Epiroc Bundle

Navigating the Epiroc Competitive Landscape: Who's the Real Competition?

Epiroc, a titan in the mining and infrastructure sectors, has consistently demonstrated its prowess through cutting-edge equipment and services. From its origins in 1873 to its spin-off in 2018, Epiroc has evolved into a global powerhouse. But in an industry ripe with innovation and fierce competition, understanding the Epiroc SWOT Analysis is paramount.

This deep dive into the Epiroc competitive landscape will dissect its strategic positioning within the mining equipment industry and the construction equipment market. We'll explore Epiroc's business strategy, identifying its key competitors and analyzing its market share. Moreover, we'll evaluate Epiroc's competitive advantages and disadvantages to provide a comprehensive Epiroc market analysis, giving you the insights needed to understand its future outlook.

Where Does Epiroc’ Stand in the Current Market?

Epiroc is a leading player in the global mining and infrastructure sectors, positioning itself as a key partner for productivity and sustainability. In 2024, the company demonstrated strong performance, achieving record revenues. The company's focus is on providing innovative and sustainable equipment, tools, and services to its customers worldwide.

The core of Epiroc's operations revolves around providing advanced equipment and services. This includes drill rigs, rock excavation equipment, and construction machinery. Epiroc also offers a wide range of tools, services, and consumables. This comprehensive approach allows the company to cater to diverse customer needs across the mining and infrastructure industries.

Epiroc's value proposition centers on delivering innovative, safe, and sustainable solutions. This is particularly evident in its advanced drilling and rock excavation technologies. The company's commitment to sustainability is reflected in its extensive offering of battery-electric machines for underground mining and electric infrastructure solutions.

Epiroc holds a strong market position, especially in the mining sector. In 2024, the company's revenues reached approximately SEK 63.6 billion (around USD 6.1 billion). The mining business accounted for 78% of orders received. This highlights the company's reliance on, and success within, the mining industry, supported by favorable market conditions.

Epiroc's product lines include drill rigs, rock excavation equipment, and construction equipment, along with tools and services. The company has the widest offering of battery-electric machines in the underground mining market. In the UK, as of January 2025, Epiroc holds a significant market share of 35.7% for hydraulic attachments and 41% in hydraulic breakers.

Epiroc serves customers in approximately 150 countries, with around 19,000 employees in 2024. Revenue distribution in 2024 showed Asia/Australia contributing 31%, North America 21%, Europe 25%, South America 8%, and Africa/Middle East 15%. The company has a strong presence in regions like Chile, Argentina, and Peru.

Despite challenges in the construction equipment market, Epiroc maintained a strong financial position. The adjusted operating margin was 19.8% in 2024. Free operating cash flow (FOCF) reached a record high of SEK 8.7 billion in 2024, with projections of SEK 8.0 billion-SEK 8.5 billion annually over 2025-2026. S&P Global Ratings expects Epiroc's adjusted FFO to debt to return above 60% in 2025.

Understanding the Brief History of Epiroc is crucial for analyzing its current market position. The company's competitive landscape is shaped by its focus on the mining and infrastructure sectors. Epiroc's ability to innovate and provide sustainable solutions positions it well against its competitors.

- Epiroc's strong market share in key product categories and regions indicates its competitiveness.

- The company's global presence and diverse revenue streams contribute to its resilience.

- Epiroc's financial performance, including strong FOCF and healthy margins, supports its competitive advantage.

- The strategic focus on electric and sustainable solutions aligns with industry trends, enhancing its long-term competitiveness.

