Evertz Technologies Bundle

How Does Evertz Technologies Thrive in a Dynamic Market?

The broadcast technology sector is undergoing a massive transformation, and Evertz Technologies Limited is at the forefront. As the media landscape shifts towards IP-based workflows and cloud solutions, understanding the Evertz Technologies SWOT Analysis is crucial for anyone looking to navigate this complex environment. This analysis will delve into Evertz Company's competitive strengths and weaknesses.

This deep dive into the Evertz Technologies competitive landscape will provide a thorough market analysis, exploring industry trends and the company's strategic positioning. We'll examine its product portfolio review, compare it against competitors, and assess its future outlook within the broadcast equipment market. This examination is essential for understanding Evertz Technologies' challenges and opportunities in a rapidly evolving industry.

Where Does Evertz Technologies’ Stand in the Current Market?

Evertz Technologies Limited is a significant player in the broadcast and media technology sector, specifically focusing on video and audio infrastructure solutions. The company's core operations revolve around providing comprehensive hardware and software products. These include routers, switchers, servers, and monitoring tools, all designed to facilitate the creation and delivery of high-quality content for the global market.

The value proposition of Evertz centers on offering end-to-end solutions that meet the evolving needs of the broadcast industry. This includes supporting live production, playout automation, and media asset management. Their focus on IP-based solutions and software-defined workflows positions them at the forefront of technological innovation, which is critical in today's rapidly changing media landscape. Evertz serves a diverse customer base, including major television broadcasters, film studios, and telecommunications companies.

Evertz holds a prominent position in the broadcast technology market, offering a wide range of solutions for video and audio infrastructure. The company's strong market standing is supported by consistent revenue and profitability, allowing for continuous investment in research and development. The company's focus on IP-based solutions and software-defined workflows has helped it to maintain its competitive relevance.

Evertz's financial health is a key indicator of its market position. For the third quarter of fiscal 2024, ending January 31, 2024, the company reported revenues of CAD 124.6 million and net earnings of CAD 25.0 million. This financial performance allows Evertz to invest in new technologies and expand its global presence. This robust financial performance is a testament to their strategic focus and market demand.

Evertz has a global customer base, serving major broadcasters, studios, and telecommunications companies across North America, Europe, and Asia. The company continues to expand its presence in emerging markets where IP migration is gaining momentum. Their ability to adapt to regional market needs and technological advancements is a key driver of their continued success.

Evertz has strategically shifted its focus to IP-based solutions and software-defined workflows to stay ahead of industry trends. This strategic pivot has allowed the company to remain at the forefront of technological innovation. This focus allows them to meet the evolving needs of their customers and maintain a competitive edge in the broadcast technology market.

Evertz's competitive advantages include its comprehensive product portfolio, strong financial performance, and global presence. The company's focus on IP-based solutions and software-defined workflows gives it a competitive edge in the evolving broadcast technology market. Moreover, their consistent investment in research and development ensures they remain at the forefront of innovation. For more insights, you can read about the Growth Strategy of Evertz Technologies.

- Comprehensive product portfolio covering various aspects of broadcast infrastructure.

- Strong financial performance, enabling investment in innovation and expansion.

- Global presence with a diverse customer base across major markets.

- Strategic focus on IP-based solutions, aligning with industry trends.

Evertz Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Evertz Technologies?

The Evertz Technologies operates in a highly competitive market, facing challenges from established giants and emerging players. Understanding the competitive landscape is crucial for assessing its market position and future prospects. This analysis considers both direct and indirect competitors, highlighting key strengths and potential threats.

The broadcast technology sector is dynamic, with constant innovation and shifting market dynamics. Examining the Evertz Company's competitors provides insights into industry trends and the competitive advantages needed to succeed. This overview aims to offer a comprehensive market analysis of the key players shaping the industry.

Direct competitors include established names in broadcast technology. Indirect competition comes from cloud service providers and emerging niche players. Strategic moves, such as acquisitions, further shape the competitive environment. This landscape analysis provides a detailed view of the challenges and opportunities facing Evertz Technologies.

Grass Valley is a major competitor, offering cameras, production switchers, and content management solutions. They directly compete with Evertz Technologies in live production and playout. Their broad portfolio and long-standing presence make them a significant player in the broadcast technology market.

Imagine Communications provides end-to-end broadcast and media solutions, specializing in ad management and networking. They compete with Evertz Technologies, particularly in IP migration projects. Their focus on comprehensive solutions makes them a strong contender.

