Eurocell Bundle

How Does Eurocell Navigate the UK Building Products Market?

The UK construction sector is undergoing a transformation, driven by sustainability and efficiency demands, making it a critical time to understand the players shaping the market. Eurocell PLC, a prominent name since 1974, has consistently adapted to these shifts. This analysis dives into the Eurocell SWOT Analysis, its competitive arena, and the strategies it employs to maintain its leading position.

Understanding the Eurocell competitive landscape is essential for investors and industry professionals alike. This in-depth Eurocell market analysis will explore its key competitors, assess its financial performance, and examine its product range overview within the Eurocell industry. We'll also delve into Eurocell's growth strategies, geographic market presence, and the impact of economic conditions on its future outlook, providing actionable insights for strategic decision-making.

Where Does Eurocell’ Stand in the Current Market?

Eurocell PLC holds a significant position within the UK's PVC building products sector. The company is involved in manufacturing, distributing, and recycling window, door, and roofline solutions. It is a leading provider in its segments, particularly within the UK market.

The primary product lines include PVC-U profiles for windows, doors, conservatory roofs, and roofline products such as fascias, soffits, and guttering. Eurocell operates a vast distribution network throughout the United Kingdom, catering to both trade professionals and DIY customers. Its strategic focus also includes sustainability, particularly through its recycling operations, which sets it apart from some competitors.

Eurocell's financial health, as reflected in its revenue and infrastructure investments, generally places it above industry averages in terms of scale and operational capacity. In recent financial reports, the company has demonstrated strong performance, highlighting its resilience in a challenging economic climate. Its focus remains on increasing its presence in key regional markets where construction activity is robust. For a deeper understanding of the company's customer base, you can explore the Target Market of Eurocell.

The Eurocell competitive landscape is primarily defined by its position in the UK PVC building products market. It competes with various manufacturers and distributors of windows, doors, and roofline products. The company's market share is consistently strong, making it a key player in the industry.

Eurocell market analysis reveals a robust operational model, supported by a wide distribution network and a focus on sustainable practices. The company's financial performance reflects its strategic investments and ability to adapt to market demands. Recent reports show consistent revenue streams and growth, despite economic challenges.

The Eurocell industry position is strong, with a focus on PVC products for the construction sector. It benefits from the increasing demand for sustainable building materials. Its comprehensive product range and extensive distribution network support its leading market position.

Eurocell financial performance is typically above industry averages, with robust revenue and consistent growth. The company's investments in infrastructure and recycling operations contribute to its financial stability. Detailed financial reports provide insights into its operational efficiency and market resilience.

Eurocell's competitive advantages include its extensive product range, strong distribution network, and focus on sustainability. The company's ability to adapt to market changes and maintain strong financial performance are also key strengths. The company's recycling initiatives further differentiate it from competitors.

- Extensive product range for windows, doors, and roofline solutions.

- Wide distribution network across the UK, serving trade and DIY customers.

- Strong emphasis on sustainability through recycling programs.

- Consistent financial performance and investment in infrastructure.

