Global Industrial Bundle

How Does Global Industrial Company Stack Up in Today's Market?

The industrial supply sector is undergoing a massive transformation, and understanding the Global Industrial SWOT Analysis is crucial. Global Industrial Company, a key player since 1949, faces a dynamic competitive landscape shaped by e-commerce and evolving supply chains. This report dives deep into the industrial market analysis to uncover the strategies and challenges shaping its future.

From its origins as a regional supplier, Global Industrial Company has grown to become a significant force. This growth reflects its ability to adapt and compete within the evolving competitive landscape. This analysis will provide insights into its market position, key competitors, and the industry trends influencing its trajectory, helping to assess its potential for future growth and market share.

Where Does Global Industrial’ Stand in the Current Market?

The Global Industrial Company holds a significant market position within the industrial distribution sector. Its extensive product catalog and broad customer base are key strengths. While specific market share data for 2024-2025 is not publicly available, the company is consistently recognized as a major player, often ranking among the top distributors alongside larger competitors. This positions it well within the competitive landscape.

The company's core offerings include material handling equipment, storage solutions, safety supplies, and HVAC equipment. These products cater to a wide range of businesses, from small to large, across manufacturing, warehousing, construction, and commercial sectors. The company's geographic presence is primarily in North America, supported by a robust online platform that complements its physical distribution network. This multi-channel approach is crucial in today's evolving industrial market.

Over time, the company has strategically evolved its market position, with a strong emphasis on digital transformation. This includes enhancing its e-commerce capabilities to reach a broader audience, aligning with industry trends toward online sales. Financially, the company has shown resilience, with analysts noting consistent revenue streams and solid operational performance. As of early 2025, its financial health is considered stable, supporting ongoing investments in technology and infrastructure. This stability is essential for navigating the competitive landscape.

While specific market share figures for 2024-2025 are proprietary, the company consistently ranks among the top industrial distributors. This places it in a strong position within the competitive landscape. Its ability to maintain a strong market position is a key indicator of its success.

The company's primary product lines include material handling equipment, storage solutions, safety supplies, and HVAC equipment. These products serve businesses of all sizes across manufacturing, warehousing, construction, and commercial sectors. This diverse product portfolio supports its market position.

Its geographic presence is primarily in North America, with a robust online platform complementing its physical distribution network. This multi-channel approach allows it to serve customers effectively. The company's distribution network is a key component of its competitive advantage.

The company has demonstrated financial resilience, with analysts often noting its consistent revenue streams and solid operational performance. As of early 2025, its financial health is generally considered stable. This financial stability supports its ongoing investments.

The company's strategic focus on digital transformation, including enhanced e-commerce capabilities, is crucial for maintaining its competitive edge. This adaptation to industry trends, combined with a strong financial foundation, supports its market position. For more insights, you can read a Brief History of Global Industrial.

- Strong product portfolio catering to diverse industrial needs.

- Robust online platform and physical distribution network.

- Financial stability supporting investments in technology and infrastructure.

- Focus on serving small to medium-sized businesses.

