Foxconn Technology Group Bundle

Can Foxconn's Growth Strategy Redefine the Future of Tech?

Foxconn Technology Group, a titan in the electronics industry, is navigating a dynamic landscape, evolving from a manufacturing giant to a key player in emerging technologies. Its strategic shift towards electric vehicles (EVs) and artificial intelligence (AI) servers signals a bold vision for the future. This transformation, built upon its unparalleled Electronics Manufacturing Services (EMS) capabilities, is a story of continuous adaptation and ambitious expansion.

From its humble beginnings producing TV components, Foxconn's journey to becoming a global leader is a testament to its robust Foxconn Technology Group SWOT Analysis and forward-thinking approach. This article delves into Foxconn's ambitious plans, exploring its investments in EVs, AI, and other innovative sectors. We'll analyze its market position, revenue growth forecast, and the strategies underpinning its continued success in the competitive global electronics market, providing insights into Foxconn's future prospects.

How Is Foxconn Technology Group Expanding Its Reach?

Foxconn is actively executing an ambitious Foxconn Growth Strategy, significantly expanding its operations beyond its traditional role in electronics manufacturing services (EMS). This expansion is particularly evident in its aggressive moves into the electric vehicle (EV) sector, aiming to capitalize on the growing demand for sustainable transportation solutions. The company's strategic initiatives are designed to diversify its revenue streams and strengthen its market position in a rapidly evolving global landscape.

The company's Foxconn Future Prospects look promising, driven by strategic investments and partnerships. These initiatives are aimed at broadening its product offerings and geographical reach. By leveraging its expertise in manufacturing and supply chain management, Foxconn is positioning itself as a key player in emerging technologies and markets. This expansion is supported by substantial investments in new facilities and research and development, ensuring the company remains competitive.

Foxconn Technology Group is focusing on several key areas to drive its expansion. These include the EV market, geographical diversification, and strategic partnerships. The company's approach involves developing common platforms for EVs, which allows for customization by automakers while reducing development costs. Simultaneously, Foxconn is increasing its manufacturing footprint in key regions like India and the United States, enhancing its global presence and mitigating geopolitical risks.

Foxconn is heavily investing in the electric vehicle (EV) sector, focusing on common platform elements to reduce development costs for automakers. This strategy mirrors its successful model in electronics manufacturing. Partnerships with companies like Mitsubishi Motors are in place to produce EV models for markets such as Australia and New Zealand, with a launch expected by late 2026. The company is also exploring partnerships with other automakers.

Foxconn plans to enter the United States EV market by the end of 2025 with its Model C crossover and Model D multi-purpose vehicle. This move is part of its broader strategy to establish a significant presence in the North American EV market. The company is also investing in key components for EVs, vehicle sales, and battery recycling, as demonstrated by its investment in Foxconn New Energy Battery (Zhengzhou) Co., Ltd.

Foxconn Interconnect Technology (FIT) has formed a joint venture, FXNWING New Energy Technology Co., Ltd., to enter the EV charger market. This venture aims to capitalize on the growing demand for EV charging infrastructure. New AC and DC chargers were launched in June 2024, showcasing the company's commitment to providing comprehensive solutions for the EV ecosystem.

A significant part of Foxconn's expansion strategy involves diversifying its manufacturing footprint, particularly in India. The company plans to double iPhone production in India to between 25 and 30 million units in 2025, up from 12 to 13 million units in 2024. A new 300-acre facility in Bengaluru is underway, with a $3 billion investment (INR 25,000 crore), expected to generate 100,000 jobs over the next decade. Foxconn is also exploring new ventures like semiconductor assembly and battery manufacturing in India.

Foxconn is investing heavily in the United States to expand its production capacity. In mid-January 2025, the company announced an investment of USD 128 million to purchase land and facilities in California to expand its AI server production. This followed a November 2024 investment of USD 33.03 million in Houston, Texas, for the same purpose. These investments highlight Foxconn's commitment to the U.S. market and its focus on high-growth areas like AI servers.