Harmonic Inc. competes in video delivery infrastructure, particularly in video streaming and cable access solutions. They impact Evertz Technologies in the content distribution segment. Harmonic's expertise in video delivery makes them a key competitor.

Ross Video is known for production switchers, graphics systems, and robotic camera systems. They present a strong challenge in live production environments. Their integrated solutions and cost-effectiveness make them a significant competitor.

AWS and Microsoft Azure are indirect competitors, offering cloud-based infrastructure for content storage and delivery. They provide scalable alternatives to traditional hardware solutions. This shift requires Evertz Technologies to enhance its software and cloud offerings.

Emerging players focusing on niche areas like AI-driven content analysis pose a long-term disruption. These companies push Evertz Technologies to continuously innovate and adapt its product portfolio. This constant evolution is essential for maintaining a competitive edge.

The broadcast technology market is subject to mergers, acquisitions, and technological shifts. These factors influence the competitive landscape and require strategic adaptation. For instance, Ross Video's acquisition of Key Code Media's Live Production business in 2024 consolidated market power. Understanding these dynamics is crucial for Evertz Technologies.

- Market Consolidation: Mergers and acquisitions reshape the competitive environment, potentially increasing the size and scope of competitors.

- Cloud Adoption: The increasing use of cloud services by media companies challenges traditional hardware providers.

- Technological Innovation: Continuous advancements in areas like AI and IP-based workflows drive the need for product innovation.

- Customer Needs: Evolving customer demands for integrated, cost-effective solutions influence product development and market strategies.

- Global Presence: Evertz Technologies' global presence places it in competition with both local and international players. For more information, you can read about Owners & Shareholders of Evertz Technologies.

Evertz Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Evertz Technologies a Competitive Edge Over Its Rivals?

Evertz Technologies' competitive landscape is defined by its robust technological prowess and strategic market positioning. The company has consistently demonstrated its ability to innovate, particularly in IP-based video and audio infrastructure, which has solidified its position in the broadcast technology sector. A deep dive into the Evertz Company reveals a focus on proprietary technologies and intellectual property, setting it apart from competitors. Understanding these advantages is crucial for a thorough market analysis.

Key to Evertz's success is its ability to offer end-to-end solutions, simplifying procurement and integration for clients. This 'one-stop shop' approach, combined with a strong reputation for product reliability, cultivates significant customer loyalty among top-tier broadcasters globally. The company's strategic partnerships and product roadmap further ensure its solutions remain relevant and competitive, navigating the dynamic industry trends.

Evertz Technologies leverages its skilled talent pool in engineering and R&D to drive continuous innovation and respond swiftly to market demands. This agility is crucial in an industry marked by rapid technological shifts. Analyzing the Evertz Technologies market share analysis reveals a strong and stable presence, supported by its competitive advantages and strategic focus.

Evertz excels in developing proprietary technologies, particularly in IP-based video and audio infrastructure. This includes advanced routing, switching, and processing capabilities. Their custom chipsets and software architectures, such as the MAGNUM-SDN orchestration system, provide a significant advantage in large-scale broadcast deployments.

The company has a strong reputation for product reliability, fostering customer loyalty among top-tier broadcasters. This trust is built on years of delivering robust, mission-critical systems that operate 24/7. This reliability is a key factor in their sustained market position.

Evertz offers comprehensive solutions from content acquisition to distribution, providing a 'one-stop shop' advantage. This simplifies procurement and integration for clients, making them a preferred partner for many broadcasters. This approach streamlines operations for their clients.

Evertz boasts a highly skilled talent pool, particularly in engineering and R&D, enabling continuous innovation. This allows them to rapidly respond to evolving market demands and maintain a competitive edge. Their ability to innovate is key to their success.

Evertz's competitive advantages are multi-faceted, encompassing technological innovation, product reliability, and a comprehensive service approach. Understanding these advantages is crucial for assessing their industry position. For more information, you can explore the Revenue Streams & Business Model of Evertz Technologies.

- Technological Leadership: Evertz leads in IP-based video and audio infrastructure.

- Customer Loyalty: Strong reputation for reliability fosters customer loyalty.

- End-to-End Solutions: Offers a one-stop shop for broadcasters.

- Innovation: Skilled talent pool drives continuous product innovation.

Evertz Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Evertz Technologies’s Competitive Landscape?

The broadcast and media technology industry is experiencing significant shifts, creating both challenges and opportunities for companies like Evertz Technologies. These changes are driven by technological advancements and evolving consumer demands. Understanding the Evertz Technologies competitive landscape is crucial for investors, analysts, and industry professionals to assess the company's position and future prospects.

