Hyundai Motor Bundle

How is Hyundai Redefining the Automotive Race?

The automotive industry is in constant flux, driven by technology, consumer demands, and sustainability goals. Hyundai Motor Company stands out as a major player, demonstrating strategic vision and adaptability. A recent partnership with Amazon for online vehicle sales in the U.S. showcases its innovative approach to market expansion.

Founded in 1967, Hyundai has grown from a Korean manufacturer into a global powerhouse, now the world's third-largest car seller. To understand its success, we must examine the Hyundai Motor SWOT Analysis and the dynamic Hyundai competitive landscape. This analysis will explore Hyundai market analysis, identifying Hyundai competitors and the strategies that position it in the automotive market.

Where Does Hyundai Motor’ Stand in the Current Market?

Hyundai Motor Company's core operations revolve around designing, manufacturing, and selling a wide array of vehicles, including passenger cars, SUVs, and commercial vehicles. The company's value proposition centers on providing quality vehicles at competitive prices, with a focus on technological innovation and customer satisfaction. Hyundai has strategically expanded its product offerings to cater to evolving consumer preferences, particularly in the SUV and electric vehicle segments.

In 2024, Hyundai, along with Kia, secured its position as the world's third-largest automaker by sales volume. This achievement underscores the company's robust market presence and its ability to compete effectively in the global automotive market. Hyundai's focus on innovation and customer-centric strategies has enabled it to maintain a strong competitive edge.

The company's success is further highlighted by its financial performance. Despite a slight dip in global sales volume, Hyundai's revenue increased by 7.7% to KRW 175.2 trillion ($122.1 billion) in 2024. This indicates strong demand and effective pricing strategies. For those interested in the company's performance, Owners & Shareholders of Hyundai Motor can find detailed insights.

In 2024, Hyundai's global sales totaled 4,141,791 vehicles. The company aims to exceed 4.17 million vehicle sales in 2025. Hyundai's North American market reported 1.1 million vehicle sales in 2024, a 5.6% increase year-over-year. This demonstrates strong sales performance in key markets.

Hyundai is strategically shifting its focus towards SUVs and the premium Genesis brand, which accounted for 61.7% of total sales in 2024. This shift indicates a move towards higher-margin segments. The company's diverse product lines include passenger cars, SUVs, and commercial vehicles, catering to a broad customer base.

Hyundai's revenue increased to KRW 175.2 trillion ($122.1 billion) in 2024. The operating profit for 2024 dropped to KRW 14.24 trillion, with an operating profit margin of 8.1%. For 2025, Hyundai targets a consolidated revenue growth of 3% to 4% and an operating profit margin of 7% to 8%.

Global electrified vehicle sales increased by 21% year-over-year in Q4 2024, reaching 209,641 units. In Q1 2025, sales of electrified models jumped 38.4% year-over-year to 212,426 units. This growth reflects Hyundai's commitment to the electric vehicle market.

Hyundai's performance is marked by strong sales in the U.S., with record-breaking sales in April and May 2025. The company's focus on SUVs and the premium Genesis brand is driving growth. The company's strategic focus on electric vehicles is also contributing to its market position.

- Hyundai's U.S. retail sales in 2024 reached 988,000 vehicles, a 9% year-over-year jump.

- In May 2025, Hyundai Motor America reported an 8% increase in sales compared to May 2024.

- Hyundai's Q1 2025 revenue reached KRW 44.41 trillion, a 9.2% increase year-over-year.

- Hyundai's North American sales increased by 5.6% year-over-year in 2024.

Hyundai Motor SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hyundai Motor?

The Growth Strategy of Hyundai Motor is significantly shaped by its competitive environment. The company navigates a complex landscape, contending with established global automakers and emerging players. Understanding the Hyundai competitive landscape is crucial for assessing its market position and future prospects.

Hyundai's market analysis reveals a dynamic industry where innovation, pricing, and strategic partnerships are key. The automotive market is constantly evolving, with shifts in consumer preferences and technological advancements influencing the competitive dynamics. Hyundai's ability to adapt and compete effectively against its rivals determines its success.

Hyundai's industry position is challenged by both direct and indirect competitors. The company faces intense competition across various segments and geographies, requiring continuous strategic adjustments to maintain and grow its market share. Analyzing Hyundai's competitors provides insights into the challenges and opportunities it faces.

The primary direct competitors of Hyundai include major global automotive manufacturers. These companies compete directly with Hyundai across various vehicle segments and geographical markets.

Toyota is a formidable rival, particularly in hybrid vehicle technology and overall reliability. In 2024, Toyota maintained a strong position in global auto sales.

Volkswagen competes across a broad spectrum of vehicle types, including a growing emphasis on electric vehicles (EVs). The group's diverse portfolio presents significant competition.

