Delta Electronics Bundle

How Does Delta Electronics Thrive in a Competitive Market?

Delta Electronics, a global leader in power and thermal management, faces a dynamic competitive landscape. Its innovations in electric vehicle (EV) charging and renewable energy solutions are pivotal. Founded in 1971, Delta has evolved from electronic components to a diverse portfolio. Understanding Delta's market position is crucial.

Delta Electronics' sustained success hinges on its ability to navigate the Delta Electronics SWOT Analysis and the ever-changing industry. This analysis will explore Delta's competitive advantages, key rivals, and market share. We will delve into Delta Electronics' business strategy, providing a comprehensive market analysis of its global market presence and future growth potential. This competitive intelligence report offers insights into Delta Electronics' financial performance compared to competitors and its challenges and opportunities.

Where Does Delta Electronics’ Stand in the Current Market?

Delta Electronics maintains a robust market position, particularly in power and thermal management solutions. While specific overall market share data isn't always available across all segments, its leadership is clear in key areas. The company is a significant player in the global power supply market, serving diverse industries. Its industrial automation solutions are widely adopted, especially in Asia, and it's growing in other markets. This makes the Delta Electronics competitive landscape quite substantial.

The company's geographic presence spans Asia, Europe, and the Americas, with manufacturing and sales offices strategically located. Delta's main product lines include power supplies, industrial automation, display solutions, and networking products. It serves a broad customer base, including industrial clients, medical device manufacturers, telecommunications providers, and the electric vehicle industry. This diversification helps mitigate risks, a key aspect of its Delta Electronics business strategy.

Over time, Delta has strategically focused on energy efficiency and smart manufacturing solutions, aligning with global sustainability trends. This includes a significant push into EV charging solutions and renewable energy infrastructure. This focus is crucial for understanding the Delta Electronics market analysis.

Delta is recognized as a major player in the global power supply market. It serves a wide array of industries, showcasing its broad market reach. This leadership position is a key factor in its competitive advantage.

Delta has a strong presence in Asia, Europe, and the Americas. Manufacturing facilities and sales offices are strategically located globally. This global presence supports its ability to serve international markets effectively.

Delta's product portfolio includes power supplies, industrial automation, display solutions, and networking products. This diversification reduces reliance on any single market segment. It allows Delta to adapt to changing market demands.

In 2023, Delta Electronics reported consolidated net sales of NT$396.9 billion (approximately US$12.3 billion). This represents a 4.9% year-over-year increase. This financial health underscores its stability and scale within the Delta Electronics industry.

Delta's financial health is robust, as demonstrated by its reported revenues and consistent profitability. In 2023, the company's consolidated net sales were approximately US$12.3 billion, a 4.9% increase year-over-year. This financial performance highlights its scale and stability. Delta holds a particularly strong position in the Asia-Pacific region and is expanding in other high-growth areas. Understanding these factors helps in evaluating Delta Electronics' market position analysis.

Delta's strengths include a strong market position, diversified product lines, and a focus on energy-efficient solutions. Its global presence and financial stability further enhance its competitive edge. These factors contribute to its ability to compete effectively in the market.

- Strong market position in power and thermal management.

- Diversified product portfolio across multiple sectors.

- Focus on energy efficiency and smart manufacturing.

- Global presence with manufacturing and sales offices worldwide.

- Consistent financial performance, with increased sales in 2023.

Delta Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Delta Electronics?

Understanding the Growth Strategy of Delta Electronics requires a close examination of its competitive landscape. The company operates in diverse sectors, each with its own set of key rivals. Analyzing these competitors provides insights into Delta's market position, challenges, and opportunities, offering a comprehensive view of its business strategy.

The competitive dynamics vary significantly across Delta's business segments, from power supplies to industrial automation and electric vehicle (EV) charging. Each sector demands a unique approach to maintain and grow market share. This article provides a detailed look at Delta Electronics' key competitors, their strengths, and how they influence Delta's strategic decisions.

Delta Electronics faces a complex competitive environment. The following sections detail key competitors in each of its primary business areas, providing an understanding of their market positions and the challenges Delta faces. This competitive analysis is crucial for evaluating Delta Electronics' market share and overall financial performance.

In the power supply market, Delta Electronics competes with several key rivals. These competitors offer similar solutions, focusing on competitive pricing and technological advancements. The market is highly competitive, requiring continuous innovation and efficiency.

Lite-On Technology is a major competitor, with a broad portfolio including power supplies, optoelectronics, and imaging products. They often compete directly with Delta in computing and consumer electronics applications. Based in Taiwan, Lite-On has a strong market presence.

AcBel Polytech is another significant player in the power supply market. They focus on providing power solutions for various applications, competing with Delta on product offerings and pricing strategies. This competition drives innovation and efficiency.

Chicony Power Technology is a key competitor, concentrating on power supply solutions. They compete with Delta in terms of product features, pricing, and customer relationships. Their presence adds to the competitive pressure.

