Euskaltel Bundle

How Did Euskaltel Navigate the Cutthroat Spanish Telecom Market?

The Spanish telecommunications sector is a battlefield of innovation and fierce competition, and Euskaltel's story is a prime example of this. From its humble beginnings in the Basque Country in 1995, Euskaltel aimed to revolutionize regional connectivity. Its journey, marked by expansion and strategic shifts, culminated in its acquisition by MásMóvil, highlighting the industry's relentless pressures.

Before delving into Euskaltel SWOT Analysis, understand that the company's evolution reflects broader trends in the Telecommunications industry Spain. This analysis will explore Euskaltel's competitive landscape, examining its Euskaltel market analysis, key Euskaltel competitors, and strategic moves. Understanding Euskaltel's business model and Euskaltel strategy is crucial to grasping its position in the Spanish broadband market and mobile network coverage compared to rivals.

Where Does Euskaltel’ Stand in the Current Market?

Before its integration into the MásMóvil Group in August 2021, Euskaltel held a strong market position, especially in the Basque Country, Galicia (under the R brand), and Asturias (under the Telecable brand). Its strength came from its fiber optic network and strong brand recognition among local customers. The company mainly served homes and businesses, offering packages that included phone, internet, and digital TV services.

Euskaltel's move into the national market with the Virgin telco brand in 2020 aimed to broaden its reach beyond its traditional areas. This shift showed a move from a regional focus to a more national strategy, targeting a wider customer base. The acquisition of Euskaltel by MásMóvil valued the company at about 3.5 billion euros, reflecting its significant scale and customer base in the Spanish telecom market at the time.

This valuation highlights its strong standing compared to other regional operators and its strategic importance in the ongoing consolidation of the Spanish telecom market. Understanding the Euskaltel competitive landscape is key to analyzing its market position and future strategies. The Telecommunications industry Spain has seen significant changes, and Euskaltel's moves reflect these shifts.

Euskaltel had a significant market share in its core regions before the merger. Exact figures post-2021 are unavailable due to the acquisition. The company's strong fiber optic network and local brand recognition contributed to its market share.

Euskaltel's primary focus was on the Basque Country, Galicia, and Asturias. These regions were key to its business, with strong customer loyalty. The company's regional strength was a key aspect of its Euskaltel business model.

The launch of Virgin telco in 2020 marked a shift towards national presence. This expansion aimed to challenge larger national operators and diversify offerings. This strategy is part of the Euskaltel strategy.

The acquisition by MásMóvil valued Euskaltel at approximately 3.5 billion euros. This valuation shows its substantial scale and customer base. This valuation is a key factor in Euskaltel market analysis.

Euskaltel's market position was built on regional strength and a strong network. The move to national expansion was a strategic shift to compete more broadly. Understanding the competitive landscape is essential for evaluating Euskaltel's performance.

- Strong regional presence in the Basque Country, Galicia, and Asturias.

- Expansion into the national market with the Virgin telco brand.

- Valuation of approximately 3.5 billion euros at the time of acquisition.

- Focus on bundled services including fixed and mobile telephony, broadband, and digital TV.