- Acquisition of a 50% stake in ZF Chassis Modules GmbH for EUR 332 million, expanding its business scope to power chassis systems.

- Expansion of its manufacturing capabilities in India with significant investments in new facilities and job creation.

- Strategic partnerships and joint ventures to enter new markets, such as the EV charger market.

- Continued investment in research and development to support innovation and maintain a competitive edge.

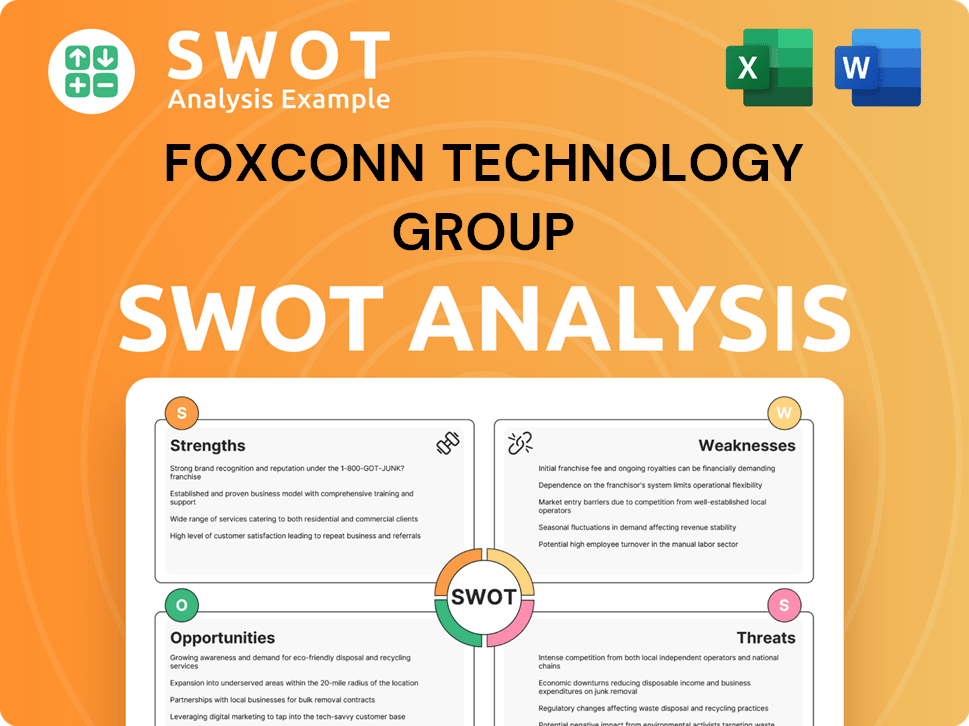

Foxconn Technology Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Foxconn Technology Group Invest in Innovation?

The core of Foxconn's sustained growth lies in its strategic focus on innovation and technology. This commitment is evident in its substantial investments in research and development (R&D) and the integration of advanced technologies across its operations. The company views 2025 as a pivotal 'AI Year', highlighting the crucial role of artificial intelligence in driving future growth.

Foxconn's approach to digital transformation and automation is particularly noteworthy. The company has deployed over 1 million robots in its factories, with plans to increase automation to approximately 30% of its workforce in the coming years. This emphasis on technology and innovation positions Foxconn favorably in the competitive Electronics Manufacturing Services (EMS) market.

The company's proactive stance on AI and its application in various sectors, including manufacturing and healthcare, showcases its adaptability and forward-thinking approach. This strategy is critical for sustaining its market position and capitalizing on emerging opportunities. For more insights into the company's ownership structure, you can explore Owners & Shareholders of Foxconn Technology Group.