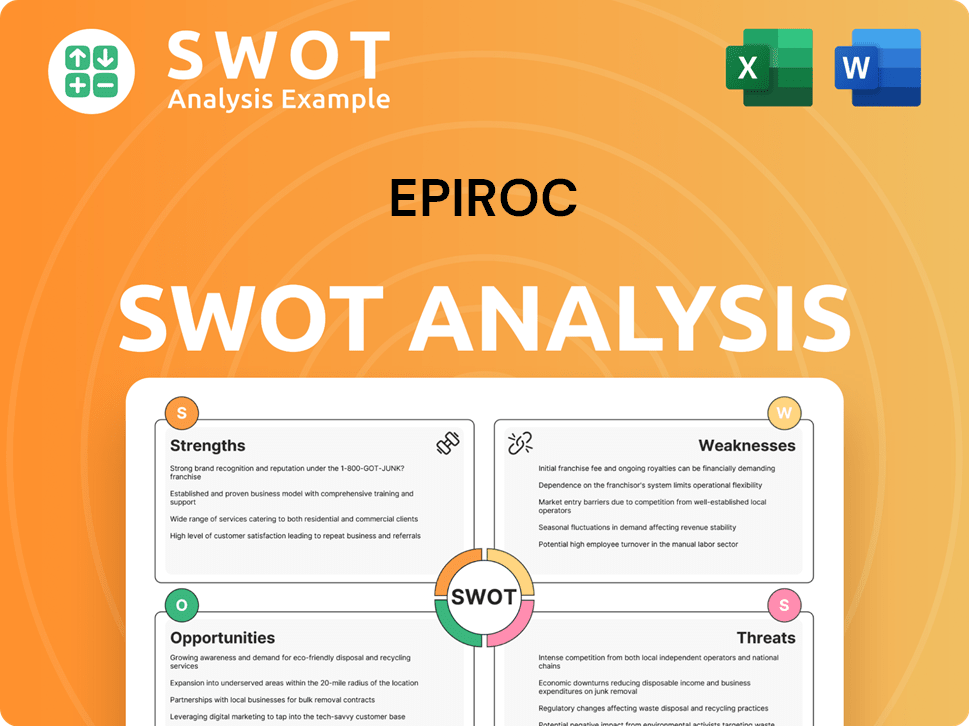

Epiroc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Epiroc?

The Epiroc competitive landscape is shaped by a mix of global giants and more specialized players. Understanding these competitors is crucial for analyzing Epiroc's market position and strategic moves. The mining and construction equipment markets are dynamic, with companies constantly vying for market share and technological leadership.

Epiroc's business strategy is heavily influenced by the actions of its competitors. These rivals employ various tactics, from offering premium products to providing cost-effective solutions, influencing Epiroc's approach to pricing, product development, and market expansion. An in-depth Epiroc market analysis includes assessing these competitive dynamics.

Epiroc faces competition from several significant players in the mining equipment industry and construction equipment market. Its main competitors include multinational corporations and smaller, regional companies. These competitors challenge Epiroc in different ways, from product offerings to geographical reach.

Sandvik AB is a major competitor, offering similar equipment and solutions for mining and rock excavation. Caterpillar Inc. and Komatsu Ltd. are also significant rivals, known for their extensive product portfolios and global presence. These companies compete directly with Epiroc across various market segments.

Other competitors include MACA, Barminco, RCS Group of Companies, and Polat, which focus on specific segments or geographies. These companies may offer specialized products or services that challenge Epiroc's market share in particular areas. Emerging players, especially those focusing on cost-effective solutions, also pose a challenge.

While Epiroc and its major multinational competitors often offer premium products, some competitors gain market share by providing cost-effective products and repair services. Local players have reportedly captured over 50% of Epiroc's medium and small segment customers, valued at over BZAR 1,432, highlighting the importance of price and responsiveness in the market.

The industry has seen strategic moves like mergers and acquisitions. Epiroc itself has been active in acquisitions, such as its purchase of the remaining shares of ASI Mining in May 2024, to enhance its advanced automation technologies. These moves aim to strengthen competitive positions through technological leadership and expanded offerings.

Analyzing Epiroc's market share requires comparing its performance against competitors like Sandvik, Caterpillar, and Komatsu. Factors such as product innovation, customer service, and pricing strategies are crucial in determining market share. Financial performance, including revenue growth and profitability, is also a key indicator of competitive success.

Epiroc's innovation in mining technology, particularly in automation and digitalization, is a key competitive factor. Competitors are also investing in these areas, leading to a race to offer the most advanced and efficient solutions. The integration of technologies like AI and IoT is transforming the industry.

