Gear4Music Bundle

Can Gear4music Sustain Its Momentum in the Competitive Music Retail Market?

Gear4music, a leading online music retailer, has experienced remarkable growth since its inception, transforming from a startup to the UK's largest musical instrument and equipment seller. With a strategic focus on e-commerce and international expansion, the company has consistently increased its revenue, demonstrating a strong understanding of the online musical instrument sales landscape. This Gear4Music SWOT Analysis will help us to understand the company's position.

This in-depth Gear4music company analysis explores the driving forces behind its financial performance, including its recent acquisition of GAK and its ambitious expansion plans. We'll delve into the Gear4music growth strategy, examining how the company intends to navigate the evolving music retailer market and capitalize on future opportunities. Understanding Gear4music's future prospects requires a close look at its e-commerce strategy, competitive landscape, and potential for sustained revenue growth.

How Is Gear4Music Expanding Its Reach?

The growth strategy of the company involves a multifaceted approach to expand its market presence and product offerings. This includes a strong focus on international expansion, particularly within Europe, and the diversification of product categories and sales channels. These initiatives are designed to drive revenue growth and enhance the company's position in the competitive music retailer market.

The company's future prospects appear promising, driven by strategic investments in e-commerce, product development, and market consolidation. The company's ability to adapt to market trends and capitalize on opportunities, such as the acquisition of assets from GAK in April 2025, positions it well for continued success. A detailed Gear4music company analysis indicates a proactive approach to growth and market share expansion.

The company's strategic moves, including the expansion of its own-brand product lines and the development of new sales channels, are designed to increase profitability and reduce reliance on traditional advertising methods. These initiatives are crucial for sustaining long-term growth and adapting to the evolving landscape of online musical instrument sales.

The company is actively pursuing international expansion, with a primary focus on Europe. Plans include establishing an additional European operation by 2025. The company already has distribution centers in Sweden, Germany, Ireland, and Spain, and localized websites in 19 countries.

Enhancing the product offer is a key component of the company's growth strategy. This includes developing second-hand product sales, which launched in March 2023, and expanding its own-brand product development. The acquisition of Studiospares Europe Limited in October 2024 supports this strategy.

The company is diversifying its channels to market, including integrations with new European platforms. Efforts are underway to enhance data and reporting tools and add new channels to reduce reliance on paid-per-click (PPC) advertising. The company is also expanding its use of influencers, affiliates, social media, and brand-building activities.

The acquisition of assets from GAK in April 2025, including stock and commercial data, is a strategic move to consolidate the market. This, along with the insolvency of BAX, presents significant market consolidation opportunities. This approach aims to benefit from a more stable pricing environment.

The company's expansion plans for 2024 and beyond are centered on three main areas: international growth, product diversification, and channel optimization. These initiatives are designed to strengthen the company's market position and drive revenue growth in the competitive landscape.

- International Expansion: Adding an additional European operation by 2025, and exploring opportunities in the USA, Australia, and India. International sales were £61.3 million in FY24.

- Product Category Enhancement: Developing second-hand product sales, and expanding own-brand product development. Own-brand products accounted for 26.0% of total revenue in FY24.

- Channel Diversification: Integrating with new European platforms and expanding the use of influencers, affiliates, social media. The recent acquisition of assets from GAK in April 2025.

The company's strategic initiatives are supported by a robust e-commerce platform and a focus on customer acquisition strategies, as highlighted in the Marketing Strategy of Gear4Music. These efforts are designed to capitalize on the growing online sales trends and ensure sustainable growth in the future of musical instrument retail.