Foxconn allocated approximately $1.1 billion to R&D in 2022, signaling a strong commitment to innovation. This investment supports the development of AI, IoT, and next-generation manufacturing technologies. These investments are crucial for maintaining a competitive edge in the rapidly evolving tech landscape.

Foxconn's AI server business is experiencing significant growth. Revenue increased by more than 50% in Q1 2025 compared to the previous year. The company anticipates AI server sales to exceed NT$1 trillion (US$33.03 billion) in 2025.

Foxconn holds a 40% share of the global AI server market, demonstrating its strong market position. The company aims to further expand its market share through strategic partnerships and technological advancements. This leadership position underscores its influence in the industry.

Foxconn has deployed over 1 million robots in its factories, significantly enhancing automation. The goal is to increase automation levels to about 30% of its workforce in the coming years. This automation drive improves efficiency and reduces costs.

Foxconn is advancing its digital health initiatives, including an AI-powered nursing collaborative robot and digital twin smart hospital development. These innovations were showcased at the 2025 GTC Taipei, demonstrating its commitment to healthcare technology. This expansion diversifies its business portfolio.

Foxconn is partnering with Nvidia to develop humanoid robots, focusing on expansion at its Kaohsiung hub. This initiative reflects its interest in advanced robotics and its potential applications. This move indicates a strategic focus on emerging technologies.

Foxconn's technological advancements are central to its Foxconn Growth Strategy and future prospects. These advancements are designed to enhance operational efficiency and drive innovation across various sectors. The company's commitment to R&D and strategic partnerships is critical for maintaining its competitive advantage.

- AI Integration: Leveraging AI for new product development and platforms.

- Smart Factories: Implementing AI, IoT, and 4IR technologies to optimize manufacturing processes.

- Healthcare Innovations: Developing AI-powered solutions for the healthcare sector, including collaborative robots.

- Humanoid Robotics: Partnering with Nvidia to develop humanoid robots.

- Sustainable Manufacturing: Focusing on optimizing recycling and reducing carbon footprints.

Foxconn Technology Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Foxconn Technology Group’s Growth Forecast?

The financial outlook for Foxconn Technology Group is notably positive, driven by strategic diversification and strong performance in key sectors. The company's robust financial health and forward-looking strategies position it favorably within the competitive landscape of Electronics Manufacturing Services (EMS). This positive trajectory is supported by significant investments in growth areas and a focus on enhancing operational efficiency.

Foxconn's financial results for 2024 and projections for 2025 showcase its resilience and adaptability in the global market. The company's ability to navigate market challenges and capitalize on emerging opportunities is a key factor in its sustained growth. This is further supported by its strategic partnerships and investments in advanced technologies.

For the full year 2024, Foxconn reported record revenue of NT$6.86 trillion (approximately USD 208 billion), marking an 11.3% increase year-on-year. Net profit reached NT$152.7 billion, a 7.5% rise, with earnings per share (EPS) at NT$11.01, a 17-year high. Gross profit increased by 10.6% to NT$428.9 billion, and operating net profit saw a 20.5% gain, reaching NT$200.6 billion. These figures highlight the company's strong financial performance and its ability to generate significant returns.

Foxconn's revenue for the full year 2024 reached NT$6.86 trillion (USD 208 billion), an 11.3% increase year-on-year. This growth reflects the company's strong performance and its ability to secure significant contracts and expand its market presence. This growth is a key indicator of Foxconn's success in the competitive EMS market.

Net profit for 2024 was NT$152.7 billion, a 7.5% increase, with EPS at NT$11.01, a 17-year high. This demonstrates the company's ability to efficiently manage its operations and generate substantial profits. These figures are crucial for understanding the financial health of Foxconn and its attractiveness to investors.

The company's gross profit margin, operating profit margin, and net profit margin for 2024 were 6.25%, 2.92%, and 2.23% respectively. These margins are critical for assessing the company's profitability and efficiency in its operations. The margins are also crucial for understanding the company's financial stability.