These established automakers compete with Hyundai in key markets, particularly in North America. They offer a wide range of vehicles, including SUVs and trucks, challenging Hyundai's market share.

Other Asian manufacturers, such as Honda, Nissan, and Mazda, are major competitors. These companies compete with Hyundai in various segments, especially in the Asian market.

Tesla poses a substantial challenge in the rapidly expanding EV market with its dedicated EV platforms and advanced technology. Tesla's focus on EVs puts direct pressure on Hyundai's electrification strategy.

Chinese EV manufacturers, such as BYD, are gaining significant ground, particularly in their domestic market. BYD's rapid expansion impacts Hyundai's sales in China and other regions.

Hyundai's global market share is influenced by its ability to compete effectively in key regions and segments. The company faces intense competition in the U.S., India, and other major markets. Understanding the competitive landscape is crucial for Hyundai's strategic planning.

- U.S. Market: Hyundai saw strong sales momentum in 2024, competing intensely for SUV and electrified vehicle market share.

- India Market: Hyundai faces an intensifying three-way contest for the number two position in the passenger vehicle market, with aggressive expansion from Tata Motors and Mahindra.

- Mergers and Alliances: The automotive industry is shaped by mergers and alliances, which affect competitive dynamics.

- Software-Defined Vehicles (SDVs): The increasing focus on SDVs and autonomous driving technology is crucial for competitive edge.

- Technological Advancements: Partnerships and technological advancements are essential for maintaining a competitive advantage.

Hyundai Motor PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hyundai Motor a Competitive Edge Over Its Rivals?

The Hyundai competitive landscape is shaped by its strategic focus on electric vehicles (EVs), proprietary technologies, and brand equity. Hyundai's aggressive push into electrification, including hybrids and battery electric vehicles (BEVs), positions it to meet evolving consumer preferences and regulatory changes. This focus is a key element in the company's strategy within the automotive market.

Key milestones include significant investments in research and development (R&D) and the expansion of its EV lineup. Hyundai's commitment to innovation is demonstrated through the development of its Integrated Modular Architecture (IMA) platform and the commercialization of autonomous driving technologies. These initiatives are designed to enhance the company's competitive edge in the automotive industry. Hyundai's focus on future mobility solutions is evident in its strategic partnerships and investments.

Hyundai's competitive edge is also bolstered by its strong brand recognition and customer loyalty, with over 17 million vehicles sold in the U.S. since 1986. The company's economies of scale, derived from its position as a major global automaker, allow for cost efficiencies in production and procurement. Hyundai's manufacturing capabilities are also being strengthened through investments in domestic EV production and the development of multi-energy plants.

Hyundai is heavily investing in electric vehicles to meet the growing demand and regulatory changes. The company aims to sell 560,000 EVs annually by 2025 and introduce over 12 BEV models. By 2030, Hyundai plans to offer a full lineup of 21 EV models and sell 2 million EVs annually. This strategy includes new Extended Range Electric Vehicle (EREV) models with a range exceeding 900 km.

Hyundai is focusing on proprietary technologies and intellectual property. The company plans to invest KRW 11.5 trillion ($7.9 billion) in 2025 for key future capabilities, including electrification and SDV. The development of the Integrated Modular Architecture (IMA) platform will standardize components, reducing costs. Hyundai is also accelerating autonomous driving technologies and plans to introduce wireless software updates (OTA) for all models by 2025.

Hyundai benefits from strong brand equity and customer loyalty, with over 17 million vehicles sold in the U.S. The company's focus on design, quality, and value contributes to its brand perception. Hyundai is also strengthening its manufacturing capabilities with a KRW 12 trillion ($8.2 billion) investment in Korea. The 'Metaplant America' in Georgia is designed for ICE, BEV, and hybrid vehicle production.

Hyundai is leveraging strategic partnerships to streamline its operations and enhance customer experience. The company has a retail collaboration with Amazon in the U.S., which simplifies the car-buying process. These partnerships are a crucial part of Hyundai's approach to maintaining its competitive advantage and adapting to the evolving automotive market.

Hyundai's competitive advantages include a strong focus on electrification, proprietary technologies, and brand equity. These strengths are supported by significant investments in R&D and manufacturing capabilities. However, the company faces challenges from imitation and rapid technological changes in the automotive sector. To maintain its competitive edge, Hyundai must continuously innovate and invest in future mobility solutions.

- Hyundai's aggressive electrification strategy positions it well for future market demands.

- Investments in R&D and proprietary technologies provide a technological edge.

- Strong brand recognition and customer loyalty drive sales and market share.

- The company's ability to adapt to market changes and consumer preferences is crucial.

Hyundai Motor Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hyundai Motor’s Competitive Landscape?

