Gear4Music Bundle

Can Gear4Music Conquer the Music Retail World?

The music retail industry is undergoing a digital revolution, and Gear4Music is at the forefront. This online retailer has rapidly expanded, challenging both traditional stores and other e-commerce giants. Understanding the Gear4Music SWOT Analysis is crucial to grasping its position in this dynamic market.

This analysis delves into the Gear4Music competitive landscape, providing a comprehensive Gear4Music market analysis. We'll identify Gear4Music competitors and evaluate their strengths and weaknesses. By examining the online musical instrument sales arena, we aim to uncover how Gear4Music is carving out its niche and what strategies it employs to stay ahead in the musical instrument market.

Where Does Gear4Music’ Stand in the Current Market?

Gear4music has established itself as a significant player in the online music retail industry, particularly within the UK and Europe. Its core operations revolve around the e-commerce platform, offering a vast selection of musical instruments and equipment. This includes everything from guitars and drums to keyboards and recording gear, catering to a broad customer base that ranges from beginners to professionals.

The company's value proposition centers on providing a wide product range, competitive pricing, and convenient online shopping experiences. This approach has enabled Gear4music to capture a substantial share of the online musical instrument sales market. Its business model is designed to efficiently manage inventory, logistics, and customer service, which supports its competitive positioning.

Gear4music's market position is strongest in the UK and has a growing presence across Europe. The company's consistent revenue generation and operational scale highlight its significant presence in the music retail industry. For the fiscal year ending March 31, 2024, Gear4music reported total revenue of £154.3 million.

The company's financial health reflects its ability to navigate market fluctuations. Gear4music's gross profit for the fiscal year ending March 31, 2024, was £43.4 million. This demonstrates the company's resilience and effective business strategies.

Gear4music serves a diverse customer base, from beginners to professionals. They offer a wide range of products, including guitars, drums, keyboards, and recording equipment. This broad selection caters to various skill levels and musical preferences.

Gear4music has a strong foothold in the UK and has expanded its reach across Europe. The company operates dedicated websites and distribution capabilities in several countries. This international presence is a key contributor to its overall revenue.

Gear4music maintains a strong competitive position through its e-commerce platform, logistics, and customer service. The company focuses on offering a balance of popular brands and its own brand products, catering to various price points. Effective online sales strategies and supply chain management are crucial for success in the online musical instrument market.

- Competitive Pricing: Gear4music's pricing strategy is a key factor in its market penetration, ensuring it remains competitive.

- Product Range: The extensive product catalog, including both well-known brands and its own, caters to a wide audience.

- Online Platform: Optimizing the e-commerce platform and user experience is crucial for driving sales and customer satisfaction.

- Logistics and Distribution: Efficient logistics and distribution networks support timely delivery and customer service.

To understand more about the company's financial performance and ownership structure, one can refer to the insights provided in Owners & Shareholders of Gear4Music.

