Harvey Norman Bundle

How Does Harvey Norman Thrive in Today's Retail Arena?

In a retail world dominated by digital disruption and evolving consumer demands, Harvey Norman continues to be a major player. Established in 1982, the company has expanded from its initial focus to become a diversified franchisor of retail stores. This enduring presence in a competitive market highlights the company's adaptability and strategic resilience, making it a fascinating case study.

This analysis dives deep into the Harvey Norman SWOT Analysis, examining the company's competitive positioning within the retail industry Australia. We'll explore the Harvey Norman competitors, dissect its Harvey Norman market analysis, and assess its Harvey Norman competitive advantages. Understanding the Harvey Norman competitive landscape is key to grasping its past performance and predicting its future trajectory, considering factors like furniture market share and electronics market competition.

Where Does Harvey Norman’ Stand in the Current Market?

Harvey Norman Holdings Limited holds a significant market position in the Australian and international retail sectors, particularly in home furnishings, electronics, and appliances. The company operates primarily as a franchisor, with its network encompassing Harvey Norman, Domayne, and Joyce Mayne stores. This structure allows for a broad market reach and operational efficiency.

As of the first half of the 2024 financial year, Harvey Norman reported a profit before tax of $272.72 million, with total sales revenue reaching $4.95 billion. This financial performance underscores its substantial operational scale and market presence. Its primary product lines span furniture, bedding, computers, communications, consumer electronics, and electrical appliances, catering to a broad spectrum of consumer needs.

Geographically, Harvey Norman has a strong presence across Australia, New Zealand, Ireland, Northern Ireland, Singapore, Malaysia, Slovenia, Croatia, and has recently expanded into Hungary. This international diversification contributes to its resilience and market reach. Over time, Harvey Norman has adapted its positioning, embracing digital transformation to complement its extensive physical store network, thereby addressing shifts in consumer purchasing habits towards omnichannel retail.

While specific market share figures for 2024-2025 are subject to ongoing market dynamics, Harvey Norman consistently ranks among the top retailers in its categories. The company's strong presence in Australia and New Zealand provides a competitive edge.

The company's financial health, as evidenced by its substantial sales revenue and profit figures, generally positions it favorably compared to many industry averages. However, it faces ongoing challenges from economic headwinds and inflationary pressures.

Harvey Norman operates in multiple countries, including Australia, New Zealand, and several European and Asian nations. This international presence helps diversify its revenue streams and mitigate risks associated with regional economic fluctuations.

Harvey Norman offers a wide array of products, including furniture, bedding, computers, communications, consumer electronics, and electrical appliances. This diverse product portfolio caters to a broad consumer base and helps the company remain competitive.

Harvey Norman's competitive advantages include its established brand recognition, extensive store network, and diverse product offerings. The company's franchise model allows for efficient expansion and local market adaptation. Furthermore, Harvey Norman continues to invest in digital transformation to enhance its online sales strategy.

- Strong brand recognition in Australia and New Zealand.

- Extensive physical store network complemented by online sales.

- Diverse product offerings catering to various consumer needs.

- Adaptive business model leveraging franchising for expansion.

