Henderson Land Bundle

How Does Henderson Land Company Navigate Hong Kong's Real Estate Market?

Henderson Land Company, a cornerstone of Hong Kong's property development scene since 1976, has consistently shaped the city's skyline. Founded by Dr. Lee Shau Kee, the company's evolution reflects a remarkable journey of adaptation and growth. From its initial focus on property development, Henderson Land has expanded into a diversified conglomerate, solidifying its position as a leading entity in the dynamic Hong Kong market.

To understand Henderson Land's current standing, a deep dive into its competitive landscape is essential. This analysis will explore the company's market position, key rivals, and unique strengths. Furthermore, we'll examine the prevailing trends and challenges shaping the future of Henderson Land in the Henderson Land SWOT Analysis. This detailed assessment will offer valuable insights for anyone interested in the real estate market and the competitive dynamics within Hong Kong.

Where Does Henderson Land’ Stand in the Current Market?

Henderson Land Company Limited holds a significant position in Hong Kong's competitive real estate market. The company's core operations involve property development, investment, and management, with a strong focus on both residential and commercial projects. In 2023, Henderson Land reported a core profit of HK$9,410 million, showcasing its substantial financial scale within the industry.

The company's value proposition centers on delivering high-quality properties and creating sustainable, smart living environments. Henderson Land caters to a broad spectrum of clients, from luxury buyers to mass-market consumers. Its integrated business model includes property management, construction, infrastructure, energy, and hotels, diversifying its revenue streams and market presence.

Geographically, Henderson Land primarily focuses on Hong Kong and mainland China, with a strategic emphasis on key urban centers. The company's commitment to sustainable development and smart living concepts in new projects reflects its move towards premium, environmentally conscious offerings. For more information, explore Owners & Shareholders of Henderson Land.

Henderson Land consistently ranks among the top-tier property developers in Hong Kong. Although specific market share figures fluctuate, the company's financial performance reflects its strong market position. The company's revenue reached HK$24,849 million in 2023, demonstrating its substantial presence in the competitive landscape.

Henderson Land's key business segments include residential and commercial property development, investment properties, and diversified ventures. The company's investment portfolio generates substantial rental income, contributing to its financial stability. Its diverse operations in property management, construction, and other sectors further strengthen its market position.

The company's primary geographic focus remains Hong Kong and mainland China. Henderson Land strategically targets key urban centers to maximize its market presence. This focus allows the company to capitalize on the high demand for both residential and commercial properties in these regions.

Henderson Land has strategically positioned itself by emphasizing sustainable development and smart living concepts. This shift towards premium and environmentally conscious offerings enhances its appeal to modern consumers. The company's investment in these areas reflects its long-term vision for the real estate market.

Henderson Land's financial health remains robust, as evidenced by its strong revenue and core profit figures. The company's ability to generate significant revenue and maintain profitability underscores its competitive advantage in the real estate market. The company's financial performance in 2023 demonstrates its resilience and strategic acumen.

- Reported revenue of HK$24,849 million in 2023.

- Core profit of HK$9,410 million in 2023.

- Strong position in prime commercial properties and large-scale residential estates.

- Strategic shift towards sustainable development and smart living.

