Finance Of America Companies Bundle

How Does Finance of America Navigate the Cutthroat World of Financial Services?

The financial services sector is a battlefield, with mortgage origination and lending constantly reshaped by interest rate fluctuations and evolving consumer preferences. Finance of America, founded in 2013, has strategically positioned itself in this dynamic environment, offering specialized financial solutions. From its inception, the company has expanded from a focused lender to a diversified financial services company, making it a key player in the mortgage industry.

This deep dive into the Finance Of America Companies SWOT Analysis will explore the company's competitive landscape, offering a comprehensive market analysis. We'll identify Finance of America's main rivals and dissect the factors that differentiate it within the financial services companies arena, providing a clear company overview. Understanding Finance of America's business model and financial performance is crucial for anyone looking to navigate the complexities of the mortgage industry.

Where Does Finance Of America Companies’ Stand in the Current Market?

Finance of America Companies Inc. (FOA) holds a distinct market position within the financial services industry. The company's core operations revolve around mortgage origination, reverse mortgages, and commercial lending. This focus allows FOA to cater to a diverse customer base, ranging from first-time homebuyers to seniors seeking to leverage their home equity. The company's business model is centered on providing financial solutions tailored to various life stages and financial needs.

FOA's value proposition lies in its specialized lending products, particularly reverse mortgages, and its broad geographic presence across the United States. This enables the company to serve a wide array of customer segments. FOA has strategically positioned itself to emphasize its expertise in these specialized areas, recognizing the growing demand within the mortgage industry. This strategic focus is a key element of its competitive landscape.

Finance of America Reverse LLC, a subsidiary of FOA, has historically been a significant player in the reverse mortgage market. While specific market share data for 2024-2025 is still emerging, the company has consistently ranked among the top reverse mortgage lenders. The company's strong presence in this niche market is a key aspect of its competitive landscape.

FOA maintains a broad presence across the United States, serving a wide array of customer segments. This extensive reach allows the company to cater to diverse needs across different regions. The company's geographic footprint is a crucial factor in its ability to compete effectively within the financial services companies sector.

FOA has strategically shifted its positioning to emphasize its expertise in specialized lending products, particularly reverse mortgages. This focus allows the company to meet the growing demand in this area. This specialization is a key element of FOA's competitive strategy within the mortgage industry.

FOA serves a diverse customer base, including first-time homebuyers and seniors. This broad customer base allows the company to offer a range of financial solutions. Understanding the needs of these segments is essential for effective market analysis and maintaining a strong industry position.

FOA's competitive advantages include its strong presence in the reverse mortgage market and its broad geographic reach. The company faces challenges such as fluctuating interest rates and increased competition within the financial services companies sector. For a deeper dive into the strategies, consider reading the Marketing Strategy of Finance Of America Companies.

- Market Position: Strong in reverse mortgages.

- Geographic Reach: Extensive across the U.S.

- Customer Focus: Diverse, from first-time buyers to seniors.

- Challenges: Interest rate volatility, competition.

