Guidewire Bundle

How Does Guidewire Power the Insurance Industry?

Guidewire Software stands as a pivotal force in the insurance sector, offering a comprehensive software platform that's reshaping how property and casualty (P&C) insurers operate. With a robust financial performance, including a 9% year-over-year revenue increase to $243.6 million in the first quarter of fiscal year 2025, Guidewire's influence is undeniable. This growth highlights its critical role in enabling insurers to modernize and thrive.

Guidewire's Guidewire SWOT Analysis can help you understand the key competitive advantages. Its cloud-first approach, particularly the Guidewire Cloud Platform, is a game-changer, attracting insurers seeking agility. This deep dive into Guidewire's operations, value proposition, and monetization strategies will provide a comprehensive view of this enterprise software leader and how it's shaping the future of insurance, from its core systems to its data and analytics capabilities.

What Are the Key Operations Driving Guidewire’s Success?

The core operations of the company center on the development and delivery of its comprehensive software platform, which is specifically designed for property and casualty (P&C) insurance carriers. The company's primary value proposition is to enable insurers to modernize their core systems, enhance operational efficiency, improve customer engagement, and leverage data for better decision-making.

Its flagship offerings include the InsuranceSuite, which comprises PolicyCenter for underwriting and policy administration, BillingCenter for billing and accounts receivable, and ClaimCenter for claims management. Beyond these core applications, the company also provides data and analytics solutions, as well as a developer platform, DevConnect. The company's focus on providing a robust and adaptable platform has positioned it as a key player in the insurance technology space, helping carriers navigate the complexities of the modern insurance landscape.

The company's operations are unique due to its deep specialization in the P&C insurance domain and its commitment to a cloud-native architecture. This specialization allows the company to develop highly tailored solutions that address the complex regulatory and operational needs of insurers. Its core capabilities translate into significant customer benefits, such as accelerated product launches, streamlined claims processing, improved policyholder experiences, and enhanced data-driven insights, ultimately leading to market differentiation for its clients.

The Guidewire platform is a comprehensive suite of software solutions designed for property and casualty insurers. This includes core systems like PolicyCenter, BillingCenter, and ClaimCenter, which manage policy administration, billing, and claims. The platform also offers data and analytics tools to improve decision-making.

The core systems are the backbone of the company's offerings. PolicyCenter handles underwriting and policy management, BillingCenter manages billing processes, and ClaimCenter supports claims processing. These modules are designed to streamline operations and enhance efficiency for insurers.

The value proposition for insurers includes modernizing core systems, enhancing operational efficiency, and improving customer engagement. The platform enables insurers to leverage data for better decision-making and streamline processes. This leads to increased agility and better market outcomes.

The company has made a strategic shift towards a cloud-first model, with its Cloud Platform serving as the foundation for its solutions. This involves continuous innovation in cloud infrastructure, security, and scalability. This architecture provides flexibility and scalability to meet the needs of the insurance industry.

The operational processes involve extensive research and development, particularly in cloud technology. The company's supply chain includes internal software development teams, cloud infrastructure providers, and a network of system integrators and consulting partners. Sales channels are primarily direct, with a dedicated sales force engaging with insurance carriers globally.

- Cloud-First Strategy: The company prioritizes cloud-based solutions, enhancing scalability and flexibility.

- Specialized Focus: Deep expertise in the P&C insurance sector allows for tailored solutions.

- Partner Ecosystem: A strong network of partners supports implementation and customization.

- Customer Support: Dedicated support teams and a robust partner ecosystem provide comprehensive customer service.

The company's commitment to innovation and customer success is evident in its financial performance. For example, in fiscal year 2024, the company reported a significant increase in subscription revenue, demonstrating the growing adoption of its cloud-based solutions. Further insights into the company's financial health can be found in the analysis of Owners & Shareholders of Guidewire, which provides a detailed look at the company's performance and strategic direction.