Epiroc's competitive advantages include its focus on innovation, strong brand reputation, and global presence. However, it faces disadvantages such as competition from lower-cost providers and the cyclical nature of the mining industry. Understanding these factors is crucial for assessing Epiroc's future outlook and competitive positioning.

- Innovation: Epiroc's focus on advanced technologies gives it an edge.

- Global Presence: Epiroc's worldwide operations provide access to diverse markets.

- Cost Competition: Local competitors offer cost-effective solutions.

- Market Cyclicality: The mining industry's volatility impacts performance.

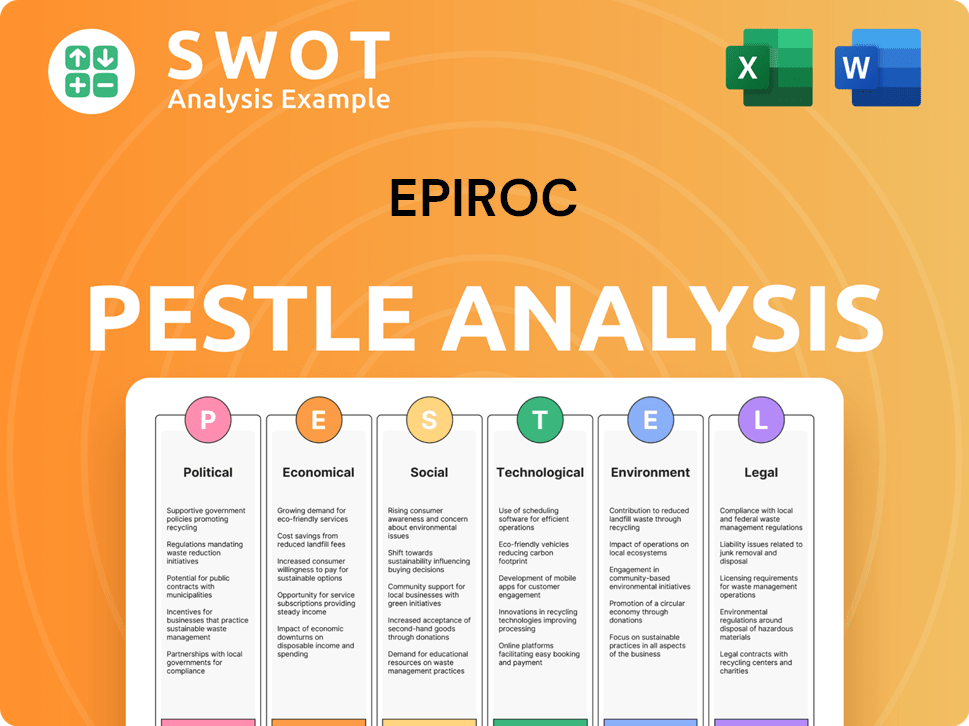

Epiroc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Epiroc a Competitive Edge Over Its Rivals?

Examining the Revenue Streams & Business Model of Epiroc, Epiroc's competitive advantages are rooted in its technological leadership, strong brand, and a robust business model. The company focuses on innovation, extensive aftermarket support, and operational excellence to maintain its edge in the mining equipment industry and construction equipment market. Understanding the Epiroc competitive landscape involves recognizing these core strengths and how they contribute to its market position.

Epiroc's strategic moves, particularly in automation, digitalization, and electrification, set it apart from competitors. The company's commitment to sustainability, with ambitious targets for zero-emission products, is a key differentiator. This forward-thinking approach is coupled with significant investments in research and development, ensuring continuous innovation and a competitive edge in the market. A thorough Epiroc market analysis reveals the impact of these strategies.

A key element of Epiroc's competitive edge is its well-structured business model, which emphasizes direct sales, a strong service business, and flexible manufacturing. Aftermarket solutions and global service presence are crucial for enhancing equipment productivity and extending service life. The company's strategic acquisitions, such as Stanley Infrastructure in 2024 and ASI Mining in May 2024, further strengthen its position. The financial health and scale of the company also contribute to its competitive advantages.

