GigaCloud Technology Bundle

Can GigaCloud Technology Conquer the B2B E-commerce Realm?

GigaCloud Technology Inc. has swiftly become a major player in the B2B e-commerce sector, specifically targeting the complex world of large parcel merchandise. Having surpassed $1 billion in annual revenue in 2024, the company's impressive growth trajectory demands a close examination of its standing within the GigaCloud Technology SWOT Analysis competitive landscape. This analysis is essential for understanding its market position and future prospects.

This exploration will dissect GigaCloud Technology's competitive advantages, revealing how it differentiates itself in the technology industry analysis. We'll identify its main rivals and assess its market share within the evolving cloud computing market. Understanding the GigaCloud Technology SWOT analysis is crucial for investors and strategists alike, providing insights into challenges and opportunities that will shape GigaCloud Technology's future outlook and growth strategies.

Where Does GigaCloud Technology’ Stand in the Current Market?

GigaCloud Technology specializes in the large parcel B2B e-commerce sector, acting as a crucial link between Asian manufacturers and resellers across the U.S., Europe, and Asia. Its core business revolves around facilitating product discovery, transactions, and logistics for bulky items like furniture and home goods through its B2B marketplace platform. This model allows the company to efficiently manage the complexities of large-item shipping and distribution, a significant advantage in the competitive landscape.

The company's value proposition lies in its ability to streamline the B2B e-commerce process for large items. By providing a comprehensive platform that handles everything from product listings to final delivery, GigaCloud Technology simplifies the supply chain for both manufacturers and resellers. This integrated approach reduces the operational burdens and costs associated with traditional methods, making it an attractive option for businesses in the technology industry analysis.

In 2024, GigaCloud Technology surpassed $1 billion in annual revenues, reaching $1,161.0 million, marking a 65.0% year-over-year increase. For the first quarter of 2025, revenue grew by 8.3% year-over-year to $271.9 million. The GigaCloud Marketplace GMV also saw substantial growth, increasing by 56.1% year-over-year to $1,416.7 million for the twelve months ending March 31, 2025. These figures highlight the company's strong market position.

The company's active buyer base increased significantly, with 9,966 active buyers as of March 31, 2025, up from 9,306 for the twelve months ended December 31, 2024. The number of active 3P sellers also rose to 1,154 for the twelve months ended March 31, 2025. GigaCloud's expansion into Europe has been particularly successful, with GMV in that region increasing over 80% in Q1 2025 and 155% in 2024, demonstrating its effective growth strategies.

GigaCloud Technology reported a gross profit of $285.2 million in 2024, a 51.2% increase year-over-year. However, gross margin decreased to 22.0% in Q4 2024 and 23.4% in Q1 2025, indicating potential challenges. Despite these margin pressures, the company maintains a strong financial position with $303.1 million in cash as of December 31, 2024, and a debt-free balance sheet, reflecting its strong operational efficiency.

The average spend per active buyer was $144,142 for the twelve months ended December 31, 2024. The company's return on equity (ROE) is 35.5%, which is a strong indicator of its profitability and efficiency. North America contributed 67% of total revenue in 2022, while Asia contributed 33%, demonstrating the geographical distribution of its market share GigaCloud.

GigaCloud Technology's competitive advantages include its specialized focus on large parcel B2B e-commerce and its integrated platform that simplifies logistics. However, the company faces challenges such as margin pressures and competition within the technology industry.

- Strong market position in a niche sector.

- Integrated platform for transactions and logistics.

- Geographic expansion, particularly in Europe.

- Margin pressures and increasing operational costs.

- Competition in the e-commerce and cloud computing market.

- Need to maintain profitability while expanding.

For more insights into the company's strategic direction, consider reading about the Growth Strategy of GigaCloud Technology.