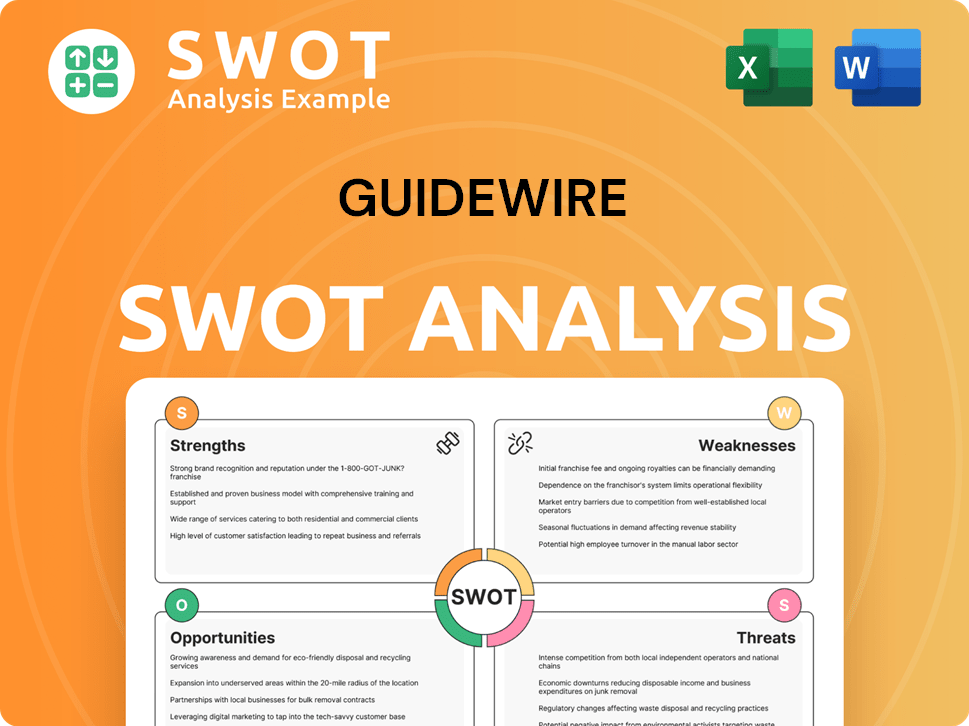

Guidewire SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Guidewire Make Money?

Understanding the revenue streams and monetization strategies of a company like Guidewire is crucial for investors and stakeholders. The company, a key player in the insurance technology space, has strategically evolved its business model to align with industry trends and customer needs. This evolution is particularly evident in its shift towards a subscription-based approach, which offers greater predictability and long-term value.

Guidewire generates revenue primarily through subscriptions, term licenses, and services. The company's focus on cloud-based solutions has significantly impacted its revenue mix, driving substantial growth in its subscription revenue. This strategic pivot is designed to foster deeper customer relationships and ensure recurring revenue streams.

In the first quarter of fiscal year 2025, Guidewire's subscription revenue reached $139.0 million, marking a significant 32% year-over-year increase. This growth highlights the success of its cloud migration strategy and the increasing adoption of its Guidewire Cloud Platform by property and casualty (P&C) insurers. The company's term license revenue, however, decreased by 52% year-over-year to $24.7 million in Q1 FY25, reflecting the transition to cloud subscriptions. Services revenue, which includes implementation and support, was $79.9 million in Q1 FY25, a decrease of 1% year-over-year.

Guidewire's monetization strategies center on its subscription model, offering tiered pricing based on usage, modules deployed, and the size of the insurance carrier. The company also employs cross-selling strategies to encourage existing customers to adopt additional products and modules within its InsuranceSuite. These strategies are designed to maximize customer lifetime value and drive sustainable revenue growth. For more insights into the company's strategic direction, consider reading about the Growth Strategy of Guidewire.

- Subscription Model: Tiered pricing based on usage, modules, and carrier size.

- Cross-selling: Encouraging adoption of additional products within InsuranceSuite.

- Cloud Transition: Focus on cloud-based solutions to drive subscription revenue.

- Services Revenue: Professional services for implementation and support.

