Guidewire Bundle

Can Guidewire Maintain Its Dominance in the Insurance Tech Arena?

The insurance industry is undergoing a digital revolution, and at the heart of this transformation lies core system modernization. Insurers are racing to boost efficiency, enhance customer experiences, and adapt to dynamic market pressures. Guidewire SWOT Analysis reveals the company's position, and its rivals in this evolving landscape.

This analysis dives deep into the Guidewire competitive landscape, providing a comprehensive Guidewire market analysis. We'll explore Guidewire competitors, evaluating their strengths and weaknesses within the insurance technology sector. Understanding the competitive dynamics is crucial for anyone seeking to make informed decisions in this rapidly changing environment, from investment strategies to business planning.

Where Does Guidewire’ Stand in the Current Market?

Guidewire maintains a strong market position within the P&C insurance software industry. It is a leader in providing comprehensive suites for policy, billing, and claims management. Guidewire's core systems offerings have established it as a key player, serving a global customer base and holding a significant market share.

The company's strategic focus on cloud solutions has allowed it to meet the growing demand for scalable and agile solutions. This strategic pivot has allowed the company to maintain its competitive edge and cater to insurers undergoing digital transformation. Guidewire's commitment to innovation and its ability to adapt to industry changes have solidified its position in the market.

Guidewire's primary product lines, including Guidewire InsuranceSuite and Guidewire Cloud Platform, cater to a wide array of P&C insurers. Its geographic presence is significant, with a strong foothold in North America, Europe, and Asia-Pacific. The company's financial health supports its continued investment in research and development and market expansion, as demonstrated by its 2023 revenue figures.

Guidewire is recognized as a leader in the P&C insurance software market. Gartner's 2023 Magic Quadrant for P&C Core Platforms positioned Guidewire as a Leader. This recognition highlights its completeness of vision and ability to execute within the Guidewire competitive landscape.

Guidewire offers a comprehensive suite of products, including InsuranceSuite, Cloud Platform, and Analytics. These solutions support policy administration, billing, claims management, and data analytics. Guidewire's product portfolio is designed to meet the diverse needs of P&C insurers, providing a robust platform for core insurance systems.

Guidewire has a substantial global presence, serving customers across North America, Europe, and Asia-Pacific. This broad geographic reach allows Guidewire to cater to a wide range of P&C insurers, including personal, commercial, and specialty lines. The company's international footprint is a key strength in the Guidewire market analysis.

Guidewire's financial performance reflects its strong market position. For fiscal year 2023, Guidewire reported total revenues of $903.4 million, marking a 9% year-over-year increase. This financial health supports ongoing investments in research and development and market expansion, as highlighted in the Growth Strategy of Guidewire.

Guidewire's strengths include its comprehensive product suite, strong market position, and global presence. The company's focus on cloud solutions and strategic partnerships further enhances its competitive advantage. These factors contribute to Guidewire's ability to serve a diverse customer base and drive innovation within the insurance technology sector.

- Leader in Gartner Magic Quadrant for P&C Core Platforms.

- Strong financial performance with revenue growth in 2023.

- Global presence with a significant market share.

- Strategic focus on cloud solutions.