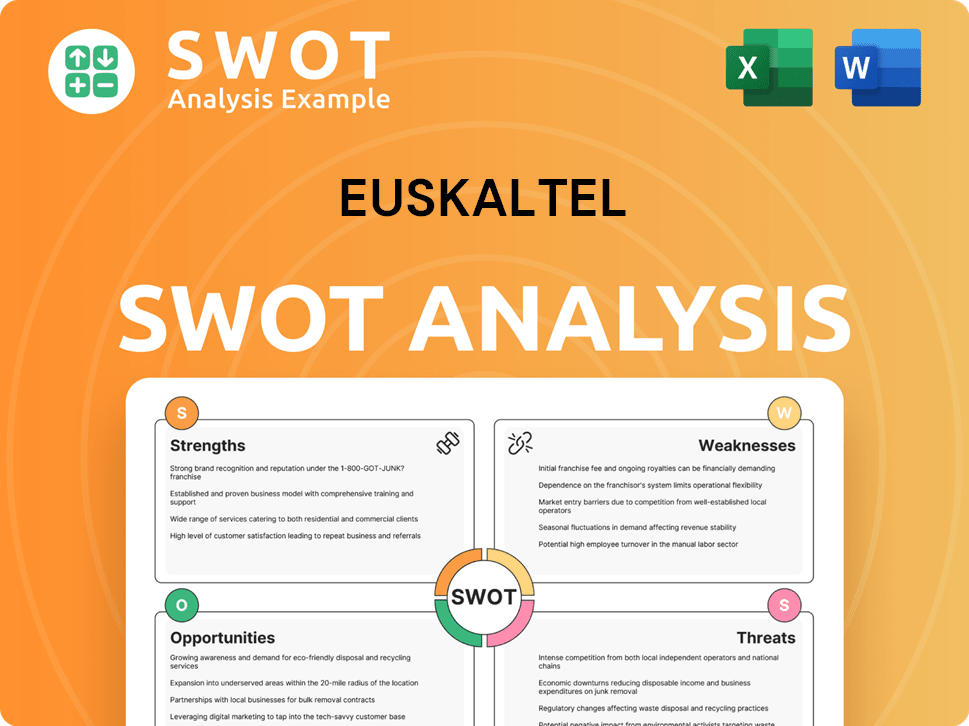

Euskaltel SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Euskaltel?

Before its acquisition, the Euskaltel competitive landscape was primarily shaped by major national telecommunications operators and a host of smaller, regional players. The company faced intense competition across various service offerings, including broadband, mobile, and television. This competitive environment significantly influenced its strategic decisions and market positioning within the telecommunications industry in Spain.

The Euskaltel market analysis reveals a dynamic interplay of market share, pricing strategies, and service bundles among the key players. The company had to constantly adapt to maintain its position, particularly in the face of aggressive tactics from larger competitors with greater resources. Understanding the competitive dynamics was crucial for Euskaltel to sustain its growth and profitability.

The competitive landscape also involved indirect competitors such as virtual mobile network operators (MVNOs) and smaller regional providers, which often focused on niche markets or highly competitive price points. The evolution of the Euskaltel business model was constantly influenced by these factors.

Telefónica (Movistar), Vodafone, and Orange were Euskaltel's main direct competitors. These companies had a significant advantage in terms of market share, infrastructure, and marketing budgets. They offered extensive service bundles, including exclusive content, to attract and retain customers.

As the incumbent, Movistar held the largest market share and possessed an extensive infrastructure. Movistar's Fusión bundles posed a direct challenge to Euskaltel's offerings. The company's broad portfolio of services, including mobile, broadband, and television, allowed it to compete aggressively across all segments.

Vodafone presented strong competition with its own comprehensive service bundles and aggressive pricing strategies. Vodafone expanded its fiber optic networks to gain traction in regions where Euskaltel had a strong local presence. Vodafone's marketing efforts and content offerings were also key competitive factors.

Orange competed with comprehensive service bundles and expanding fiber optic networks. Orange sought to gain market share in regions where Euskaltel had a strong local presence. Aggressive pricing and content packages were central to Orange's strategy.

Euskaltel also contended with a growing number of virtual mobile network operators (MVNOs) and smaller regional providers. These competitors often focused on niche markets or highly competitive price points. The MVNOs and regional providers added complexity to the competitive landscape.

The entry of new players and industry consolidation, such as the MásMóvil-Orange merger, reshaped market share dynamics and strategic alliances. These changes intensified the Euskaltel competitive landscape. The industry was constantly evolving, requiring Euskaltel to adapt its Euskaltel strategy.

Euskaltel's strategies included offering competitive bundled services, focusing on customer service, and investing in its fiber optic network to differentiate itself. The company aimed to maintain a strong presence in the Basque Country while exploring expansion opportunities. Understanding the Euskaltel market share analysis 2024 is crucial for assessing its position.

- Focus on Bundled Services: Euskaltel offered bundled services (e.g., internet, TV, and mobile) to attract and retain customers.

- Customer Service: Euskaltel emphasized customer service to differentiate itself from larger competitors.

- Network Investment: Investments in fiber optic infrastructure were key to providing high-speed internet services.