Epiroc leads in automation, digitalization, and electrification solutions. It has the widest offering of battery-electric machines in the underground mining market. The company aims to transition its entire product range to zero-emission options by 2030, with the underground division targeted for 2025.

Epiroc invests heavily in research and development, with over SEK 2 billion invested in 2024. Approximately 10% of its employees are dedicated to R&D, ensuring continuous innovation. Recent innovations include the Powerbit X drill bit and the Titan Collision Avoidance System (CAS).

Epiroc's business model emphasizes direct sales, a strong service business, and flexible manufacturing. Aftermarket solutions and global service presence are essential for customer relationships. This model provides a resilient source of recurring business.

In 2024, Epiroc achieved record-high revenues of SEK 63.6 billion. The company reported a strong operating cash flow of SEK 8.7 billion. This financial strength supports continued investment in innovation and strategic acquisitions.

Epiroc's competitive advantages include its technological leadership in automation and electrification, a well-structured business model, and strong financial performance. These factors contribute to its ability to compete effectively in the mining and construction equipment markets. The company’s focus on sustainability and innovation provides a significant edge.

- Leadership in automation, digitalization, and electrification.

- Strong aftermarket solutions and global service presence.

- Strategic acquisitions to enhance market position.

- Robust financial health supporting innovation and growth.

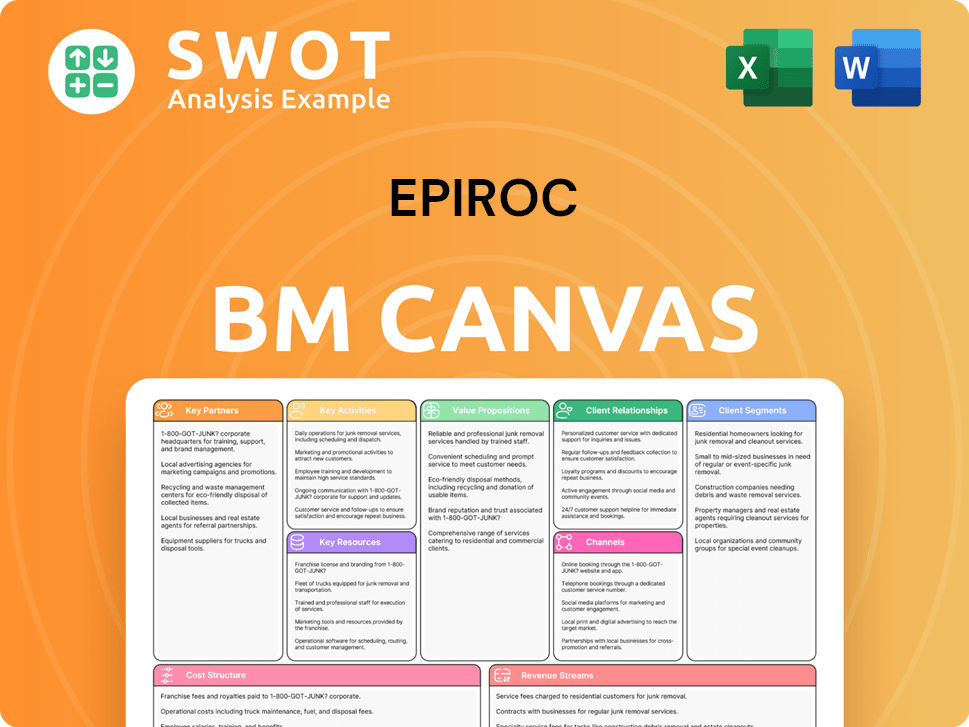

Epiroc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Epiroc’s Competitive Landscape?

The Epiroc competitive landscape is significantly shaped by the dynamic shifts in the mining and infrastructure sectors. The company faces both challenges and opportunities stemming from technological advancements, economic conditions, and evolving customer demands. An understanding of the industry trends, future challenges, and opportunities is crucial for assessing its strategic positioning and growth potential.

The Epiroc market analysis reveals a company adapting to industry changes, particularly in automation, digitalization, and electrification. Its commitment to sustainability and innovation is a key aspect of its business strategy. However, it must navigate macroeconomic uncertainties and competition to maintain and expand its market share.