Foxconn has adjusted its full-year outlook for 2025 to 'significant growth,' primarily due to favorable exchange rates. In Q1 2025, revenue reached a record high of NT$1.6443 trillion, up 24% year-on-year. This positive outlook reflects the company's confidence in its future performance and its ability to capitalize on market opportunities.

In the first quarter of 2025, Foxconn's revenue reached a record high for the period at NT$1.6443 trillion, marking a 24% increase year-over-year. Net profit attributable to the parent company surged 91% year-on-year to NT$42.1 billion, with an EPS of NT$3.03. The company anticipates substantial growth in AI server revenue, projecting a nearly doubling quarter-on-quarter and year-on-year increase in Q2 2025. For the full year 2025, Foxconn forecasts AI server sales to exceed NT$1 trillion (US$33.03 billion), with AI server revenue expected to constitute over 50% of the Group's total server share. This highlights the importance of AI servers in driving the company's future growth.

Foxconn expects AI server revenue in Q2 2025 to nearly double quarter-on-quarter and year-on-year. For the full year 2025, AI server sales are projected to surpass NT$1 trillion (US$33.03 billion). This strong growth in AI servers is a key driver of Foxconn's overall revenue and profitability.

Foxconn anticipates an increase in capital expenditure by over 20% in 2025, with 60-70% allocated for expansion. This significant investment underscores the company's commitment to growth and its strategic focus on expanding its manufacturing capabilities and technological infrastructure.

The company plans to distribute a cash dividend of NT$5.80 per share for 2024, a record level since its listing in 1991. This reflects Foxconn's strong financial performance and its commitment to rewarding shareholders. This is a positive sign for investors and reflects the company's financial stability.

Foxconn's expansion plans, including investments in new facilities and technologies, are crucial for its future growth. These plans are designed to increase production capacity and enhance its competitive edge. The company's expansion plans are a key part of its long-term strategy.

Foxconn's strong market position is supported by its diversified product portfolio and its ability to adapt to changing market demands. The company's market share is a key indicator of its success in the EMS industry. The company's market share is a key indicator of its success in the EMS industry.

Foxconn's commitment to sustainable manufacturing practices is a key factor in its long-term success. This commitment includes investments in renewable energy and initiatives to reduce its environmental impact. These initiatives are becoming increasingly important in the global market.

Further insights into Foxconn's strategic approach and market position can be found in an analysis of the Marketing Strategy of Foxconn Technology Group. The company's focus on innovation, supply chain management, and strategic partnerships positions it well for continued success in the dynamic electronics manufacturing industry.

