Harvey Norman Bundle

Unveiling the Inner Workings of Harvey Norman: How Does It Thrive?

Harvey Norman, a leading Harvey Norman SWOT Analysis, isn't just a retailer; it's a retail powerhouse with a unique franchising model. This Australian retailer has carved a significant niche in the market, offering a diverse range of products from consumer electronics to furniture. Understanding the Harvey Norman business model is key to grasping its success.

This exploration into Harvey Norman operations will dissect its core strategies, revealing how this retail company generates revenue and maintains its competitive edge. From its expansive network of Harvey Norman store locations to its diverse Harvey Norman product range, we'll uncover the secrets behind its enduring presence in the dynamic retail landscape. Whether you're interested in Harvey Norman customer service or the company's Harvey Norman financial performance, this analysis provides valuable insights.

What Are the Key Operations Driving Harvey Norman’s Success?

The core of the Harvey Norman business model lies in its franchisor structure, which significantly shapes its operations and value proposition. This structure allows the company to offer a wide variety of products, including furniture, bedding, computers, consumer electronics, and appliances, to a diverse customer base. The value proposition is centered on providing a broad selection of goods under well-known brand names, supported by localized service and expertise from individual franchisees.

Operationally, Harvey Norman provides branding, marketing, administrative support, and inventory management systems to its franchisees. Franchisees manage their stores' day-to-day operations, including sales, customer service, and local marketing. This decentralized approach allows for flexibility and responsiveness to local market conditions while maintaining a consistent brand image. The company's supply chain is robust, leveraging its scale to source products efficiently from a global network of suppliers. Distribution networks are established to deliver products to individual stores and directly to customers.

The unique aspect of Harvey Norman's operations is the entrepreneurial drive of its franchisees, who are directly invested in the success of their individual businesses. This incentivizes strong sales performance and customer engagement. This operational structure translates into customer benefits such as a wide product range, competitive pricing, and personalized service, differentiating it from traditional big-box retailers. In 2024, the company reported strong sales figures, demonstrating the effectiveness of its operational model.

The Harvey Norman business model is primarily a franchise model, where franchisees operate individual stores under the Harvey Norman brand. This structure allows for localized management and customer service. The company supports franchisees with branding, marketing, and supply chain management.

Harvey Norman offers a wide range of products, including consumer electronics, furniture, bedding, and appliances. This diverse product range caters to a broad customer base, providing convenience and choice. The company constantly updates its product offerings to meet changing consumer demands.

Harvey Norman's supply chain is designed for efficiency, sourcing products globally and distributing them to stores and customers. This robust supply chain ensures product availability and competitive pricing. The company's distribution networks support both in-store sales and online orders.

Franchisees play a crucial role in the Harvey Norman operations, managing day-to-day store activities. They are incentivized through direct investment in their businesses, promoting strong sales and customer engagement. This structure fosters a customer-focused approach.

Harvey Norman's operational structure provides several benefits to customers, including a wide product range, competitive pricing, and personalized service. This approach differentiates it from other retailers. The focus on customer service and product variety helps maintain a strong market position.

- Wide product selection across multiple categories.

- Competitive pricing and promotional offers.

- Personalized customer service and expert advice.

- Convenient store locations and online shopping options.