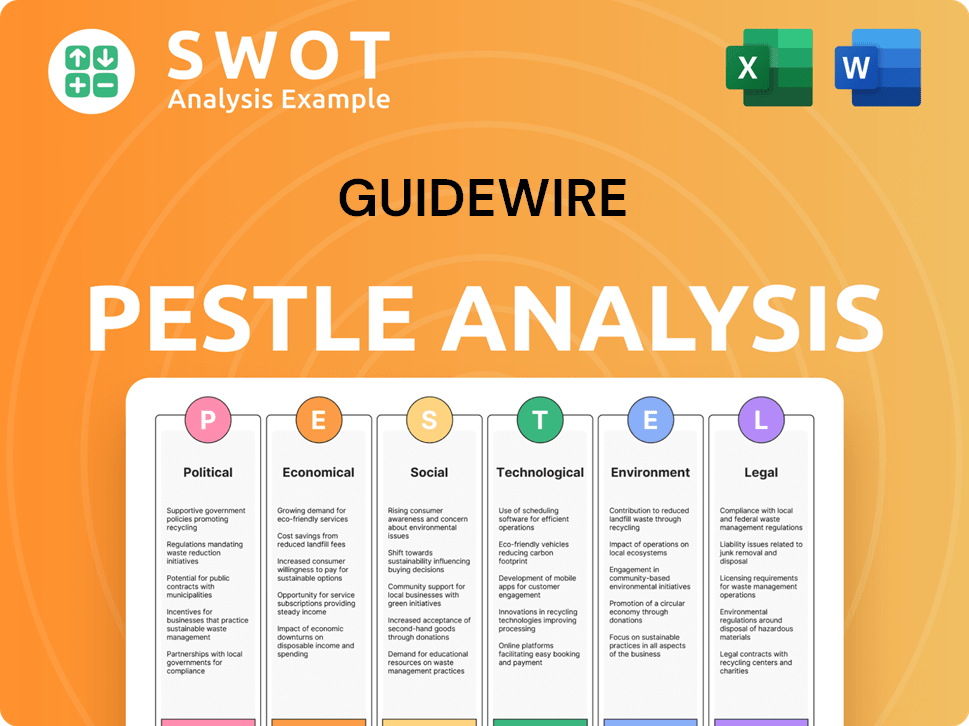

Guidewire PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Guidewire’s Business Model?

The journey of Guidewire has been marked by significant milestones and strategic shifts, particularly its aggressive move towards a cloud-first strategy. This transition has been pivotal in shaping its operations and financial performance. A key milestone was the widespread adoption and enhancement of the Guidewire Cloud Platform, which has become the cornerstone of its product delivery. This strategic move enables Guidewire to offer its comprehensive InsuranceSuite as a service, helping insurers reduce IT infrastructure costs and accelerate their digital transformation initiatives.

Guidewire's strategic moves have been instrumental in its growth. The company's continued investment in cloud innovation is evident in its strong subscription revenue growth, which increased by 32% year-over-year to $139.0 million in the first quarter of fiscal year 2025. This focus on cloud solutions has allowed Guidewire to stay competitive in the rapidly evolving insurance technology landscape. The company's ability to adapt and innovate has been crucial to its success.

Operational and market challenges have included the inherent complexity of migrating large, legacy insurance systems to the cloud, as well as intense competition from both established enterprise software vendors and emerging InsurTech companies. Guidewire has responded by investing heavily in research and development, forming strategic partnerships with cloud providers like Amazon Web Services (AWS) and Google Cloud, and expanding its ecosystem of system integrators. The company's approach to these challenges has been proactive and strategic.

The widespread adoption of the Guidewire Cloud Platform is a key milestone. This platform has become central to its product delivery, enabling insurers to reduce costs and accelerate digital transformation. The company's focus on cloud solutions has been critical for its success.

Guidewire's strategic moves include a cloud-first approach and investments in R&D. Partnerships with cloud providers like AWS and Google Cloud are also important. Expanding its ecosystem of system integrators has been another key strategy.

Guidewire's deep domain expertise in the P&C insurance sector provides a significant advantage. Technology leadership, particularly in cloud-native insurance software, is another key differentiator. The company's strong brand reputation creates a powerful network effect.

