Hörmann Holding GmbH & Co. KG Bundle

How Does Hörmann Holding GmbH & Co. KG Navigate the Cutthroat Building Products Market?

In the dynamic world of building products, Hörmann Holding GmbH & Co. KG SWOT Analysis is a key player, known for its doors, gates, and operators. Founded in 1935, the company has evolved from a regional innovator to a global force with production sites worldwide. Understanding the Competitive Landscape is critical for investors and strategists alike.

This Company Analysis dives deep into Hörmann Holding GmbH & Co. KG, exploring its market share, key competitors, and the industry trends shaping its future. We'll examine its competitive advantages and challenges, providing insights into its business strategy and financial performance. Get ready to uncover the strategies that define Hörmann Holding GmbH & Co. KG's market position analysis and its ability to thrive in a competitive environment.

Where Does Hörmann Holding GmbH & Co. KG’ Stand in the Current Market?

Hörmann Holding GmbH & Co. KG, a key player in the building products and industrial sectors, holds a significant market position. The company is recognized as a leading manufacturer of doors, gates, frames, and operators, particularly in Europe. Its diverse product lines cater to residential, commercial, and industrial applications, supported by production sites across Europe, North America, and Asia.

The company's competitive landscape includes major entities such as JELD-WEN Holding, Inc., Masonite International Corporation, and ASSA ABLOY Group. Hörmann's primary product offerings include garage doors, entrance doors, industrial doors, and loading technology. The group's structure incorporates divisions like Automotive, Communication, Intralogistics, and Engineering, each contributing differently to the overall market position.

In the broader European doors market, Hörmann Group, alongside competitors, accounts for roughly 30% of the overall market share, highlighting its substantial presence. The group's financial health, as reported by Hörmann Industries GmbH, showed sales of EUR 678.9 million in 2024, with an EBIT of EUR 24.3 million. The company's equity stood at EUR 138.8 million as of December 31, 2024, maintaining an equity ratio of 36.2%. For a deeper understanding, you can read the Brief History of Hörmann Holding GmbH & Co. KG.

Hörmann Holding GmbH & Co. KG, a key player in the building products and industrial sectors, holds a significant market position. The company is recognized as a leading manufacturer of doors, gates, frames, and operators, particularly in Europe. The company's primary product lines span garage doors, entrance doors, industrial doors, and loading technology, catering to residential, commercial, and industrial applications.

Hörmann Industries GmbH reported sales of EUR 678.9 million in 2024, with an EBIT of EUR 24.3 million. The company's equity stood at EUR 138.8 million as of December 31, 2024, maintaining an equity ratio of 36.2%. The Automotive division experienced a significant decline, while the Communication division performed positively.

Hörmann Industries GmbH operates through four main divisions: Automotive, Communication, Intralogistics, and Engineering. The Automotive division was the largest by revenue but saw a sales decline. The Communication division showed growth, with sales reaching EUR 214.8 million in 2024. The Intralogistics division also faced a sales decrease.

Hörmann competes with major entities like JELD-WEN Holding, Inc., Masonite International Corporation, and ASSA ABLOY Group. The company's market position is influenced by its diversified structure and performance across various divisions. While some divisions faced challenges, others, like Communication, showed positive results.

Hörmann Holding GmbH & Co. KG faces challenges and opportunities across its various divisions. The Automotive division's sales decline highlights the impact of economic conditions and weaker demand. Conversely, the Communication division's growth indicates potential in profitable niche markets.

- Market Share: The company holds a significant market share in the European doors market.

- Financial Performance: Despite challenges, the group maintained a solid financial standing in 2024.

- Division Performance: Varied performance across divisions, with some experiencing growth while others faced declines.

- Strategic Focus: The company's backlog in Communication and Intralogistics supports its positioning.

Hörmann Holding GmbH & Co. KG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hörmann Holding GmbH & Co. KG?

The Competitive Landscape for Hörmann Holding GmbH & Co. KG is multifaceted, encompassing both direct and indirect competitors across its diverse business segments. A thorough Company Analysis reveals that the firm faces varying degrees of competition depending on the specific market it operates in, from doors and gates to automotive components and communication systems. Understanding these competitive dynamics is crucial for assessing Hörmann's market position and future growth prospects.

Hörmann's strategic approach, as detailed in Growth Strategy of Hörmann Holding GmbH & Co. KG, highlights its focus on innovation and market expansion. This strategy is essential for navigating the competitive pressures and adapting to evolving industry trends. The company's ability to maintain its market share and achieve financial performance, compared to its competitors, hinges on its capacity to differentiate its product portfolio and effectively manage its sales and distribution strategies.