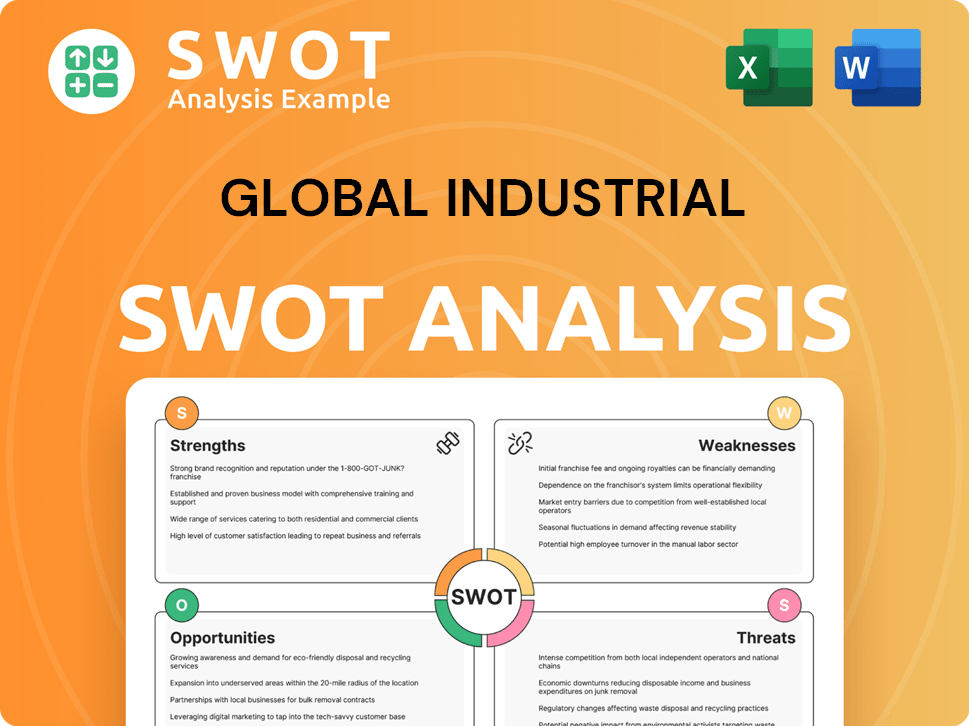

Global Industrial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Global Industrial?

The competitive landscape for a Global Industrial Company is complex, shaped by established giants and emerging specialists. The industrial market analysis reveals a dynamic environment where companies continuously vie for market share. Understanding the competitive landscape is crucial for strategic decision-making and sustained growth.

Key competitors challenge Global Industrial Company through various means, including pricing, delivery speed, and specialized solutions. This competitive pressure is intensified by industry trends such as the push for faster delivery times and the adoption of digital platforms. A comprehensive competitive analysis is essential to navigate these challenges effectively.

The competitive landscape analysis for a Global Industrial Company requires a deep dive into its key players and their strategies. Revenue Streams & Business Model of Global Industrial provides insights into how this company operates within this competitive environment.

Grainger is a major competitor due to its extensive product offerings and strong brand recognition. In 2024, Grainger reported net sales of approximately $16.8 billion, demonstrating its substantial market presence. Grainger's global reach and comprehensive service offerings pose a significant challenge.

McMaster-Carr competes through its vast inventory and rapid delivery capabilities. Known for its efficiency, McMaster-Carr provides unparalleled product availability. Their focus on logistical prowess and product breadth makes them a formidable competitor.

Fastenal challenges Global Industrial Company with its focus on vending solutions and on-site inventory management. Fastenal's integrated supply chain services and customer relationships are key competitive advantages. In 2024, Fastenal's net sales were around $7.2 billion, reflecting its strong market position.

Amazon Business, an indirect competitor, leverages its vast network to disrupt traditional distribution models. Amazon Business's entry into the industrial supply space has intensified competition. The platform's technological infrastructure and extensive reach are key factors.

Emerging players, specializing in niche product categories or digital experiences, contribute to the dynamic landscape. These companies often offer highly tailored solutions. Their agility and focus on specific market segments pose a challenge.

Mergers and alliances constantly reshape the competitive dynamics. Acquisitions by larger distributors to expand portfolios or geographic reach are common. These strategic moves impact market share and competitive positioning.

The industrial market analysis reveals several competitive strategies. Key factors include pricing, delivery speed, and specialized solutions. Understanding these strategies is essential for a Global Industrial Company to maintain its market position.

- Pricing Pressures: Intense competition often leads to price wars, impacting profit margins.

- Speed of Delivery: The demand for faster delivery times puts pressure on logistics and inventory management.

- Specialized Solutions: Offering tailored products and services can differentiate a company from its competitors.

- Digital Transformation: Leveraging technology to enhance customer experience and streamline operations is crucial.

- Supply Chain Management: Efficient supply chain management is vital for reducing costs and improving delivery times.

