First Republic Bank Bundle

What Happened to First Republic Bank's Competitive Edge?

The collapse and subsequent acquisition of First Republic Bank by JPMorgan Chase in 2023 serve as a stark reminder of the dynamic nature of the First Republic Bank SWOT Analysis. This event not only reshaped the banking industry but also highlighted the critical importance of understanding a bank's competitive landscape. Founded in 1985, First Republic Bank initially thrived by focusing on personalized services for high-net-worth clients, setting it apart from larger financial institutions.

This analysis delves into the factors that contributed to First Republic Bank's downfall, examining its market position and identifying its key bank competitors. We'll explore First Republic Bank's main competitors, conduct a thorough competitive analysis of First Republic Bank, and assess the impact of economic changes on its business model. Understanding First Republic Bank's strengths and weaknesses will provide valuable insights into the broader market analysis of the regional banking sector.

Where Does First Republic Bank’ Stand in the Current Market?

Before its acquisition, First Republic Bank held a distinct market position within the banking industry, focusing on high-net-worth individuals and businesses. Its approach centered on personalized private banking, private business banking, and wealth management services. This focus allowed it to cater to a specific clientele, differentiating it from larger, more generalized financial institutions.

The bank's primary geographic presence was in affluent coastal markets, particularly California, New York, Massachusetts, and Florida. This strategic location allowed it to target a significant portion of its desired clientele. Its product lines were centered around relationship-based banking, offering a suite of services including residential lending, commercial real estate lending, small business loans, and a comprehensive wealth management platform.

First Republic Bank's commitment to high-touch service and its focus on a profitable client segment allowed it to maintain strong financial health for many years. For instance, at the end of 2022, First Republic Bank reported total assets of $212.6 billion and total deposits of $176.4 billion. This unique positioning allowed it to command strong customer loyalty, particularly in regions like the San Francisco Bay Area and New York City, where it had a deeply entrenched client base.

First Republic Bank's core operations revolved around providing a range of financial services tailored to high-net-worth individuals and businesses. This included residential and commercial real estate lending, small business loans, and wealth management services such as investment management and trust services. The emphasis was on building strong client relationships and offering personalized solutions.

The value proposition of First Republic Bank was centered on providing exceptional customer service and a high-touch banking experience. It offered tailored financial solutions, including residential lending, commercial real estate lending, small business loans, and wealth management services. This approach aimed to build long-term relationships with clients, offering them a premium banking experience.

First Republic Bank's market position was unique due to its focus on affluent clients and personalized services. This approach allowed it to differentiate itself from larger bank competitors. Its strong customer loyalty, particularly in key markets, was a testament to its successful strategy. For more insights, check out the Revenue Streams & Business Model of First Republic Bank.

- Targeted affluent clients with high deposit balances.

- Maintained a strong presence in affluent coastal markets.

- Offered a comprehensive suite of services, including lending and wealth management.

- Focused on relationship-based banking and high-touch customer service.

