Global Brass and Copper, Inc. Bundle

How Does Global Brass and Copper Navigate the Brass and Copper Industry?

The Global Brass and Copper, Inc. SWOT Analysis unveils the intricate dynamics of a pivotal player in the global brass and copper market. From automotive to electronics, the brass and copper industry underpins essential sectors, making understanding its competitive landscape crucial. This analysis delves into Global Brass and Copper's market position, its rivals, and the factors driving its success.

This exploration of the Global Brass and Copper Competitive Landscape offers a comprehensive Market Analysis, highlighting key Industry Trends and the company's strategic positioning. We'll examine the Company Overview, its competitive advantages, and the challenges it faces within the Brass and Copper Industry. Understanding these elements is crucial for anyone seeking insights into the Global Brass and Copper Inc. competitors analysis and the broader brass and copper market size and growth.

Where Does Global Brass and Copper, Inc.’ Stand in the Current Market?

Global Brass and Copper, Inc. holds a significant position within the North American brass and copper industry. Its operations are centered on the fabrication and distribution of copper and brass products, serving diverse sectors such as automotive, building products, and electronics. The company's focus on integrated processing and manufacturing enables it to maintain control over its supply chain, ensuring product quality and consistency for its customers.

The company's product range includes sheet, strip, plate, foil, rod, and ingot, fabricated components. These products are crucial for various industries, highlighting the company's importance in the supply chain. Global Brass and Copper's strategic approach involves serving multiple customer segments across North America, solidifying its presence in the market. The company's ability to adapt to industry trends and customer needs is a key factor in its sustained market position.

The company's market position is strengthened by its focus on integrated processing, fabricating, manufacturing, and distribution capabilities. This comprehensive approach allows the company to maintain control over its supply chain and offer a consistent quality of products. Its geographic presence is primarily concentrated in North America, where it leverages its established manufacturing facilities and distribution networks to serve its diverse customer base effectively.

While precise 2024-2025 market share data for Global Brass and Copper are not available, the company's historical performance indicates a strong presence, particularly through its subsidiaries like Olin Brass. The brass and copper market is influenced by factors such as demand from the automotive and construction sectors. The brass and copper market size is influenced by global economic conditions and industry-specific demands.

Global Brass and Copper offers a wide range of fabricated copper and brass products, including sheet, strip, plate, and rod. These products are essential for various industries, including automotive, building products, and electronics. The company's product portfolio is designed to meet the diverse needs of its customer base, ensuring its relevance in the market. The company's product offerings are critical to multiple sectors.

The company serves a diverse customer base across North America, including the automotive, building products, and electronics sectors. Its geographic focus is primarily on North America, where it leverages its manufacturing and distribution networks. This strategic focus allows for efficient service and strong customer relationships. The company's focus on North America allows for streamlined operations.

Global Brass and Copper's competitive advantages include its integrated processing capabilities and its ability to offer a wide range of products. The company's established presence in key sectors, such as ammunition and coinage, further strengthens its position. These advantages enable the company to maintain a strong presence in the brass and copper market. The company's integrated model and focus on key sectors are critical.

The brass and copper industry faces challenges related to raw material prices and global economic conditions. Industry trends include increasing demand from the automotive and construction sectors. Companies in the industry must adapt to changing market dynamics and technological advancements. The industry must navigate economic fluctuations.

- Fluctuations in raw material costs, particularly copper and zinc.

- Economic cycles impacting demand from key sectors like construction and automotive.

- Competition from both domestic and international manufacturers.

- Technological advancements and the need for continuous innovation in production.