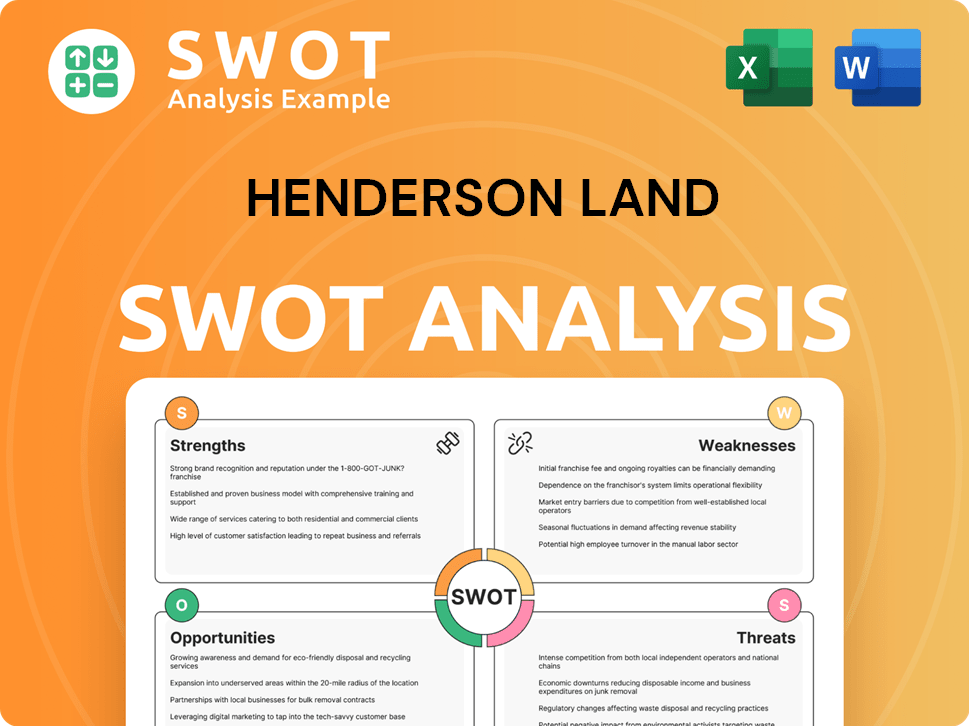

Henderson Land SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Henderson Land?

The Henderson Land Company operates within a dynamic and competitive real estate market, particularly in Hong Kong. Its success hinges on navigating a complex competitive landscape, which includes both direct and indirect rivals. Understanding these competitors and their strategies is crucial for assessing the company's position and future prospects.

This analysis delves into the key players challenging Henderson Land Company, examining their strengths, strategies, and the broader market dynamics that influence the company's performance. The competitive environment is shaped not only by established property developers but also by emerging trends and new entrants.

The property development and investment sector in Hong Kong is highly competitive, with several major players vying for market share. Henderson Land Company faces significant competition from established firms that have substantial resources and extensive portfolios. The competitive intensity is further amplified by the high value of land and the strategic importance of prime locations.

Henderson Land Company's primary direct competitors include large-scale property developers in Hong Kong. These companies compete across various segments, including residential, commercial, and industrial properties. The competition is fierce, with each company vying for market share through strategic land acquisitions and innovative development projects.

CK Asset Holdings Limited is a major conglomerate that competes directly with Henderson Land Company. It has a diversified portfolio spanning residential, commercial, and industrial properties. CK Asset often challenges Henderson Land on pricing and the scale of development projects.

Sun Hung Kai Properties Limited is known for its premium residential developments and extensive investment property portfolio. It directly competes with Henderson Land in the luxury and high-end commercial segments. This company's focus on quality and prime locations places it as a key rival.

New World Development Company Limited focuses on large-scale mixed-use developments and emphasizes cultural and lifestyle elements. This approach offers a differentiated competitive strategy against Henderson Land. Its projects often incorporate unique design and amenities to attract buyers and tenants.

Sino Land Company Limited presents a direct challenge in both residential and commercial property markets. It competes with Henderson Land through its diverse portfolio and strategic land acquisitions. The company's presence is significant in the Hong Kong real estate market.

Beyond direct rivals, Henderson Land Company faces indirect competition from various players in its diversified businesses. The competitive landscape is also influenced by new entrants and market trends. Mergers and alliances among competitors further shape the market dynamics.

The primary strategies employed by these competitors include aggressive land acquisition, innovative property design, and strategic marketing campaigns. These strategies aim to attract buyers and tenants while maximizing profitability. The Hong Kong real estate market is characterized by intense competition, with companies continuously seeking to gain an edge.

- Land Acquisition: Intense bidding for prime land parcels is a common strategy.

- Marketing Campaigns: Extensive marketing efforts to attract buyers and tenants.

- Innovation: Continuous innovation in property design and amenities.

- Diversification: Diversifying portfolios to mitigate risks and capture different market segments.

- Strategic Partnerships: Forming alliances to enhance market share and competitive positioning.

For more details on the company's history, you can read a Brief History of Henderson Land.