The mining and infrastructure industries are undergoing major transformations. Automation, digitalization, and electrification are key trends, driven by the need for increased safety, productivity, and sustainability. Epiroc is actively involved in this transition, aiming for zero-emission offerings by specific target dates.

Technological advancements, such as autonomous mining solutions and remote monitoring, are crucial. Epiroc's investments in innovation, including new innovation centers, are critical. Their focus on battery-electric vehicles and collision avoidance systems addresses customer needs and regulatory pressures.

Macroeconomic uncertainties and geopolitical tensions pose challenges. The construction sector's fragility and cost-push inflation impact manufacturers. Local competitors offering cost-effective products also present a competitive challenge, particularly in specific customer segments.

Emerging markets, like India, are becoming important manufacturing and innovation hubs. The replacement cycle for mining machines, with an average fleet age of 8.4 years in 2024, offers substantial opportunities. High gold and copper prices support positive demand in mining.

To maintain its competitive edge, Epiroc focuses on strategic acquisitions and a multibrand strategy. The company's commitment to innovation and its ability to adapt to market changes are key. These efforts aim to strengthen its market position and capitalize on growth opportunities, especially in the face of challenges.

- Strategic Acquisitions: Strengthens market position.

- Multibrand Strategy: Offers cost-effective products.

- Innovation Focus: Drives technological leadership.

- Adaptability: Responds to changing market demands.

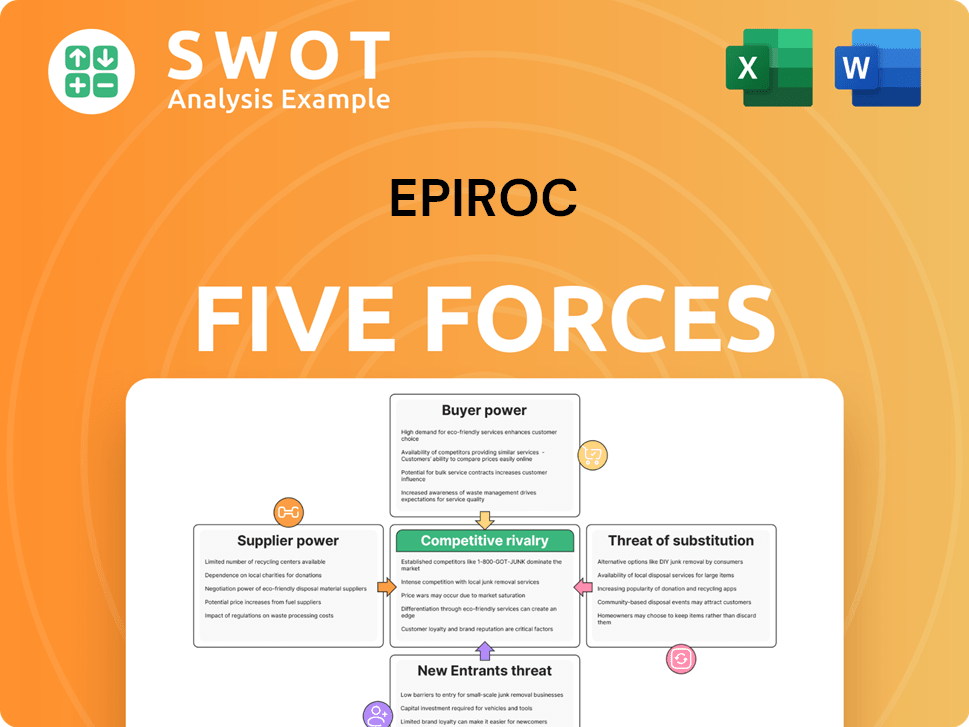

Epiroc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Epiroc Company?

- What is Growth Strategy and Future Prospects of Epiroc Company?

- How Does Epiroc Company Work?

- What is Sales and Marketing Strategy of Epiroc Company?

- What is Brief History of Epiroc Company?

- Who Owns Epiroc Company?

- What is Customer Demographics and Target Market of Epiroc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.