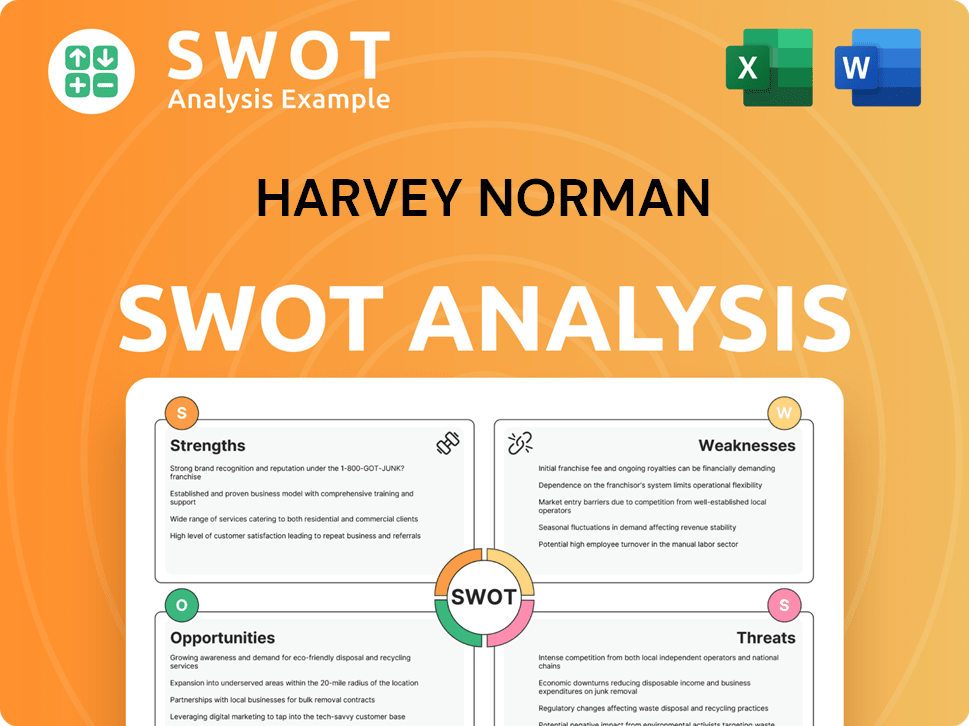

Harvey Norman SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Harvey Norman Make Money?

Understanding the revenue streams and monetization strategies of a company like Harvey Norman is crucial for grasping its financial health and operational dynamics. The company's approach to generating income is multifaceted, involving both direct sales and ongoing relationships with its franchisees.

The primary revenue streams for Harvey Norman stem from its franchisor operations and the direct sale of goods. This dual approach allows the company to leverage its brand and network to maximize sales and profitability. Analyzing these streams provides insight into the company's overall financial performance.

In the first half of the 2024 financial year, Harvey Norman reported a total aggregated sales decline of 1.2% to $5.27 billion. The company's profit before tax was down 18.7% to $370.81 million. Net profit after tax for the six months ended 31 December 2023 was $285.69 million.

Harvey Norman's monetization strategies are designed to maximize revenue through various channels. The company focuses on driving traffic to its stores and leveraging its extensive product range.

- Franchise Fees and Royalties: Revenue is generated through franchise fees, ongoing royalties, and rental income from properties leased to franchisees.

- Sales of Goods: The company sells goods to franchisees for resale, which is a significant revenue source.

- Company-Operated Stores: Revenue is generated from its own company-operated stores, although the franchised model is the primary source.

- Cross-selling and Up-selling: Encouraging customers to purchase complementary items across different departments.

- Property Portfolio: Revenue is also generated from its property portfolio, including owned and leased properties.

