F.I.L.A. - Fabbrica Italiana Lapis ed Affini Bundle

Can F.I.L.A. Continue to Color the World with Success?

F.I.L.A. - Fabbrica Italiana Lapis ed Affini, a name synonymous with quality art supplies, has evolved from a humble Italian workshop into a global powerhouse. The strategic acquisition of Daler-Rowney in 2016 was a pivotal move, significantly bolstering its presence in the fine art materials sector. This F.I.L.A. - Fabbrica Italiana Lapis ed Affini SWOT Analysis provides a comprehensive look at its journey and future potential.

This deep dive into F.I.L.A. explores its impressive Growth Strategy, examining how the company has navigated Market Trends and achieved significant Business Development. We'll dissect its expansion plans, assess its financial performance, and analyze how F.I.L.A. aims to maintain its competitive edge in a dynamic industry. Understanding the Fabbrica Italiana Lapis ed Affini story is crucial for anyone interested in investment opportunities and the future of creative tools.

How Is F.I.L.A. - Fabbrica Italiana Lapis ed Affini Expanding Its Reach?

The growth strategy of F.I.L.A., or Fabbrica Italiana Lapis ed Affini, hinges on robust expansion initiatives designed to strengthen its global footprint. These initiatives focus on both geographical expansion and diversification of product offerings. The aim is to reach new customer segments and boost revenue streams, particularly in the art and stationery markets.

A core component of F.I.L.A.'s strategy involves international expansion, especially in emerging markets. These markets exhibit growing demand for art and stationery products. The company also actively seeks mergers and acquisitions (M&A) opportunities to align with its core business and strategic objectives, similar to its successful integration of Daler-Rowney. These acquisitions help access new distribution channels, expand the brand portfolio, and increase market share in specific product categories or geographies.

F.I.L.A. is committed to product development, launching new products and services that cater to evolving consumer preferences and industry trends. This includes a focus on sustainable and eco-friendly art materials. Enhancing existing product lines through innovation in materials and design is also a priority. Furthermore, partnership strategies are crucial for F.I.L.A., enabling collaborations with educational institutions, artists, and other companies to co-develop products, enhance brand visibility, and explore new business models. For a deeper understanding of the company's marketing approach, consider reading the Marketing Strategy of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

F.I.L.A. focuses on expanding its presence in emerging markets. This includes regions with increasing demand for art and stationery products. The company aims to capitalize on the growing interest in creative activities worldwide.

F.I.L.A. actively seeks M&A opportunities to strengthen its market position. These acquisitions provide access to new distribution networks. They also allow for brand portfolio expansion and increased market share.

The company is dedicated to launching new products and services. This includes a focus on sustainable and eco-friendly art materials. Innovation in materials and design is also a key priority.

F.I.L.A. collaborates with educational institutions and other companies. These partnerships aim to co-develop products and enhance brand visibility. They also help explore new business models.

F.I.L.A. aims to achieve a consolidated net revenue of over €1 billion by 2024, demonstrating ambitious growth targets. The company's strategic focus on expansion and product innovation is expected to drive this growth. Market trends indicate a rising demand for art supplies, which supports F.I.L.A.'s growth strategy.

- Revenue Targets: Aiming for over €1 billion in consolidated net revenue by 2024.

- Market Demand: Capitalizing on the increasing demand for art and stationery products.

- Strategic Focus: Emphasis on international expansion and product innovation.

- Acquisition Strategy: Seeking strategic mergers and acquisitions to expand market reach.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does F.I.L.A. - Fabbrica Italiana Lapis ed Affini Invest in Innovation?

The innovation and technology strategy of F.I.L.A. (Fabbrica Italiana Lapis ed Affini) is a critical component of its growth strategy. The company consistently invests in research and development (R&D) to maintain its competitive edge. These investments are geared towards developing new materials, improving product performance, and enhancing manufacturing processes, directly impacting its future prospects.

Digital transformation is a key aspect of F.I.L.A.'s approach, encompassing automation in production, optimization of supply chain management, and enhanced customer engagement through online platforms. Sustainability initiatives are also deeply integrated into its innovation strategy, reflecting a commitment to eco-friendly products and sustainable manufacturing practices. This dual focus on technological advancement and environmental responsibility positions the company well for future growth.

The company's commitment to innovation is evident in its approach to product development and market responsiveness. F.I.L.A. leverages technology to streamline operations and enhance its offerings, ensuring it remains competitive in a dynamic market. For more insights into the company's foundational principles, you can explore the Mission, Vision & Core Values of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

F.I.L.A. dedicates resources to R&D to develop new materials and improve product performance. This includes in-house development of advanced formulations for paints and markers.

The company embraces digital transformation through automation in production and optimization of supply chain management. Online platforms are used to enhance customer engagement.

