F.I.L.A. - Fabbrica Italiana Lapis ed Affini Bundle

Can F.I.L.A. Conquer the Evolving Creative Landscape?

F.I.L.A. - Fabbrica Italiana Lapis ed Affini, a titan in the art supplies industry, faces a dynamic competitive landscape. With the stationery market projected to reach nearly a quarter of a trillion dollars by 2032, understanding F.I.L.A.'s position is crucial. This analysis delves into F.I.L.A.'s key rivals, strategic moves, and market dynamics to provide actionable insights.

The F.I.L.A. - Fabbrica Italiana Lapis ed Affini SWOT Analysis reveals the company's strengths and weaknesses in the face of its competitors. This exploration of the F.I.L.A. competitive landscape will examine how F.I.L.A., an Italian company, leverages its brand portfolio, including Giotto and Lyra, to compete in the art supplies industry. We'll dissect F.I.L.A.'s market share analysis and its strategic positioning against rivals like Faber-Castell and Staedtler, offering a comprehensive F.I.L.A. company analysis.

Where Does F.I.L.A. - Fabbrica Italiana Lapis ed Affini’ Stand in the Current Market?

F.I.L.A., or Fabbrica Italiana Lapis ed Affini, holds a significant position in the global creative expression tools market. Specializing in items for coloring, drawing, modeling, writing, and painting, the company caters to artists, students, and consumers of all ages. With a focus on innovation and a broad product range, F.I.L.A. aims to provide high-quality tools that inspire creativity worldwide.

The company's value proposition centers on offering a comprehensive suite of creative tools. This includes a wide variety of products designed to meet the diverse needs of its customers. Through strategic acquisitions and a global presence, F.I.L.A. has expanded its reach and strengthened its market position. The company emphasizes both product quality and brand recognition to maintain its competitive edge in the art supplies industry.

In 2024, F.I.L.A. recorded net sales of €612.6 million. North America contributed significantly with 41.3% of sales, followed by Europe at 39.4%. Central and South America accounted for 14.2%, Asia for 4.5%, and other regions for 0.6%. Despite a slight overall revenue decline of 5.0%, or 2.8% at constant exchange rates, the company maintained a strong global footprint.

F.I.L.A. demonstrated resilience in profitability, with adjusted EBITDA increasing by 7.2% to €118.2 million. The adjusted EBITDA margin improved to 19.3% from 17.1% in 2023. Adjusted net profit also grew by 33.3% to €40.9 million from €30.9 million in 2023. The company's net financial position improved significantly, reaching -€181.1 million.

F.I.L.A. has expanded its product lines and geographic presence through acquisitions, including Adica Pongo, Dixon Ticonderoga Company, and Canson. A key strategic asset is its stake in DOMS Industries, valued at approximately €471 million as of May 2025. This partnership includes exclusive distribution rights for DOMS products in F.I.L.A. territories for five years.

While F.I.L.A. maintains a strong presence in Europe, the North American market experienced a revenue contraction of 6.9% in 2024. This was partly due to the rollout of the SAP Extended Warehouse Management (EWM) module and macroeconomic uncertainties. The company operates globally through 22 production facilities and 32 subsidiaries.

The F.I.L.A. competitive landscape is shaped by its global presence and diverse product offerings. The company's ability to adapt to market changes and leverage strategic partnerships is crucial for sustained growth. For more insights into F.I.L.A.'s growth strategy, consider reading Growth Strategy of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

- F.I.L.A. faces competition from various players in the stationery market and art supplies industry.

- Key rivals include both established and emerging companies, necessitating continuous innovation.

- Strategic acquisitions and partnerships, such as the one with DOMS Industries, are vital for expanding market reach.

- The company's financial health, as reflected in its improved profitability and net financial position, supports its ability to invest in future growth strategies.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging F.I.L.A. - Fabbrica Italiana Lapis ed Affini?

The F.I.L.A. competitive landscape is shaped by a mix of direct and indirect rivals in the stationery and art supplies markets. This Italian company faces competition from established global players and emerging brands. Understanding the competitive dynamics is crucial for assessing Fabbrica Italiana Lapis ed Affini competitors and its strategic positioning.

The market is influenced by factors like product quality, brand reputation, and distribution networks. The company's success depends on its ability to differentiate itself through innovation, product design, and sustainable practices. The company must navigate challenges from both traditional stationery companies and larger, diversified corporations.

FILA company analysis reveals a multifaceted competitive environment. Key competitors in the art supplies and writing instruments market include J.S. Staedtler, Faber-Castell, and Caran d'Ache. These companies compete on product quality, innovation, and brand recognition.