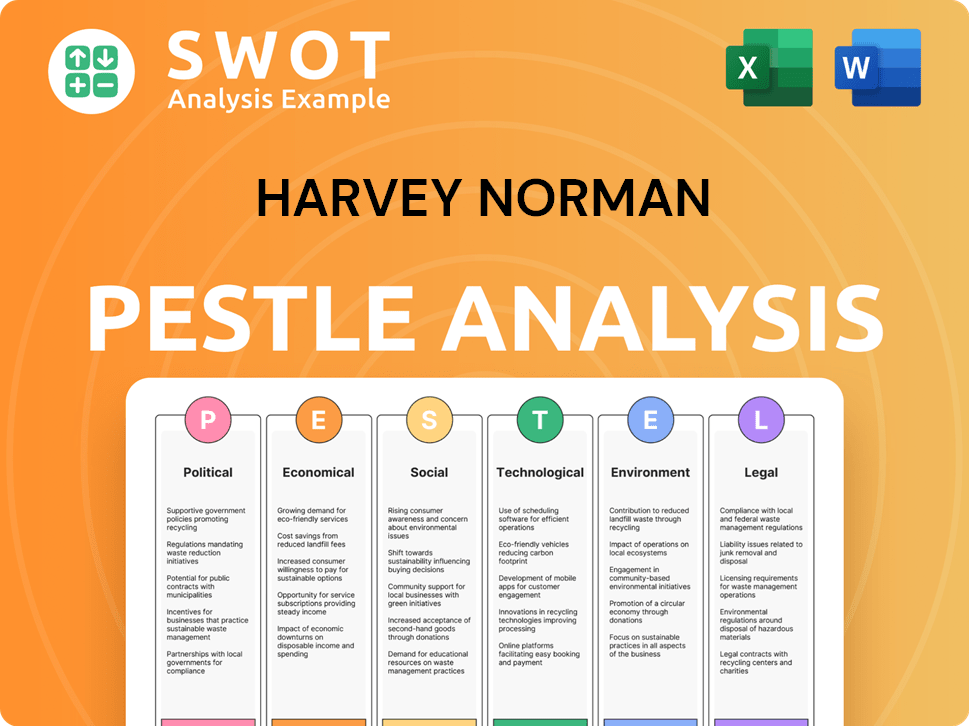

Harvey Norman PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Harvey Norman’s Business Model?

The journey of Harvey Norman has been marked by significant milestones and strategic shifts that have shaped its current operational and financial standing. A key element of its strategy has been the continuous expansion of its franchised network, both domestically and internationally. This expansion has enabled the company to achieve economies of scale in sourcing and marketing, influencing its ability to compete in the retail sector.

The company has navigated operational challenges, such as supply chain disruptions, particularly during the COVID-19 pandemic, by adapting its logistics and inventory management to meet changing consumer demands. For instance, the company reported an increase in inventory levels by 2.2% to $1.02 billion in the first half of the 2024 financial year, indicating a strategic response to supply chain dynamics. This adaptability is crucial for maintaining its competitive edge in the dynamic retail landscape.

Harvey Norman's competitive advantage stems from a multifaceted approach. Its strong brand recognition across its Harvey Norman, Domayne, and Joyce Mayne banners provides a significant advantage, fostering customer trust and loyalty. The decentralized franchisor model also contributes to its competitive edge, empowering local franchisees to respond swiftly to market trends and customer preferences, while benefiting from the parent company's bulk purchasing power and marketing reach. This hybrid model allows for both standardization and localized flexibility.

Harvey Norman's history includes significant expansions and adaptations. The company has grown its store network, both in Australia and internationally, to increase its market presence. Strategic moves include entering new markets and adjusting to shifts in consumer behavior, such as the rise of online shopping. These moves are crucial for its sustained growth.

The company has consistently invested in its supply chain and logistics to improve efficiency. A key strategy involves adapting to the growth of e-commerce by investing in its online platforms and integrating online and offline shopping experiences. This omnichannel approach is vital for maintaining its business model against evolving competitive threats.

Harvey Norman's competitive edge is built on its strong brand recognition and franchised business model. This model allows for a balance of centralized control and local market responsiveness. The company's ability to adapt to changing consumer behavior, including the shift towards online retail, is also a key factor in its competitive strategy.

The company is continually adapting to new trends, particularly the shift towards online retail, by investing in its e-commerce platforms and integrating online and offline shopping experiences. This omnichannel approach is crucial for sustaining its business model against evolving competitive threats from pure-play online retailers and other traditional brick-and-mortar stores.

The success of Harvey Norman as an Australian retailer is underpinned by several key elements. These include a strong brand presence, a flexible business model, and a commitment to adapting to market changes. The company's ability to navigate challenges, such as supply chain issues, has also been crucial.

