase to 19.3 million tickets sold in 2024. Revenue for Live grew 7% year-over-year to €12.4 million in Q4 2024, maintaining a healthy gross margin of 85%.

CM.com's global presence is strengthened by its international traction, with new order wins in France and the UK for its Live product in Q4 2024. The company's ability to attract more volumes from a large global tech platform based in the US further underscores its market position.

- CM.com competitive landscape includes various players in the CPaaS and conversational commerce space.

- The company's growth strategy focuses on profitable expansion and strategic shifts.

- CM.com's financial performance analysis reveals a commitment to improving earnings.

- The company’s key partnerships and customer base contribute to its market share analysis.

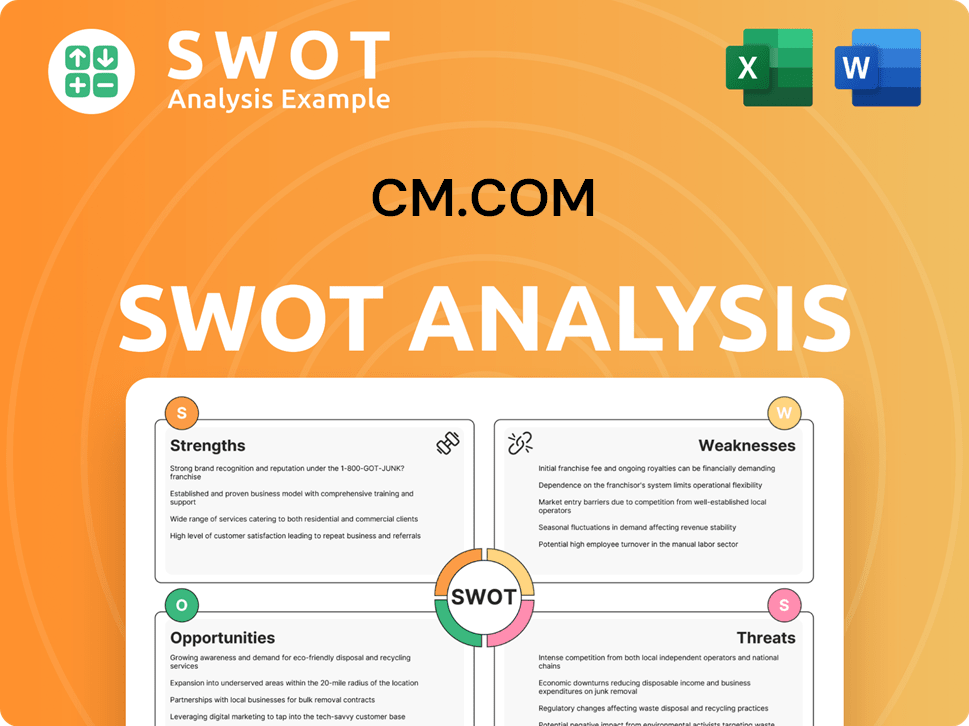

CM.com SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CM.com?

The CM.com competitive landscape is shaped by its operations in cloud communications and conversational commerce. This market is dynamic, with established global players and emerging specialized providers vying for market share. A CM.com market analysis reveals intense competition across messaging, voice, payments, and customer engagement software.

CM.com's business model focuses on providing a unified platform for customer engagement. This strategy positions it to compete effectively in a market increasingly looking for consolidated solutions. The company's recent strategic moves, such as becoming an 'AI-First company' and launching the HALO platform, are aimed at differentiating its offerings and maintaining a competitive edge.

The competitive environment for CM.com services is multifaceted, involving direct competitors in CPaaS and business messaging, as well as companies in payments and ticketing. The company also faces competition from emerging players and is impacted by industry shifts, particularly in AI.

Twilio is a market leader in CPaaS, offering a comprehensive suite of communication APIs. It has a strong developer-centric approach and a wide global reach, competing directly with CM.com's Connect business unit.

Sinch provides messaging, voice, and video solutions to enterprises, competing with CM.com in global messaging and voice services. It is a major player in cloud communications.

MessageBird, another European CPaaS provider, offers similar services to CM.com, including messaging, voice, and payments. It often targets similar customer segments, with a focus on customer experience.

Vonage (now part of Ericsson) provides a robust CPaaS platform with API-driven communications, including voice, video, and messaging. It competes in the core communication services.