Sustainability is integrated into F.I.L.A.'s innovation strategy, focusing on eco-friendly products and sustainable manufacturing practices. This is crucial for appealing to environmentally conscious consumers.

F.I.L.A. collaborates with external innovators and research institutions. This helps bring cutting-edge solutions to market.

The company focuses on efficiency and market responsiveness, suggesting an underlying embrace of modern technological advancements. This includes streamlining operations and enhancing offerings.

F.I.L.A. aims to be responsive to market changes. Digital tools and online platforms help the company adapt to evolving consumer needs.

F.I.L.A.'s innovation strategy encompasses several key areas that drive its growth strategy and future prospects. These strategies are designed to enhance product offerings, improve operational efficiency, and align with sustainability goals.

- R&D Investments: Continuous investment in research and development to create new materials and improve product performance.

- Digital Transformation: Implementation of automation in production processes and optimization of supply chain management through digital tools.

- Sustainability: Developing eco-friendly products and sustainable manufacturing practices to meet the demands of environmentally conscious consumers.

- Collaboration: Partnering with external innovators and research institutions to bring cutting-edge solutions to market.

- Market Responsiveness: Utilizing digital platforms to enhance customer engagement and adapt to changing market trends.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is F.I.L.A. - Fabbrica Italiana Lapis ed Affini’s Growth Forecast?

The financial outlook for F.I.L.A. (Fabbrica Italiana Lapis ed Affini) is robust, underpinned by strong performance indicators that support its growth strategy and future prospects. For the first nine months of 2023, the company demonstrated a positive financial trajectory, which is crucial for its expansion plans and strategies. This performance reflects the company's ability to adapt to market changes and capitalize on opportunities within the art supplies market.

F.I.L.A.'s consolidated net revenues for the first nine months of 2023 reached €578.4 million, marking a 7.7% increase compared to the same period in 2022. This growth is a testament to the effectiveness of its business development initiatives and market positioning. The adjusted EBITDA for the same period was €90.9 million, representing 15.7% of revenues. The net result after tax was €27.2 million, showing a significant improvement from the previous year, indicating enhanced profitability and operational efficiency. This financial performance positions F.I.L.A. well within the competitive landscape.

The company's financial ambitions include reaching a consolidated net revenue of over €1 billion by 2024. This ambitious target is supported by strategic initiatives and a strong market presence. F.I.L.A. continues to manage its debt effectively, with a net financial position of €340.5 million as of September 30, 2023. This financial discipline is critical for funding future expansion and innovation efforts, ensuring sustainable business practices.

F.I.L.A.'s revenue growth of 7.7% in the first nine months of 2023, reaching €578.4 million, highlights its strong market performance. This growth is supported by a focus on product innovation and development, allowing the company to capture market share. The expansion is a key element of the F.I.L.A. company growth strategy analysis.

The adjusted EBITDA of €90.9 million, representing 15.7% of revenues, demonstrates F.I.L.A.'s commitment to profitability. The net result after tax of €27.2 million further underscores the company's financial health. These figures are crucial for understanding Fabbrica Italiana Lapis ed Affini financial performance.

With a net financial position of €340.5 million as of September 30, 2023, F.I.L.A. maintains a solid financial foundation. This strong financial position supports the company's ability to invest in future growth. It also provides a buffer against the impact of economic factors on F.I.L.A.

F.I.L.A. aims to achieve over €1 billion in consolidated net revenue by 2024. This ambitious goal is supported by strategic initiatives and market positioning. This target reflects the long-term goals of Fabbrica Italiana Lapis ed Affini.

The company's ability to adapt to market conditions is evident in its consistent performance. This adaptability is crucial for navigating the competitive landscape. Competitors Landscape of F.I.L.A. - Fabbrica Italiana Lapis ed Affini provides further insights into the competitive environment.

Strategic investments in key areas are critical for funding future expansion and innovation efforts. The financial narrative for F.I.L.A. is one of steady growth and strategic investment. This approach is essential for F.I.L.A.'s investment opportunities and risks.

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow F.I.L.A. - Fabbrica Italiana Lapis ed Affini’s Growth?

The F.I.L.A. – Fabbrica Italiana Lapis ed Affini company faces various potential risks and obstacles as it pursues its growth strategy in the global market for art materials and stationery. These challenges span competitive pressures, regulatory changes, supply chain vulnerabilities, and internal resource constraints. Understanding and proactively managing these risks is crucial for the company's sustained success and ability to achieve its long-term goals.

Market competition presents a significant hurdle, with numerous established players and new entrants constantly vying for market share. This necessitates continuous innovation, effective marketing, and a strong brand presence to maintain customer loyalty and attract new consumers. Additionally, regulatory changes, particularly concerning environmental standards and product safety, could impact operations and product development, demanding ongoing compliance efforts.

