Global Brass and Copper, Inc. Bundle

What's Next for Global Brass and Copper, Inc.?

In 2019, a pivotal acquisition reshaped Global Brass and Copper, Inc. (GBC), integrating it into the expansive Wieland Group. This strategic move set the stage for significant changes within the Global Brass and Copper, Inc. SWOT Analysis. Now, as a key player in the global brass and copper industry, what are GBC's plans for the future?

This analysis delves into the growth strategy of GBC, exploring its position in the dynamic brass and copper market. We'll examine the future prospects of the company, considering market trends and potential growth drivers. Furthermore, we'll conduct a detailed market analysis to understand the competitive landscape and identify investment opportunities within the global brass and copper industry.

How Is Global Brass and Copper, Inc. Expanding Its Reach?

As a key player in the global brass and copper industry, Global Brass and Copper (GBC), now part of the Wieland Group, is strategically positioned for expansion. Their growth strategy involves several key initiatives, including market penetration, product diversification, and potential mergers and acquisitions. This approach leverages their established global presence and the growing demand for copper and brass products.

GBC currently operates manufacturing and distribution facilities across the United States, Mexico, Germany, and China. This extensive network provides a competitive advantage in market reach and responsiveness, allowing them to serve a worldwide customer base efficiently. The company's ability to cater to diverse markets is crucial for sustained growth in the brass and copper market.

The company's expansion strategy is closely aligned with the overall trends in the global brass and copper market. The market is projected to grow significantly, with a compound annual growth rate (CAGR) of 6.2% from 2024 to 2032. This growth is driven by increasing demand from sectors like construction, electrical, and electronics. This expansion is also supported by the parent company's strategic moves, such as the acquisition of Aurubis AG's brass division in September 2024, valued at €2 billion. This merger is expected to create one of the largest brass manufacturers globally.

GBC aims to increase its market share within existing regions. This involves strengthening relationships with current customers and attracting new ones. The company's diverse product offerings, including sheets, strips, foils, rods, and fabricated components, support this strategy.

Expanding the range of copper and brass products to meet evolving customer needs is a key focus. This could involve developing new alloys or specialized components for emerging applications. The growth in the automotive segment, which was the largest application segment in the brass market in 2024, presents significant opportunities.

The parent company, Wieland Group, has a history of strategic acquisitions to strengthen its market position. GBC may benefit from these moves, potentially expanding its manufacturing capabilities and market reach. For instance, the acquisition of Aurubis AG's brass division is a prime example of this strategy.

While specific details are not always public, GBC may explore entering new geographic markets. This could involve establishing new distribution centers or partnerships in regions with high growth potential. The company's existing global footprint provides a solid foundation for further expansion.

The brass and copper market is driven by factors such as increasing demand from the construction, electrical, and electronics industries. The automotive sector remains a significant consumer, with brass used in components like radiators and fuel systems. However, the industry faces challenges like fluctuating raw material prices and supply chain disruptions.

- Construction: Copper and brass are essential in plumbing, wiring, and HVAC systems.

- Electronics: Demand for copper in electronic devices is rising.

- Automotive: Brass is used extensively in various vehicle components.

- Renewable Energy: The shift towards renewable energy sources increases demand for copper.

For a broader understanding of the competitive environment, including how GBC stacks up against its rivals, consider reading the Competitors Landscape of Global Brass and Copper, Inc. article. This will provide additional context on the company's position within the global brass and copper industry and its potential for future growth.