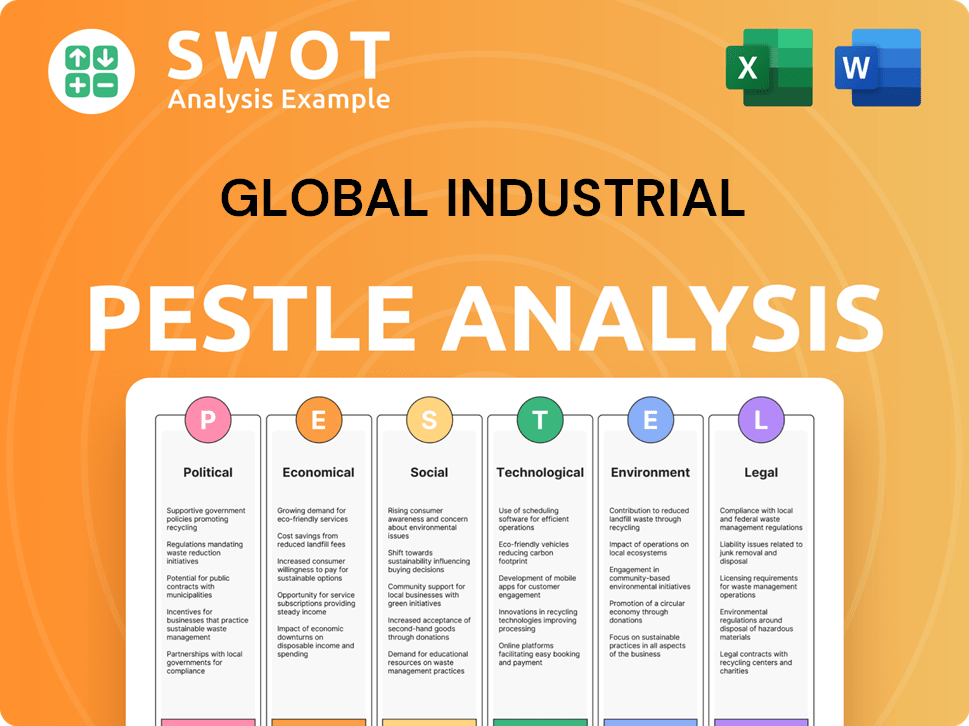

Global Industrial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Global Industrial a Competitive Edge Over Its Rivals?

The competitive landscape for a global industrial company is shaped by its ability to maintain a robust market position amidst fierce competition. Key milestones, strategic moves, and the competitive edge of companies like Global Industrial are crucial for understanding their success. An in-depth industrial market analysis reveals the strategies that enable these companies to thrive. This involves a close look at market share, industry trends, and a detailed competitive analysis.

Global Industrial distinguishes itself through several core competitive advantages. These advantages are critical in a market where companies constantly strive to gain an edge. The company's success is closely tied to its ability to adapt to the ever-changing dynamics of the industrial sector. Understanding these competitive advantages is essential for anyone looking to invest in or analyze the industrial market.

The company's extensive and diverse product catalog, offering over a million products across various categories, is a significant strength. This broad selection serves as a one-stop shop for businesses, enhancing customer convenience and loyalty. Coupled with this is a robust distribution network, strategically located to ensure efficient and timely delivery, which is critical in the industrial supply sector.

Global Industrial offers an extensive product catalog with over a million items. This vast selection caters to diverse industrial needs, making it a convenient choice for customers. The wide range boosts customer loyalty by providing a comprehensive shopping experience.

The company's distribution network is strategically positioned for efficient delivery. This ensures timely product availability, which is crucial in the industrial supply sector. Efficient logistics directly impact customer satisfaction and operational success.

The company's investment in its e-commerce platform provides a significant advantage. It offers a seamless online purchasing experience, catering to the growing preference for digital procurement. This enhances accessibility and convenience for customers.

The company benefits from strong brand equity developed over decades. This fosters trust and recognition among its customer base. Brand recognition is a key factor in customer loyalty and market share.