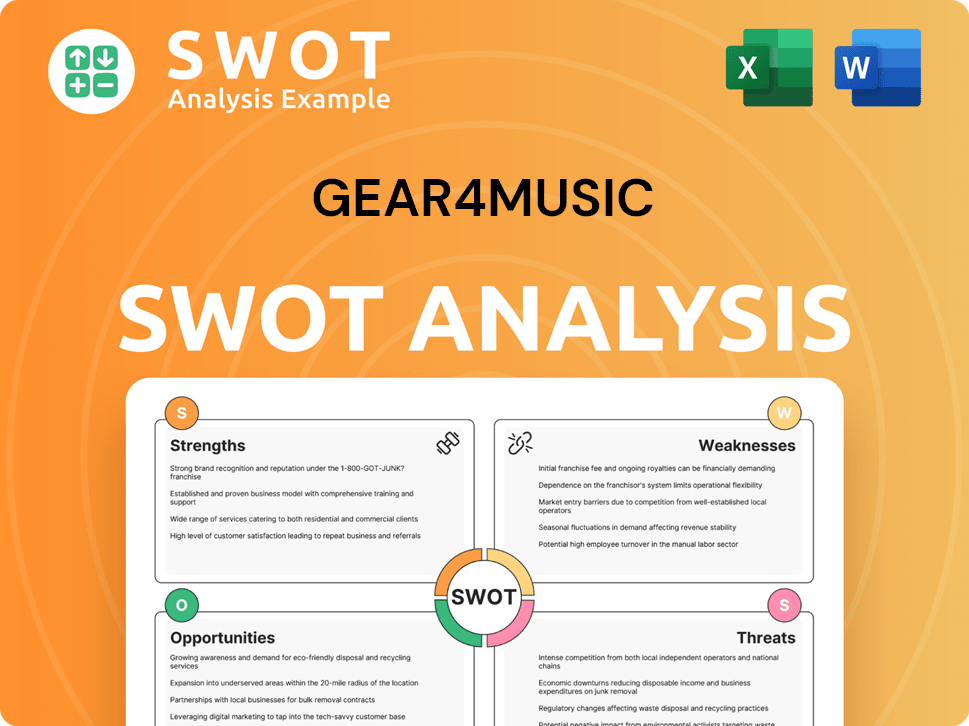

Gear4Music SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Gear4Music Invest in Innovation?

The Gear4music growth strategy heavily relies on continuous investment in innovation and technology. This approach is crucial for maintaining a competitive edge in the dynamic music retailer market. The company's focus on technological advancements is designed to enhance the customer experience and streamline operations.

A key element of Gear4music's future prospects is its proprietary e-commerce platform. This platform, which has been developed over two decades, supports multilingual and multicurrency transactions across websites localized for 19 countries. The ongoing development of this platform is central to the company's strategy.

The company's commitment to technological advancement is evident in its AI initiatives and the expansion of its digital capabilities. These efforts aim to drive efficiencies, improve customer engagement, and support the company's sustained growth objectives. For a deeper understanding of the company's origins, you can read a Brief History of Gear4Music.

The e-commerce platform is a core element of Gear4music's e-commerce strategy. Continuous improvements are being made to enhance user experience and backend systems.

AI is being integrated across the business to improve customer service and marketing. An AI chatbot for customer service has been launched.

AI marketing tools are in use, with initial challenges resolved in the first half of FY25. An AI Forecasting & Purchasing Platform is planned for deployment by Spring 2025.

The company is expanding its digital capabilities, including tools for second-hand and digital download sales. This reflects a broader digital transformation agenda.

A dedicated in-house team of 32 developers is supported by external contractors for specific projects. This hybrid approach supports R&D and development efforts.

Technological advancements are designed to drive efficiencies and improve the customer proposition. These improvements contribute to the company's sustained growth objectives.

The company's technology strategy includes several key initiatives aimed at enhancing its operational capabilities and market reach. These initiatives are designed to drive Gear4music revenue growth drivers and strengthen its position in the online musical instrument sales market.

- Continuous updates to the e-commerce platform, including UX upgrades.

- Implementation of AI-driven tools for customer service and marketing.

- Development of an AI Forecasting & Purchasing Platform.

- Expansion of digital capabilities, such as tools for second-hand sales.

- Maintenance of a dedicated in-house development team.