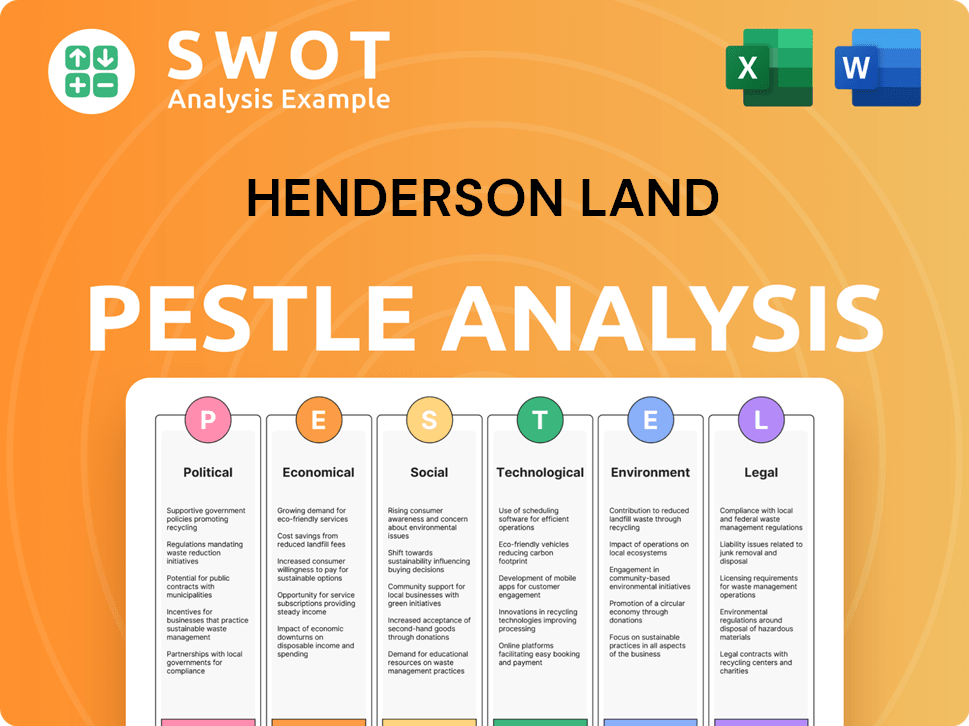

Henderson Land PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Henderson Land a Competitive Edge Over Its Rivals?

The competitive advantages of Henderson Land Company Limited are rooted in its strategic assets and operational strengths within the dynamic real estate market. These advantages enable the company to maintain a strong position against its rivals. The company’s ability to navigate the complexities of the Hong Kong and mainland China markets is a key differentiator, allowing it to capitalize on growth opportunities and manage risks effectively.

A significant advantage is Henderson Land's extensive land bank, which provides a stable pipeline for future developments. This strategic land reserve allows the company to control development costs and respond to market demands. Furthermore, its diversified business model, encompassing property development, investment, and other sectors, provides a robust revenue stream and mitigates risks.

Henderson Land's long-standing presence and deep understanding of the local markets, particularly in Hong Kong, offer invaluable insights into consumer preferences and regulatory landscapes. Brand equity and customer loyalty are also key strengths, fostering strong customer trust and repeat business. Its commitment to sustainable development and smart technologies further enhances its appeal.

Henderson Land's substantial land bank in Hong Kong and mainland China is a critical competitive advantage. This land reserve allows for a consistent supply of development projects, offering a buffer against market fluctuations. The strategic locations of these land holdings also provide opportunities for high-value developments, enhancing profitability.

The company has built a strong brand reputation over decades, synonymous with quality construction and reliable property management. This reputation fosters customer loyalty, resulting in repeat business and positive word-of-mouth referrals. This brand strength provides a significant edge in attracting both residential and commercial clients.

Henderson Land operates a diversified business model, encompassing property development, investment, management, construction, infrastructure, energy, and hotels. This diversification spreads risk across multiple sectors, protecting the company from the volatility of any single market. It also facilitates synergistic opportunities, such as leveraging its construction arm for its own projects.

The company's strong financial position and access to capital are essential advantages, enabling it to undertake large-scale projects and weather economic downturns. This financial strength allows for strategic investments in prime properties and development opportunities. It also supports the adoption of advanced technologies and sustainable practices.

Henderson Land Company's competitive advantages are multifaceted, stemming from its strategic land holdings, strong brand reputation, diversified business model, and financial strength. These elements collectively position the company favorably within the real estate market. The company's ability to adapt to market trends and leverage its strengths ensures its continued success.

- Extensive Land Bank: Strategic land reserves provide a consistent pipeline of projects.

- Strong Brand: Reputation for quality construction and reliable property management.