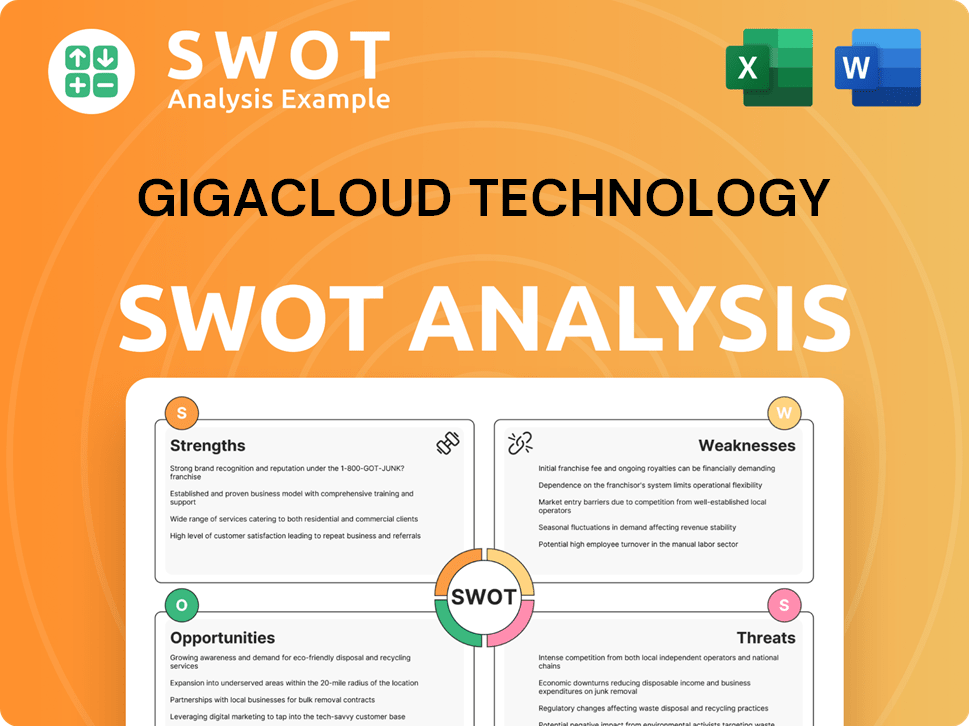

GigaCloud Technology SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging GigaCloud Technology?

The Competitive Landscape for GigaCloud Technology involves a diverse range of competitors across the retail and logistics sectors. The company, specializing in large parcel B2B e-commerce, faces challenges from both direct and indirect rivals. Understanding these competitors is crucial for assessing GigaCloud's market position and strategic opportunities.

GigaCloud Technology's competitors span various segments, including general e-commerce platforms, specialized logistics providers, and traditional retailers. These entities compete through brand recognition, customer base, product offerings, pricing, and specialized services. The dynamic nature of the e-commerce sector necessitates continuous innovation to maintain a competitive edge, with new players and technological advancements constantly reshaping the market.

The competitive environment is also influenced by mergers, acquisitions, and strategic alliances among competitors, potentially leading to larger, more integrated rivals. To gain a deeper understanding of the company, consider reading Owners & Shareholders of GigaCloud Technology.

Direct competitors for GigaCloud Technology include companies that offer similar B2B e-commerce solutions, particularly those focused on large parcel or furniture sales. These competitors often compete on price, service quality, and geographical reach.

Indirect competitors include traditional retailers and broader e-commerce platforms that may sell similar products but operate under different business models. Logistics providers that offer services relevant to GigaCloud's operations also fall into this category.

Key players in the retail sector that compete with GigaCloud include Academy Sports and Outdoors (ASO), Cosan (CSAN), Camping World (CWH), Victoria's Secret & Co. (VSCO), Savers Value Village (SVV), Revolve Group (RVLV), Guardian Pharmacy Services (GRDN), Grocery Outlet (GO), Suburban Propane Partners (SPH), and Arhaus (ARHS).

In the logistics management solutions for e-commerce businesses, top competitors include Delhivery, Shadowfax, and XpressBees. These companies compete based on speed, cost, and specialized services.

GigaCloud Technology's competitive advantages may include its focus on large parcel B2B e-commerce, its established relationships with suppliers, and its logistics capabilities. These factors help it differentiate itself from competitors.

Market trends such as the growth of e-commerce, increasing demand for furniture and large items, and the need for efficient logistics solutions are shaping the competitive landscape. GigaCloud needs to adapt to these trends to remain competitive.

GigaCloud faces challenges from established retailers with strong brand recognition and diversified product offerings. Logistics companies may compete on price and service speed. New entrants and technological advancements can disrupt the market.

- Market Share: GigaCloud Technology needs to analyze its market share relative to competitors like Amazon, Wayfair, and other B2B platforms.

- Financial Performance: Comparing GigaCloud's financial performance (revenue, profit margins) with competitors provides insights into its competitive position.

- Growth Strategies: GigaCloud can focus on expanding its product offerings, improving logistics efficiency, and entering new geographic markets to gain a competitive edge.

- Technological Advancements: Investing in technology to improve supply chain management and customer experience can help GigaCloud stay competitive.

- Strategic Partnerships: Forming alliances with suppliers, retailers, and logistics providers can strengthen GigaCloud's market position.