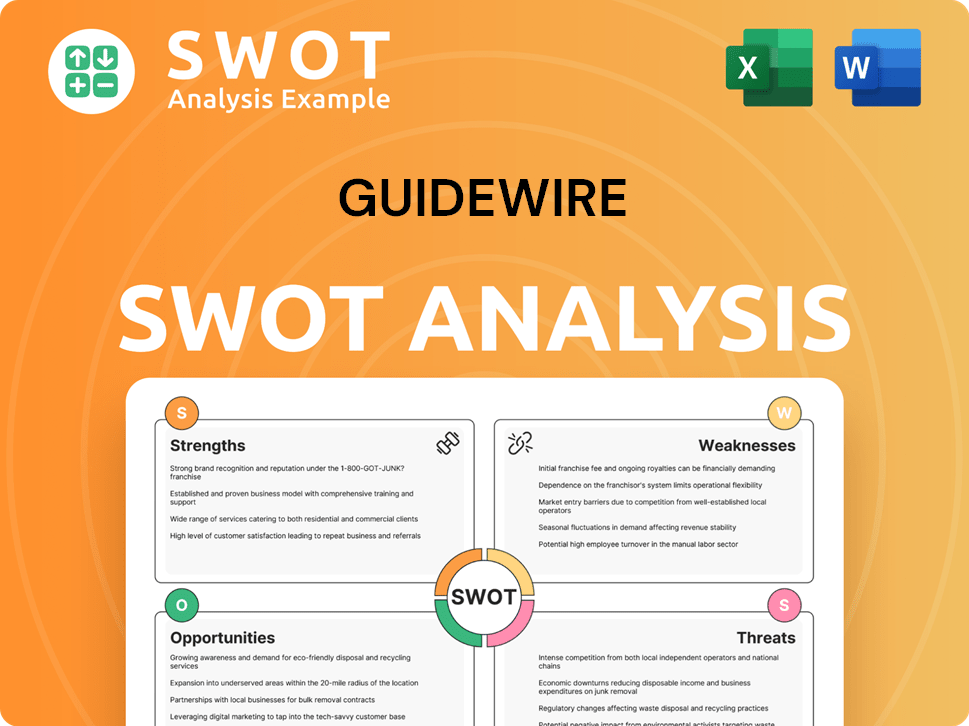

Guidewire SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Guidewire?

The Guidewire competitive landscape is shaped by a dynamic mix of established players and emerging challengers in the property and casualty (P&C) insurance software sector. Understanding the key competitors is crucial for any Guidewire market analysis. The competitive environment influences product development, pricing strategies, and market positioning, impacting the overall success of companies operating in this space.

The P&C insurance software market is highly competitive, with various vendors offering core insurance systems and related services. The competition extends beyond direct rivals to include indirect competitors and new entrants, all vying for market share. This competitive pressure drives innovation and influences the strategic decisions of all involved.

Direct competitors pose the most immediate challenges. These companies offer similar solutions and directly compete for the same customer base. Indirect competitors and emerging players also affect the landscape, introducing new technologies and business models that challenge established players.

Sapiens is a significant direct competitor, providing a comprehensive suite of insurance software solutions. They focus on a wide array of insurance lines and maintain a strong global presence. Sapiens competes with Guidewire across various segments of the P&C insurance market.

Verisk Analytics offers data analytics and underwriting solutions, but also provides core system capabilities that compete with Guidewire. Verisk's offerings are particularly relevant in claims and policy processing. Verisk's market position is strengthened by its data-driven approach and industry insights.

Duck Creek Technologies is a pure-play P&C insurance software provider, directly competing with Guidewire, especially in the cloud-native core systems space. Duck Creek often emphasizes its agility and configurable platform as key differentiators. They are a significant player in the insurance technology market.

Large enterprise software providers like SAP and Oracle offer modules that can compete with aspects of Guidewire's offerings. These are particularly relevant for larger insurers seeking integrated enterprise solutions. These companies have a broad reach across various industries.

A growing number of InsurTech startups are disrupting the traditional competitive landscape. They offer niche, innovative solutions often built on modern cloud architectures. These startups challenge established players with their speed and specialized functionalities. They are driving innovation in the insurance software vendors market.

Mergers and alliances, such as Sapiens' acquisitions, continually reshape competitive dynamics. These actions lead to intensified competition and the need for continuous innovation. The market is constantly evolving, with companies adapting to new challenges and opportunities.

Several factors drive competition within the P&C insurance software market, including product functionality, pricing, customer service, and technological innovation. Companies must continually invest in these areas to remain competitive. For a deeper dive into Guidewire's business model, consider reading Revenue Streams & Business Model of Guidewire.

- Product Features: The breadth and depth of features offered, including core systems, data analytics, and digital engagement tools.

- Cloud Capabilities: The ability to deliver solutions on the cloud, offering scalability, flexibility, and cost efficiency.

- Implementation and Support: The ease of implementation, training, and ongoing support provided to customers.