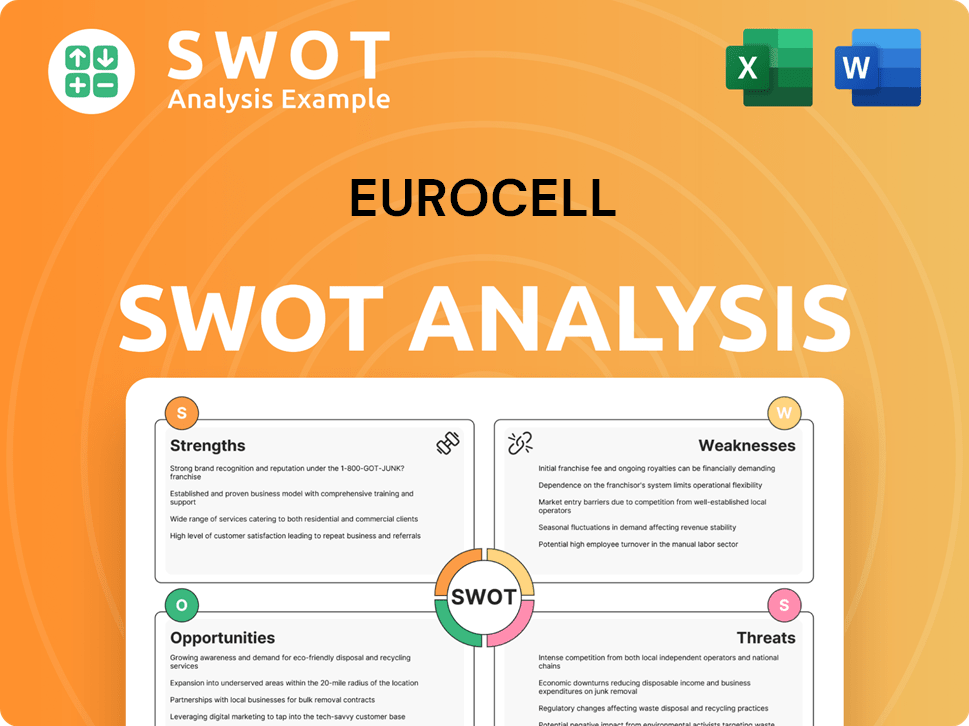

Eurocell SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Eurocell?

The Revenue Streams & Business Model of Eurocell operates in a competitive environment. Understanding the Eurocell competitive landscape is crucial for assessing its market position and growth potential. This analysis examines key competitors and their strategies within the Eurocell industry.

Eurocell's market position is influenced by both direct and indirect competitors. A thorough Eurocell market analysis involves evaluating these competitors' strengths, weaknesses, and market strategies. The competitive dynamics impact Eurocell's financial performance and strategic decisions.

Eurocell PLC faces competition from various players in the PVC building products sector. Analyzing Eurocell competitors helps to understand its market share comparison and competitive advantages and disadvantages.

Direct competitors of Eurocell include manufacturers and distributors of PVC-U profiles and related building materials in the UK. These companies compete directly in the Eurocell PVC products market.

Key competitors include Rehau, VEKA, and Deceuninck. These companies have a significant presence in the Eurocell industry.

Rehau offers a broad range of polymer-based solutions. Rehau leverages its global presence and strong brand recognition.

VEKA is known for its extensive range of window and door systems. VEKA is committed to recycling.

Deceuninck focuses on innovative and sustainable building solutions. Deceuninck presents a strong challenge in energy-efficient products.

Competitors challenge Eurocell through price competition, product innovation, and distribution networks. Product performance, lead times, and customer support are critical factors.

Indirect competitors include manufacturers of alternative materials like timber or aluminum. These cater to similar customer segments and architectural preferences. Emerging players in modular construction also represent potential disruption.

- Market Share: In 2024, the UK construction market showed a slight decrease in overall output, impacting all players.

- Innovation: Eurocell and its competitors are investing in sustainable PVC products.

- Economic Impact: Economic conditions significantly influence the demand for building products.

- Future Outlook: The future outlook depends on innovation, sustainability, and economic stability.

