Epiroc Bundle

Can Epiroc Conquer the Future of Mining and Infrastructure?

Epiroc, a global powerhouse in mining and infrastructure, is charting a course for significant growth. This Epiroc SWOT Analysis reveals the company's strategic moves in a rapidly evolving market. From strategic acquisitions to groundbreaking innovations, Epiroc is poised to reshape its industry.

This in-depth analysis explores Epiroc's Epiroc growth strategy, examining its recent acquisitions, including the significant investment in Stanley Infrastructure, and its ambitious goals to outpace the mining equipment market. We'll dissect Epiroc's Epiroc future prospects, focusing on its innovation in automation, digitalization, and electrification, and how these initiatives will drive its long-term success. Furthermore, this Epiroc company analysis will provide insights into its Epiroc business model and Epiroc financial performance, offering a comprehensive view of its potential.

How Is Epiroc Expanding Its Reach?

The expansion initiatives of Epiroc are designed to drive growth across geographical regions and product categories. These initiatives aim to access new customer segments, diversify revenue streams, and maintain industry leadership. A key component of this strategy includes mergers and acquisitions, which have been a significant part of Epiroc's recent activities.

In 2024, Epiroc completed five acquisitions, demonstrating its commitment to strategic growth. These acquisitions are aimed at strengthening its market position and expanding its offerings. The company's focus on electrification and automation further supports its growth strategy, aligning with the evolving demands of the mining equipment market.

Epiroc's strategic initiatives for expansion are multifaceted, focusing on both organic growth and strategic acquisitions. This approach allows the company to adapt to changing market demands and capitalize on emerging opportunities. The company’s global presence and expansion plans are crucial for its long-term growth strategy.

Epiroc's growth strategy includes strategic mergers and acquisitions to expand its market presence. In 2024, the company acquired Stanley Infrastructure for SEK 8.2 billion, enhancing its position in infrastructure niches. Additional acquisitions like ASI Mining and Radlink further strengthen its portfolio and digital capabilities.

Epiroc is actively expanding its presence in key growth markets, particularly in India. The company broke ground in Hyderabad, India, to expand its rock drilling tool manufacturing facility. This expansion supports the 'Make in India' initiative and creates new job opportunities.

Epiroc is focused on expanding its product pipeline, particularly in electrification and automation. The company aims to offer a full range of emission-free alternatives. In Q1 2025, Epiroc secured its largest contract ever, valued at SEK 2.2 billion, to deliver autonomous and electric mining equipment.

Epiroc is investing heavily in automation and digitalization to enhance its offerings. Order growth for digital solutions increased by 30% in 2024. The automated fleet of driverless machines grew by 21% to over 3,450 by the end of 2024. This demonstrates Epiroc's commitment to innovation.

Epiroc's commitment to sustainability and innovation, combined with strategic acquisitions and geographical expansion, positions it well for future growth. The company's focus on electrification and automation is a key driver in the Brief History of Epiroc, and its ability to secure large contracts demonstrates its competitive advantage in the mining industry. These initiatives contribute to Epiroc's financial performance and long-term prospects.

Epiroc's expansion initiatives are supported by several key metrics, reflecting its growth and market position. The company's investments in R&D and its focus on sustainable solutions are crucial for its long-term success.

- Acquisition of Stanley Infrastructure for SEK 8.2 billion in 2024.

- Order growth for digital solutions increased by 30% in 2024.

- The automated fleet of driverless machines grew by 21% to over 3,450 by year-end 2024.

- Secured a SEK 2.2 billion contract for autonomous and electric mining equipment in Q1 2025.

