Foxconn Technology Group Bundle

Can Foxconn Maintain Its Dominance in the Cutthroat EMS Industry?

The Foxconn Technology Group SWOT Analysis reveals a fascinating story of growth and strategic maneuvering in the electronics manufacturing services (EMS) industry. From its origins as a component manufacturer, Foxconn has become a global powerhouse, supporting the tech giants we all know. But how does Foxconn navigate the complex Foxconn competitive landscape and maintain its leading position?

This exploration of Foxconn's competitive landscape will analyze its main rivals, providing a detailed Foxconn market analysis. We'll examine its competitive advantages, including its massive manufacturing footprint and key customer relationships. Understanding Foxconn's position is crucial for anyone interested in the future of the EMS industry and the impact of supply chain dynamics.

Where Does Foxconn Technology Group’ Stand in the Current Market?

Foxconn Technology Group, a dominant player in the electronics manufacturing services (EMS) industry, holds a significant market position. As the world's largest contract electronics manufacturer, it consistently leads the Foxconn competitive landscape, far ahead of its rivals. The company specializes in high-volume manufacturing for major tech companies, with a global footprint centered in Asia.

The company's core business revolves around manufacturing a wide array of products. These include smartphones, consumer electronics, communication devices, and computer products. Its value proposition lies in its ability to provide comprehensive manufacturing solutions at scale, supporting the complex supply chain needs of its clients. This is a key factor in understanding the Foxconn market analysis.

Foxconn's strategic focus includes diversifying its manufacturing base to mitigate risks. This involves expanding operations beyond China, with significant investments in countries like India and Vietnam. This shift is crucial for supply chain resilience and meeting evolving global demands. The company's financial performance reflects its strong market position, with substantial revenue and profit figures.

Foxconn maintains a leading position in the EMS industry. While exact market share fluctuates, it consistently holds the top spot. This dominance is a key factor in its competitive advantage.

Foxconn has a vast global presence, with major manufacturing hubs in Asia. It is expanding its operations in regions like India, Vietnam, Mexico, and the United States. This expansion supports its supply chain resilience.

In 2023, Foxconn reported a net profit of NT$142.06 billion (approximately US$4.4 billion). The company's revenue for 2023 was NT$6.16 trillion (approximately US$199.1 billion). These figures demonstrate its financial stability.

Foxconn is diversifying into new areas, such as electric vehicles (EVs) through Foxtron. This strategic move aims to capture new growth opportunities. It is also expanding its manufacturing capacity in India.

Foxconn's primary customers are large multinational technology companies that outsource their manufacturing. These relationships are crucial to its business model. The company's ability to meet the complex manufacturing needs of these clients is a key strength.

- Apple is one of Foxconn's biggest customers.

- Foxconn's manufacturing of iPhones is a significant part of its business.

- The company's success is closely tied to its ability to manage these relationships effectively.

- Understanding who are Foxconn's biggest customers is crucial for understanding the Foxconn competitors.

For more insights into Foxconn's target market, consider reading about the Target Market of Foxconn Technology Group. This provides a deeper understanding of the company's strategic positioning and customer base.