- Diversified Business Model: Spreads risk and creates synergistic opportunities.

- Financial Strength: Ability to undertake large-scale projects and withstand market downturns.

- Sustainable Development: Commitment to green buildings and smart technologies.

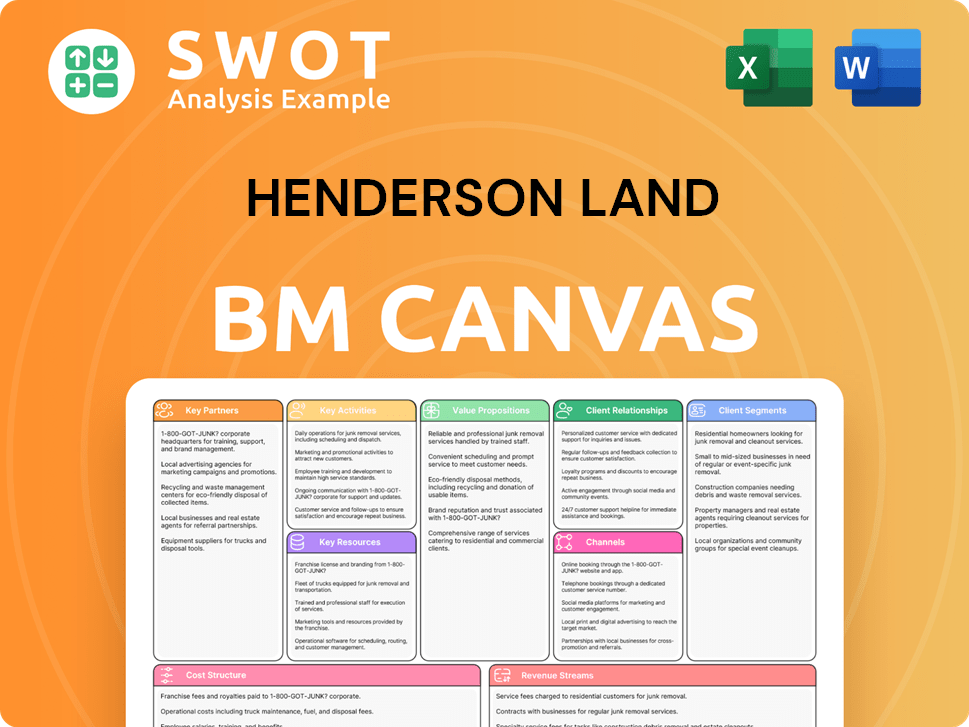

Henderson Land Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Henderson Land’s Competitive Landscape?

The competitive landscape for Henderson Land Company is significantly influenced by industry dynamics, presenting both challenges and opportunities within the real estate market, particularly in Hong Kong and mainland China. Technological advancements, regulatory changes, and evolving consumer preferences are key drivers shaping the company's strategic direction. Understanding these factors is crucial for assessing Henderson Land Company's future prospects and its ability to maintain a strong market position.

This analysis explores the industry trends, future challenges, and growth opportunities impacting Henderson Land Company. It examines how the company can adapt to changing market conditions, leverage emerging technologies, and capitalize on its strengths to ensure sustainable growth. A comprehensive understanding of the competitive environment is essential for making informed investment decisions and developing effective business strategies.

Technological advancements, including smart building technologies and proptech, are transforming property development and management. Regulatory changes, especially regarding land supply and environmental protection, impact development timelines and costs. Shifting consumer preferences, with a growing demand for flexible workspaces and eco-friendly living spaces, are also key factors.

Potential economic slowdowns impacting property demand and prices pose a significant challenge. Increased interest rates can affect borrowing costs and profitability. Intense competition for prime land parcels and the threat of new market entrants utilizing disruptive technologies are also concerns. Geopolitical uncertainties can impact investor confidence.

Ongoing urbanization in mainland China presents vast opportunities for property development and investment. The increasing focus on sustainable development and green buildings allows for differentiation and attracting environmentally conscious buyers. Strategic partnerships and integration of smart city initiatives in key markets also offer growth prospects.

Henderson Land's competitive position will likely evolve towards greater emphasis on sustainable, technologically advanced, and diversified urban developments. Strategies will focus on innovation, strategic acquisitions, and enhancing its rental portfolio to ensure resilience and continued growth. The company must navigate changing consumer demands and economic fluctuations.