The Hörmann Holding GmbH & Co. KG faces a complex competitive environment. The Key Competitors vary depending on the specific business segment. For instance, in the core doors and gates market, the company competes with firms like Novoferm, Teckentrup, and Garador. In the automotive sector, Hörmann Automotive faces competition from various suppliers, although specific competitors are not detailed. The communication and intralogistics divisions also encounter specialized competitors.

In the doors and gates market, Hörmann directly competes with companies such as Novoferm, Teckentrup, and Garador. These competitors offer similar products, including garage doors and industrial doors. The competition is driven by pricing strategies, product quality, and technological innovation.

Hörmann Automotive, which produces frame mounting parts and body components, competes with various automotive suppliers. Sales in this segment faced declines in 2024 due to challenging economic conditions and reduced demand from OEM customers in the truck and agricultural machinery industries.

In the communication segment, Hörmann's subsidiary Funkwerk AG competes with specialized communication technology providers. These providers offer solutions for the rail and public transport sectors. The competition focuses on technological advancements and specific industry requirements.

The intralogistics division, focused on automated high-bay warehouses, competes with general contractors and technology providers in the logistics automation industry. The engineering division also faces competition from other engineering service providers. These competitors offer similar solutions.

New and emerging players, especially those leveraging advanced technologies, could disrupt the traditional competitive landscape. The focus on smart and connected doors and sustainability could shift competitive dynamics, requiring continuous innovation and adaptation from established players.

Industry trends such as technological advancements and sustainability are key factors shaping the competitive environment. These trends require companies like Hörmann to continuously innovate and adapt their strategies. This includes integrating smart technologies and focusing on sustainable practices.

Hörmann's competitive advantages include its established market presence and diversified product portfolio. However, the company faces challenges such as economic fluctuations, technological disruptions, and intense competition. To maintain its market position, Hörmann must focus on innovation, cost management, and strategic partnerships.

- Market Share: Maintaining and growing market share in a competitive environment is a key focus.

- Industry Trends: Adapting to industry trends, such as smart technology and sustainability, is essential.

- Key Competitors: Understanding and responding to the strategies of key competitors is crucial.

- Product Portfolio Comparison: Differentiating the product portfolio through innovation and quality is important.

- Market Challenges: Addressing market challenges, such as economic downturns and technological disruptions, is vital.

Hörmann Holding GmbH & Co. KG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hörmann Holding GmbH & Co. KG a Competitive Edge Over Its Rivals?

Understanding the Competitive Landscape of Hörmann Holding GmbH & Co. KG involves assessing its strengths and how it differentiates itself. The company, a key player in the industry, has cultivated a strong market position over many years. This analysis delves into the factors that contribute to its success and how it maintains a competitive edge.

Hörmann Holding GmbH & Co. KG, with its extensive history, has established itself as a prominent entity. Its strategic moves and investments have shaped its competitive advantages. The company's commitment to quality, innovation, and customer experience are central to its ongoing success in a dynamic market.

The company's competitive advantages are multifaceted, encompassing brand recognition, a broad product portfolio, technological advancements, and a focus on sustainability. These elements collectively position Hörmann favorably against its rivals, allowing it to adapt and thrive in the evolving market landscape. For more insights, explore the Growth Strategy of Hörmann Holding GmbH & Co. KG.

Hörmann Holding GmbH & Co. KG benefits from a robust brand reputation built over nine decades. This long-standing presence has fostered trust and recognition among customers. The company's early innovation with the up-and-over garage door in 1952 solidified its market leadership in Germany.

The company's diverse product range, including doors, gates, and operators, caters to various needs. This comprehensive offering allows Hörmann Holding GmbH & Co. KG to serve residential, commercial, and industrial markets. The broad product scope supports a wide market reach.

Hörmann Holding GmbH & Co. KG invests heavily in staff skills, training, and cutting-edge technology. The company is actively involved in digital transformation, using AI and machine learning. Initiatives such as integrating SAP Sales Cloud and SAP Service Cloud aim to enhance customer experience.

The company's diversified structure across automotive, communication, intralogistics, and engineering provides stability. This diversification helps to offset challenges in individual sectors. For example, the communication division showed strong performance in 2024, stabilizing overall sales.

Hörmann Holding GmbH & Co. KG's competitive advantages include a strong brand, a broad product portfolio, and technological innovation. The company's focus on sustainability and its diversified business model further enhance its market position. These factors contribute to its sustained competitiveness.

- Strong brand recognition and reputation.

- Extensive product portfolio serving diverse customer needs.

- Continuous investment in staff skills and cutting-edge technology.

- Diversified business model providing stability across different sectors.

Hörmann Holding GmbH & Co. KG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hörmann Holding GmbH & Co. KG’s Competitive Landscape?