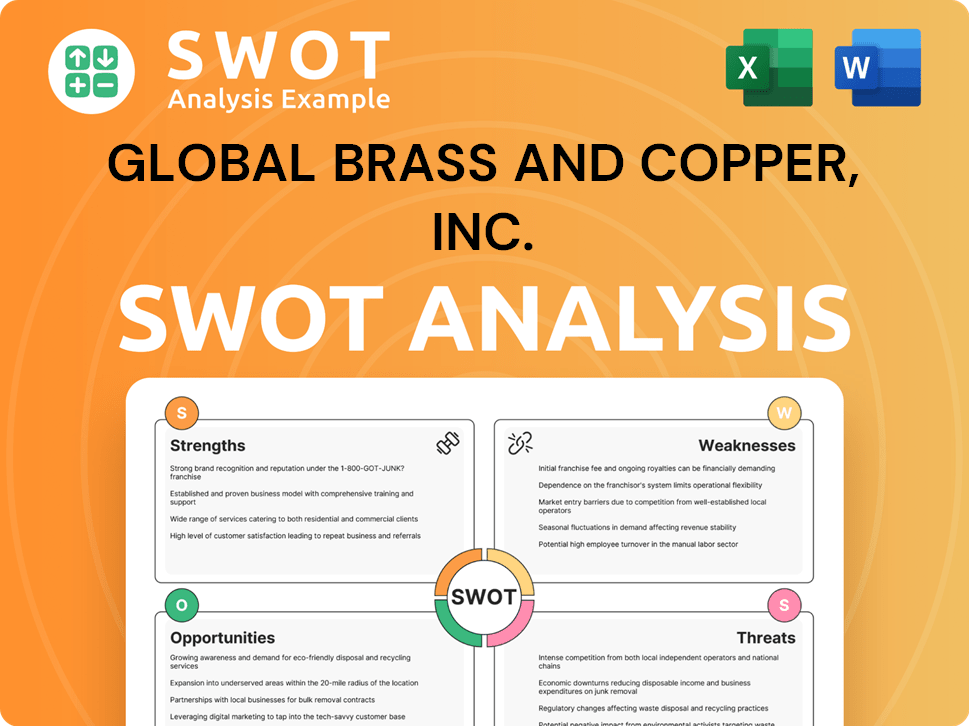

Global Brass and Copper, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Global Brass and Copper, Inc.?

The Global Brass and Copper operates within a competitive brass and copper industry, facing challenges from both large, diversified metals companies and specialized fabricators. Understanding the competitive landscape is crucial for assessing its market position and strategic direction. This analysis considers direct and indirect competitors, as well as industry trends impacting its operations.

Market Analysis reveals that the company competes in a sector influenced by factors such as raw material prices, technological advancements, and shifts in end-market demand. The company's success hinges on its ability to manage costs, innovate, and adapt to evolving customer needs. This overview provides insights into the key players and competitive dynamics shaping its business environment.

This article provides a detailed look at the competitive environment, including major rivals and the strategies they employ. The aim is to offer a comprehensive view of the market dynamics and the factors influencing the company's performance, supporting informed decision-making for stakeholders.

Wieland North America, part of the global Wieland Group, is a significant competitor. It offers a wide array of copper and copper alloy products. Wieland's global reach and technological capabilities give it a competitive edge.

Mueller Industries is a key competitor, manufacturing copper tubing, brass rods, and other industrial products. It competes through strong distribution networks and a solid presence in various sectors. Operational efficiency and a well-established customer base are its strengths.

These companies specialize in niche products, offering competitive pricing within specific areas. They challenge the company through localized service and flexibility. Their focus on specific markets allows for tailored offerings.

Materials like aluminum, steel, and plastics provide indirect competition. They are used as substitutes for copper and brass in certain applications. The automotive sector's use of lightweight materials is a factor.

Consolidation in the metals industry leads to larger, integrated competitors. These changes impact the competitive landscape. The emergence of bigger players affects market dynamics.

The push for sustainability introduces new competitive pressures. This includes a focus on recycled content and eco-friendly production methods. New players are entering the market with sustainable practices.

Several factors influence the competitive landscape in the brass and copper industry. These include product offerings, distribution networks, pricing strategies, and operational efficiency. Understanding these factors is vital for market analysis and strategic planning.

- Product Portfolio: The breadth and depth of product offerings, including specialized alloys and custom solutions, are critical.

- Distribution Network: The efficiency and reach of distribution channels, including direct sales, distributors, and online platforms.

- Pricing Strategy: Competitive pricing based on raw material costs, manufacturing expenses, and market demand.

- Operational Efficiency: Manufacturing processes, cost management, and supply chain optimization.

- Customer Service: Responsiveness, technical support, and building strong customer relationships.

- Innovation: Development of new products, alloys, and manufacturing techniques.