- Brand Recognition: Strong brand presence across various banners.

- Franchise Model: A decentralized franchisor model that enables local responsiveness.

- Supply Chain Management: Strategic inventory management to address disruptions.

- E-commerce Integration: Investment in online platforms and omnichannel experiences.

For further insights into the company's growth strategy, consider reading about the Growth Strategy of Harvey Norman.

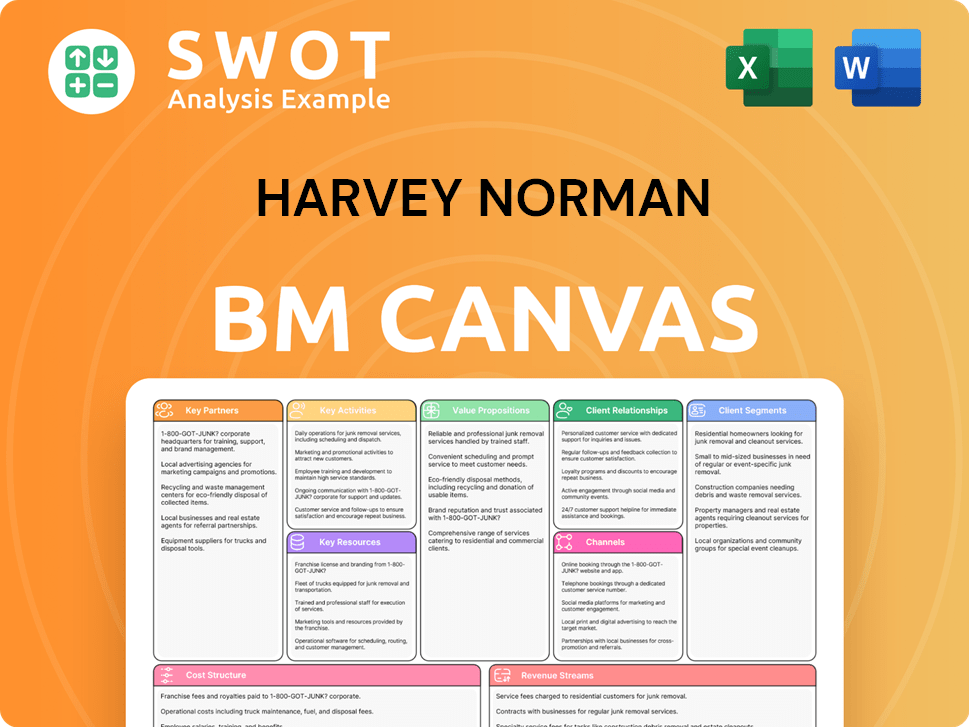

Harvey Norman Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Harvey Norman Positioning Itself for Continued Success?

Analyzing the industry position, risks, and future outlook of the retail company, it's clear that Harvey Norman holds a prominent position, particularly within the Australian retail landscape. The company's business model, built on franchised stores and a well-established brand, has allowed it to capture significant market share in sectors like furniture, bedding, consumer electronics, and appliances. This strong foundation supports its operations and market presence, both domestically and internationally.

However, Harvey Norman faces several key risks. These include intense competition from both traditional and online retailers, potential shifts in consumer preferences, and economic downturns that could affect spending on big-ticket items. Regulatory changes and the need to adapt to evolving retail trends also present ongoing challenges. Understanding these factors is crucial for evaluating the company's long-term prospects.

Harvey Norman is a leading Australian retailer specializing in furniture, bedding, appliances, and consumer electronics. Its extensive network of franchised stores and established brand contribute to its strong market share. The company's operations are supported by a well-recognized brand and a broad product range, making it a key player in the retail sector.

Harvey Norman faces risks including competition from both traditional and online retailers. Economic downturns and shifts in consumer preferences pose further challenges. Regulatory changes and the need to adapt to changing retail trends also present potential hurdles. The company must navigate these risks to maintain its profitability.