Analyzing the Competitive Landscape of Hörmann Holding GmbH & Co. KG involves understanding its position amidst evolving Industry Trends, future challenges, and opportunities. This Company Analysis reveals the dynamics shaping its strategic direction. The firm's ability to adapt to technological advancements, navigate economic uncertainties, and meet changing consumer demands is crucial for maintaining and enhancing its market position.

Hörmann faces risks related to economic downturns, intense competition, and reliance on subsidiaries. However, it also has opportunities in emerging markets, innovative products, and strategic partnerships. The company's financial performance, with 2024 sales at EUR 678.9 million, reflects the need for strategic adjustments. For a deeper dive into the ownership structure, consider reading Owners & Shareholders of Hörmann Holding GmbH & Co. KG.

Digital transformation and the adoption of technologies like AI and machine learning are key trends. Consumer demand for sustainable solutions is increasing. These trends present both opportunities and challenges for Hörmann. The company must invest in technology and adapt to the market.

Maintaining profitability during economic slowdowns and intense competition is a challenge. Dependence on subsidiaries for cash flow poses a business risk. Strengthening global market diversification and international presence is also a challenge. Navigating volatile market demand remains a key issue.

Emerging markets, product innovations with smart features, and strategic partnerships offer significant opportunities. A robust order backlog, especially in the Communication division, indicates strong demand. Continued investment in all divisions to strengthen competitiveness is a key strategy.

For 2025, Hörmann forecasts sales between EUR 690 million and EUR 720 million. Stable performance from the Automotive division is expected. The Communication sector anticipates 10% growth. Proactive investment and diversification are crucial for resilience.

Hörmann's strategy involves adapting to digital transformation and consumer demand for sustainable solutions. The company is focused on innovation and strategic partnerships. A proactive approach to investment and diversification is essential to capitalize on future opportunities.

- Embracing digital transformation to enhance operational efficiency.

- Focusing on sustainability to meet evolving consumer preferences.

- Investing in all divisions to strengthen competitiveness.

- Expanding market presence in emerging markets.

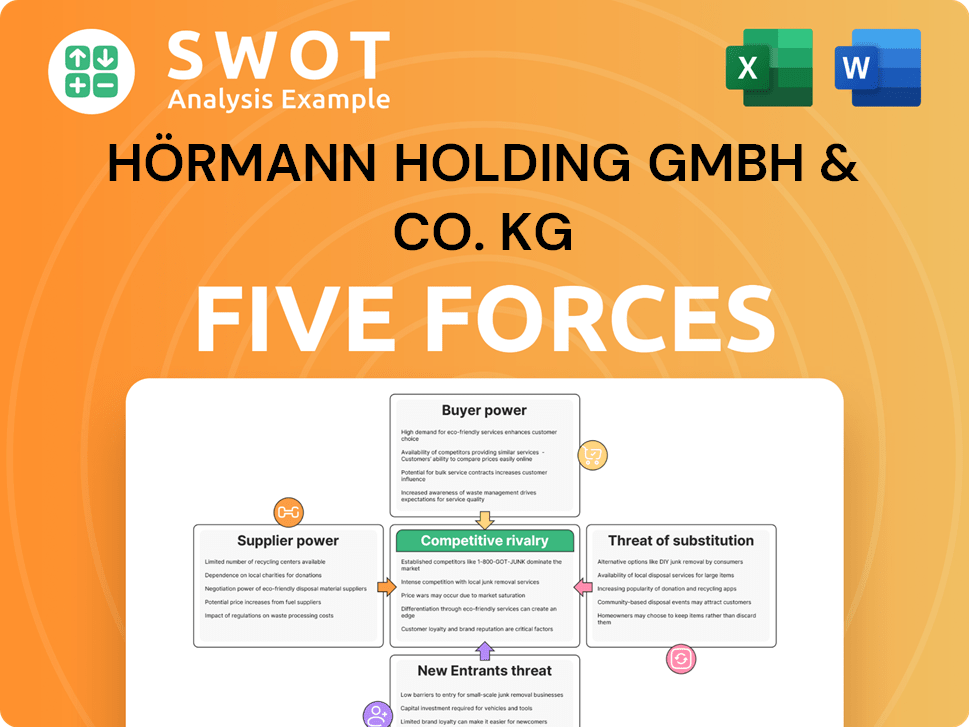

Hörmann Holding GmbH & Co. KG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hörmann Holding GmbH & Co. KG Company?

- What is Growth Strategy and Future Prospects of Hörmann Holding GmbH & Co. KG Company?

- How Does Hörmann Holding GmbH & Co. KG Company Work?

- What is Sales and Marketing Strategy of Hörmann Holding GmbH & Co. KG Company?

- What is Brief History of Hörmann Holding GmbH & Co. KG Company?

- Who Owns Hörmann Holding GmbH & Co. KG Company?

- What is Customer Demographics and Target Market of Hörmann Holding GmbH & Co. KG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.