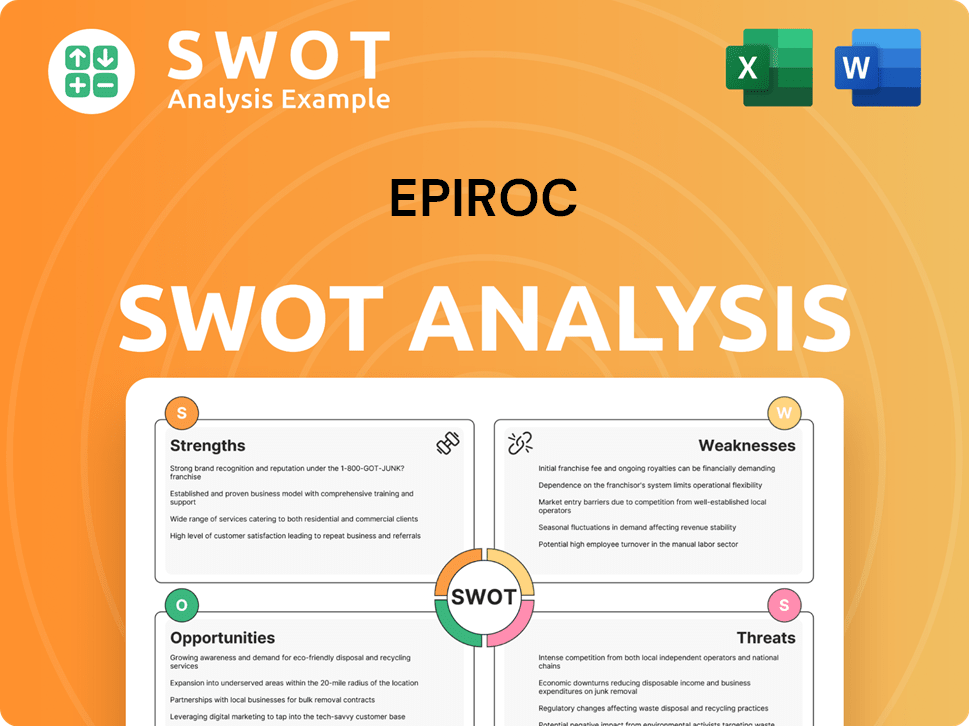

Epiroc SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Epiroc Invest in Innovation?

The company's innovation and technology strategy is a cornerstone of its long-term growth, focusing on advancements in automation, digitalization, and electrification. This approach is designed to meet evolving customer needs in the mining equipment market, offering solutions that enhance productivity, safety, and sustainability. The company’s commitment to these areas positions it well for future prospects in a rapidly changing industry.

The company strategically allocates resources to research and development (R&D), with a significant portion of its workforce dedicated to innovation. This investment supports the development of cutting-edge technologies and services, solidifying its position as a technology leader. The company's focus on these areas is a key element of its Epiroc growth strategy.

The company's strategic initiatives are designed to address the changing demands of the mining sector, focusing on sustainability and efficiency. The company's approach to innovation is a key factor in its competitive landscape, helping it to maintain and expand its market share.

Innovation is a core value, with 10% of the workforce dedicated to R&D. The company's commitment is evident in its record-high investments in this area in 2024.

The company aims to offer a full range of emission-free alternatives for underground operations by 2025 and surface operations by 2030. In 2024, 42% of the fleet was available in an emissions-free version, up from 35% in 2021.

Successful launches include the Minetruck MT66 S eDrive (hybrid). The company is testing battery-electric underground loaders with customers like Codelco in Chile. In January 2025, a memorandum of understanding was signed with ABB to advance collaboration on underground trolley solutions.

The company is a market leader, particularly in mixed-fleet automation. The number of driverless machines in operation increased by 21% in 2024, surpassing 3,450 units. Automated drill rigs and mixed-fleet autonomous load/haul solutions increased by 20% and 23% respectively by year-end 2024.

Digital solutions experienced a 30% order growth in 2024. The company uses AI to enhance internal processes and improve external offerings. Circular service offerings grew strongly, up 19% in 2024.

The company has set ambitious 2030 sustainability targets, validated by the Science Based Targets initiative (SBTi). The goal is to halve greenhouse gas (GHG) emissions in its own operations, transport, and the use of sold products compared to 2019. Emissions from its own operations have seen a 47% reduction, and renewable energy use increased to 59% in 2024.

The company's innovation strategy is multifaceted, encompassing several key areas to drive growth and efficiency. These initiatives are crucial for the company's long-term success and its ability to navigate the challenges and opportunities within the mining sector. The company's focus on these areas is a key element of its Competitors Landscape of Epiroc.