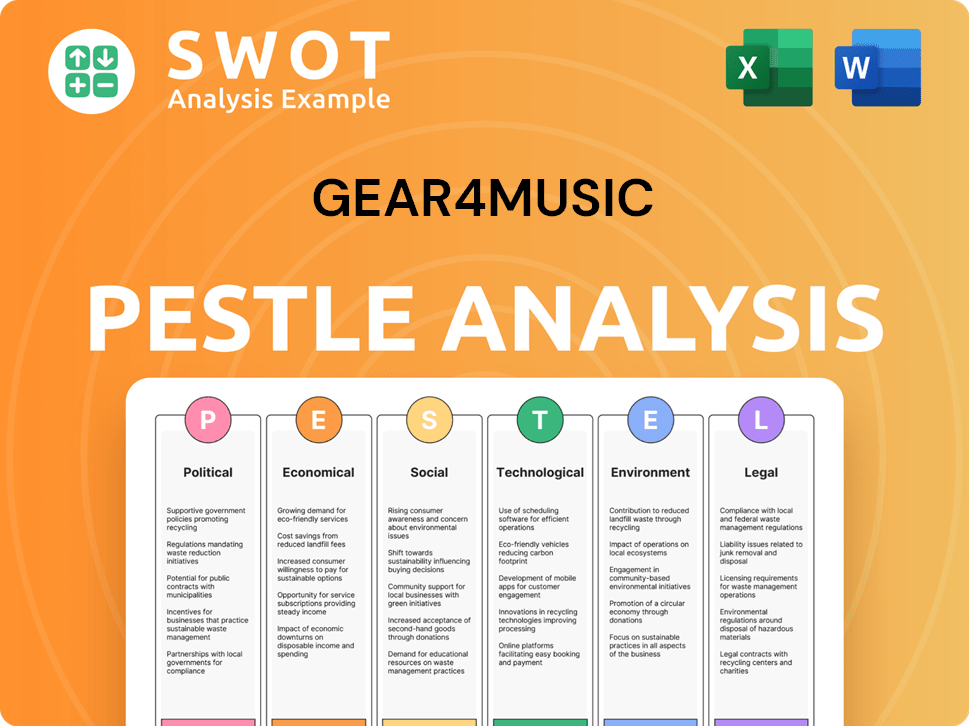

Gear4Music PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Gear4Music’s Growth Forecast?

The financial outlook for Gear4music anticipates a strategic shift towards profitable growth, building on recent improvements. The company's financial performance is poised for positive developments in the coming years. This outlook is supported by strategic initiatives aimed at enhancing revenue and profitability.

For the fiscal year ending March 31, 2025 (FY25), the company projects total sales to reach £146.7 million, reflecting a 2% increase from £144.4 million in FY24. This growth is driven by a focus on key markets and strategic initiatives. The company's financial strategy emphasizes sustainable expansion and enhanced shareholder value.

Gear4music's performance is influenced by its geographical market presence. The UK market is expected to show robust growth, with sales increasing by 9% to £90.2 million in FY25. However, European and Rest of the World sales are expected to decline by 8% to £56.5 million, reflecting competitive pressures. Understanding the Target Market of Gear4Music is crucial for analyzing its financial performance.

EBITDA is expected to reach £10.0 million, up from £9.4 million in FY24. Profit Before Tax (PBT) is projected to significantly improve to £1.6 million, compared to £0.6 million in FY24. The gross margin is expected to be 27.1% for FY25.

Net bank debt is expected to decrease to £6.4 million by March 31, 2025, down from £7.3 million at the end of March 2024. This reduction in net debt translates into a leverage of 0.6 times FY25 EBITDA.

Current consensus forecasts for FY26 predict revenues of £153.8 million. EBITDA is expected to be £10.9 million, and profit before tax is projected at £2.65 million.

Gear4music's continued profitable growth will be driven by its revised growth strategy. This includes investments in new own-brand products, expanded second-hand offerings, and enhanced e-commerce platform.