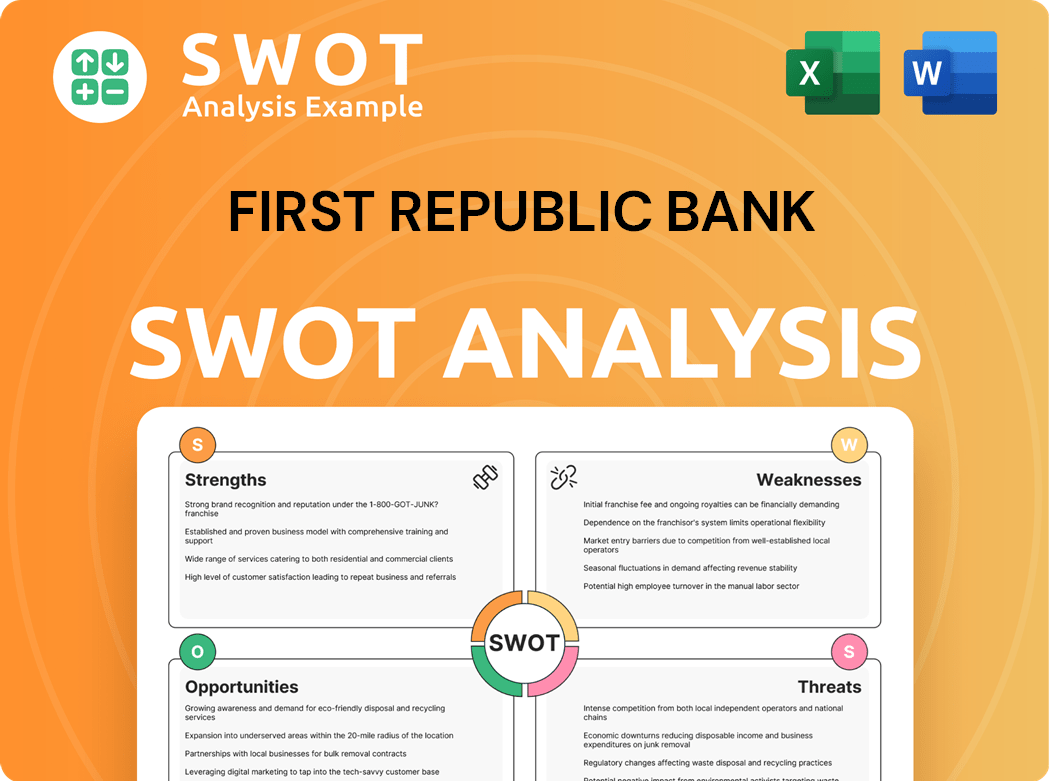

First Republic Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging First Republic Bank?

The Growth Strategy of First Republic Bank faced a complex and dynamic competitive landscape. The bank competed with a variety of financial institutions, each vying for market share in the banking industry. Understanding the key competitors is crucial for a thorough market analysis and assessing First Republic Bank's position.

First Republic Bank's competitive environment was shaped by its focus on high-net-worth individuals and personalized services. This positioning meant it directly battled with other banks offering similar wealth management and private banking services. Additionally, indirect competitors, such as fintech companies, added another layer to the competitive analysis.

The competitive landscape for First Republic Bank included both direct and indirect competitors, each with distinct strengths and strategies.

Direct competitors included regional banks with a strong wealth management focus. These institutions often targeted the same affluent client base as First Republic Bank.

Before its collapse and acquisition, SVB Financial Group was a direct competitor. It focused on serving the venture capital and startup ecosystem.

Signature Bank, before its closure, was another direct competitor known for its private client banking services.

City National Bank, a subsidiary of Royal Bank of Canada, also directly competed by targeting affluent clients with personalized services.

Private banking and wealth management arms of money center banks like JPMorgan Chase, Bank of America Private Bank, and Wells Fargo Private Bank were significant competitors. These institutions offered a broader range of services and had greater financial resources.

Indirect competitors included independent wealth management firms, registered investment advisors (RIAs), and online investment platforms.

The competitive dynamics were characterized by a focus on relationship management and bespoke financial solutions. The acquisition of First Republic Bank by JPMorgan Chase highlights the ongoing consolidation within the banking sector.

- JPMorgan Chase: Following the acquisition, JPMorgan Chase now integrates First Republic Bank's assets, expanding its wealth management services.

- Market Share: The acquisition altered the market share distribution, with JPMorgan Chase gaining a larger share in the high-net-worth client segment.

- Fintech Impact: Fintech companies continue to evolve, offering digital lending and investment advisory services, potentially impacting traditional banks' competitive advantages.

- Economic Changes: Economic changes, such as interest rate fluctuations and market volatility, influence the competitive landscape by affecting lending rates and investment strategies.