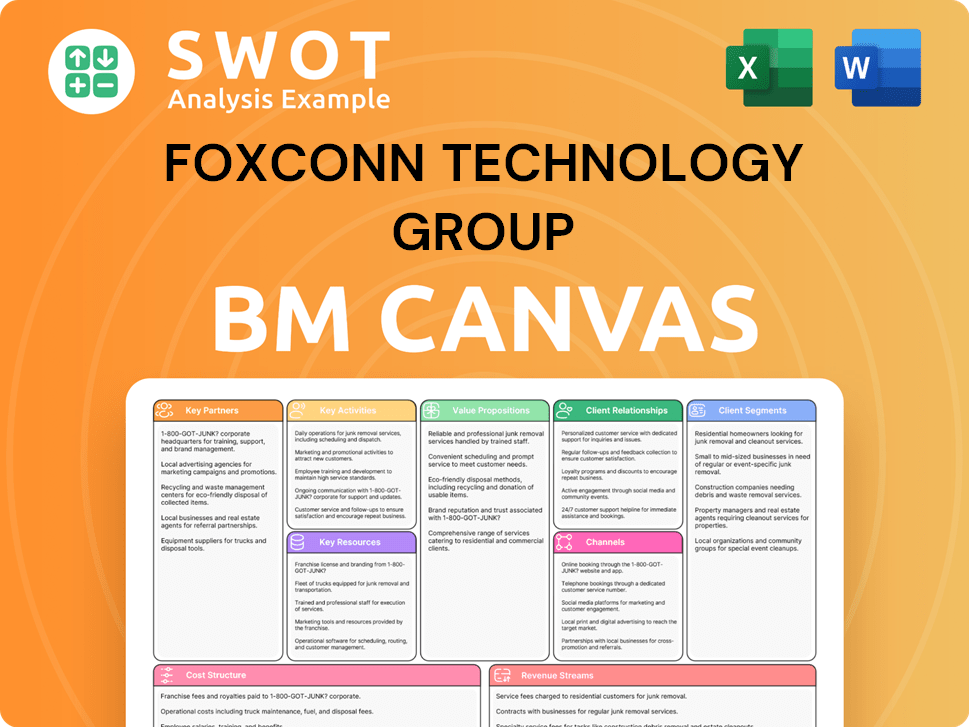

Foxconn Technology Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Foxconn Technology Group’s Growth?

The path to future success for Foxconn Technology Group isn't without its hurdles. Several factors could potentially slow down or even derail its ambitious goals, ranging from intense competition in the Electronics Manufacturing Services (EMS) sector to the unpredictable nature of global politics and supply chains. Understanding these risks is crucial for evaluating the long-term viability of Foxconn's growth strategy.

Market dynamics and geopolitical tensions present significant challenges. Regulatory changes and trade disputes, particularly between the U.S. and China, demand careful navigation. These factors, along with the need for robust supply chain management, are critical elements that can impact the company's operational efficiency and financial performance. The volatility in the global landscape necessitates a proactive approach to risk management and strategic planning.

Technological advancements and internal resource constraints also pose significant risks. The fast-paced evolution of the tech industry and the need for securing talent and capacity for essential manufacturing processes can impact the company's ability to stay competitive. Foxconn's future prospects depend on its ability to adapt to these changes and maintain a strong market position.

The EMS sector is highly competitive, with companies like Amkor Technology and ASE Group vying for market share. These competitors are particularly strong in outsourced semiconductor assembly and test (OSAT). This competitive landscape puts pressure on Foxconn's market position and profitability, necessitating continuous innovation and efficiency improvements.

Geopolitical tensions, especially between the U.S. and China, create significant risks. Trade policies and tariff developments can impact Foxconn's operations. The company's Taiwanese roots and non-Chinese facilities like UTAC may help mitigate some risks. However, the situation requires close monitoring and strategic adaptation.

Supply chain disruptions, as seen during the COVID-19 pandemic, pose a significant threat. Natural disasters and trade disputes can exacerbate these vulnerabilities. Foxconn is actively diversifying its suppliers and expanding manufacturing to new regions like India and the U.S. to enhance supply chain resilience.

The rapid pace of technological change presents ongoing challenges. Downstream demand in areas like AI and EVs necessitates continuous R&D investments. Foxconn is investing heavily in cutting-edge technologies to stay ahead. However, adapting to evolving market demands requires agility and strategic foresight.

Securing talent and ensuring adequate capacity for 'back-end' semiconductor manufacturing are critical. The company's plan to separate chairman and CEO roles and implement a rotating CEO system aims to address leadership succession and broaden management experience. These internal factors can influence Foxconn's ability to execute its strategic plans effectively.

The collapse of proposed deals, such as the acquisition of UTAC, could negatively impact Foxconn. If other buyers offer higher bids, the company may lose out on strategic opportunities. Foxconn must carefully assess the potential risks associated with its acquisition and partnership strategies to maintain its growth trajectory.

Foxconn is significantly expanding its manufacturing operations in India. This expansion is part of its strategy to diversify its supply chain and reduce its reliance on China. The company plans to invest heavily in the country, with a focus on producing smartphones and other electronic devices. This move is a direct response to geopolitical risks and the need for supply chain resilience. The company is also exploring opportunities in the electric vehicle (EV) market in India.