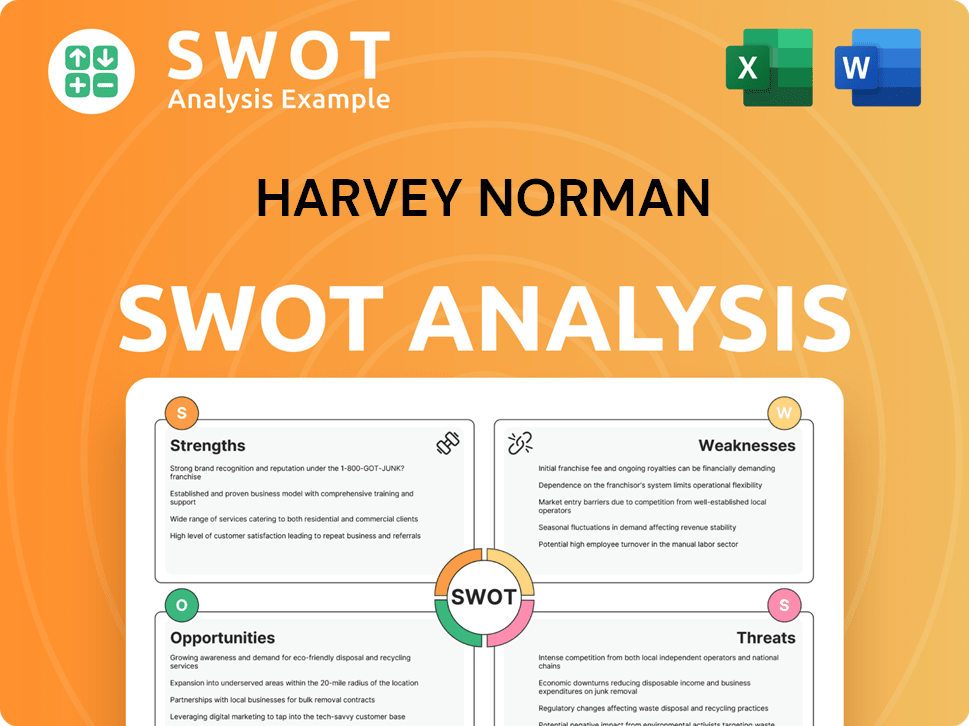

Harvey Norman SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Harvey Norman?

The Harvey Norman competitive landscape is shaped by a diverse range of players across its various product categories and geographic markets. Understanding these competitors is crucial for a comprehensive Harvey Norman market analysis. The retail industry in Australia is particularly competitive, with several key players vying for market share.

Harvey Norman competitors span direct and indirect channels, from established brick-and-mortar stores to rapidly growing online platforms. The company faces pressure to adapt and innovate to maintain its market position. Analyzing these competitive dynamics is essential for assessing Harvey Norman's business strategy and future outlook.

In the consumer electronics and appliance segments, Harvey Norman faces intense competition. Key direct competitors include JB Hi-Fi and The Good Guys, which compete on price, product range, and customer service. The market is also influenced by online marketplaces and emerging e-commerce players.

JB Hi-Fi is a major direct competitor, particularly in consumer electronics and appliances. They focus on competitive pricing, extensive product ranges, and customer service. JB Hi-Fi reported record sales of $9.63 billion in the 2023 financial year, highlighting its significant market presence.

Owned by JB Hi-Fi, The Good Guys is another significant competitor in the consumer electronics and appliance market. They compete on similar factors, including price and product selection. The acquisition of The Good Guys by JB Hi-Fi has consolidated the market, intensifying competition.

Officeworks is a key competitor, especially in the computers and office supplies segment. They offer a wide range of products and services, targeting both individual consumers and businesses. Officeworks' presence adds to the competitive pressure in the retail sector.

Major online marketplaces like Amazon and eBay offer a vast selection of products at competitive prices. They challenge traditional brick-and-mortar retailers by offering convenience and often lower overheads. These platforms are a significant source of indirect competition.

In the furniture and bedding categories, Harvey Norman competes with specialist retailers, department stores, and online-only furniture retailers. This market is fragmented, with various players vying for market share. The online segment is growing rapidly.

Department stores like Myer and David Jones also compete with Harvey Norman, particularly in furniture and bedding. These stores offer a wide range of products, including furniture and home goods. They contribute to the competitive landscape.

The competitive landscape is dynamic, with new entrants and emerging players constantly disrupting the market. To maintain its position, Harvey Norman must enhance its online presence and omnichannel capabilities. For more insights into Harvey Norman's strategic direction, consider reading about the Growth Strategy of Harvey Norman.

Several factors influence the competitive dynamics in the retail industry. These include pricing strategies, product range, customer service, and online presence. The ability to adapt to changing consumer preferences and market trends is crucial for success.

- Pricing: Competitive pricing is essential to attract customers.

- Product Range: Offering a wide variety of products helps cater to diverse customer needs.

- Customer Service: Providing excellent customer service builds loyalty.