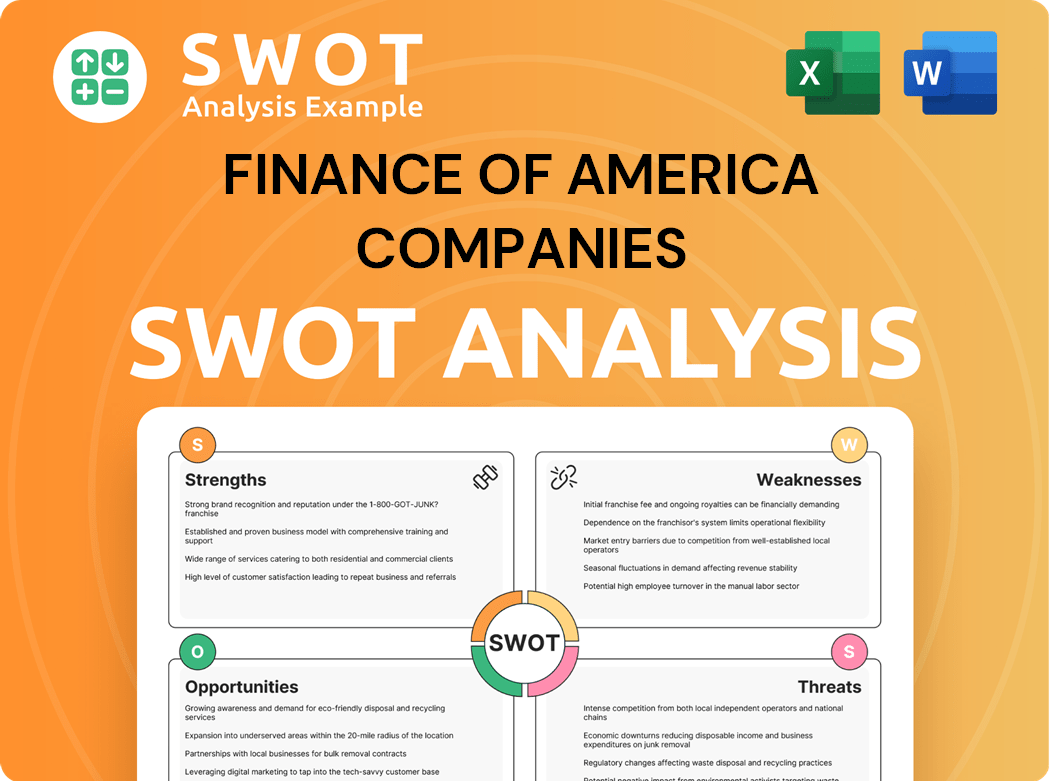

Finance Of America Companies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Finance Of America Companies?

The competitive landscape for Finance of America Companies (FOA) is dynamic, encompassing a wide array of financial services companies. Understanding the key players and their strategies is crucial for a thorough market analysis. This competitive environment impacts FOA's financial performance and strategic decisions, influencing its ability to gain market share and maintain profitability.

FOA's position in the mortgage industry is constantly challenged by both traditional and innovative financial institutions. The company's ability to navigate this competitive landscape is essential for its long-term success. A detailed examination of its rivals reveals the complexities of the financial services sector.

The competitive dynamics within the financial services sector are significantly influenced by technological advancements and evolving consumer preferences. Companies are continuously adapting their business models to meet these challenges, making the competitive landscape highly fluid. For a deeper dive into FOA's mission, consider exploring the Growth Strategy of Finance Of America Companies.

In the reverse mortgage segment, FOA faces competition from established players like American Advisors Group (AAG) and Mutual of Omaha Mortgage. AAG is known for its extensive marketing efforts and broad network, while Mutual of Omaha leverages its brand reputation. These companies compete for market share by offering various financial products and services.

In the broader mortgage origination market, FOA competes with large retail banks such as Wells Fargo and JPMorgan Chase. Non-bank lenders like Rocket Mortgage and United Wholesale Mortgage also pose significant challenges. These competitors often utilize scale, technology, and pricing to gain an edge in the market.

FOA's commercial lending operations compete with regional banks, credit unions, and specialized commercial lenders. These entities often have established client relationships and niche expertise. The competitive landscape is further shaped by fintech innovations, which introduce new underwriting and digital platform models.

Fintech companies are increasingly disrupting traditional lending models through AI-driven underwriting and digital platforms. These innovations present a significant challenge to established players like FOA. The ability to adapt to these technological advancements is crucial for maintaining a competitive edge.

Market share in the mortgage industry is highly competitive, with constant shifts among lenders. Understanding the market share of key competitors is essential for assessing FOA's position. The competitive landscape is influenced by economic conditions and interest rate fluctuations.

Competitors employ various strategies, including aggressive pricing, technological innovation, and extensive marketing. FOA must develop and implement effective strategies to compete successfully. These strategies include customer service, product diversification, and operational efficiency.

Several factors influence the competitive landscape for FOA, including market share, financial performance, and customer satisfaction. Understanding these factors is essential for assessing the company's position and formulating effective strategies.

- Market Share: Analyzing the market share of key competitors provides insights into the competitive dynamics.

- Financial Performance: Comparing financial metrics, such as revenue and profitability, helps assess the competitive position.

- Technological Innovation: The adoption of new technologies, like AI-driven underwriting, impacts competitiveness.

- Customer Service: Providing excellent customer service is crucial for retaining and attracting customers.

- Pricing Strategies: Competitive pricing is essential for attracting customers in the mortgage industry.

Finance Of America Companies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Finance Of America Companies a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of financial services companies requires a deep dive into their strengths. For Finance of America, several core advantages shape its position in the mortgage industry. These advantages are particularly evident in its specialized focus and operational efficiencies, which allow it to compete effectively.