- Regional Focus: Euskaltel concentrated on the Basque Country, leveraging its local presence and brand recognition.

- Competitive Pricing: Euskaltel used competitive pricing strategies to attract customers.

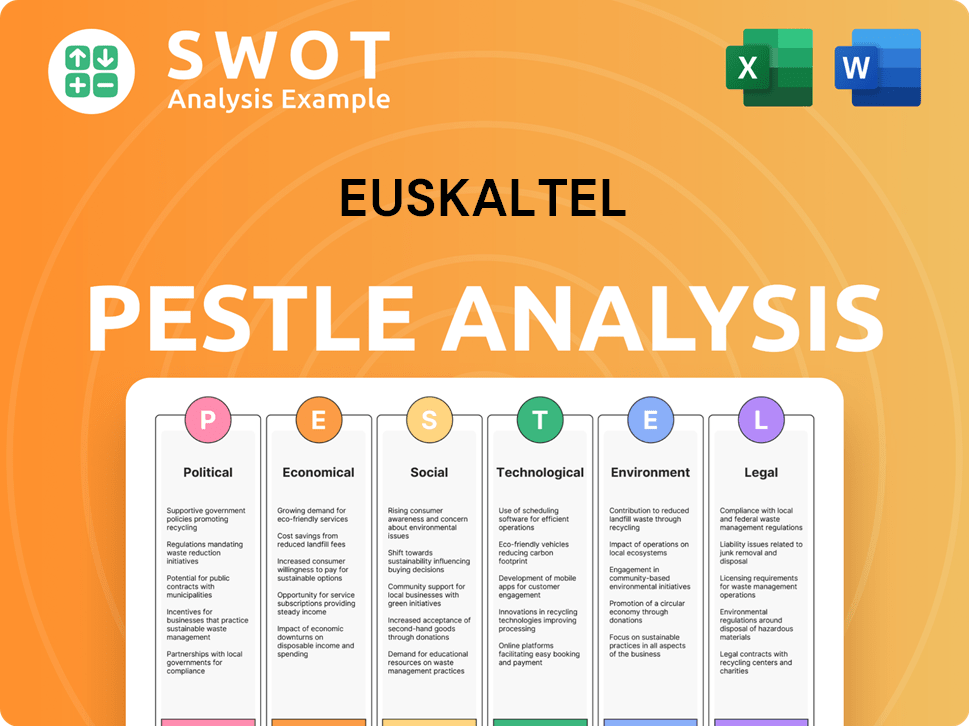

Euskaltel PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Euskaltel a Competitive Edge Over Its Rivals?

Understanding the Euskaltel competitive landscape requires a look at its core strengths. The company's regional focus, especially in the Basque Country, Galicia, and Asturias, gave it a significant advantage. This localized approach allowed for tailored services and strong customer relationships, a key element in its Euskaltel strategy.

Euskaltel's success was built on its proprietary fiber optic network within its primary operating regions. This infrastructure enabled high-speed broadband and reliable services. This infrastructure allowed for superior service quality and faster deployment of new services compared to national competitors relying on shared or less extensive regional networks. This localized network was a cornerstone of its competitive edge.

The company's strong brand equity and customer loyalty within its traditional operating areas were also crucial. Its local focus, tailored customer service, and community engagement fostered a sense of regional identity and trust among its subscribers, differentiating it from larger, more impersonal national operators. This customer-centric approach translated into higher customer retention rates and a stable subscriber base in its core markets.

Euskaltel's proprietary fiber optic network provided a significant advantage in its core regions. This infrastructure enabled high-speed broadband and reliable services. This allowed for superior service quality compared to national competitors.

Euskaltel cultivated strong brand equity and customer loyalty within its traditional operating areas. Its local focus and community engagement fostered a sense of regional identity and trust. This customer-centric approach translated into higher customer retention rates.

Euskaltel offered competitive bundled packages, often leveraging its local content partnerships. This strategy helped to solidify its market position. Bundling services like internet, TV, and mobile enhanced customer value.

Operational efficiencies in managing its regional networks were a key advantage. This allowed for cost-effective service delivery. Efficient operations supported profitability and competitiveness.