- Pricing Models: The cost-effectiveness of the software, including licensing fees, subscription models, and implementation costs.

- Customer Satisfaction: Positive customer reviews and high customer retention rates.

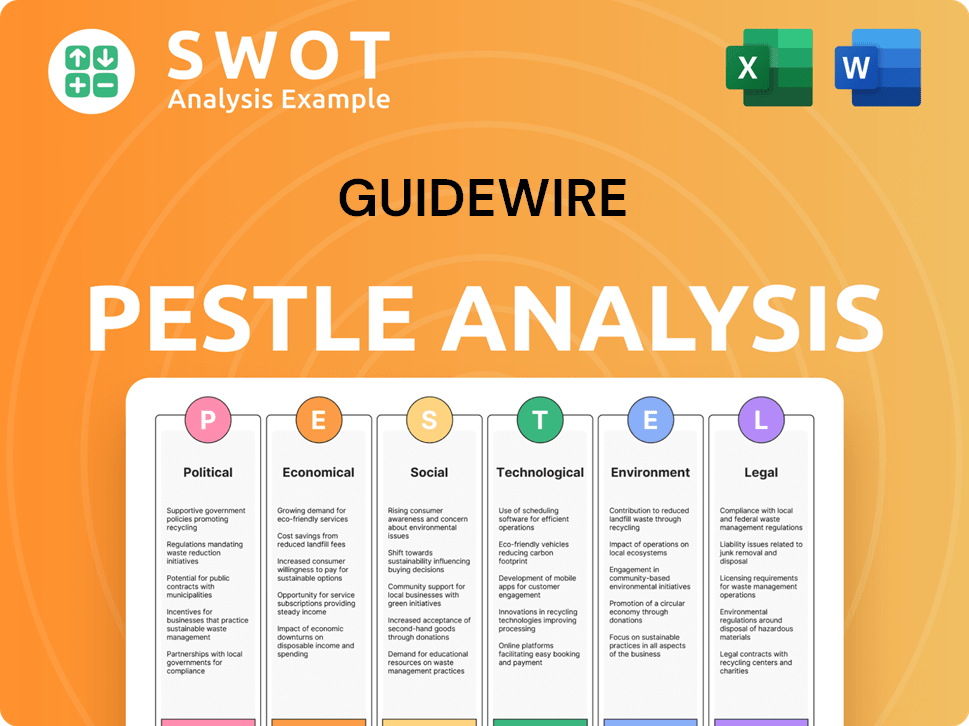

Guidewire PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Guidewire a Competitive Edge Over Its Rivals?

Understanding the Guidewire competitive landscape is crucial for anyone involved in the insurance technology sector. The company has established itself as a leader in the P&C insurance software market, and its competitive advantages are key to its success. Analyzing Guidewire competitors and the broader Guidewire market analysis provides valuable insights into the dynamics of the industry.

Guidewire's position is built on several core strengths. These include a comprehensive and integrated platform, deep domain expertise in the P&C insurance industry, and a robust ecosystem of partners. These elements collectively contribute to Guidewire's ability to maintain its leadership and drive innovation in the insurance software market. For those looking to understand the company's value, a review of Owners & Shareholders of Guidewire is essential.

Guidewire's strategy has evolved, particularly with its cloud-first approach. This shift has enhanced its competitive edge, enabling insurers to adapt more quickly to market changes. While facing competition from other insurance software vendors, Guidewire continues to invest in its platform and partnerships to maintain its market position.

Guidewire's InsuranceSuite provides a unified solution for policy, billing, and claims management. This integration streamlines workflows and reduces complexity for insurers. The platform's breadth and depth are significant advantages, especially when compared to point solutions offered by some core insurance systems providers.

Guidewire's profound understanding of the P&C insurance industry is a key differentiator. This expertise is embedded in its product design and functionality, making its solutions highly relevant to insurers. This industry-specific knowledge allows Guidewire to anticipate and address the evolving needs of its customers more effectively.