Payment Gateways like Adyen, Stripe, and PayPal compete with CM.com's Pay business unit in online payment processing. CM.com's Pay business saw a 14% year-over-year increase in processed volumes to €2.8 billion in 2024, but faced strong competition in Q4 2024, leading to a revenue decline.

Ticketing Platforms such as Ticketmaster, Eventbrite, and specialized event technology companies compete with CM.com's Live business unit. CM.com is expanding its Live offering, including a ticket resell platform launched in Q1 2025.

The competitive landscape is influenced by technological advancements, such as AI. CM.com's strategy to become an 'AI-First company' and the launch of its HALO platform are designed to integrate AI into its product portfolio. The company is focused on offering a unified platform for customer engagement and conversational commerce. To learn more about the company's history, you can read a Brief History of CM.com.

- AI Integration: CM.com is leveraging AI to differentiate its offerings.

- Platform Strategy: The company focuses on providing a unified platform for customer engagement.

- Market Trends: The increasing demand for consolidated customer engagement and conversational commerce solutions shapes the competitive environment.

- Strategic Initiatives: CM.com is actively expanding its Live offering, including a ticket resell platform.

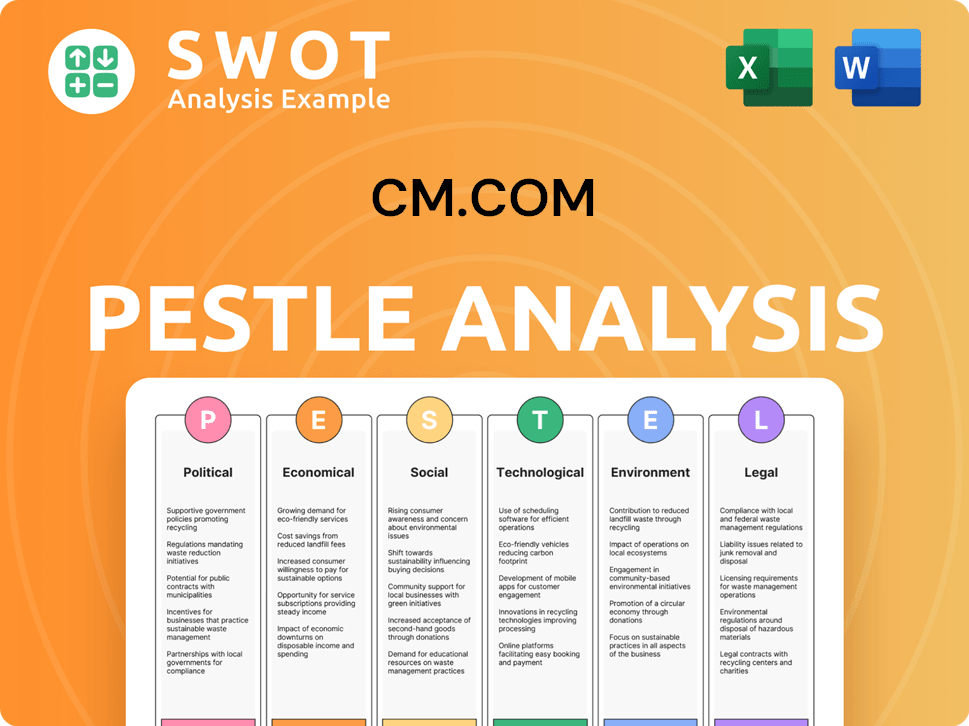

CM.com PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CM.com a Competitive Edge Over Its Rivals?

The competitive landscape for CM.com is shaped by its integrated platform, AI innovation, and diverse product offerings. The company focuses on a unified customer engagement platform, merging communication, commerce, and customer interaction. This strategy aims to provide a seamless experience for clients, enhancing cross-selling opportunities and reducing customer churn. A comprehensive Marketing Strategy of CM.com highlights the company's approach to customer engagement and market positioning.

CM.com's proprietary technology and robust platform infrastructure, developed since 1999, are key strengths. The platform allows clients to manage all aspects of customer-brand interactions, including messaging, voice, payments, and ticketing. This unified approach enhances the customer experience and offers significant operational efficiencies. The company's commitment to AI, particularly with its HALO platform, further differentiates it in the market.

The company's focus on profitable growth and disciplined cost management has positioned it as a leaner and more agile organization, better able to respond to market changes. However, sustained success depends on continuous innovation and adaptation to technological advancements, especially in AI. Ongoing investment in R&D and strategic partnerships will be crucial to maintaining its competitive edge in the dynamic cloud communication industry.