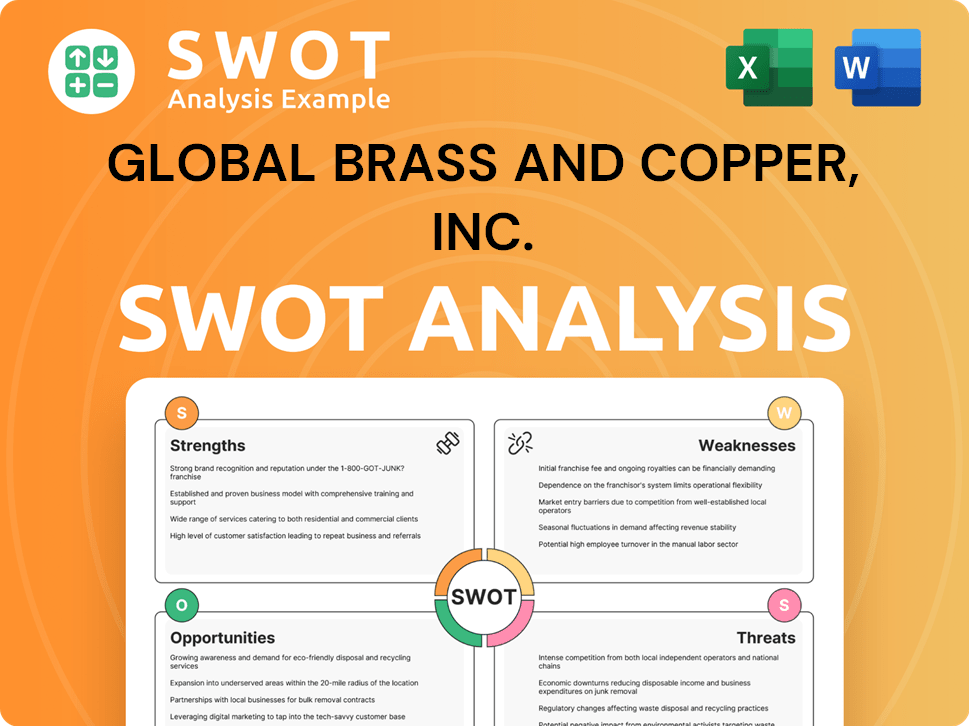

Global Brass and Copper, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Global Brass and Copper, Inc. Invest in Innovation?

The innovation and technology strategy of Global Brass and Copper (GBC), as part of the Wieland Group, is geared towards sustained growth in the competitive global brass and copper industry. While specific details on GBC's independent R&D investments are not widely publicized, the Wieland Group's focus on technology and innovative solutions is well-known. This approach is critical in a market where technological advancements drive growth.

The copper and copper alloy market is poised for significant expansion due to technological advancements. This includes improvements in processing, fabrication, and manufacturing techniques for a diverse product portfolio, covering copper and brass sheet, strip, plate, foil, rod, and fabricated components. Digital transformation and automation are becoming increasingly vital in manufacturing, which necessitates investments in efficiency and advanced manufacturing processes.

Sustainability initiatives are also a key driver of innovation. The broader copper industry is seeing efforts towards responsible sourcing and production, potentially involving new technologies to reduce environmental impact. The rising demand for copper in green energy projects, such as electric vehicles (EVs), solar power, and wind power, directly contributes to growth objectives and necessitates innovation in copper and brass products. For example, each battery electric vehicle (BEV) requires approximately 83kg of copper, significantly more than traditional internal combustion engine vehicles.

Digital transformation is crucial for efficiency. This involves integrating advanced technologies like AI and IoT in manufacturing processes. The metals industry is increasingly adopting these technologies for better performance.

Sustainability is a major focus. Efforts include responsible sourcing and production methods. This is driven by environmental concerns and regulatory pressures.

Demand from green energy projects is rising. EVs, solar, and wind power are key drivers. This boosts the need for innovative copper and brass products.

Electric vehicles significantly increase copper demand. Each BEV uses approximately 83kg of copper. This trend is expected to grow with EV adoption.

Wieland Group provides extensive R&D resources. This supports innovation and market leadership. The integration enhances GBC's capabilities.

The Olin Brass segment offers technical expertise. This segment is known for superior quality products. It contributes significantly to GBC's innovation.

The Revenue Streams & Business Model of Global Brass and Copper, Inc. highlights how the company's growth strategy is closely tied to technological advancements and market trends. These advancements are crucial for the future prospects of the global brass and copper industry.

- Advanced Manufacturing: Implementing automation and smart technologies to improve efficiency and reduce waste.

- Material Science: Developing new copper alloys with enhanced properties to meet specific industry demands.

- Digitalization: Utilizing data analytics and AI to optimize production processes and improve decision-making.

- Sustainability: Investing in eco-friendly production methods and recycling technologies to minimize environmental impact.