- Online Presence: A strong online presence is vital for reaching a broader audience.

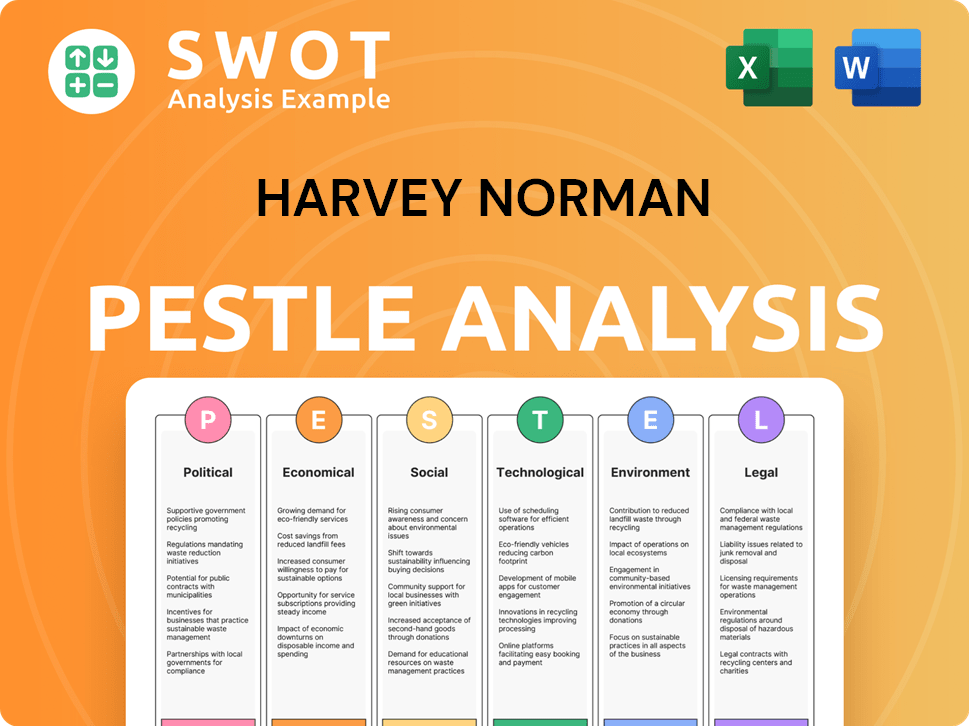

Harvey Norman PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Harvey Norman a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Harvey Norman involves recognizing its key competitive advantages. These advantages are crucial for navigating the complex retail industry in Australia and beyond. The company's success is built on a unique blend of operational models, brand strength, and strategic market positioning.

Harvey Norman's competitive edge is significantly shaped by its franchisor model, allowing for localized decision-making and entrepreneurial drive within each store. This structure fosters a strong sales culture and adaptability to local market conditions. The company's extensive retail footprint, including physical stores across Australia, New Zealand, and other international markets, provides a significant advantage, particularly for customers who prefer in-store experiences.

Brand equity, built over decades, is another crucial advantage. The Harvey Norman, Domayne, and Joyce Mayne brands are well-recognized and trusted by consumers, contributing to customer loyalty and repeat business. The company leverages economies of scale in purchasing and marketing, enabling competitive pricing and extensive promotional campaigns. Harvey Norman has also invested in its supply chain and logistics to ensure efficient product delivery.

The franchisor model allows for localized decision-making and entrepreneurial drive. This fosters a strong sales culture and adaptability to local market conditions. The model also provides a degree of insulation from direct operational costs and risks compared to a fully corporate-owned model.

Harvey Norman's vast network of physical stores across Australia, New Zealand, and other international markets provides a significant advantage. This is particularly true for customers who prefer to see, touch, and test products before purchasing. It also benefits those who require immediate pick-up and after-sales support.

The Harvey Norman, Domayne, and Joyce Mayne brands are well-recognized and trusted by consumers. This contributes to customer loyalty and repeat business. Brand recognition is a key factor in maintaining market share and attracting new customers in a competitive market.