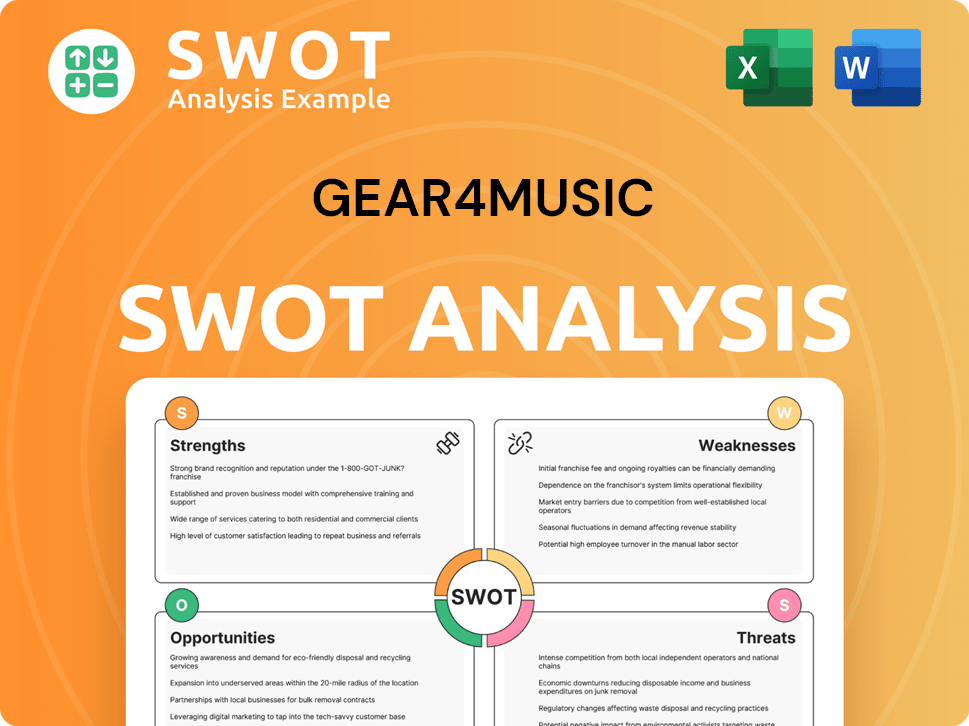

Gear4Music SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Gear4Music?

The Gear4music competitive landscape is shaped by a mix of online and traditional music retailers. The company faces competition from direct online rivals and hybrid businesses that blend online and physical store presences. Understanding this landscape is crucial for Gear4music market analysis and strategic planning. The music retail industry is dynamic, with competition often centered on price, product availability, and customer service.

Online musical instrument sales have grown significantly in recent years, intensifying the competition. Gear4music's ability to compete depends on its ability to differentiate itself through pricing strategies, product offerings, and customer experience. The musical instrument market continues to evolve, with new players and changing consumer preferences influencing the competitive dynamics.

Gear4music operates in a competitive landscape with both direct online retailers and traditional music stores. Its most significant direct competitors include Thomann, based in Germany, which is one of the largest online retailers of musical instruments globally, offering an extensive product range and competitive pricing. Another key online rival is Sweetwater in the US, known for its strong customer service and deep product expertise, although its primary market is North America. In the UK, PMT (Professional Music Technology) represents a significant hybrid competitor, combining a strong online presence with a network of physical stores, offering customers the option of in-person trials and advice.

Thomann, based in Germany, is a major online retailer of musical instruments. They offer a vast product range and competitive pricing, making them a significant competitor to Gear4music. Their established European logistics network gives them a strong advantage.

Sweetwater, based in the US, is known for its excellent customer service and product expertise. Although primarily focused on North America, they represent a strong online competitor. They offer a high level of customer support.

PMT in the UK combines a strong online presence with physical stores. This hybrid model allows customers to try products in person. They offer a blend of online convenience and in-store experience.

Amazon, as a general e-commerce platform, also sells musical instruments. While their selection may be less specialized, their vast reach and competitive pricing pose a challenge. They have a broad customer base.

Local independent music shops offer personalized service and community engagement. Although smaller, they can compete by building strong customer relationships. They offer personalized service.

Niche online stores focus on specific instrument categories, providing specialized expertise. These stores can attract customers looking for particular products. They offer specialized expertise.

The competitive landscape is shaped by price, product availability, shipping speed, and customer support. Gear4music must continually adapt to maintain market share. Understanding the strategies of competitors like Thomann, with its vast inventory and logistics, is crucial. For more details, you can read about the Revenue Streams & Business Model of Gear4Music.

- Pricing Strategy: Competitive pricing is essential to attract customers.

- Product Availability: Offering a wide range of products is crucial.

- Shipping Speed: Fast and reliable shipping enhances customer satisfaction.

- Customer Support: Excellent customer service builds loyalty.