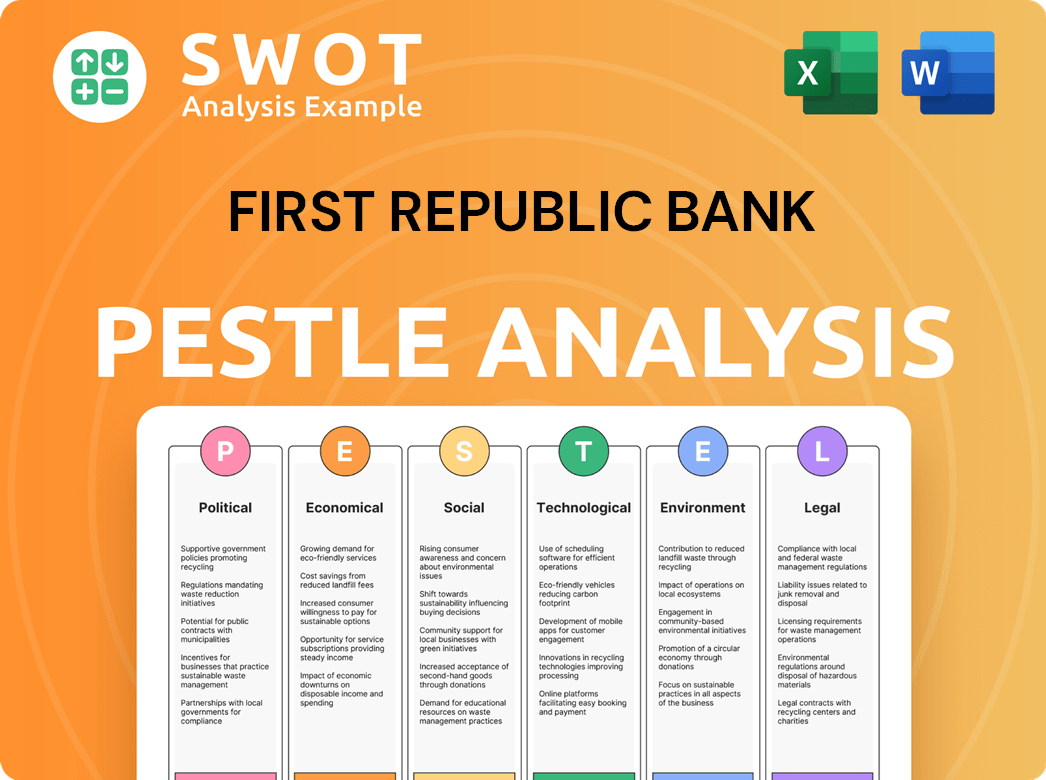

First Republic Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives First Republic Bank a Competitive Edge Over Its Rivals?

The competitive landscape for First Republic Bank, particularly before its collapse, was defined by its unique approach to client service and its focus on high-net-worth individuals. This strategy, while successful for a time, created both strengths and vulnerabilities. Understanding the bank's competitive advantages requires examining its core differentiators and how they stacked up against its rivals in the banking industry.

First Republic Bank's competitive edge stemmed from its ability to cultivate strong customer relationships and provide personalized financial solutions. This approach contrasted with the more standardized services offered by larger financial institutions. However, this model also made the bank susceptible to market fluctuations and concentration risks, as demonstrated by the events of 2023. A detailed market analysis is essential to understanding the bank's position.

Analyzing First Republic Bank's competitive advantages highlights its strengths, such as its customer-centric model and localized expertise, but also reveals weaknesses, including its reliance on a specific customer segment and the concentration of its deposit base. Exploring these aspects is crucial for a comprehensive competitive analysis.

First Republic Bank built a strong brand reputation by offering white-glove service, fostering significant customer loyalty, especially among high-net-worth clients. This personalized approach, including direct access to bankers, was a key differentiator. High client retention rates were a testament to this success, although the bank's model ultimately faced challenges.