- Electrification: Expanding its range of emission-free equipment.

- Automation: Leading in mixed-fleet automation and driverless machines.

- Digitalization: Leveraging AI and digital solutions for enhanced efficiency.

- Sustainability: Reducing GHG emissions and promoting circular services.

- R&D: Investing heavily to maintain its technological leadership.

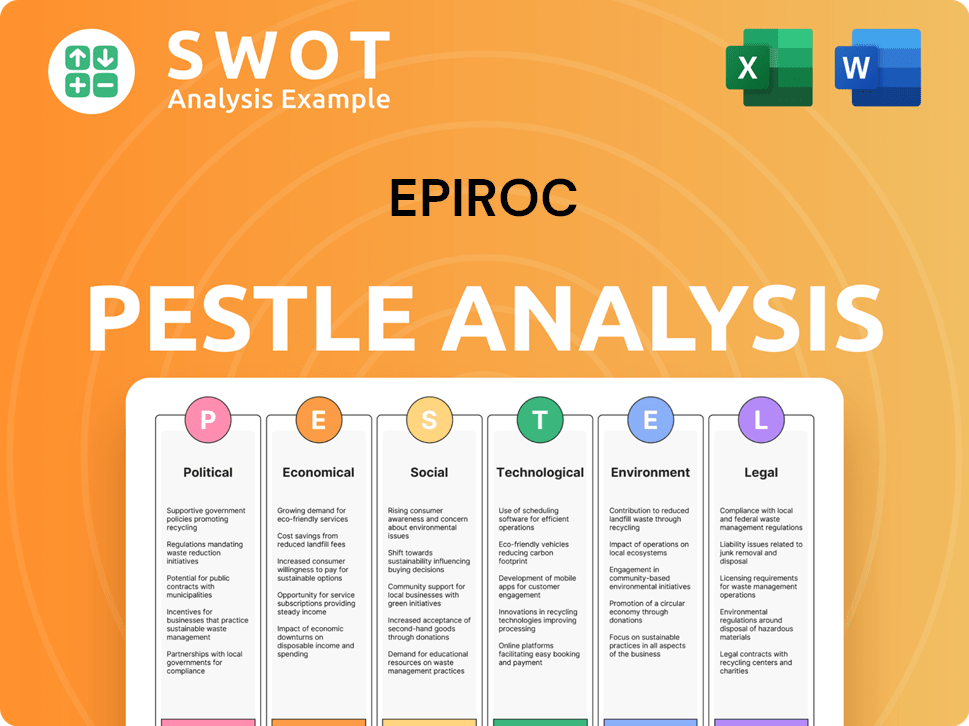

Epiroc PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Epiroc’s Growth Forecast?

The financial outlook for Epiroc is shaped by a strategic approach to achieve sustainable growth. The company aims for an annual revenue growth of 8% over a business cycle, exceeding the market's pace. This strategy involves a combination of organic growth and strategic acquisitions, coupled with a strong emphasis on profitability and operational efficiency. This approach is designed to solidify Epiroc's position within the mining equipment market and drive long-term value.

In 2024, Epiroc demonstrated robust financial performance, achieving record-high revenues and orders. This performance was supported by strong demand within the mining sector and strategic acquisitions. The company's ability to secure significant contracts, such as the one with Fortescue, further underscores its market position and growth potential. The company's financial health and profitability are key indicators of its success.

The company's financial strategy is designed to navigate market dynamics and capitalize on opportunities. Epiroc is focused on innovation in automation and digitalization, which is a key aspect of its long-term growth strategy. Furthermore, Epiroc's commitment to sustainability efforts and its response to changing market demands are integral to its future prospects.

In 2024, Epiroc's revenues reached a record high of SEK 63.6 billion, marking a 5% increase. Orders received also hit a record, increasing by 6% to SEK 62.2 billion. The adjusted operating profit for the year was SEK 12.6 billion, with an adjusted operating margin of 19.8%.

For Q4 2024, revenues increased by 11% to SEK 17,251 million, with an organic increase of 4%. Orders received increased by 12% to SEK 16,182 million, with an organic increase of 5%.