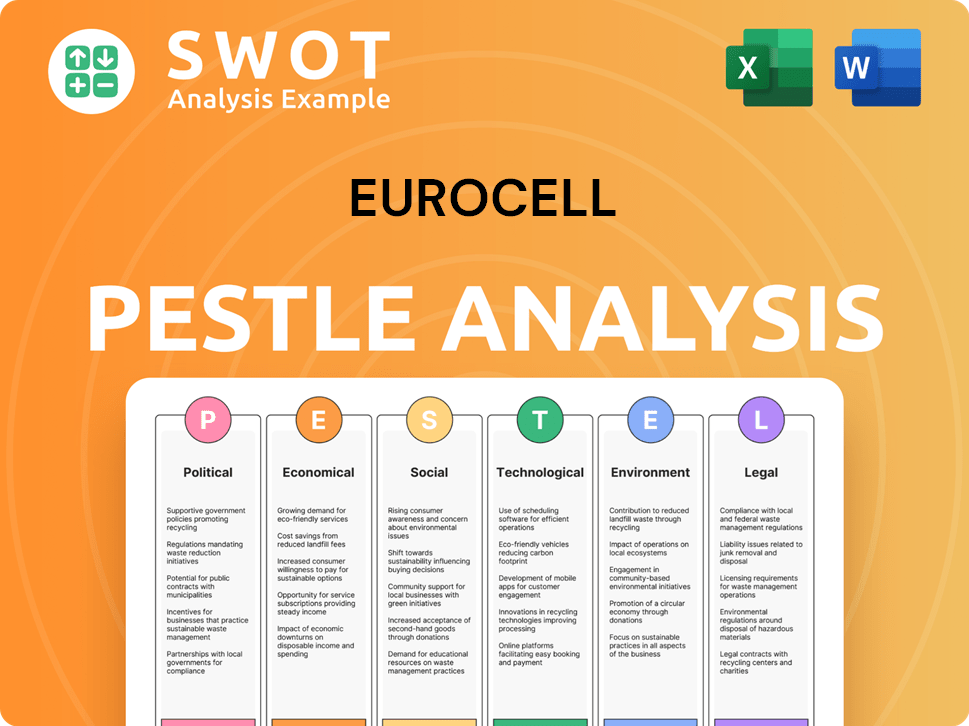

Eurocell PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Eurocell a Competitive Edge Over Its Rivals?

Analyzing the Eurocell competitive landscape reveals a company with several key advantages. These advantages stem from its integrated business model, robust recycling capabilities, and extensive distribution network. This strategic approach allows for a strong market position within the Eurocell industry.

A core strength of Eurocell lies in its proprietary extrusion technology and manufacturing processes. This enables the production of high-quality, durable PVC-U profiles. The company's vertical integration, encompassing raw material sourcing, manufacturing, and distribution, provides significant control over the supply chain. This control ensures consistent product quality and efficient cost management, which is crucial for maintaining a competitive edge in the Eurocell market analysis.

Furthermore, Eurocell's pioneering work in PVC recycling sets it apart. Investments in advanced recycling facilities align with increasing environmental regulations and consumer demand for sustainable products. This approach provides a cost-effective and secure source of recycled material, reducing reliance on virgin PVC and mitigating price volatility. This commitment to sustainability is a key differentiator in the Eurocell PVC products sector.

Eurocell's integrated model, from raw material sourcing to distribution, ensures consistent product quality and efficient cost management. This vertical integration provides a significant competitive advantage in the market. This approach allows for better control over the supply chain and responsiveness to market changes.

The company's investment in advanced recycling facilities sets it apart, aligning with environmental regulations and consumer demand. This reduces reliance on virgin PVC and mitigates price volatility. This commitment to sustainability enhances its brand image and market position.

Eurocell's network of over 200 branches across the UK provides unparalleled accessibility for trade customers. This widespread network acts as a significant barrier to entry for new competitors. This extensive reach fosters strong customer relationships and repeat business.

Continuous investment in product development, such as enhanced thermal performance in window and door systems, ensures competitiveness. This focus on innovation helps meet evolving building regulations. This strategy helps maintain a strong market position.

Eurocell's competitive advantages include its integrated business model, which provides control over the supply chain. The company's recycling capabilities and extensive distribution network also contribute significantly to its market position. These factors make it difficult for rivals to imitate quickly.

- Vertical Integration: Control over the entire value chain from sourcing to distribution.

- Sustainability: Commitment to PVC recycling and eco-friendly practices.