Direct competitors primarily operate within the stationery and art supplies sectors. They focus on similar product lines, such as pencils, pens, art materials, and related accessories. These companies compete directly for market share by offering comparable products.

Indirect competitors include larger, diversified companies that may have product offerings overlapping with F.I.L.A.'s. These companies may not focus solely on stationery but still compete for consumer spending. This includes sportswear and athletic apparel brands.

The stationery market is a significant segment for F.I.L.A., particularly school supplies. This segment is driven by rising student populations and government investments in education. This creates increased demand for basic stationery and art supplies.

Companies compete on product quality, innovation, brand reputation, and distribution networks. Differentiation through unique designs, customizable products, and sustainable materials is also crucial. Marketing strategies and geographical presence are important.

Emerging players, especially those focusing on eco-friendly products, present a growing challenge. These companies often appeal to environmentally conscious consumers. They compete by offering sustainable alternatives.

The brand recognition of 'FILA' can lead to perceived competition with athletic brands, although F.I.L.A. - Fabbrica Italiana Lapis ed Affini focuses on art materials. This can sometimes create confusion among consumers.

In the sportswear and athletic apparel segments, the brand 'Fila' (Fila Holdings Corp., now Misto Holdings Company) operates as a separate entity. Its competitors include Nike, Adidas, Puma, Reebok, New Balance, ASICS, and Under Armour. Nike's revenue was $12.825 billion as of May 31, 2023. Adidas generates 672% the revenue of F.I.L.A. Holdings Corp. These companies challenge through extensive marketing, sponsorships, and broad product portfolios. For a deeper dive into the company's strategy, consider reading a comprehensive analysis of F.I.L.A. - Fabbrica Italiana Lapis ed Affini by exploring its market position.

The competitive landscape is shaped by several key factors that influence market share and profitability. These factors are crucial for understanding the dynamics of the stationery and art supplies industries.

- Product Quality and Innovation: Offering high-quality products and continuous innovation is essential. Companies that invest in research and development to create new and improved products gain a competitive edge.

- Brand Reputation and Marketing: Building a strong brand reputation through effective marketing and advertising campaigns is crucial. This helps in creating brand loyalty and attracting new customers.

- Distribution Networks: Establishing efficient and extensive distribution networks ensures that products are readily available to consumers. This includes online and offline channels.

- Product Differentiation: Differentiating products through unique designs, customization options, and sustainable materials is important. This allows companies to stand out in a crowded market.

- Pricing Strategies: Competitive pricing strategies are essential for attracting customers. Companies must balance pricing with product costs and perceived value.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives F.I.L.A. - Fabbrica Italiana Lapis ed Affini a Competitive Edge Over Its Rivals?

In the dynamic F.I.L.A. competitive landscape, the company has carved out a strong position through strategic moves and a focus on innovation. The company's ability to adapt and expand its global footprint is a key factor in its ongoing success. Understanding the FILA company analysis reveals a commitment to both organic growth and strategic acquisitions, solidifying its market presence.

Fabbrica Italiana Lapis ed Affini competitors face a formidable rival in F.I.L.A., which has a diversified product range and a strong brand portfolio. These brands, including Giotto and Lyra, enjoy high recognition. The company's strategic partnerships and geographical expansion also contribute to its competitive edge.

A detailed look at Growth Strategy of F.I.L.A. - Fabbrica Italiana Lapis ed Affini reveals the core elements that drive its competitive advantages. Its focus on profitability and operational efficiency is another advantage, which is crucial in maintaining its position in the art supplies industry.

F.I.L.A. benefits from a portfolio of well-known brands. These brands, such as Giotto, Lyra, Daler-Rowney, and Maimeri, are recognized globally. This brand recognition fosters customer loyalty and provides a competitive edge in the stationery market.

The company offers a wide range of products, including coloring pencils, paints, and markers. This diversified product range helps F.I.L.A. cater to a broad customer base. It also provides resilience against fluctuations in demand for specific product categories.

With 22 production facilities worldwide, F.I.L.A. has a strong global presence. This enables efficient production and distribution. It also allows the company to tap into various international markets, enhancing its competitive position.

F.I.L.A. has expanded its market reach through strategic acquisitions. Notable acquisitions include Dixon Ticonderoga Company and Pacon Group in the US. The company's partnership with DOMS Industries further enhances its competitive position.

F.I.L.A.'s focus on profitability and operational efficiency is a key advantage. Despite a slight revenue decline in 2024, the company improved its adjusted EBITDA margin to 19.3% from 17.1% in 2023. This financial resilience supports investments in product development and strategic initiatives.

- The ability to implement price increases in certain markets indicates strong brand value.

- Strategic acquisitions have strengthened distribution networks.