Guidewire has built a robust network of system integrators, solution partners, and a developer community. This ecosystem extends the capabilities of its platform and facilitates successful implementations. The strength of this network is critical for supporting customer success and driving platform adoption.

The move to a cloud-first model with Guidewire Cloud Platform offers scalability, flexibility, and accelerated innovation. This strategy allows insurers to adapt more quickly to market changes and leverage advanced analytics and AI capabilities. This focus on cloud technology is a key competitive advantage.

Guidewire's competitive advantages include its comprehensive platform, deep domain expertise, strong ecosystem, and cloud-first strategy. These factors enable it to maintain a leading position in the P&C insurance software market. The company's focus on innovation and customer success further strengthens its competitive edge.

- Comprehensive Platform: Integrated solutions for policy, billing, and claims.

- Domain Expertise: Deep understanding of P&C insurance processes and regulations.

- Strong Ecosystem: Extensive network of partners and developers.

- Cloud-First Strategy: Scalable, flexible, and innovative cloud platform.

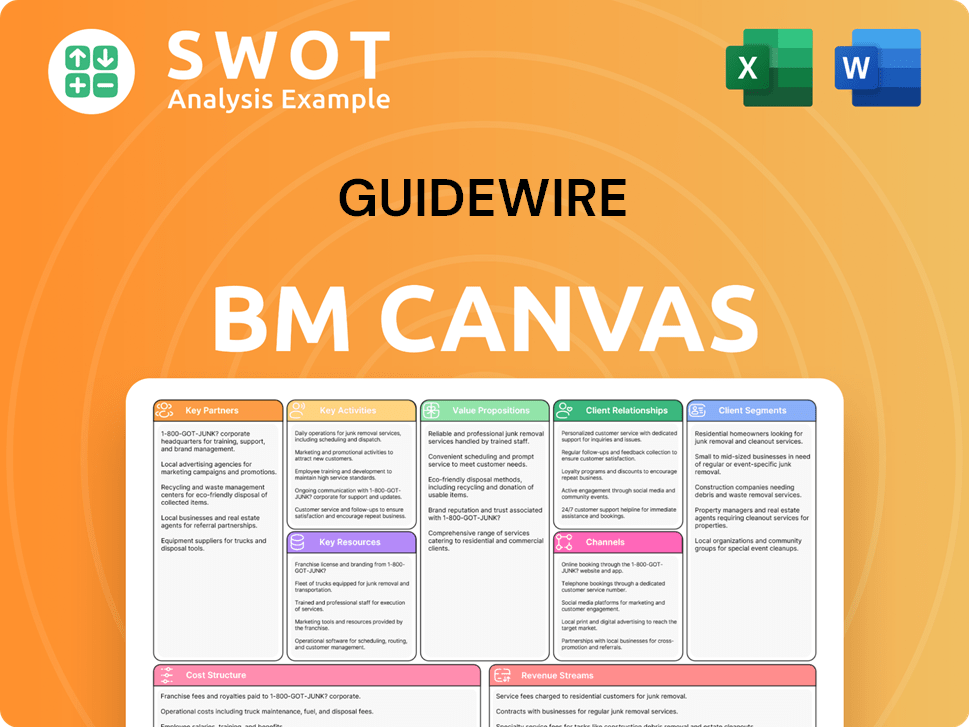

Guidewire Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Guidewire’s Competitive Landscape?

The P&C insurance industry is undergoing a significant transformation, driven by technological advancements and evolving customer expectations. This dynamic environment presents both challenges and opportunities for companies like Guidewire. Understanding the Guidewire competitive landscape is crucial for stakeholders, including investors and industry professionals, to make informed decisions.

Guidewire faces competition from various insurance software vendors, each vying for market share in a sector ripe with innovation. The company's future outlook hinges on its ability to adapt to these changes, leverage emerging technologies, and maintain a strong position in the market. For an in-depth look at the target audience, check out the Target Market of Guidewire.

Key trends include the adoption of AI, ML, and data analytics to improve underwriting and claims processing. Regulatory changes and consumer preferences for digital interactions are also reshaping the industry. Embedded insurance and ESG factors are gaining importance, driving the need for flexible and adaptable core insurance systems.