- Brand Reputation: Strong brand equity built over decades in the UK market.

- Distribution Network: Over 200 branches providing easy access for trade customers.

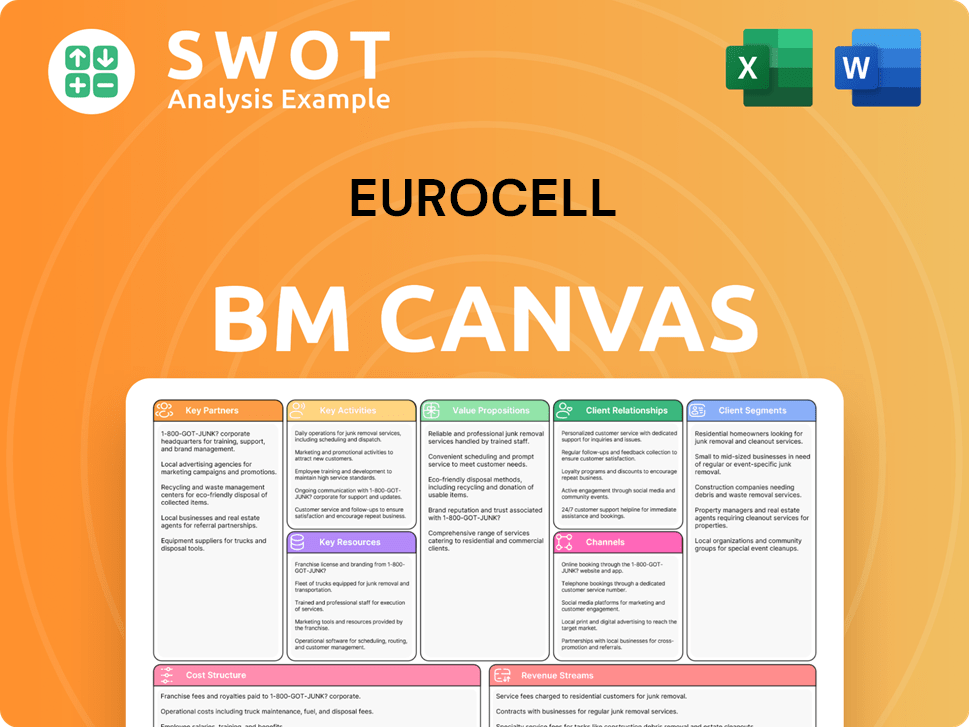

Eurocell Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Eurocell’s Competitive Landscape?

The competitive landscape for Eurocell is significantly influenced by evolving industry trends, including technological advancements, regulatory changes, and shifting consumer preferences. Understanding these dynamics is crucial for assessing Eurocell's market position, identifying potential risks, and forecasting its future outlook. This analysis provides a detailed examination of the current competitive environment, including key challenges and opportunities for Eurocell.

The company faces both internal and external pressures. Internal factors include operational efficiency and product innovation, while external factors encompass market dynamics, competitor actions, and economic conditions. This analysis aims to provide a comprehensive understanding of these elements to assess Eurocell's strategic positioning and future prospects. For a deeper dive into the company's origins, consider reading the Brief History of Eurocell.

Technological advancements in smart home integration and material performance are driving demand for advanced window and door systems. Regulatory changes, especially concerning energy efficiency and carbon emissions, are pushing manufacturers to innovate. Consumer preferences are evolving towards aesthetically pleasing, efficient, and environmentally friendly products, impacting the Eurocell competitive landscape.

Adapting to stringent building regulations and maintaining a competitive edge in product innovation are key challenges for Eurocell. Rising raw material and energy costs pose a continuous threat to profitability. Potential disruptions could arise from new market entrants with disruptive technologies or alternative building materials, affecting Eurocell market analysis.