In the industrial automation space, Delta competes with global giants. These companies offer comprehensive automation solutions, including PLCs, HMIs, and motion control systems, challenging Delta in large-scale industrial projects. The competition is intense.

Siemens is a dominant force with a vast global presence and extensive R&D capabilities. They often challenge Delta in large-scale industrial projects, offering comprehensive automation solutions. Their market share is significant.

ABB offers a wide range of industrial automation and robotics solutions, creating direct competition in manufacturing and process automation. They are a major player with a global presence, impacting Delta's market position. ABB's revenue in 2024 was approximately $32.2 billion.

- ABB's strong presence in robotics and automation directly competes with Delta's offerings.

- Their global reach and comprehensive solutions create significant competitive pressure.

- ABB's investments in R&D and innovation keep them at the forefront of the industry.

- The competition between Delta and ABB drives advancements in automation technologies.

In the EV charging infrastructure market, Delta faces competition from specialized EV charging companies and other power electronics manufacturers. The market is rapidly expanding, with new entrants continually disrupting the competitive landscape. The EV charging market is projected to reach a global value of $75 billion by 2028.

- ChargePoint is a key competitor, known for its extensive charging network and software platforms.

- EVgo focuses on fast-charging solutions and is expanding its network across the U.S.

- ABB E-mobility is another significant player, leveraging its power electronics expertise.

- The entry of new players and partnerships between automakers and charging providers create dynamic challenges.

Delta Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Delta Electronics a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Delta Electronics involves analyzing its key strengths and how it differentiates itself in the market. The company has established a robust position through strategic investments in research and development, a comprehensive product portfolio, and a focus on sustainability. These elements contribute to its ability to compete effectively against other players in the industry.

Delta's competitive advantages are multifaceted, encompassing technological innovation, operational efficiency, and a strong brand reputation. These advantages have allowed the company to maintain a significant market share and capitalize on emerging market trends. Examining these factors provides a clear picture of Delta's strategic positioning and its ability to sustain growth.

The analysis of Delta Electronics' competitive advantages is crucial for investors and industry analysts. It helps in assessing the company's long-term growth potential, its ability to navigate market challenges, and its overall financial performance compared to competitors. This article aims to provide a detailed overview of Delta's strengths and how they contribute to its success in the Growth Strategy of Delta Electronics.

Delta Electronics consistently invests a significant portion of its revenue in research and development, fostering a continuous stream of innovative products. This commitment is evident in its extensive patent portfolio, which protects its intellectual property and provides a barrier to entry for competitors. Delta's advancements in power conversion efficiency are critical for its power supply and EV charging solutions, offering customers lower operating costs and reduced environmental impact.

Delta's comprehensive product portfolio and vertical integration give it greater control over its supply chain and enables it to offer integrated solutions. This approach helps in maintaining quality control, reducing costs, and accelerating time-to-market. The company designs and manufactures a wide range of components and systems, providing a competitive edge in the market. This strategy allows for better responsiveness to market demands and enhanced customer satisfaction.

Delta's established global distribution network and strong brand equity contribute significantly to its competitive edge. The brand is synonymous with reliability and quality in the power and thermal management sectors, fostering strong customer loyalty. Its extensive sales and service network ensures widespread product availability and robust post-sales support. This strong market presence allows Delta to effectively reach and serve customers worldwide.

Delta's strategic focus on sustainability and smart manufacturing aligns with global trends, positioning it favorably in emerging markets. Its expertise in areas like renewable energy solutions and smart factory automation caters to growing demands for eco-friendly and efficient industrial processes. This focus allows Delta to tap into new market segments and strengthen its position as a leader in sustainable technology solutions.

Delta Electronics' competitive advantages include continuous innovation, a broad product range, and a strong global presence. The company's focus on power electronics and thermal management, coupled with its sustainability initiatives, sets it apart in the industry. These factors have helped Delta maintain a strong market position and drive growth.

- R&D Investment: Delta invests a significant portion of its revenue in R&D, ensuring continuous innovation. In recent years, R&D spending has been consistently above 7% of its revenue.

- Product Portfolio: The company offers a wide range of products, including power supplies, industrial automation solutions, and renewable energy systems.

- Global Presence: Delta operates in numerous countries, with manufacturing facilities and sales offices worldwide, ensuring widespread product availability and support.

- Sustainability Focus: Delta's commitment to sustainability is evident in its products and operations, catering to the growing demand for eco-friendly solutions.

Delta Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Delta Electronics’s Competitive Landscape?

The Delta Electronics competitive landscape is significantly influenced by global trends, particularly the shift towards sustainability and technological advancements. This includes the growing demand for renewable energy solutions and the expansion of the electric vehicle (EV) market. Understanding these trends is crucial for assessing Delta Electronics' market analysis and future prospects. Target Market of Delta Electronics provides additional insights into the company's strategic positioning.