Euskaltel's competitive advantages included a strong regional presence, a proprietary fiber optic network, and strong customer relationships. These factors helped the company maintain a solid market position. These advantages were crucial in the telecommunications industry Spain.

- Strong Regional Presence: Focused operations in the Basque Country, Galicia, and Asturias.

- Proprietary Fiber Optic Network: Provided high-speed broadband and reliable services.

- Customer Loyalty: Strong brand equity and customer retention in core markets.

- Competitive Bundled Packages: Offering combined services to attract customers.

- Operational Efficiencies: Effective management of regional networks.

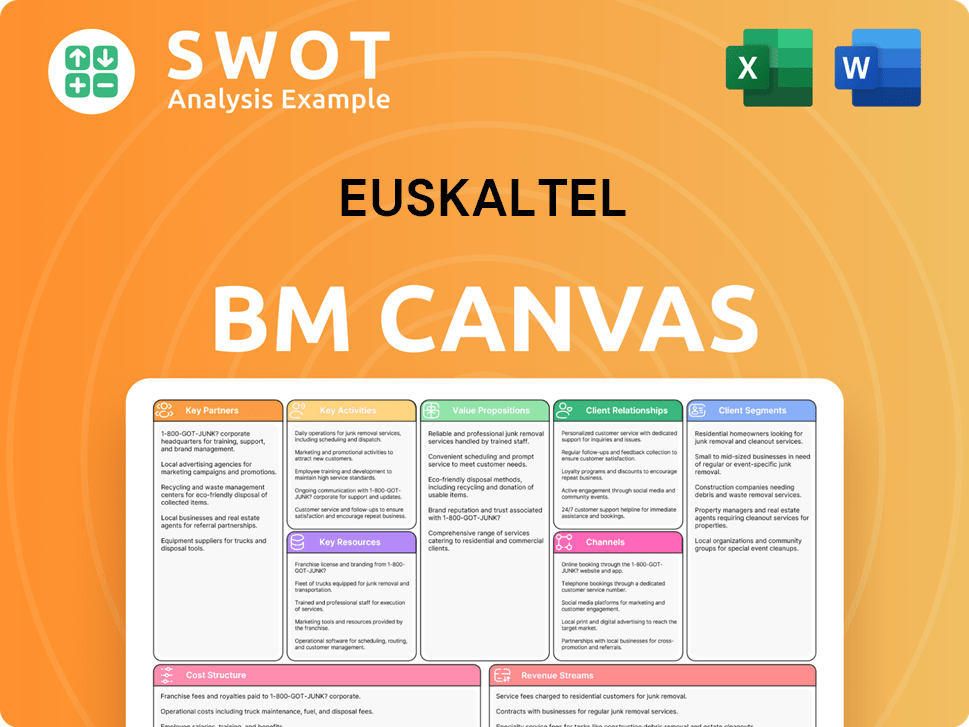

Euskaltel Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Euskaltel’s Competitive Landscape?

The Spanish telecommunications industry is currently undergoing significant shifts, impacting companies like Euskaltel. Key trends include the ongoing rollout of 5G, the increasing demand for fiber broadband, and a wave of market consolidation. Understanding the Euskaltel competitive landscape is crucial for stakeholders seeking to assess its future prospects. This analysis examines the industry dynamics, potential challenges, and growth opportunities for Euskaltel within the context of the broader Spanish telecom market.

As part of the MásMóvil Group, Euskaltel faces a complex environment characterized by intense competition and rapid technological advancements. The market is influenced by major national players and low-cost mobile virtual network operators (MVNOs). The integration into MásMóvil offers potential synergies, but also brings the need to navigate regulatory changes and adapt to evolving consumer preferences. A thorough Euskaltel market analysis is essential to understand its current position and future trajectory.

The Spanish telecom sector is driven by 5G deployment, increasing fiber broadband adoption, and market consolidation. 5G is expanding, with operators investing heavily in infrastructure. Fiber-to-the-home (FTTH) continues to grow, with significant coverage expansions in recent years. Mergers and acquisitions are reshaping the competitive landscape, as seen with the proposed merger between Orange and MásMóvil.