Subscription revenue growth increased by 32% year-over-year to $139.0 million in the first quarter of fiscal year 2025. This growth highlights the success of Guidewire's cloud-first strategy. The company's financial performance reflects its strategic initiatives.

Guidewire's competitive advantages are multifaceted, including deep domain expertise and technology leadership. Its extensive customer base and strong brand reputation also contribute to its success. The company continues to adapt to new trends such as artificial intelligence and machine learning.

- Deep Domain Expertise: Provides a significant barrier to entry for competitors.

- Technology Leadership: Particularly in cloud-native insurance software.

- Strong Brand Reputation: Creates a powerful network effect within the industry.

- Adaptation to New Trends: Integrating AI and machine learning for advanced analytics.

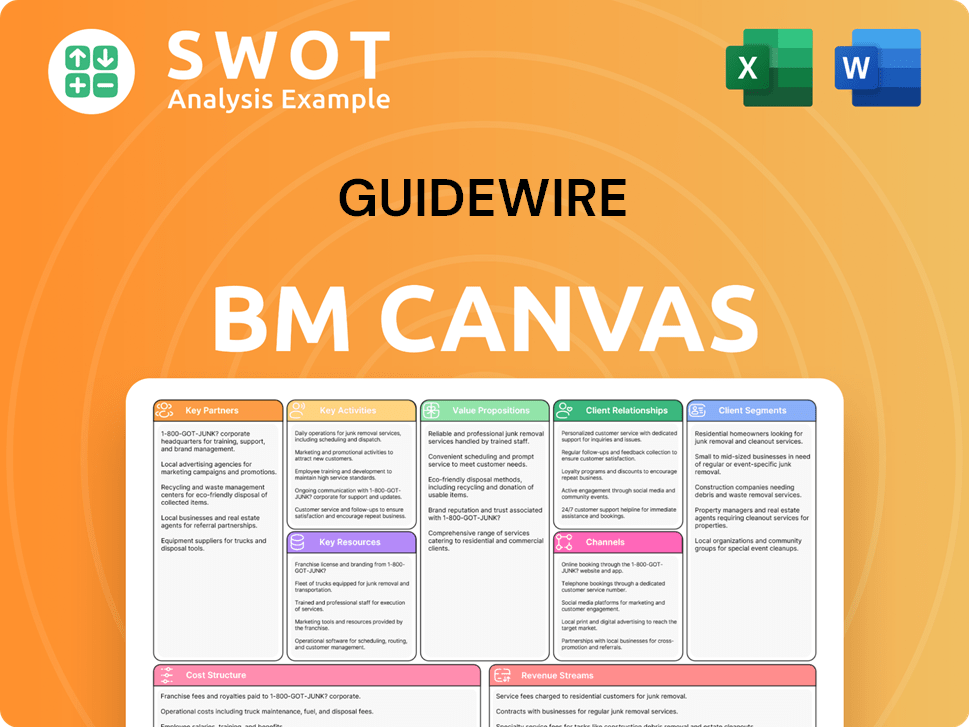

Guidewire Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Guidewire Positioning Itself for Continued Success?

The company, a prominent player in the insurance technology space, holds a significant position in the property and casualty (P&C) insurance software market. Its success stems from its comprehensive Guidewire platform, particularly its InsuranceSuite, favored by many large P&C carriers. The company's strategic shift towards cloud solutions has further solidified its standing, aligning with the industry's increasing focus on agility and scalability. The company's global reach extends across North America, Europe, Asia, and other key insurance markets, reflecting its widespread adoption and influence.

Despite its strong market presence, the company faces several risks. These include the potential impact of regulatory changes, the threat from agile InsurTech startups, and the rapid advancements in technologies like AI and blockchain. The pace of cloud adoption, economic downturns, or catastrophic events could also impact the company's financial health. Understanding these factors is crucial for assessing the company's long-term prospects and investment viability.

The company maintains a leading position in the P&C insurance software market. The Guidewire insurance software is a preferred choice for core system modernization. It has a global reach, serving insurers across North America, Europe, and Asia.

Regulatory changes and competition from InsurTech startups pose threats. Rapid technological advancements, like AI and blockchain, require continuous innovation. Economic downturns or slower-than-expected cloud adoption could impact the company's financial performance.