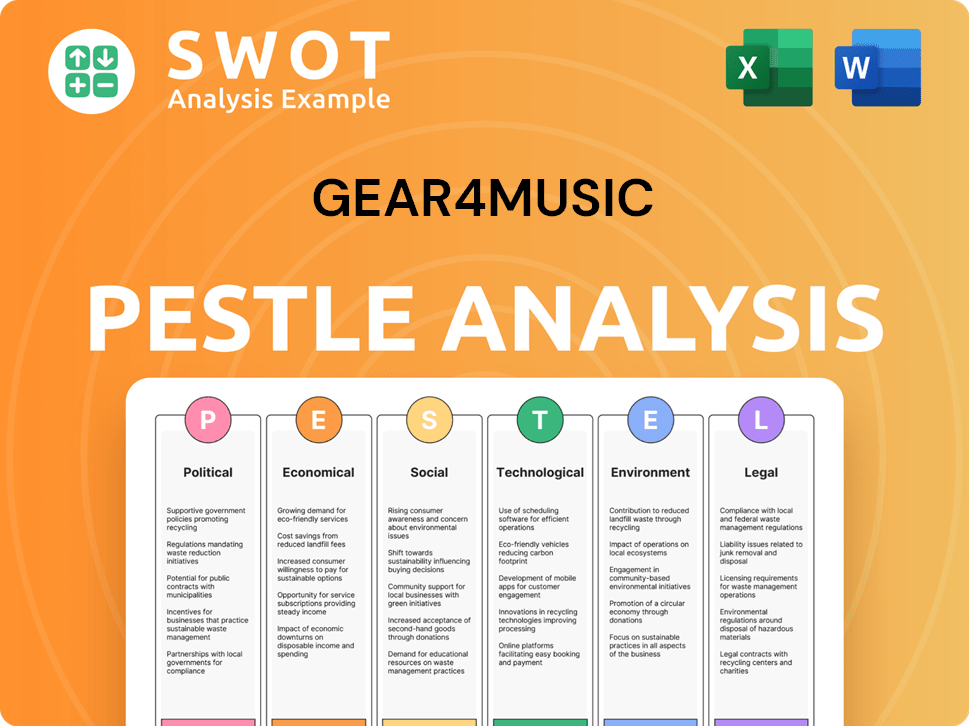

Gear4Music PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Gear4Music a Competitive Edge Over Its Rivals?

The competitive landscape for Gear4music is shaped by its e-commerce focus, extensive product offerings, and efficient distribution. The company has carved a niche in the music retail industry by providing a wide array of instruments and equipment online. This approach allows for a broader reach and potentially lower overhead costs compared to traditional brick-and-mortar stores. A detailed Growth Strategy of Gear4Music analysis reveals the company's strategic moves and competitive advantages.

Gear4music's primary competitive advantages stem from its robust online platform, comprehensive product range, and effective distribution network. The company offers a vast selection of musical instruments and equipment from leading brands, along with its own-brand products, providing customers with diverse choices across various price points. This broad inventory, easily accessible online, sets it apart from many smaller retailers. Furthermore, Gear4music's well-established logistics and distribution infrastructure, including large warehouse facilities in the UK and Europe, enables efficient order fulfillment and international shipping, a critical advantage in the online retail space.

The company leverages its strong brand equity within the musical instrument community, built over years of online presence and customer engagement. Its digital-first strategy allows for lower overheads compared to traditional brick-and-mortar stores, which can translate into competitive pricing. Gear4music consistently invests in its online user experience, making it easier for customers to browse, compare, and purchase products. While not possessing unique proprietary technologies in the same vein as a manufacturing company, its optimized e-commerce technology and data analytics capabilities contribute to its operational efficiency and targeted marketing.

Gear4music's e-commerce platform is a key differentiator. The platform offers a user-friendly experience with detailed product information, customer reviews, and easy navigation. This focus on the customer experience helps drive sales and build brand loyalty.

The company offers a vast selection of musical instruments and equipment. This extensive product range caters to musicians of all levels, from beginners to professionals. The variety ensures that customers can find what they need.

Gear4music has a well-established logistics and distribution network. This network includes large warehouses in the UK and Europe, enabling efficient order fulfillment and international shipping. Efficient logistics are crucial for online retail success.

The company has built strong brand equity within the musical instrument community. This brand recognition is built over years of online presence and customer engagement. Strong brand recognition can lead to customer loyalty and repeat business.