Geopolitical tensions, particularly between the U.S. and China, present significant challenges. Trade policies and tariffs can directly affect Foxconn's operations and profitability. The company's strategic response includes diversifying its manufacturing locations and closely monitoring trade developments. The ongoing trade disputes and regulatory changes necessitate a flexible and adaptable business approach.

Foxconn invests heavily in R&D to stay at the forefront of technological advancements. The company focuses on cutting-edge technologies to address the rapid evolution of downstream demand, particularly in AI, EVs, and robotics. These investments are critical for maintaining its competitive edge in the rapidly changing tech industry. The company's commitment to innovation is essential for its future success.

Foxconn is implementing various strategies to enhance supply chain resilience. These include diversifying suppliers and expanding manufacturing to new regions. The company's focus on supply chain management is a direct response to the vulnerabilities exposed by global events such as the COVID-19 pandemic. This proactive approach is crucial for mitigating risks and ensuring operational continuity.

To learn more about the company's financial structure and business model, you can read this article: Revenue Streams & Business Model of Foxconn Technology Group.

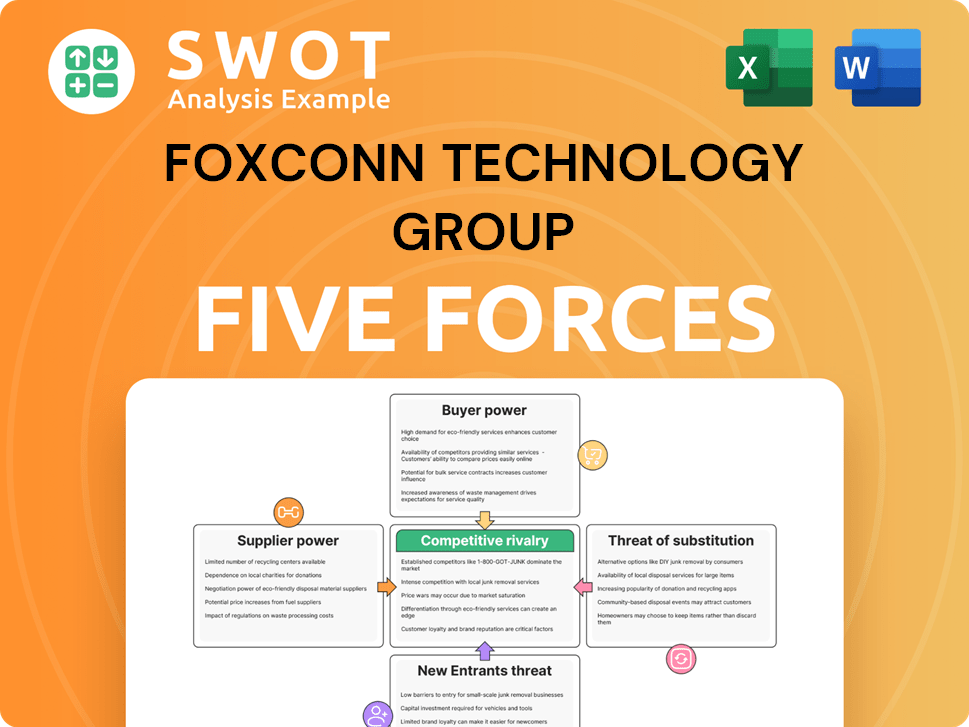

Foxconn Technology Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Foxconn Technology Group Company?

- What is Competitive Landscape of Foxconn Technology Group Company?

- How Does Foxconn Technology Group Company Work?

- What is Sales and Marketing Strategy of Foxconn Technology Group Company?

- What is Brief History of Foxconn Technology Group Company?

- Who Owns Foxconn Technology Group Company?

- What is Customer Demographics and Target Market of Foxconn Technology Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.