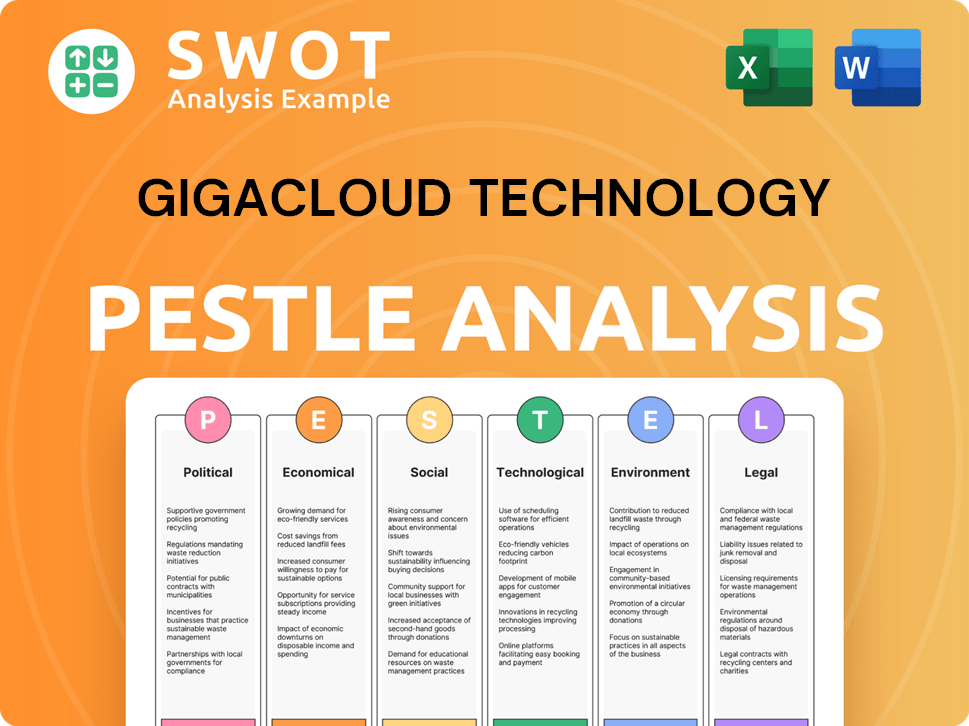

GigaCloud Technology PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives GigaCloud Technology a Competitive Edge Over Its Rivals?

The competitive landscape for GigaCloud Technology is shaped by its unique business model and operational strengths. The company's 'supplier-fulfilled retailing' (SFR) model is a key differentiator, allowing suppliers to ship directly to consumers, which reduces costs and streamlines the supply chain. This approach enhances efficiency and scalability for both sellers and buyers on the platform, setting it apart in the technology industry analysis.

GigaCloud's extensive logistics network, including a substantial fulfillment center footprint, is another significant advantage. As of March 31, 2025, the company operated 35 fulfillment centers across five countries, totaling over 10.5 million square feet of space. This infrastructure supports competitive ocean freight, warehousing, and fulfillment, offering fixed-price, door-to-door logistics for large parcel merchandise. This integrated solution is difficult for new entrants to replicate, providing a strong market position analysis.

Proprietary technologies and operational efficiencies further enhance GigaCloud's competitive edge. Recent upgrades have decreased operational costs by approximately 15%. The company's proprietary technology is also noted for reducing downtime by 30% compared to industry norms, attracting more clients. These advantages support the company's growth and are leveraged in its marketing and strategic partnerships, although sustained imitation or industry shifts could pose threats.

The SFR model allows suppliers to ship directly to end consumers, eliminating the need for retailers to hold inventory. This reduces costs and streamlines the supply chain, enhancing efficiency. This model significantly reduces costs and streamlines the supply chain, offering increased efficiency, flexibility, and scalability.

GigaCloud operates 35 fulfillment centers across five countries, totaling over 10.5 million square feet of space. This network supports competitive ocean freight, warehousing, and fulfillment. This integrated, end-to-end solution for large parcel delivery is difficult for new entrants to replicate.

GigaCloud leverages AI-driven analytics and automation to improve customer experience and drive efficiency. Recent upgrades have decreased operational costs by approximately 15%. Proprietary technology reduces downtime by 30% compared to industry norms.

Founder Larry Wu's relationships with manufacturers in China and Southeast Asia provide access to reliable, low-cost, and high-quality suppliers. This ensures a consistent supply of goods for buyers on the platform. These relationships are a key factor in GigaCloud's competitive advantages.

GigaCloud Technology's competitive advantages stem from its innovative business model, extensive logistics network, and proprietary technologies. These elements combine to create a strong market position, as highlighted in the Growth Strategy of GigaCloud Technology. The company's focus on customer satisfaction and operational efficiency further enhances its competitive edge.

- Supplier-Fulfilled Retailing (SFR) model eliminates the need for retailers to hold inventory.

- A vast logistics network, including 35 fulfillment centers, supports efficient delivery.

- Proprietary technologies reduce operational costs and downtime.