The industry's future hinges on adapting to new technologies and market dynamics. This involves navigating intense competition, investing in research and development, and exploring strategic partnerships. The following sections provide insights into the industry trends, challenges, and opportunities facing Evertz Company.

The broadcast technology sector is rapidly evolving, with a strong emphasis on IP-based workflows and cloud adoption. This transition necessitates continuous innovation in software-defined solutions. The demand for remote production capabilities and higher resolution content, including 4K and 8K, is also increasing.

Evertz Technologies faces challenges such as intense competition from IT and cloud giants entering the media space. Significant R&D investments are needed to keep pace with technological advancements, and pricing pressures may arise as software-defined solutions become more prevalent. The adoption of cloud-based services could impact demand for traditional hardware.

Evertz Company is well-positioned to capitalize on the ongoing IP transition, leveraging its established expertise and product portfolio. The demand for scalable, flexible, and secure cloud-based media solutions offers strong growth potential. Strategic partnerships with cloud providers and AI companies can help expand its ecosystem.

The company's competitive position is likely to shift towards a more software-centric and services-oriented model. Continued emphasis on interoperability and open standards is crucial to remain competitive. This approach will help Evertz Technologies capture new market share in the evolving media landscape.

To stay competitive, Evertz must focus on software innovation, cloud solutions, and strategic partnerships. The company needs to adapt to the changing market dynamics and evolving customer needs. A detailed look at the company's market position can be found in a comprehensive Marketing Strategy of Evertz Technologies.

- Prioritize investments in software-defined solutions and cloud-native architectures.

- Explore strategic partnerships with cloud providers and AI companies.

- Focus on developing AI-powered tools for content management and automation.

- Enhance interoperability and support open standards to ensure compatibility.

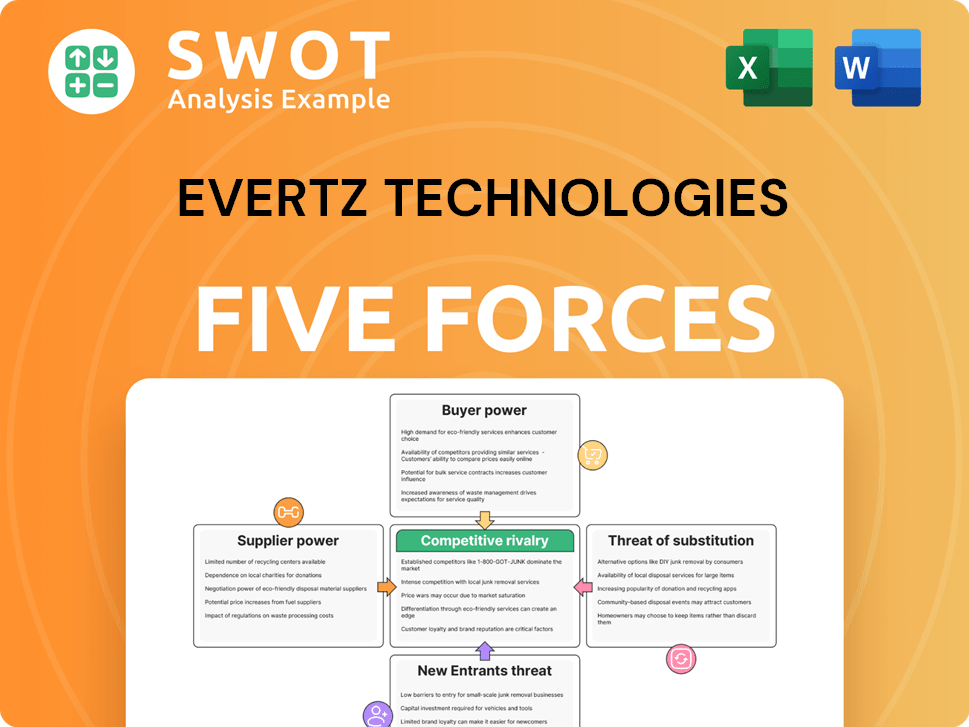

Evertz Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Evertz Technologies Company?

- What is Growth Strategy and Future Prospects of Evertz Technologies Company?

- How Does Evertz Technologies Company Work?

- What is Sales and Marketing Strategy of Evertz Technologies Company?

- What is Brief History of Evertz Technologies Company?

- Who Owns Evertz Technologies Company?

- What is Customer Demographics and Target Market of Evertz Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.