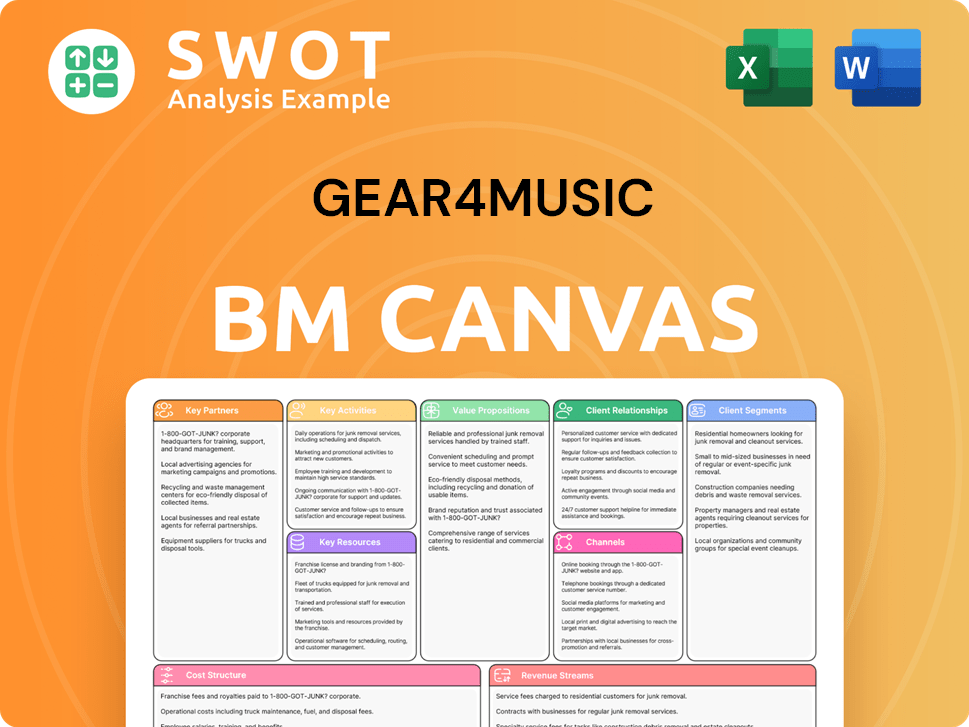

Gear4Music Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Gear4Music’s Growth?

The Gear4music growth strategy faces several risks, primarily stemming from market competition and fluctuating consumer confidence. A key challenge is the aggressive discounting by competitors, which has impacted financial performance. However, market consolidation, such as acquisitions and insolvencies, may alleviate these pressures.

Weak consumer confidence presents an ongoing obstacle, requiring the company to prioritize cost control. Technological disruptions, including the implementation of new systems, also pose risks, as seen with the initial challenges of the AI-based marketing system. Addressing these issues is crucial for maintaining Gear4music financial performance.

Supply chain vulnerabilities and the effective implementation of new systems are also key considerations. The company's ability to adapt to market changes, such as shifts in the competitive landscape, is crucial for its Gear4music future prospects. Furthermore, a significant net debt reduction strengthens its financial resilience against unforeseen obstacles.

Aggressive discounting from underperforming competitors, both in the UK and Europe, has subdued financial performance. Recent market consolidation, including asset acquisitions and insolvencies, indicates a potential easing of these competitive pressures. Understanding the Gear4music competitive landscape is vital for strategic planning.

Weak consumer confidence remains an ongoing obstacle. The company addresses this by prioritizing cost control and improving gross margins, which has resulted in increased EBITDA and improved profit before tax. This proactive approach is essential for navigating economic uncertainty and ensuring positive Gear4music revenue growth drivers.

The rollout of a new AI-based marketing system initially caused challenges, temporarily increasing marketing costs. These issues have since been resolved, and marketing investments have stabilized. Successful implementation of technology is crucial for Gear4music e-commerce strategy and overall performance.

Supply chain vulnerabilities, while not explicitly detailed, are an inherent risk for a retailer sourcing from over a thousand manufacturers. Mitigating these risks involves a focus on expanding the own-brand portfolio and second-hand offerings. Effective supply chain management is a key aspect of Gear4music product portfolio analysis.

Management's proactive approach to risk is evident in their ongoing strategic review and ability to adapt to market changes. The company's significant net debt reduction also strengthens its financial resilience. This adaptability is critical for achieving Gear4music investment potential.