The bank's unique culture empowered employees to build deep, lasting relationships with clients. This relationship-centric model allowed for a more comprehensive understanding of clients' financial needs, which led to cross-selling opportunities. This approach helped the bank achieve a higher share of wallet, which was a key driver of its financial performance.

First Republic Bank's lending practices, especially in residential mortgages and commercial loans, attracted clients seeking flexible terms. Its focus on affluent urban markets allowed it to develop deep local market expertise. This localized knowledge and streamlined decision-making processes provided agility, appealing to its discerning clientele.

While not reliant on proprietary technologies, First Republic Bank's operational efficiencies in delivering personalized service were a key strength. This efficiency allowed the bank to maintain a high level of customer satisfaction and manage its operations effectively. The bank's ability to streamline processes was a significant advantage.

First Republic Bank's competitive advantages were rooted in its customer-centric approach, strong brand reputation, and localized market expertise. These factors contributed to its success in attracting and retaining high-net-worth clients. However, the bank's reliance on a specific customer base and geographic concentration created vulnerabilities. For a deeper understanding of the bank's strategic initiatives, consider reading about the Growth Strategy of First Republic Bank.

- Customer-Centric Model: The bank's focus on building strong client relationships and providing personalized services set it apart.

- Localized Expertise: Deep understanding of local market dynamics and strong referral networks in affluent urban areas.

- Efficient Operations: Streamlined decision-making and operational efficiencies in delivering personalized services.

- High Client Retention: Strong brand reputation and white-glove service fostered significant customer loyalty.