- The company's global presence enables efficient production and distribution.

- The diversified product range caters to a broad customer base.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping F.I.L.A. - Fabbrica Italiana Lapis ed Affini’s Competitive Landscape?

The creative tools and stationery industry, where F.I.L.A. operates, is currently experiencing significant shifts. These changes present both challenges and opportunities for the company. Understanding the F.I.L.A. competitive landscape is crucial for navigating these dynamics and ensuring sustained growth.

The art supplies industry and stationery market are influenced by consumer preferences, technological advancements, and global economic factors. This industry analysis is essential for Fabbrica Italiana Lapis ed Affini competitors and stakeholders to make informed decisions and adapt to market changes. The FILA company analysis reveals strategic positioning within this evolving environment.

A key trend is the rising demand for sustainable and eco-friendly products, impacting manufacturers. Technological advancements, especially in digital creative software, are also significant. The global creative software market is projected to reach USD $17.35 billion by 2033, indicating a shift in creative expression.

The global stationery market is expected to grow from USD $158.39 billion in 2024 to USD $238.46 billion by 2032. Factors such as increasing educational institutions and e-commerce are fueling this growth. This expansion offers opportunities for companies like F.I.L.A.

Intense competition from established and niche brands poses a challenge. Macroeconomic uncertainties and potential tariff changes could impact sales. Supply chain restructuring, including the closing of a Chinese subsidiary, may lead to transitional difficulties. These factors require strategic planning.

Expanding into emerging markets presents growth opportunities. Product innovation, especially in eco-friendly offerings, is crucial. Strategic partnerships, like the one with DOMS Industries, can strengthen market position. F.I.L.A.'s strategic plan focuses on growth and sustainability.

F.I.L.A.'s strategic plan for 2025-2029 emphasizes growth through efficiency, new products, digital transformation, and strategic M&A. The company aims for low-to-mid single-digit revenue growth and mid-single-digit normalized EBITDA growth in 2025. For a deeper understanding of the company's background, consider reading a Brief History of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

- Focus on sustainability and improved cash flow generation.

- Expansion into emerging markets.

- Continued product innovation.

- Strategic partnerships to strengthen market position.

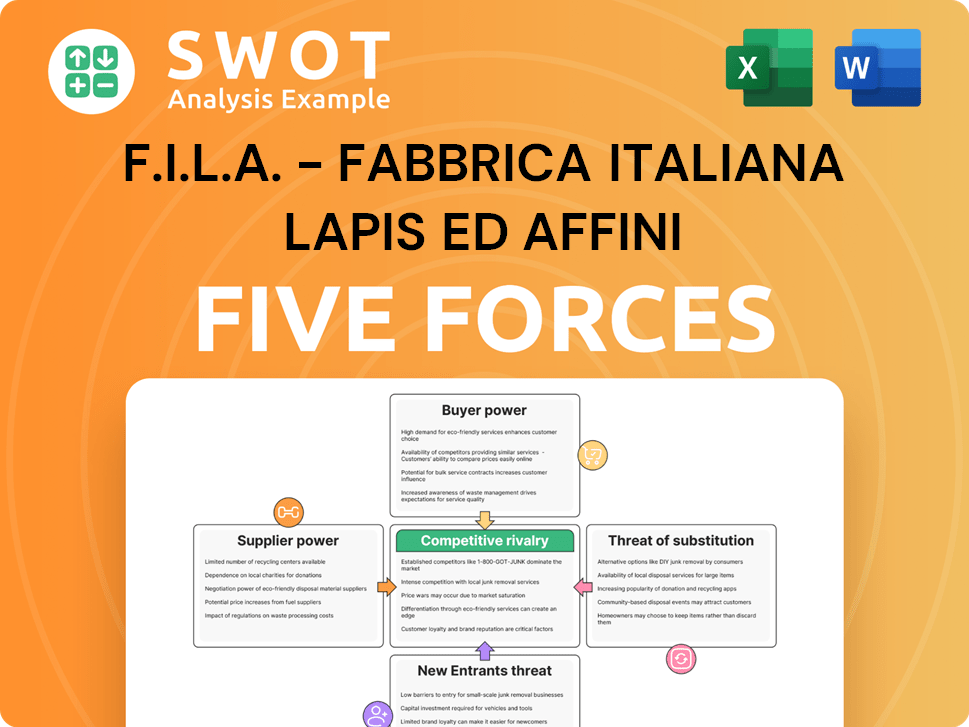

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Growth Strategy and Future Prospects of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- How Does F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company Work?

- What is Sales and Marketing Strategy of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Brief History of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- Who Owns F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Customer Demographics and Target Market of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.