The automotive industry is experiencing a period of significant transformation, largely driven by technological advancements, regulatory changes, and evolving consumer preferences. For Hyundai Motor, understanding and adapting to these trends is critical for maintaining and enhancing its competitive position. This involves strategic shifts towards electrification, autonomous driving, and software-defined vehicles, while also navigating the complexities of global economic shifts and intense market competition.

The future outlook for Hyundai is influenced by its ability to successfully execute its strategic initiatives. These initiatives include significant investments in research and development, strategic partnerships, and a flexible approach to market dynamics. The company faces challenges like intense competition and supply chain disruptions. However, it also has significant opportunities for growth in emerging markets and through product innovations.

The automotive industry is rapidly evolving, with electrification, autonomous driving, and software-defined vehicles at the forefront. Government regulations and consumer demand are driving the shift toward electric vehicles (EVs). However, the industry faces challenges like a potential plateau in EV demand in some markets, known as the 'electric vehicle chasm'.

Key challenges include intense competition from traditional automakers and new EV players, and potential shifts in government policies. Economic uncertainties, such as interest rates and inflation, can impact vehicle demand and profitability. Additionally, supply chain disruptions and the high costs associated with advanced technologies pose significant hurdles.

Significant growth opportunities exist in emerging markets and through product innovations in electrified and hydrogen fuel cell vehicles. Strategic partnerships and the development of new business models, such as mobility services, also present avenues for expansion. Hyundai is investing heavily in R&D to support its future mobility vision.

Hyundai's strategy focuses on electrification, advanced technology, and a flexible response to market conditions. The 'Hyundai Way' strategy emphasizes dynamic capabilities, becoming a mobility game changer, and an energy mobilizer. The company is investing KRW 120.5 trillion through 2033 to enhance EV and hybrid competitiveness.

Hyundai is making substantial investments to secure its future in the automotive market. These investments are aimed at strengthening its position in the

- Hyundai aims to sell 2 million EVs globally by 2030.

- The company plans a record investment of KRW 24.3 trillion ($16.6 billion) in Korea in 2025, with nearly half allocated to R&D.

- Hyundai is investing KRW 120.5 trillion through 2033 to support its 'Hyundai Way' strategy.

- The company is exploring new business models, such as mobility services.

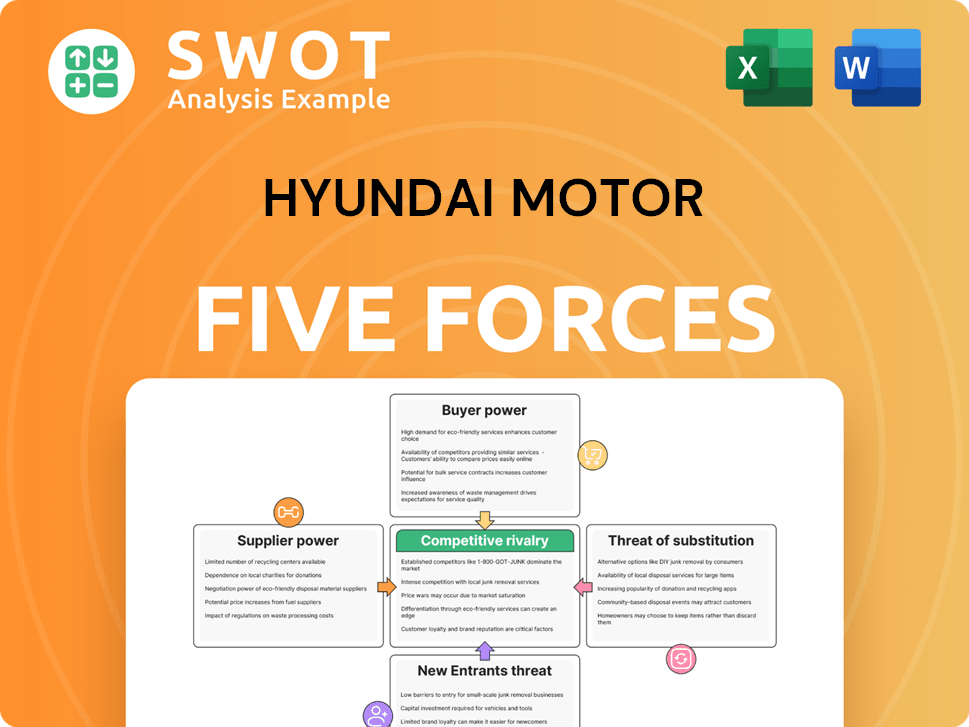

Hyundai Motor Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hyundai Motor Company?

- What is Growth Strategy and Future Prospects of Hyundai Motor Company?

- How Does Hyundai Motor Company Work?

- What is Sales and Marketing Strategy of Hyundai Motor Company?

- What is Brief History of Hyundai Motor Company?

- Who Owns Hyundai Motor Company?

- What is Customer Demographics and Target Market of Hyundai Motor Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.