S&P Global Ratings forecasts total revenue growth of 3% for 2025, with 2-3% from acquisitions. For 2026, organic growth of about 3% is expected, leading to total growth of 4-5%. Adjusted EBITDA margin is expected to reach 24% in 2025.

Epiroc's fund from operations (FFO) to debt is projected to recover to 63% in 2025 and 64% in 2026, from 59% in 2024. Free operating cash flow (FOCF) is expected to remain strong at SEK 8.0-8.5 billion annually over 2025-2026, with FOCF to sales remaining above 10%.

Epiroc had a solid start to 2025, with orders received increasing 17% to MSEK 16,586, representing an organic increase of 10%. Revenues increased 10% to MSEK 15,536, with an organic increase of 3%. Operating profit increased 12% to MSEK 3,088, and the adjusted operating margin remained stable at 19.9%. The company secured a significant SEK 2.2 billion contract in Q1 2025.

- The company is committed to operational efficiency and cost control.

- Analysts forecast earnings and revenue to grow by 8.1% and 4.5% per annum respectively.

- EPS is expected to grow by 7.8% per annum.

- Return on equity is forecast to be 19.7% in three years.

To further understand the company's financial structure, you can explore the Revenue Streams & Business Model of Epiroc.

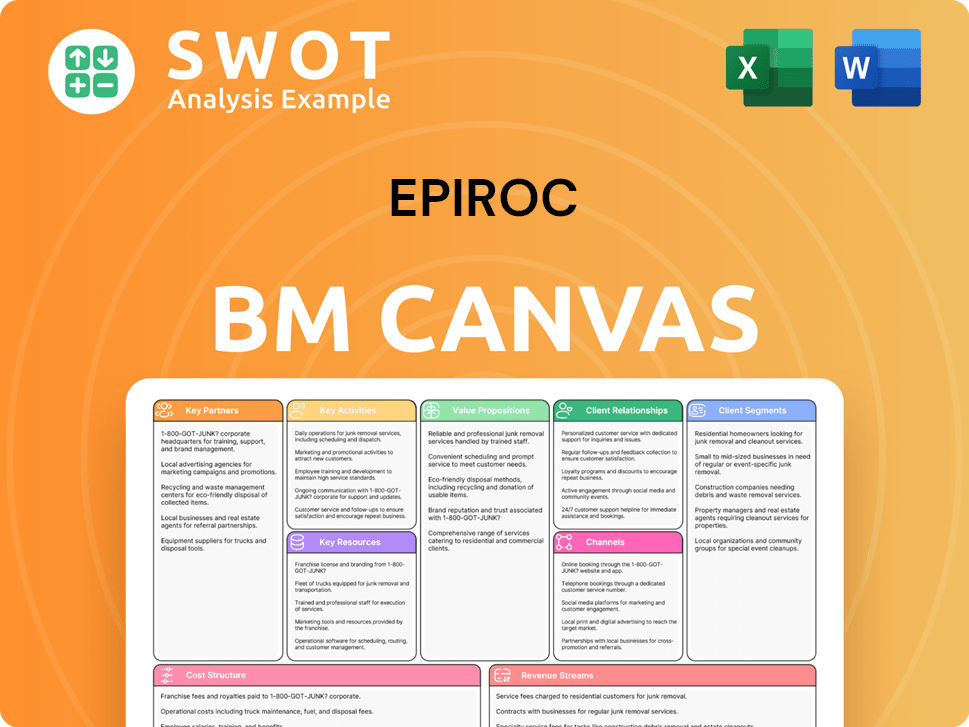

Epiroc Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Epiroc’s Growth?

The path to growth for Epiroc, while promising, is not without its challenges. The company faces a complex interplay of market dynamics, regulatory changes, and operational hurdles that could impact its ambitious expansion plans. Understanding these potential risks is crucial for evaluating the overall Epiroc growth strategy and its long-term success.

Market volatility, particularly in the construction sector, presents a significant risk. Furthermore, external factors such as currency fluctuations and supply chain disruptions can also impact Epiroc's financial performance and operational efficiency. Managing these risks effectively is vital for maintaining profitability and achieving its strategic goals.