Challenges include competition from cloud-native competitors and the migration of existing customers to cloud solutions. Continuous innovation is essential to keep pace with rapid technological advancements. The ability to offer comprehensive, innovative solutions and navigate complex regulatory environments is also crucial.

Growth opportunities lie in expanding into emerging markets and further developing the cloud ecosystem. Strategic partnerships with InsurTechs can provide more comprehensive solutions. The platform-centric model, emphasizing open APIs and a marketplace, can help capture new market share in the dynamic P&C insurance sector.

Guidewire is likely to evolve towards a more platform-centric model, emphasizing open APIs and a marketplace of solutions. This approach aims to enhance its resilience and capture new market share. The company's ability to innovate and adapt will be key to its success in the future.

The Guidewire market analysis reveals a competitive landscape shaped by innovation and evolving customer demands. The company's cloud platform features and product suite overview are critical for insurers. The partner ecosystem plays a vital role in expanding its reach and capabilities.

- Guidewire competitors include Duck Creek Technologies, Majesco, and other top insurance software providers.

- Migration to the cloud continues to be a major focus, with cloud adoption rates in the insurance sector steadily increasing.

- Strategic partnerships and acquisitions, as seen in recent years, are essential for expanding service offerings and market reach.

- Regulatory changes, such as those related to data privacy and cybersecurity, impact the entire industry.

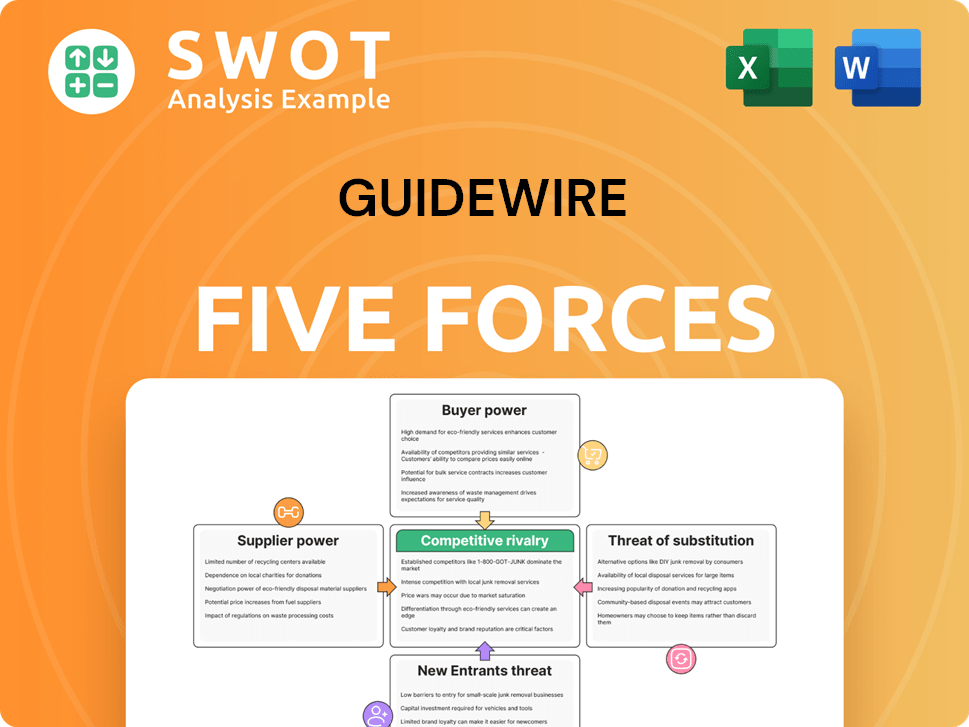

Guidewire Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guidewire Company?

- What is Growth Strategy and Future Prospects of Guidewire Company?

- How Does Guidewire Company Work?

- What is Sales and Marketing Strategy of Guidewire Company?

- What is Brief History of Guidewire Company?

- Who Owns Guidewire Company?

- What is Customer Demographics and Target Market of Guidewire Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.