CM.com offers a unified platform that integrates communication, commerce, and customer engagement. This approach allows clients to manage all aspects of customer-brand interactions from a single interface. The seamless experience enhances cross-selling and reduces churn rates, providing a significant advantage over competitors.

CM.com is an 'AI-First company', with significant investments in AI, including the Agentic AI platform HALO. HALO enhances customer engagement and improves internal processes, leading to increased efficiency and cost savings. As of Q1 2025, nearly 100 deals have been secured for the HALO platform, indicating strong early adoption.

The company's offerings span four business units: Connect, Engage, Pay, and Live. This breadth of services, including new products like RCS and Offline Payments introduced in 2024, caters to a wide range of client needs. This diversification allows customers to leverage the full spectrum of the platform for maximum value.

CM.com emphasizes profitable growth and disciplined cost management. This approach has made the company leaner and more agile, enabling it to respond quickly to market changes. The focus on financial performance ensures sustainable growth and strengthens its competitive position.

CM.com's competitive advantages are its integrated platform, AI capabilities, and diversified product portfolio. The company's focus on AI, particularly HALO, provides detailed consumer insights and automates processes. This allows clients to save costs and enhance efficiency, improving the overall customer experience. These strengths are crucial in the CM.com competitive landscape.

- Integrated Platform: A unified platform for all customer-brand interactions.

- AI-Driven Solutions: HALO enhances customer engagement and internal processes.

- Diversified Offerings: Products across Connect, Engage, Pay, and Live.

- Profitable Growth: A focus on financial performance and cost management.

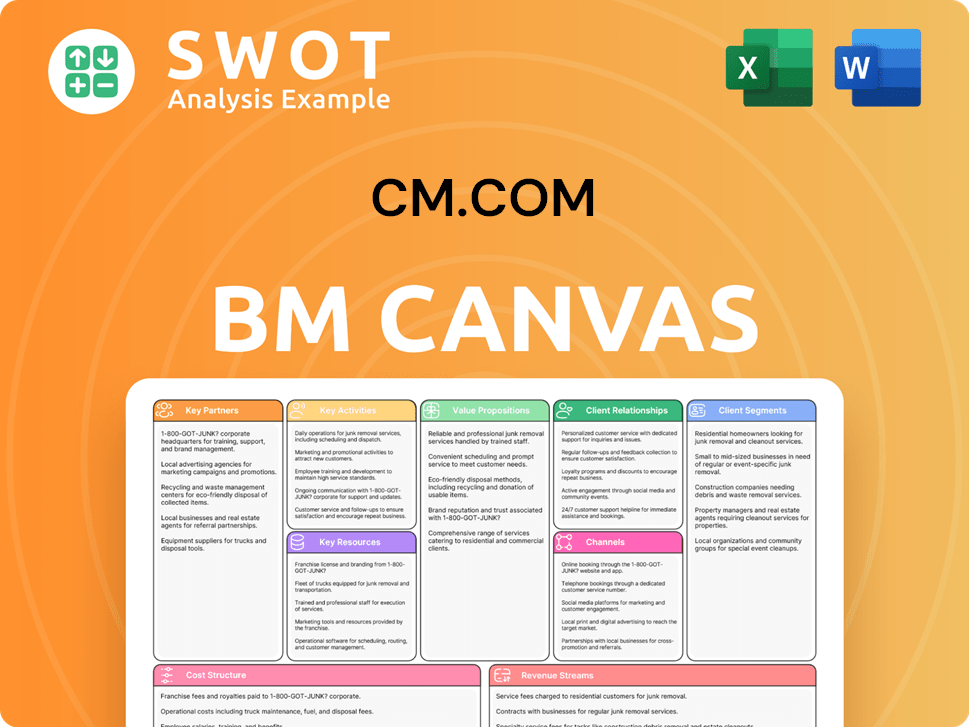

CM.com Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CM.com’s Competitive Landscape?

The competitive landscape for CM.com is shaped by industry trends, including the rise of AI, changing consumer preferences, and evolving regulations. CM.com's strategic moves, such as becoming an 'AI-First company' and launching the HALO Agentic AI platform, reflect its response to these trends. This positions CM.com to offer advanced AI-powered solutions, focusing on customer engagement and automation, which is crucial for maintaining a strong position in the market.