Harvey Norman's future hinges on its ability to adapt to evolving retail trends and manage inflationary pressures. The company is focused on its integrated retail strategy, combining physical stores with a growing online presence. Ongoing investments in technology and supply chain efficiency are also key strategies. The resilience of its franchise model is crucial for future growth.

Key strategies include strengthening its online presence and optimizing supply chain efficiency. The company is also focused on enhancing customer experience through technology. These initiatives are designed to maintain its competitive edge and drive future growth. For more details on the ownership and financial structure, see the article on Owners & Shareholders of Harvey Norman.

Harvey Norman's financial performance is closely tied to consumer spending and market conditions. The company's ability to manage costs and adapt to changing consumer behaviors is crucial. The retail sector is experiencing significant shifts due to e-commerce growth and evolving customer expectations.

- Harvey Norman's revenue is influenced by factors like interest rates, inflation, and consumer confidence.

- The company must continuously invest in its online platform to compete effectively with e-commerce giants.

- Supply chain disruptions and rising operational costs can impact profitability.

- Adapting to sustainability and environmental standards is becoming increasingly important.

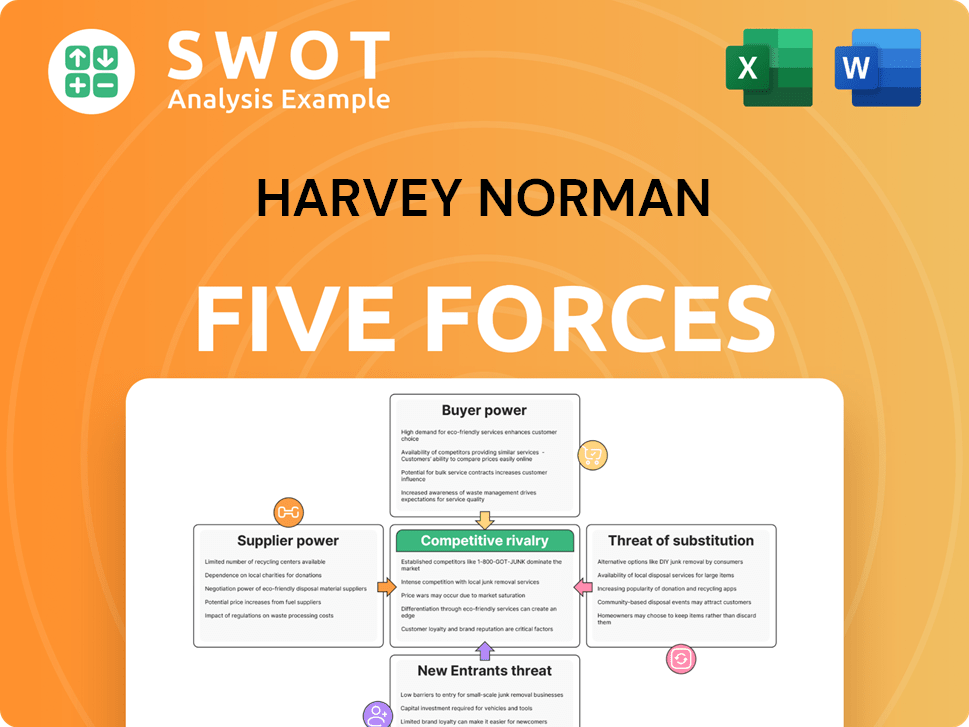

Harvey Norman Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Harvey Norman Company?

- What is Competitive Landscape of Harvey Norman Company?

- What is Growth Strategy and Future Prospects of Harvey Norman Company?

- What is Sales and Marketing Strategy of Harvey Norman Company?

- What is Brief History of Harvey Norman Company?

- Who Owns Harvey Norman Company?

- What is Customer Demographics and Target Market of Harvey Norman Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.