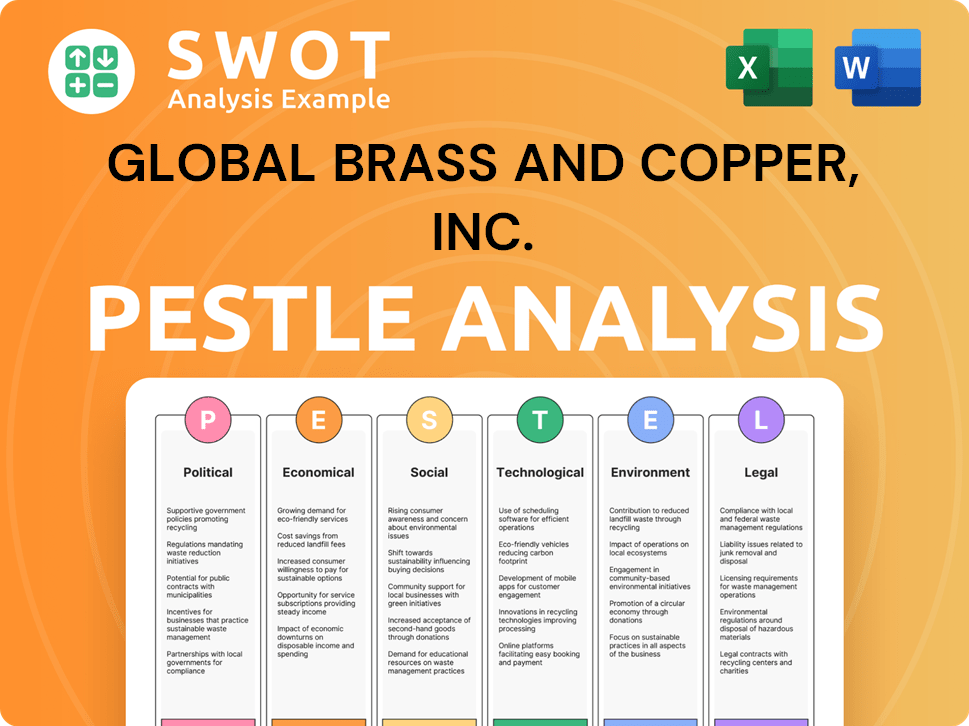

Global Brass and Copper, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Global Brass and Copper, Inc.’s Growth Forecast?

The financial outlook for Global Brass and Copper Holdings, Inc. (GBC) appears positive, supported by favorable market conditions and growth forecasts. While specific financial reports for GBC as an independent entity are limited due to its acquisition, the broader brass and copper market indicates robust expansion. This positive trend suggests that GBC, as part of Wieland-Werke AG, is well-positioned to benefit from the overall market growth.

As of May 23, 2024, the stock price of GBC was valued at $43.990 USD. Projections suggest the stock price could reach $61.272 USD by August 28, 2024. This indicates potential for short-term gains. Furthermore, a five-year investment could yield a return of approximately +39.29%, turning a $100 investment into roughly $139.29 by 2030. These figures highlight the potential of GBC as a profitable investment.

The global brass and copper industry is experiencing significant growth, driven by increasing demand from various sectors. The global copper and copper alloy market was valued at USD 356.61 billion in 2023 and is expected to reach USD 577.03 billion by 2032, with a compound annual growth rate (CAGR) of 6.2% from 2024 to 2032. This growth is fueled by the construction, electrical, and electronics industries, creating a favorable environment for GBC.

The brass and copper market is influenced by both immediate and long-term factors. Base metal prices are anticipated to remain steady in 2024 before seeing a slight increase in 2025. Copper prices are forecast to rise modestly by 5% in 2024. These trends indicate a stable and growing market for copper products.

Key drivers of demand include the construction, electrical, and electronics sectors. These industries rely heavily on copper and its alloys. The increasing adoption of energy transition technologies is also a significant factor, as these technologies require substantial amounts of copper.

In 2025, a significant surplus of 289,000 tonnes of copper is expected, more than double the 138,000 tonnes from the previous year. This is mainly due to increased mine supply and smelting capacity. Despite this, a long-term structural deficit is still anticipated.

Refined copper demand is projected to almost double, from over 25 million metric tons in 2021 to nearly 49 million metric tons in 2035. This growth is largely driven by energy transition technologies. These factors support a positive future of brass and copper industry.