Epiroc's ability to navigate these challenges will be critical for realizing its Epiroc future prospects. The company's focus on innovation, diversification, and operational excellence will play a key role in mitigating these risks and ensuring sustainable growth within the mining equipment market.

Intense competition requires continuous innovation and differentiation to maintain market leadership. The Epiroc business model must adapt to stay ahead.

Fluctuations in end-markets, especially construction, can negatively affect profitability. A downturn could impact Epiroc's financial performance.

Changes in regulations and geopolitical tensions pose potential headwinds. Currency fluctuations, such as the appreciation of the Swedish krona, can impact revenue growth.

Increased working capital due to acquisitions and currency fluctuations poses challenges. Managing inventory levels remains crucial.

Rapid technological advancements necessitate continuous R&D. The company's ambitious goals for emission-free products require ongoing commitment.

Attracting and retaining talent is crucial, and workforce reductions must be balanced with the need for a skilled workforce. The Epiroc company analysis shows that this is an ongoing challenge.

Epiroc mitigates risks through diversification across mining and infrastructure. Its strong aftermarket business, representing 63% of revenues in Q4 2024, provides resilience. The company's strategy includes risk management frameworks and scenario planning.

Selective acquisitions entail execution risk, as seen with the dilutive impact on profit margins in 2024. However, Epiroc anticipates adjusted EBITDA reaching 24% in 2025, demonstrating a commitment to improving profitability. For more information about the company's financial health, check out this article from Owners & Shareholders of Epiroc.

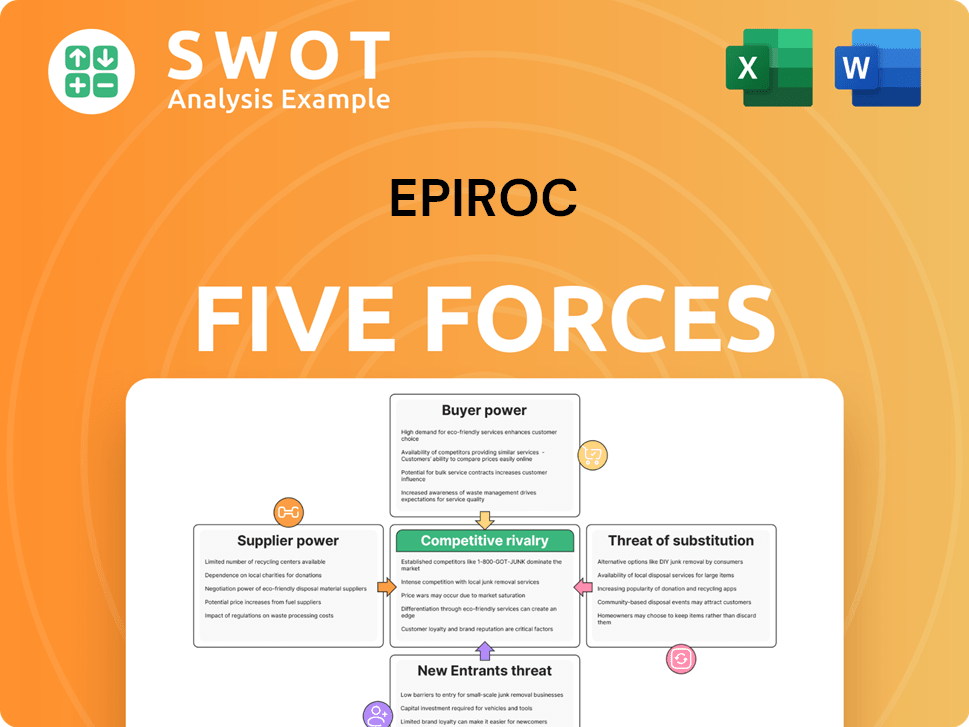

Epiroc Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Epiroc Company?

- What is Competitive Landscape of Epiroc Company?

- How Does Epiroc Company Work?

- What is Sales and Marketing Strategy of Epiroc Company?

- What is Brief History of Epiroc Company?

- Who Owns Epiroc Company?

- What is Customer Demographics and Target Market of Epiroc Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.