- Strong supplier relationships ensure access to reliable, low-cost manufacturers.

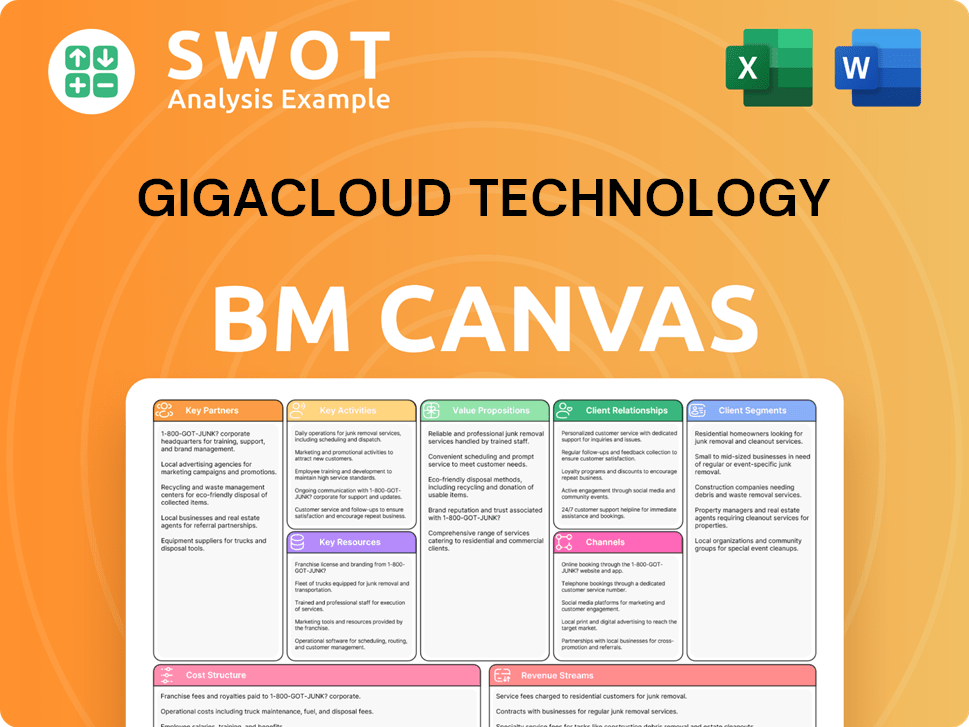

GigaCloud Technology Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping GigaCloud Technology’s Competitive Landscape?

The competitive landscape for GigaCloud Technology is shaped by industry trends, technological advancements, and economic shifts. The increasing digitization of B2B commerce and the demand for efficient logistics for large items present both challenges and opportunities for GigaCloud. Understanding the GigaCloud Technology competitive landscape is crucial for investors and stakeholders.

GigaCloud Technology faces challenges like margin pressures and macroeconomic conditions, yet it also has opportunities for growth through international expansion and strategic investments. The company's ability to navigate these dynamics will determine its future success in the cloud computing market and the broader technology industry analysis.

Technological advancements, particularly in AI and automation, offer opportunities for operational optimization. The trend towards expanding product categories beyond furniture presents a growth opportunity. The increasing digitization of B2B commerce is a key trend.

Margin pressures from rising logistics costs and competitive pricing impact profitability. Macroeconomic conditions and potential declines in the U.S. market could affect performance. Geopolitical tensions and ongoing securities litigation also pose risks. The GigaCloud competitors are also a factor.

Strategic expansion into international markets, especially Europe, shows significant GMV growth. Potential mergers and acquisitions in European infrastructure could accelerate business reach. A strong cash position supports future growth investments. Read more about the Target Market of GigaCloud Technology.

GigaCloud had a strong cash position of $303.1 million as of December 31, 2024. The company's strategic initiatives include core business optimization and technology enhancement. GMV in Europe grew by 155% in 2024.

GigaCloud Technology's strategic initiatives are aimed at sustaining its competitive position and driving long-term value. These initiatives include core business optimization, service offerings elevation, and technology enhancement. The company is focused on expanding its market share and improving its financial performance.

- Core business optimization to improve efficiency.

- Service offerings elevation to enhance customer experience.

- Technology enhancement to drive innovation.

- Strategic expansion in international markets.

GigaCloud Technology Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of GigaCloud Technology Company?

- What is Growth Strategy and Future Prospects of GigaCloud Technology Company?

- How Does GigaCloud Technology Company Work?

- What is Sales and Marketing Strategy of GigaCloud Technology Company?

- What is Brief History of GigaCloud Technology Company?

- Who Owns GigaCloud Technology Company?

- What is Customer Demographics and Target Market of GigaCloud Technology Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.