Gear4music's competitive advantages are multifaceted, encompassing its e-commerce platform, extensive product range, and efficient distribution network. These factors combine to create a strong position in the music retail industry. The company's ability to adapt and innovate is crucial for maintaining its competitive edge.

- E-commerce Focus: A strong online presence allows for broader market reach and potentially lower overhead costs.

- Extensive Product Range: Offers a wide variety of instruments and equipment, catering to a diverse customer base.

- Efficient Distribution: Well-established logistics and warehousing enable efficient order fulfillment and international shipping.

- Brand Recognition: Strong brand equity built through years of online presence and customer engagement.

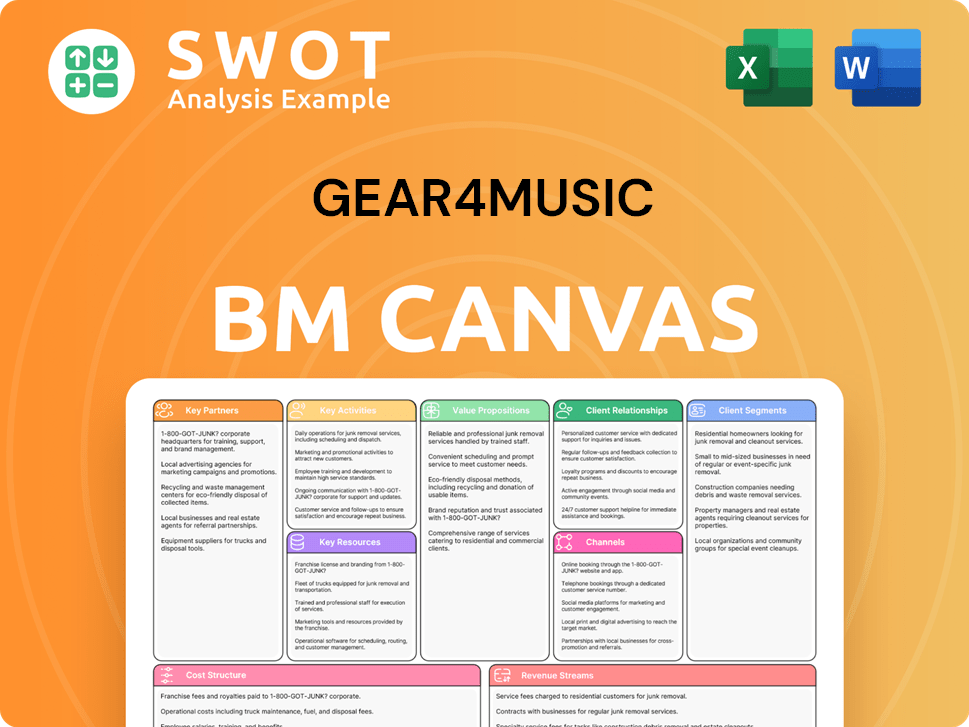

Gear4Music Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Gear4Music’s Competitive Landscape?

The musical instrument and equipment market is currently experiencing significant shifts driven by e-commerce, home studio growth, and online content creation. These trends present both challenges and opportunities for companies like Gear4music. Understanding the evolving Gear4Music competitive landscape is essential for strategic planning and sustained growth within the music retail industry.

The Gear4Music market analysis reveals a dynamic environment where online sales and technological advancements are key drivers. The ability to adapt to these changes, optimize digital platforms, and expand product offerings will be crucial for maintaining a competitive edge. This includes addressing risks such as economic fluctuations and intense competition from other online retailers.

E-commerce continues to dominate the online musical instrument sales sector, with a projected global market value of $10.5 billion by 2028. The rise of home recording studios and content creators fuels demand for a wide variety of instruments and equipment. Technological advancements, such as AI-driven personalized shopping experiences, are also reshaping the market.

Intense competition from established online retailers and new entrants, particularly those leveraging AI and efficient supply chains, presents a significant challenge. Economic factors, such as inflation and fluctuations in consumer spending, can impact demand. Maintaining profitability while investing in technology and expanding product lines is crucial.