Harvey Norman leverages economies of scale in purchasing and marketing due to its large network. This enables competitive pricing and extensive promotional campaigns. The company's size allows for more favorable terms with suppliers and greater marketing reach.

Harvey Norman's competitive advantages include its franchisor model, extensive retail footprint, brand equity, and economies of scale. These elements support the company's strong market position. The company’s ability to adapt to changing market dynamics is crucial for its future success.

- Franchisor Model: Allows for localized decision-making and entrepreneurial drive.

- Extensive Retail Footprint: Provides a significant advantage for in-store customer experiences.

- Brand Equity: Contributes to customer loyalty and repeat business.

- Economies of Scale: Enables competitive pricing and extensive promotional campaigns.

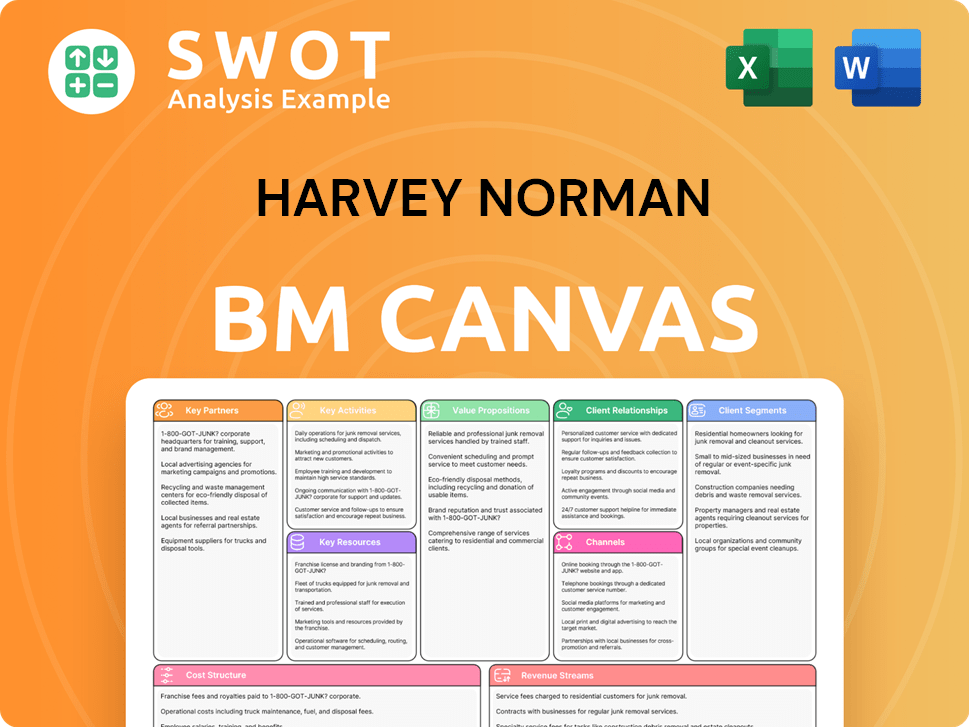

Harvey Norman Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Harvey Norman’s Competitive Landscape?

The retail industry is currently undergoing significant transformations, driven by technological advancements and evolving consumer behaviors. These changes present both challenges and opportunities for companies like Harvey Norman. The company's ability to adapt to these shifts will be crucial for maintaining its competitive edge and ensuring future growth. This article provides a detailed look at the Harvey Norman competitive landscape, examining industry trends, potential challenges, and future opportunities.

Understanding the Harvey Norman market analysis is essential for assessing its position within the retail sector. Factors such as e-commerce growth, changing consumer preferences, and economic conditions play a significant role in shaping the company's performance. This analysis will help to clarify the strategies and adaptations required for Harvey Norman to thrive in a dynamic market environment.

Key trends shaping the retail industry Australia include the rise of e-commerce, the demand for omnichannel experiences, and the increasing importance of sustainability. Consumers are increasingly shopping online, necessitating robust digital platforms and efficient logistics. Regulatory changes, such as those related to consumer protection and environmental standards, are also impacting operations.