Finance of America distinguishes itself through its expertise in niche lending markets, especially reverse mortgages. This specialization allows for tailored customer service and efficient processing, which many generalized lenders might not prioritize. The company's established brand within the reverse mortgage sector has fostered customer loyalty and trust.

Furthermore, Finance of America's proprietary technology and operational efficiencies, designed specifically for its specialized lending products, contribute to its competitive edge. These systems are optimized to handle the unique underwriting and compliance requirements of reverse mortgages and other specialized loans, leading to a more streamlined experience for both customers and internal operations. These advantages have evolved as Finance of America has refined its focus, allowing it to maintain a strong position in its chosen markets despite broader industry fluctuations.

Finance of America's deep knowledge of reverse mortgages and other niche products allows it to offer specialized services. This focus enables the company to develop efficient processing systems and provide tailored customer support. This specialized approach is a key differentiator in the competitive landscape.

The company's technology and operational efficiencies are specifically designed for its specialized lending products. These systems streamline underwriting and compliance, leading to a better customer experience. This operational strength supports its competitive position.

Finance of America has built a strong brand within the reverse mortgage sector, fostering customer loyalty. This trust is built on years of focused service in this specific area. This customer-centric approach is crucial in the financial services sector.

Finance of America's ability to adapt and maintain a strong market position is a key advantage. Continuous innovation within its specialized product offerings and maintaining high customer satisfaction are critical. This adaptability helps it thrive despite industry fluctuations.

Finance of America's competitive advantages are rooted in its specialization and operational efficiencies. The company's focus on niche lending markets, like reverse mortgages, allows it to offer tailored services and efficient processing. This specialization, combined with proprietary technology, creates a strong market position.

- Specialized Product Focus: Deep expertise in reverse mortgages and other niche lending products.

- Efficient Operations: Proprietary technology streamlines underwriting and compliance.

- Customer Trust: Strong brand reputation and customer loyalty in the reverse mortgage sector.

- Adaptability: Ability to maintain a strong market position despite industry changes.

Finance Of America Companies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Finance Of America Companies’s Competitive Landscape?

The financial services sector, especially the mortgage industry, is currently navigating through significant shifts. Rising interest rates and inflationary pressures are creating headwinds, potentially impacting loan demand and refinancing activity. Simultaneously, regulatory changes and evolving consumer preferences towards digital solutions are reshaping the competitive landscape for companies like Finance of America.

These factors influence Finance of America's industry position, presenting both risks and opportunities. The company's future outlook hinges on its ability to adapt to macroeconomic trends, technological advancements, and evolving consumer behaviors. Understanding these dynamics is crucial for assessing its competitive standing within the financial services companies.

The mortgage industry faces challenges from rising interest rates and inflation, potentially decreasing loan demand. Regulatory changes and increased scrutiny on lending practices are also impacting the sector. Consumer demand for digital-first solutions and personalized financial advice is accelerating the need for technological investments.

A tightening mortgage market could affect overall origination volumes, presenting a challenge for Finance of America's growth. Increased competition from fintech companies, offering technology-driven solutions, poses another threat. Adapting to changing regulations and maintaining compliance will require continuous effort and investment.

The aging population in the United States presents a significant growth opportunity, particularly in the reverse mortgage sector, where Finance of America has a strong presence. Innovation in product development, such as hybrid mortgage products, could create new revenue streams. Strategic partnerships with financial advisors can expand market reach.

Finance of America can leverage its specialization in niche lending areas to maintain a competitive edge. Investing in digital transformation and exploring emerging markets or underserved segments are crucial. Adaptability to macroeconomic shifts and technological advancements will be key to long-term success.

The company needs to focus on adapting to changing market conditions and consumer preferences. Strategic partnerships and product innovation are essential for growth. Maintaining a strong position requires continuous investment in technology and a focus on customer experience.

- Market Analysis: Continuously monitor market trends and competitor activities.

- Technological Advancement: Invest in digital platforms and data analytics.

- Customer Focus: Enhance customer experience through personalized solutions.

- Strategic Partnerships: Collaborate with financial advisors and wealth management firms.

Finance Of America Companies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Finance Of America Companies Company?

- What is Growth Strategy and Future Prospects of Finance Of America Companies Company?

- How Does Finance Of America Companies Company Work?

- What is Sales and Marketing Strategy of Finance Of America Companies Company?

- What is Brief History of Finance Of America Companies Company?

- Who Owns Finance Of America Companies Company?

- What is Customer Demographics and Target Market of Finance Of America Companies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.