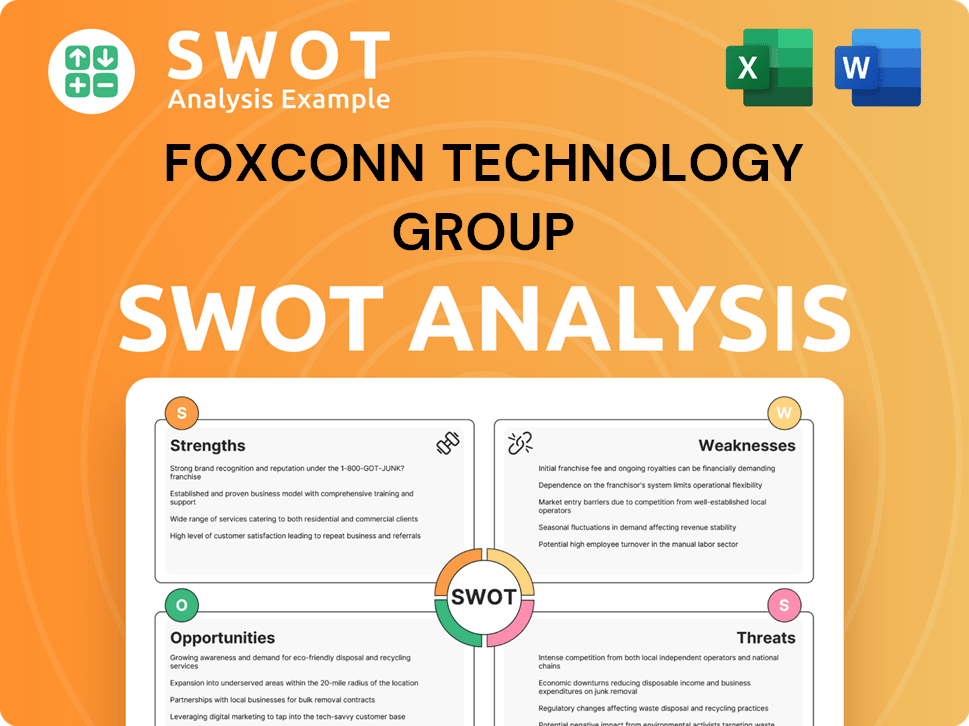

Foxconn Technology Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Foxconn Technology Group?

The Foxconn competitive landscape is primarily shaped by its position within the Electronics Manufacturing Services (EMS) industry. This sector is characterized by intense competition, driven by factors such as pricing, manufacturing efficiency, technological innovation, and geographical reach. Understanding Foxconn's market analysis requires a close look at its direct and indirect competitors and how they vie for market share.

As a leading player in the EMS industry, Foxconn Technology Group faces a dynamic competitive environment. The company's ability to maintain and expand its market share depends on its capacity to adapt to changing market conditions, technological advancements, and the strategic moves of its rivals. This includes securing contracts with major tech companies and diversifying into new sectors like electric vehicles.

The EMS industry is highly competitive, with companies constantly striving to improve their manufacturing processes and offer competitive pricing. The competitive dynamics are frequently influenced by the ability to secure contracts with major tech companies and the capacity to adapt to changing market conditions. For more insights, you can explore the Growth Strategy of Foxconn Technology Group.

Key direct competitors of Foxconn include Pegatron, Wistron, Flex, Jabil, and Quanta Computer.

Pegatron is a Taiwanese company that manufactures consumer electronics, including iPhones, and competes directly with Foxconn.

Wistron competes in notebook and server manufacturing, although it is smaller than Foxconn and Pegatron.

Flex and Jabil are US-based companies offering diverse manufacturing services across various industries, including automotive and medical.

Quanta Computer is a major competitor in the notebook and server manufacturing sectors, often serving the same clients as Foxconn.

Competition is driven by pricing, innovation, specialized services, and geographical proximity to markets.

The competitive landscape for Foxconn is multifaceted, involving both direct and indirect rivals. The dynamics are influenced by factors such as pricing, innovation, and geographical reach.

- In the server manufacturing space, Foxconn competes with Quanta Computer and Inventec.

- In the EV sector, Foxconn faces competition from established automotive manufacturers and EV startups.

- Emerging players focused on automation and AI-driven manufacturing could disrupt the traditional EMS landscape.

- Mergers and alliances, like Jabil's acquisition of assets, reshape competitive dynamics.

- Securing contracts for new product lines from major tech companies is a key battleground.

Foxconn Technology Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Foxconn Technology Group a Competitive Edge Over Its Rivals?

The competitive advantages of Foxconn Technology Group, a major player in the electronics manufacturing services (EMS) industry, are rooted in its significant scale, vertically integrated supply chain, and expertise in complex manufacturing processes. This enables cost-effective production and efficient operations. The company's focus on smart manufacturing and diversification into areas like electric vehicles further strengthens its position. For a deeper understanding of its strategic direction, consider exploring the Growth Strategy of Foxconn Technology Group.

Foxconn's ability to produce millions of sophisticated electronic units annually, meeting the demands of major tech companies, highlights its operational prowess. The company's vertically integrated model, encompassing component manufacturing, assembly, and logistics, provides greater supply chain control and efficiency. This integrated approach reduces lead times and enhances overall operational effectiveness. Recent data shows the EMS market is highly competitive, with Foxconn maintaining a substantial share, but facing increasing pressure from rivals.