One of the main challenges is managing the shift towards online retail and competing with online-only businesses. Economic factors, including inflation and potential downturns in consumer spending, could negatively impact sales. Furthermore, competing with larger retailers and marketplaces offering wider product ranges and competitive pricing poses a significant hurdle.

The growth of smart home technology and sustainable products presents opportunities for product innovation and market expansion. Expanding into emerging markets or strengthening its presence in existing territories could unlock new revenue streams. Strategic partnerships and leveraging its physical stores as experiential hubs also offer competitive advantages.

Harvey Norman's established physical presence, diverse product offerings, and brand reputation provide it with several competitive advantages. Its ability to adapt its franchise model and embrace digital transformation is crucial. The company has a strong presence in the furniture market share and electronics sectors, which it can leverage for growth.

To better understand the company's financial standing, consider the insights from Revenue Streams & Business Model of Harvey Norman. This analysis provides a comprehensive overview of the company's financial performance and strategic direction.

Harvey Norman must navigate the increasing electronics market competition while adapting to changing consumer behaviors. The company needs to invest in its online platform and logistics to compete effectively in the e-commerce space. Strategic partnerships and innovative marketing campaigns are crucial for maintaining and growing its customer base.

- Enhance the online shopping experience to match customer expectations.

- Explore strategic partnerships to broaden its product and service offerings.

- Leverage its physical stores to create unique customer experiences.

- Focus on sustainable products and practices to meet consumer demand.

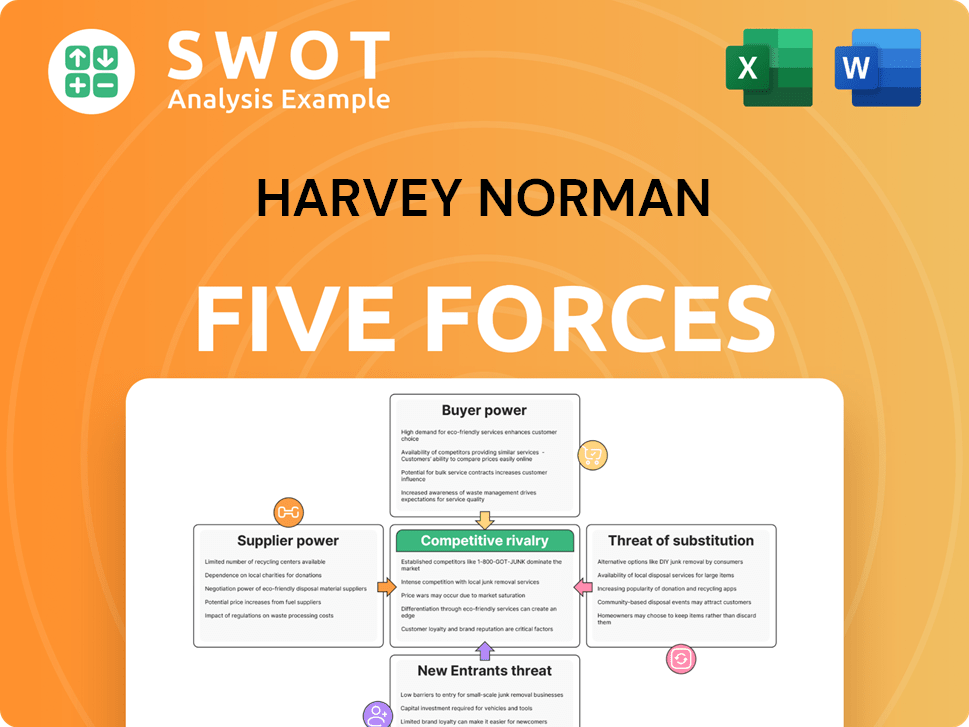

Harvey Norman Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Harvey Norman Company?

- What is Growth Strategy and Future Prospects of Harvey Norman Company?

- How Does Harvey Norman Company Work?

- What is Sales and Marketing Strategy of Harvey Norman Company?

- What is Brief History of Harvey Norman Company?

- Who Owns Harvey Norman Company?

- What is Customer Demographics and Target Market of Harvey Norman Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.