However, CM.com faces challenges like the need for continuous investment in AI and competition from tech giants and startups. Regulatory changes and potential declines in traditional communication segments also pose risks. Despite these challenges, opportunities exist in emerging markets and through strategic partnerships. The company's outlook includes achieving an EBITDA within a range of €22-27 million for FY 2025, supported by its AI-first strategy and partnerships, as highlighted in the Growth Strategy of CM.com.

The adoption of AI, particularly generative AI and agentic AI, is a major industry trend. Consumer preferences are shifting towards hyper-personalized and automated interactions. The growth in rich text messaging, with an 18% increase in messages processed in 2024, reflects this trend.

Rapid AI advancements require significant R&D investment. Increased competition from tech giants and AI-focused startups poses a threat. Regulatory changes in data privacy and consumer communication could introduce complexities. Declining demand in traditional communication segments is another challenge.

Emerging markets offer significant growth potential due to digital transformation. Product innovations, such as Voice AI Agents and the ticket resell platform in Q1 2025, create new revenue streams. Strategic partnerships, especially with large tech platforms, are crucial for market expansion.

CM.com aims for gross profit growth of at least 15% annually by 2028, with a gross margin of approximately 35% and an EBITDA margin of 12-15%. The company focuses on partnerships, a unified platform, and accelerating its AI-first transformation. The online payment proposition faced strong competition in Q4 2024.

CM.com's competitive landscape includes evolving consumer preferences, which the company addresses through its unified platform and AI capabilities, focusing on tailored customer journeys. The company’s strategy involves leveraging AI and partnerships for growth. The increasing competition in online payments, as seen in Q4 2024, highlights the dynamic nature of the market and the need for continuous innovation.

- Focus on AI-powered solutions for customer engagement and automation.

- Strategic partnerships to accelerate growth and expand market penetration.

- Continuous investment in R&D to stay ahead of technological advancements.

- Adaptation to regulatory changes and consumer communication preferences.

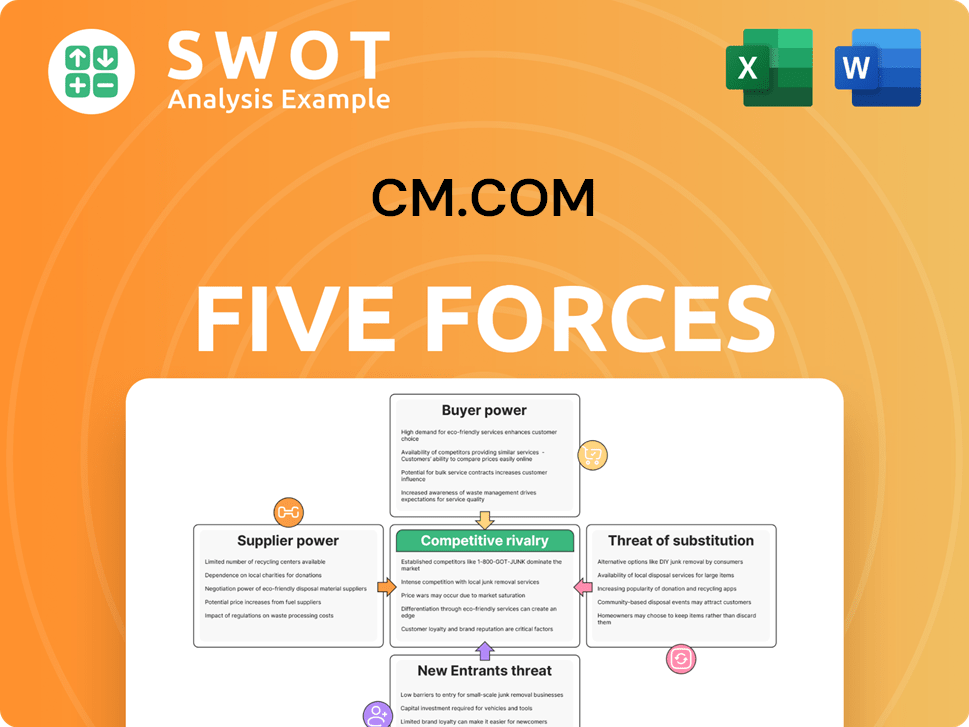

CM.com Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CM.com Company?

- What is Growth Strategy and Future Prospects of CM.com Company?

- How Does CM.com Company Work?

- What is Sales and Marketing Strategy of CM.com Company?

- What is Brief History of CM.com Company?

- Who Owns CM.com Company?

- What is Customer Demographics and Target Market of CM.com Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.