- Sustainability: Adoption of eco-friendly practices and use of recycled materials.

- Global Presence: The ability to serve customers in various geographic regions.

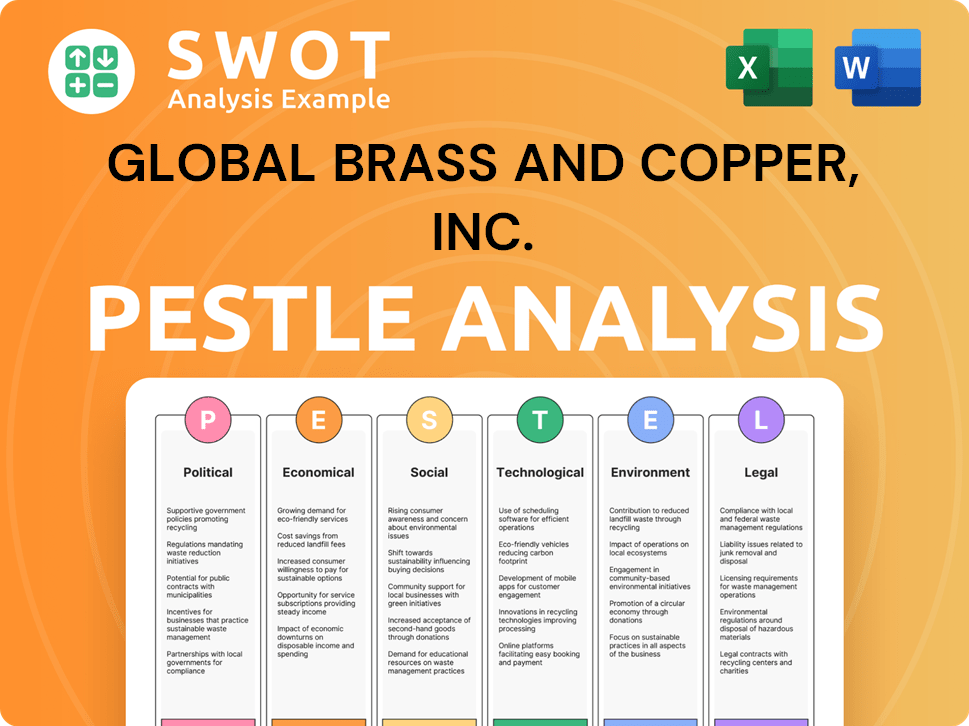

Global Brass and Copper, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Global Brass and Copper, Inc. a Competitive Edge Over Its Rivals?

The competitive landscape for Global Brass and Copper, Inc. (GBC) is shaped by its strategic advantages within the brass and copper industry. These advantages have allowed GBC to maintain a strong position in the market. A detailed Growth Strategy of Global Brass and Copper, Inc. provides further insights into its market approach.

GBC's operational model is a key differentiator. Its integrated approach, which includes processing, manufacturing, and distribution, gives it greater control over product quality and cost management. This vertical integration is a significant competitive strength, especially when compared to companies that depend on external suppliers for various production stages. This approach improves the company's ability to meet specific customer requirements.

Another advantage is GBC's expertise and established relationships within specialized sectors. Its long-standing presence in high-value areas like ammunition and coinage has fostered strong customer loyalty. This specialization creates high barriers to entry for new competitors. The ability to produce high-quality materials for critical applications underlines its technical capabilities and adherence to industry standards.

GBC's integrated model, encompassing processing, fabricating, manufacturing, and distribution, allows for superior control over quality and costs. This comprehensive approach ensures consistent product quality and efficient production cycles. This integrated structure enhances its ability to meet diverse customer specifications and maintain a competitive edge in the brass and copper industry.

GBC's expertise in specialized sectors, such as ammunition and coinage, is a significant advantage. Long-standing relationships and proven reliability in these demanding areas create strong customer loyalty. This specialization results in high barriers to entry for competitors, solidifying GBC's position in the market.

GBC benefits from an extensive distribution network across North America, ensuring timely delivery to a wide customer base. This enhances customer satisfaction and market reach. The established distribution channels contribute to the company's ability to efficiently serve its customers.