The company's net debt reduction strengthens financial resilience against unforeseen obstacles. Focusing on cost control and margin improvement has resulted in increased EBITDA and improved profit before tax, despite revenue fluctuations. This solid financial footing is crucial for Gear4music expansion plans 2024 and beyond.

The music retailer market is subject to rapid changes. The ability to navigate economic uncertainty and adapt to shifts in the competitive landscape is crucial for success. The company's proactive risk management and strategic review processes are essential for long-term viability. For a deeper understanding of the competitive environment, check out our analysis of the Competitors Landscape of Gear4Music.

The successful implementation of new systems and mitigation of supply chain vulnerabilities are critical for operational efficiency. Addressing these challenges requires a focus on technology, supply chain diversification, and robust risk management. Managing these operational aspects is crucial for achieving sustainable Gear4music profitability analysis.

Prioritizing cost control and improving gross margins are key strategic initiatives. Expanding the own-brand portfolio and second-hand offerings can provide diversification. These initiatives are designed to enhance Gear4music online sales trends and overall financial performance.

Despite revenue fluctuations, the company has increased EBITDA and improved profit before tax. Significant net debt reduction strengthens financial resilience. These financial metrics indicate the company's ability to manage risks effectively and maintain a positive trajectory. These financial strategies are key to Gear4music stock performance review.

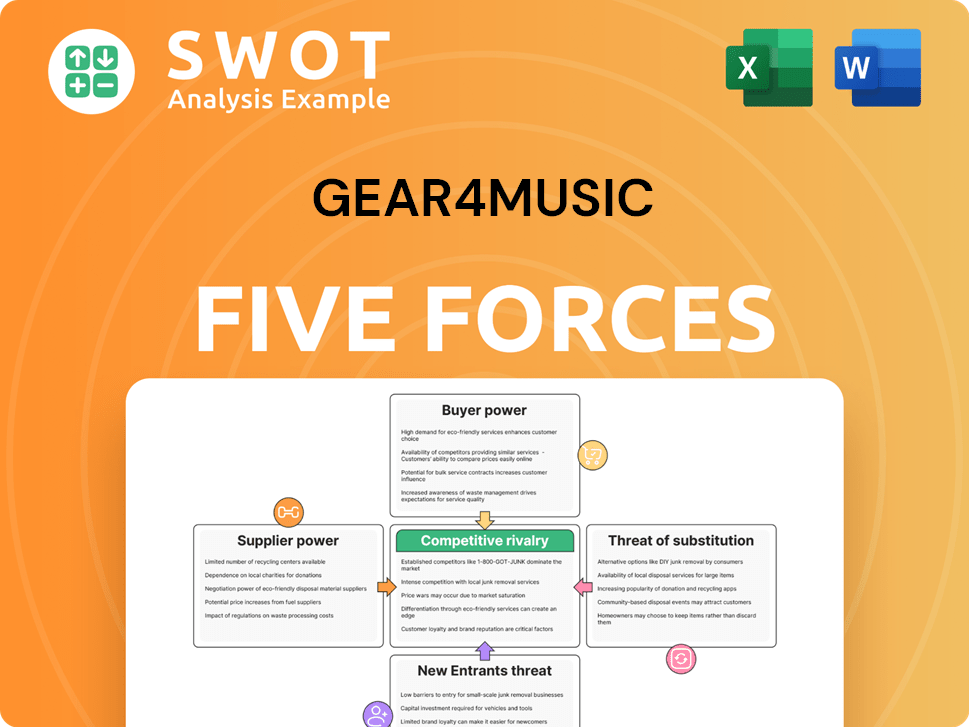

Gear4Music Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gear4Music Company?

- What is Competitive Landscape of Gear4Music Company?

- How Does Gear4Music Company Work?

- What is Sales and Marketing Strategy of Gear4Music Company?

- What is Brief History of Gear4Music Company?

- Who Owns Gear4Music Company?

- What is Customer Demographics and Target Market of Gear4Music Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.