The company faces both challenges and opportunities in this dynamic environment. Intense competition, supply chain disruptions, and rapid technological changes are key risks. However, the expanding market for sustainable solutions and strategic partnerships offer substantial growth potential, shaping Delta Electronics' business strategy.

The primary drivers for Delta Electronics' industry include the global focus on decarbonization, leading to increased demand for renewable energy solutions, energy storage systems, and efficient power management products. The EV market's growth and associated charging infrastructure needs also present significant opportunities. Digital transformation, including Industry 4.0 and the IoT, further fuels demand for the company's industrial automation and networking solutions.

Delta Electronics' key rivals and the company itself face challenges such as intense competition from established players and new entrants, potentially leading to price pressures. Geopolitical tensions and supply chain disruptions pose risks to manufacturing and distribution. Rapid technological advancements require continuous innovation to avoid obsolescence. Regulatory changes related to energy efficiency and environmental standards can also impact product development and market access.

Significant opportunities exist in the expanding market for sustainable solutions, including solar inverters, energy storage systems, and smart grid technologies. Delta Electronics' competitive advantages include strong R&D capabilities, positioning it well to capitalize on emerging technologies. Strategic partnerships with automotive manufacturers, utilities, and smart city developers can expand its market reach, driving Delta Electronics' future growth potential.

Delta Electronics aims to remain resilient through continued investment in R&D, diversifying its product portfolio to meet new market needs, and expanding its global footprint. This strategy includes a focus on regions with high growth potential for sustainable and smart solutions. The company's focus on innovation and strategic partnerships supports its market position analysis.

The global renewable energy market is projected to reach significant values in the coming years. The EV market is also experiencing rapid growth, with sales increasing substantially. Delta Electronics' financial performance compared to competitors reflects its strategic positioning and ability to capture market share. Delta Electronics' market share in various segments provides insights into its competitive standing.

- The global renewable energy market is expected to be worth over $2 trillion by 2030.

- The EV market is expected to grow at a CAGR of over 20% through 2030.

- Delta Electronics has been increasing its investments in R&D by approximately 10% annually.

- The company's revenue from sustainable solutions has grown by over 25% in the last year.

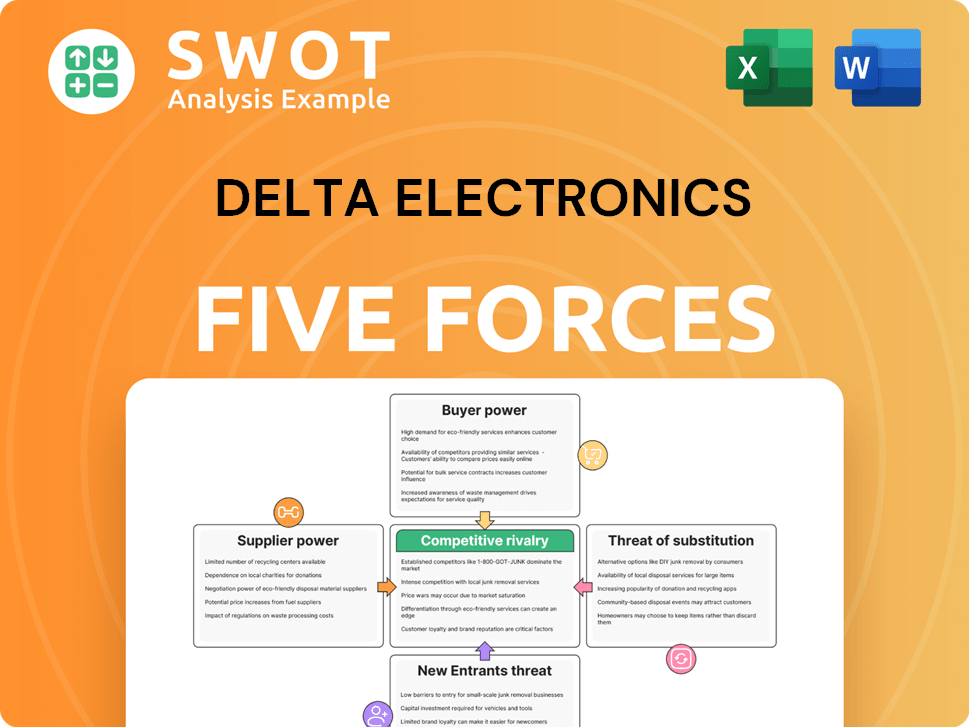

Delta Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Delta Electronics Company?

- What is Growth Strategy and Future Prospects of Delta Electronics Company?

- How Does Delta Electronics Company Work?

- What is Sales and Marketing Strategy of Delta Electronics Company?

- What is Brief History of Delta Electronics Company?

- Who Owns Delta Electronics Company?

- What is Customer Demographics and Target Market of Delta Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.