Expanding into new geographic markets, especially in regions with growing music education and entertainment sectors, offers substantial growth potential. Diversifying product offerings, including niche instruments or services like online lessons, can attract new customers. Strategic partnerships with music educators, artists, or technology providers can enhance market reach.

Gear4music is likely to focus on optimizing its digital platform, enhancing its logistics, and expanding its product range. Exploring new service offerings and adapting to evolving consumer preferences will be essential. Understanding the Gear4Music competitors and their strategies is vital for maintaining a competitive edge.

To thrive, Gear4music should prioritize enhancing its online platform, optimizing its supply chain, and expanding its product range. This includes a focus on customer experience and leveraging data analytics for personalized marketing. Strategic partnerships and potential acquisitions could also enhance its market position.

- Enhance the digital platform for improved user experience and sales.

- Optimize supply chain and logistics to reduce costs and improve delivery times.

- Expand product offerings, including niche instruments and accessories.

- Explore strategic partnerships with music educators and content creators.

- Consider expansion into new geographical markets.

For example, in 2024, the global musical instrument market was valued at approximately $7.8 billion, with projections for continued growth. The increasing adoption of digital instruments and online music education platforms is expected to drive further expansion. For more insights into the company's origins, check out this Brief History of Gear4Music.

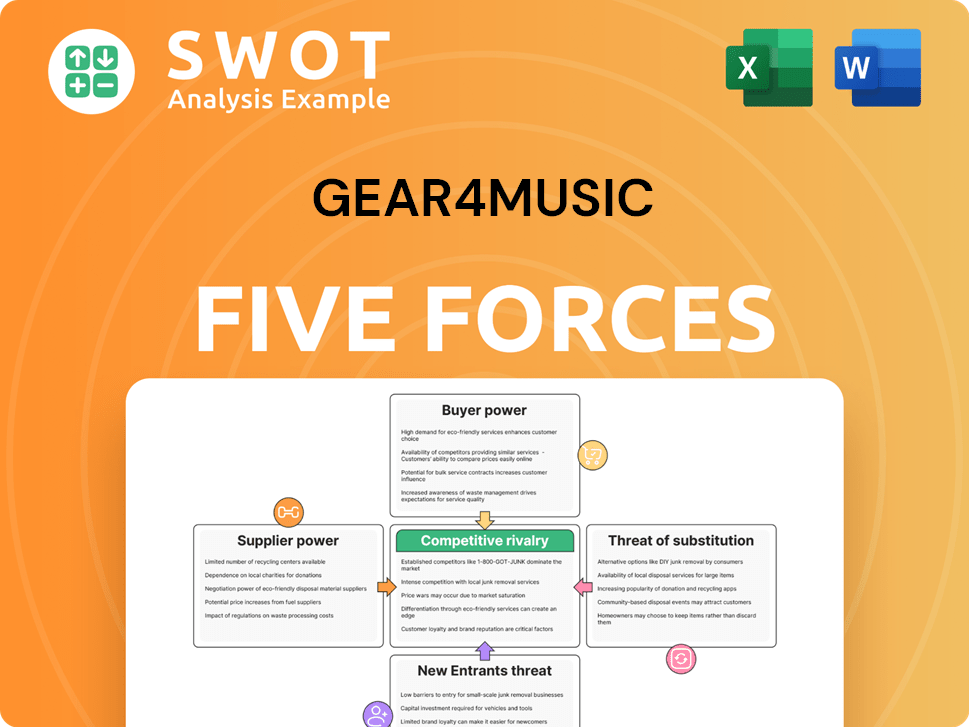

Gear4Music Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gear4Music Company?

- What is Growth Strategy and Future Prospects of Gear4Music Company?

- How Does Gear4Music Company Work?

- What is Sales and Marketing Strategy of Gear4Music Company?

- What is Brief History of Gear4Music Company?

- Who Owns Gear4Music Company?

- What is Customer Demographics and Target Market of Gear4Music Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.