Further advantages include a focus on customer service and technical support. This contributes to customer retention and satisfaction. The company's ability to cater to a wide range of customer segments, from small businesses to large enterprises, allows for diversified revenue streams and reduces reliance on any single market. These advantages have evolved with technological advancements, as the company has leveraged data analytics to optimize inventory management and personalize customer interactions. For more information on the company's ownership and financial performance, you can read about Owners & Shareholders of Global Industrial.

- Customer Service and Technical Support: High-quality support enhances customer loyalty.

- Wide Customer Base: Serving both small and large businesses diversifies revenue.

- Data Analytics: Optimizing inventory and personalizing interactions with data.

- Market Share: The company's market share is a key indicator of its competitive position.

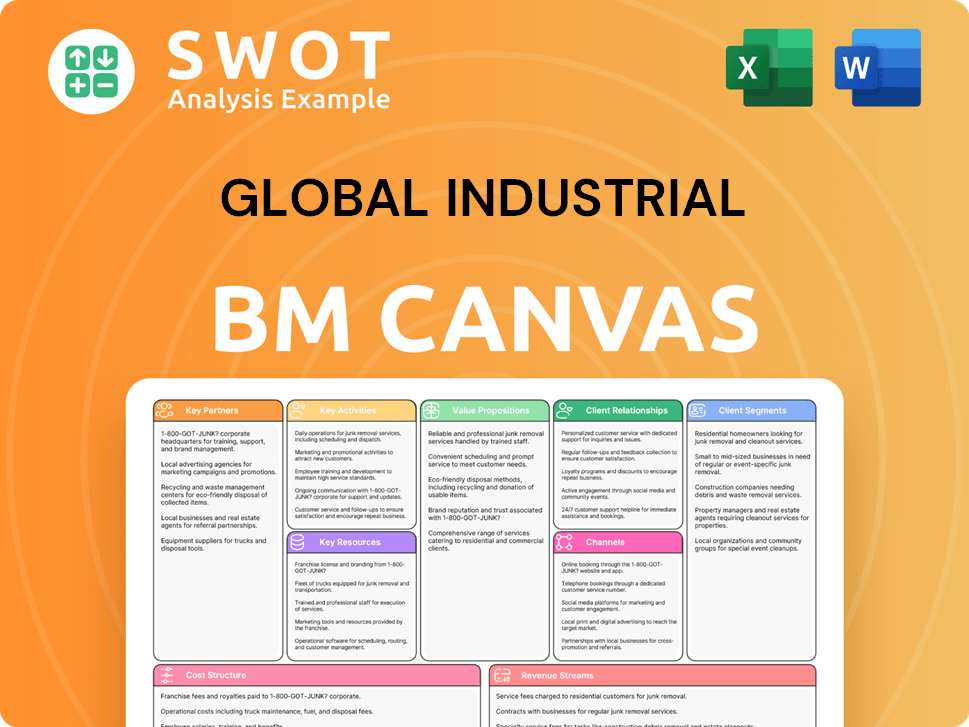

Global Industrial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Global Industrial’s Competitive Landscape?

The competitive landscape for a global industrial company is currently shaped by evolving industry trends, presenting both challenges and opportunities. These trends include the rise of e-commerce, the need for supply chain efficiency, and the growing focus on sustainability. Technological advancements, such as AI-driven inventory management, are also transforming operational paradigms. Understanding these dynamics is crucial for Global Industrial Company to maintain and improve its market position.

Several factors could impact Global Industrial Company's future. These include aggressive pricing strategies from competitors and potential economic downturns. The company must also address the challenge of attracting and retaining skilled labor in a competitive job market. However, opportunities exist in emerging markets and through the diversification of product offerings.

The industrial distribution sector is experiencing significant shifts. E-commerce is growing rapidly, with online sales in the industrial sector projected to reach $838 billion by 2025, according to a 2023 report by Digital Commerce 360. Supply chain efficiency is becoming more critical, driven by the need for faster delivery times and reduced costs. Sustainability is also gaining importance, with customers and regulators demanding environmentally friendly practices.