The company's commitment to innovation, particularly in automation and advanced manufacturing techniques, is a key differentiator. Foxconn invests heavily in robotics and AI-driven production lines to optimize processes and reduce labor costs. Its extensive distribution networks and established relationships with key suppliers and customers further solidify its market position. Despite these strengths, the company faces challenges from competitors and geopolitical shifts, requiring continuous adaptation and investment.

Foxconn's massive production capacity allows it to achieve significant economies of scale. This enables cost-effective production, a key advantage over smaller rivals. The ability to produce millions of units annually showcases its operational efficiency and market dominance.

The vertically integrated model, from component manufacturing to final assembly, provides greater control over the supply chain. This reduces lead times and enhances efficiency, a critical factor in the EMS industry. This integration allows for better management of costs and resources.

Foxconn invests heavily in robotics and AI-driven production lines. This focus on operational efficiency allows for competitive pricing while maintaining high-quality output. The company's smart manufacturing initiatives are a key differentiator.

Extensive distribution networks and strong relationships with key suppliers and customers solidify its market position. These relationships are crucial for securing contracts and maintaining a steady flow of business. This ensures a stable revenue stream.

Foxconn's competitive advantages include its scale, vertical integration, and technological innovation, which enable it to offer competitive pricing and maintain high-quality output. The company's strong relationships with key suppliers and customers further solidify its position. Despite these strengths, the company faces challenges from competitors and geopolitical shifts.

- Scale: Massive production capacity and global footprint.

- Vertical Integration: Control over the entire supply chain.

- Technological Innovation: Investments in automation and AI.

- Customer Relationships: Strong ties with key suppliers and customers.

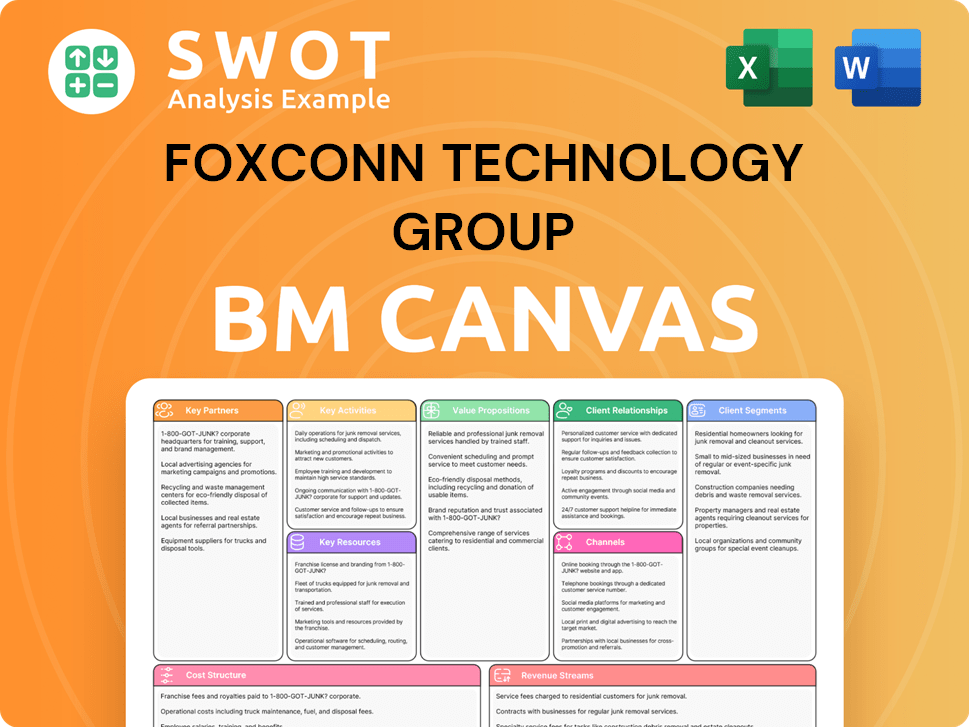

Foxconn Technology Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Foxconn Technology Group’s Competitive Landscape?

The electronics manufacturing services (EMS) industry, where Foxconn Technology Group operates, is undergoing significant shifts. These changes present both challenges and opportunities for companies in the space. Understanding the Foxconn competitive landscape involves analyzing these trends to gauge the company's future position and how it stacks up against its Foxconn competitors.