Large-scale manufacturing capabilities enable GBC to produce significant volumes efficiently, leading to cost advantages. This efficiency supports its competitive pricing strategies. Economies of scale are crucial for maintaining profitability in the brass and copper market.

GBC's competitive edge is built on its integrated operations, specialized expertise, extensive distribution network, and economies of scale. These factors contribute to its strong market position. Continuous investment in manufacturing infrastructure and operational excellence are crucial for sustaining these advantages.

- Integrated Operations: Control over the entire production process.

- Specialized Expertise: Strong presence in high-value sectors.

- Extensive Distribution Network: Efficient delivery across North America.

- Economies of Scale: Cost advantages through large-scale production.

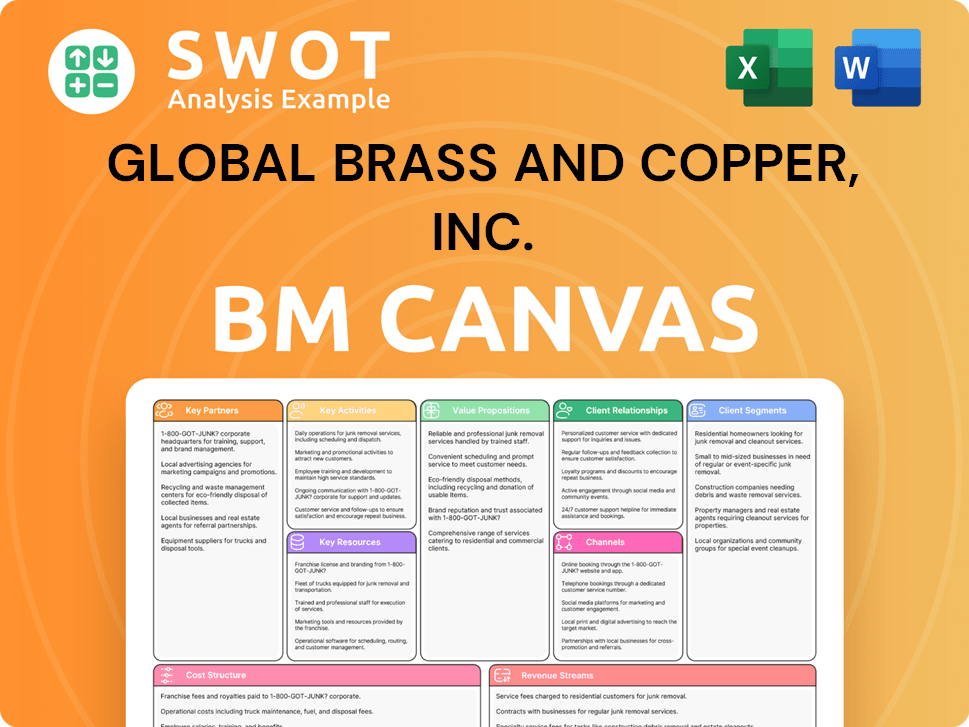

Global Brass and Copper, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Global Brass and Copper, Inc.’s Competitive Landscape?

Understanding the Competitive Landscape within the Brass and Copper Industry requires a close examination of current trends, potential challenges, and future opportunities. This includes assessing how companies like Global Brass and Copper, Inc. navigate market dynamics. The industry is influenced by factors such as technological advancements, raw material prices, and global economic shifts. Analyzing these elements provides a comprehensive view of the sector's trajectory and the strategic positioning of key players.

The Global Brass and Copper market is subject to various risks, including fluctuations in commodity prices, geopolitical instability, and evolving environmental regulations. These factors can significantly impact operational costs and market access. However, they also present opportunities for innovation and strategic adaptation. For a detailed look at the company's background, you can read the Brief History of Global Brass and Copper, Inc.

Industry Trends are shaped by sustainability, technological advancements, and global economic shifts. The demand for recycled content and eco-friendly production methods is increasing. Technological innovations, such as 3D printing, are changing manufacturing processes. Economic factors like commodity prices and geopolitical events impact raw material costs and demand.

Future Challenges include adapting to sustainability demands and integrating circular economy practices. Companies must manage volatile commodity prices, geopolitical risks, and evolving environmental and trade regulations. The need to adopt new technologies and maintain cost competitiveness is critical. Failure to adapt to these challenges may result in reduced market share.