The growing emphasis on net-zero carbon buildings and the circular economy aligns with Eurocell's strengths in PVC recycling and sustainable product development. Retrofitting existing buildings to improve energy efficiency and supplying products for new, sustainable developments offer significant growth opportunities. Expanding product lines and entering new geographic markets could also drive growth.

Continuous investment in recycling infrastructure and product innovation, combined with a strong distribution network, positions Eurocell to capitalize on opportunities. This strategy helps the company remain resilient in the evolving competitive landscape. Focus on Eurocell PVC products and sustainable practices are key.

The Eurocell industry is influenced by sustainability trends and technological advancements. The company's ability to adapt to these changes will determine its success. Understanding Eurocell competitors and their strategies is crucial for maintaining a competitive edge.

- Sustainability Initiatives: Eurocell's focus on PVC recycling and sustainable product development is a significant advantage, aligning with growing market demands.

- Innovation in PVC Products: Continuous investment in research and development is essential to meet evolving customer needs and regulatory requirements.

- Geographic Expansion: Exploring new markets, particularly within Europe, could provide additional growth avenues.

- Financial Performance: Monitoring Eurocell financial performance, including revenue and profit margins, is critical for assessing its overall health and ability to invest in future growth. In recent financial reports, Eurocell has shown a commitment to these areas.

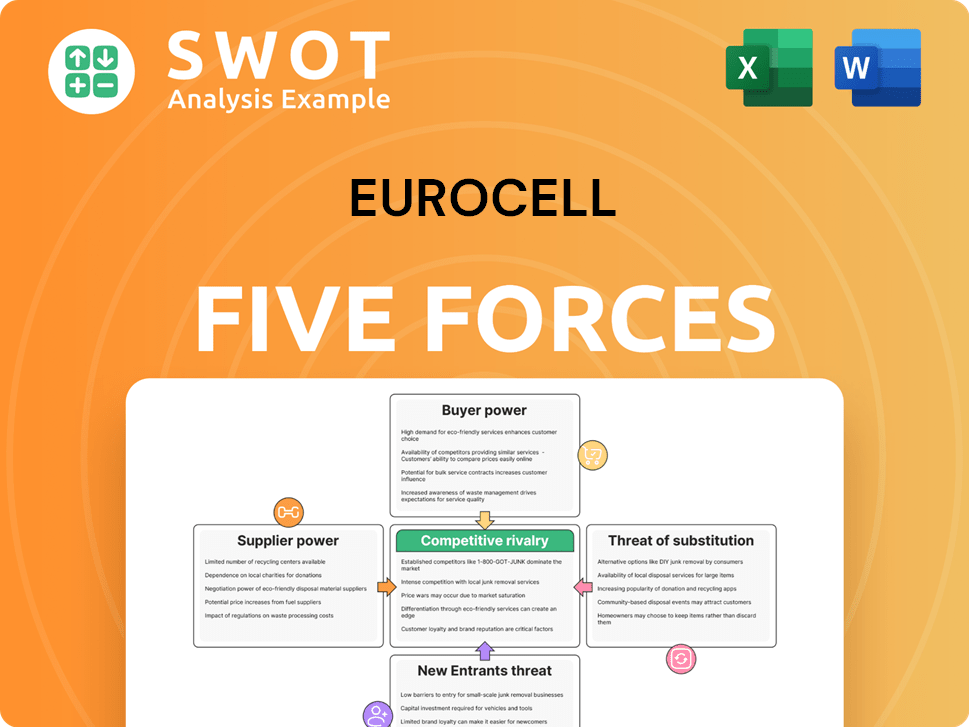

Eurocell Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Eurocell Company?

- What is Growth Strategy and Future Prospects of Eurocell Company?

- How Does Eurocell Company Work?

- What is Sales and Marketing Strategy of Eurocell Company?

- What is Brief History of Eurocell Company?

- Who Owns Eurocell Company?

- What is Customer Demographics and Target Market of Eurocell Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.