The positive outlook for the brass and copper market presents attractive investment opportunities. Investors interested in GBC and the broader market can benefit from the projected growth. For a deeper understanding, consider exploring the Target Market of Global Brass and Copper, Inc. to gain insights into its strategic positioning.

- The rising demand from key industries.

- The expected increase in copper prices.

- The potential for long-term growth in the market.

- The role of GBC within the Wieland-Werke AG.

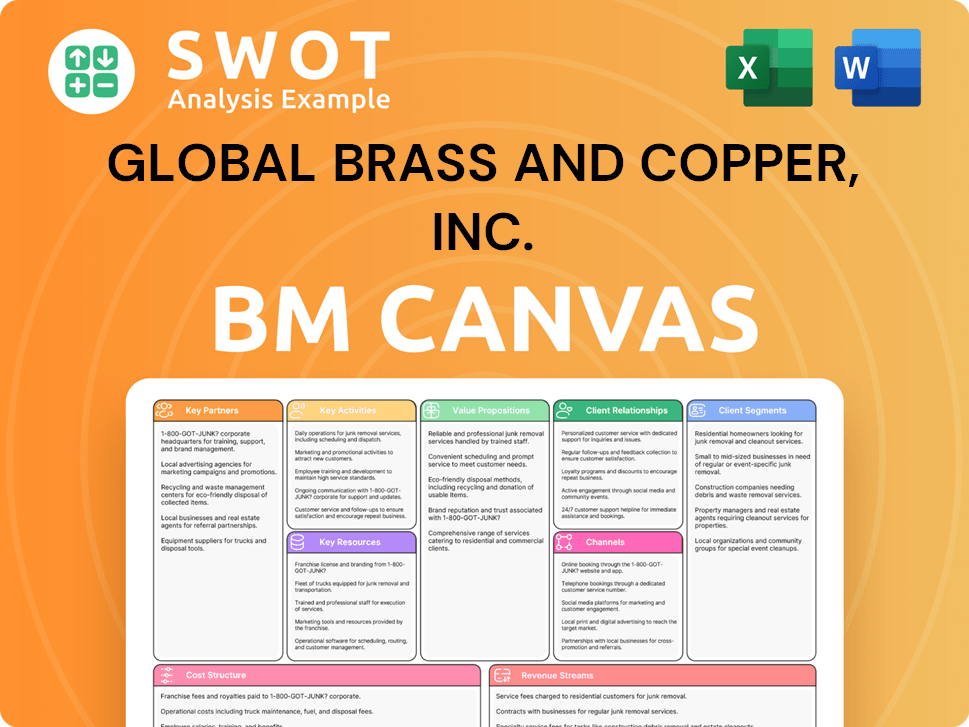

Global Brass and Copper, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Global Brass and Copper, Inc.’s Growth?

The Global Brass and Copper, Inc., faces several significant risks and obstacles that could affect its growth within the competitive global brass and copper industry. These challenges range from market dynamics and regulatory changes to supply chain vulnerabilities and technological disruptions. Understanding these potential pitfalls is crucial for anyone evaluating the brass and copper company's future prospects and investment opportunities.

The brass and copper market is subject to constant fluctuations, requiring strategic agility to maintain a competitive edge. Furthermore, the industry must navigate the complexities of regulatory changes and supply chain vulnerabilities, which can substantially impact operational costs and material availability. These factors underscore the need for proactive risk management and robust strategic planning.

Market competition is a primary concern. Companies in the global brass and copper industry are continuously innovating and expanding their product offerings. This necessitates ongoing efforts from Global Brass and Copper, Inc. (GBC) to maintain its competitive position through product development and market strategies.

Regulatory changes pose a significant risk. Potential copper import tariffs in the U.S. could reshape the global copper market. Forecasts suggest that copper tariffs could reach as high as 25% by the fourth quarter of 2025, leading to disruptions and increased expenses.

Supply chain vulnerabilities are a critical concern. The global copper supply faces risks due to political, technical, environmental, and socio-economic factors. The International Copper Study Group (ICSG) noted a global refined copper deficit of 22,000 metric tons in December 2024. While a surplus of 289,000 tonnes is projected for 2025, a long-term structural deficit is still expected.