The industry is influenced by technological advancements, supply chain dynamics, and regulatory pressures. Companies must adapt to these factors to remain competitive. For a deeper dive into the company's origins, consider reading the Brief History of Foxconn Technology Group.

Key trends include automation, AI integration, and the demand for supply chain resilience. These are driven by geopolitical tensions and the need for diversified manufacturing locations. Regulatory changes related to ESG are also shaping the EMS industry.

Challenges include the acceleration of regionalized manufacturing, intensified competition, and the risk of declining demand for legacy products. Global trade complexities and the need for continuous innovation pose ongoing hurdles. Companies must navigate these challenges to maintain their market share.

Growth opportunities exist in emerging markets, particularly in Southeast Asia and India. Product innovations in electric vehicles, AI hardware, and advanced semiconductor packaging offer new avenues for expansion. Strategic partnerships and diversification efforts are crucial for success.

Foxconn's strategies include investments in 'lights-out' factories and expanding its global footprint. The company's '3+3' strategy, focusing on electric vehicles, digital health, and robotics, alongside AI, semiconductors, and next-generation communication technologies, is key. This will help them to remain competitive.

Foxconn's competitive advantages include its scale, advanced manufacturing capabilities, and strong customer relationships. The company's focus on technological innovation and geographic diversification is crucial for future growth. The ability to adapt to changing market conditions and emerging technologies is critical.

- Leveraging economies of scale to reduce costs and improve efficiency.

- Investing in advanced manufacturing technologies like AI and robotics.

- Expanding its global footprint to mitigate supply chain risks.

- Forming strategic partnerships to enter new markets.

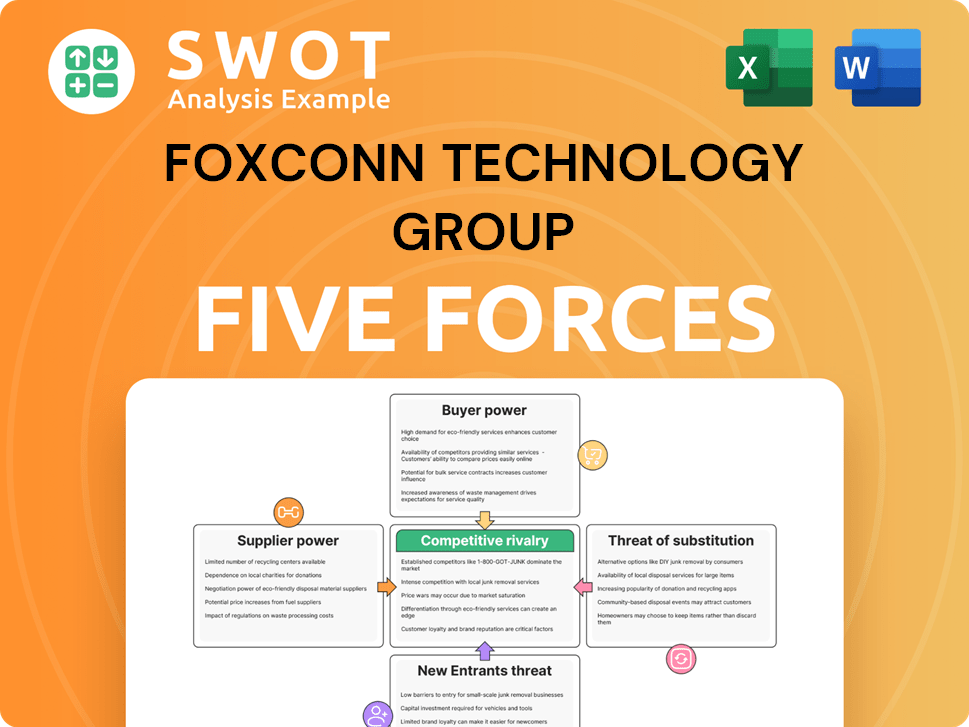

Foxconn Technology Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foxconn Technology Group Company?

- What is Growth Strategy and Future Prospects of Foxconn Technology Group Company?

- How Does Foxconn Technology Group Company Work?

- What is Sales and Marketing Strategy of Foxconn Technology Group Company?

- What is Brief History of Foxconn Technology Group Company?

- Who Owns Foxconn Technology Group Company?

- What is Customer Demographics and Target Market of Foxconn Technology Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.