Supply chain disruptions, including raw material price fluctuations, logistics issues, and geopolitical events, pose ongoing risks to production and distribution. Internal resource constraints, such as talent acquisition and retention, also present challenges. Addressing these risks requires strategic planning, diversification of product portfolios and geographical markets, and robust risk management frameworks. For a deeper dive into the company's target audience, consider reading this article: Target Market of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

The art supplies market is highly competitive, with both established brands and emerging players. Competitive pressures require consistent innovation and effective marketing to maintain market share. The competitive landscape necessitates continuous adaptation to consumer preferences and market trends.

Changes in environmental standards and product safety regulations can impact product development and operations. Compliance with evolving regulations demands ongoing investment and adaptation of manufacturing processes. Regulatory compliance adds to operational costs and may require adjustments in product formulations.

Raw material price fluctuations, logistics disruptions, and geopolitical events can disrupt production and distribution. Supply chain vulnerabilities require robust inventory management and supplier diversification strategies. Geopolitical instability can lead to significant delays and increased costs.

The rise of digital art tools presents a long-term challenge to traditional art materials. Adapting to digital trends and integrating them into product offerings is crucial. Technological advancements can shift consumer preferences and market dynamics.

Talent acquisition and retention can impact the ability to execute growth strategies effectively. Attracting and retaining skilled employees is vital for innovation and market expansion. Resource constraints can hinder the implementation of strategic initiatives.

Economic downturns and fluctuations in currency exchange rates can impact sales and profitability. Economic instability can affect consumer spending and demand for art supplies. Managing financial performance during economic uncertainties is crucial.

F.I.L.A. mitigates risks through diversification of suppliers, robust inventory management, and strategic planning. Geographical market diversification reduces dependence on any single region. Strategic partnerships and acquisitions can strengthen market position and expand product offerings. Continuous monitoring of market trends and consumer preferences is also essential.

The financial performance of F.I.L.A. is closely tied to its ability to navigate these risks. Key financial metrics, such as revenue growth, profit margins, and return on investment, are directly influenced by how well the company manages these challenges. Market fluctuations and economic uncertainties can significantly affect financial outcomes.

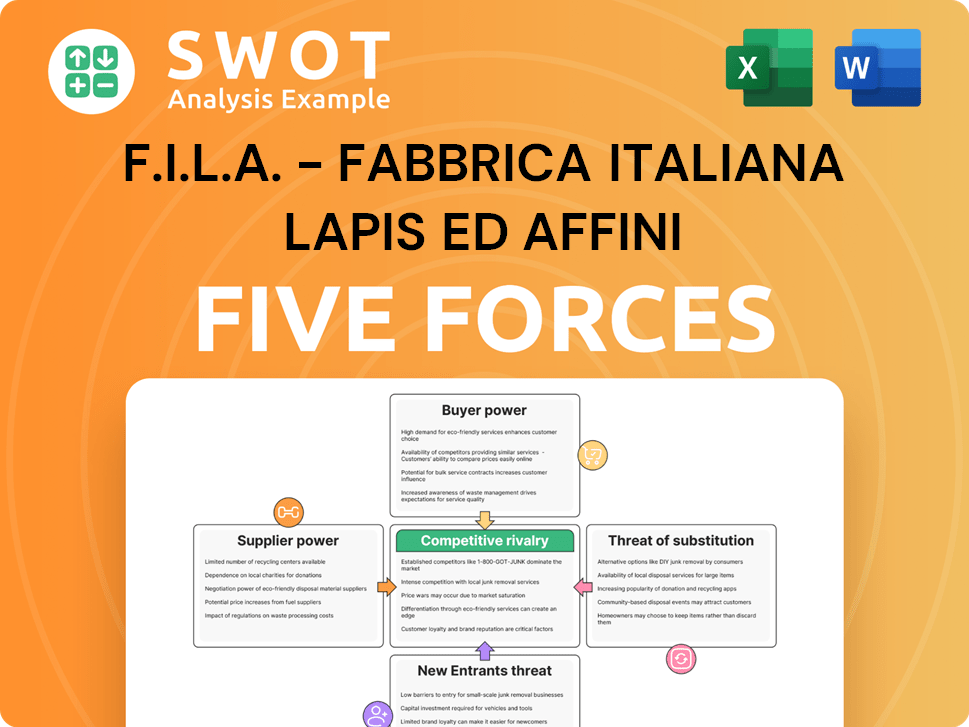

F.I.L.A. - Fabbrica Italiana Lapis ed Affini Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Competitive Landscape of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- How Does F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company Work?

- What is Sales and Marketing Strategy of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Brief History of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- Who Owns F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

- What is Customer Demographics and Target Market of F.I.L.A. - Fabbrica Italiana Lapis ed Affini Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.