Opportunities lie in expanding into renewable energy and electric vehicle sectors. Diversification into new product lines and strategic partnerships can boost growth. Companies that invest in R&D and adapt to changing market demands can gain a competitive edge. These strategic moves support long-term sustainability and market share.

Strategic Initiatives include innovation, supply chain risk management, and strategic investments. Companies must innovate to meet changing market needs and manage supply chain risks effectively. Strategic investments in growth areas are essential. These actions will support long-term resilience and capitalize on future industry expansion.

The Brass and Copper Industry is projected to grow. The demand for copper, in particular, is expected to increase due to its use in electric vehicles and renewable energy infrastructure. Market Analysis indicates opportunities for companies that can adapt to changing market demands and invest in strategic growth areas. The industry's future depends on innovation, supply chain resilience, and strategic partnerships.

- The global copper market was valued at approximately $188.8 billion in 2023, and is expected to reach $270.8 billion by 2032, growing at a CAGR of 4.1% from 2024 to 2032.

- The electric vehicle market's growth is a significant driver for copper demand, with each EV using significantly more copper than traditional gasoline-powered vehicles.

- The renewable energy sector, including solar and wind power, also boosts copper demand due to its use in electrical wiring and components.

- Geopolitical events and trade policies influence raw material costs and market access, impacting the industry's competitive dynamics.

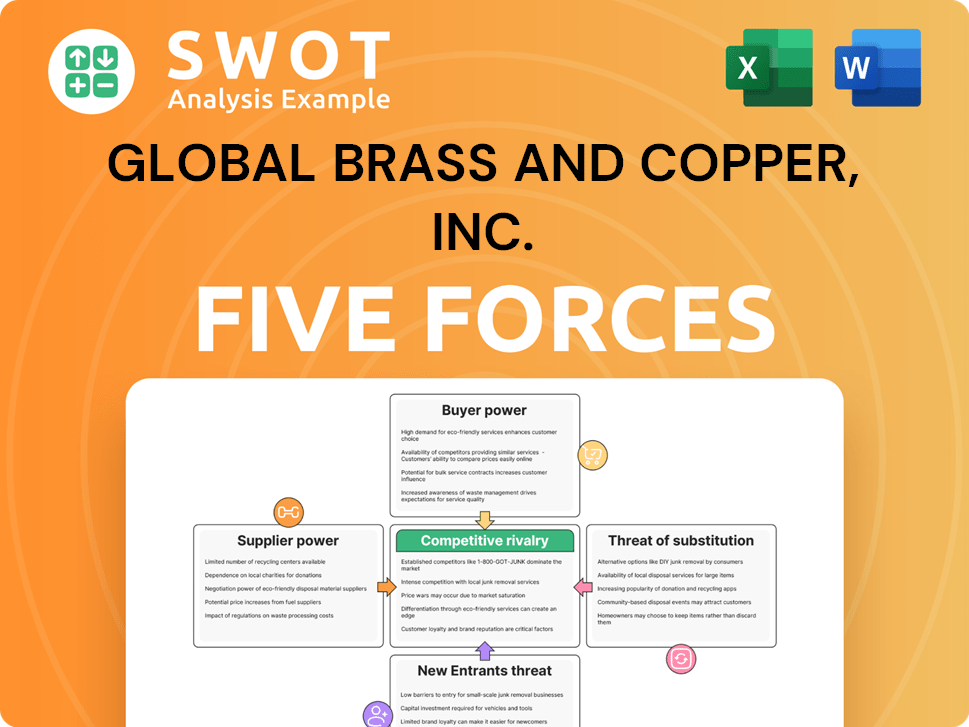

Global Brass and Copper, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Global Brass and Copper, Inc. Company?

- What is Growth Strategy and Future Prospects of Global Brass and Copper, Inc. Company?

- How Does Global Brass and Copper, Inc. Company Work?

- What is Sales and Marketing Strategy of Global Brass and Copper, Inc. Company?

- What is Brief History of Global Brass and Copper, Inc. Company?

- Who Owns Global Brass and Copper, Inc. Company?

- What is Customer Demographics and Target Market of Global Brass and Copper, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.