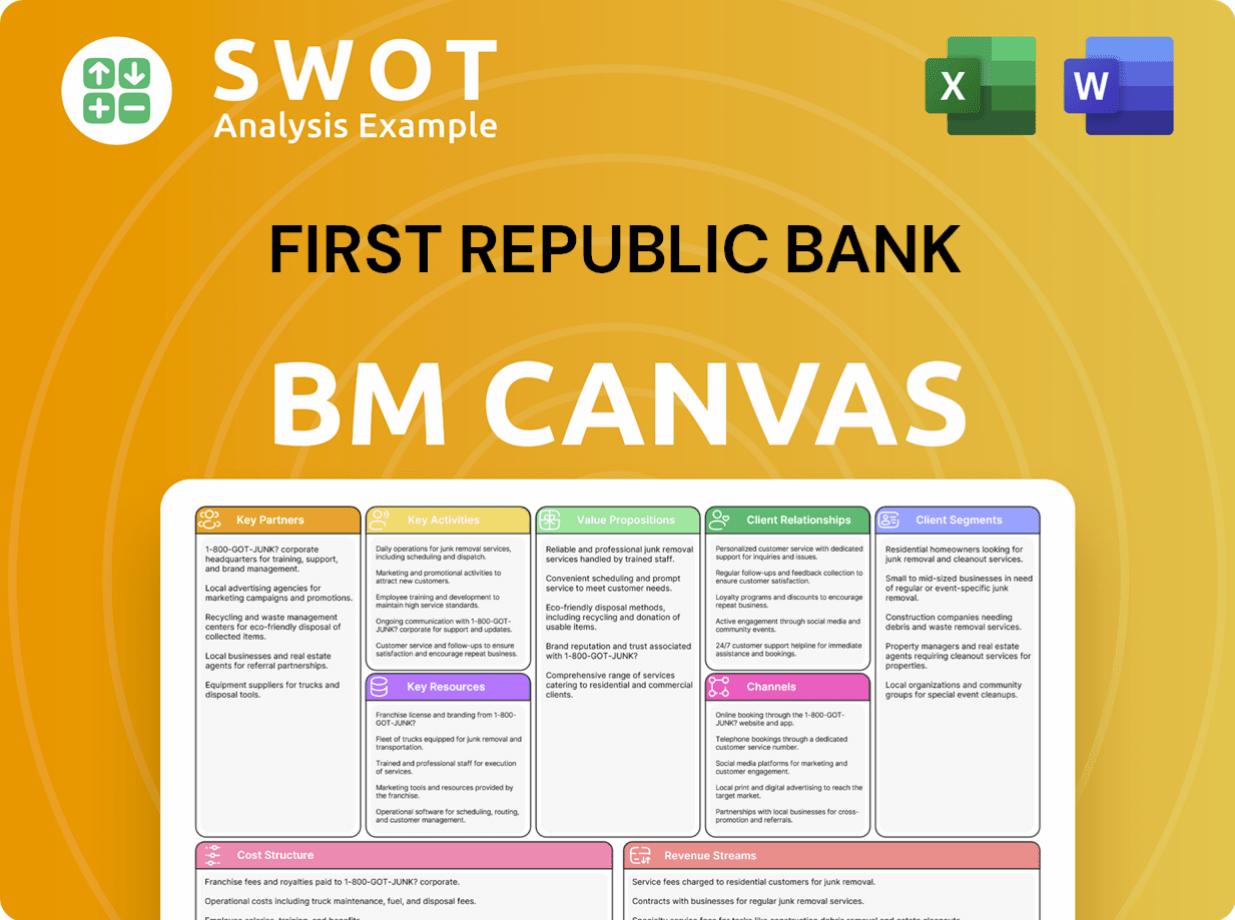

First Republic Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping First Republic Bank’s Competitive Landscape?

The banking industry is in constant flux, and understanding the competitive landscape is crucial for any financial institution. Had First Republic Bank remained independent, it would have faced a dynamic environment shaped by digital transformation, evolving customer preferences, and increased regulatory scrutiny. A thorough market analysis reveals the challenges and opportunities that would have defined its future.

The competitive landscape for First Republic Bank, even before its acquisition, was characterized by intense competition from both traditional financial institutions and fintech disruptors. Maintaining its unique high-touch service model while adapting to technological advancements would have been a key challenge. The bank's future outlook hinged on its ability to navigate these complexities and capitalize on emerging opportunities.

The banking industry is experiencing rapid digital transformation. Consumer preferences are shifting towards online and mobile banking, necessitating significant investments in technology. Increased regulatory scrutiny and the growing importance of ESG factors are also shaping the industry's trajectory.

Maintaining a high-touch service model in an increasingly digital world poses a significant challenge. Managing interest rate risks effectively and diversifying the deposit base to mitigate concentration risks are also critical. Competition for high-net-worth clients from larger institutions remains intense.

Expanding wealth management offerings through acquisitions or partnerships presents a significant opportunity. Leveraging technology to enhance personalized service, such as AI-driven insights, could further strengthen client relationships. Adapting to evolving regulatory landscapes is also crucial for long-term success.

The Marketing Strategy of First Republic Bank provides insights into its competitive positioning. Key competitors included large national banks and regional players. Understanding their strengths and weaknesses is essential for strategic planning.

The banking industry's market analysis reveals a competitive environment. Fintech companies continue to disrupt traditional models. The future outlook for institutions like First Republic Bank depends on strategic adaptability and innovation.

- Digital Transformation: Banks must invest heavily in digital infrastructure to meet evolving customer expectations.

- Regulatory Compliance: Navigating complex and changing regulations is a constant challenge.

- Economic Volatility: Economic downturns and high inflation can significantly impact loan quality and deposit levels.

- Customer Retention: Maintaining strong customer relationships is crucial in a competitive market.

First Republic Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of First Republic Bank Company?

- What is Growth Strategy and Future Prospects of First Republic Bank Company?

- How Does First Republic Bank Company Work?

- What is Sales and Marketing Strategy of First Republic Bank Company?

- What is Brief History of First Republic Bank Company?

- Who Owns First Republic Bank Company?

- What is Customer Demographics and Target Market of First Republic Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.