Several challenges could affect Global Industrial Company. Increased competition from online retailers and other distributors is a significant concern. Regulatory changes related to product safety and environmental standards also pose challenges. Economic downturns could decrease industrial demand. The labor market also presents difficulties, with a skills gap in areas like automation and digital technologies.

Several opportunities exist for Global Industrial Company. Emerging markets, with their growing industrialization, offer significant growth potential. Diversifying product offerings to cater to specialized industry needs can also drive growth. Strategic partnerships with technology providers or complementary businesses could unlock new avenues for efficiency and market expansion.

To remain competitive, Global Industrial Company is focusing on several key strategies. Enhancing digital capabilities, including e-commerce platforms and data analytics, is a priority. Optimizing the supply chain for resilience and speed is also crucial. Exploring new product categories to meet evolving customer needs is another important focus. Read more about the Growth Strategy of Global Industrial.

To thrive in the evolving industrial market, Global Industrial Company must adopt a multi-faceted approach. This includes a focus on digital transformation, supply chain optimization, and strategic partnerships.

- Investing in e-commerce platforms and digital marketing to enhance online presence.

- Implementing advanced analytics and AI to improve inventory management and predict demand.

- Forming strategic alliances with technology providers to offer innovative solutions.

- Expanding into emerging markets with high growth potential.

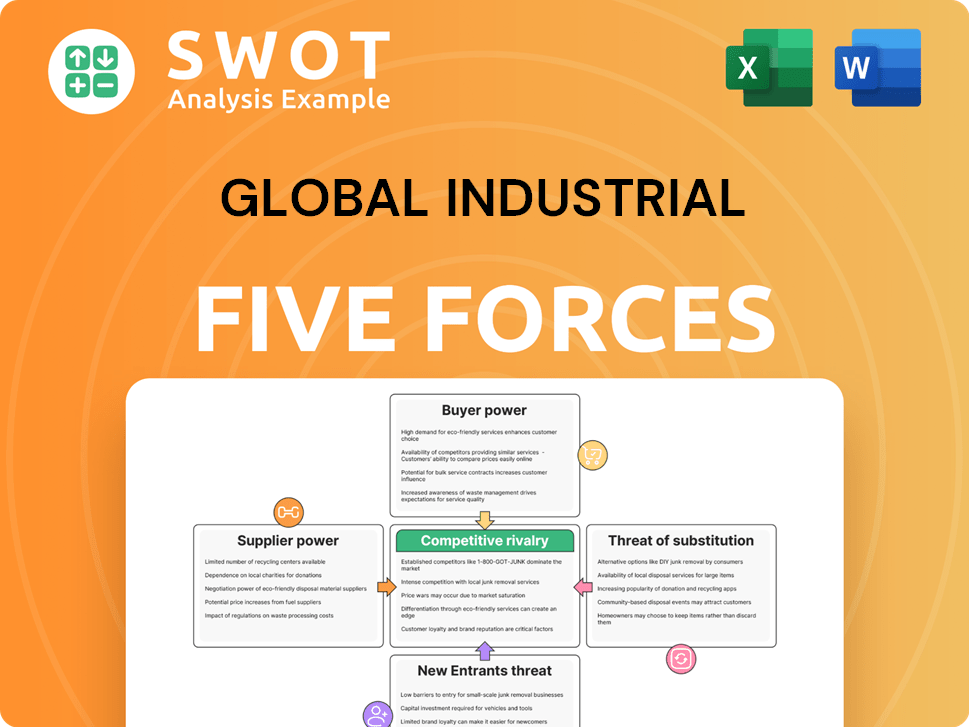

Global Industrial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Global Industrial Company?

- What is Growth Strategy and Future Prospects of Global Industrial Company?

- How Does Global Industrial Company Work?

- What is Sales and Marketing Strategy of Global Industrial Company?

- What is Brief History of Global Industrial Company?

- Who Owns Global Industrial Company?

- What is Customer Demographics and Target Market of Global Industrial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.