Intense price competition poses a major challenge, particularly from larger national players and MVNOs. Regulatory changes could affect network access and service pricing. The proposed merger between Orange and MásMóvil, if approved, may lead to a more concentrated market. Maintaining customer experience and tailored regional offerings is crucial for retaining customers.

Expanding converged services, leveraging the combined customer base, and network assets of the MásMóvil Group. Exploring new B2B services, smart home solutions, and IoT connectivity for new revenue streams. Focusing on customer experience and regional offerings can provide a competitive advantage. Strategic partnerships and acquisitions could also unlock additional market share.

Euskaltel's strategy must adapt to a dynamic market. This includes optimizing network investments, expanding services, and enhancing customer experience. The company must compete effectively on price, service quality, and innovation. The company's focus on regional offerings is a key differentiator. For more details, explore the Revenue Streams & Business Model of Euskaltel.

Euskaltel's success hinges on several factors, including its ability to navigate market consolidation and maintain customer loyalty. The company must invest strategically in 5G and fiber infrastructure to remain competitive. Effective cost management and operational efficiency are also critical.

- Market Dynamics: Understanding and responding to competitive pressures from major players like Telefónica (Movistar), Vodafone, and Orange.

- Regulatory Environment: Adapting to changes in regulations related to network access and pricing.

- Technological Advancements: Investing in 5G and fiber infrastructure to meet evolving consumer demands.

- Customer Retention: Focusing on customer experience and personalized regional offerings to retain its customer base.

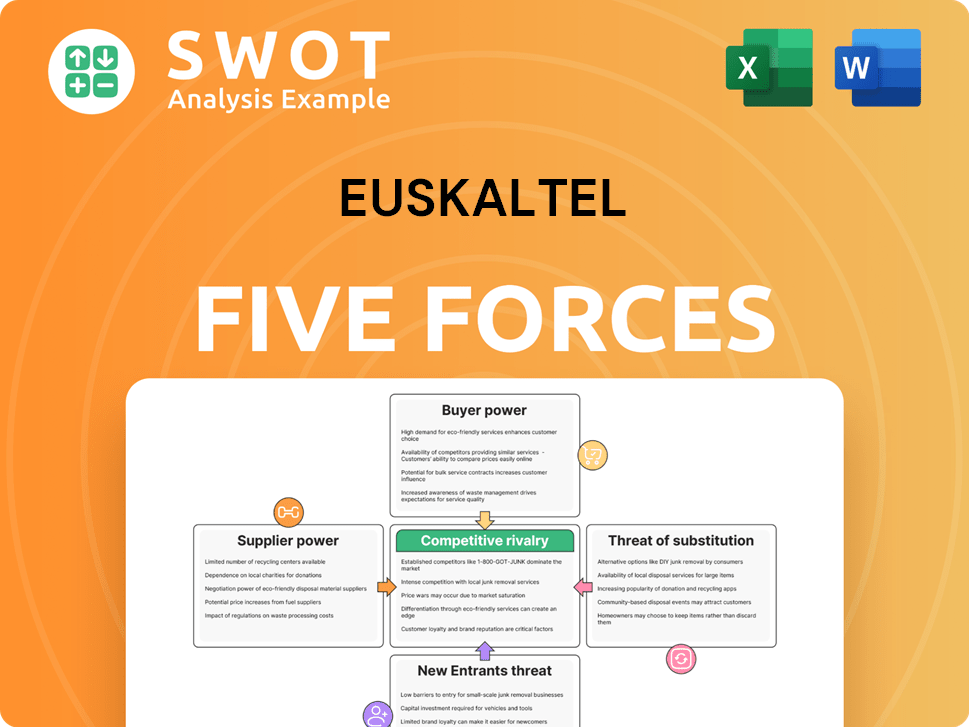

Euskaltel Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Euskaltel Company?

- What is Growth Strategy and Future Prospects of Euskaltel Company?

- How Does Euskaltel Company Work?

- What is Sales and Marketing Strategy of Euskaltel Company?

- What is Brief History of Euskaltel Company?

- Who Owns Euskaltel Company?

- What is Customer Demographics and Target Market of Euskaltel Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.