The future appears strong, driven by digital transformation in the insurance industry. The company's focus on cloud expansion and innovation positions it well. Its established market position and commitment to innovation support long-term growth.

The company is focused on expanding its cloud footprint and enhancing its product offerings. It aims to increase customer lifetime value and explore new growth avenues. Leadership emphasizes innovation and a long-term vision for empowering insurers.

The company's strategic initiatives are centered on expanding its cloud footprint and enriching its product offerings with advanced analytics and AI capabilities. The company aims to sustain and expand its ability to make money by continuing to drive cloud adoption, increasing the lifetime value of its customer relationships, and exploring new avenues for growth within the broader insurance technology landscape. The company’s commitment to innovation and its long-term vision of empowering insurers to navigate a rapidly changing world are key to its future. The company's future outlook appears strong, underpinned by the ongoing digital transformation within the insurance industry and its established position as a trusted technology provider. For a deeper dive into the competitive landscape, explore the Competitors Landscape of Guidewire.

The company's growth is driven by several key factors, including cloud adoption and product innovation. Its focus on customer lifetime value and expansion into new markets supports its long-term strategy. The digital transformation within the insurance industry is a significant tailwind.

- Continued cloud adoption among insurers.

- Expansion of product offerings with advanced analytics and AI.

- Strategic partnerships and ecosystem development.

- Focus on customer retention and lifetime value.

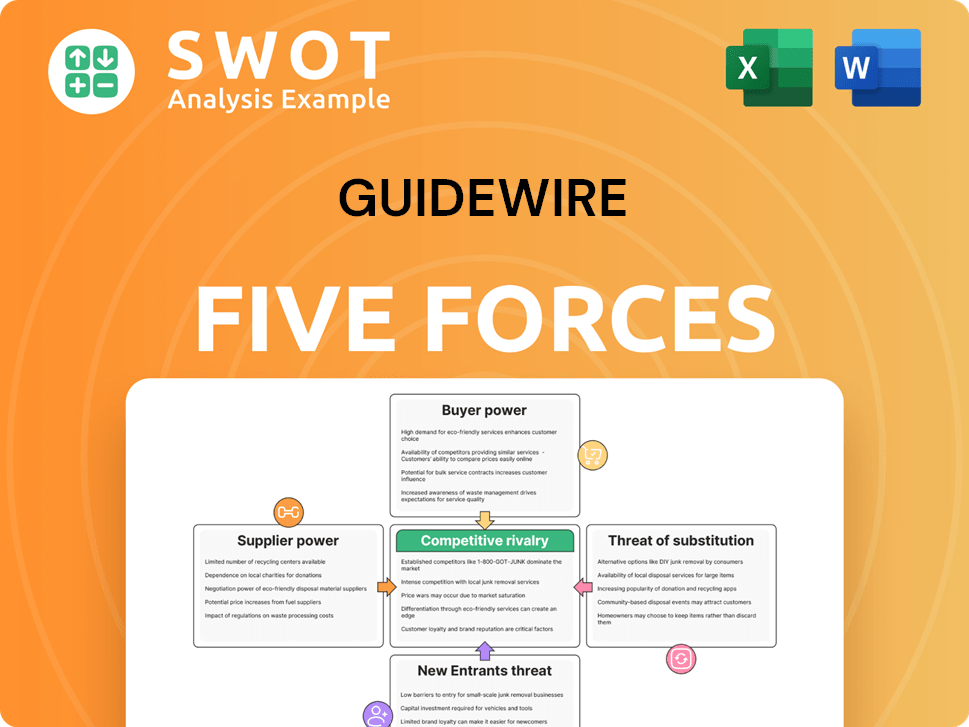

Guidewire Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guidewire Company?

- What is Competitive Landscape of Guidewire Company?

- What is Growth Strategy and Future Prospects of Guidewire Company?

- What is Sales and Marketing Strategy of Guidewire Company?

- What is Brief History of Guidewire Company?

- Who Owns Guidewire Company?

- What is Customer Demographics and Target Market of Guidewire Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.