Technological disruption presents a risk. Rapid advancements in manufacturing processes could necessitate significant investments to remain competitive. Cybersecurity threats, with increasing sophistication, could also impact supply chains via third-party vendors in 2025.

Internal resource constraints can affect operations. Talent shortages in key sectors could impact operations and growth. The company's integration into the Wieland Group suggests an ability to navigate these challenges through strategic planning.

Geopolitical instability and economic fragmentation add to the risk landscape. Shifting trade alliances and export controls contribute to the complex risk environment for businesses like GBC. These factors require continuous monitoring and adaptive strategies.

Copper price volatility is a major concern. The potential long-term supply shortfall could lead to price volatility and impact raw material availability. Copper miners are increasingly cautious of counterparty risks when agreeing to long-term contracts, especially for 2025 and beyond.

The brass and copper market trends in 2024 and beyond are influenced by factors such as infrastructure development, the growth of electric vehicles, and technological advancements. Demand for copper is expected to increase due to its use in renewable energy and electric vehicle production. Understanding these market dynamics is crucial for strategic planning and investment.

The future of the brass and copper industry is closely tied to global economic trends and technological innovations. The global brass and copper market forecast indicates continued growth, driven by increasing demand from various sectors, including construction, electronics, and renewable energy. The ability to adapt to changing market conditions will be key for sustained success.

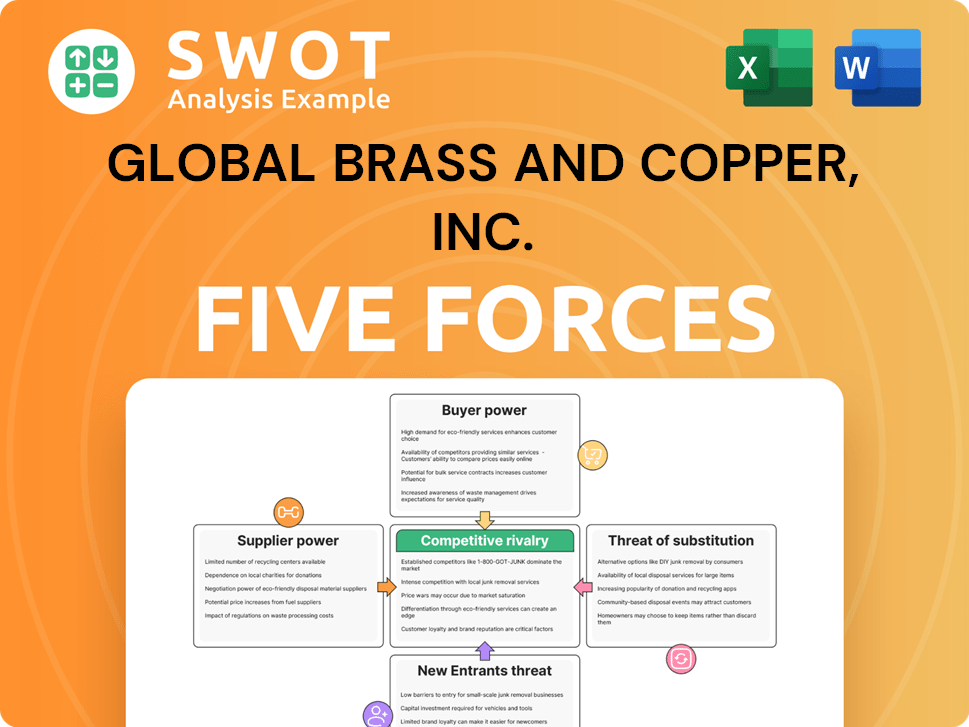

Global Brass and Copper, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Global Brass and Copper, Inc. Company?

- What is Competitive Landscape of Global Brass and Copper, Inc. Company?

- How Does Global Brass and Copper, Inc. Company Work?

- What is Sales and Marketing Strategy of Global Brass and Copper, Inc. Company?

- What is Brief History of Global Brass and Copper, Inc. Company?

- Who Owns Global Brass and Copper, Inc. Company?

- What is Customer Demographics and Target Market of Global Brass and Copper, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.