A detailed competitive analysis of Henderson Land Company reveals its strengths and weaknesses relative to its rivals. Understanding the competitive advantages of Henderson Land is crucial for investors and stakeholders. The company's financial performance, development projects, and investment strategies are key areas of focus.

- Market Share and Position: Henderson Land holds a significant market share in the Hong Kong real estate market. Its position is influenced by its portfolio of properties and its ability to secure prime land parcels.

- Key Competitors: Key competitors include other major property developers in Hong Kong, such as Sun Hung Kai Properties and New World Development. These companies compete on factors like project quality, location, and pricing.

- Financial Performance: Henderson Land's financial performance is a critical indicator of its success. Analyzing its revenue, profit margins, and return on investment provides insights into its profitability and efficiency.

- Development Projects: Henderson Land's development projects, including residential, commercial, and retail properties, contribute significantly to its revenue and market presence. Understanding these projects is vital for assessing its growth potential.

The Target Market of Henderson Land analysis highlights the importance of understanding consumer preferences and market dynamics. In 2024, the Hong Kong real estate market saw fluctuations, with residential property prices experiencing moderate changes. The company's investment strategies and ability to adapt to changing market conditions will be crucial for its future success. For instance, the demand for sustainable and smart buildings is growing, which presents an opportunity for Henderson Land to differentiate itself. Furthermore, the company’s ability to secure prime land parcels and manage its development projects efficiently will be key factors in maintaining its competitive edge. In mainland China, urbanization continues to drive demand, offering significant growth potential for Henderson Land. The company's strategic focus on innovation and diversification will be essential to navigate the challenges and leverage the opportunities in the dynamic real estate market.

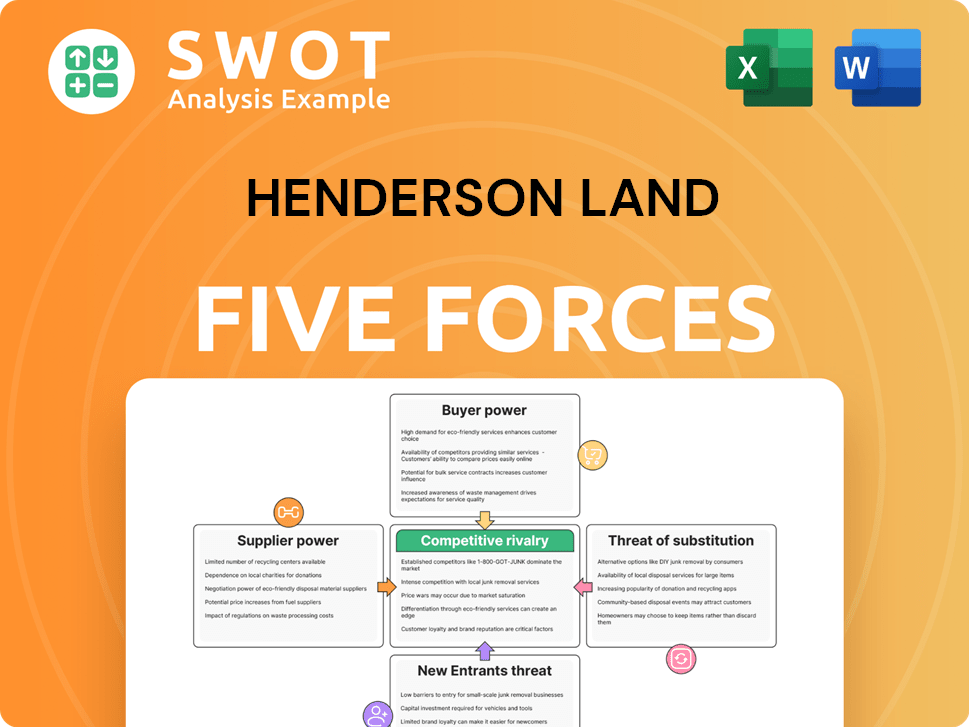

Henderson Land Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Henderson Land Company?

- What is Growth Strategy and Future Prospects of Henderson Land Company?

- How Does Henderson Land Company Work?

- What is Sales and Marketing Strategy of Henderson Land Company?

- What is Brief History of Henderson Land Company?

- Who Owns Henderson Land Company?

- What is Customer Demographics and Target Market of Henderson Land Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.